Four Pillar Deep Dive Report: From Concept to Implementation, Taiko Redefines Ethereum L2 Solutions

TechFlow Selected TechFlow Selected

Four Pillar Deep Dive Report: From Concept to Implementation, Taiko Redefines Ethereum L2 Solutions

Taiko is striving to become an Ethereum-equivalent, fully decentralized Layer 2 (L2) blockchain with a strong focus on developers.

Author: FourPillar

Translation: TechFlow

Ethereum launched in 2015 with the goal of unlocking blockchain’s potential through smart contracts and decentralized applications (dapps). However, as the number of users and transactions on the Ethereum network rapidly grew, it encountered serious scalability issues.

Initially, transaction volume on Ethereum was relatively low, so processing capacity wasn't a problem. Transactions could be processed quickly and cheaply, and the network operated smoothly. But as Ethereum's popularity surged, various dapps—such as DeFi platforms, games, and NFT marketplaces—emerged, leading to an explosion in transaction volume. As a result, the time required to include transactions in blocks increased, and transaction fees rose significantly. This placed a heavy burden on users conducting small transactions or requiring fast processing times.

To address scalability challenges, the Ethereum Foundation and community explored multiple solutions. Among them, sharding stood out as a prominent approach. Sharding is a scalability technique that divides the blockchain network into smaller “shards,” dramatically increasing transaction throughput. Just as multiple computers can process tasks simultaneously, sharding enables the Ethereum network to handle more transactions quickly and efficiently. Ethereum planned to introduce this technology to greatly enhance the network’s processing capability.

Despite high expectations for this technology, concerns about centralization and technical hurdles causing development delays led Ethereum to shift from directly implementing sharding toward Layer 2 (L2) approaches.

With Ethereum fully embracing L2 solutions, numerous Ethereum L2 projects have emerged. Taiko, the subject of this article, stands out due to its unique development direction, differing from many other Ethereum L2s. Because Taiko aims to comprehensively solve problems faced by existing Ethereum L2s, we will first examine the evolution of Ethereum L2s and the challenges they’ve encountered before diving deeper into Taiko.

1. The Golden Age of Ethereum L2 Blockchains

1.1 The Rise of Ethereum L2 Blockchains: Diverse Approaches and Philosophies

Ethereum Layer 2 refers to blockchain infrastructures designed to improve transaction processing speed and reduce fees while maintaining the security of Ethereum’s mainnet (Layer 1). The most well-known types of L2s include Plasma, Optimistic Rollup, and zk Rollup. Ethereum L2 projects began developing their own blockchains based on distinct methods, philosophies, and beliefs, all sharing the common goal of solving Ethereum’s scalability issue. As a result, users enjoyed lower fees and faster transaction speeds. But was this progress aligned with the right direction, or merely focused on speed? Amid the rapid proliferation of Ethereum L2 blockchains, Ethereum itself and its core scalability challenges began taking a back seat.

Fundamentally, Ethereum L2s were created to solve Ethereum’s scalability problem. Yet, many of these projects increasingly prioritized promoting their own mainnets over addressing the original challenge. Many Ethereum L2s deliberately reduced their operational integration with Ethereum, offering only minimal value linkage via bridges—or in some cases, no support at all. This led to the emergence of effectively independent blockchains unrelated to Ethereum.

For example, Blast launched its mainnet on February 29, 2024, initially emphasizing its positioning and philosophy as an Ethereum L2. However, at some point, it began referring to itself as a “full-stack chain,” gradually distancing itself from Ethereum. The change of Blast’s official account on X (formerly Twitter) from @Blast_L2 to @blast was no accident.

Source: Jim X

This suggests that although many Ethereum L2s claim to value connectivity with Ethereum and are committed to expanding its scalability, seemingly no true Ethereum L2 has fulfilled its promise of collaboration with Ethereum. So where exactly is the problem?

1.1.1 Declining Connectivity with Ethereum

Many L2 solutions are placing increasing emphasis on their unique features and functions, resulting in gradually weakening connectivity with Ethereum. This intent to build independent ecosystems stems from a pursuit of autonomy. However, such independence may hinder interoperability with the Ethereum mainnet, making seamless interaction between L2 and Ethereum difficult. As a result, L2 blockchains originally created to solve Ethereum’s scalability issues end up undermining the overall integrity of the network. This deviates from the original purpose of Ethereum scalability solutions and may cause fragmentation across the entire Ethereum ecosystem.

1.1.2 Centralization in the Name of Efficiency

Some L2 projects have adopted centralized approaches in pursuit of efficiency. While this method may improve performance and reduce fees in the short term, it undermines the foundational principle of decentralization in blockchain technology. This could damage trust and security in the technology over the long term. Moreover, centralized structures create single points of failure, increasing vulnerability to attacks and posing significant risks to users and developers.

1.1.3 Neglecting Developer Needs

As L2 projects build their ecosystems, they often create confusion and burdens for developers. Since each L2 project adopts different technical approaches, developers are forced to learn and adapt to multiple platforms, creating a high barrier to developing new dApps or porting existing ones to L2 blockchains. Additionally, due to the lack of standardized protocols among L2 blockchains, developers face the challenge of modifying code to fit different infrastructures. This situation not only reduces developer efficiency but also hinders innovation and growth within the Ethereum ecosystem.

L2 projects might argue they had no choice but to make these decisions to expand their ecosystems and secure funding. However, this trend ultimately weakens the security of the Ethereum mainnet and negatively impacts the broader Ethereum ecosystem.

1.2 Returning to the Core

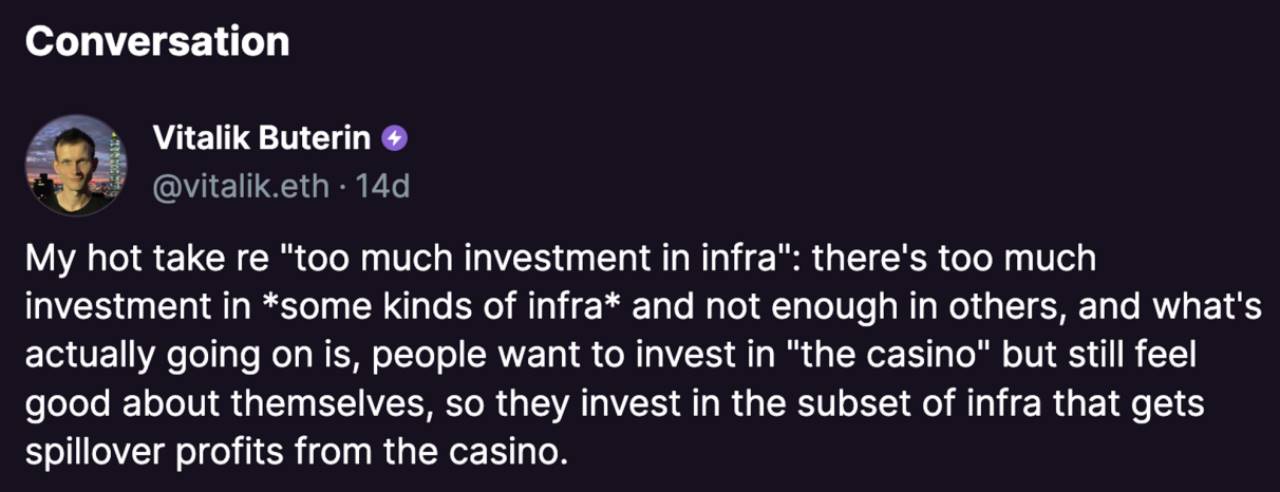

Source: Vitalik Buterin on Warpcast

In July 2024, Ethereum co-founder Vitalik Buterin published a critique highlighting excessive investment in infrastructure within the current blockchain industry. Vitalik pointed out that this overinvestment stems from investors indirectly channeling funds into technical areas rather than directly investing in tokens, perhaps to soothe their moral conscience. His observation appears consistent with the chaotic emergence of L2 projects. With massive capital flowing into infrastructure, projects have arisen that focus solely on profit rather than advancing Ethereum’s scalability narrative, pushing Ethereum and its scalability concerns further out of the L2 discourse.

Of course, investing in the L2 ecosystem isn’t inherently bad. Capital is crucial for project operations. However, such capital should not be the top priority. What matters most is focusing on the problems the L2 solution aims to solve and how it intends to achieve those goals.

L2 projects must remember their original mission: solving Ethereum’s scalability issues. Maintaining interoperability with Ethereum, adhering to decentralization principles, and providing an environment where developers can easily participate are essential. If L2 solutions fail to strike this balance, not only will the development of the Ethereum ecosystem be threatened, but the long-term trust and security of blockchain technology will also be compromised. True progress in blockchain technology will only be realized when L2 projects return to their core principles and work closely with Ethereum to solve its scalability challenges.

2. Taiko: A Genuine Ethereum L2

What does it take for an Ethereum L2 to truly solve Ethereum’s scalability problem? There are three key criteria: 1) Is it fully integrated with Ethereum? 2) Is it completely decentralized? 3) Does it adequately consider the needs of developers within the Ethereum environment? Let’s examine Taiko’s efforts to become a genuine Ethereum L2 based on these factors.

2.1 An Ethereum-Equivalent L2

A solution to Ethereum’s scalability problem must naturally integrate tightly with Ethereum. Here, integration means not just system-level alignment, but also value-based and even philosophical alignment. Of course, “integration” doesn’t mean being identical or redundant in every aspect. However, it is an essential trait for becoming a true Ethereum L2, as many blockchains operating as Ethereum L2s do not follow these fundamental principles.

2.1.1 Type-1 EVM Blockchain

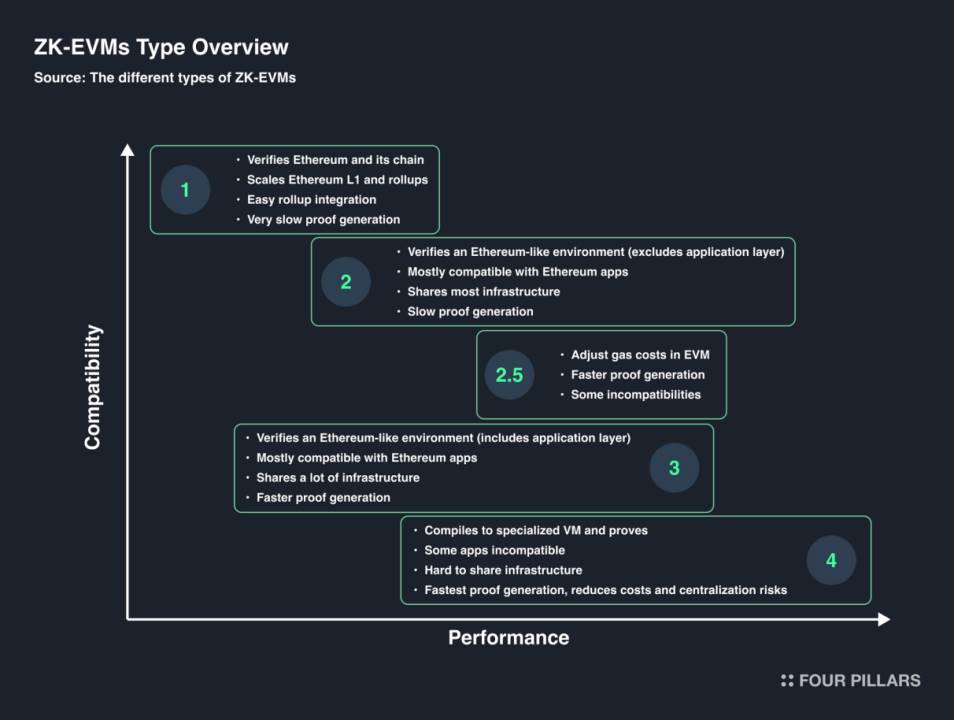

On August 4, 2022, Vitalik Buterin published The Different Types of ZK-EVMs, analyzing and categorizing zkEVMs. According to his analysis, zkEVMs are classified into Type 1, 2, 2.5, 3, and 4—with higher numbers indicating lower interoperability and compatibility with Ethereum, but greater efficiency in proof generation and overall performance. In other words, higher-numbered zkEVM types involve modifications such as altering the core EVM or introducing additional modules to optimize performance.

While Vitalik noted in the article that no single zkEVM type holds a clear technical advantage and that multiple types may coexist, he concluded:

“Personally, I hope that over time, both ZK-EVMs and Ethereum itself improve to become more ZK-SNARK-friendly, so that everything becomes Type 1.” — Vitalik Buterin (Ethereum Co-Founder)

Ultimately, when choosing between interoperability and performance, Vitalik chose interoperability for Ethereum scalability.

Although written in 2022, this insight remains relevant today amid the surge of Ethereum L2 blockchains. To truly function as an Ethereum L2 blockchain, the ultimate goal should be achieving a Type-1 zkEVM.

While the article only classifies zkEVMs, from a broader perspective, the structure of L2s themselves can also be categorized based on their degree of integration with Ethereum—extending the concept to EVM or L2 types. From this viewpoint, Taiko aims to achieve Ethereum scalability by using a Type-1 EVM equivalent to Ethereum.

Because Taiko aims to be an Ethereum-equivalent L2 blockchain, it inevitably performs relatively slower than other Ethereum L2 blockchains like Type 2 or Type 3. However, considering that other L2 blockchains haven’t fully committed to Ethereum scalability, this trade-off is justified. Importantly, this isn’t a major concern, as the Taiko team acknowledges this limitation and explicitly aims to improve performance shortcomings through internal protocol design.

2.1.2 Based Rollup

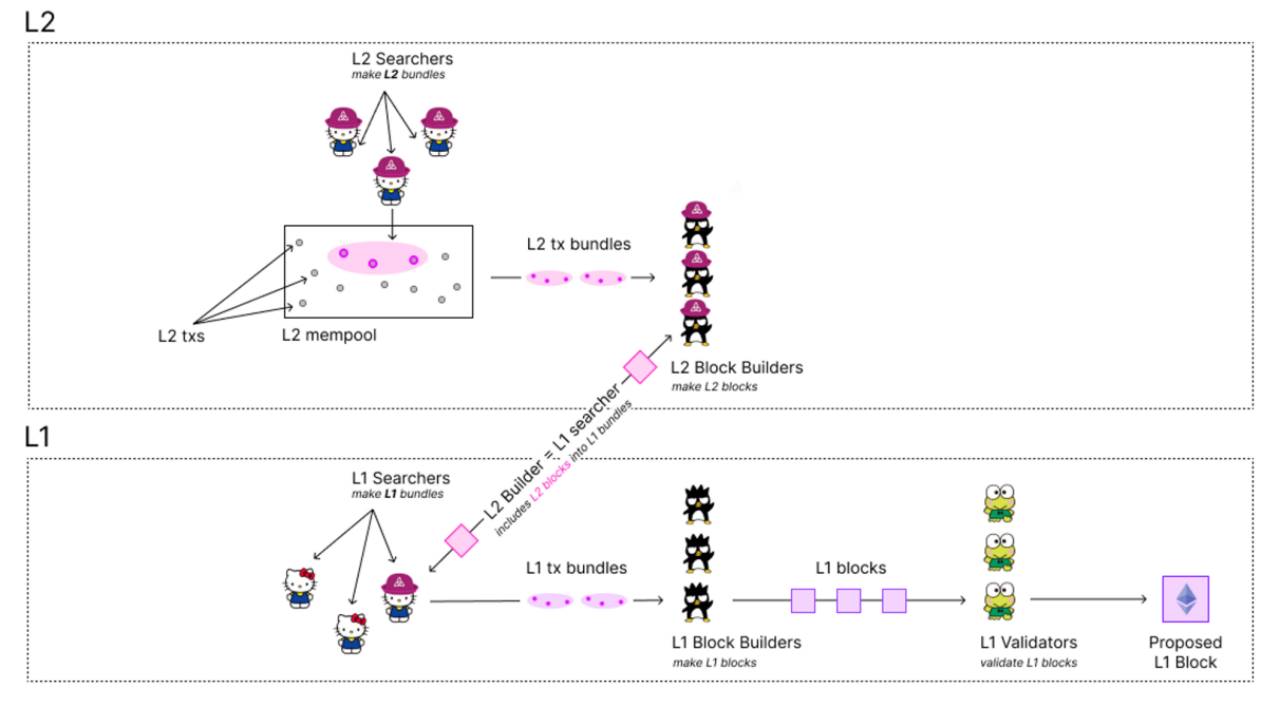

Source: MEV for "Based Rollup"

Taiko not only fully integrates Ethereum’s system infrastructure but also strives to align with Ethereum in terms of security. Taiko adopts a concept called Based Rollup, which operates without a centralized sequencer. Instead, Ethereum validators also act as Taiko’s sequencers, responsible for ordering transactions and blocks. Thanks to these characteristics, fragmentation within the Ethereum ecosystem has the potential to reintegrate into a unified whole.

Based on the properties of Based Rollup, Ethereum block proposers serve as Taiko’s sequencers. This role comes with specific responsibilities, including acting as MEV (Maximal Extractable Value) beneficiaries on Taiko to maintain profitability and stay active as sequencers. This additional incentive mechanism encourages them to operate more carefully.

2.2 The Path Toward Full Decentralization

From a systems perspective, decentralization is a complex and inconvenient concept. Frankly, if everything were handled and managed by a single centralized entity, it would be more efficient and easier to maintain. This is why many Ethereum L2s have opted for a centralized sequencer model. However, this approach has flaws—for instance, a malicious sequencer might censor transactions or exacerbate single points of failure. In such a scenario, who would trust the system? The blockchain industry was born precisely because no one can be fully trusted. To eliminate these potential risks, achieving full decentralization is critical.

Source: Based Contestable Rollup (BCR): A Configurable, Multi-Proof Rollup Design

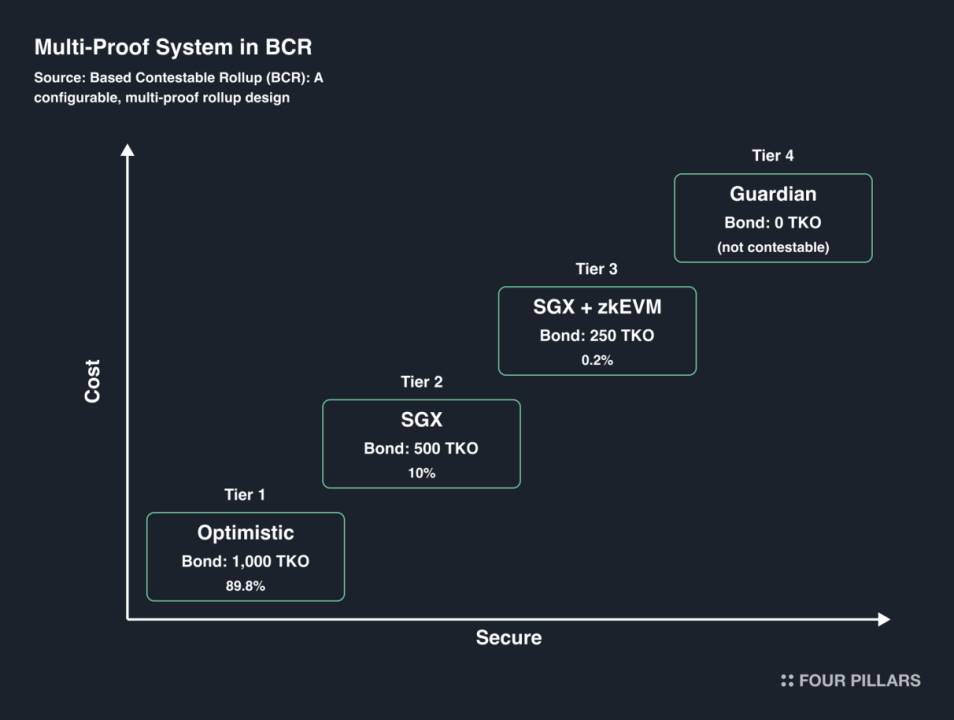

What conditions are needed to achieve full decentralization? Taiko addressed this question by launching the Based Contestable Rollup (BCR). The key to avoiding centralization lies in ensuring multi-party participation, preventing collusion, and encouraging competition. The BCR adopted by Taiko is a rollup protocol with a competitive mechanism that plays a role in rollup proofs and sequencing, covering all necessary elements.

“34,469 lines of code are hard to get right over long periods.” — Vitalik Buterin

The reason Taiko chose the BCR structure is to achieve full decentralization. Vitalik Buterin pointed out that zk-SNARKs are currently not yet a fully reliable technology. In particular, the latest zk-SNARK systems have become significantly more complex, greatly increasing the likelihood of errors. As this technology is still immature and expected to grow even more complex, it becomes more prone to technical bugs. When such vulnerabilities exist, centralized rollups can prevent issues from worsening severely, since there is an entity responsible for resolving any technical errors or specific risks. However, Taiko pursues a fully decentralized environment, making it difficult to clearly resolve these issues. Therefore, Taiko avoids relying on blindly trusting zk-SNARK structures. In other words, through the BCR structure, Taiko prepares for the possibility of rollup proof errors and establishes a system where incorrect rollup proofs can be challenged.

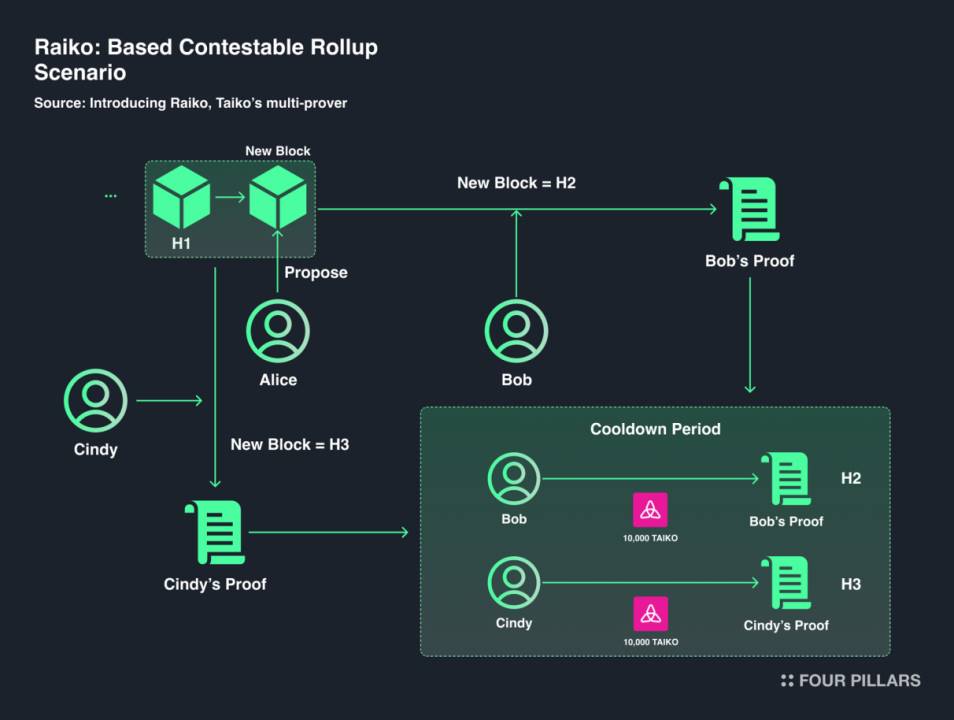

To understand how Taiko’s BCR works, a simple example may be more effective than a complex explanation.

Alice proposes a new block.

Bob submits a state transition proof from H1 → H2. H1 is the parent hash, and H2 is the new block hash. Bob stakes 10,000 TAIKO as collateral. His proof enters a cooling-off period.

Bob’s proposed state information and attached proof are publicly disclosed.

Cindy believes Bob’s state transition should be H1 → H3 instead of H1 → H2. During the cooling-off period, Cindy stakes her 10,000 TAIKO as competing collateral and challenges Bob’s proof.

The disputed state transition between Bob and Cindy waits during the cooling-off period for a higher-level proof. This higher-level proof allows Bob and all other provers the opportunity to challenge it.

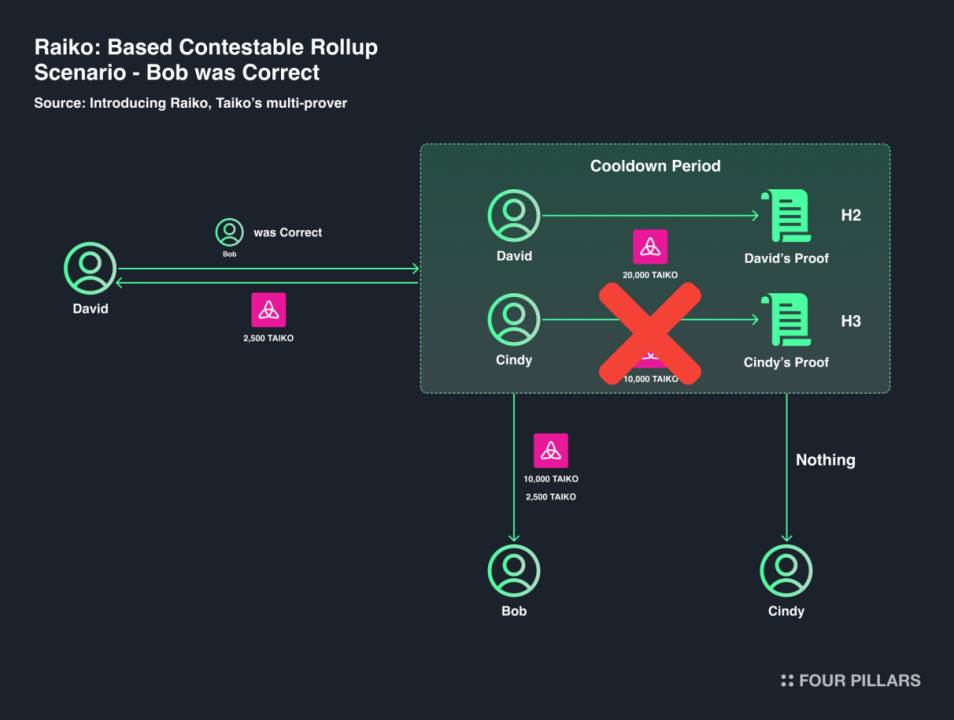

Scenario 1 - If Bob’s proposal is correct:

David verifies Bob’s H1 → H2 proposal, confirming Bob is correct. David receives 2,500 TAIKO as a reward for completing the higher-level verification and becomes the H1 → H2 verifier, staking 20,000 TAIKO as deposit.

Cindy loses her entire deposit for proposing an incorrect modification.

Bob recovers his original 10,000 TAIKO deposit and receives an additional 2,500 TAIKO reward for proposing the correct solution.

David’s new proposal and verification cooling-off period begins.

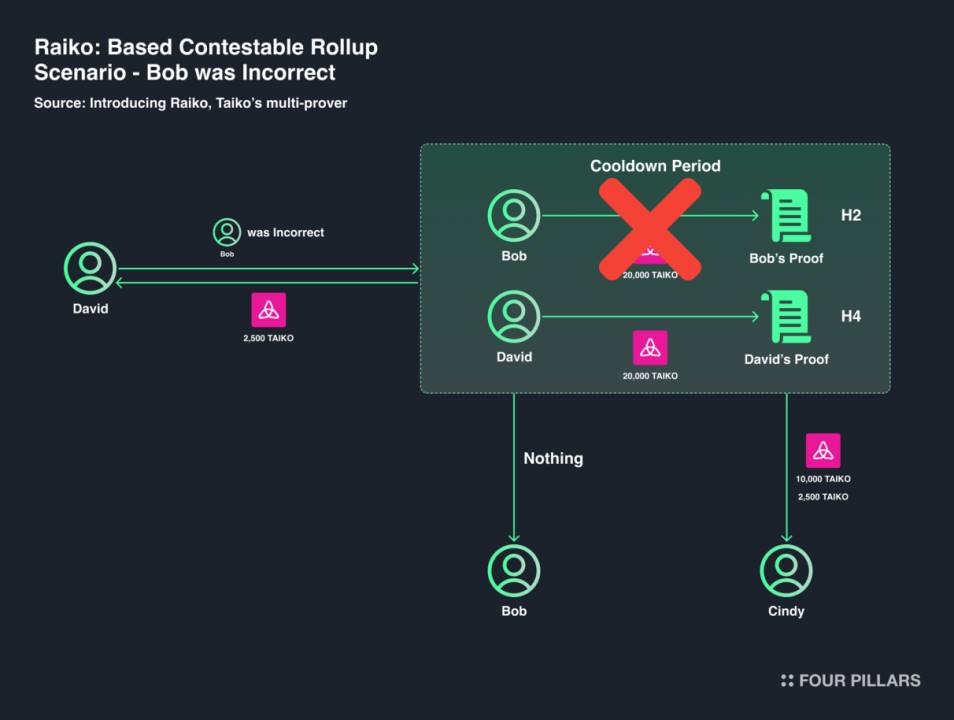

Scenario 2 - If Bob’s proposal is incorrect and David proposes a new one:

David provides a three-step transition proof from H1 → H4, proving Bob’s transition was wrong. David receives 2,500 TAIKO as a reward and stakes 20,000 TAIKO as deposit, backing his modified state information and proof with capital.

Cindy recovers her original 10,000 TAIKO deposit and receives an additional 2,500 TAIKO reward for successfully challenging Bob’s incorrect state transition.

Bob has his entire deposit confiscated for proposing an incorrect state transition and proof.

David’s new proposal and verification cooling-off period begins.

This structure uses competitive staking to incentivize rollup verifiers to remain accountable when challenging and prevents unnecessary attacks. Notably, as verification rounds increase, the required stake for competition rises significantly, preventing unnecessary contestation cycles.

Additionally, Taiko employs multiple proof systems within BCR. This system allows different rollup verification systems (e.g., SGX, ZK, SGX+ZK) to be used at different stages, ensuring flexibility and more stable operation. Despite these advantages, this design has a drawback: when competition frequency is low, verifier activity diminishes. The verifier mechanism relies on frequent competition for profit, so in environments with insufficient competition, they may choose not to participate. To address this, Taiko implements dynamic adjustments across different rollup verification systems to overcome this challenge.

During early service phases, competition frequency may be low. To address this, a group of validators called Guardian Provers will use a multisig scheme as a safety net until the system matures. As the system evolves, their role will gradually diminish and eventually disappear, enabling full decentralization.

2.3 Built for EVM Builders

Various features of Ethereum L2s and more decentralized L2s are attractive and necessary. However, we often overlook a key question: Why do Ethereum L2s exist? Who are they built for? The answer is simple: they exist for participants in their ecosystems who wish to use them. Among these, developers—who attract large user bases and drive the entire L2 ecosystem—are especially important. Yet, in this golden age of Ethereum L2 blockchains, numerous infrastructures with their own rules have emerged. This situation resembles operating the same service across countries with different laws and regulations, requiring significant unnecessary time and money to manage differences.

To help developers effectively concentrate resources on service development, we need to standardize rules and minimize gaps between infrastructures. For this, integrating historically proven or widely adopted infrastructures is crucial. Yes, we need to bring in infrastructures used within the Ethereum environment. This will allow developers to leverage methodologies and expertise accumulated on Ethereum, enabling them to seamlessly integrate into Ethereum L2 blockchains.

“Taiko only matters in this world when it helps others change the world.” — Taiko Labs

In this regard, Taiko demonstrates genuine commitment to developers. As stated in Taiko’s blog post, Taiko will benefit by empowering ecosystem participants—especially developers—to work freely. To fulfill this promise, Taiko continues to open-source all development implementations and has adopted a framework called Based Booster Rollup (BBR) to help EVM developers transition faster and more easily.

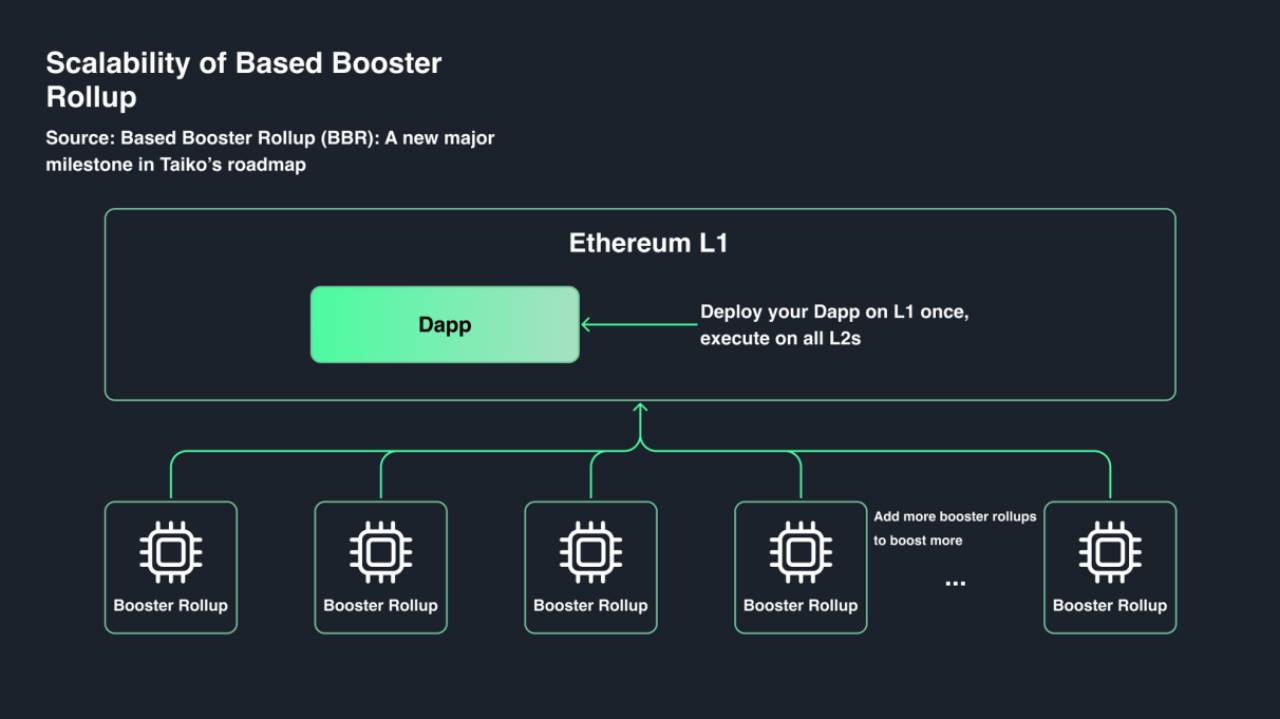

BBR extends the advantages of Based Rollup from a developer’s perspective, exploring how Based Rollup benefits can be applied to application-layer infrastructure. Through Taiko’s BBR, developers can deploy their dApp once on L1 Ethereum and achieve automatic dApp deployment across all L2s without additional work or resource investment.

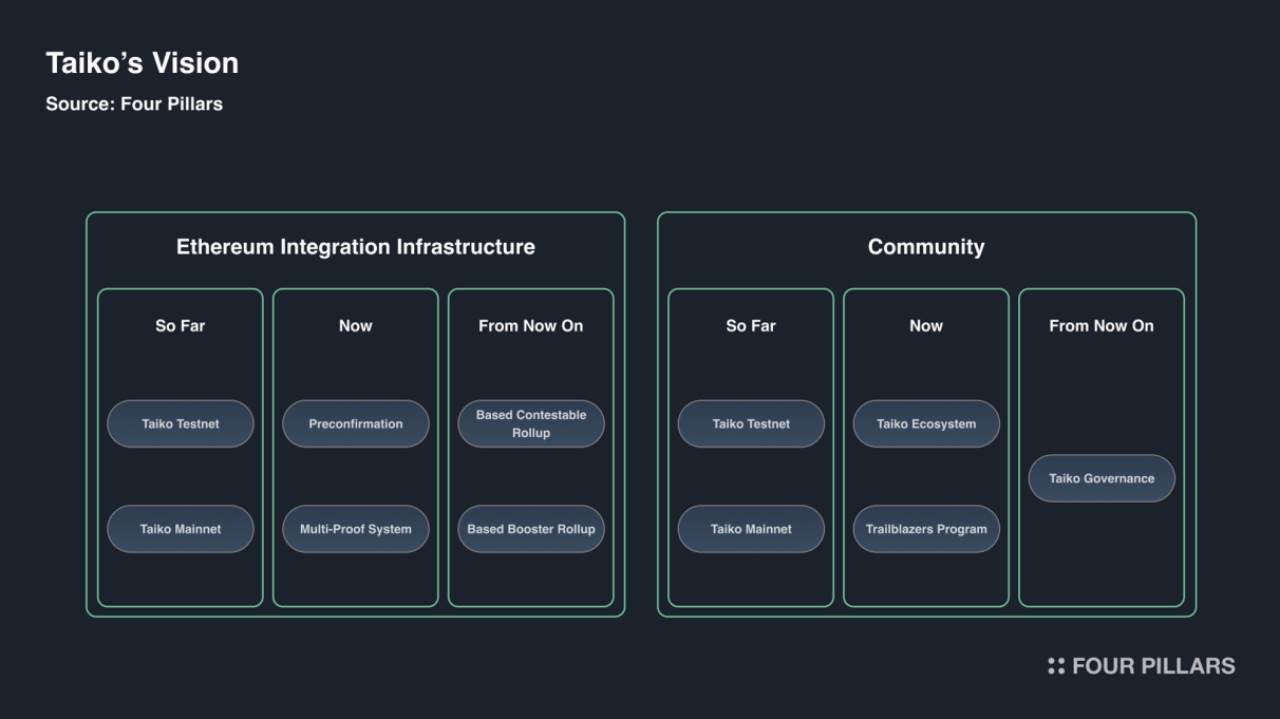

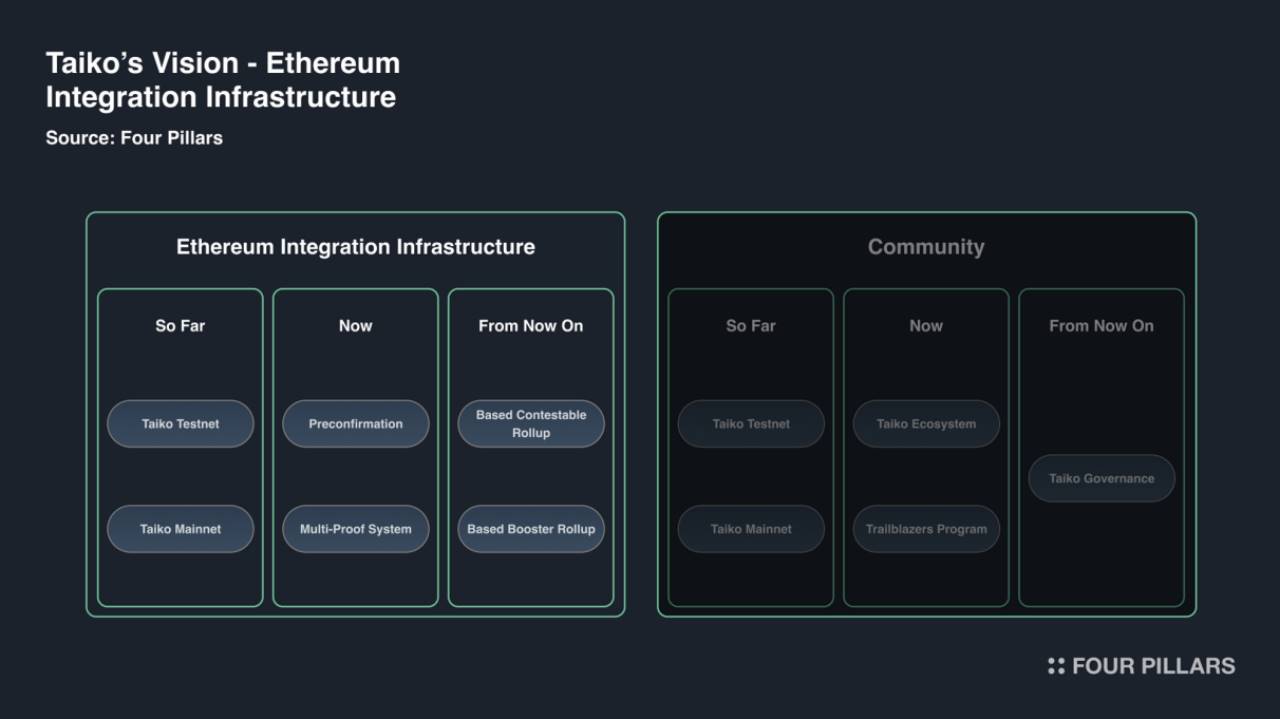

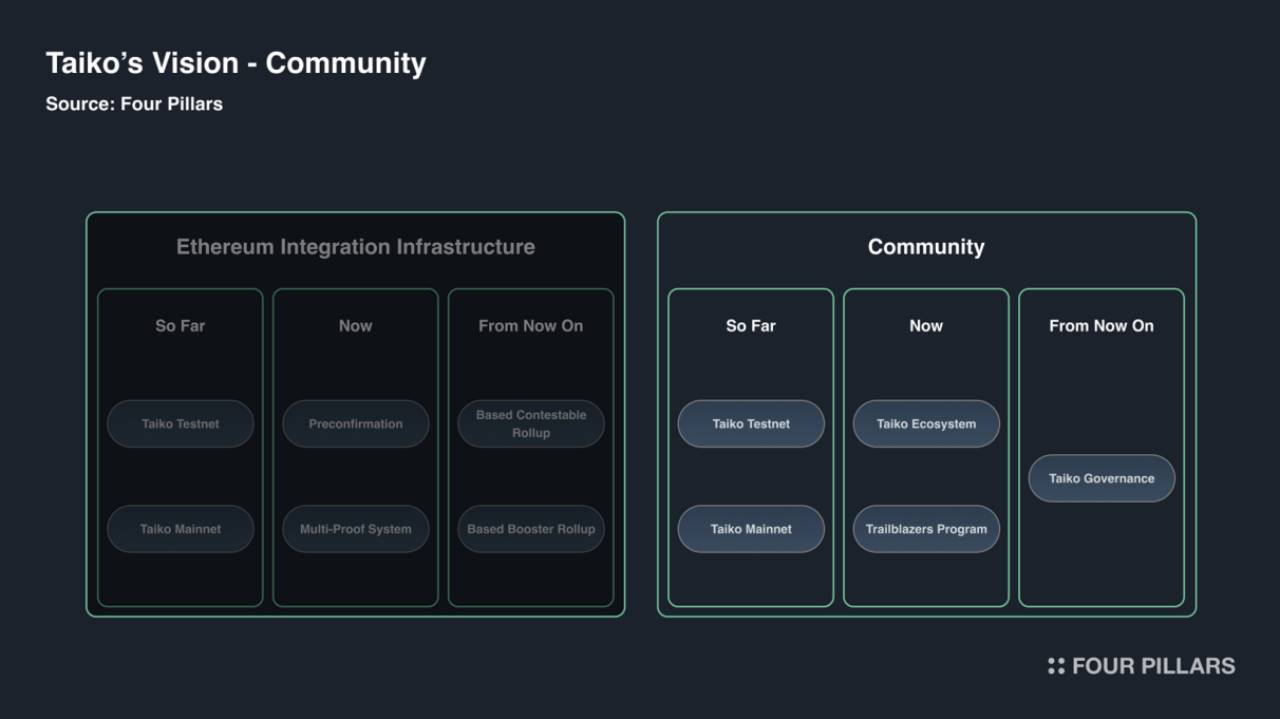

3. Taiko’s Vision: Integrated Ethereum Infrastructure and Community

We’ve explored the direction Taiko pursues. Although strong in理念,理念 alone cannot transform an industry. These理念 must be implemented on a defined timeline, allowing others to benefit, creating a virtuous cycle, and becoming an industry disruptor. Now, let’s examine how Taiko plans to become such a disruptor—from past, present, and future perspectives.

3.1 Ethereum-Integrated Infrastructure

One key pillar is infrastructure. As a cornerstone of becoming a true Ethereum L2, Taiko is leveraging multiple technological advantages to build this infrastructure. Let’s explore how Taiko’s infrastructure has evolved.

3.1.1 So Far—From Taiko Testnet to Mainnet

Taiko didn’t try to achieve all goals simultaneously. To reach the major milestone of mainnet launch, it conducted up to seven alpha testnets, progressively preparing for Taiko’s vision. Let’s review the content of these seven alpha testnet phases.

Alpha Testnet-1 (Snæfellsjökull)

All developers could deploy smart contracts, and users could use all Ethereum and Solidity tools just like on Ethereum. This allowed everyone to test transactions. This version enabled anyone interested to run an L2 node and participate in block proposing. Taiko planned to run some nodes and propose blocks, inviting everyone to join. The testnet included a bridge for transferring assets between the testnet and Ethereum, and a block explorer for checking transaction history.

Alpha Testnet-2 (Askja)

This was the first testnet to successfully verify that the network could operate via a proof mechanism open to all. It laid the foundation for full decentralization in this version. Additionally, blockchain network monitoring and alerting capabilities were implemented, and developers could directly deploy their dApps onto this testnet without modifying code used on Ethereum.

Alpha Testnet-3 (Grímsvötn)

This version established and implemented a token economic model based on new fee and reward models. It also included testing the necessary proof cooling mechanism in the proof mechanism and initial testing of Taiko L3’s starting layer.

Alpha Testnet-4 (Eldfell L3)

In this version, the initial layer of L3 was deployed for the first time, introducing the concept of rollup-on-rollup. Since Taiko L2 is fully integrated with Ethereum, Taiko treats L2 as L1 and attempts to extend to L3. Additionally, a new staking-based validation mechanism was introduced to prevent validator centralization and ensure fair rewards.

Alpha Testnet-5 (Jólnir)

This version introduced a new proposal and validation implementation based on proposer-builder separation (PBS). PBS is a series of processes involving economic mechanisms between proposers and builders, aimed at ensuring decentralized block construction. Unlike previous testnets that did not incorporate this aspect, this version adopted an open market model for block building.

Alpha Testnet-6 (Katla)

In the sixth testnet Katla, the initial version of BCR (Blockchain Consensus Rule) was implemented. Since Taiko aims to be an Ethereum-equivalent L2, this version tested and prepared for recent Ethereum updates such as EIP-4844, even though they hadn’t been activated yet. Additionally, the bridge was updated, and the block explorer enhanced to provide more comprehensive information.

Alpha Testnet-7 (Hekla)

The final testnet Hekla focused on activating EIP-4844, which had been prepared in the previous testnet. This successfully implemented and adopted the new rollup storage mechanism Blob on Ethereum mainnet. Additionally, this testnet version introduced improvements including adjustments to L2 block gas issuance, activation of snap sync, and modifications to EIP-1559 settings. Based on features applied and tested in this testnet version, the mainnet is now ready without issues.

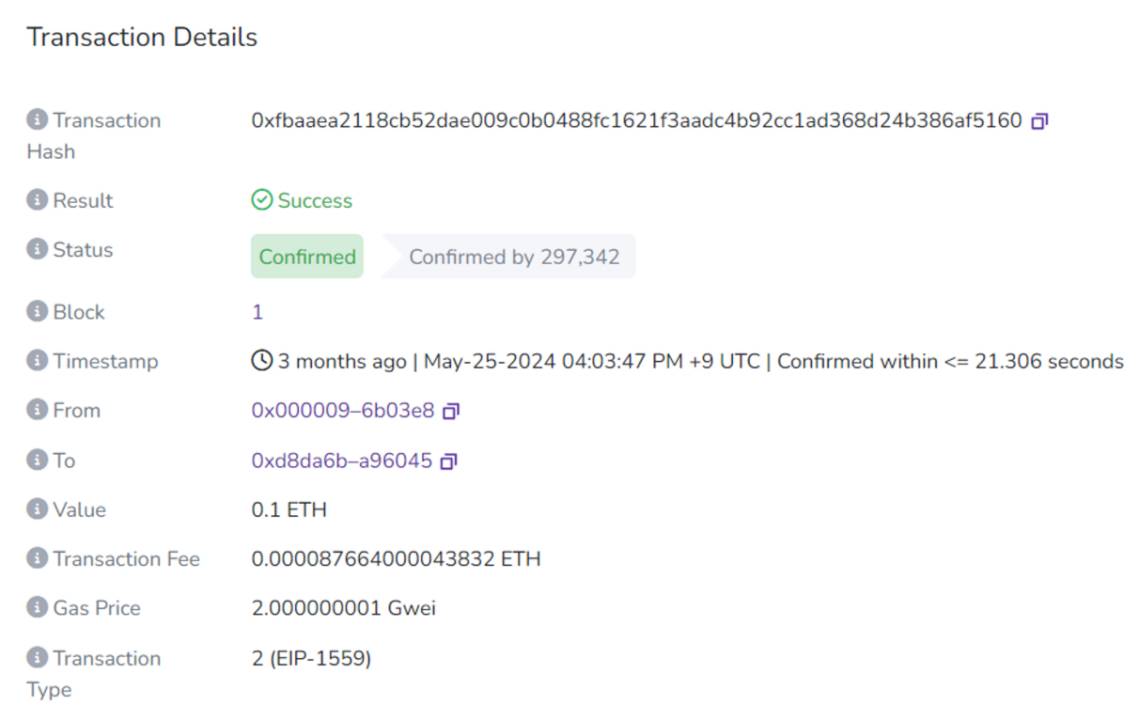

Source: Taiko Mainnet #1 Block

Taiko Mainnet

The blockchain network content verified and secured during the testnet phase is now showcased globally via the mainnet launch. Notably, Ethereum co-founder Vitalik Buterin generated the next block immediately after the genesis block, adding significance. General users can transfer ETH from Ethereum to Taiko mainnet via bridge and directly interact with decentralized applications (dApps) on the Taiko blockchain. Especially for developers, they can run nodes, propose and validate blocks, actively participating in the highly promising Taiko blockchain. Technically, Taiko introduced modules like BCR and Raiko, reflecting its determination to become a true Ethereum L2.

3.1.2 Present - Pre-confirmations and Multi-Proof Systems

During Taiko’s successful mainnet launch via six testnets, it continuously strengthened its internal structure to become a more advanced Ethereum L2. Two of the most notable developments are pre-confirmations and multi-proof systems, discussed in detail below.

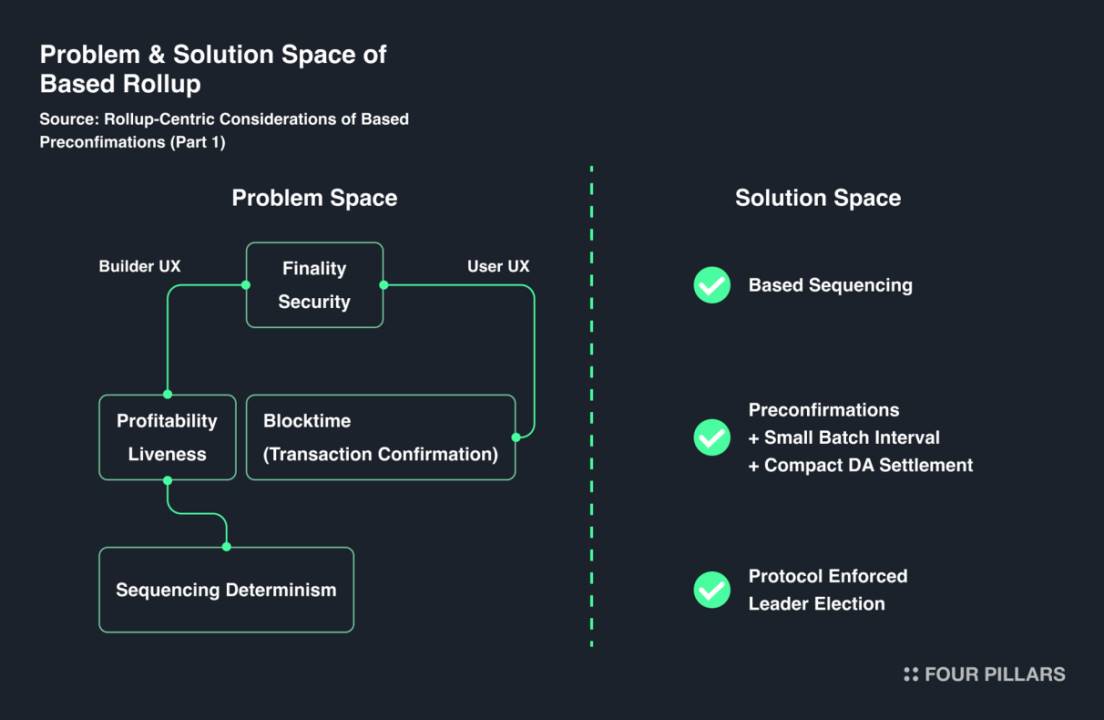

Pre-confirmations

Even after mainnet launch, Taiko continues striving to inherit Ethereum’s security and finality. However, this development brings risks—proposers may face survival challenges due to lack of profitability. For example, in liquidity-scarce ecosystems like Taiko, users typically offer proposers very low tips, making Taiko’s 12-second block time insufficient for any proposer to profit. Thus, Taiko Labs temporarily operates proposers without pursuing profit to prevent this. Without intervention, Taiko mainnet block times would continue increasing.

To address L2 block-building profitability, block time improvements, and data publishing efficiency, Taiko plans to introduce a concept called pre-confirmation. Pre-confirmation is a major R&D focus in the second half of 2024 and will play an important role beyond the Taiko mainnet. With pre-confirmation, L2 block building can become more efficient and stable, allowing users to enjoy faster transaction confirmation speeds. Additionally, pre-confirmation can simplify and strengthen rollup architecture by integrating roles of L2 and L1 proposers. This relates to ordered-based mechanisms, which may face practical difficulties when considering builder profitability, survival mechanisms, and fast block time configurations. However, if multiple pre-confirmation participants execute pre-confirmation, forks may occur on the Taiko mainnet. Therefore, despite some controversy, mechanisms like leader selection are being discussed as practical compromises.

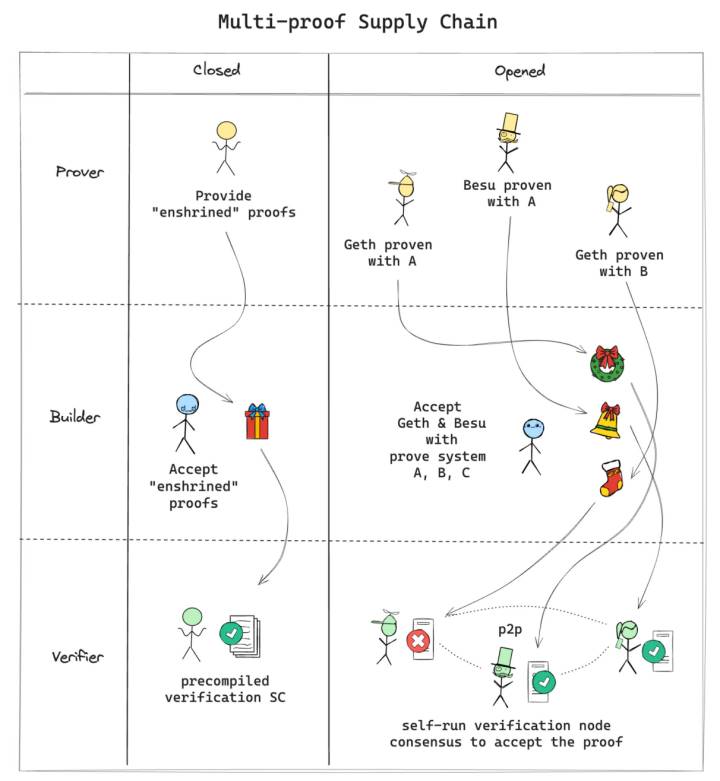

Multi-Proof System

Another R&D focus for Taiko is the multi-proof system, designed to integrate multiple clients and various proof systems. The multi-proof approach reduces risks from client implementation and proof system vulnerabilities, ensuring that even if one method is compromised, others can prevent the same exploit.

Source: Taiko’s Approach to Multi-Proofs

First, Taiko plans to establish an “open” multi-client system where each client independently verifies blocks. This allows users to choose preferred clients for block verification, bringing accessibility and scalability benefits. It also serves as a basic safeguard against single points of failure, contributing to secure mainnet operation. However, since this requires Ethereum (as the L1 network) to support multi-client functionality, Taiko plans to use a “closed” system employing multiple improved-type validators until full support is achieved.

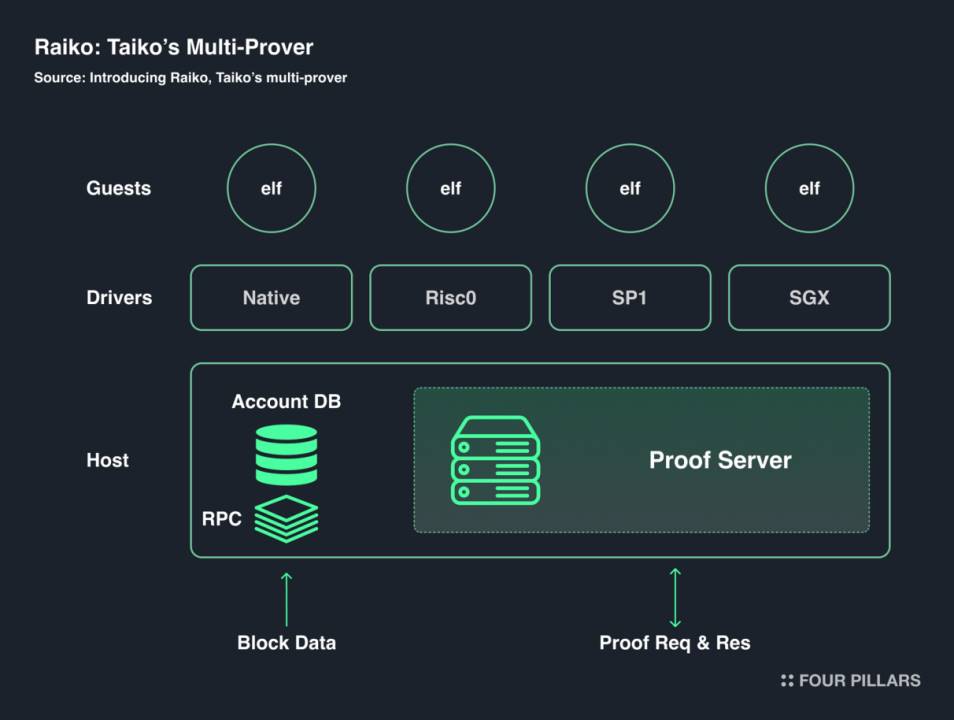

Moreover, Taiko runs a free-market-style multi-proof system where proposers seek validators, propose blocks, and use their chosen proof systems for validation. This multi-proof system emphasizes modularity and openness, enabling multiple clients and proof systems to collaborate when generating multiple proofs. To this end, Taiko collaborates with companies like Powdr Labs and Risc Zero to enhance compiler and zk-SNARK system interoperability and build a modular ZK stack.

The implementation of these concepts is known as “Raiko.” Raiko supports multiple zkVMs and enhances security using SGX. The system improves block proof flexibility through a ZK/TEE architecture and enhances zkVM and TEE via standardized input methods. Taiko plans to continue integrating more zkVMs and expanding Wasm zkVM. The system aims to provide a user-friendly, integrated environment for EVM-compatible block proofs.

3.1.3 Looking Ahead - Through BCR and BBR

Despite Taiko’s significant progress, the goal of becoming a disruptor still seems distant. Ultimately, Taiko’s path to fulfilling its final vision largely depends on two core components—BCR and BBR—which have been preliminarily implemented but still require further refinement.

Although we’ve already explained BCR and BBR above, let’s revisit them.

BCR allows users and developers to propose blocks, run nodes, and deploy smart contracts just like on Ethereum, while introducing a dispute resolution mechanism to quickly handle errors in rollups. This ensures determinism and accuracy within the blockchain, making BCR the cornerstone of Taiko’s core technology.

Source: Based Booster Rollup (BBR): A New Major Milestone in Taiko’s Roadmap

BBR leverages the advantages of Based Rollup to deliver higher efficiency and full Ethereum interoperability. This enables users to use integrated dApps across all L2s without switching between them, while developers can deploy dApps once and have them automatically adapt across all L2s. Furthermore, BBR solves fragmentation issues inherent in all rollups, significantly reducing transaction costs and improving throughput. Thus, Taiko believes BBR has the potential to fundamentally expand the Ethereum ecosystem—once applied, all Ethereum network users and developers can expect a better experience.

Taiko’s mainnet aims to support developers, users, and builders, enabling flexible and efficient operation within the Ethereum environment by focusing on these two core pillars. However, since these pillars are not yet perfect, they require continuous development and improvement to become key technological components enabling Taiko’s vision. As these pillars grow stronger and more complete, Taiko will be able to set a new standard for L2s—offering full Ethereum interoperability, complete decentralization, and closer alignment with users and builders.

3.2 Community

Another crucial pillar is community. To ensure the platform built by Taiko through its infrastructure holds real value, community engagement is vital. To this end, Taiko makes efforts across multiple areas—including token distribution, token economics development, ecosystem activation, and governance environment establishment. Let’s explore some of Taiko’s initiatives in these domains.

3.2.1 So Far - TAIKO Token Launch and Distribution

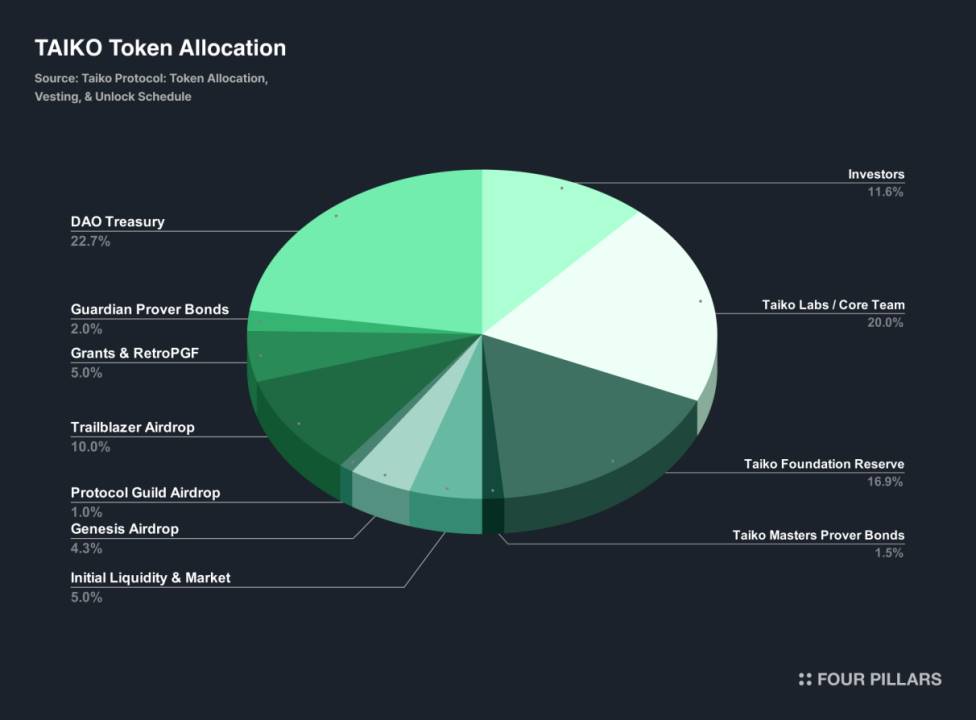

After Taiko mainnet launch, a TAIKO airdrop occurred—the native token of the Taiko network. TAIKO sits at the heart of Taiko’s economic mechanism and tokenomics, with a total supply of one billion tokens. Taiko’s Token Generation Event (TGE) took place on June 5, 2024. Specific allocations are as follows: 11.62% of total supply allocated to investors, 9.81695% to the Taiko Labs core team, as shown in the illustration.

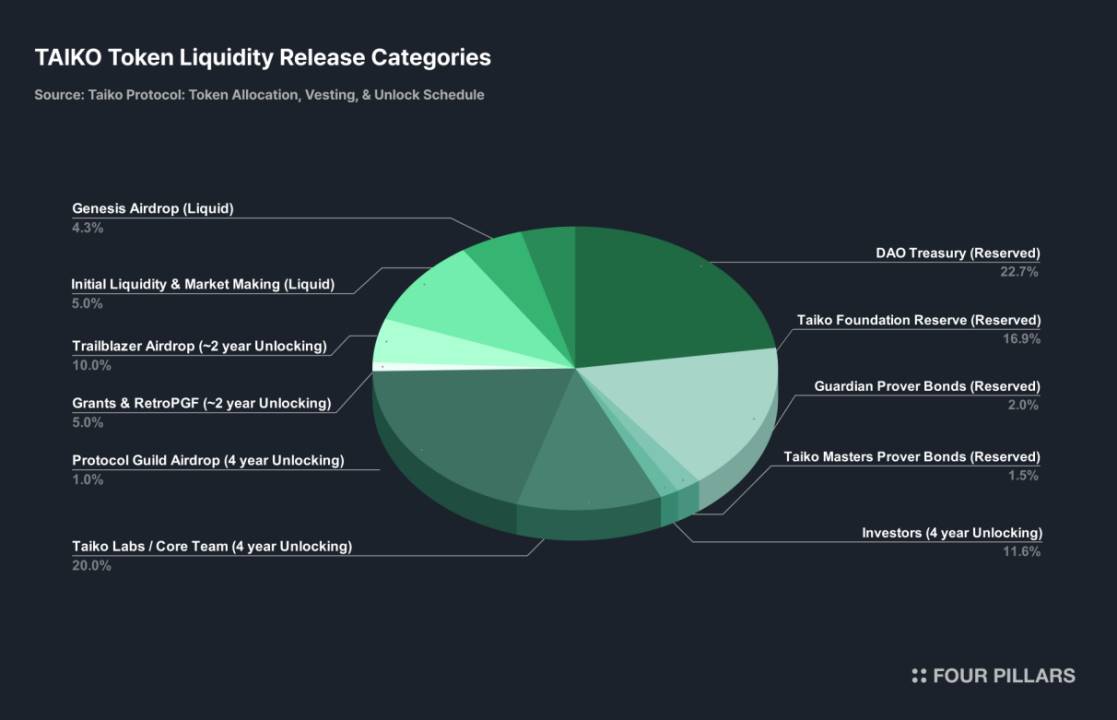

Distributed TAIKO tokens have an initial 12-month lock-up period. After the lock-up ends, 25% of locked tokens will be unlocked, with the remaining 75% gradually released over three years. This vesting structure is designed to minimize market volatility, encourage long-term participation in the Taiko ecosystem, and ultimately contribute to the success of the Taiko project.

The token liquidity release schedule is illustrated above, where green indicates distributed tokens, yellow represents tokens to be distributed over 2–4 years, orange shows tokens to be gradually distributed over three years starting one year after launch, and pink denotes tokens allocated to protocol development, DAO governance, and network operations over five years or longer.

3.2.2 Present - Expanding Taiko Ecosystem

Source: Introducing Trailblazers: Explore Taiko and Get Rewarded

Taiko’s Trailblazers Program is a loyalty initiative where users earn experience points (XP) and rewards through various on-chain activities on the Taiko mainnet. 10% of the total TAIKO token supply has been allocated to this program, allowing users to gain more XP and level up through participation. Certain NFT holders receive XP bonuses, and the program offers diverse activities and special events.

The program aims to encourage users to explore the Taiko ecosystem and actively engage with the community. XP can be earned through activities such as bridging, increasing transaction volume, and proposing blocks on the Taiko mainnet. At the end of each season, rewards are distributed based on accumulated XP.

Additionally, the Trailblazers Program features a faction system where users form teams and compete within two factions (Based and Boosted). Users collect badges associated with each faction, which provide bonus XP and other perks. At season’s end, the faction with the highest XP earns extra rewards. Developers can also participate and win awards for top-performing applications.

The Trailblazers Program aims to attract more users to the Taiko ecosystem, letting them gain experience and rewards through various activities.

With Taiko’s active support, the Taiko ecosystem is growing rapidly. More details on this will be covered in Chapter 4.

3.2.3 From Now On - Achieving Full Decentralization via Taiko Governance

To achieve full decentralization, Taiko will enable community participation in decision-making via a DAO. Major decisions will be made through voting by TAIKO token holders to determine the network’s operational direction. However, Taiko’s governance is still in early stages and not yet fully active. Therefore, an initial committee will be formed by Taiko Labs, with committee member additions and removals decided by Taiko DAO votes.

3.3 A Challenging Yet Progressive Path

Taiko is moving steadily forward—not quickly, but consistently progressing toward its desired理念 and goals. Taiko particularly emphasizes becoming a user- and developer-friendly blockchain, evident in the growing Taiko ecosystem following mainnet launch. In the next chapter, we’ll dive deeper into the development of the Taiko ecosystem.

4. Taiko’s Ecosystem

The Taiko ecosystem is a dynamic and collaborative space aiming to create a highly “Ethereum-friendly” environment for developers and users. Though currently in early stages, it aims to provide the tools and support that Ethereum offers. Key milestones include the Alpha-1 testnet launch in December 2022 and the mainnet launch in May 2024, which included a genesis airdrop and laid the foundation for community-driven development and governance.

A major initiative within Taiko is its grant program, providing financial and other support to projects on the platform. By supplying resources needed to realize ideas, Taiko supports developers. Through these grants, Taiko not only helps individual projects but also strengthens the entire ecosystem, encouraging product development for the broader Ethereum community.

Next, let’s explore the components that make up the “Taiko Ecosystem.”

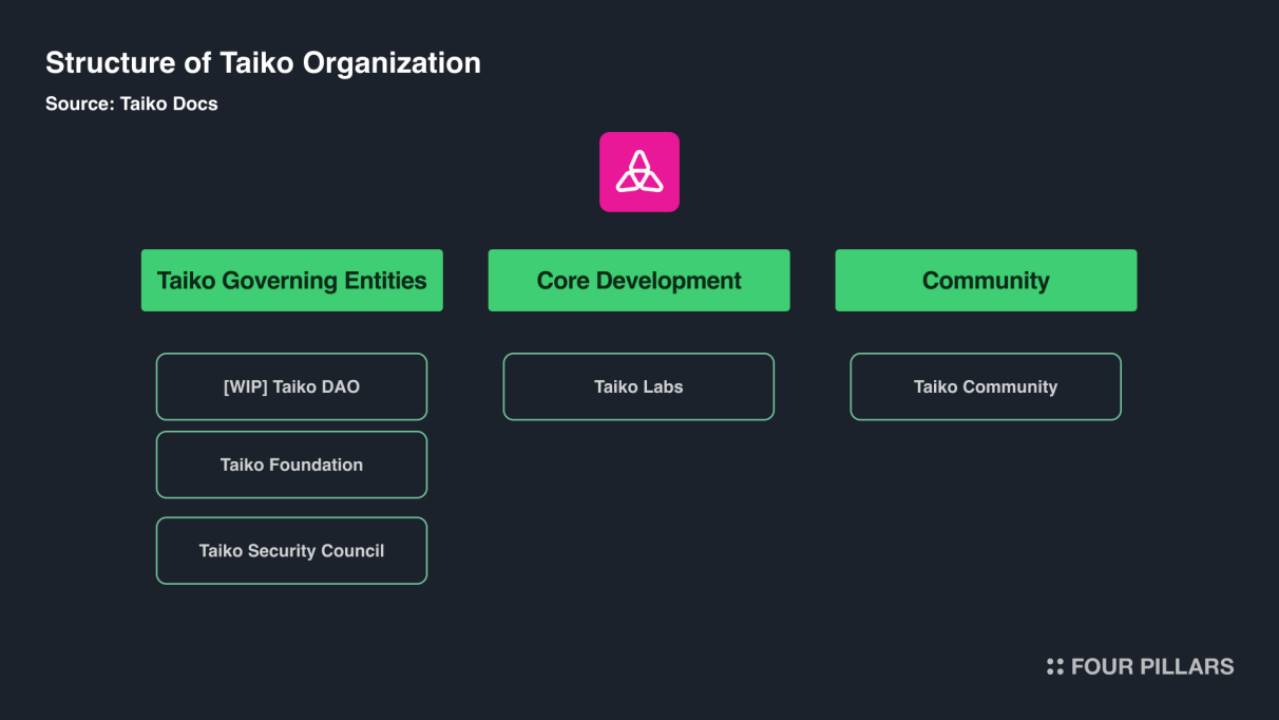

4.1 Taiko Organizational Structure

Source: What is Taiko? | Docs

Taiko L2’s organizational structure consists of several key parts, each playing a distinct role in managing the Taiko ecosystem.

4.1.1 Taiko Governing Entities

Taiko DAO

This DAO will be developed as the governing body of the Taiko protocol. TAIKO token holders will have voting rights to participate in decisions regarding smart contract upgrades and other network-related issues. This democratic structure ensures collective community control over all smart contract aspects of the Taiko protocol. Additionally, the Taiko treasury is managed by the DAO, handling revenue generated by the Taiko protocol to appropriately allocate financial resources supporting the protocol’s ongoing development and operational needs.

Taiko Foundation

The foundation oversees management of the Taiko protocol and its ecosystem. It supports the Taiko DAO and token holders by providing transparent funding for technical development, ecosystem growth, partnership agreements, and event organization.

Taiko Security Council

Elected by the Taiko DAO, the Security Council handles emergencies and takes necessary actions to ensure protocol security. It supervises critical upgrades and changes, manages Guardian Provers, and safeguards the integrity and security of the Taiko protocol.

4.1.2 Core Development

Taiko Labs

This is a team focused on research and development of the Taiko protocol. Taiko Labs is dedicated to advancing technology to enhance the protocol’s functionality and performance.

4.1.3 Community

Taiko Community

This includes all social groups and accounts related to Taiko, such as Taiko Discord and Taiko Twitter. The community serves as the primary platform for communication, interaction, and information sharing among Taiko enthusiasts and stakeholders.

4.2 Taiko Team Members

Co-Founder & CEO - Daniel Wang

An experienced blockchain entrepreneur and technical expert, Daniel Wang is widely recognized for founding the Loopring Foundation—one of the early zkRollups built for decentralized exchanges. From 2017 to 2021, his leadership helped make the Loopring protocol a major player in the DeFi space, improving transaction and payment efficiency. Prior to that, Wang held senior engineering roles at ZhongAn Insurance, JD.com, and Google, honing skills in managing complex systems and large teams. At Taiko, Wang successfully raised $37 million and is leading a project to develop an Ethereum-equivalent zkRollup aimed at scaling Ethereum while preserving its core principles of decentralization and security.

Co-Founder & COO - Terence Lam

He plays a key role in corporate strategy and operations. With thirty years of experience in both Web2 and Web3 industries, including multinational Fortune 500 companies and numerous startups, Terence brings extensive expertise to Taiko. He played a pivotal role in securing $37 million in funding from renowned venture capital firms such as Lightspeed Faction and Hashed. Before joining Taiko, he was an associate professor at the University of Hong Kong and graduated from several prestigious institutions including Harvard Business School.

Co-Founder & CTO - Brecht Devos

He gained deep technical experience through his work at Loopring. At Taiko, Brecht plays a key role in designing the technical architecture of the Ethereum-equivalent zkRollup, including innovative designs such as the contestable rollup (BCR) and booster rollup (BBR). This architecture aims to streamline the Layer 2 value chain, reduce trust assumptions, and promote developer adoption. His leadership was crucial to successfully executing six testnets involving over 1.1 million unique wallets and an active developer community, preparing for Taiko’s successful mainnet launch.

Chief Community Officer - Ben Wan

As Taiko’s Chief Community Officer, Ben Wan played a key role in growing what is now the largest crypto community on Discord, with over 1,000,000 members. His leadership was instrumental in the success of Taiko’s testnets and the rapid growth of its mainnet. Ben’s background in managing global IT projects for major multinational corporations enables him to effectively guide and support Taiko’s diverse, global community.

4.3 Ecosystem Overview

Taiko’s ecosystem is built around a community-driven model emphasizing open-source development. Additionally, Taiko supports a wide range of applications and tools across multiple domains, including DeFi, bridges, and Web3 infrastructure. Because Taiko is fully EVM-compatible, Ethereum dApps can be ported more easily and with lower risk.

Let’s dive deeper into this ecosystem—from infrastructure to user experience.

Source: Ecosystem - Taiko

4.3.1 Core Infrastructure

From the beginning, the ecosystem has prioritized developer-friendly tools. Key partnerships with industry leaders have been established to provide core services: ANKR for RPC, Covalent and Subgraphs for indexing, Pyth and Redstone for oracle solutions, and Tenderly for developer tools. This suite ensures developers have access to highly reliable infrastructure from the earliest testnet stages. Below is an overview of key participating projects:

ANKR

ANKR provides remote procedure call (RPC) services, essential for developers interacting with blockchain networks. RPC services facilitate communication between dApps and blockchains, enabling developers to efficiently execute commands and retrieve data. ANKR’s infrastructure is known for reliability and speed, crucial for maintaining seamless operations within the Taiko ecosystem.

Covalent and Subgraphs for Indexing

Covalent and Subgraphs provide indexing solutions that allow developers to easily query blockchain data. Covalent offers a unified API that aggregates data from multiple blockchains, making it easier for developers to access and analyze blockchain information. Subgraphs, part of The Graph protocol, enable efficient querying through decentralized indexing services. Together, these tools provide developers with the infrastructure needed to build data-driven applications and effectively access and utilize blockchain data.

Pyth and Redstone for Oracle Solutions

Oracles are core components of blockchain ecosystems, as they deliver external data to smart contracts. Pyth and Redstone are two oracle solutions integrated into the Taiko ecosystem. Pyth focuses on delivering high-fidelity financial market data, crucial for DeFi applications needing real-time price information. Meanwhile, Redstone provides a flexible and decentralized oracle network supporting multiple data feeds.

Tenderly for Developer Tools

Tenderly provides a suite of developer tools that optimize the development and debugging of smart contracts. Featuring real-time monitoring, alerts, and advanced debugging capabilities, Tenderly helps developers quickly identify and resolve issues. Tenderly’s tools are especially useful during testing and deployment phases, offering deep analysis of smart contract performance and behavior.

4.3.2 Applications - DeFi

Since the mainnet launch in late May, the DeFi sector has seen significant growth, blending mature and native blockchain projects. Users can access various DEXs, including OKU (Uniswap V3), and native versions Ritsu and Henjin DEX. Other notable projects include:

iZUMi Finance (DEX)

iZUMi Finance is a multi-chain DeFi protocol that has expanded its services to the Taiko blockchain, focusing on providing liquidity solutions. On Taiko, iZUMi Finance launched

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News