Horizontal Expansion, Narrative Upgrade: Can mETH, with LRT Integration, Become the Liquidity Hub of the Crypto World?

TechFlow Selected TechFlow Selected

Horizontal Expansion, Narrative Upgrade: Can mETH, with LRT Integration, Become the Liquidity Hub of the Crypto World?

This article aims to dive into mETH and explore the current staking (re-staking) landscape as well as the competition among L2s.

Author: TechFlow

Staking (and restaking) has been a key narrative in this market cycle. However, unlike the exuberance seen at the beginning of the year, recent stagnation in on-chain data growth has led many to realize that staking and restaking may now be entering a paradoxical and challenging phase:

On one hand, staking (and restaking) aims to unlock liquidity, enabling more efficient asset circulation and participation in diverse yield opportunities;

On the other hand, increasingly low barriers to launching new chains have brought a surge of new L1s, intensifying the competition among chains for liquidity—resulting in fragmented liquidity and restricted user access.

Faced with these challenges, how can we break through?

Tracing back to the root: assets are the ultimate anchor of liquidity. Therefore, compared to improving interoperability, focusing directly on assets appears to be a more intuitive and effective solution.

So, is there a possibility: to build an asset that combines usability, practicality, and universality—one that not only horizontally connects major L1s and L2s, but also vertically integrates native assets, staking, and restaking, even bridging DeFi and TradFi, ultimately becoming a true cross-domain liquidity hub?

This is undoubtedly an ambitious vision, requiring both robust technical infrastructure and a thriving ecosystem. For a long time, the community has speculated about which of the current ecosystem leaders might emerge as frontrunners.

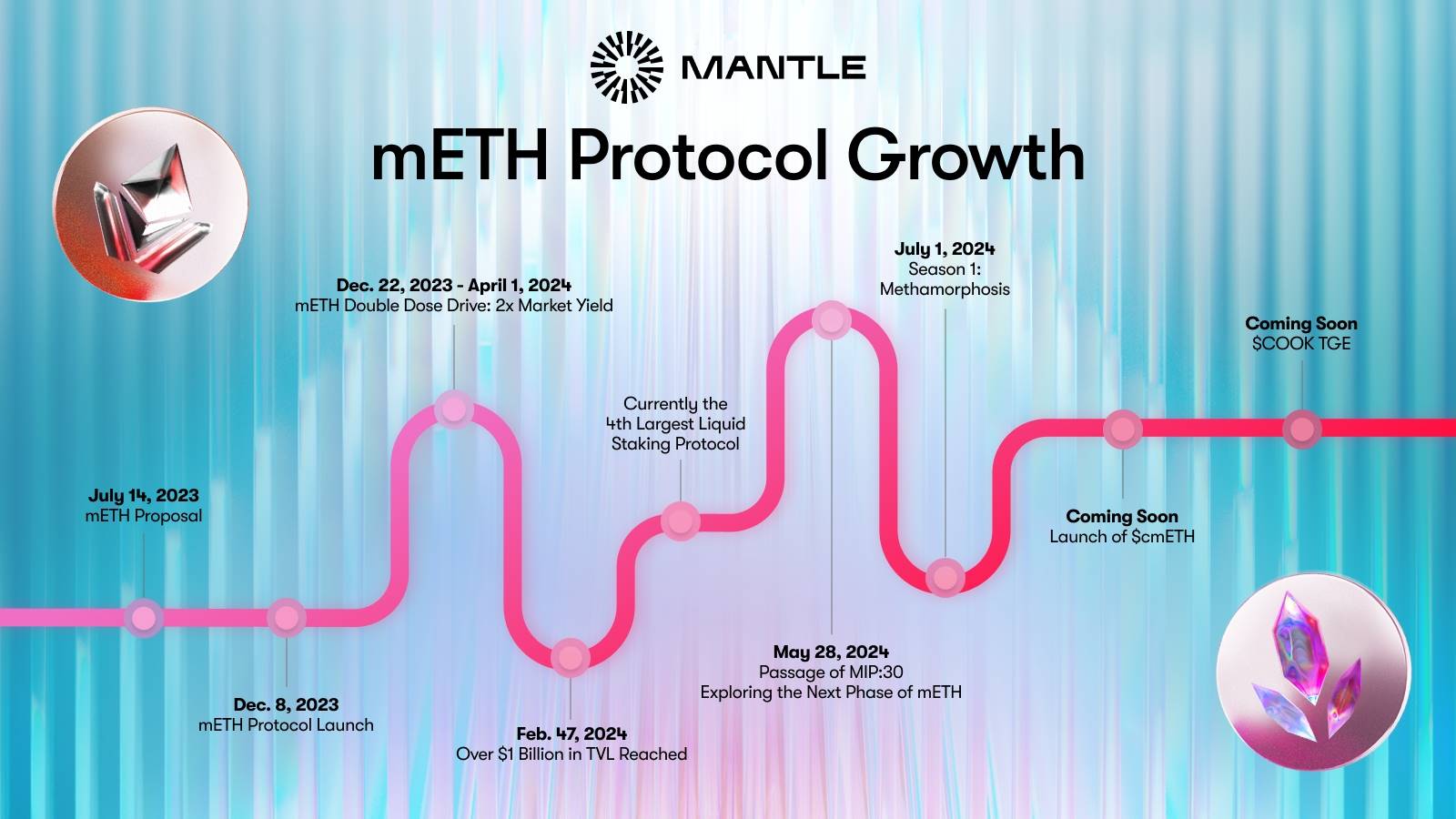

With Bybit officially launching cmETH on October 23, attention has turned to the Mantle ecosystem: As Mantle’s native LSD protocol, mETH has experienced rapid growth since its launch on December 4, 2023, reaching a TVL of $1.28 billion, making it the fourth-largest Ethereum LSD product.

The ongoing upgrade from mETH to cmETH, the upcoming TGE of the COOK token (governance token for mETH and cmETH), and deep integrations with chains like Berachain and Fuel have further given the community a concrete candidate for realizing this grand vision in practice.

This article dives into mETH, exploring its operational mechanics, core ecosystem advantages, and strong growth prospects driven by multiple upcoming milestones—offering insights into the current state of the staking (restaking) landscape and the competitive dynamics among L2s.

Image source: Twitter @mETHProtocol

Origins: In the LSD Battlefield, Native Yield-Generating mETH Achieves Exponential Growth

In simple terms, mETH is a permissionless, non-custodial ETH liquid staking protocol allowing users to stake ETH and receive mETH. As the second core product in the Mantle ecosystem, it was initially known as “Mantle LSP,” but in August 2024, the Mantle ecosystem rebranded it as mETH to emphasize its focus on assets.

Looking back to June 2023 when mETH was first conceived, Ethereum had already transitioned from PoW to PoS. Lido Finance had firmly established dominance with $13 billion in TVL, followed closely by other strong players like Rocket Pool (rETH). The LSD space was fiercely competitive—clearly placing mETH, then just starting discussions on the Mantle governance forum, at a disadvantage in terms of first-mover advantage.

However, built on extensive community governance and solid technical preparation, the ETH liquid staking protocol (then called Mantle LSP) launched publicly on December 4, 2023—and defied expectations by carving out a path of explosive growth, earning its title as the undisputed "monster rookie" in the LSD sector at the time:

According to DeFi Llama, Mantle LSP reached over $100 million in TVL within just one week of launch. It continued its meteoric rise, peaking at $2.1 billion in TVL in March this year, and currently holds $1.34 billion in TVL—making it the fourth-largest LSD on Ethereum. Additionally, official data shows mETH has over 8,000 wallets on Ethereum and 26,000 on Mantle, demonstrating strong user engagement and activity.

Image source: DeFi Llama

Markets do not favor commoditized products without reason. From a foundational design perspective, mETH’s success clearly sets it apart from other LSD offerings.

Let’s briefly examine how mETH works:

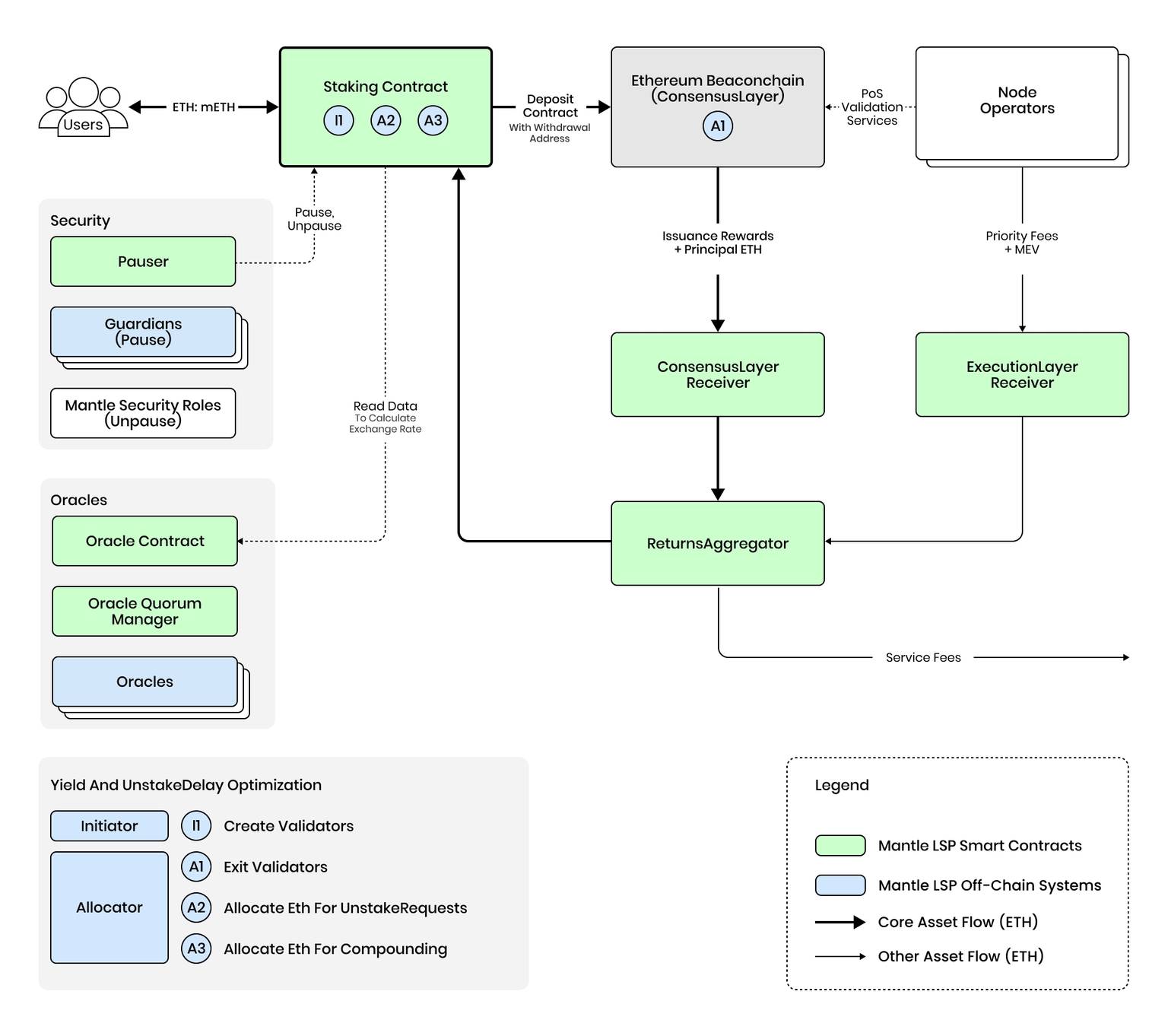

Users send ETH to a staking contract to receive mETH. This contract handles initiating stakes, unstaking, and compounding reinvestment.

Oracle contracts and oracles provide essential external data, while the Oracle Quorum Manager ensures consensus among oracles before data is used.

Node operators perform ETH staking on Ethereum and provide validation services for the network.

mETH offers diverse revenue streams—including issuance rewards, staking rewards, MEV, and priority fees—all collected via Consensus Layer Receiver and Execution Layer Receiver into a Returns Aggregator, then distributed to mETH holders after service fees.

Image source: https://docs.mantle.xyz/meth

mETH leverages advanced designs introduced by Ethereum’s Shanghai upgrade. Post-upgrade, staking derivatives (LSTs) can be directly redeemed back into ETH, stabilizing their peg and reinforcing mETH’s status as a high-quality asset comparable to ETH. Combined with improvements in smart contract functionality and base-layer security, this enhances both efficiency and safety.

As the first L2 ETH with native yield-generating properties, this inherent income-bearing feature is key to mETH’s differentiation in the LSD race: Through a permissionless ERC-20 receipt token design, mETH automatically accumulates yield within the token itself. This natural yield-bearing property not only increases capital efficiency and holding returns but also makes mETH easily adoptable by applications, enabling deeper integration across a broader range of ecosystem scenarios.

Security is the foundation of any DeFi protocol, so mETH must be built on a robust security framework. Its strong security foundation stems partly from being permissionless and non-custodial, ensuring users retain full control over their assets throughout participation. ETH stakes remain within protocol-defined smart contract addresses, with core contracts enforcing strict boundaries and risk limits.

The other part comes from meticulous security module design: The Pauser can suspend the protocol during anomalies; the Guardian can proactively pause contracts; and the Mantle Security Role resumes operations once issues are resolved. These three roles work together to safeguard the protocol.

These foundational design advantages are the necessary prerequisites and technical bedrock for mETH’s explosive growth. But digging deeper into its impressive performance, it's the powerful ecosystem empowerment through horizontal and vertical expansion that serves as the main engine behind its momentum.

Ecosystem Empowerment: How Is mETH Expanding Horizontally and Vertically to Become a 'Universal Liquidity Hub'?

Visiting the mETH website, one phrase immediately stands out:

mETH aims to become the most widely adopted and capital-efficient ETH staking token.

mETH aims to become the most widely adopted and capital-efficient ETH staking token.

This is a concise expression of mETH’s vision—and effectively charts its strategic direction.

After all, achieving both widest adoption and highest capital efficiency requires a rich and mature ecosystem.

As the second core product in the Mantle ecosystem, mETH enjoys a natural advantage in deep integration with Mantle, especially in the DeFi space.

According to L2 beat data, Mantle currently has $1.45 billion in TVL. As a top-four L2, its ecosystem has grown significantly over time, with DeFi forming the cornerstone—evident on DeFi Llama, where the top three projects by TVL in the Mantle ecosystem—Agni Finance, INIT Capital, and Merchant Moe—are all DeFi protocols.

Through deep integration with Mantle’s DeFi ecosystem, mETH plays a central role as a liquidity hub: Exploring mETH’s ecosystem page reveals partnerships with 38 projects spanning restaking, lending, DEXs, and MEMEs—including major restaking protocols like Eigenlayer, Symbiotic, Karak, and well-known names such as Zircuit, INIT Capital, and Pendle.

Notably, in early October, Mantle successfully distributed EIGEN rewards to eligible mETH holders in two phases, totaling 2,098,636.67 tokens.

Mantle’s rich and mature ecosystem not only provides mETH with more liquidity use cases and diversified yield opportunities but also strengthens demand for mETH. This healthy, self-reinforcing cycle further drives sustained growth and prosperity.

Image source: https://meth.mantle.xyz/explore

Another critical competitive edge comes from the powerful backing of the Mantle Treasury:

At its peak, the Mantle Treasury was the largest project treasury in crypto, valued at over $5 billion. It strategically holds mETH as a key reserve asset:

Image source: https://www.mantle.xyz/

The Mantle Treasury’s strategic support for mETH optimizes reward distribution, delivering higher yields to mETH holders, while also enhancing protocol liquidity and improving trading experiences.

Going forward, as the Mantle Treasury continues fulfilling its commitment to supporting mETH’s sustainable development, mETH will maintain strong competitiveness in the market.

Beyond DeFi, mETH’s strategy in CeFi deserves special mention:

mETH has formed a deep partnership with Bybit, allowing users to directly stake ETH into mETH on Bybit. Holding mETH on Bybit earns chain-linked points and qualifies it as collateral for trading.

As a leading centralized exchange, Bybit’s support gives mETH a regulatory head start and opens up compelling CeFi narratives. Bybit’s vast user base and extensive project resources accelerate mETH’s journey toward “widest adoption,” bringing in new users and unlocking future collaboration opportunities.

Image source: Bybit Announcement

Of course, thanks to its native yield-bearing nature, beyond the Mantle ecosystem, mETH can seamlessly integrate into broader on-chain and off-chain applications:

In the future, mETH plans to partner with emerging L1s/L2s such as Avail, Fuel, and Berachain, serving as initial LP assets to deepen on-chain demand. By using assets as leverage to make mETH a cross-chain “universal asset” that aggregates fragmented liquidity, mETH moves closer to becoming a universal “cross-domain liquidity hub,” offering users more efficient capital management and asset allocation solutions.

Notably, the rise of RWA in the Mantle ecosystem is expanding mETH’s reach into TradFi:

Previously, Mantle partnered deeply with Ondo Finance, leading to widespread adoption of USDY across the Mantle ecosystem (including Agni Finance and FusionX Finance), creating opportunities for mETH to combine with RWA assets. This enables deeper integration between mETH and traditional financial institutions and capital, helping break down barriers between crypto and TradFi and fostering innovative financial products and services.

Thus, mETH’s horizontal expansion—from Mantle to multi-chain, from DeFi to CeFi, from crypto-native to TradFi—is steadily materializing. And with the arrival of cmETH, its vertical integration—from staking to restaking—is quietly beginning.

Second Growth Curve: mETH’s Next Step ➡️ cmETH

For both mETH and the community, the biggest milestone in Q4 2024 is undoubtedly the COOK token TGE launched on October 23.

Image source: Twitter @mETHProtocol

In June 2024, the approval of governance proposal MIP-30 marked cmETH as the new Liquid Restaking Token (LRT), signaling mETH’s official evolution from LSD to LSD + LRT.

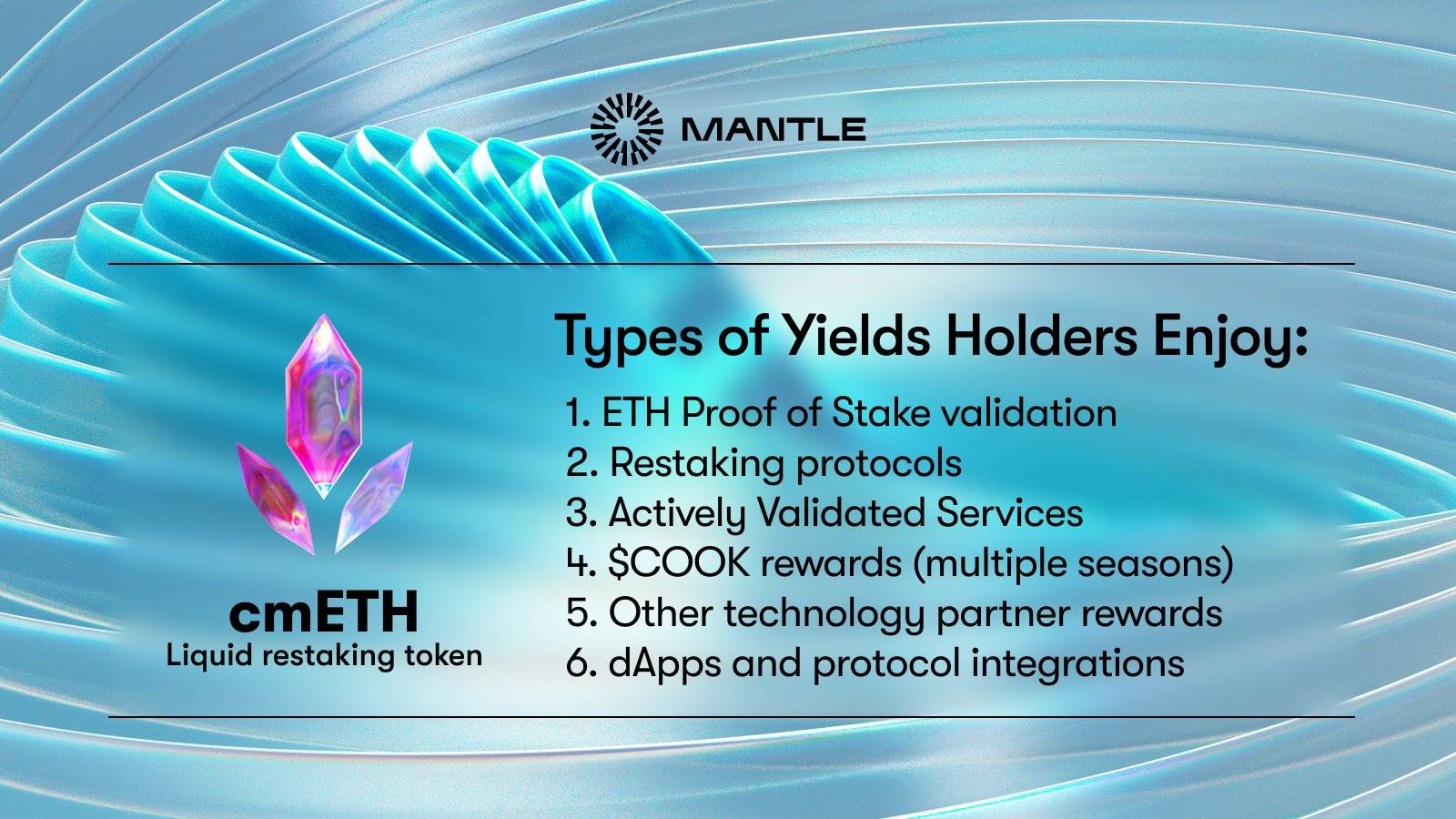

Specifically: mETH is a liquid staking token—users stake ETH to get mETH; cmETH is a liquid restaking token—users stake mETH to get cmETH.

Like mETH, cmETH will be highly composable within the Mantle ecosystem (including EigenLayer, Symbiotic, Karak, Zircuit, etc.), allowing users to retain mETH’s benefits while exploring additional yield opportunities through L2s and decentralized apps and protocols.

The cmETH upgrade introduces restaking functionality and adds even more yield opportunities to mETH’s already diverse income structure. Currently, participating in cmETH offers six layers of yield:

-

ETH staking rewards

-

Restaking protocol rewards (with diverse options including Eigenlayer, Symbiotic, Karak)

-

AVS rewards

-

COOK token rewards

-

Other partner rewards

-

dApp and protocol integrations

Image source: Twitter @mETHProtocol

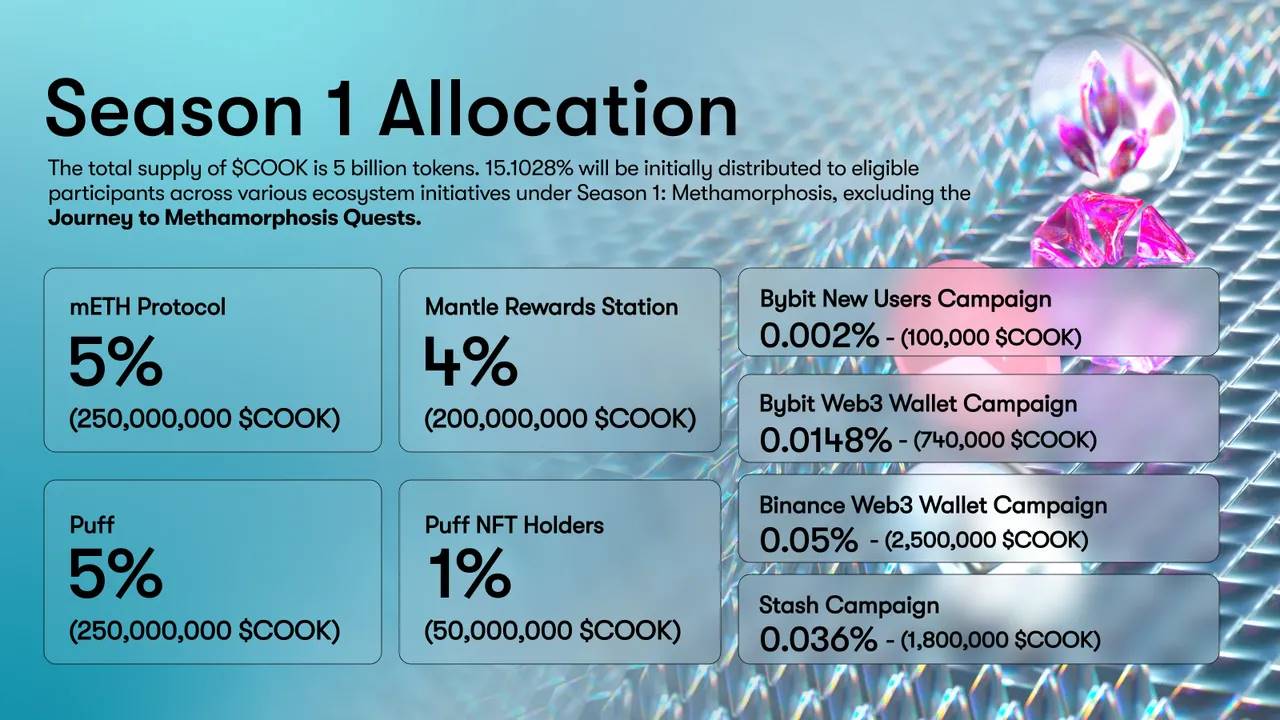

The COOK token is introduced as the new governance token for Mantle LSP. According to official documentation, it has a total supply of 5 billion, and holders can participate in ecosystem governance through voting.

Notably, according to the allocation plan, 10% of COOK tokens go to core contributors, locked for 1 year and linearly released over 3 years; 30% allocated to Mantle Treasury; 10% to private sale; and the remaining 50%—a significant majority—goes entirely to the mETH protocol community.

The reason the COOK TGE is seen as a celebration for both project and community lies largely in its generous incentives for participants.

Earlier, to boost community engagement and broaden participation, mETH launched comprehensive incentive campaigns.

The most prominent was the first Methamorphosis campaign:

Over this 100-day event, mETH leveraged its ecosystem strength to announce 23 partners—including EigenLayer, Symbiotic, Karak, Zircuit, and Pendle. Users who held mETH and completed interactions earned Power points, which could later be converted into COOK tokens—the more Power accumulated, the more COOK received.

Different projects offered varying Power rewards, with each mETH / cmETH LP eligible for up to 40 Power points. Additionally, mETH launched a referral program alongside Methamorphosis—users who successfully referred friends earned extra Power rewards.

5% of the total COOK supply—250 million tokens—was allocated to reward participants in the first Methamorphosis season.

Image source: Mantle Medium

Mantle Rewards Station focused more on MNT holders: Users locking MNT tokens earn COOK rewards, with higher multipliers available for fixed-term locks. 4% of total COOK supply—200 million tokens—is allocated for this program.

Users can also earn COOK rewards by participating in Puff, a top MEME project in the Mantle ecosystem, and Puff NFTs. 5% and 1% of total COOK supply are allocated respectively. Puff previously announced holders could burn or lock PUFF to claim COOK:

Users burning PUFF share 4.5% of total supply—225 million $COOK—fully unlocked at TGE; those locking PUFF for 6 months receive a free mETH loan plus 22.5 million COOK; users doing neither still receive 2.5 million COOK.

Additionally, through joint campaigns with Bybit, Binance, Stash, and others, more users learned about and actively participated. From July 1 to October 9, 2024, during this intense 100-day period, mETH drove remarkable on-chain growth across the Mantle ecosystem:

Cumulative active users on Mantle Network increased by 67%, exceeding 4.39 million;

Net growth in MNT staking on Mantle Rewards Station reached 125%, surpassing 148 million;

mETH TVL on Ethereum and Mantle networks rose 12.5% to $1.21 billion;

Participating users surged by 2,154%, growing from 1,600 to over 3,700 by campaign end…

Although Season One of Methamorphosis has ended, many community members are already anticipating the next season.

Image source: Mantle Medium

Conclusion

In crypto, a project’s TGE strategy profoundly impacts its future trajectory. The strong on-chain growth observed clearly reflects the community’s and users’ broad enthusiasm for mETH / cmETH, laying a solid foundation for the future of cmETH and COOK.

Of course, having seen countless examples of “TGE as the project’s last hurrah,” what makes mETH / cmETH different? The answer lies in execution: Thanks to cutting-edge foundational design and powerful ecosystem empowerment, mETH rapidly grew into the fourth-largest Ethereum LSD product.

In this market cycle—defined by even greater liquidity fragmentation—mETH horizontally aggregates liquidity from L1s, L2s, and even traditional finance (DeFi, CeFi, TradFi), pushing toward its vision of becoming the most widely adopted, capital-efficient, cross-chain universal asset and thus a true “universal liquidity hub”—unlocking vast future growth potential.

And as mETH begins its vertical narrative shift from LSD to LSD + LRT, will cmETH—built on the same foundation—be able to quickly capture a significant share of the billion-dollar restaking market?

If history is any guide, with the completion of the cmETH upgrade, the launch of COOK, and the realization of multiple ecosystem milestones, the community remains optimistic about mETH / cmETH entering a new phase of accelerated growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News