The Impact of Interest Rate Cuts on the Crypto Market: $321 Million Inflows

TechFlow Selected TechFlow Selected

The Impact of Interest Rate Cuts on the Crypto Market: $321 Million Inflows

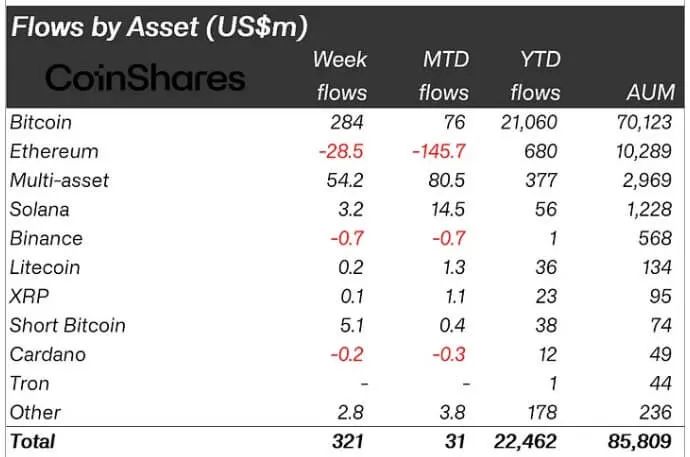

A breakdown of fund flows shows that BTC-based investment products led the inflows, generating a net gain of $284 million globally last week.

Source: cryptoslate

Compiled by: Blockchain Knight

According to CoinShares' latest weekly report, digital asset investment products saw inflows for the second consecutive week this month, with investors injecting $321 million into the sector.

The investor surge increased total assets under management (AuM) in crypto asset ETPs by 9% to $85.8 billion. Total trading volume in investment products also rose to approximately $9.5 billion.

James Butterfill, head of research at CoinShares, linked this positive trend to the Federal Reserve's recent decision to cut interest rates by 50 basis points.

He explained: "This surge was likely driven by comments from the Federal Open Market Committee (FOMC) last Wednesday, which took a more dovish stance than expected, including a 50-basis-point rate cut."

A breakdown of fund flows shows that BTC-based investment products led the inflows, generating $284 million in net gains globally last week.

Notably, major crypto asset funds from firms such as BlackRock, Bitwise, Fidelity, ProShares, and 21Shares contributed to this rebound, with combined net inflows totaling $321 million.

BTC’s positive price momentum also attracted bearish investors, who poured $5.1 million into short-BTC funds.

Ethereum faced outflows for the fifth consecutive week, totaling $29 million. This trend stems from ongoing withdrawals from Grayscale's ETHE product and declining interest in new offerings.

Data from Farside shows that ETHE experienced outflows ranging between $13 million and $18 million over three consecutive days last week, outweighing minor inflows into other products, including Grayscale's mini trusts.

In the meantime, Solana maintained its current positive trend, adding $3.2 million in inflows last week.

This inflow coincides with several traditional financial institutions announcing plans to launch financial services on the network during the recent Solana Breakpoint event in Singapore.

Other large-cap altcoins, including XRP and LTC, recorded combined inflows of $300,000.

By region, the United States unsurprisingly led last week’s inflows, accounting for $277 million, followed by Switzerland with $63 million.

In contrast, Germany, Sweden, and Canada saw outflows of $9.5 million, $7.8 million, and $2.3 million respectively.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News