After the 1011 Era: How Can Exchanges Restart the Market Pulse?

TechFlow Selected TechFlow Selected

After the 1011 Era: How Can Exchanges Restart the Market Pulse?

Market recovery requires joint efforts from exchanges and retail investors.

Author: WhiteRunner

The "1011" incident triggered the entire crypto market, with 19.2 billion USD in futures contracts liquidated overnight—a historical record. In the following weeks, Bitcoin further dropped below $100,000, leaving widespread despair across the market—meanwhile, major exchanges launched a series of coordinated actions.

Recap of the "1011" Incident: The Largest Liquidation in Crypto History

October 11, 2025 will forever be etched into the history of the cryptocurrency industry. The global crypto market endured its darkest six hours. As U.S. President Trump announced 100% tariffs on Chinese goods, panic selling erupted, triggering a chain reaction of liquidations. Within 24 hours, the derivatives market suffered $19.2 billion in liquidations—the largest single event in crypto history. This not only surpassed the $3 billion record set during the 2020 "312 crash," but exceeded the combined total of all previous major liquidation events. Bitcoin dropped approximately 13.5% in a short time, altcoins plunged dramatically, and some low-market-cap tokens nearly reached zero. After several weeks of volatility, the market sharply declined again on November 4, with Bitcoin falling below the $100,000 mark—the lowest level in nearly five months—reigniting waves of retail investor despair. These events shook confidence in exchange asset security and compliance mechanisms, prompting massive capital flows toward top-tier platforms in search of greater transparency and risk protection.

In the aftermath of the "1011" incident, major exchanges including Binance, Bitget, OKX, and Bybit almost simultaneously initiated response measures. As market confidence gradually recovered, "listing pace" became a key signal for exchanges to demonstrate trustworthiness and execution capability. Each platform conveyed its stability and screening standards through different strategies, yet all shared the same goal: rebuilding user trust through transparency, project quality, and risk control systems. During this period, listing activities shifted from "traffic competition" to a contest of risk management capabilities and ecosystem resilience, marking the beginning of a new era in the crypto space centered on "compliance, stability, and value selection."

This article analyzes the underlying causes, strategic differences, and potential impacts of these initiatives, aiming to reconstruct the framework of exchange-level competition behind the scenes and provide key indicators for future observation.

Overview of Major Exchanges' Performance

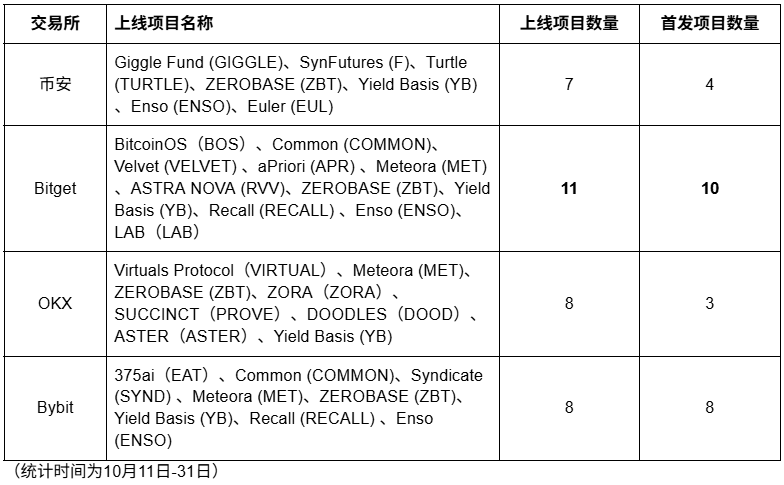

Data shows that from October 11 to October 31, 2025, the four major exchanges collectively launched over 30 projects—an annual high. This reflects not only the speed at which exchanges regained confidence but also reveals their divergent strategic directions.

Below is a summary of overall data:

Notably, Bitget stood out by launching 11 projects, including 10 initial listings, with an average initial market cap of $280.6 million—performing the strongest among peers. Binance had relatively few initial listings, but its projects were predominantly tied to the BSC ecosystem, reflecting a focused strategy. OKX selected mostly high-FDV projects such as ZORA and SUCCINCT, reinforcing its positioning as a "hub for premium projects." Bybit pursued a strategy of maximizing initial listing volume to capture market attention, though project valuations showed significant volatility.

The listing landscape during this phase essentially reflects an accelerating divergence in exchange positioning: Binance maintains its ecosystem moat; Bitget emphasizes launch quality and speed; OKX focuses on stability and brand trust; Bybit chases traffic and short-term effects.

Therefore, investors now need more than just "finding projects"—they must decide "on which platform to find the right projects."

Binance: Stability with Evolution and Ecosystem Development

Binance maintained its consistent, steady rhythm. Between October 11 and 31, it launched seven projects, including four initial listings, with an average initial market cap of $267.3 million.

Binance’s listing logic differs significantly from other exchanges: it prioritizes projects closely linked to the BSC ecosystem. For example, Giggle Fund (GIGGLE) and SynFutures (F) are tightly integrated with its on-chain ecosystem, aiming to strengthen its own ecosystem moat and reinforce the long-term value system being built around the BSC chain.

While Binance's performance in October was not spectacular, it was stable and precise—representing the typical behavior of a mature exchange: preferring fewer listings to ensure every project aligns with its ecosystem goals. For investors, choosing Binance initial listings may not yield returns as rapidly as those on Bitget, but offers higher certainty, lower volatility risk, and stable long-term value.

Bitget: Building a High-Quality Launch Moat

If the October listing race was a battle for supremacy, Bitget was undoubtedly the star of the month. From October 11 to 31, Bitget launched 11 projects, 10 of which were initial listings, spanning multiple sectors—including DeFi, AI, and GameFi.

Moreover, Bitget’s listing quality and market cap tier far exceeded industry peers. Its average initial FDV reached $280.6 million, with stable distribution: five projects above $200 million in market cap, all others exceeding $80 million, and no so-called "air coins" or low-value tokens. Thus, Bitget led not only in quantity but also demonstrated strong quality.

Bitget’s strategy is clear:

-

Prioritize high-potential projects to capture first-wave market traffic;

-

Utilize the Bitget Onchain Challenge mechanism to offer secondary listing pathways for quality projects;

-

List 100% spot pairs that later become available on Binance Perp, positioning itself as a "launchpad for Binance Perp."

For investors, this strategy implies stronger price discovery and a higher safety margin. Once a project launches on Bitget, it has typically passed both market and risk control validation. This is why, starting in late October, Bitget effectively became the "incubator for next-generation high-quality projects."

OKX: Focusing on Ecosystem Completeness

OKX launched eight projects, only three of which were initial listings. While lagging in numbers, OKX’s selections were characterized by high FDV and high recognition, such as ZORA, SUCCINCT, and Virtuals Protocol. This highlights OKX’s emphasis on maintaining brand quality and ecosystem integrity. For instance, SUCCINCT (PROVE) relates to Layer 2, while DOODLES and ZORA belong to the NFT space—aligning with OKX’s recent expansion strategy into the broader Web3 ecosystem.

OKX is attempting to build unique competitiveness through an ecosystem-driven approach.

Bybit: Pursuing Diversity and Short-Term Volatility

Bybit launched eight projects, all initial listings. However, data reveals extreme valuation disparities among them—the highest, Yield Basis (YB), had an FDV of $573 million, while the lowest, 375ai (EAT), was only $36 million, a nearly 16-fold difference. This wide gap indicates Bybit places greater emphasis on diversity and explosive potential rather than stability.

Bybit’s strategy shares similarities with Bitget’s: using numerous initial listings to attract short-term capital and high-risk-tolerance investors—a "traffic-driven listing logic." However, due to the large volatility of small-cap tokens among Bybit’s listings, investors should exercise caution.

Therefore, for average investors, Bybit suits a "short-term speculative" strategy—quickly identifying trends, participating in short-term rallies, and strictly managing take-profit and stop-loss levels.

Three Key Metrics Investors Should Monitor

In today’s crypto landscape, relying solely on "rumors" or "hype chasing" is no longer sufficient to evaluate project quality. Understanding the listing logic behind exchanges and analyzing project data have become essential for reducing risk and increasing returns. The following three metrics are the most critical investment references post-2025:

-

FDV: Fully Diluted Valuation represents a project’s total valuation if all tokens were fully circulating. An excessively high FDV suggests limited short-term growth potential, while an overly low one may indicate lack of market trust. It is recommended to prioritize mid-sized projects with FDVs between $100M and $400M, offering the best balance of risk and potential.

-

Balancing Listing Volume and Quality: Frequent listings often signal an exchange in expansion mode, but project quality remains crucial. Pay attention to the "listing density-to-quality ratio"—exchanges with high listing frequency but consistently low market caps warrant caution.

-

Follow-up Listings and Ecosystem Support: Non-initial listings often reflect an exchange’s ecosystem maturity. For example, OKX and Binance enhance user experience by completing ecosystem chains (NFT, DeFi, AI, etc.). Prioritize exchanges that maintain steady ecosystem expansion and exhibit synergy with other leading platforms.

In summary, investors should replace "emotion-driven FOMO" with "data-driven rational decision-making." Only by understanding exchange strategies and listing standards can one find stable return anchors amid market volatility.

Data Trend Forecast: Three Ongoing Directions Expected in Q4

Based on October’s listing data and market feedback, the exchange landscape in Q4 is expected to continue along three key trends:

-

Binance may strengthen its ecosystem-focused listing strategy: With rising activity on the BSC chain, Binance is likely to favor more BSC-linked projects, such as GameFi and AI-integrated assets. Its strategy may shift from "defensive recovery" to "ecosystem expansion."

-

Bitget’s dominance in initial listings will likely grow stronger: The on-chain Bitget Onchain Challenge mechanism has attracted numerous high-quality projects seeking listing eligibility. Bitget is expected to maintain a pace of 1–2 initial listings per week in November, further solidifying its position as the "king of launches."

-

Bybit and OKX will compete in the non-initial listing space: Bybit may begin adding select high-FDV projects to boost platform credibility, while OKX might moderately accelerate its initial listing pace to regain public attention. This cross-strategy competition will inject greater dynamism into the market in November.

Overall outlook: Q4 2025 will be a period of "parallel initial listings and ecosystem catch-up, with trust and ecosystem development advancing together." Exchange listing strategies are becoming increasingly rational and systematic, and short-term speculation will gradually give way to structural investment opportunities.

Opportunity Amid Crisis: Rebuilding Trust and Order Through Volatility

The sharp decline following the "1011" incident plunged the market into despair, with many retail investors losing confidence amid repeated violent swings. Yet, it is precisely this crisis-induced reflection and adjustment that opens new opportunities. Exchanges are gradually shifting from "speed competition" to "quality and structural competition," driving the market toward greater rationality and balance, and offering more choices for investors with varying risk appetites.

The market recovery after the "1011" incident marks a critical phase of trust reconstruction. Despite the sell-offs shaking investor confidence, the market did not collapse entirely—instead, it opened a window for rebirth. Investors who understand exchange listing strategies and align them with their own risk profiles still stand to gain stable returns from future structural market movements.

However, this responsibility does not rest solely on exchanges. Market recovery requires joint efforts from both platforms and retail users. Exchanges must enhance compliance and risk controls to provide safer environments, while retail investors’ rationality and patience are equally vital. Only through firm confidence and collective progress can the crypto space emerge from its downturn and embrace a more robust future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News