New Vision: Stablecoins After Recognition and Granting of Legal Status

TechFlow Selected TechFlow Selected

New Vision: Stablecoins After Recognition and Granting of Legal Status

Without understanding regulation, one cannot truly understand innovation or envision the future.

By Sima Cong, AI Channel

This report does not involve valuation analysis and includes minimal token analysis. It focuses on clarifying investment logic rather than typical token economics or price trend analysis of tokens.

What Should We Envision?

Don't be numb or complacent—embrace the trend. We can envision the following:

-

l A new landscape for the crypto asset market;

-

l Integration of traditional finance with crypto;

-

l Innovative business models;

-

l Dividends brought by regulatory recognition;

-

l Expansion of use cases, leading to broader business and revenue models. For example, an app could instantly convert any stablecoin into another institution’s stablecoin with immediate settlement—an idea nearly unimaginable in traditional finance (provided KYC and AML requirements are met).

The driving force behind governments, regions, and commercial institutions worldwide: getting ahead of the curve.

As for mainland China, it can leverage Hong Kong's window for offshore RMB-backed stablecoins to go global.

However, one must pay special attention: without understanding regulation, one cannot truly understand innovation or envision the future. Only when we recognize the value of regulation can we fully appreciate the value of innovation. Regulation not only addresses current issues but also establishes stability for future norms—this stability and predictability being essential reference points for investment.

Underlying Logic in History: Regulatory Recognition and Legitimization Are Necessary Conditions for Industry Growth

Regulation itself is not an obstacle to innovation—it is a necessary condition for industry development.

There are countless examples. History shows that regulation is not a hindrance to innovation but a crucial catalyst for moving industries from niche experimentation to mainstream adoption, ultimately enabling prosperity and sustained innovation through regulatory support.

Fintech —— The UK’s Fintech Regulatory Sandbox as a Case Study

After the 2008 financial crisis, traditional banking systems came under scrutiny. New financial services such as P2P lending, digital payments, cryptocurrencies, and blockchain rapidly emerged amid regulatory gaps. Startups grew unchecked, leading to frequent risk incidents (e.g., Lending Club scandal, Mt. Gox exchange collapse). In response, the UK Financial Conduct Authority (FCA) launched the "Regulatory Sandbox," allowing startups to test new products or services in a controlled environment. As a result, the UK became one of the world’s leading Fintech hubs; London became Europe’s largest destination for Fintech investment; globally recognized companies like Revolut, Monzo, and TransferWise (now Wise) emerged; and countries around the world began adopting similar sandbox approaches, creating a global trend.

To this day, Hong Kong regulators continue to use the sandbox approach for stablecoin market entry.

In 2022, the USDT depeg triggered a stablecoin credibility crisis, raising doubts about whether USDT held sufficient dollar reserves. Indeed, USDT has flaws—the automated mechanism fails to grasp core financial principles, especially during liquidity crises. In 2023, the Silicon Valley Bank crisis caused USDC to plummet due to its large holdings at SVB. These events made more people realize that stablecoins are not inherently safe and must be brought under regulatory oversight.

A Concrete Scene from Recent Developments

Walmart and Amazon are exploring issuing their own stablecoins.

Ø Stablecoins could save merchants billions in fees and enable faster payment processing.

Ø Whether they proceed depends on the U.S. Congress’s ongoing discussion of the “Genius Act,” which aims to establish a regulatory framework for stablecoins.

Ø Imagine merchant-issued stablecoins becoming as common as coupons—beyond cost reduction and fast settlements, they could also serve as promotional tools for core businesses.

Shifting massive cash and card transactions outside the traditional financial system could save them billions in transaction fees.

Walmart, Amazon.com, and other multinational giants have recently been considering launching their own stablecoins in the United States.

Expedia Group and other major enterprises (such as airlines) have also discussed plans related to issuing stablecoins.

Currently, stablecoins are used to store cash or purchase other cryptocurrency tokens. They should maintain a 1:1 peg with the U.S. dollar or other fiat currencies and be backed by reserves such as cash or cash equivalents (like U.S. Treasury bonds).

The final decision for these retailers will depend on the proposed “Genius Act,” which would begin establishing a regulatory framework for stablecoins. The bill recently cleared another procedural hurdle but still needs approval from both the Senate and House of Representatives.

Stablecoins allow merchants to bypass traditional payment channels, saving them billions annually in fees—including those charged when customers use credit cards.

Traditional payment settlements may take days, slowing down how quickly merchants receive sales proceeds. Stablecoins promise much faster settlement, particularly appealing to businesses with overseas suppliers.

For years, merchants have tried to develop alternative payment methods beyond card payments to break free from the Visa-Mastercard-dominated system, though most attempts have failed to gain traction.

According to *The Wall Street Journal*, large banks are also considering forming their own stablecoin consortium.

In recent years, merchant industry groups have engaged with lawmakers to advocate for the passage of the Genius Act. Led by the “Merchant Payments Coalition,” these organizations argue that a regulatory framework for stablecoins would offer merchants a lower-cost alternative capable of competing directly with Visa and Mastercard.

From this, we clearly see a real narrative emerging: a piece of legislation called the Genius Act—that is, centralized regulatory recognition and legitimization.

What signal does this send?

A clear signal: digital finance is leaving behind its era of unregulated growth and entering a mature phase built on compliance.

This Is the Underlying Logic

As we’ve seen, Bitcoin’s two significant price surges breaking all-time highs were driven by centralized regulatory recognition and legitimization—one via spot Bitcoin ETF approval, the other through Donald Trump’s election and repeated promises of crypto-friendly policies.

The approval of spot ETFs provided a legitimacy foundation for continuous capital inflows. Similarly, Trump’s election paved the way for everything we now observe—including legislative proposals like the Genius Act. At its core, this marks a pivotal shift—from past non-recognition or even suppression toward active recognition and legitimization by centralized regulators.

The only remaining question:

In the face of this unstoppable trend, where lies the opportunity? What exactly is it?

The Trend Is Plainly Visible

Ant International: Accelerate Application for Hong Kong Stablecoin License

Hong Kong’s Stablecoin Ordinance will take effect on August 1, while Singapore’s Monetary Authority (MAS) released its stablecoin regulatory framework back in August 2023.

On June 12, 2025, Ant International responded that it is accelerating investments and expanding partnerships in global treasury management, aiming to deploy its innovations in AI, blockchain, and stablecoins into reliable, large-scale applications.

Ant International stated: “We welcome the Legislative Council’s passage of the Draft Stablecoin Bill, which will come into effect on August 1 after being signed by the Chief Executive and gazetted on May 30. Once the application channel opens, we will submit our application promptly and hope to contribute further to Hong Kong’s development as an international financial center.”

Ant Digital Technologies has already initiated the application process for a Hong Kong stablecoin license and has held multiple rounds of discussions with regulators. It is reported that Ant Digital has designated Hong Kong as its global headquarters this year and has already participated in regulatory sandbox trials there.

As a bridge connecting traditional finance and tokenized assets, stablecoins possess vast market potential. Their core value lies in expanding use cases and building compliance.

Hong Kong’s Stablecoin Bill (Draft) passed its third reading in the Legislative Council on May 21, 2025, was signed by the Chief Executive, gazetted on May 30, and officially implemented on August 1, 2025, with transition arrangements expected to be completed within the year and the first licenses issued accordingly.

On August 15, 2023, the Monetary Authority of Singapore (MAS) announced the final version of its stablecoin regulatory framework, becoming one of the first jurisdictions globally to bring stablecoins under local regulation. MAS allows issuance of stablecoins pegged to a single currency—either the Singapore dollar (SGD) or G10 currencies (including AUD, CAD, GBP, EUR, JPY, NZD, NOK, SEK, CHF, and USD). However, MAS prohibits stablecoins linked to baskets of currencies, digital assets, or algorithmically generated stablecoins.

On June 10, 2025, South Korean President Lee Jae-myung, just elected less than a week prior, swiftly fulfilled his campaign promise—allowing domestic enterprises to issue stablecoins. Media reports indicate that Lee’s Democratic Party proposed the Digital Asset Basic Act, stipulating that South Korean companies with equity exceeding 500 million KRW (~$368,000) may issue stablecoins.

Wealth Effects Are Real and Tangible

Circle, the world’s second-largest stablecoin issuer, listed on the NYSE with a first-day gain of 168.48%.

On June 5, local time, Circle, the issuer of the global second-largest stablecoin USDC, officially listed on the New York Stock Exchange under stock code CRCL at $31 per share. Circle triggered circuit breakers multiple times post-opening, closing up 168.48% at $83.23, with a total market cap of $18.4 billion. Trading volume reached 47.109 million shares, equivalent to approximately $3.941 billion.

As of March 31, 2025, Circle held USDC worth $59.976 billion. Circle’s business model is straightforward: it issues the dollar-pegged stablecoin USDC and invests user deposits ($59.976 billion) in short-term U.S. Treasuries and cash, earning risk-free returns. In 2024 alone, it earned about $1.6 billion in reserve income (interest), accounting for 99% of its total revenue.

In 2024, the total transaction volume of stablecoins reached $27.6 trillion, surpassing the combined annual transaction volume of Visa and Mastercard (~$25.5 trillion) for the first time. The global stablecoin market cap now stands at $248 billion, with Circle’s USDC capturing ~25% market share (market cap ~$60 billion), ranking second only to Tether’s USDT (~61% market share). Beyond USDC, Circle also issues and manages the euro-denominated stablecoin EURC (market cap ~$224 million) and actively expands into markets in the Middle East, Africa, and Latin America.

Founded in October 2013 in Boston, USA, Circle initially launched a payment product called Circle Pay. In 2018, Circle co-founded the Centre Consortium with Coinbase and launched the USDC stablecoin. In August 2023, the Centre Consortium disbanded, and Circle acquired full ownership from Coinbase, becoming the sole issuer and manager of USDC.

Liquidity Within the Imagination Is Immense

U.S. Treasury Secretary Bessent: The market cap of dollar-pegged stablecoins could reach $2 trillion or higher.

Bessent, who previously worked in hedge funds specializing in foreign exchange trading, said historical concerns over the dollar’s status have repeatedly surfaced—but new dynamics continually reinforce the dollar, ultimately dispelling such worries.

“This administration is committed to preserving and strengthening the dollar’s reserve currency status,” Bessent said during a hearing before the Senate Appropriations Committee. He emphasized a pending congressional bill requiring dollar-pegged stablecoins to be backed by high-quality assets such as Treasury bills.

Bessent noted estimates suggesting the stablecoin market cap could reach $2 trillion in the coming years. Other forecasts are more conservative—for instance, Citigroup analysts earlier this year projected their base case scenario to include over $1 trillion in additional U.S. Treasury purchases by stablecoins by 2030.

Ngan Kam-hung, Deputy CEO of the Hong Kong Monetary Authority (HKMA), said at the Caixin Summer Summit on June 13 that in five years, tokenized transactions in financial markets will rise significantly, and regulators need to proactively build tokenized clearing platforms—with stablecoins serving as a core clearing unit.

Returning to First Principles: Regulation and Its Top-Level Design Logic

Without understanding regulation, one cannot truly understand innovation or envision the future.

Global stablecoin regulation today exhibits accelerated standardization alongside regional differentiation. Major financial jurisdictions—including the U.S., Hong Kong, the EU, and Singapore—have密集 introduced or implemented stablecoin regulations over the past two years, marking a new phase in global digital asset regulation. The establishment of these frameworks not only reshapes compliance requirements for stablecoin issuance and operations but also directly impacts the structure of the crypto asset market.

Regulatory Logic and Objectives: The four regions differ in focus. The U.S., through the Genius Act, explicitly defines stablecoins as “payment instruments,” emphasizing the maintenance of the dollar’s leadership in the digital economy, positioning dollar-pegged stablecoins as global digital payment tools. Hong Kong aims to enhance its competitiveness as an international financial center, attracting institutional participation through market regulation and reserving space for future offshore RMB stablecoins. The EU’s MiCA framework prioritizes unified market rules, eliminating regulatory disparities among member states while emphasizing financial stability and consumer protection. Singapore focuses on value stability assurance, imposing high standards to ensure reliability and security of single-currency stablecoins.

Definition and Classification: There are notable differences across regions. Hong Kong uses the concept of “specified stablecoins,” focusing on those pegged to legal tender or officially designated units. The EU adopts a dual classification: electronic money tokens (EMT) and asset-referenced tokens (ART), each subject to different rules. Singapore limits its scope to single-currency stablecoins, excluding algorithmic or multi-currency basket stablecoins. The U.S. Genius Act uniformly defines “payment stablecoins” but explicitly excludes them from securities and commodities classifications.

Licensing System Design: Each region displays distinct characteristics. Hong Kong implements a unified licensing regime administered centrally by the HKMA, requiring a minimum paid-up capital of HK$25 million—significantly higher than elsewhere. The U.S. employs a federal-state dual-track system: federal oversight applies to large issuers (market cap > $10 billion), while smaller ones fall under state-level regulation. The EU relies on national authorization, requiring EMT issuers to be e-money institutions or credit institutions. Singapore does not implement a formal licensing system but creates effective entry barriers via stringent requirements.

Core Risk Controls: High consensus exists across regions. Hong Kong, the EU (for EMT), and Singapore all require 100% reserve backing and asset segregation. The U.S. mandates high-quality liquid assets but does not specify a ratio. On redemption rights: Hong Kong requires licensed entities to redeem at par under “reasonable conditions”; the EU mandates free face-value redemption for EMT; Singapore requires redemption within five business days; the U.S. Genius Act requires face-value redemption but does not define timing.

Extraterritorial Reach: Hong Kong and the EU exhibit strong extraterritorial effects. Hong Kong regulates foreign issuers anchoring to HKD and actively promotes stablecoin activities targeting Hong Kong’s public. MiCA, as a unified EU regulation, applies across the entire single market. The U.S. promotes cross-border cooperation through reciprocity agreements. Singapore primarily regulates domestic activities, with limited extraterritorial application.

The U.S. stablecoin regulatory framework is undergoing a critical transformation—from fragmented oversight to unified legislation. After the Trump administration took office, it visibly accelerated the formulation of crypto regulatory policies, aiming to resolve previous overlaps and ambiguities in regulatory authority. In early 2025, two key federal bills were proposed: the Stablecoin Transparency and Accountability to Better Ensure Ledger Economy Stability Act (STABLE Act) and the Guiding and Establishing National Innovation in U.S. Stablecoins Act (GENIUS Act), together forming a new paradigm for U.S. stablecoin regulation.

Regulatory Architecture: The U.S. adopts a federal-state dual-track model. Under the Genius Act, federal agencies including the Office of the Comptroller of the Currency (OCC) and the Federal Reserve oversee “federally qualified nonbank issuers,” while state regulators supervise “state-qualified issuers”—but only if they can demonstrate their framework is “substantially similar” to the federal one; otherwise, issuers must transition to federal oversight. Notably, the bill sets a size threshold: stablecoin issuers with a market cap exceeding $10 billion are mandatorily brought into the federal regulatory framework. This design respects traditional U.S. state-level financial regulatory powers while ensuring uniform oversight of large-scale stablecoin systems.

Issuer Restrictions: The bill clearly states only licensed payment stablecoin issuers may issue fiat-pegged stablecoins; unauthorized issuance constitutes illegality. It also clarifies the legal nature of payment stablecoins, stating they are neither securities nor commodities, thus avoiding applicability under other financial regulations. This clarification resolves long-standing uncertainty in the U.S. stablecoin market and clears obstacles for compliant issuance.

Any entity conducting “regulated stablecoin activities” in Hong Kong must apply for a license from the Monetary Authority. Applicants must be Hong Kong-registered companies or recognized institutions with a registered office in Hong Kong and meet a series of strict criteria:

-

Financial Requirements: Maintain a minimum paid-up capital of HK$25 million and hold sufficient highly liquid reserve assets (e.g., government bonds, bank deposits) to ensure 1:1 stablecoin redemption capability.

-

Reserve Segregation: Customer assets must be properly segregated and not used for other purposes.

-

Management Capability: Demonstrate sound corporate governance and expertise in blockchain technology, financial regulation, and risk management.

-

Technical Security: Distributed ledger platforms must pass third-party security audits to ensure system safety and processing capacity.

-

Redemption Assurance: Process redemption requests at par value under reasonable conditions, without imposing excessively restrictive terms.

-

Retail Investor Protection: Only licensed institutions may issue fiat-backed stablecoins to retail investors, and only licensed stablecoins may advertise. This design greatly reduces retail exposure to fraud or mis-selling, representing one of the stricter investor protection measures globally.

-

Transition Arrangements: To ensure smooth market adaptation, flexible mechanisms are in place: institutions already operating regulated activities in Hong Kong may continue for the first three months after implementation; those submitting applications within six months and receiving acceptance may extend operations until then; temporary licenses may also be granted by the HKMA. Currently, five firms—JD Blockchain, OSL, Standard Chartered Bank, among others—are in the HKMA’s “sandbox” program, allowed to operate during the transition period.

MiCA divides stablecoins into two categories for differentiated regulation:

-

Electronic Money Tokens (EMT): Pegged to a single fiat currency (e.g., euro), treated as payment instruments. Issuers must issue at 1:1 par value and cannot pay interest. Holders may redeem freely at face value at any time.

-

Asset-Referenced Tokens (ART): Linked to multiple assets (e.g., currencies, commodities, cryptos), treated as investment instruments. Issuers must isolate reserves, though redemption timelines and value guarantees are weaker than for EMT.

EMTs must be 100% backed by fiat cash or cash equivalents; ARTs require diversified asset backing meeting minimum liquidity thresholds. All reserve assets must be strictly segregated from the issuer’s own assets.

The Monetary Authority of Singapore (MAS) finalized its stablecoin regulatory framework on August 15, 2023:

-

Asset Segregation: Reserves must be effectively separated from the issuer’s own assets and managed by independent custodians.

-

Redemption Rights: Holders have the right to redeem at face value within five business days.

-

Audit Transparency: Reserve holdings must be published monthly and verified by independent auditors to ensure transparency.

Regulation, in Essence, Is Also a Dividend

Rising compliance thresholds and market concentration are inevitable trends. Stringent regulatory requirements are increasing industry entry barriers, pushing market structures toward institutionalization and centralization. Hong Kong’s HK$25 million minimum paid-up capital requirement, the EU’s authorized institution thresholds, and the U.S. federal licensing system all pose challenges to small startups. Traditional financial institutions and large tech companies, leveraging capital and compliance advantages, are accelerating their entry into the stablecoin market.

A new market landscape dominated by licensed institutions is taking shape.

Cross-border payments and currency internationalization opportunities are opening up. Improved regulatory frameworks remove barriers for stablecoin applications in cross-border payments. Stablecoins enable real-time settlement, drastically shortening transaction cycles and reducing fees to 1/10–1/100 of traditional banking costs. In emerging markets, stablecoins are gradually replacing local fiat for daily payments and payroll. Notably, stablecoins are emerging as new tools for currency internationalization. Hong Kong’s proactive promotion of stablecoins may facilitate exploration of offshore RMB stablecoins, enhancing competitiveness via mainland China’s vast market.

Real-World Asset Tokenization (RWA) is poised for rapid development. Compliant stablecoins are seen as the key “engine” and “foundation” of the RWA ecosystem. In tokenizing traditional assets like trusts, real estate, and commodities, stablecoins provide value anchoring and transaction medium functions, effectively driving RWA scale expansion.

Currently, the U.S. Bitcoin futures market is mainly led by CME Group, Bakkt, and Cboe Digital, while Deribit dominates ~85–90% of global Bitcoin and Ethereum options trading. Additionally, numerous crypto-derivative products exist in the U.S., such as Bitcoin futures ETFs.

Derivatives are gaining increasing importance in the virtual asset space. Virtual asset derivatives not only become ideal trading tools for highly volatile assets but also accelerate the integration of virtual assets into the modern financial system. Today, derivatives account for over 70% of total crypto market trading volume—meaning most crypto transactions occur via futures contracts, perpetual swaps, or other derivatives. Centralized platforms dominate derivative trading, though decentralized platforms offer wider varieties of derivatives, indicating that developing virtual asset derivatives is an inevitable trend and an indispensable part of future growth. These derivatives provide professional investors with enhanced hedging and yield-generation tools, expand overall market liquidity, and offer diverse risk-return profiles. They also enrich structured products linked to virtual asset derivatives, unlocking greater opportunities in wealth management. Hong Kong’s explicit move to introduce virtual asset derivatives will bring greater prospects to its virtual asset market, accelerating alignment with the modern financial system and enhancing product diversity, thereby significantly boosting attractiveness.

The Securities and Futures Commission (SFC) of Hong Kong has already issued 10 virtual asset trading platform licenses to major players such as OSL and HashKey.

From the perspective of money as a medium of exchange, stablecoins represent digital infrastructure. By setting stablecoin standards early, the U.S. links traditional fiat with crypto assets, seizing dominance over crypto transaction infrastructure. If global trade and settlement increasingly adopt stablecoins, it will reshape traditional cross-border and trade payment ecosystems, dramatically lowering associated costs.

Stablecoins may reshape the global financial ecosystem. Dollar-pegged stablecoins backed by U.S. short-term Treasuries signify that crypto assets are becoming mainstream U.S. monetary assets. Stablecoins also present new challenges to central bank digital currencies (CBDCs) and financial regulation. The current Stablecoin Act appears to be an official effort by the U.S. to bolster confidence in crypto assets, using sovereign currency and the most liquid assets (U.S. short-term Treasuries) as collateral—thus granting U.S. crypto assets sovereign credit backing. Moreover, President Trump and his family have personally issued cryptocurrencies, and key members of his administration—including the Treasury Secretary and Commerce Secretary—are known supporters and beneficiaries of crypto assets.

Let’s Revisit Blockchain Itself: The Starting Point

Ø Investing in infrastructure always brings the first wave of dividends, but one must analyze and distinguish between hype-driven valuations and genuine fundamentals in tokenomics.

Ø The next upgrade in crypto-financial infrastructure will shift from “decentralized experiments” to “compliance-driven reconstruction.” Stablecoins are the spark, blockchains the pipelines, identity the valves, and financial institutions the catalysts.

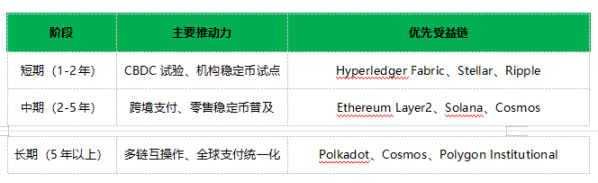

Once KYC/AML procedures are applied to senders and recipients, blockchain technology will truly shine in the stablecoin era. Meanwhile, blockchains (public, private, or consortium chains) become critical infrastructure—the pace of development must align with the implementation and practical adoption of stablecoin laws.

Ø Base and Polygon are most likely to become preferred compliant settlement layers under U.S. regulations, while Ethereum will remain the premium audit platform for stablecoins (e.g., USDC).

Ø Quorum and Hyperledger Fabric are most likely to become the “interbank back-end systems” for global financial compliant stablecoins, handling cross-border clearing and value settlement.

Ø Who will become the “infrastructure of the new financial internet?”

Consider the following dimensions:

Ø Compliance and Licensing: Only projects meeting KYC/AML and stablecoin law requirements can achieve mass adoption—likely those with strong ties to traditional financial institutions or already operating within regulatory sandboxes.

Ø Technical Maturity and Scalability: Mass stablecoin transactions demand high-performance, low-latency, high-throughput blockchain networks.

Ø Security and Stability: As financial infrastructure, security is paramount.

Ø Interoperability: Seamless interaction between different stablecoins and blockchains will be key to efficiency and cost reduction.

Ø Ecosystem and Adoption: Active developer communities, rich DApp ecosystems, and existing collaboration or adoption by financial institutions are important indicators.

Ø Governance Model: Blockchains capable of adapting to future regulatory changes and offering stable, reliable governance hold greater advantages.

Under strong regulation, public chains that truly become stablecoin infrastructure must combine high transparency and decentralization with compatibility with regulatory demands.

In the context of stablecoin laws being enacted and practically adopted, the projects best positioned to capture early-era dividends will be those that:

1. Directly meet the compliance needs of financial institutions and large enterprises.

2. Provide high-throughput, low-cost, secure, and reliable transaction infrastructure.

3. Enable seamless transfer of stablecoins across different chains.

Are DeFi and RWA the First Wave of Dividends?

Ø After stablecoins gain regulatory acceptance, RWA is likely to become the second compliant asset class endorsed by regulators—deeply integrating with real-world financial systems and creating massive opportunities in asset tokenization, globalized trading, and transparent custody.

Ø It's important to note that regulatory rules prohibiting interest payments to stablecoin holders mean issuers cannot perform basic commercial banking functions like “deposit-lending.” They must find alternative ways to cover operational costs and innovate business models—relying on innovative applications of stablecoins within the broader financial system.

As of end-May 2025, the combined market cap of major stablecoins was approximately $230 billion—over 40x growth since early 2020, showing rapid expansion. Yet compared to traditional financial systems, this remains small—equivalent to just 1% of onshore U.S. deposits. However, in terms of transaction volume, stablecoins play a vital role as payment instruments and infrastructure in the crypto ecosystem. Leading stablecoins (USDT and USDC) recorded annual transaction volumes of $28 trillion—surpassing Visa and Mastercard. With stablecoins now integrated into financial regulatory frameworks, decentralized finance (DeFi) is poised for growth and deeper integration with traditional finance.

Stablecoins act as the “bridge” between traditional finance and decentralized finance (DeFi).

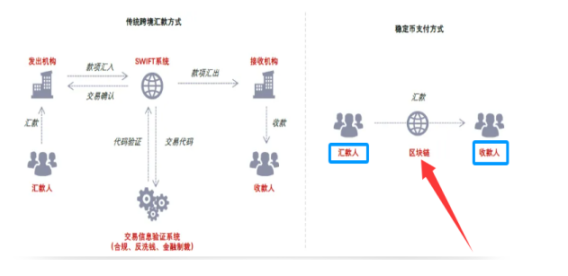

According to World Bank data, as of Q3 2024, the global average remittance fee was 6.62%, while the UN’s 2030 Sustainable Development Goals call for reducing this to no more than 3%, with settlement times of 1–5 business days. Traditional systems suffer from inefficiencies due to reliance on multiple intermediary banks via the SWIFT network. In contrast, stablecoin-based remittances typically cost less than 1% and settle within minutes. However, prior to regulation, stablecoin payments lacked KYC and anti-money laundering oversight, posing challenges to capital controls in emerging markets. Thus, while technologically superior, the advantage partly stems from regulatory arbitrage. As regulations tighten, compliant stablecoin usage may incur higher costs.

Theoretically, the 100% reserve requirement restricts stablecoin issuers’ ability to create credit. Converting bank deposits into stablecoins is essentially transferring deposits rather than creating new money—so stablecoin issuance doesn’t directly affect dollar supply. However, sustained outflows could lead banks to shrink balance sheets and reduce money supply. When other currencies are exchanged into dollar-pegged stablecoins, this reflects cross-border or cross-account dollar flows but does not alter total dollar supply.

Lending platforms using crypto as collateral function similarly to banks by enabling credit creation, increasing the supply of “quasi-money” (i.e., stablecoins) in DeFi—though this doesn’t impact traditional monetary aggregates. Since crypto financial applications focus largely on payments and investments, lending is often speculative. As of end-2024, the size of crypto lending platforms was about $37 billion—still relatively small.

Converting deposits into stablecoins risks deposit outflows—a phenomenon akin to the impact of money market funds and high-yield bonds on banks. For example, since 2022, about $2.3 trillion in U.S. deposits flowed into money market funds amid rising interest rates, contributing to the Silicon Valley Bank crisis.

As of Q1 2025, USDT and USDC issuers collectively held about $120 billion in U.S. Treasuries. If grouped as a single “economy,” they would rank 19th among foreign holders of U.S. debt—between South Korea and Germany.

Stablecoins primarily absorb short-term U.S. Treasuries (under 3 months), with limited capacity for long-term bonds. Short-term yields are influenced by central bank policy, inflation, and employment. From a monetary policy standpoint, stablecoin purchases of Treasuries suppress short-end yields, potentially forcing central banks to tighten monetary policy. Long-term, the attraction of deposits into stablecoins may fuel disintermediation—shifting funding from traditional finance to DeFi—and weaken the effectiveness of central bank monetary control.

Key Considerations and Challenges

Ø Legal and Regulatory Frameworks: This is the core of RWA development. Definitions and regulations regarding “security tokens,” “digital assets,” and “stablecoins” vary widely across jurisdictions. Compliance is key to project success.

Ø Asset Valuation and Custody: Off-chain asset valuation, legal title transfer, physical custody, and auditing are complex yet essential components of RWA tokenization.

Ø Off-Chain to On-Chain Linkage: Securely and reliably mapping off-chain asset information and legal status onto on-chain tokens requires robust oracles and legal agreements.

Ø Liquidity and Market Depth: Even when tokenized, insufficient buyers and sellers can result in poor liquidity. The widespread adoption of compliant stablecoins may help alleviate this.

Ø Interoperability: Different RWA tokens may exist on different blockchains. Cross-chain technologies will be crucial for enabling seamless trading and transfers.

Projects best positioned to capture early-era dividends will be those:

Ø With strong traditional financial backgrounds and licenses, or deeply partnered with such institutions (e.g., Franklin Templeton, BlackRock, JPMorgan’s Onyx, and service providers like Securitize).

Ø Capable of effectively solving complex problems in legal compliance, asset custody, valuation, and off-chain/on-chain mapping.

Ø Deployed on blockchain platforms—whether Layer 2s of public chains or consortium chains—that are regulatory-friendly and offer high performance and liquidity potential.

RWA Ecosystem Landscape (by Function)

1. Real Estate / Trust Assets Tokenization (Easiest to Implement)

Real estate is one of the most receptive RWA categories to stablecoins as “on-chain dollars,” offering stable returns and clearability. Many traditional REITs or private real estate funds may choose to tokenize their shares. This lowers investment thresholds, attracts small investors, and enhances secondary market liquidity. Regulators in places like Hong Kong and Dubai are actively promoting real estate tokenization projects.

2. Government Bonds / Corporate Bonds and Financial Instruments (High Growth Potential)

Stablecoins are a natural fit for “dollar-backed + yield distribution”; Treasuries + stablecoins form a combination highly favored by regulators. This category is currently the fastest-growing and largest in the RWA space. Compliant stablecoins (like USDC or future bank-issued stablecoins) serve directly as settlement currencies for these tokenized securities.

3. Gold / Commodities RWA (Natural Anchor for Stablecoins)

Gold is naturally suitable for tokenization, and stablecoins themselves can use gold as a reserve option; on-chain gold-backed systems can support hedging and safe-haven asset allocation.

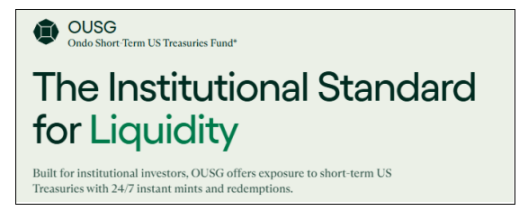

Ondo Finance (example only, not investment advice, no opinion on token price)

An RWA tokenization platform focused on fixed-income assets (e.g., U.S. Treasuries, ETFs, real estate trusts), offering high-yield opportunities for institutional and retail investors.

Technical Features:

Ø Built on Ethereum Layer 1 and Layer 2 (e.g., Optimism), enabling low-cost, fast transactions.

Ø Offers structured financial products (e.g., senior/subordinated tokens) catering to different risk appetites.

Ø Integrates Chainlink oracles for transparent asset pricing.

Ø Partners with SEC-registered broker-dealers to ensure compliance with U.S. regulations.

Ø Supports KYC/AML and regular audits, meeting GENIUS Act requirements.

Issued to qualified purchasers, requiring strict KYC/qualified investor verification.

Available to non-U.S. individual and institutional users, generating returns from short-term U.S. Treasuries and bank deposit interest.

Flux Finance is a decentralized lending protocol built on the Compound V2 asset pool model. It allows users to borrow stablecoins using high-quality RWA assets (currently only OUSG) as collateral, or lend idle stablecoins to earn interest.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News