Interview with the Founder of DeFiance: Low Interest Rates Fuel Crypto Investments, Private Market Surplus Drives Valuations of Strong Projects Even Higher

TechFlow Selected TechFlow Selected

Interview with the Founder of DeFiance: Low Interest Rates Fuel Crypto Investments, Private Market Surplus Drives Valuations of Strong Projects Even Higher

A deep dive into the differences between liquidity investments and venture investments in cryptocurrency investing.

Compiled & translated by: TechFlow

Guest: Arthur Cheong, Founder of Defiance Capital

Podcast Source: The DCo Podcast

Original Title: Ep 21 - On Navigating Crypto Cynicism, Liquid Ventures, and DeFi’s Evolution with Arthur Cheong

Release Date: October 14, 2024

Background

In this episode of The DCo Podcast, we welcome Arthur Cheong, founder of Defiance Capital. We dive deep into the differences between liquidity investing and venture capital in crypto investing. Amid fierce competition among venture capitalists vying for private deals and driving up valuations before projects go public, the relatively less competitive liquid markets often offer smarter and more flexible investment opportunities. Arthur shares how he identifies such opportunities and discusses the unique advantages of investing from an Asian perspective.

Getting to Know Arthur from Defiance Capital

-

Arthur began investing in traditional financial markets over a decade ago and started applying his traditional finance experience to the crypto market in 2017. The host notes that Arthur wrote a paper on synthetic assets during the 2018 bear market, which first caught his attention, and since then, he has closely followed and learned from Arthur’s insights.

Arthur’s Investment Journey

-

Arthur shares his personal investment journey. He mentions being interviewed by a local media outlet at age 21 as a representative of young investors, due to his active involvement in his university's investment club.

-

Arthur started investing in the stock market at 19 and has always firmly believed in the importance of financial education. Coming from a modest background where his parents frequently argued about finances, he saw learning financial management as key to improving life outcomes.

-

Arthur studied economics and used his small savings to learn about markets and investing. After graduation, he continued investing and began exploring cryptocurrency in 2017, eventually focusing entirely on crypto asset investments.

Transitioning into Crypto

-

Arthur recounts his shift from traditional markets to crypto. He says Ethereum’s rise in 2017 sparked his interest, captivated by the potential to build various decentralized applications on blockchain. He highlights crypto’s global nature as one of its unique advantages—unconstrained by geography, it opens vast opportunities for investors.

-

Arthur points out that the crypto industry is still relatively young, allowing new entrants to make a bigger impact. In traditional markets, extensive experience is usually required to compete with established players, whereas crypto offers more room for risk-takers. Additionally, the potential for high returns in a short time was a major factor in his transition to crypto.

The Impact of Low Interest Rates

-

Arthur notes that many investors experienced zero interest rates for the first time after the financial crisis. Following the 2008 crisis, near-zero rates persisted for years, making illiquid investments more attractive, as investors were willing to take on more risk for higher returns. With safe investments yielding very low returns (e.g., only 2% or 3%), investors leaned toward riskier options aiming for 70% returns to meet portfolio goals.

-

Arthur believes this is one reason alternative investments—especially illiquid ones—have grown rapidly over the past 15 years. Low rates incentivize chasing higher-risk opportunities.

-

The host adds that there's a correlation between low interest rates and growing interest in crypto. He recalls that a few years ago in Singapore, crypto.com offered 4% yields while local bank rates were zero, drawing massive inflows into crypto. Arthur agrees, noting that earning 0% in banks makes any return above that significantly more appealing, pushing people to explore emerging opportunities like crypto.

Crypto Cynicism

-

Arthur suggests that market maturity over time may lead to greater cynicism. He argues this isn’t solely due to collapses like FTX or Three Arrows Capital, but rather stems from investors’ own experiences and growth within the crypto space. While traditional markets push investors toward early maturity through intense competition, crypto participants are often initially drawn by ideals like decentralization and censorship resistance.

-

Over time, Arthur says investors realize that many theoretically sound concepts face real-world challenges, leading to increased skepticism. He notes that crypto’s low barrier to entry attracts both brilliant innovators and opportunists, creating extreme disparities and market uncertainty.

-

Arthur emphasizes the importance of maintaining “cynical optimism.” Investors shouldn’t blindly trust everything, nor should they completely dismiss new technologies’ potential. Striking this balance is difficult—many tend to lean too far in either direction.

-

On managing risk through cynicism, Arthur believes this mindset helps investors focus more on downside risks. Identifying potentially bad investments is key to success, especially in less liquid markets.

-

Finally, Arthur shares tips for avoiding investment traps, including watching whether project teams are open to feedback and improvement. If a team ignores external input, it’s often a red flag indicating deeper issues.

Bridging East and West in Crypto

-

Arthur notes that while crypto is a global industry, mindsets in the East and West differ significantly. Assets that achieve consensus across both regions often perform better. For example, Ethereum gained strong recognition from Chinese communities in its early years, laying the foundation for its later success.

-

Arthur explains how geography shapes investment thinking. Western communities often focus more on technology itself, while Eastern investors pay closer attention to a project’s background, backers, and market distribution. Eastern investors recognize that factors beyond tech can heavily influence a project’s success.

-

The host adds that the West has the tech, while the East has the users. Eastern markets often adopt new technologies faster, partly because their regulatory environments are more ambiguous, enabling innovation. Additionally, Eastern entrepreneurs tend to prioritize product distribution, while Western founders are often obsessed with the technology itself.

-

When asked how to bridge the East-West gap, Arthur says investors can leverage their understanding of both perspectives. Living in Singapore—a global city—he interacts with founders and investors from China, gaining balanced market insights.

-

Lastly, Arthur notes that the early internet also experienced similar asymmetries, particularly as countries like China and India caught up with U.S. infrastructure and user behavior. He sees similar dynamics now in crypto, especially regarding investment opportunities and market responses.

Liquidity Investing vs. Venture Capital

-

Arthur points out a current imbalance: excess private capital versus insufficient professional capital in public markets. This imbalance creates more opportunities for investors. While venture capital remains well-funded, the number of high-quality projects is limited, enabling top projects to command inflated valuations.

-

Arthur further explains that traditional markets are dominated by retail investors, but crypto is the opposite. In crypto, venture capital far exceeds hedge fund activity, creating an unusual situation: without retail participation, VCs struggle to find exits. Therefore, Arthur believes liquidity investing offers higher return potential due to less competition in public markets.

-

He also emphasizes that liquidity investors can better manage risk, especially in fast-moving industries requiring flexible portfolio adjustments. Over the past two years, NFT markets have seen extreme volatility, and many investors suffered losses by failing to adapt quickly.

-

Arthur notes that while VC traditionally relies on the "power law"—where a few winners cover all losses—exits in crypto have become harder and valuations compressed. Thus, he favors liquidity investing for more effective risk management.

-

On project valuation, Arthur advises teams to consider appropriate pricing when going public. A valuation that’s too low may signal poor quality, while one that’s too high could hinder price discovery. He recommends benchmarking to ensure reasonable valuations and provide upside potential for public market investors.

-

Arthur adds that although many projects launch at valuations far exceeding his recommendations, this doesn’t mean the market will correct itself. He believes the current high-valuation issue needs resolution, and both investors and teams must act more cautiously.

Market Downturns and Exchange Influence

-

The host notes that in the current downturn, the challenge for liquidity investors isn't just waiting for valuations to drop—it's recognizing the need for market participants who can provide liquidity at fair valuations. Exchanges shouldn’t be the sole arbiters of listing prices. As markets mature, a liquidity fund ecosystem may develop, helping prevent 90% post-listing crashes.

-

Arthur adds that while VCs may inflate valuations, exchanges play a significant role too. Over the past decade, many major crypto events have involved exchanges, and the market still can't fully escape their influence. Exchanges have incentives to list projects at high valuations, often tied to launchpool incentives. Projects may pay 5% to 10% of supply as listing fees, and higher valuations make these incentives more valuable.

-

Arthur also notes that when the market turns down, these incentives have already been distributed, and recipients may dump tokens quickly, further driving prices down. Thus, exchanges play a crucial role in pricing, and their influence is substantial.

The Role of Narrative in Market Dynamics

-

The host says this is a perfect moment to discuss his article last year titled “Narrative Advantage.” The core idea is that all markets operate on narratives. Products or projects need foundational ideas that allow them to be categorized broadly, and such categorization drives inequality. He observes that attention and capital flow like rivers—investors can ride the current or swim against it, or think of it as sails catching wind. Smart positioning and narrative enable riding the flow of capital and attention.

-

He further notes that attention and capital are highly correlated. Without attention, even large capital inflows matter little; without capital, attention can’t be effectively monetized. Understanding and leveraging narrative is therefore critical in market dynamics.

-

This narrative power not only influences investor decisions but also shapes overall market trends and sentiment. Effective storytelling helps projects attract more attention and funding, standing out in competition.

The Impact of AI and Other Trends

-

AI today is a prime example—consumer attention is heavily focused here, so AI-focused companies can raise large amounts of capital and convert it into user growth. Clearly, this trend should eventually translate into meaningful user bases and returns. But if it collapses, problems arise. The host recalls similar cycles in gaming and NFTs, and suggests something similar might happen with HDI. Overall, he stresses narrative’s importance—companies can’t ignore it, nor can they build solely on narrative.

-

Arthur agrees, saying the article perfectly captures certain market-driving beliefs. Many intuitively understand this, but few can articulate it clearly in writing. In crypto, this is especially evident due to the lack of valuation frameworks. People invest in search of breakthrough projects—any project showing potential to change the world or shift paradigms typically gains disproportionate attention, capital, and resources, even if unproven.

-

He cites data availability (DA) as an example, referencing Celestia’s launch. Celestia briefly approached 10x gains in public markets, though it later pulled back. Doubts are growing about how much long-term value DA layers can capture and whether they’ll face zero-sum competition on fees. As a result, Celestia’s valuation has adjusted. However, for those who deeply understand DA and believe it will be central to modular architectures, early heavy bets on Celestia or other DA solutions made sense.

-

The host continues discussing Celestia’s price action, noting it once traded around $2, then surged to $17–$18—or even over $20—when DA became the narrative. He calls this a great example of an asset being undervalued for a period, then rising sharply as the narrative takes hold.

The Parasitic Nature of L2s on Ethereum

-

The host points out that before version 1.5, L2s paid Ethereum a portion of user MEV (miner extractable value) and transaction fees. But since blobs were introduced, L2 payments to Ethereum have dropped by 90%, even 98% or 99%. He compares this to cloud providers like Amazon lowering storage costs—though fees fall, rising demand may compensate.

-

He then poses a question: If L2 fees drop 98%, will increased L2 demand make up for it? He’s uncertain whether this demand will materialize. He also notes that L2s have flexibility in when they submit data to Ethereum, allowing them to somewhat “game” gas fees. Unless L2s bring MEV back to L1, he believes they remain parasitic on Ethereum so far.

-

Arthur agrees, stating that L2s are currently parasitic on L1 as all fees decline. He notes that L2s mainly capture existing users, not bringing new users to hold ETH as an asset. Despite improved tech and scalability, this hasn’t translated into greater demand for Ethereum as an asset. He believes L2s won’t be seen as parasitic only if they expand the total market size.

-

Arthur further explains that current L2 fees largely come from priority fees and minimal MEV, giving L2s no incentive to pass value back to L1. He stresses that L2s must attract new users to sustain demand for Ethereum as collateral, preserving its role in the broader L2 ecosystem.

-

The host then asks whether wallet account abstraction and chain abstraction might change L2s’ native fee assets, possibly using other assets for gas.

-

Arthur believes this won’t significantly affect Ethereum’s position, as current ETH demand stems more from its programmable money properties than gas usage.

-

Arthur adds that long-term, this may not be ideal, as value capture typically requires closeness to users. Though Ethereum’s brand remains strong short-term, over five to ten years, this distance could start to matter.

-

The host adds that many early DNS and router companies crashed after going public. He likens the gas fee discussion to bandwidth—L2s can scale infinitely, but will this increase Ethereum’s value over time? It’s unclear.

-

Arthur further notes that Ethereum’s success as a tech platform may not align with its success as a valuable asset—an unsustainable relationship. He emphasizes that while Ethereum’s brand is strong today, capturing value will grow increasingly important in future markets.

Revisiting Game Theory

-

Arthur and his team wrote a comprehensive paper years ago on gaming, identifying three key parameters for evaluating good games: team background, product and distribution, and economic sustainability. Arthur says they’ve revisited this framework and still see these as critical to Web3 game success. Recently, he’s been playing *Black Desert*, China’s first AAA game, which gave him new insights.

-

He notes that excessive financialization of consumer products makes it hard to determine true product-market fit. Building without genuine fit but pouring in resources is dangerous for founders and teams. Many games rely initially on incentives, with no self-sustaining, economically viable model yet.

-

Arthur adds that while they’ve seen limited successes, these haven’t excited crypto investors. For example, Pixelmon maintains 2 million daily active users, but compared to other Layer 1s, its valuation remains low. He believes crypto investors generally discount the gaming sector, and the current Web3 gaming industry hasn’t delivered big enough hits to shift market perception.

-

He notes that over the past two years, Web3 gaming attracted massive capital—between $15–20 billion. So funding is no longer an excuse; the next one to two years will be critical in proving results. If no meaningful outcomes emerge, VCs and investors may stop funding Web3 gaming.

-

The host shares his view, mentioning he recently played *Red Dead Redemption* and found it beautiful. He says he won’t engage with Web3 gaming unless games of similar quality emerge. He points out that many Web3 game studios may not focus on gameplay itself, but rather on data availability layers or repackaging the same content differently.

-

He suggests teams may use time as an excuse, claiming great games take years to build. Speaker 1 jokes that when apps fail, teams pivot to infrastructure.

-

Arthur agrees, noting a growing trend in crypto of building “apps for developers,” which is becoming common in game development too.

The Future of DeFi and Aave’s Potential

The host brings up Arthur’s recent paper on Aave. He wonders whether DeFi primitives (like lending) should eventually converge in valuation with traditional finance. He asks Arthur for his thoughts and a deeper explanation of their Aave thesis.

-

Arthur responds that on valuation, since DeFi is still small, multiples don’t need to converge—DeFi still has vast growth potential. For example, JPMorgan is already the world’s largest bank; you can’t expect it to double without economic growth. But DeFi still has exponential room to grow, even if the rest of the world stays flat. So he believes DeFi valuations shouldn’t match traditional finance, given its growth runway.

-

He adds that DeFi is far more scalable than other financial services. Compared to traditional finance and fintech, DeFi’s marginal cost is extremely low. As market size and user base grow, Aave doesn’t need to do much to scale. In contrast, fintech often just offers a better frontend for traditional finance, without fundamentally changing anything. As they scale, fintech inherits traditional finance’s cost structure.

-

Arthur believes DeFi avoids this issue due to low marginal costs—given a solid product, it can scale rapidly. He notes that DeFi’s explosive growth in 2021 stemmed precisely from this advantage.

-

On Aave’s potential, Arthur expresses confidence in DeFi’s future. He believes decentralized money (like Bitcoin and stablecoins) and financial use cases (speculation, fundraising) have already achieved product-market fit. He’s confident DeFi will exist in five years, but cares whether it can grow tenfold. When investing in DeFi, he focuses not on survival, but on surpassing current levels.

-

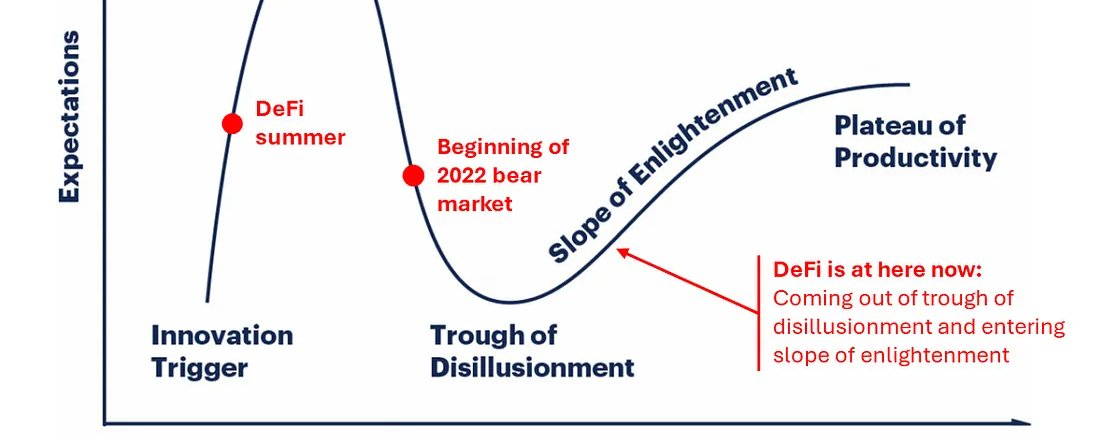

Arthur also notes that DeFi is going through a classic Gartner hype cycle—peak excitement in 2025, followed by hacks and setbacks. He believes DeFi is now emerging from the trough of disillusionment and may gradually enter the enlightenment phase in coming years, with renewed focus on fundamentals and recognition that blockchain remains best-in-class for financial use cases.

-

He concludes that finance is currently crypto’s largest use case—others are interesting but dwarfed in scale. He expects that when this becomes widely recognized, leaders in DeFi will be repriced accordingly.

-

Finally, Arthur points out that while many infrastructure projects are valued at $10–20 billion, Aave sits at just $1.5 billion. As one of the most important primitives in the space, he believes Aave has significant room for valuation expansion.

Challenges and Opportunities in DeFi

The host notes that Arthur has been observing DeFi for six to seven years. He asks what changes during this time keep Arthur optimistic and convinced that DeFi will persist and grow.

-

Arthur responds that first, increasing wealth is being stored on-chain in digital assets like Bitcoin, Ethereum, and stablecoins, creating demand for financial services. If DeFi lacked product-market fit or momentum, he’d be pessimistic. But as long as on-chain asset totals keep rising, he remains bullish on DeFi growth—they’re directly linked.

The host further asks whether there have been internal DeFi changes beyond these external factors—such as shifts in core primitives or improvements in user experience.

-

Arthur believes security practices and vulnerability prevention have improved over the past two years, as awareness of the stakes has grown. He cites the recent fundraising by Hyper Native, a cybersecurity firm focused on detecting vulnerabilities before exploits occur. He expects security to improve in coming years, and on-chain UX/UI to become more user-friendly, resembling Web2 login flows (email and password). The tech is ready, and widespread adoption is likely.

-

Arthur adds that those who lived through the past two years know which models aren’t sustainable, so he doesn’t expect immediate repetition. He doesn’t foresee a return to similarly unsustainable policies.

-

The host offers a counterpoint, arguing unsustainable patterns still exist. He references Pump Fund, noting that out of 2 million tokens launched, only about 92 have market caps over $1 million. He suggests some veteran crypto figures may not realize this.

-

Arthur agrees Pump Fund was a bubble, not just a simple Ponzi. Participants in Ponzi schemes usually know they’re likely to lose 99% of the time. His concern with DeFi is that many projects made false promises—Luna was marketed as sustainable, but wasn’t.

-

Arthur stresses that while Pump Fund participants knew what they were doing, many DeFi projects made unrealistic claims. Even if Pump Fund was a value-extraction scheme, at least it operated transparently.

-

On Friend.tech, Arthur says it could grow larger, but currently lacks sufficient decentralization. Speaker 3 adds that Friend.tech’s success relied on major funds, and since control hasn’t been returned to the community, its decentralization is questionable.

-

Finally, Arthur believes DeFi’s future remains full of opportunities—despite challenges, technological progress and market maturation will drive continued evolution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News