ETH's inflation dilemma: caused by the successful Cancun upgrade?

TechFlow Selected TechFlow Selected

ETH's inflation dilemma: caused by the successful Cancun upgrade?

When will ETH start to become deflationary based on Gas levels?

By 0XNATALIE

The Ethereum Execution Layer Meeting 195 discussed a proposal to adjust the minimum blob base fee. Blobs are a type of data storage introduced by EIP-4844 in the Cancun upgrade, enabling lower-cost data storage and processing on Ethereum. The current minimum base fee (MIN_BASE_FEE_PER_BLOB_GAS) is set at 1 wei. SMG researcher Max Resnick proposed increasing this minimum fee to accelerate fee adjustments during network congestion.

Raising Blob Base Fees: A Cure or Poison?

The minimum base fee represents the lowest cost required for processing blob data. Since the implementation of EIP-1559, Ethereum's gas structure has changed. Previously, transaction fees were determined through an auction mechanism—users who bid higher had their transactions prioritized for inclusion in blocks. This led to bidding wars during network congestion, causing unpredictable spikes in transaction costs. EIP-1559 split gas fees into two components: the base fee and the priority fee. The base fee is burned with every transaction and automatically adjusts based on network congestion. When block utilization increases due to high transaction volume, the base fee rises, making transaction costs more predictable while reducing ETH inflation through token burning. Users can still offer a priority fee to incentivize validators to prioritize their transactions; this portion is not burned but paid directly to validators as a reward. Setting a minimum base fee for blobs ensures that even during periods of low network activity, the cost of processing blob data won't fall below this threshold. Increasing this floor would raise the cost for L2s posting data to the mainnet and theoretically result in more ETH being burned.

Max proposes raising the minimum base fee from 1 wei to 160,217,286 wei. His goal is to reduce the time needed for prices to reach equilibrium levels. He argues that under the current setup, blob prices rise too slowly when entering price discovery (i.e., determining the appropriate blob gas price). Starting from nearly zero, it takes about 160 blocks (approximately 32 minutes) to reach a reasonable level, resulting in excessive delays before reaching appropriate fee levels during congestion. By setting the minimum closer to what would be considered a fair market value, fees could stabilize much faster. This, he believes, would allow Ethereum to handle transactions and blob data more quickly and stably. Max contends that adjusting to 160,217,286 wei wouldn’t significantly increase the final blob gas price but would drastically shorten the time to reach price equilibrium.

Community Perspectives

This proposal has sparked debate within the community. Ryan Berckmans opposes raising the blob base fee, arguing that Ethereum’s current strategy relies on offering low-cost or even free data availability (DA) during periods of low congestion to attract more users and developers, thereby building network effects. This approach resembles a "first-mover" market capture strategy aimed at securing greater future market share and ecosystem value. He warns that raising fees would create higher barriers to entry, weaken network neutrality, and notes that the blob market hasn’t yet fully stabilized—making such a change premature.

Team D from Blockworks argues that increasing the minimum fee won't solve Ethereum’s scalability challenges and may actually undermine its competitiveness in data availability services. Instead, they advocate expanding L1 capacity to increase execution fees while making DA services cheaper—strengthening Ethereum’s overall competitive edge and attracting more rollups, which would further drive ETH usage and demand. Foobar, founder of clusters, shares a similar view, calling the fee hike short-sighted. He warns it could damage Ethereum’s credibility and push rollups toward alternative chains like Celestia, weakening Ethereum’s core value proposition.

Bena Adams, a development contributor at Nethermind, supports the proposal. She points out that while economically, 1 wei and 1 gwei might seem negligible, using 1 wei as the smallest unit becomes impractical during network congestion. Although fees theoretically rise with demand, starting from just 1 wei means the adjustment is too slow to reflect real-time congestion accurately, failing to regulate network demand effectively.

Ethereum researcher Potuz adds that if the fee were set by the consensus layer (CL) rather than the execution layer (EL), the minimum might have been set directly at 1 Gwei (i.e., 1 billion wei). The consensus layer uses uint64 instead of uint256 for fee calculations, which has lower precision for small decimal values. As a result, extremely small units like 1 wei would likely be avoided altogether. Had the initial design used CL-based pricing, this controversy over excessively granular minimum fees might never have arisen.

Will It Actually Help Reduce ETH Inflation?

Proponents also argue that raising the blob base fee could help mitigate ETH inflation. For example, Cygaar from Abstract notes that prior to EIP-4844 (before March 13, 2024), rollups were the primary consumers of ETH gas fees. Now, however, blob space is nearly free for rollups, meaning Ethereum gains little economic value from L2 DA costs. A short-term fix, according to him, is to raise the blob base fee—increasing fee burn and thus reducing inflationary pressure on ETH.

However, Doug Colkitt, founder of ambient, counters that despite blob space utilization reaching around 80%, much of it is occupied by low-value spam transactions. These transactions are highly sensitive to fee changes—meaning even a slight increase in blob fees would cause them to drop off rapidly or disappear entirely. Consequently, the actual impact on total ETH burned would remain minimal.

When Will ETH Become Deflationary?

Setting aside blob fees, at what base fee level would ETH begin to become deflationary?

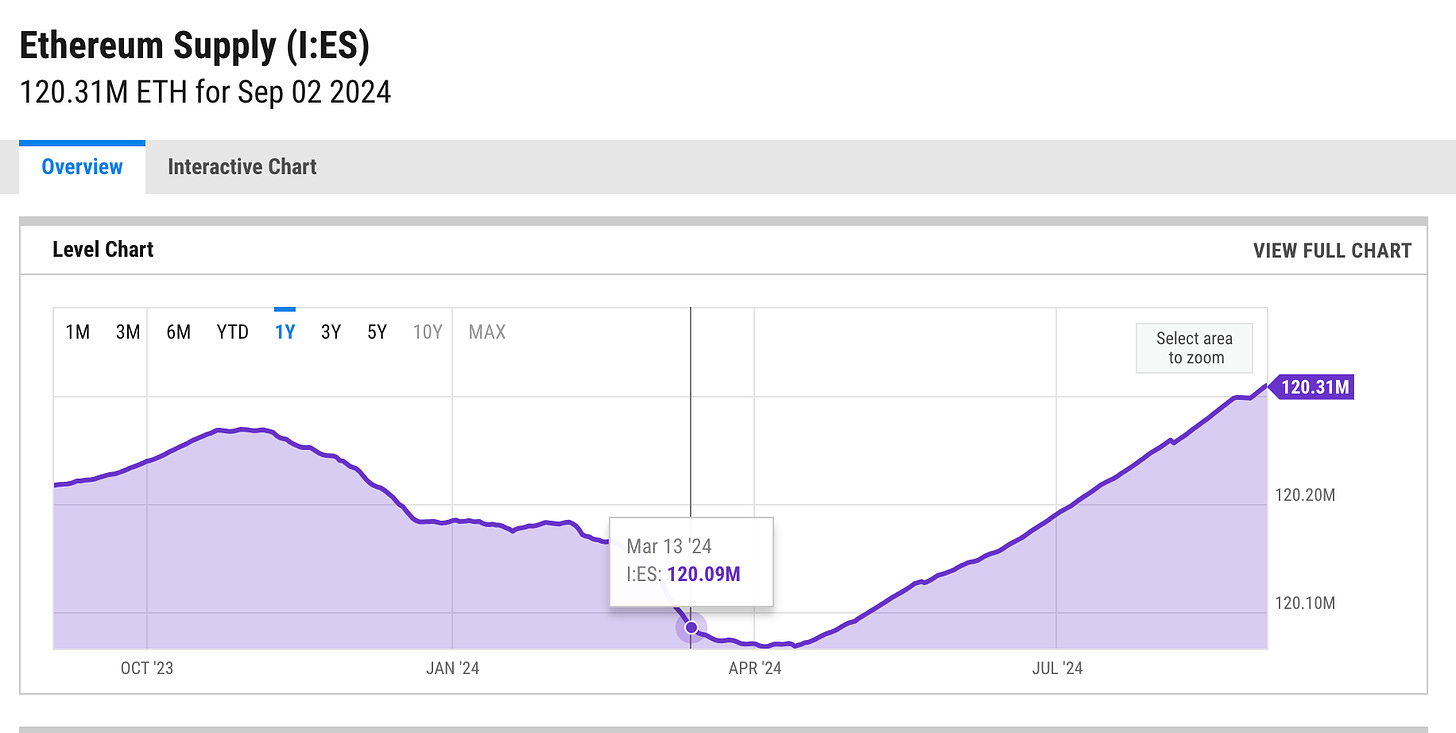

ETH has no fixed supply cap. Under PoS, annual issuance depends primarily on the amount of staked ETH and overall network activity. More staking leads to higher issuance, partially offset by the burn mechanism introduced via EIP-1559. Post-EIP-1559, the annual issuance rate ranges between 0.5% and 2%, depending on staking levels and network usage. The average block size target is 15,000,000 gas, with an average block time of 12.05 seconds. ETH becomes deflationary when the amount burned exceeds annual issuance.

The amount of ETH burned per block equals the sum of base fees across all transactions in that block: base fee × block size (using the target of 15,000,000 gas). Annual burn is then calculated as: per-block burn × number of blocks per year (approximately 2,620,000 blocks annually based on 12.05-second intervals).

Assuming a 1% annual issuance rate and a current supply of 120,330,000 ETH, annual issuance amounts to roughly 1,203,300 ETH. For ETH to become deflationary, annual burns must exceed this figure. Therefore:

Base Fee × 15,000,000 × 2,620,000 > 1,203,300

Solving this equation shows that ETH would start becoming deflationary at a base fee of approximately 30.62 Gwei. Similarly, with a 0.5% issuance rate, the threshold drops to about 15.31 Gwei. At a 2% issuance rate, the required base fee rises to around 61.23 Gwei for deflation to occur.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News