How Cobo Helps Payment Companies Rapidly Transform in the New Era of Cross-Border Payments?

TechFlow Selected TechFlow Selected

How Cobo Helps Payment Companies Rapidly Transform in the New Era of Cross-Border Payments?

Cobo's one-stop stablecoin solution for cross-border payments enables payment companies to quickly gain stablecoin cross-border payment capabilities without having to build from scratch.

By Alex Liu, Foresight News

Challenges of Traditional Cross-Border Payments

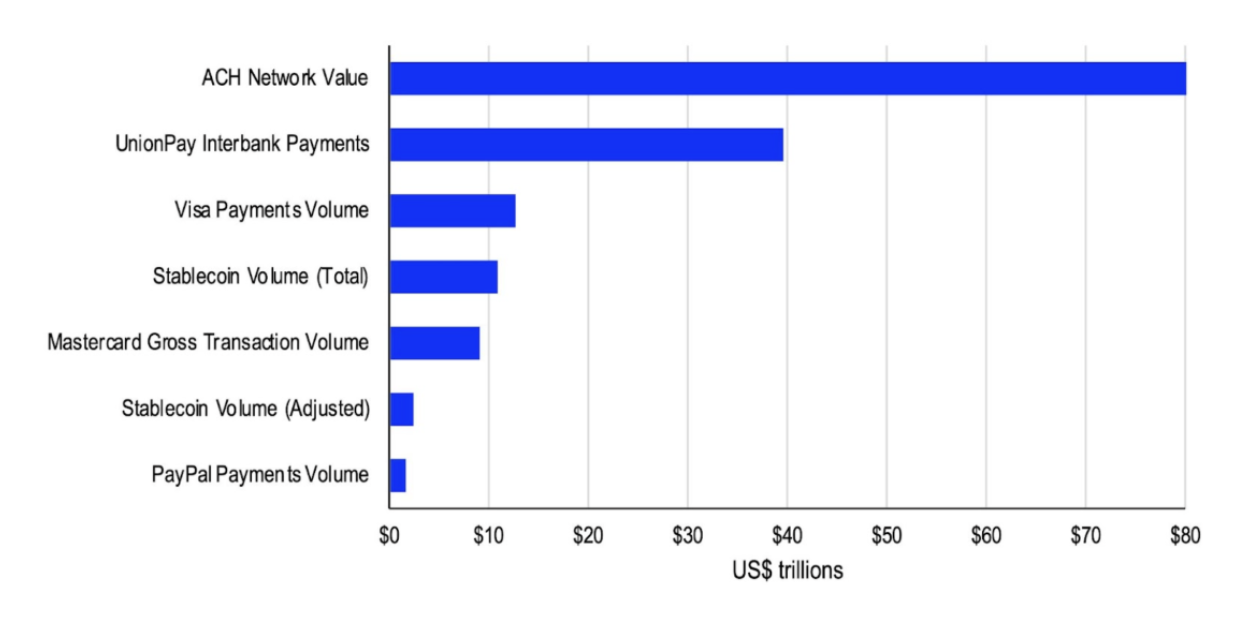

As global economic integration deepens, cross-border payments—serving as a vital link connecting international trade and finance—are becoming increasingly important. However, traditional payment methods such as ACH network transfers, UnionPay, Visa, and Mastercard come with numerous limitations that prevent businesses from enjoying efficient and low-cost services.

Cross-border transactions often take several days due to multi-layered clearing through intermediaries, resulting in high fees and low efficiency. Meanwhile, differing regulatory requirements across countries have led to growing compliance costs for enterprises. This not only increases operational expenses but also degrades user experience due to opaque pricing and lengthy processes.

These issues have fueled strong demand from businesses and individuals for faster, lower-cost payment solutions. The rise of stablecoins has emerged as a breakthrough under this backdrop.

Stablecoins combine the advantages of blockchain technology with the value stability of fiat currencies, eliminating redundant intermediaries through peer-to-peer transactions.

This innovative payment method significantly reduces transaction fees while greatly accelerating capital turnover. Moreover, users anywhere in the world can complete transactions as long as they have a blockchain wallet. These highly efficient and accessible features have driven rapid adoption of stablecoins in global payments.

In 2023, stablecoin payment transaction volume exceeded $10 trillion. Source: Coinbase

In 2023, stablecoin payment transaction volume surpassed $10 trillion, demonstrating substantial market demand for this payment method. Take Bridge, for example—a company focused on helping enterprises accept and use stablecoin payments. By offering API interfaces, it enables seamless conversion between fiat and stablecoins, supporting companies in conducting cross-border payments, exchanges, and even issuing custom stablecoins globally. Its services dramatically reduce payment time and cost while allowing flexible operations across multiple stablecoins.

Bridge's success attracted the attention of payments giant Stripe, which ultimately acquired the company for $1.1 billion. This case further highlights the commercial value and growth potential of stablecoins in cross-border payments, prompting more payment companies to explore entry into this space.

However, it is no easy task for traditional payment providers to enter the stablecoin payment arena. High technical barriers associated with blockchain, complexity in compliance adaptation, and stringent risk management requirements represent three major challenges facing traditional payment firms during transformation.

Cobo’s Solution: One-Stop Web3 Payment Infrastructure Service

Cobo’s Web3 cross-border payment solution is specifically designed to address these pain points. The solution packages complex blockchain technology into easy-to-use modules, enabling payment companies to quickly launch stablecoin payment services without significant investment.

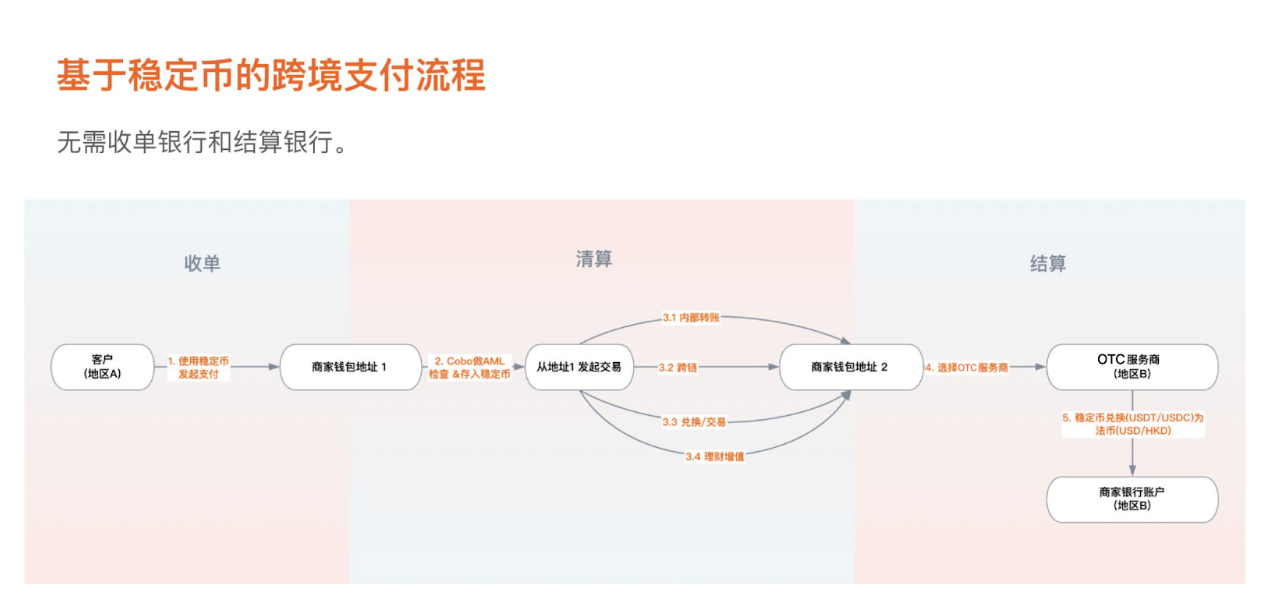

Cobo Cross-Border Payment Solution Workflow

Simplifying Technical Development: Making Innovation Accessible

Cobo’s cross-border payment solution offers end-to-end capabilities—from cryptocurrency collection and wallet management to compliance and risk control, on-chain fund processing, asset management, and fiat conversion—comprehensively meeting diverse needs of payment enterprises. With high flexibility, its components can be integrated on demand.

Core Functional Modules

Acquiring:

-

Supports both full custody and MPC (Multi-Party Computation), offering payment providers diverse wallet management options. Whether preferring centralized, highly secure full custody or seeking greater autonomy via MPC, businesses’ needs are met, ensuring both security and flexible fund allocation.

-

Enables automatic fund aggregation, greatly simplifying fund management workflows, improving capital utilization efficiency, avoiding tedious manual operations, and making fund management smarter and more convenient.

-

Features robust compliance and risk control mechanisms, including built-in advanced AML systems and comprehensive compliance solutions. It monitors transaction risks in real-time, ensuring every transaction complies with regulations and effectively preventing various risk incidents, safeguarding stable business growth for clients.

Clearing: Integrates rich fund-processing tools to help payment companies efficiently manage on-chain funds. For instance, it provides convenient exchange services to meet cross-currency conversion needs; supports cross-chain switching to adapt to diverse blockchain ecosystems; and includes wealth management features to generate returns on idle funds, comprehensively optimizing liquidity and value appreciation capabilities.

Settlement: Integrates multiple compliant OTC service providers and supports opening accounts with crypto-friendly banks, bridging the path from crypto to fiat currency. This ensures smooth and legal fund flow, providing complete settlement solutions so payment companies can easily overcome challenges related to fiat conversion and settlement in cross-border payments.

Additionally, recognizing that traditional financial institutions may face high barriers when adopting blockchain technology, Cobo has carefully designed a series of functions to effectively abstract away blockchain complexity.

For example, automatic fund aggregation eliminates the need for customers to handle complicated aggregation procedures; stablecoins can be used to pay gas fees, reducing financial accounting burdens; and one-stop KYC services streamline identity verification—all lowering the barrier to entry and friction in using blockchain. This allows payment clients to focus more energy on expanding and innovating their core businesses rather than being hindered by blockchain complexities.

Furthermore, Cobo plans to introduce additional automation features, such as enabling users to set up payment workflows for automated execution, further enhancing user experience and operational efficiency, continuously creating value for clients.

Cobo provides one-stop resource integration services, helping payment companies streamline the entire cross-border payment process. By integrating multiple compliant payment platforms and supporting rapid bank account setup, Cobo not only optimizes fund clearing routes but also significantly reduces operational complexity and improves overall efficiency.

Compliance and Risk Control: The Sword of Damocles in Payments

Another major challenge for payment companies in cross-border payments lies in compliance and risk management.

Different jurisdictions have varying regulatory policies toward blockchain-based payments—from customer identification (KYC) and anti-money laundering (AML) to transaction monitoring (KYT) and data privacy protection—requiring enterprises to meet multifaceted requirements.

To address traditional payment players' concerns regarding blockchain-related regulation, Cobo has embedded a comprehensive compliance system within its solution.

Specifically, Cobo’s compliance solution offers automated risk analysis tools and partners with multiple leading global compliance service providers to deliver real-time policy updates and recommendations. Its built-in AML system analyzes the risk profile of each on-chain transaction in real time, identifying high-risk addresses and blocking suspicious activities promptly through intelligent algorithms. This comprehensive risk management capability enables enterprises to confidently comply with diverse regulatory regimes worldwide.

Moreover, Cobo offers dual-mode wallet services—HSM full custody and MPC co-management—to meet different markets’ compliance demands. Under full custody mode, based on Cobo’s centralized custodial wallets, enterprises can conduct payment operations and asset management within a compliant framework, greatly simplifying processes and boosting efficiency. In self-custody mode, leveraging Cobo’s Multi-Party Computation (MPC) technology, enterprises can define custom risk control rules, achieving flexible asset management and enhanced security. In short, full custody delivers high efficiency and strong security, whereas MPC offers greater enterprise control and management flexibility.

Value-Added Services and Ecosystem Co-Building

Beyond core payment functionalities, Cobo offers a suite of value-added services tailored for enterprises. For instance, to address corporate liquidity needs, Cobo has launched a stablecoin wealth management module, allowing companies to deploy idle funds into low-risk on-chain investment instruments, thereby increasing capital efficiency. Additionally, Cobo provides customized technical and risk control solutions based on specific client business scenarios, ensuring each enterprise succeeds in its target market.

The effectiveness of Cobo’s solution has already been validated in the market. For example, one payment company successfully integrated a digital currency wallet with its internal systems within just two weeks using Cobo’s solution, completing its first cross-border stablecoin transaction and gaining powerful support for business expansion.

As an open blockchain platform, Cobo focuses not only on developing technological solutions but also on building a stable, secure, and compliant payment ecosystem that empowers upstream and downstream partners.

Through an open architecture, Cobo’s cross-border payment solution offers one-stop technical support to various enterprises and institutions, helping them rapidly integrate into the global digital payment network. Furthermore, Cobo allows partners to deeply integrate their products with the platform, creating synergies and enabling shared value creation. Target clients and partners include cross-border payment providers, acquirers, compliant OTC desks, stablecoin issuers, card issuers, and more.

Conclusion: Web3 Payments Are Here

The current trajectory of the global payments industry is becoming increasingly clear.

First, demand for cross-border payments will continue to grow explosively. As global economic integration accelerates, international trade, cross-border e-commerce, overseas investments, tourism, and education are all thriving, raising expectations for convenience, speed, and cost-effectiveness in cross-border payments.

Second, digital payments will fully penetrate every corner of socioeconomic life—from high-end shopping malls in bustling cities to village convenience stores and street-side mobile vendors—making digital payment methods standard and further shrinking the use cases for cash.

Third, security and privacy protection will become paramount in the evolution of the payments industry. With massive growth in payment data and increasingly sophisticated cyberattack techniques, consumer and enterprise concerns about payment security have reached unprecedented levels. Future payment technologies must incorporate strong encryption algorithms and multi-layered defense mechanisms to ensure secure, worry-free transactions.

Finally, the integration of payments with financial services will deepen. Payments will no longer merely serve as conduits for fund transfers but will carry broader financial functions such as wealth management, credit, and insurance, delivering one-stop financial experiences for users.

At this pivotal moment, Cobo has emerged prominently. By encapsulating complex blockchain infrastructure and stablecoin mechanics into standardized, plug-and-play modules, it simplifies access to cutting-edge technology.

This approach allows payment companies to bypass the thorny path of R&D, avoiding the need to invest heavily in understanding底层 technologies. Simply by integrating Cobo’s APIs, they can rapidly adopt advanced payment solutions, drastically lowering the barrier to entering emerging payment fields.

Meanwhile, amid tightening global regulations, Cobo has assembled dedicated legal and compliance teams to thoroughly study regulatory differences across regions, crafting tailored compliance pathways for partner companies. This helps clients avoid policy risks and successfully dismantle dual barriers of technology and compliance, facilitating a smooth transition for traditional payment institutions toward digital and intelligent payment models.

Whether Web3 technology will reshape the existing payment landscape remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News