How can crypto mining companies use small arrangements to generate big returns?

TechFlow Selected TechFlow Selected

How can crypto mining companies use small arrangements to generate big returns?

Tax arrangements are not a one-size-fits-all formula, but need to be customized according to the specific circumstances of the enterprise.

By: FinTax

As the wave of blockchain technology surges forward, cryptocurrency mining companies have become a global investment hotspot. In this digital gold rush, the United States is rapidly emerging as the dominant global hub for crypto mining, leveraging its unique advantages—favorable regulatory environment, low energy costs, and geopolitical-driven onshoring trends. According to data from the White House Office of Science and Technology Policy, by 2022 the U.S. accounted for over 37.84% of global Bitcoin mining hashrate, ranking first worldwide, while attracting dozens of listed companies to establish operations. The industry landscape of crypto mining is expanding at an unprecedented pace.

However, beneath this prosperous picture, mining firms operating in the U.S. that mine and directly sell cryptocurrency face a double tax burden. Cryptocurrency obtained through mining must be reported as income at its fair market value upon receipt; then, when sold in the future, any appreciation relative to the acquisition value is subject to additional capital gains taxation. This layered tax burden objectively imposes significant tax pressure on crypto mining enterprises. Nevertheless, through proper tax planning, mining companies can legally and reasonably reduce substantial tax liabilities, transforming what would otherwise be a tax burden into a competitive advantage.

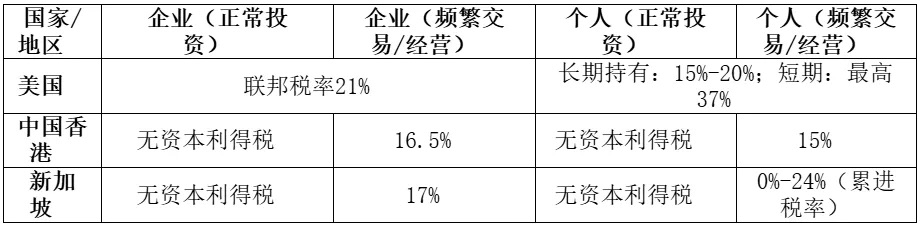

1. U.S., Singapore, Hong Kong: A Comparison of Capital Gains Tax Systems

Tax policies on cryptocurrency vary across jurisdictions. The U.S. treats cryptocurrency as property, and gains from selling or exchanging it are subject to capital gains tax. For corporations (defaulting to C-corporations unless otherwise specified), asset appreciation is taxed at a flat federal rate of 21%. Individuals face different rates depending on holding periods: short-term holdings (less than one year) are taxed at ordinary income rates up to 37%, while long-term holdings (over one year) benefit from preferential rates ranging from 15% to 20%. Whether selling occasionally for liquidity, trading frequently, or conducting business operations, U.S. tax law applies uniformly—any taxable transaction generating profit must be reported and taxed accordingly. This "tax-on-every-gain" design places considerable tax pressure on domestic crypto investors and miners.

In contrast, Singapore and Hong Kong offer much more favorable capital gains tax regimes. Both jurisdictions currently do not impose capital gains tax on profits earned by individuals or corporations from non-regular investments in cryptocurrency. This means that as long as transactions are classified as capital investment returns, investors are not required to pay taxes on asset appreciation, thereby achieving true zero-tax benefits for long-term holding. Of course, if a taxpayer’s activities are deemed frequent trading or conducted as a business operation, profits will be subject to corporate or personal income tax. In Singapore, such profits are taxed at the corporate income tax rate of approximately 17%, while individuals face progressive rates from 0% to 24%; in Hong Kong, regular crypto trading profits are taxed at a corporate rate of 16.5% or personal rate of 15%. Although active traders still incur tax liability, compared to the U.S. maximum individual rate of 37% or federal corporate rate of 21%, Hong Kong and Singapore clearly offer stronger tax competitiveness.

2. Routing Through Singapore: An Option for U.S. Mining Companies

Leveraging differences in tax systems across jurisdictions, a tailored tax strategy has emerged for U.S.-based crypto mining firms. Take, for example, a Bitcoin mining company operating in the U.S. It could establish a cross-border structure to legally alleviate tax pressure arising from cryptocurrency appreciation: the company sets up a subsidiary in Singapore, sells its daily mined Bitcoin to this subsidiary at fair market price, and then allows the subsidiary to resell the Bitcoin to global markets. Through this “domestic first, then external” transaction structure, the U.S. parent company only needs to pay corporate income tax on initial mining revenue, while the Singapore subsidiary's profits from Bitcoin appreciation may qualify for exemption from capital gains tax, provided certain conditions are met.

The tax-saving effect of this structure is evident. Since Singapore does not levy capital gains tax on profits from long-term holding and subsequent sale of crypto assets, the margin profit realized by the Singapore subsidiary from selling Bitcoin is nearly tax-free locally. In contrast, if the U.S. company directly held the Bitcoin until appreciation and sold it domestically, the gain would be subject to a federal long-term capital gains tax of up to 21%. By shifting the appreciation phase to a jurisdiction with no capital gains tax, mining firms can significantly reduce their overall tax burden, freeing up more capital for reinvestment or shareholder distributions, thereby unlocking greater profitability.

3. Risk Considerations: Multiple Factors in Tax Planning

It must be emphasized that all tax arrangements must operate within legal and reasonable frameworks. To achieve the intended tax outcomes described above, both transaction pricing and underlying business substance must be carefully structured to comply with local regulations. For instance, U.S. tax law imposes strict transfer pricing rules on asset transactions between related parties, requiring all such transactions to occur at arm’s length market prices. Failure to comply may result in severe tax audits and penalties. Meanwhile, the Singapore tax authority evaluates whether a subsidiary’s Bitcoin sales constitute capital gains or business income based on factors such as transaction frequency and intent. Only gains classified as investment returns qualify for tax exemption. Therefore, implementing such a cross-border structure requires professional tax advisory and compliance support to ensure the arrangement achieves tax efficiency without triggering regulatory risks.

4. Conclusion

The approach discussed here represents only a preliminary tax planning concept. In practice, numerous factors—including a mining firm’s business model, shareholder structure, state laws, and international tax treaties—will influence the design of an optimal solution. Tax planning is not a one-size-fits-all formula but must be customized to each enterprise’s specific circumstances. The FinTax consulting team offers end-to-end financial and tax solutions, helping businesses enhance compliance and financial efficiency, with extensive hands-on experience in complex cross-border tax matters, serving numerous Crypto-focused U.S.-listed companies and multinational enterprises. If you wish to further explore and implement a tailored tax strategy, please feel free to contact us.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News