With over 480,000 ETH staked, what makes mETH stand out?

TechFlow Selected TechFlow Selected

With over 480,000 ETH staked, what makes mETH stand out?

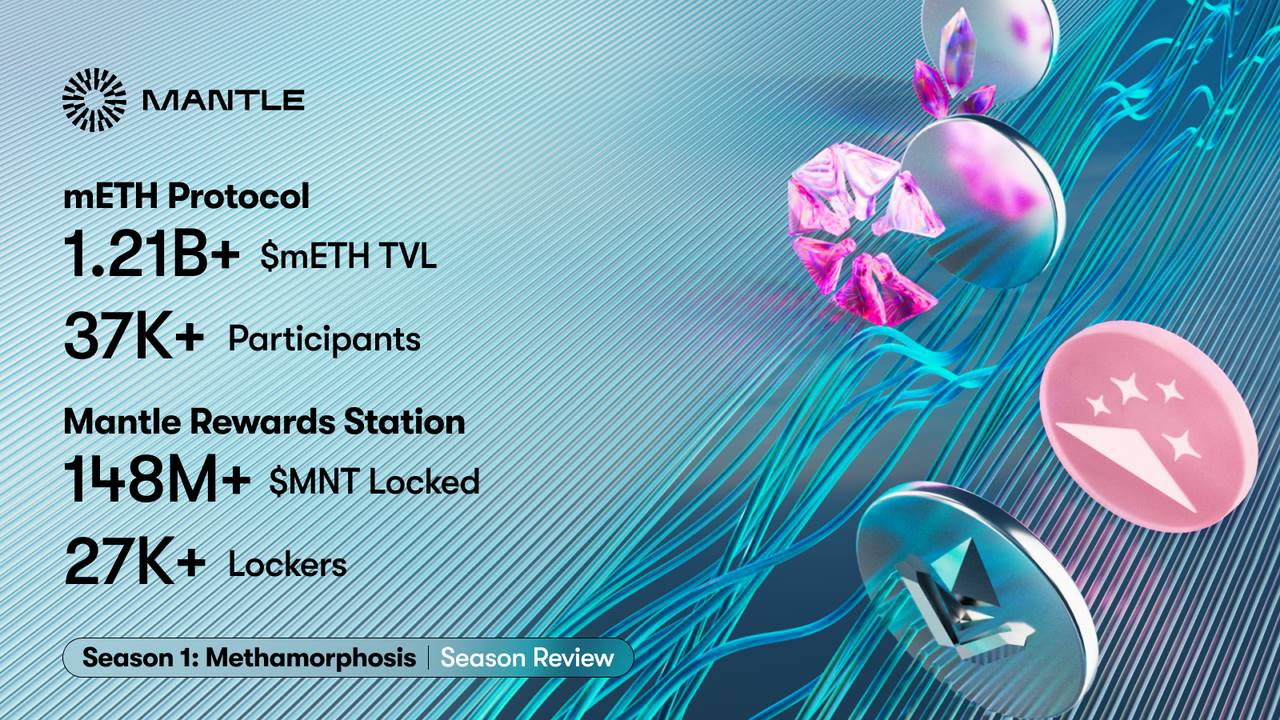

Currently, over 480,000 ETH are staked on mETH, with TVL rising to $1.189 billion.

By: 1912212.eth, Foresight News

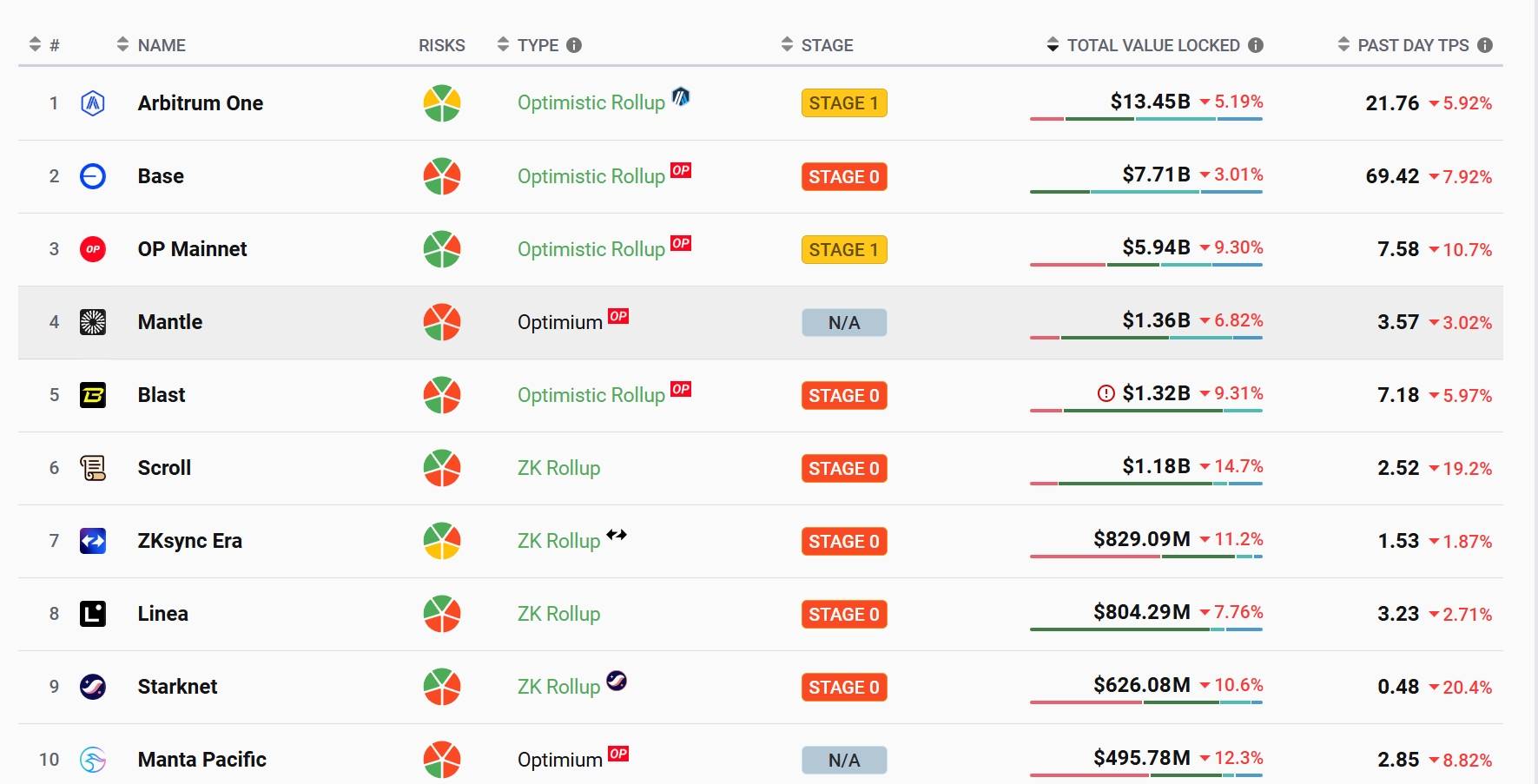

Three years ago, Dragonfly partner Haseeb Qureshi expressed both excitement and concern about Rollups, wondering whether they would launch too early and go unnoticed. At that time, chains like Polygon and BNB Chain were at their peak, drawing massive attention. Meanwhile, today’s leading L2 mainnets hadn’t even launched yet. Who could have imagined that within just two years, the L2 landscape would explode into a vibrant, fiercely competitive arena?

If emerging Layer 1 blockchains can be counted on one hand, the number of current L2 solutions is now far beyond what a few hands could tally. Although launching a new L2 has become relatively inexpensive, very few have managed to capture significant market attention or recognition.

While technical differentiation in the sector remains largely confined to OP vs. ZK rollups, what truly sets projects apart are ecosystem development, user experience, and liquidity incentives.

Currently, aside from the top-tier leading L2s, most others don’t differ significantly in terms of TVL. Minor differentiators have proven underwhelming, leading to several pressing issues.

First is fragmented liquidity. As the number of L2s grows, assets circulating across these layers become increasingly scattered. Transferring assets between L2s is often time-consuming and cumbersome, negatively impacting user experience. This is precisely why some capital continues to favor high-performance Layer 1 chains.

Second is the general lack of wealth effects. Unlike Solana, which has seen meme-driven surges, most L2 ecosystems haven’t sparked similar frenzies. Even when applications build on L2 infrastructure, the appeal falls short compared to the draw of strong wealth-generation narratives. Coupled with weak token price performance, this diminishes the attractiveness of L2s for average users.

Therefore, solving liquidity fragmentation and expanding yield opportunities for users’ assets have become critical paths for many L2s to break through.

mETH Protocol Overview

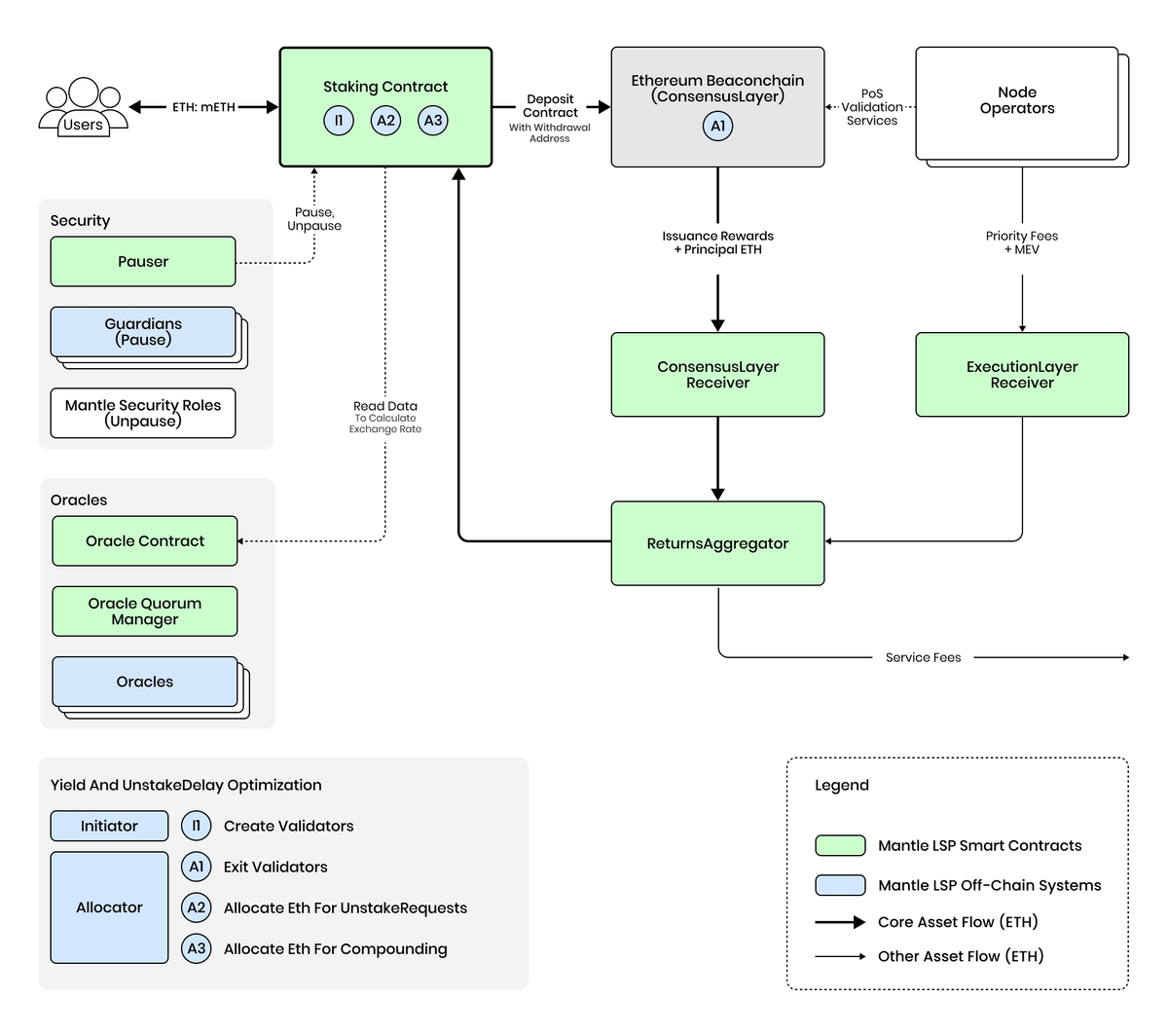

mETH is a permissionless, non-custodial liquid staking protocol for ETH on Ethereum. At the end of 2023, Mantle identified an opportunity in liquid staking and launched Mantle LSP. In August this year, the brand was upgraded and rebranded as mETH Protocol. The name "mETH" stands for Mantle-staked ether, offering a more concise and brand-appropriate identity.

For every ETH staked, users receive an mETH receipt token. Upon unstaking, they retrieve their original ETH plus staking rewards.

While Lido, the dominant player in liquid staking, continues to lead the ETH staking market, competition among subsequent protocols remains fierce and rankings frequently shift. Data shows that over 480,000 ETH are currently staked via mETH, with TVL rising to $1.189 billion.

This amount exceeds Coinbase’s staked ETH volume by more than double. Considering that the second-largest entity is Binance, and the third is a well-established staking pioneer, mETH’s achievement stands out remarkably.

In its official documentation, mETH aims to become the most widely adopted and capital-efficient staked ETH token. So far, numerous brand partnerships and integrations have played a crucial role in expanding mETH’s reach and capturing market share from competitors.

In terms of risk management, mETH's core smart contracts and off-chain services are non-custodial, minimizing associated risks. Additionally, it follows design principles introduced after Ethereum’s Shanghai upgrade, prioritizing ETH integrity. The mETH token on L1 avoids adding complexity from other PoS tokens or chains, facilitating smoother integration with future systems.

Amid shifting market dynamics, restaking—led by EigenLayer—has reignited an arms race among liquid staking protocols. Protocols such as Swell, Renzo, and eth.fi have surged forward, reshaping the landscape.

Given this trend, mETH’s entry into the restaking space is a natural progression.

Restaking: cmETH

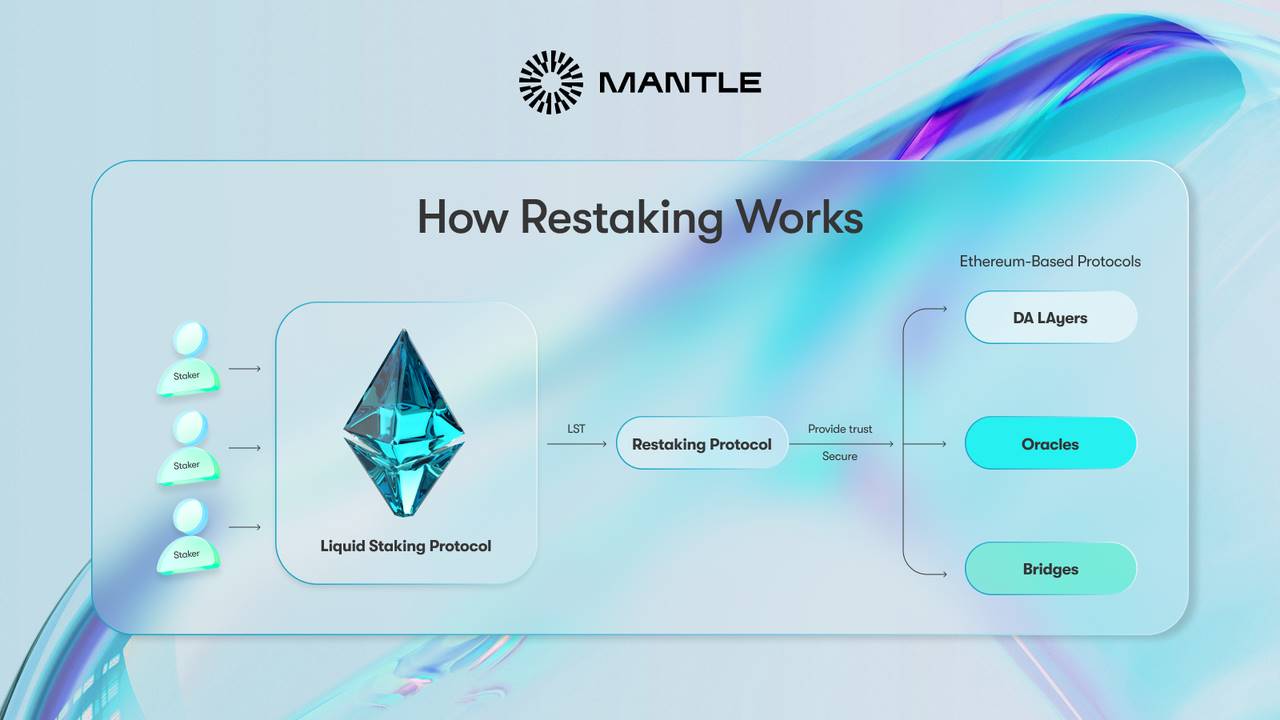

Restaking allows staked assets from PoS chains to be reused to secure other Ethereum-based protocols. This enables DApps to leverage Ethereum’s PoS security instead of building their own staking mechanisms, thereby extending the utility of staked ETH beyond its primary network security function.

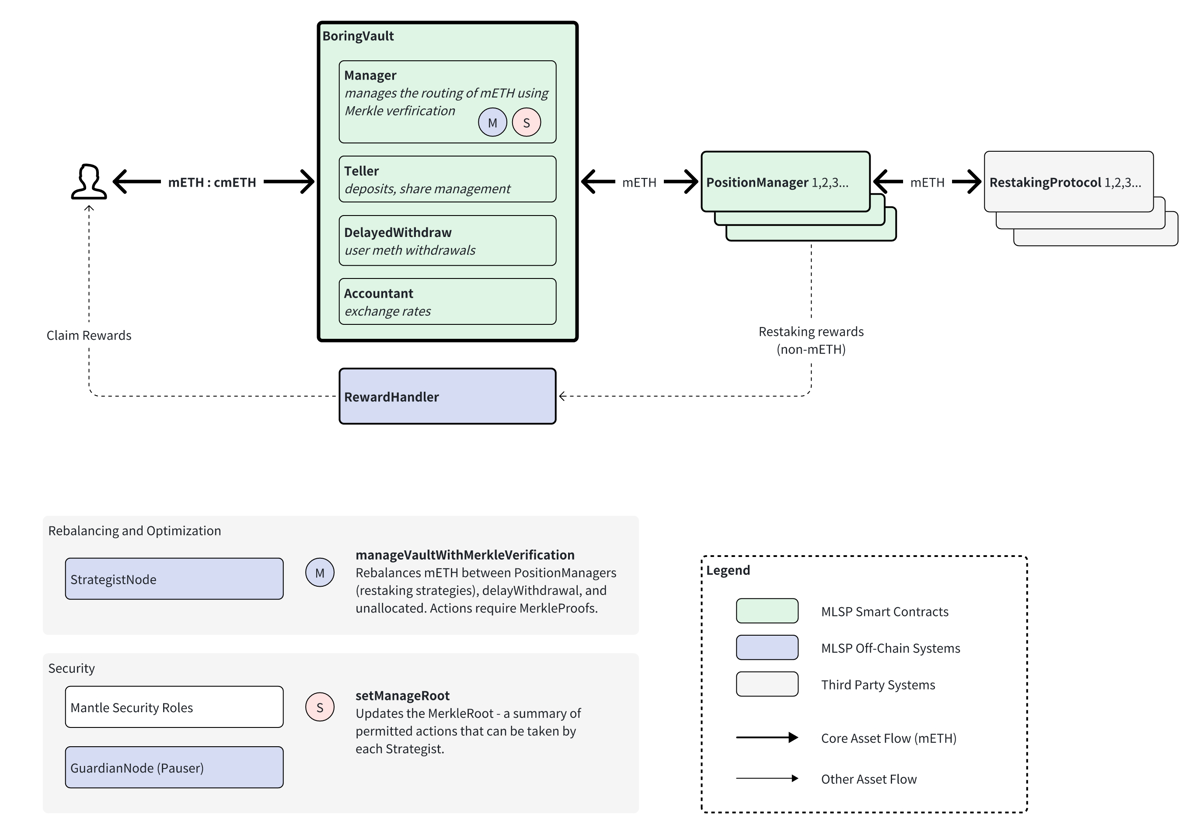

The mETH protocol allows users to benefit from capital efficiency, convenience, and diverse use cases within the Mantle ecosystem. However, during DeFi staking, funds are typically locked, reducing capital efficiency. Restaking helps maximize this efficiency. Following mETH, the restaking derivative cmETH has naturally emerged.

Users deposit their LSTs into the restaking protocol, with security ensured by oracles, cross-chain bridges, and data availability (DA) layers. A portion of the staking rewards and generated income flows back to cmETH holders.

Advantages of Liquid Assets

Capital efficiency is paramount in crypto markets. Beyond the base ~3.43% annual yield from staking ETH, the mETH receipt token itself carries native yield-generating capabilities. Don’t underestimate this feature—when an asset inherently earns yield, ETH bridged to its L2 automatically accrues interest, strongly appealing to yield-sensitive capital.

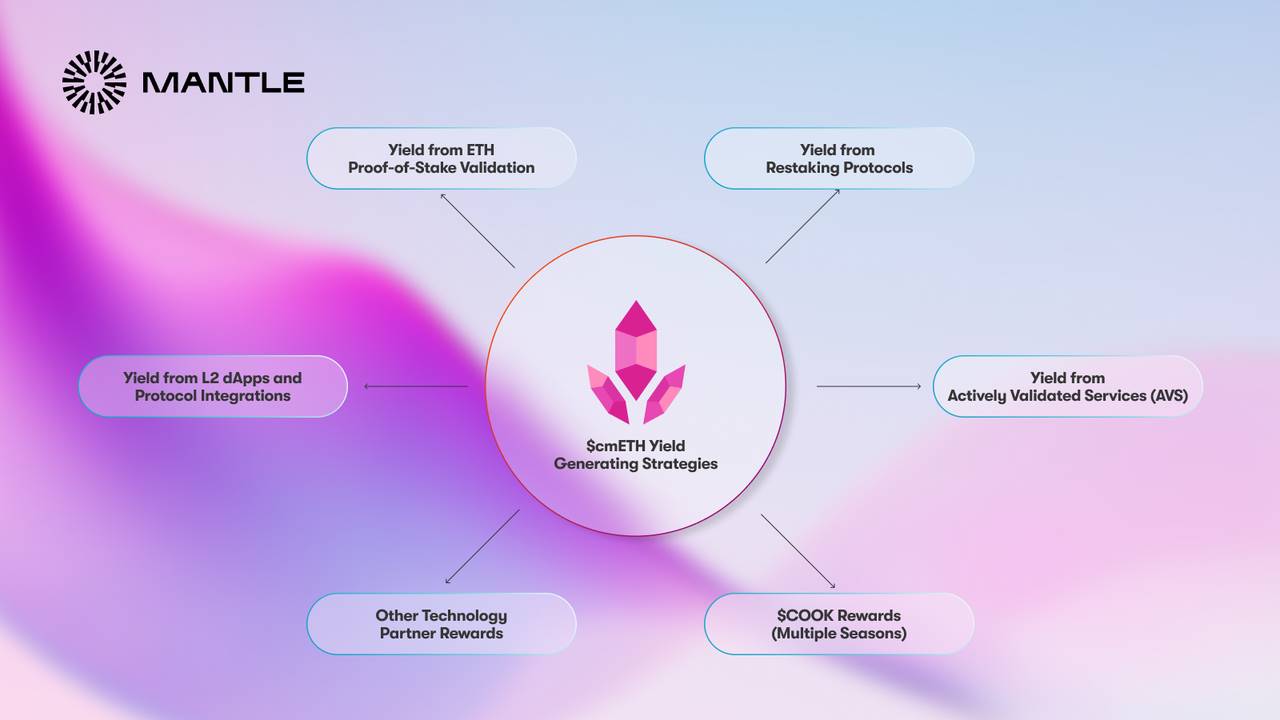

Beyond this, cmETH has aggressively expanded through partnerships with other restaking protocols such as EigenLayer, Symbiotic, and Karak, enabling cmETH holders to earn points and additional yields.

cmETH demonstrates strong composability within the Mantle ecosystem. Holders benefit not only from ETH Proof-of-Stake validator rewards (provided by underlying mETH), but also from AVS (Actively Validated Services) rewards, COOK token incentives, and integrated yields from other L2 dApps. Its on-chain advantages are clear.

However, protocol integration isn't limited to on-chain efforts—off-chain collaborations, especially with centralized exchanges, are equally vital. After all, on-chain users aren't the majority; many prefer keeping funds on exchanges due to liquidity and convenience.

Bybit has enabled staking for mETH and listed the token. According to CCData, Bybit’s spot market share rose to third globally by the end of September. CryptoRank data also shows that Bybit ranks second worldwide in exchange app downloads with 4.5 million, trailing only Binance. Such major exchange exposure significantly boosts mETH’s visibility.

Notably, mETH is also supported as margin collateral on Bybit. Margin plays a key role in risk control, market liquidity, and credit assurance. For large-scale traders and trading teams, having mETH accepted as margin greatly expands its utility. This makes hesitant teams more willing to park capital in mETH. In turn, as more funds flow in, mETH’s liquidity increases, creating a positive feedback loop.

Market trends shift rapidly, and only those protocols that stay aligned with evolving interests can amplify their influence. Where will the next wave emerge? Likely where market momentum already points. Looking ahead, mETH plans to collaborate with highly anticipated networks like Berachain and Fuel to further strengthen liquidity integration.

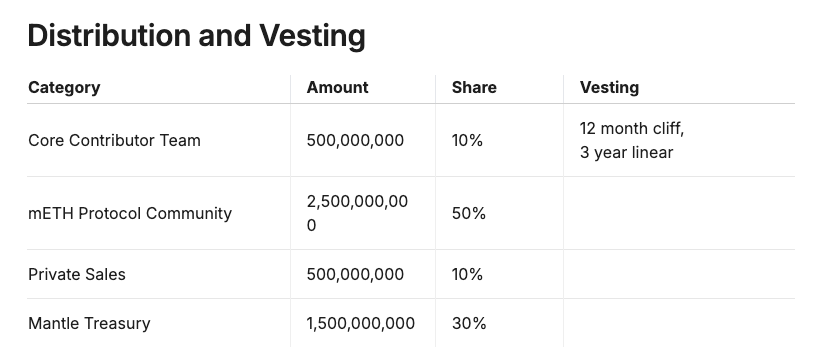

COOK Tokenomics

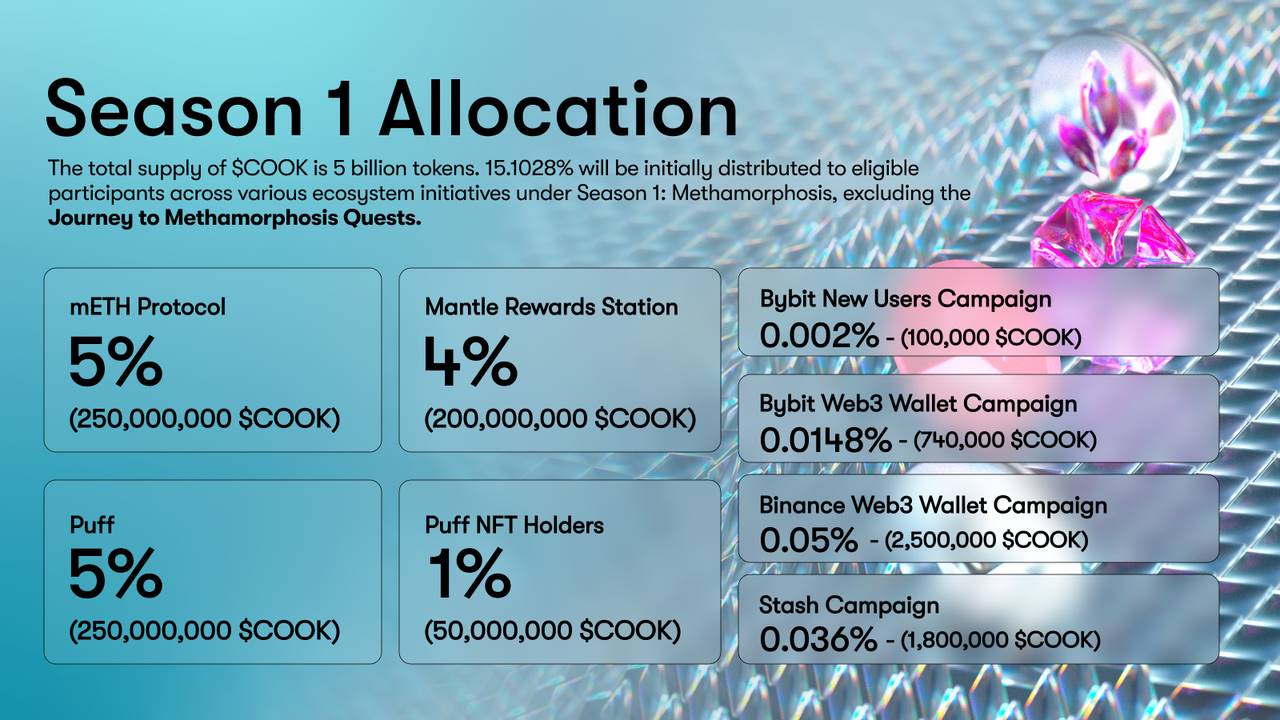

COOK is the new governance token for the mETH ecosystem. It is primarily used for voting on ecosystem direction and strategic decisions. The total supply is 5 billion tokens, with 15.1028% allocated to eligible participants in Q1 ecosystem activities.

Within this allocation: 5% goes to mETH users, 4% to the Mantle Rewards Hub, 5% to the Puff Protocol, 1% to Puff NFT holders, and the remainder to joint campaign rewards.

At a time when VC allocations are increasingly criticized, few projects are willing to adjust their token distribution models. Retail investors are frustrated by large VC allocations leading to constant selling pressure and losses. Fairness—true fairness—is essential. Projects that allow community members to participate in wealth creation will gain growing support.

Looking at COOK’s overall token distribution, both the core team and private investors each receive only 10%. Combined, community and protocol treasury allocations reach 60%, clearly responding to market demands and embedding fairness into the token design from day one.

Compare EigenLayer, the leader in restaking, which currently has a market cap around $600 million and a fully diluted valuation (FDV) of approximately $5.6 billion. mETH’s current TVL is nearly $1.3 billion, while EigenLayer’s stands at $11.15 billion—over eight times higher. If valuations were strictly proportional to TVL, COOK’s estimated FDV could be around $700 million upon launch.

COOK is expected to launch this month, though specific details may change.

From July 1 to early October, during the “mETHamorphosis” campaign, performance metrics were impressive. mETH holders earned points on Mantle by staking, interacting with ecosystem protocols, and providing liquidity. These points are ultimately redeemable for COOK tokens.

With Q1 concluded, details of the upcoming Q2 campaign will be revealed soon.

Conclusion

After months of FUD surrounding Ethereum, market capital is beginning to return. Many restaking protocols launched tokens amid bearish conditions, causing restaking enthusiasm to cool for an extended period. With anticipated Federal Reserve rate cuts, DeFi is likely to attract more yield-seeking capital and increased liquidity. How the restaking sector—and COOK—will perform going forward is worth watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News