Amid the shadow of war, has the crypto market once again become a frightened bird?

TechFlow Selected TechFlow Selected

Amid the shadow of war, has the crypto market once again become a frightened bird?

Leverage stacked to the maximum, ultimately leading to a sharp market correction.

Written by: 1912212.eth, Foresight News

In the early hours of June 13, Bitcoin dropped from $108,000 to as low as $102,664, forming a rare seven consecutive declines on the four-hour chart. Ethereum fell from around $2,800 to $2,455, posting an unusual nine-session losing streak on its four-hour chart. Affected by the broader market downturn, most altcoins experienced significant declines.

Regarding open interest data, Coinglass shows that total liquidations across all platforms reached $1.12 billion in the past 24 hours, with long positions accounting for $1.04 billion of that amount. The largest single liquidation occurred on Binance's BTCUSDT pair, valued at $201 million.

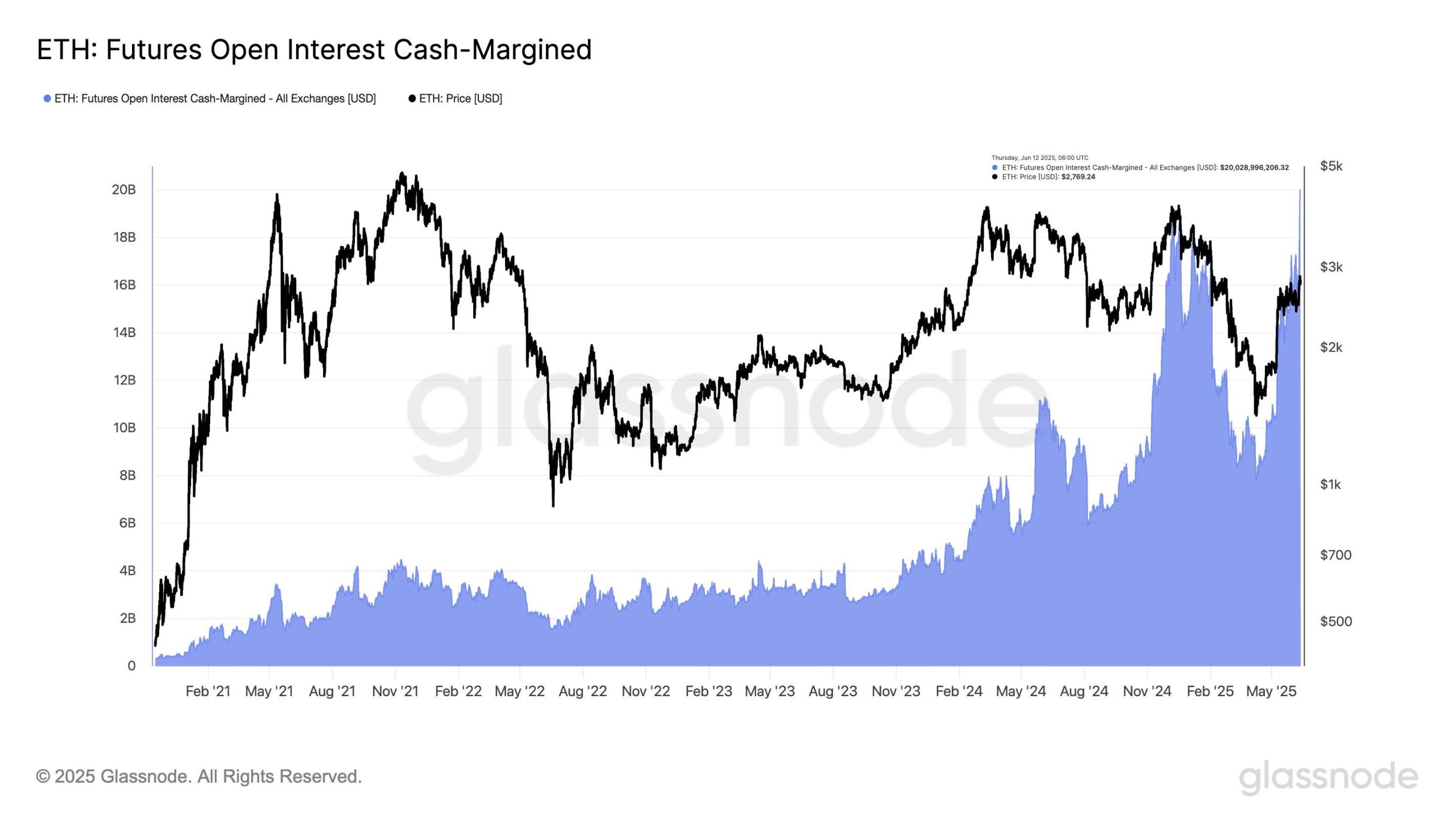

On June 12, Glassnode monitoring data showed Ethereum’s open interest had just hit a record high, surpassing $20 billion. Although ETH price pulled back slightly from the $2,800 level, market leverage continues to accumulate as traders increasingly use stablecoins to increase their exposure.

In addition, SharpLink Gaming, the publicly traded company known as "MicroStrategy for ETH," saw its stock plunge approximately 70% after hours following its SEC filing regarding potential share sales by PIPE investors, which negatively impacted ETH sentiment.

The company filed an S-3ASR registration statement allowing resale of up to 58,699,760 shares held by over 100 shareholders related to its Private Investment in Public Equity (PIPE) financing. Markets initially interpreted this as confirmation that PIPE investors had already dumped their holdings. However, Joseph Lubin, chairman of the company’s board, clarified on X that the market had “misread” the S-3 filing—this document merely pre-registers shares for potential future resale and is a standard procedure in traditional finance after PIPE deals, not indicative of actual selling.

The sharp rise in futures open interest indicates that the recent price surge was primarily driven not by spot buyers but by leveraged futures traders. In contrast to Bitcoin, which remains largely driven by spot demand, Ethereum has shown divergence. A recent surge in call option buying, combined with gamma hedging effects, exposes ETH to clear gap risk. The market is becoming increasingly fragile and highly sensitive to shifts in momentum.

Just as the market anticipated Ethereum leading a strong altcoin rebound, prices abruptly reversed downward. What exactly happened?

Israel and Iran Engage in Military Conflict Again

In the early hours of June 13 local time, Israeli Defense Minister Katz announced that Israel had launched airstrikes against Iran. He stated that following preemptive strikes, Israel expects imminent missile and drone attacks from Iran soon. According to Xinhua News Agency, Israeli Prime Minister Netanyahu said on the 13th that the military's strikes against Iran would continue for "several days."

Currently, Israel has entered a state of emergency nationwide. CNN, citing Israeli sources, reported that Israel is preparing for a major retaliatory strike from Iran—one larger in scale than any previous Iranian attack on Israel. Sources said Israel intends to keep attacking Iran until it believes the nuclear threat has been neutralized, although there are internal doubts within Israel’s security agencies about whether unilateral action can truly achieve this goal. Israel’s main targets include Iran’s nuclear facilities, military assets, and key figures within the Iranian military.

Iranian state television has just reported unconfirmed claims that General Salami, commander of Iran’s paramilitary Revolutionary Guard, may have been killed in the Israeli strikes. The broadcaster added that another senior guard official and two nuclear scientists might also have died. No further details were provided.

International markets reacted sharply: Brent and WTI crude oil futures both surged over 8%. Nasdaq futures briefly widened losses to 2%, while S&P 500 futures fell 1.8% and Dow Jones futures declined 1.6%. Spot gold briefly rose above $3,420 per ounce, gaining nearly 1% during the session.

Fed Delays Rate Cuts

Since the Federal Reserve’s rate cut in December 2024, it has shown no signs of softening its stance on further easing.

U.S. President Trump has recently expressed frustration repeatedly. He has frequently taken to social media urging the Fed to lower interest rates: "We have a lot of short-term debt. I prefer long-term, low-interest debt. If we reduce rates by 1%, that means we pay 1% less."

"I suggest the Fed cut rates by 200 basis points."

Chairman Powell hasn’t yielded. While some speculated Trump might fire him, Trump later stated he wouldn't dismiss Powell—"he just needs to lower rates; our inflation numbers look good."

Hedge fund magnate Paul Tudor Jones predicted that President Trump will appoint a "very dovish" new Fed chair.

Following recent CPI and May core PPI data releases, traders now expect the Fed to begin cutting rates twice this year, starting in September.

With current tight liquidity conditions in financial markets, even minor triggers can spark sharp sell-offs.

Black Swan Events Multiply

Global markets have faced growing turbulence recently. On June 12, an Indian airline Boeing 787 aircraft crashed en route to the UK—the first fatal accident involving this aircraft model. Multiple media outlets reported more than 240 fatalities. Boeing’s stock dropped over 6% following the news.

Prior tensions between Tesla founder Musk and President Trump escalated into a public feud, but recently de-escalated after Musk appeared to concede. According to Reuters, President Trump praised Tesla during an event at the White House focused on California’s EV regulations: "I like Tesla... I discussed electric vehicles with Musk," he said, adding, "Musk actually likes me."

Civil unrest continues in Los Angeles, with curfews imposed in certain areas. Global Times reported that at least 378 people have been arrested in LA since last Saturday. On the evening of June 10 local time, the mayor of Los Angeles announced a curfew from 8 PM to 6 AM in parts of downtown, with the duration subject to ongoing assessment. The verbal clash between President Trump and California Governor Newsom continues. Protests opposing immigration enforcement actions continue spreading beyond Los Angeles to other regions of the United States.

Outlook for Future Market Movements

Rui, Investment Manager at HashKey Capital, tweeted: "Liquidity in altcoins has frozen completely. Excluding market makers, trading volumes are at new lows. Order books lack buy or sell orders—prices slowly drift down. Even positive news fails to attract buyers. Exchange listing pumps last only thirty seconds, driven solely by bots. Once newly listed coins finish their brief spikes, they immediately enter a downtrend. Whether rising or falling, altcoin cycles have become much shorter—miss the timing, and you’re out."

Trader Million ERIC noted that after Bitcoin generated an oversold signal this time, it only rebounded slightly before resuming its decline. He highlighted that the key support zone to watch going forward is around $101,000.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News