What is the core logic behind Cobo SuperLoop in rebuilding trust in exchanges?

TechFlow Selected TechFlow Selected

What is the core logic behind Cobo SuperLoop in rebuilding trust in exchanges?

Crypto custody platform Cobo is recently upgrading its long-standing Loop Alliance (a cross-platform cryptocurrency clearing and settlement network) to the new Cobo SuperLoop (an OTC custody and settlement network for exchanges).

By Nancy

It's often said that confidence is more important than gold. After the 2022 crypto market suffered from centralized entity collapses and frequent hacking incidents, retail investors tightened their belts and initiated a mass withdrawal movement from centralized exchanges, while traditional institutions slowed their entry into the market amid a string of negative news. Thus, rebuilding trust became one of the core themes for industry development in 2023.

Retail investor confidence can be easily restored by a few strong market rallies, but institutional players and legacy capital require policy support and robust infrastructure to build a solid shield of trust. Recognizing this market need, crypto custodian platform Cobo recently upgraded its long-standing Loop Alliance (a cross-platform cryptocurrency clearing and settlement network) into Cobo SuperLoop (an over-the-counter custody and settlement network for exchanges). This enables trading teams to conduct transactions on exchanges while retaining control over their assets, safeguarding asset security and helping rebuild trust between trading institutions and exchanges—ultimately revitalizing liquidity in the crypto market.

Solving Trust Crises with Trustless Technical Assumptions

The collapse of centralized entities like FTX not only caused direct user asset losses but also triggered a far more devastating crisis of trust due to issues such as related-party transactions and misuse of customer funds. For a long time after the FTX incident, even though centralized exchanges provided proof-of-reserves, their balances still sharply declined, while both whale and retail holders saw net increases in their on-chain wallet balances.

Although centralized trading platforms dominate asset storage due to their ease of operation and trading, they face inherent risks including potential malfeasance by centralized entities, various forms of hacker attacks, and uncontrollable human errors such as lost coins. The crypto industry is seen by hackers as a "land flowing with milk and honey." According to SlowMist’s Hacked database, there were 306 security incidents in 2022 alone, resulting in total losses amounting to $4.382 billion (calculated at event occurrence prices).

Influenced by the FTX fallout, the U.S. SEC even launched investigations into investment advisors regarding crypto custody. Under U.S. law, investment advisors who fail to meet certain asset protection requirements are prohibited from holding client funds or securities. While countries have tightened regulatory policies following events like FTX, mitigating asset risks at CEXs through regulation remains difficult, especially given the complexity of international coordination.

Compared to CEXs, wallets and DEXs (decentralized exchanges) appear to be becoming mainstream choices for storing user assets, yet risks remain—particularly for users managing large capital volumes. Wallets carry risks of hacking and private key loss, while DEXs, although they place user assets under smart contract custody to eliminate operational risks like theft, suffer from limited trading depth and liquidity, making their trading experience inferior to that of CEXs.

At the root of CEX-related asset security risks lies the entanglement of trading and fund management. In traditional finance, strict separation between trading, clearing, and settlement has long been an effective risk prevention method. This is why in traditional custody industries, strict asset segregation ensures all parties' rights and interests are protected—even in bankruptcy, entrusted assets aren't included in liquidation proceedings, avoiding the kind of legal limbo experienced by FTX customers. Yet even if CEXs separate trading from fund custody functions, the fundamental risks posed by centralization itself cannot be fully eliminated.

Against this backdrop, the market demands independent third-party solutions. Cobo’s newly upgraded product, SuperLoop, represents such an attempt—using technological innovation to ensure fund independence and safety, thereby helping rebuild trust between CEXs and users. The predecessor to SuperLoop, the Loop Alliance, was launched by Cobo in 2019, enabling alliance members (such as exchanges and trading institutions) to complete fund custody and conduct off-chain instant settlement of trades. The upgraded SuperLoop now becomes an over-the-counter custody and settlement network for exchanges, allowing users to trade on exchanges while maintaining full control over their funds.

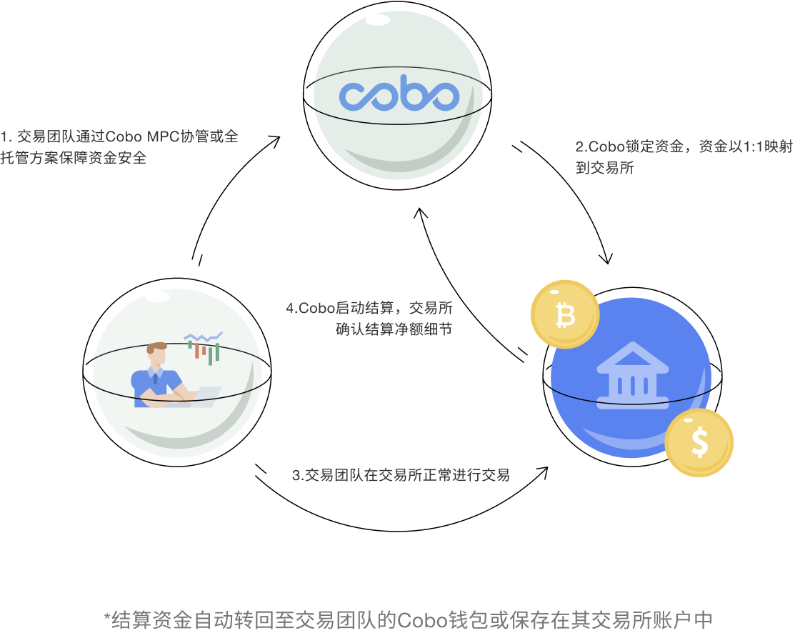

How does it work exactly? SuperLoop allows users to leverage MPC (Multi-Party Computation)-based multi-party co-management schemes, enabling them to trade via mirrored funds on exchanges without pre-funding their exchange accounts. As a technical custodian, Cobo assists users in locking their funds held in Cobo custody on demand. Prior to trading, these funds are mapped 1:1 (without actual fund transfer) to the user-selected trading platform. Users can then freely trade using these mirrored funds, with final settlement executed through SuperLoop after trades are completed.

For trading teams such as hedge funds/market makers, prime brokers, asset management teams, VC funds, and family offices, mapping funds via SuperLoop on CEXs not only avoids on-chain transfer risks but also improves capital efficiency and reduces the cost and barriers for institutions accessing multiple exchanges. Of course, for exchanges themselves, this model enhances transparency, lowers counterparty risk, attracts more trading teams and higher trading volumes, boosts trading activity, and even ensures traders’ ability to fulfill obligations before executing trades.

Notably, if both the trading user and the exchange maintain fully managed accounts with Cobo, transactions conducted via Cobo SuperLoop can bypass congested blockchain networks altogether, offering users the dual benefits of zero transaction fees and instant fund settlement.

By separating trading from fund management, Cobo SuperLoop allows custodial users to enjoy the convenience of CEX operations without worrying about fund security, while achieving greater asset efficiency and flexibility—and CEXs can regain trading volume.

Dual Solutions to Safeguard Asset Security

Beyond native participants in the crypto world, players from the traditional financial world are accelerating their entry into the crypto market. However, for institutional users managing substantial capital, security concerns have placed them in a dilemma. If choosing wallet storage, they face not only hacker threats but also risks around private key backup and custody responsibilities. Additionally, during active trading across multiple platforms requiring repeated logins and multi-level authorizations, their assets become exposed to further risks. Moreover, although many CEXs offer institutional custody solutions, the “player-as-referee” model inherently carries hidden dangers.

In contrast, third-party asset custody, as a critical component of crypto infrastructure, has become a vital bridge for traditional institutions entering the space. Security, being the core responsibility of any custodian, is also a primary competitive factor in the market. To strengthen its foundation in fund security, SuperLoop offers a dual approach combining MPC (Multi-Party Computation) co-management and full custody, aiming to keep risks securely boxed away.

Cobo’s MPC co-management solution leverages cutting-edge MPC-TSS (Threshold Signature Scheme) technology. With MPC-TSS, multiple parties—the client, Cobo, and a third party designated by the client—each hold a fragment of a private key. Through distributed computing, actions such as creating, signing, and recovering keys are performed collaboratively, ensuring no party’s private key is ever exposed during interaction, and the original private key never exists in whole form anywhere.

MPC-TSS technology enables individuals and enterprises to use cryptographic keys more conveniently, securely, and in alignment with business logic. Compared to multi-signature approaches, MPC-TSS offers advantages such as eliminating single points of failure, reducing transaction fees, improving operational efficiency, supporting flexible deployment, and securely storing key shards.

Under Cobo’s full custody solution, user funds are stored within the Cobo Custody platform, granting users bank-grade fund protection without the burden of managing shared keys or maintaining servers.

As custodians like Cobo continue to strengthen the baseline of asset security, they may further break down the barriers preventing traditional institutions from entering the crypto market.

With Crypto Custody Platforms Competing Fiercely, What Sets SuperLoop Apart?

As more traditional players add crypto assets to their investment portfolios, the total assets under custody (AUC) on crypto platforms have grown rapidly. Market research firm Bernstein estimates in a recent report that the custody revenue opportunity could grow from less than $300 million today to $8 billion by 2033.

This confirms that crypto custody remains a promising frontier worth deep exploration—one that naturally attracts both new and established players eager to claim a share. For example, Citibank provides digital asset custody through Swiss-based Metaco; Goldman Sachs is exploring custody services in the crypto market; Fidelity has launched an institutional-grade crypto investment custody platform; and BNY Mellon has received regulatory approval to offer crypto custody services to clients.

To succeed in this fiercely competitive custody arena, developing differentiated value propositions is key. Across the crypto custody industry, companies are actively researching and building products similar to Cobo SuperLoop. For exchanges and trading teams, the question is no longer whether to adopt third-party custody, but rather how to choose the most suitable provider.

Exchanges primarily consider how intrusive a third-party custody solution might be to their existing operations. Some institutional custody models require exchanges to hold funds on the custodian’s platform—or even demand partial sharing of user trading data with the custodian—clearly increasing operational burdens and presenting unacceptable conditions for many exchanges.

Whether a custody platform truly implements MPC-based co-management is another crucial factor. MPC co-management requires private key fragments to be distributed among different parties. If assets move from an MPC-managed account—even if they remain within the same platform—security may be compromised. Other considerations include integration difficulty, manpower investment, compliance standards, and overall security level, all of which influence an exchange’s choice of custody solution.

Beyond business models, due to regulatory gaps in crypto custody across most jurisdictions, mature and compliant custody services have become a prerequisite for major traditional financial institutions entering the crypto market—and a key to earning broader institutional trust. Licenses and compliance audits provide strong credibility.

On all these fronts, Cobo SuperLoop has been thoroughly optimized. It does not intrude on exchange operations but instead serves as an additional deposit channel via fund mirroring, leaving the transaction flow between exchanges and trading teams unchanged. Furthermore, Cobo holds licenses in the U.S., Hong Kong, Lithuania, and Dubai, and has obtained SOC 2 Type I certification. Previously, Cobo Loop already attracted participants including bit.com, Deribit, F2pool, BitFuFu, Pionex, and MXC, spanning exchanges, mining pools, and cloud computing sectors. With SuperLoop即将正式发布, BitMart has officially announced its participation in the SuperLoop network, and several other leading exchanges are currently in close integration talks.

The custody sector is one of the key infrastructures linking the crypto and mainstream worlds. Only through continuous evolution and service iteration can it meet broader market demands. Products like SuperLoop reflect the growing maturity of the custody industry, further promoting the development and adoption of crypto, while the programmable nature of the crypto world suggests future custody services may become even more diverse than traditional asset custody.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News