Hack VC: A Deep Dive into the Pros and Cons of Ethereum's Modular Journey

TechFlow Selected TechFlow Selected

Hack VC: A Deep Dive into the Pros and Cons of Ethereum's Modular Journey

From a business strategy perspective, Ethereum's modular transformation aims to maintain its dominant position within the ecosystem.

Authors: Alex Pack & Alex Botte

Translation: TechFlow

Executive Summary

-

Ethereum has underperformed compared to Bitcoin and Solana. Critics argue this is primarily due to Ethereum’s choice of a modular strategy. Is that true?

-

In the short term, yes. We find that Ethereum's shift toward a modular architecture has contributed to ETH price declines, driven by reduced fees and lower token burn rates.

-

The picture changes when considering the combined market cap of Ethereum and its modular ecosystem. In 2023, Ethereum's modular infrastructure tokens generated value comparable to Solana’s total market cap—around $50 billion. However, in 2024, they collectively underperformed Solana. Moreover, the gains from these tokens have largely flowed to teams and early investors, not ETH holders.

-

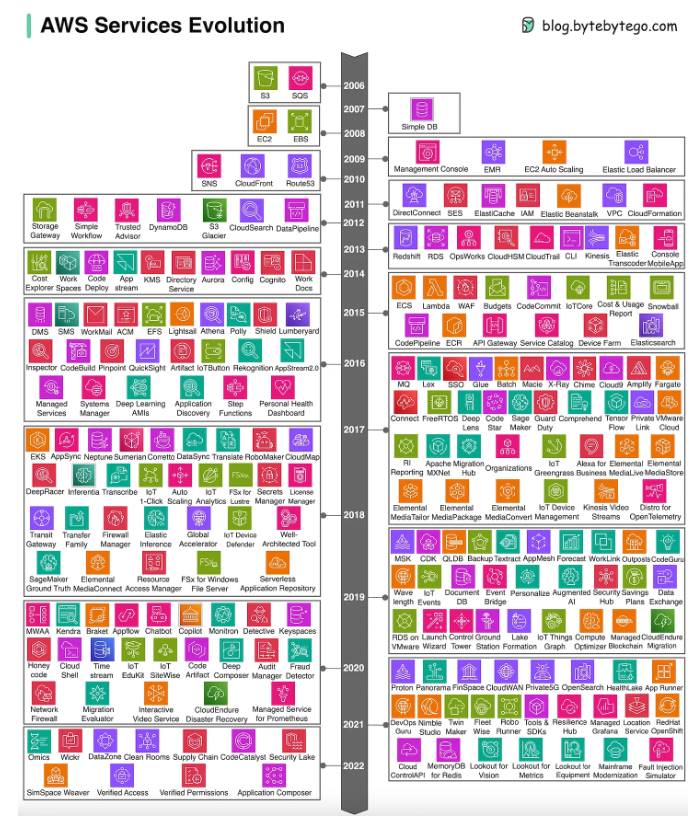

From a business strategy perspective, Ethereum’s modular transition aims to preserve its dominance within the ecosystem. A blockchain’s value lies in the scale of its ecosystem. Although Ethereum’s market share has declined from 100% to 75% over the past nine years, this remains substantial (we compare it to Amazon Web Services in Web2 cloud computing, whose share dropped from nearly 100% to 35%).

-

In the long run, Ethereum’s modular strategy offers a key advantage: resilience against technological disruption. Through its Layer 2s, Ethereum has successfully navigated the first major challenge to Layer 1 blockchains, laying the foundation for long-term durability (albeit with trade-offs).

Introduction: What’s the Problem?

In this market cycle, Ethereum has underperformed both Bitcoin and Solana. Since early 2023, ETH has risen 121%, while BTC and SOL have surged 290% and 1,452%, respectively. Why? Common explanations include irrational markets, lagging technical roadmaps, poor user experience, and loss of ecosystem market share to competitors like Solana. Could Ethereum become the AOL or Yahoo! of crypto?

A key reason behind this underperformance stems from a deliberate strategic decision made by Ethereum about five years ago: transitioning to a modular architecture while decentralizing and deconstructing its infrastructure development roadmap.

In this article, we explore Ethereum’s modular strategy, using data analysis to assess its impact on ETH’s short-term performance, Ethereum’s market position, and long-term prospects.

Ethereum’s Strategic Shift to Modularity: How Bold Was It?

In 2020, Vitalik Buterin and the Ethereum Foundation (EF) made a bold and controversial decision: to deconstruct Ethereum’s infrastructure into separate components. Instead of handling all aspects of the platform (execution, settlement, data availability, sequencing, etc.) itself, Ethereum began encouraging other projects to provide these services in a composable way. This started with promoting new rollup protocols as Layer 2s (L2s) on Ethereum for execution (see Vitalik’s 2020 post “A Rollup-Centric Ethereum Roadmap”), and today hundreds of different infrastructure protocols compete to deliver services once exclusive to Layer 1 (L1).

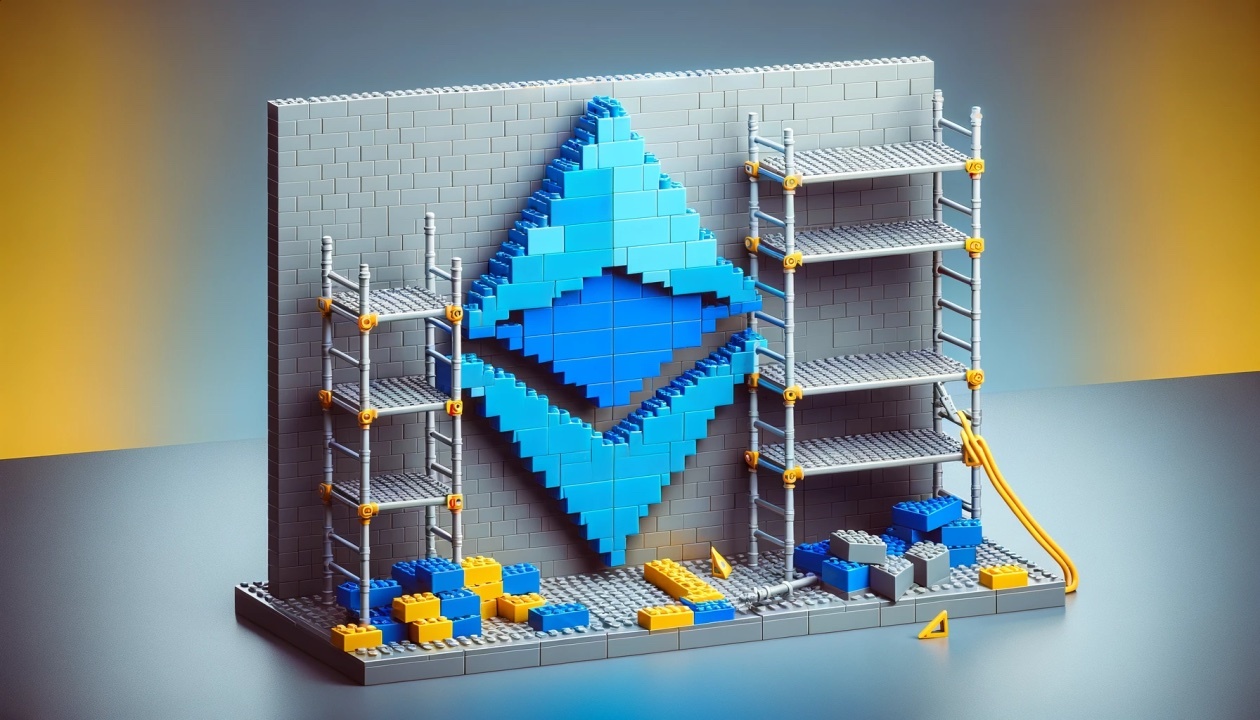

To grasp how radical this idea was, consider a Web2 analogy. In the Web2 world, Ethereum resembles Amazon Web Services (AWS), the leading cloud infrastructure platform for building centralized applications. Imagine if, two decades ago at launch, AWS had focused only on flagship products like storage (S3) and compute (EC2), rather than expanding into dozens of services today. AWS might have missed huge revenue opportunities from service expansion. Moreover, by offering a comprehensive suite, AWS created a “walled garden,” making it hard for customers to integrate with other providers—locking them in. That’s exactly what happened. AWS now offers dozens of services, and ecosystem stickiness makes customer churn difficult, growing revenue from early hundreds of millions to an estimated $100 billion annually.

Yet, AWS’s market share has gradually eroded by rivals like Microsoft Azure and Google Cloud, which grow steadily each year. Its initial near-100% share has now dropped to around 35%.

What if AWS had taken a different path? Suppose it acknowledged that other teams might excel in specific services, chose to open its APIs, and prioritized modularity and interoperability over locking in users. AWS could have enabled developers and startups to build complementary infrastructure, creating more specialized services and a developer-friendly ecosystem with better overall user experience. While this might not boost AWS revenue in the short term, it could lead to greater market share and a more vibrant ecosystem.

Still, for Amazon, this wouldn’t make sense. As a public company, it must prioritize current revenue over a “more vibrant ecosystem.” Thus, deconstruction and modularity are unsuitable for Amazon. But for Ethereum—a decentralized protocol, not a corporation—this approach may be rational.

Decentralized Protocols vs. Companies

Decentralized protocols resemble companies in generating usage fees and even having a form of “revenue.” But does that mean protocol value should be measured solely by revenue? No—and it isn't today.

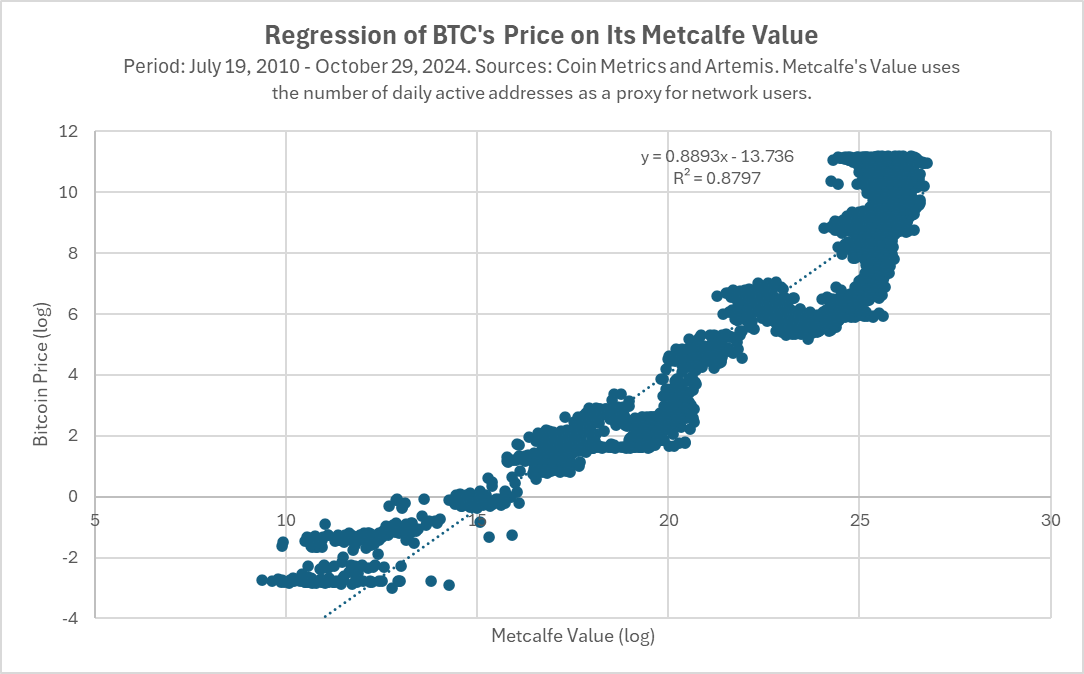

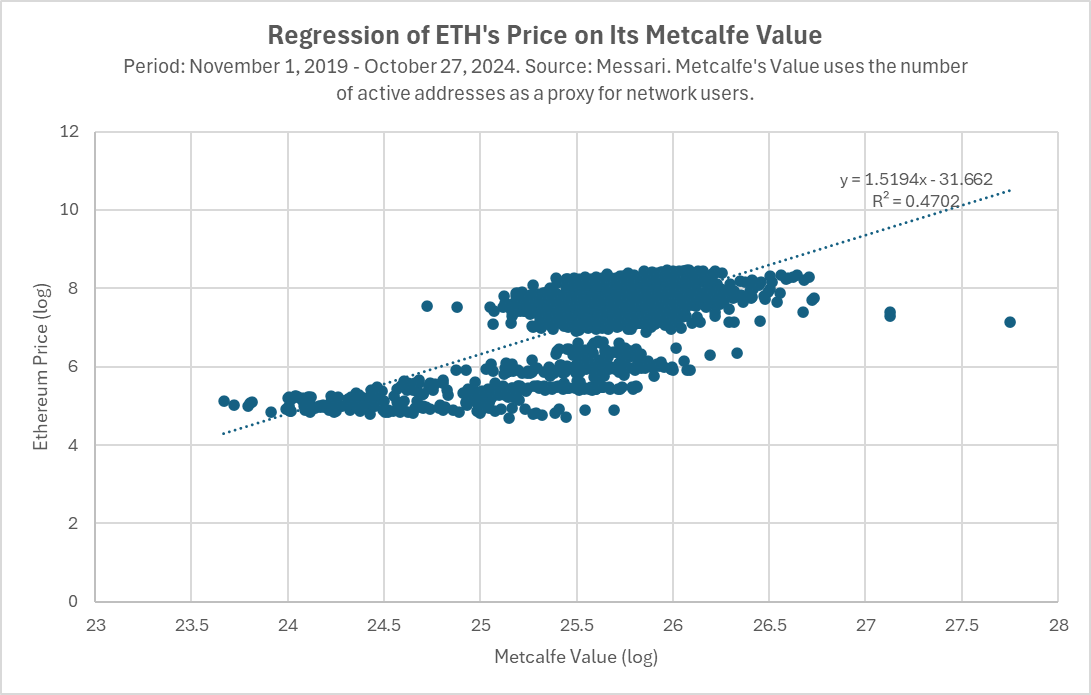

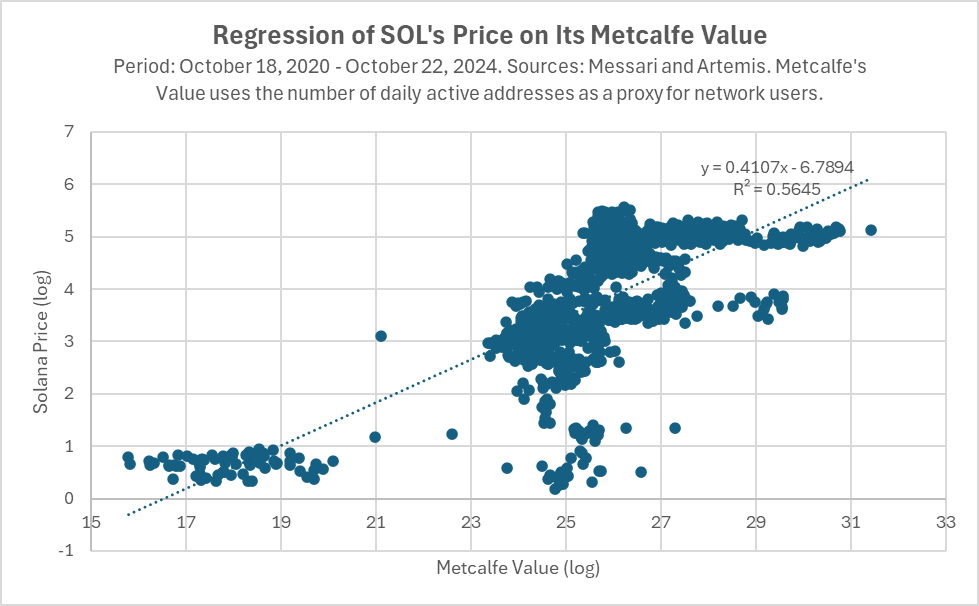

In Web3, a protocol’s value depends more on overall platform activity and whether it hosts the most active developer and user ecosystems. Our analysis of Bitcoin, Ethereum, and Solana shows a strong correlation between token prices and Metcalfe’s value (a metric estimating network user count)—a relationship holding for Bitcoin for over a decade.

Why do markets place such high weight on ecosystem vibrancy when pricing tokens? After all, stocks are typically priced on growth and earnings. Yet, theories on how blockchains create token value remain nascent and lack strong real-world explanatory power. Therefore, assessing crypto networks by activity—users, assets, transactions—is more reasonable.

Specifically, token prices should reflect the future value of the network (just as stock prices reflect a company’s future, not current, value). This leads to Ethereum’s second rationale for modularity: future-proofing its product roadmap to increase the likelihood of long-term dominance.

In 2020, when Vitalik wrote his “Rollup-Centric Roadmap,” Ethereum was still on version 1.0. As the first smart contract blockchain, it clearly needed orders-of-magnitude improvements in scalability, cost, and security. For pioneers, the biggest risk is failing to adapt quickly to new tech shifts and missing the next leap. For Ethereum, this meant transitioning from PoW to PoS and achieving 100x higher scalability. The EF needed to cultivate an ecosystem capable of scaling and delivering breakthroughs—or risk becoming the era’s Yahoo or AOL!

In the Web3 world, where decentralized protocols replace traditional companies, Ethereum believes fostering a strong, modular ecosystem is more valuable long-term than full control over infrastructure—even if it means relinquishing control over infrastructure roadmaps and core service revenues.

Next, we examine the real-world outcomes of this modular decision through data.

Impact of Ethereum’s Modular Ecosystem on ETH

We analyze modularity’s impact on Ethereum across four dimensions:

1. Short-term price (negative impact)

2. Market capitalization (beneficial for some)

3. Market share (strong performance)

4. Future tech roadmap (debatable)

1. Negative Impact: Fees and Price

In the short term, Ethereum’s modular strategy has clearly hurt ETH’s price. Despite a significant rebound from lows, ETH has underperformed BTC, rivals like SOL, and even the Nasdaq Composite at times—largely due to its modular approach.

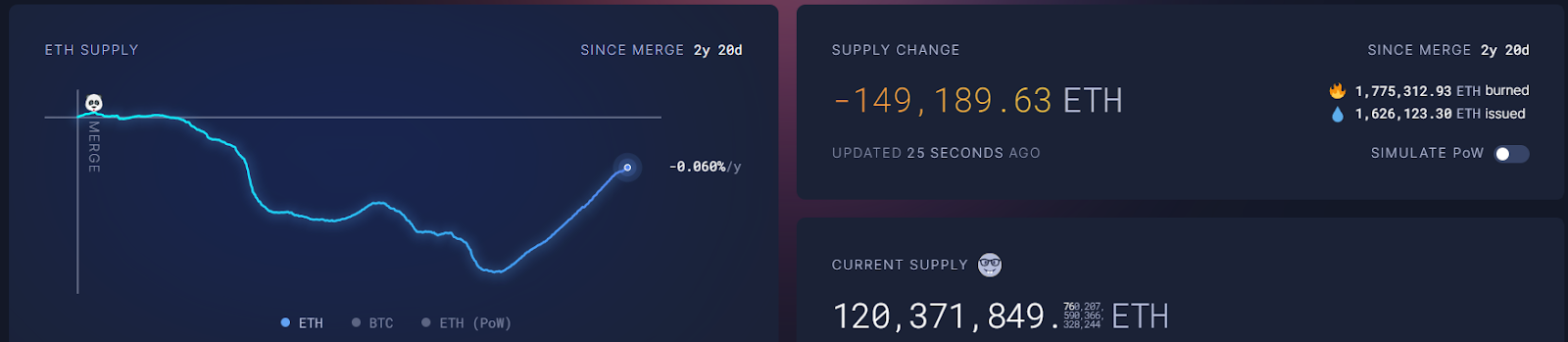

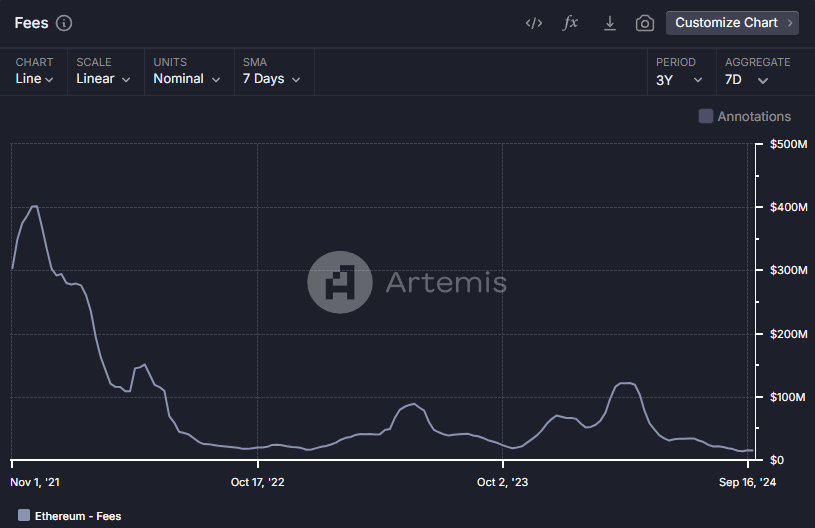

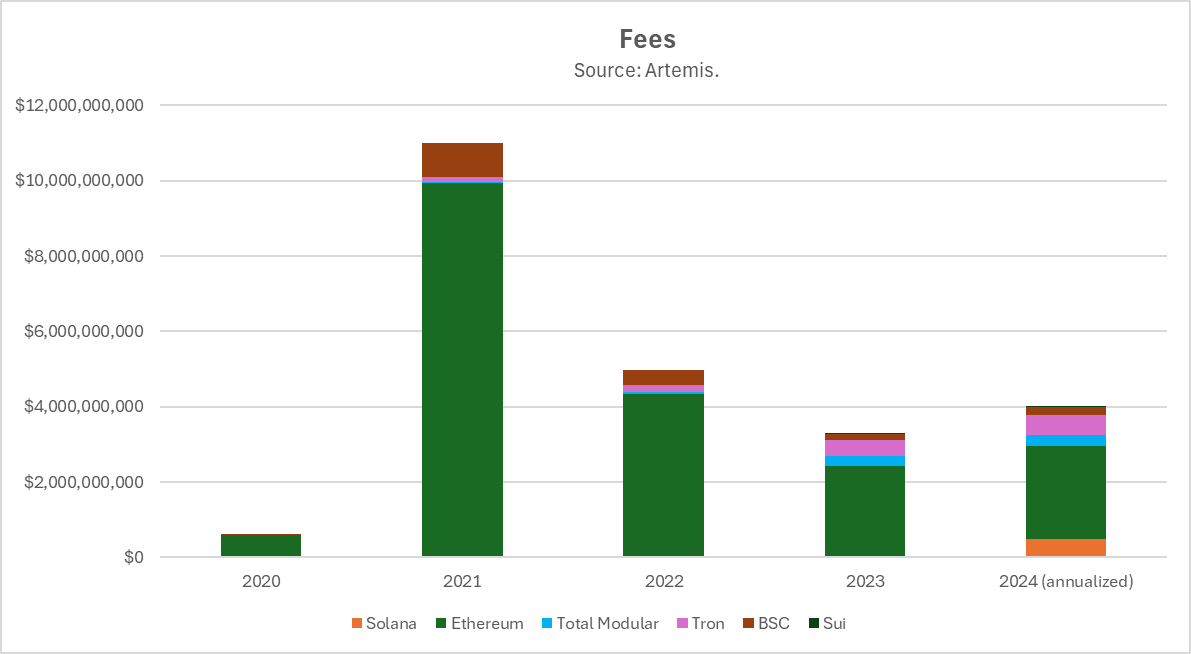

Ethereum’s modular strategy first impacted ETH’s price by reducing fees. In August 2021, Ethereum implemented EIP-1559, burning excess network fees, thereby reducing ETH supply. This resembles stock buybacks and theoretically supports price—working for a time.

However, with the rise of L2 execution layers and alternative data availability layers like Celestia, Ethereum’s fees began declining. By giving up a core revenue stream, Ethereum saw lower fees and income—significantly impacting ETH’s price.

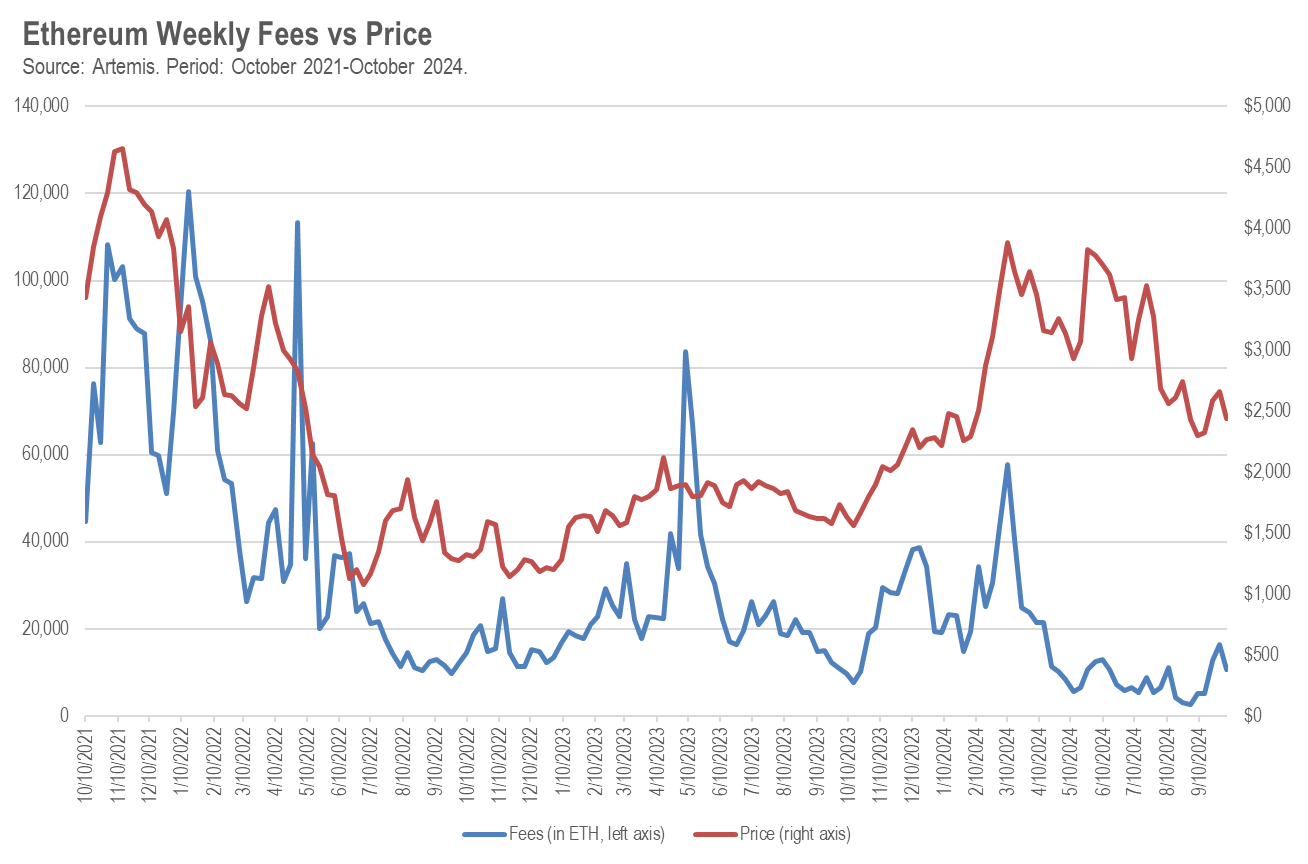

Over the past three years, there’s been a statistically significant correlation (+48%) between Ethereum’s fees (in ETH) and ETH price at a weekly frequency. If Ethereum’s fees drop by 1,000 ETH in a week, ETH’s price tends to fall by $17 on average.

Thus, outsourcing execution to L2s reduces L1 fees, lowering ETH burns and contributing to price declines. At least in the short term, this is bad news for ETH.

But these fees didn’t disappear—they shifted to new blockchain protocols, including L2s and DA layers. This also introduces a second potential negative effect on ETH’s price: most new modular chains have their own tokens. Previously, investors bought one infrastructure token (ETH) to gain exposure to all innovation in the Ethereum ecosystem. Now, they must choose among many (with CoinMarketCap listing 15 in the "modular" category, plus more VC-backed projects in development).

The new class of modular infrastructure tokens may affect ETH’s price in two ways. First, if blockchains were companies, the combined market cap of all “modular tokens” might otherwise belong to ETH. This resembles corporate spin-offs, where the parent company’s market cap typically decreases by an amount similar to the new entity’s value.

For ETH, the situation may be worse. Many crypto traders aren’t sophisticated investors; facing dozens of tokens to access “all innovation on Ethereum,” they may feel overwhelmed and opt out. The psychological burden and transaction costs of buying multiple tokens instead of one may negatively impact both ETH and modular token prices.

2. The Upside (for Some): The Market Cap Story

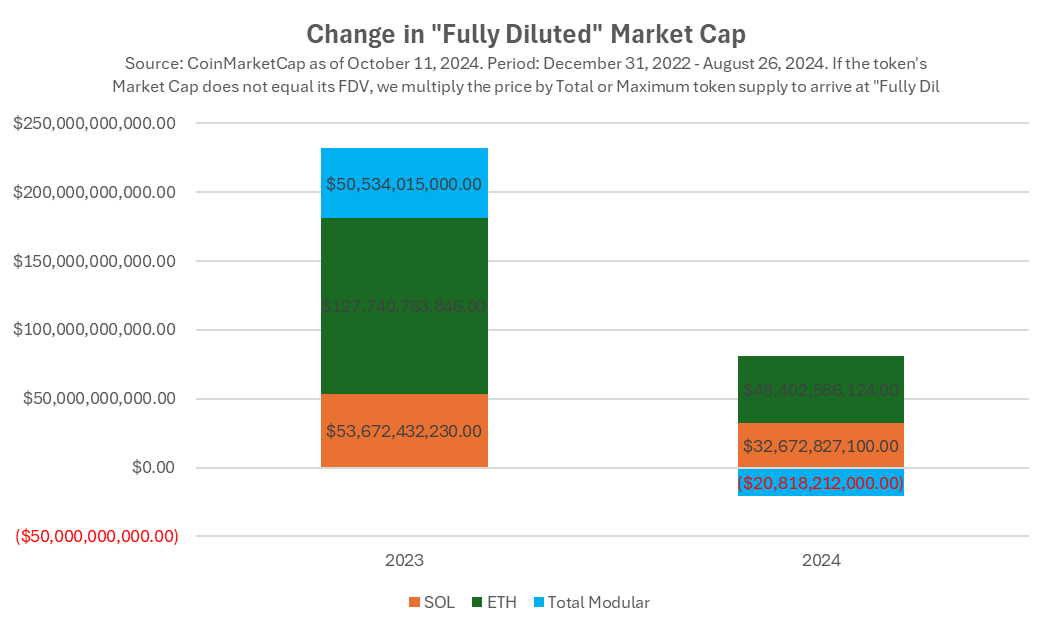

Another way to evaluate Ethereum’s modular strategy is by tracking market cap changes. In 2023, ETH’s market cap grew by $128 billion. Solana’s increased by $54 billion. While ETH’s absolute gain was higher, Solana started from a lower base, so its price rose 919% versus ETH’s 91%.

However, the picture shifts when including all new “modular” tokens emerging from Ethereum’s modular strategy. In 2023, these tokens’ market caps grew by $51 billion—nearly matching Solana’s increase.

What does this mean? One interpretation: the Ethereum Foundation (EF), via its modular shift, created value in the Ethereum-related modular infrastructure ecosystem equivalent to Solana’s entire market cap. Plus, it generated $128 billion in value for itself—an impressive feat! Just imagine Microsoft or Apple spending years and billions building developer ecosystems—how amazed they’d be at Ethereum’s achievement.

Yet, this trend didn’t continue into 2024. SOL and ETH kept growing (though slower), while modular blockchain market caps overall declined. This could signal waning market confidence in Ethereum’s modular strategy in 2024, pressure from token unlocks, or investor fatigue from buying multiple tokens when one (SOL) suffices to invest in Solana’s tech ecosystem.

Let’s move from price action and market sentiment to fundamentals. Perhaps 2024’s market judgment is wrong, and 2023’s was right. Has Ethereum’s modular strategy helped or hindered it in becoming the leading blockchain ecosystem and mainstream cryptocurrency?

3. Strong Performance: Ethereum Ecosystem and ETH Dominance

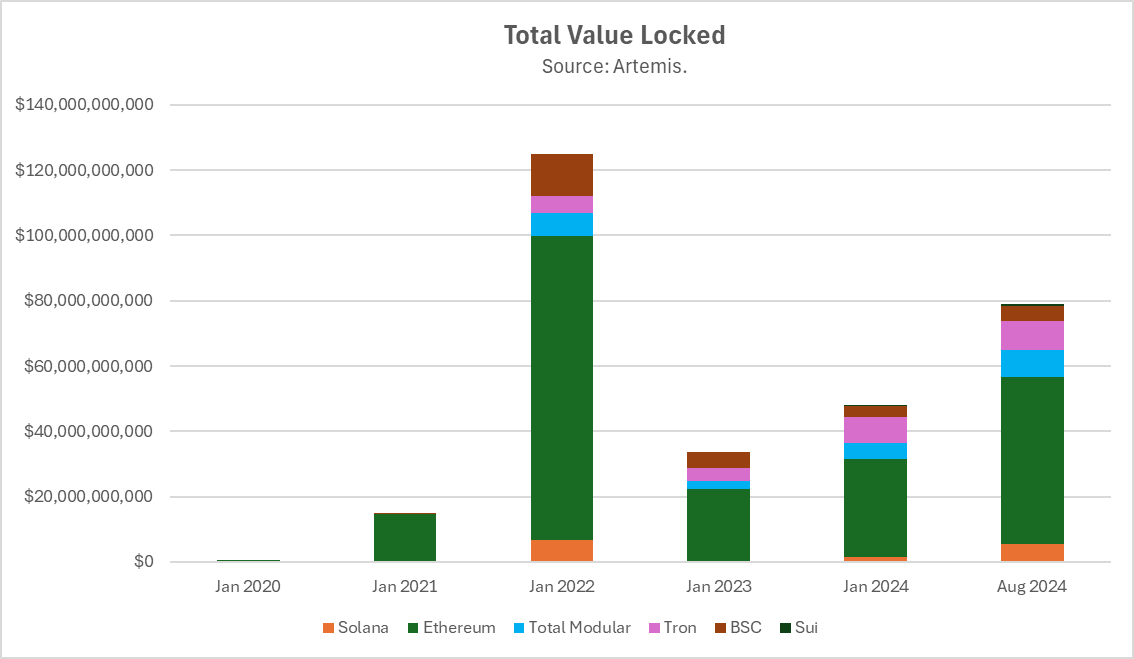

Fundamentally and in terms of usage, Ethereum-related infrastructure performs exceptionally well. Among peers, Ethereum and its L2s hold the highest total value locked (TVL) and fees. Ethereum and its L2s have 11.5x more TVL than Solana; even L2s alone exceed Solana’s TVL by 53%.

In terms of TVL market share:

Since its 2015 launch, Ethereum initially held 100% market share. Despite hundreds of competing L1s, Ethereum and its modular ecosystem still maintain ~75% share. Dropping from 100% to 75% over nine years is outstanding! By contrast,AWS dropped from 100% to ~35% over a similar timeframe.

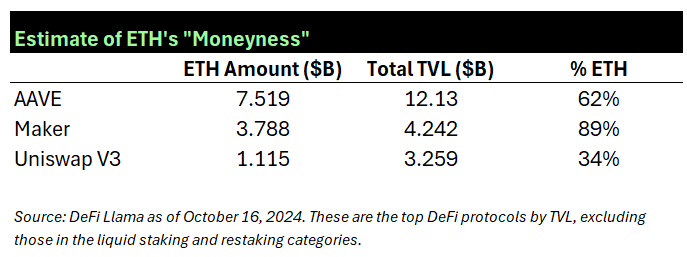

Does ETH truly benefit from the “Ethereum ecosystem’s” dominance? Or are Ethereum and its modular parts thriving without relying on ETH as an asset? In fact, ETH plays a central role in the broader Ethereum ecosystem. As Ethereum scales via L2s, ETH scales too. Most L2s use ETH as gas (network currency), and in most L2 TVLs, ETH holdings exceed other tokens by at least 10x. See the table below for ETH’s dominance in three major DeFi apps across mainnet and L2 instances.

4. Debatable: The Technology Roadmap Story

From a technology roadmap perspective, Ethereum’s decision to modularize its L1 into independent components allows projects to specialize and optimize in their domains. As long as components remain composable, dApp developers can leverage best-in-class infrastructure, ensuring efficiency and scalability.

A larger advantage of modularity is future adaptability. Imagine a game-changing innovation—only protocols adopting it survive. This has happened repeatedly in tech history: AOL’s valuation fell from $200B to $4.5B after missing the shift from dial-up to broadband. Yahoo’s dropped from $125B to $5B after failing to adopt new search algorithms (like Google’s PageRank) and mobile transition.

But if your tech stack is modular, as an L1 you don’t need to chase every innovation wave yourself—your modular partners can do it for you.

Has this strategy worked? Let’s look at actual infrastructure built around Ethereum:

-

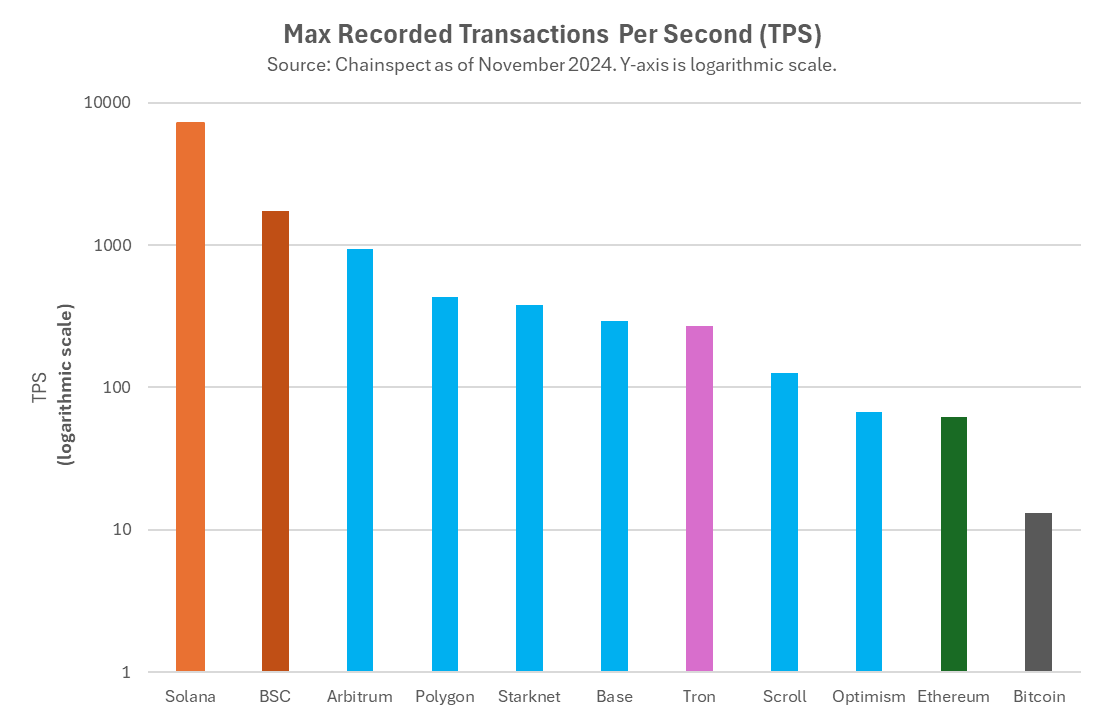

Ethereum’s L2s offer superior scalability and execution cost. Two key innovations succeeded here: optimistic rollups like Arbitrum and Optimism, and zk-based rollups like ZKSync, Scroll, Linea, and StarkNet. Plus, numerous other high-throughput, low-cost L2s. These advancements have brought order-of-magnitude scalability improvements to Ethereum—an achievement few others match. Dozens, even hundreds of L1s launched after Ethereum still haven’t delivered 2.0 versions with 100x scalability and cost improvements. With these L2s, Ethereum survived the blockchain’s “first great extinction event”: increasing TPS by 100x.

-

New blockchain security models. Innovation in blockchain security is critical for survival—just observe how every major L1 transitioned from PoW to PoS. EigenLayer’s “shared security” model may be the next big shift. While other ecosystems have similar shared security protocols (e.g., Bitcoin’s Babylon, Solana’s Solayer), EigenLayer is the pioneer and largest in Ethereum.

-

New virtual machines (VMs) and programming languages. A major criticism of Ethereum is its Ethereum Virtual Machine (EVM) and Solidity language. While relatively easy to code in, Solidity is low-abstraction, error-prone, and hard to audit—one reason Ethereum smart contracts face frequent attacks. For non-modular blockchains, experimenting with new VMs or replacing the original is nearly impossible, but Ethereum is different. A new wave of L2s using alternative VMs lets developers code in other languages, independent of EVM, yet still within Ethereum’s ecosystem. Examples include Movement Labs using the Move VM developed by Meta and promoted by top L1s like Sui and Aptos; zk-VMs like RiscZero and Succinct, and those developed by A16Z’s research team; and teams bringing Rust and Solana’s VM to Ethereum, such as Eclipse.

-

New scalability strategies. Like internet infrastructure or AI, we expect order-of-magnitude scalability leaps every few years. Even now, Solana waits years for Jump Trading’s next major upgrade—Firedancer. Plus, new ultra-scalable technologies are emerging, such as parallel architectures by L1 teams like Monad, Sei, and Pharos. If Solana fails to keep up, these could threaten its survival—but not Ethereum, which can easily integrate such advances via new L2s. This is the strategy new projects like MegaETH and Rise are attempting. These modular infrastructure partners help Ethereum absorb major tech innovations, avoid obsolescence, and co-evolve with competitors.

However, trade-offs exist. As previously noted, modular architectures work well only if components remain composable. As our friend “Composability Kyle” points out, Ethereum’s modular shift increased user experience complexity. Ordinary users find monolithic chains like Solana easier to use, avoiding cross-chain bridging and interoperability issues.

In the Long Run

So, where does this leave us?

-

The modular ecosystem sparked debate. In 2023, market expectations for Ethereum-related modular infrastructure tokens matched Solana’s growth; in 2024, that changed.

-

At least in the short term, the modular strategy has negatively impacted ETH’s price, mainly due to lower fees and burns.

-

Viewed as a business strategy, modularity makes sense. Over nine years, Ethereum’s market share declined from 100% to 75%, while AWS in Web2 dropped from 100% to ~35% in a similar period. In the world of decentralized protocols, ecosystem size and token dominance matter more than fees—good news for Ethereum.

-

In the long run, Ethereum’s modular strategy and its efforts to future-proof against becoming crypto’s AOL or Yahoo! are performing well. Through L2s, Ethereum has already survived the first “great extinction” for L1 blockchains.

Still, trade-offs remain. Post-modularity, Ethereum sacrifices some composability compared to monolithic chains, affecting user experience.

It remains unclear when the benefits of modularity will outweigh the fee reductions and competition from modular infrastructure tokens for ETH’s price. For early investors and teams in these new modular tokens, capturing value from Ethereum’s market cap is beneficial—but the launch of these tokens at unicorn valuations suggests economic gains are unevenly distributed.*

In the long run, Ethereum may emerge stronger due to its investment in broader ecosystem development. Unlike AWS losing partial market share in cloud computing, or Yahoo! and AOL nearly collapsing in internet platforms, Ethereum is positioning itself to adapt, scale, and succeed in the next wave of blockchain innovation. In an industry where success hinges on network effects, Ethereum’s modular strategy may be key to maintaining its dominance among smart contract platforms.

Acknowledgments

Special thanks to Kyle Samani (Multicoin), Steven Goldfeder (Arbitrum), Smokey (Berachain), Rushi Manche (Movement Labs), Vijay Chetty (Eclipse), Sean Brown, and Chris Maree (Hack VC) for reviewing drafts, arguments, and data in this article.

Footnotes

*We must disclose potential bias: our venture firm Hack VC is an early investor in many Ethereum-related modular infrastructure tokens mentioned earlier. Thus, in some cases, we are among those benefiting from Ethereum’s market cap—a dynamic that may be unfavorable to ETH holders in the short term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News