2025 Cryptocurrency Regulation Revelation

TechFlow Selected TechFlow Selected

2025 Cryptocurrency Regulation Revelation

From regulatory crackdowns to systematic integration of cryptocurrency, America's era of large-scale consolidation has officially begun.

Author: Tristero Research

Translation: Saoirse, Foresight News

In 2025, U.S. cryptocurrency policy underwent a major turning point. For years prior, the industry had operated under a regime of "regulation by enforcement"—replacing clear rules with lawsuits, applying outdated legal precedents to emerging technologies, and causing markets to swing violently based on news headlines. Compliance became a guessing game, and talent fled to Europe and Asia, where regulations at least existed in written form.

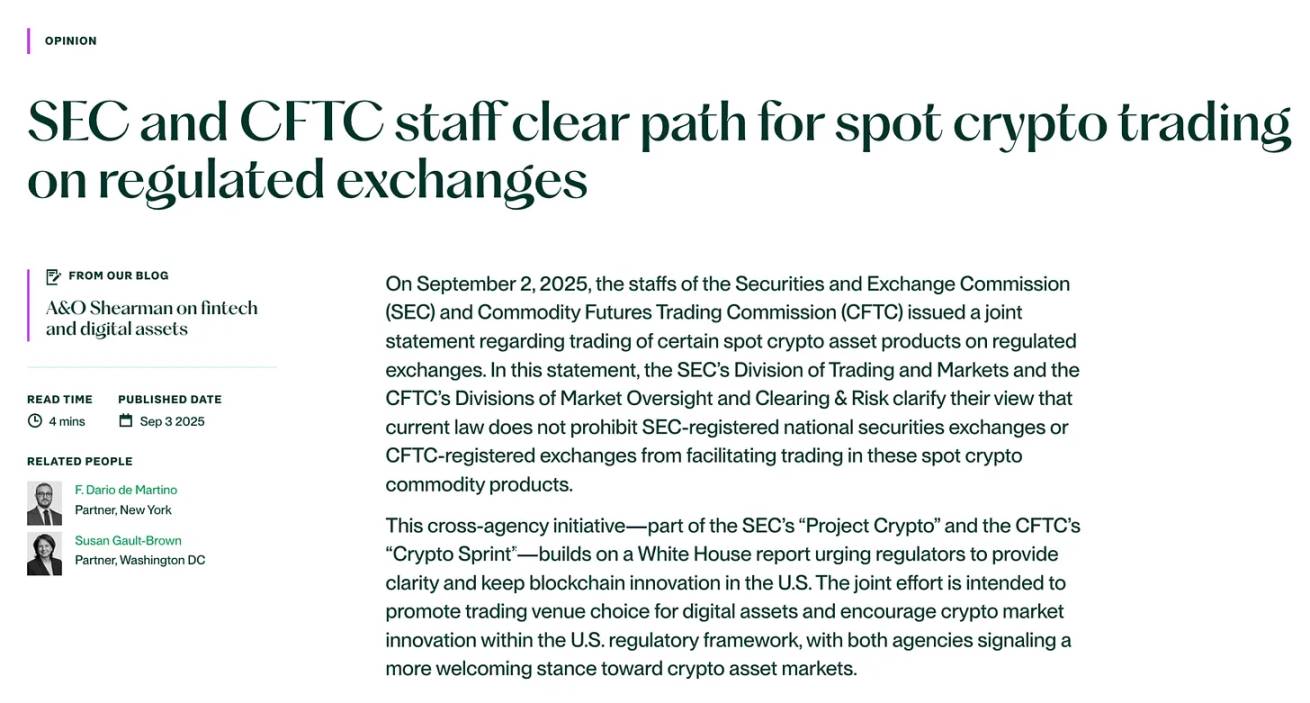

This year, the situation finally changed. In January, SAB 121, which previously blocked banks from offering crypto custody services, was repealed. In June, the U.S. Congress passed the GENIUS Act, federally recognizing stablecoins for the first time and anchoring their value to the U.S. dollar. On September 2, the U.S. SEC and the Commodity Futures Trading Commission (CFTC) ended years of stalemate by issuing a joint statement inviting Nasdaq, the Chicago Mercantile Exchange (CME), and other institutions to list spot Bitcoin and Ethereum products under the same standards applied to stocks and futures.

Now, there is finally a narrow but real pathway for launching crypto projects, enabling bank custody operations, and allowing institutional investment—without fear that the rules will suddenly shift in court. The signal is clear: the United States wants to incorporate cryptocurrency into its financial system and intends to set global standards for how it operates.

The Enforcement Era (2021 – January 2025)

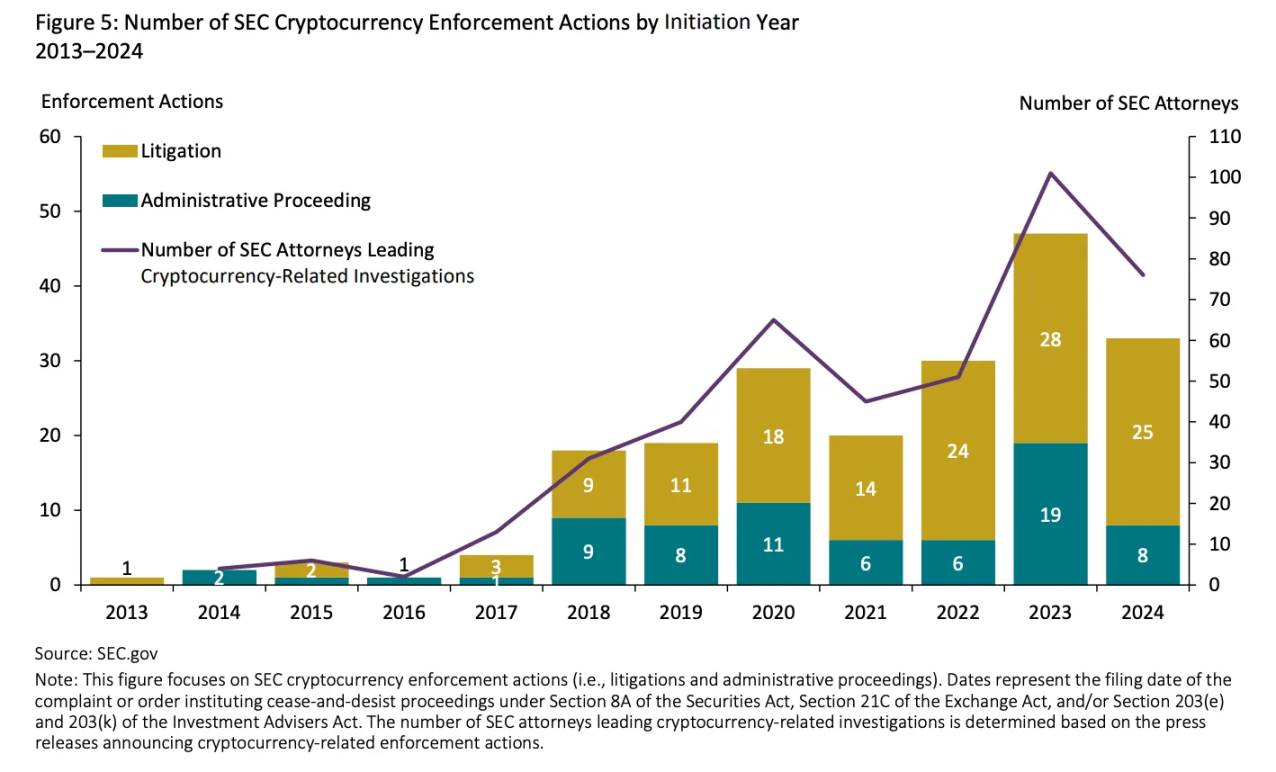

For most of the past decade, the U.S. cryptocurrency industry has been shrouded in legal uncertainty. During Gary Gensler’s tenure as SEC Chair, regulators relied on a 79-year-old precedent—the Howey Test—to define the entire sector. This 1946 Supreme Court ruling determined that if buyers of Florida citrus groves expected profits from the efforts of others, then the sale constituted an “investment contract.” A logic that made sense in the mid-20th century was forcibly applied to tokens, blockchains, and decentralized networks. The SEC argued that whenever people bought tokens expecting developers to increase their value, those tokens qualified as securities. Under this standard, nearly every asset in crypto could be deemed a security.

Critics pointed out that this wasn’t “regulation” at all, but rather a political and legal tactic aimed at controlling the industry without providing a path to compliance. The result was years of courtroom battles instead of a clear regulatory framework.

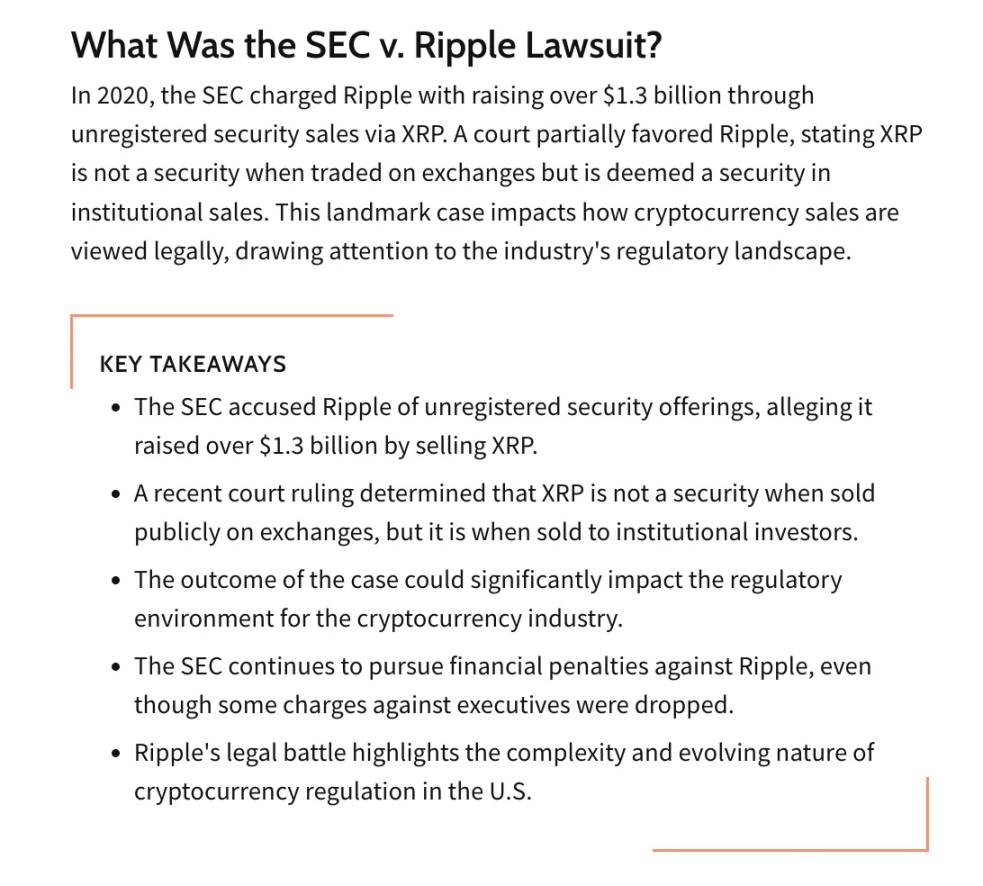

Ripple Case: One Token, Two Legal Identities

In December 2020, the SEC sued Ripple Labs, alleging it raised $1.3 billion through unregistered securities offerings of its XRP token.

After years of litigation, Judge Analisa Torres issued a partial summary judgment in July 2023: XRP sold publicly on exchanges did not constitute a security (because retail buyers didn't rely on Ripple’s efforts to profit), but when sold directly to institutions, with contracts and marketing linking the token’s value to Ripple’s work, it was deemed a security. This created a bizarre precedent: the same asset could legally be both a security and not a security depending on context. Exchanges and issuers were left confused, unable to determine which actions might trigger SEC liability.

Coinbase Case: Approved First, Sued Later

The SEC’s case against Coinbase highlighted regulatory contradictions. In 2021, Coinbase completed its IPO using an S-1 registration statement formally approved by the SEC. Yet two years later, in June 2023, the SEC sued Coinbase, accusing it of operating as an unregistered exchange, broker, and clearing agency.

Coinbase pushed back, noting that the SEC had reviewed and approved its disclosures during its IPO. It even invoked the doctrine of equitable estoppel, arguing that the government’s silence during its listing amounted to “implied approval,” making the later lawsuit an act of “affirmative misconduct.” While legally challenging, this defense perfectly captured industry frustration: no matter how compliant companies tried to be, the rules shifted afterward, as if the system were designed for failure.

The Cost of Uncertainty

The market didn’t wait for final rulings. Academic event studies show that when the SEC labeled an asset a security, its price plummeted—down 5.2% within three days and over 17% within a month.

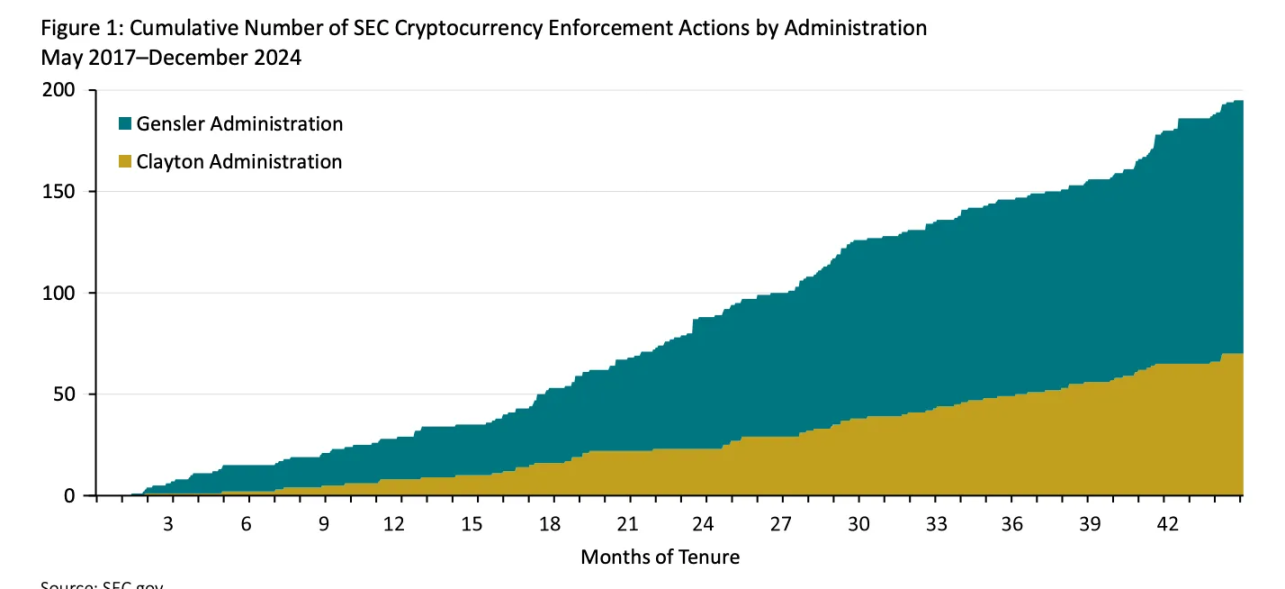

Traders refer to this as the “SEC effect”—sell-offs driven not by fundamentals, but by regulatory news. Talent and capital flowed to Europe (e.g., the EU’s MiCA regulation) and Asia (e.g., Singapore’s licensing regime), where rules at least clarified what was allowed. Meanwhile, the SEC in Washington expanded its enforcement team: under Gensler, each crypto case averaged 8.3 lawyers, up from 5.9 under his predecessor Jay Clayton, underscoring the intensity of enforcement-driven regulation.

In early 2025, this strategy finally reached its end. The new administration dropped pending lawsuits against firms like Coinbase, marking the close of the enforcement era. Though leaving behind legacies of uncertainty, innovation stagnation, and capital flight, it paved the way for a major regulatory shift: agencies would no longer fight the industry in court but instead build a systemic framework for it.

The 2025 Spring Agenda: Building a New Regulatory Framework

In 2025, U.S. cryptocurrency regulation made a complete turnaround. The White House turned its campaign promise of becoming the “global crypto capital” into policy, instructing regulators to stop treating crypto as a “problem to punish” and instead treat it as an “industry to regulate.” A working group was formed with a clear mission: use existing regulatory authority to clarify rules, attract talent, and secure America’s leadership in blockchain innovation.

The SEC and CFTC responded with a dual-track approach—Project Crypto and Crypto Sprint—marking the first coordinated effort to establish a long-term regulatory architecture for digital assets.

Redrawing the Regulatory Map: A Paradigm Shift

The biggest change was philosophical. In a landmark speech, SEC Chair Paul Atkins declared: “Most crypto assets are not securities.”

This overturned the previous assumption—that nearly every token automatically met the Howey Test’s definition of a security—and adopted a more nuanced classification approach. Project Crypto launched shortly after, aiming to modernize securities law through rulemaking and guidance, creating space for assets that don’t fit 20th-century categories.

Safe Harbor: Unlocking Innovation

For years, new network projects faced a catch-22—any token distribution risked being labeled a “security offering.” The new agenda introduced exemptions and safe harbor rules, allowing projects to launch under regulatory oversight while fulfilling disclosure obligations and gradually achieving “full decentralization.” This recognized the evolutionary nature of crypto projects: tokens need not remain securities forever.

Spot Access: Opening the Door to Mainstream Markets

On September 2, 2025, the joint statement from the SEC and CFTC sent shockwaves through the market, clarifying that existing laws do not prohibit national exchanges like Nasdaq, NYSE, or CME from listing spot Bitcoin and Ethereum products.

With regulatory safeguards around surveillance, secure custody, and transparent reporting, digital assets were officially allowed into the same trading venues as traditional securities and commodities.

Unlocking Custody: The Key Step for Institutional Entry

For years, SAB 121 blocked institutional participation—the rule required banks to treat customer crypto as their own liabilities, making capital requirements so high it became a “poison pill.” One of the new framework’s first moves was repealing SAB 121, followed by updated custody guidelines allowing banks and custodians to safely hold digital assets. This opened the door for traditional finance, finally meeting investors’ demand for “institution-grade secure custody.”

The Rise of the “Super App”: An Integrated Services Framework

Atkins also tasked his team with designing a framework for “integrated intermediaries,” envisioning a single licensed entity offering trading, lending, staking, and custody for both securities and non-securities. Instead of navigating today’s fragmented and overlapping licensing landscape, U.S. firms could offer consolidated digital financial services on one platform, similar to popular models in Asia.

A Coherent Strategy: Aligning Crypto with Wall Street

Together, these measures represent a coordinated push to integrate cryptocurrency into the U.S. financial system. The previous enforcement era drove talent and trillions in market value overseas; the new agenda combines nationalist rhetoric like “American leadership” and the “golden age of crypto” with mechanisms favoring large, regulated institutions. Allowing spot ETPs, bank custody, and licensed super apps points in one direction: aligning crypto with Wall Street’s infrastructure.

This strategy brings stability and investor protection, but narrows ecosystem diversity. For most, the future of U.S. crypto will depend on familiar financial institutions—not peer-to-peer protocols. Decentralization isn’t dead, but it’s been pushed to the margins of a system designed for rapid integration into traditional finance.

A New World Order: Global Benchmark for Crypto Regulation

The U.S. regulatory shift is not isolated. Globally, other power centers are shaping crypto rules according to their own logics, forming three core models: Europe’s “rulebook model,” the U.S. and U.K.’s “integration model,” and Asia’s “sandbox model.”

Europe: The Rulebook Model

The EU’s Markets in Crypto-Assets (MiCA) regulation took full effect at the end of 2024, providing a unified legal framework across 27 member states. It strictly classifies tokens (e.g., asset-referenced, e-money) and establishes a “single license” regime—once approved, firms can operate across the EU. While MiCA offers legal certainty, it lacks flexibility and currently excludes NFTs and DeFi from its scope.

United Kingdom: Deep Integration Model

The U.K. expanded the scope of its Financial Services and Markets Act (FSMA) to include crypto, even defining custody and staking as “regulated activities.” This “beyond-MiCA” approach is both detailed and comprehensive, requiring all foreign firms serving U.K. retail customers to comply with local rules.

Asia: Sandbox Hub Model

While the U.S. was bogged down in litigation, Singapore and Hong Kong pursued pragmatic paths:

-

Singapore established a tiered licensing system under the Payment Services Act, implemented strict anti-money laundering / counter-terrorism financing (AML/CFT) rules, and set detailed standards for stablecoins;

-

Hong Kong reopened its crypto market via exchange licensing and recently expanded retail access to major tokens.

Both aim clearly to rapidly attract business and iteratively update rules to become global crypto hubs.

China: The Special Exception

China still bans all private crypto transactions, mining, and exchange operations, focusing instead on developing its digital yuan. However, U.S. moves in stablecoins—especially the GENIUS Act—are forcing Beijing to reconsider: USDT is already widely used domestically to circumvent controls. Policymakers are now weighing whether to allow RMB-backed stablecoins, with Hong Kong likely to serve as the pilot zone.

These models outline a fragmented global crypto landscape: Europe seeks control via uniform rules, Asia prioritizes flexibility and competitiveness, while the U.S. integrates crypto into Wall Street, betting that its capital market depth will make its model the global default.

Market Reaction

Markets are forward-looking. Well before the SEC and CFTC issued their joint statement, investor behavior signaled expectations of a policy shift: every regulatory move in 2025—repealing SAB 121 in January, dropping the Coinbase suit in March, Senate passage of the GENIUS Act in June—gave markets momentum. When Chair Atkins delivered his “Project Crypto” speech in September, the financial world understood: the enforcement era was officially over.

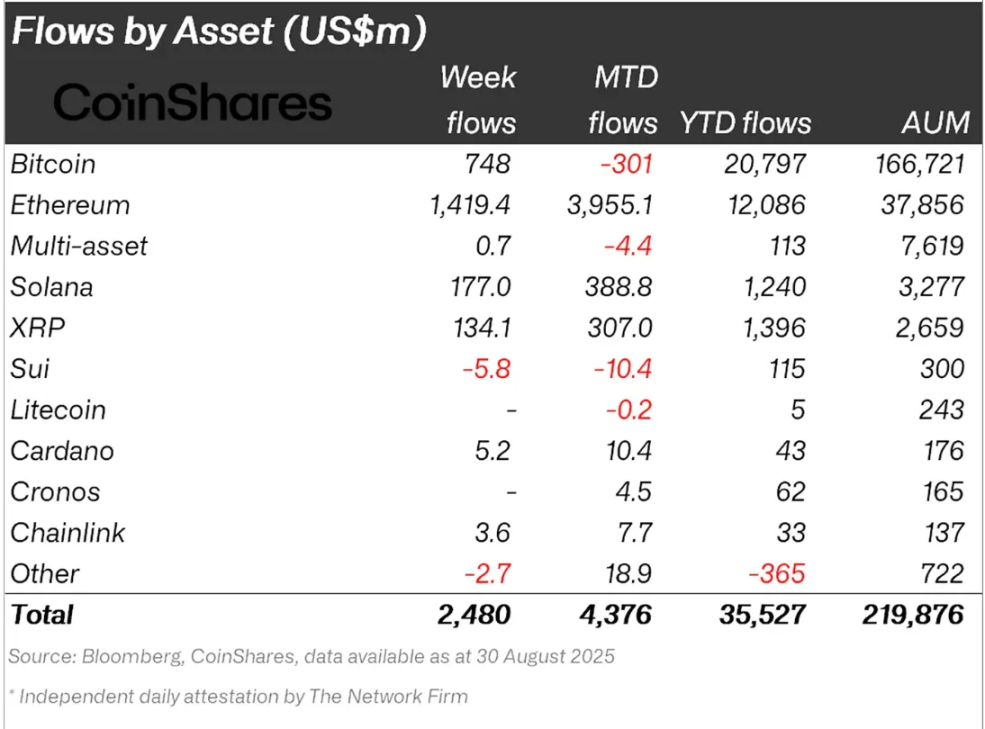

Institutional Inflows: ETPs as Key Indicators

The clearest evidence comes from exchange-traded products (ETPs): from January through September 2025, U.S. crypto ETPs saw net inflows exceeding $35 billion, with Ethereum funds leading the way. In August alone, inflows reached $4.9 billion, nearly $4 billion of which went to Ethereum-related products.

The shift from Bitcoin to Ethereum reflects growing institutional confidence—once trust in the regulatory framework is secured, institutions begin allocating to riskier assets along the curve.

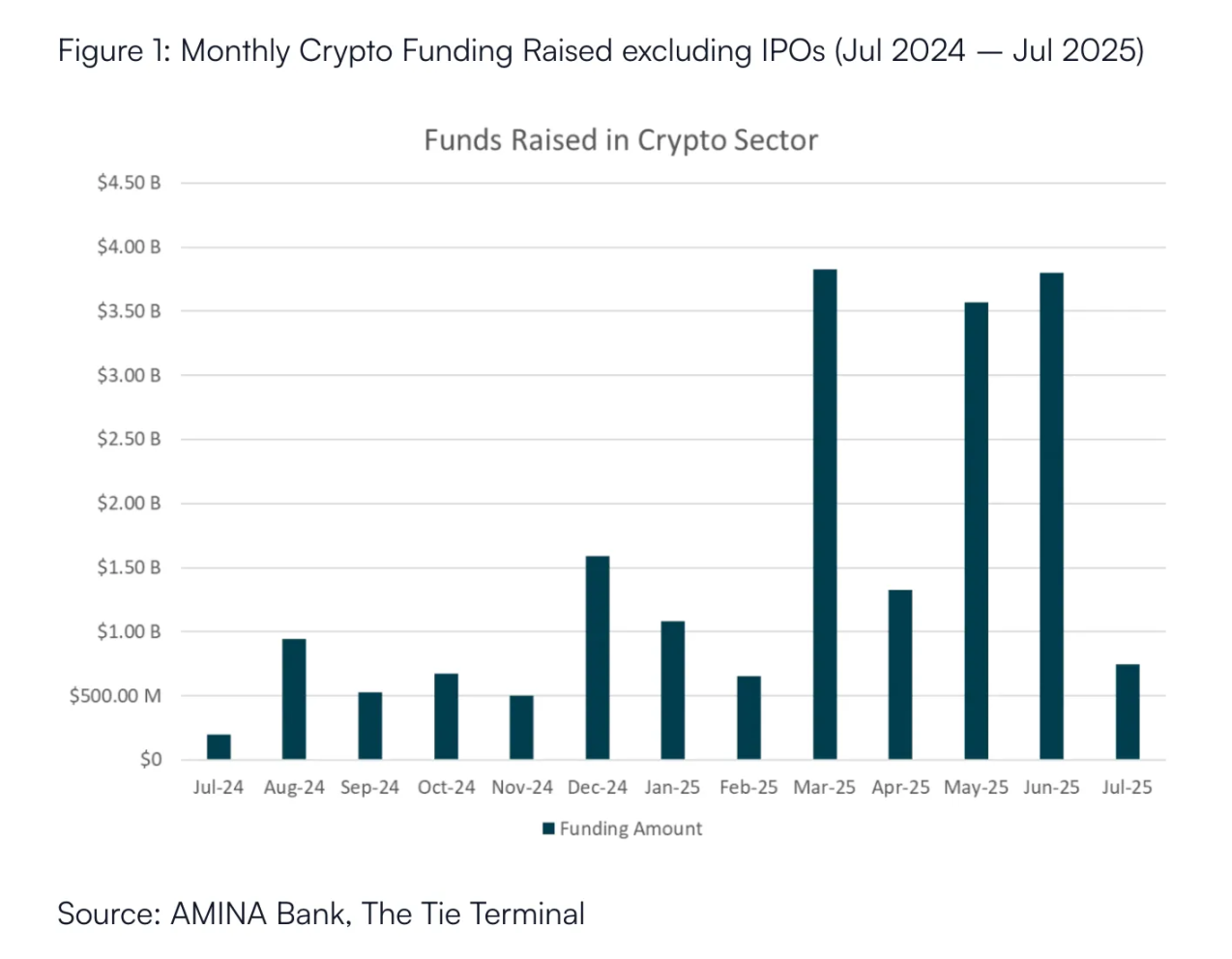

VC Revival: From Speculation to Compliance

In Q2 2025, crypto startups raised over $10 billion—double the amount from the same period the prior year and the strongest quarter since the 2021 bull run.

Unlike earlier patterns of scattered bets on trending concepts, funding is now more disciplined: nearly half went to exchanges and compliance infrastructure, showing venture capital is following regulatory clarity, not hype cycles.

Retail Sentiment: Optimism Returns to 2021 Levels

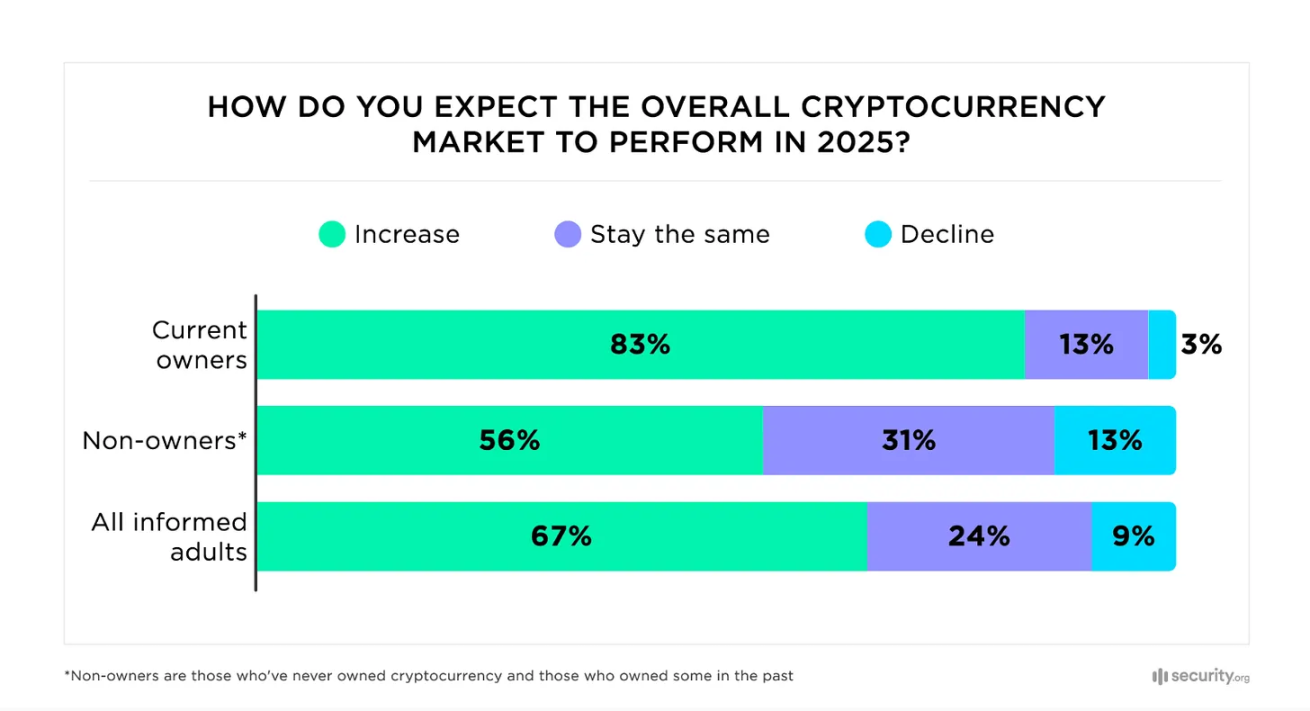

Early summer surveys showed U.S. investor optimism about crypto reaching its highest level since 2021: over 60% of Americans familiar with crypto expect prices to rise during the new president’s term; two-thirds of current holders plan to buy more.

In short, the market had already “read the signals” well before the September declaration. Each policy move—scrapping strict accounting rules, dropping lawsuits, passing stablecoin legislation—pushed more capital from “wait-and-see” to “all-in.” The SEC and CFTC joint statement merely formalized expectations already priced in: the U.S. is back in the crypto race, and capital is flowing back.

Winners, Losers, and New Vulnerabilities

Every major rule change creates winners, losers, and hidden risks. The U.S. regulatory shift is no exception—it not only opens doors for innovation but also redraws the competitive landscape by favoring some players and marginalizing others.

Winners: The Compliant and Traditional Finance Giants

-

Compliant Exchanges: Platforms like Coinbase and Kraken, which spent years building compliance systems, have become the “default gateways” for U.S. capital. After the SEC dropped its case against Coinbase in early 2025, it became the de facto domestic exchange.

-

Wall Street Institutions: With SAB 121 repealed and spot products approved, banks and asset managers can now enter. Core financial services—custody, ETFs, in-kind subscriptions—are now live, allowing giants like BlackRock and Fidelity to easily integrate crypto into existing distribution channels and quickly capture market share.

-

Compliant Stablecoin Issuers: Stablecoins that meet the GENIUS Act’s strict requirements (e.g., Circle’s USDC) turn regulatory compliance from a liability into a competitive advantage. Market reactions were immediate: Coinbase shares rose on expectations of USDC growth, while Visa and Mastercard fell amid concerns that stablecoins could disrupt credit card settlement.

-

Tokenized RWA Platforms: Clear securities definitions and compliant issuance safe harbors provide a clear path for tokenizing real-world assets like real estate, private equity, and bonds, accelerating growth in the RWA sector.

Losers: Arbitrage Players and Non-Mainstream Assets

-

Offshore Exchanges: Offshore platforms relying on “regulatory arbitrage” face shrinking space. OKX’s guilty plea and fine in February 2025 highlighted the risks of serving U.S. users—now, the U.S. market is “riskier than rewarding.”

-

Algorithmic Stablecoins: The dream of “collateral-free money” is dead. Unable to meet the “1:1 liquid reserve backing” requirement, algorithmic stablecoins are effectively banned in the U.S.

-

Privacy Coins: Anonymous assets like Monero and Zcash clash directly with AML/KYC rules and are being delisted from regulated platforms, becoming the “junk bonds of crypto”—trading only at the fringes, with high risk.

DeFi at a Crossroads

DeFi faces two paths:

-

Regulated DeFi (RegDeFi): Integrate KYC/AML into smart contracts or frontends to enable institutional participation;

-

“Wild West”: Maintain permissionless design but remain isolated from mainstream liquidity.

Regulators reject the notion that “fully decentralized means unregulatable.” As the Bank for International Settlements (BIS) notes, the “illusion of decentralization”—nearly all DeFi projects have identifiable pressure points (e.g., governance token holders, core developers, web interfaces) that can be targeted.

This regulatory pressure also enables regulatory capture: well-funded giants like Coinbase, Wall Street banks, and asset managers are best positioned to influence rulemaking. The risk is that regulation becomes a barrier to entry, locking out smaller innovators. For example, Coinbase’s lobbying on stablecoin legislation—which may disadvantage Tether—already shows signs of this “big-player dominance.”

New Risks: Systemic Interconnectedness

A deeper risk lies in systemic interconnectedness. While the old regulatory system was messy, it had a firewall: when FTX collapsed, fallout remained largely confined to crypto. The new framework removes that wall—banks now offer custody, stablecoins enter payment rails, and ETFs directly link crypto to retirement portfolios.

This means crypto risks are no longer isolated: failures in bank custody units, systemic ETF breakdowns, or sudden collapses of compliant stablecoins could ripple into traditional markets. Ironically, rules meant to “make crypto safer” tie it more tightly to traditional finance—though the house is rebuilt, its foundation is now fused with the old system, so any tremor shakes everything.

Outlook: Three Possible Paths Beyond 2026

The 2025 regulatory shift has set the stage, but the story continues. As the dust settles, three paths are most likely:

Grand Integration (Most Likely)

The U.S. successfully embeds crypto into its financial system. By 2026, token issuance safe harbors are implemented, and the SEC and CFTC finalize registration rules for digital asset intermediaries. Federally compliant USD-backed stablecoins under the GENIUS Act become mainstream payment rails, integrated into fintech and traditional banking. Spot Bitcoin and Ethereum ETPs become standard portfolio holdings, with banks and asset managers offering large-scale custody and investment products. Markets consolidate around a few major compliant exchanges, while DeFi evolves into an “institutional-grade RegDeFi” layer by embedding KYC/AML. Leveraging the depth of U.S. capital markets, this framework becomes the global default, with other jurisdictions gradually aligning to maintain market access.

Fragmented World (Moderately Likely)

The U.S. may stall due to internal obstacles: political gridlock, legal challenges, or jurisdictional disputes between the SEC and CFTC could leave the regulatory framework fragmented and unenforceable. In that case, the EU, with its unified MiCA rules, could become the central hub for large-scale compliant crypto businesses, while Singapore and Hong Kong continue attracting high-growth projects via flexible sandbox regimes. The world ends up with three separate regulatory tracks, highly fragmented markets, and low interoperability, forcing firms to split operations regionally and adapt to divergent rules.

Decentralization Revival (Low Probability)

Excessive centralization may spark backlash: if regulation heavily favors traditional financial giants and recreates Wall Street’s inefficiencies—high fees, limited choice—developers and users may exit the mainstream system en masse. Breakthroughs in zero-knowledge proofs, decentralized identity, and cross-chain tech could fuel a censorship-resistant parallel economy—not replacing the compliant system, but running alongside it, offering users sovereignty and resilience beyond any single nation’s control, becoming a new vessel for crypto’s original decentralized ideals.

Conclusion: The Grand Integration Era Has Begun

The significance of this regulatory shift depends on perspective: for the public, it’s about safety and stability; for investors, legitimacy and market access; for industry builders, a long-awaited roadmap; for policymakers, a geopolitical strategy to reclaim U.S. leadership in fintech.

These views converge on one truth: the grand integration of cryptocurrency into the core of the U.S. financial system has officially begun. The risks behind this integration—systemic interdependence, tensions between decentralization and traditional finance, and the potential for a decentralized revival—will shape the next chapter of the crypto industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News