Modular Narrative Watch: Over 80 Projects Focused on This Direction, Celestia's Market Share Rises to 40%

TechFlow Selected TechFlow Selected

Modular Narrative Watch: Over 80 Projects Focused on This Direction, Celestia's Market Share Rises to 40%

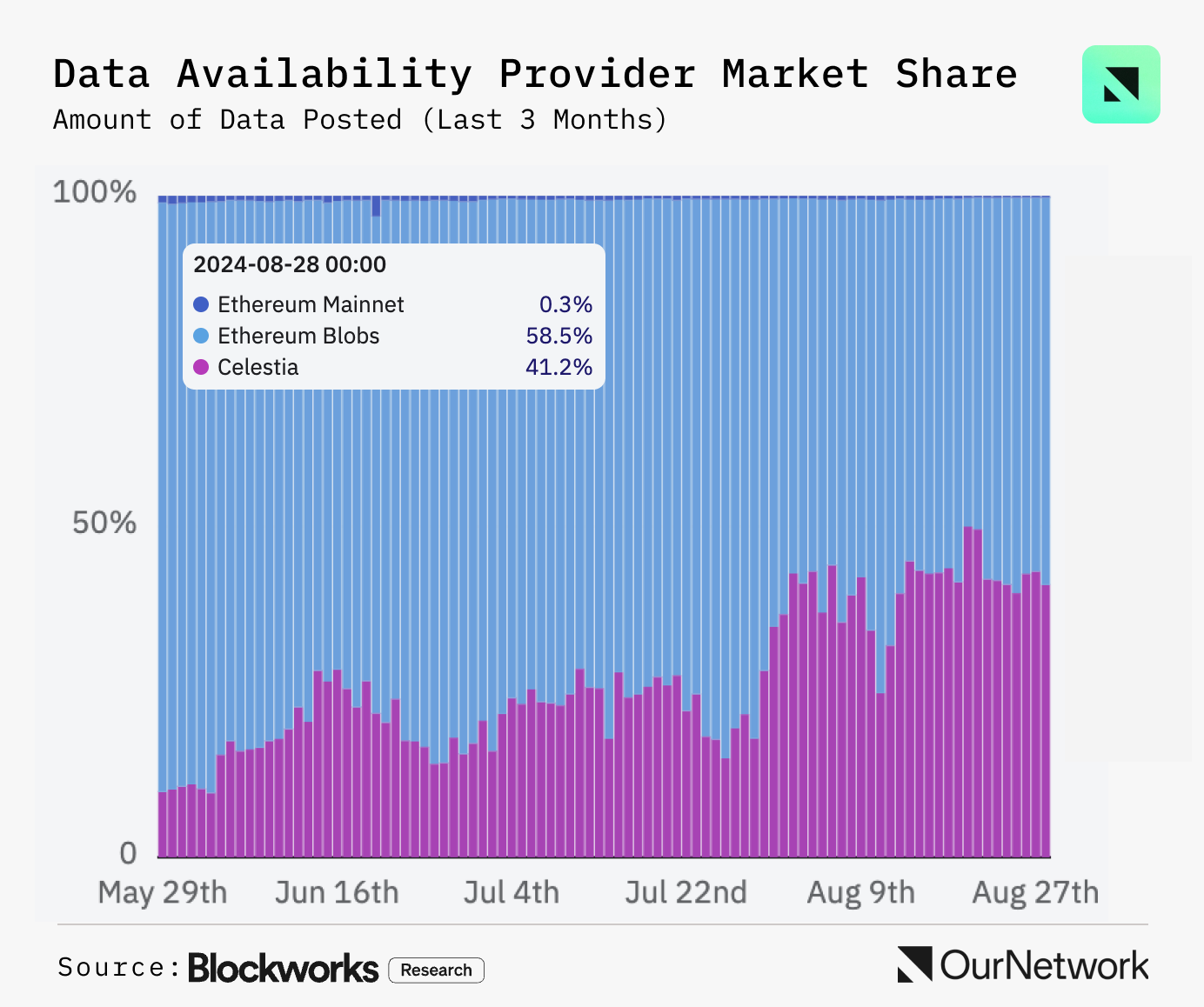

Over the past three months, Celestia's data availability market share has grown from around 10% to over 40%.

Author: OurNetwork

Translation: TechFlow

A new paradigm is emerging. Modular blockchains enable more customized construction of new chains, achieving scalability beyond what ETH L1 alone can offer. Modularity refers to breaking down blockchain functions into composable, plug-and-play protocols across execution, settlement, consensus, and data availability.

-

Execution: This is the environment where applications reside and state changes are processed.

-

Settlement: An optional hub for validating proofs from execution layers, resolving fraud disputes, and bridging between different execution layers.

-

Consensus: Agreement on the order of transactions.

-

Data Availability: Ensuring transaction data is downloadable and verifiable.

Moving execution off the mainnet, L2s were Ethereum’s first major step toward modularity. Since then, other projects have begun focusing on different components of the blockchain tech stack, each aiming to improve scalability and throughput through distinct trade-offs. In this edition, we’ve invited several leading figures to introduce some of the most influential and emerging projects in the modular space. Stay tuned!

Modular Celestia | Omni Network | AltLayer | Conduit

Over 80 teams are building in the modular ecosystem

-

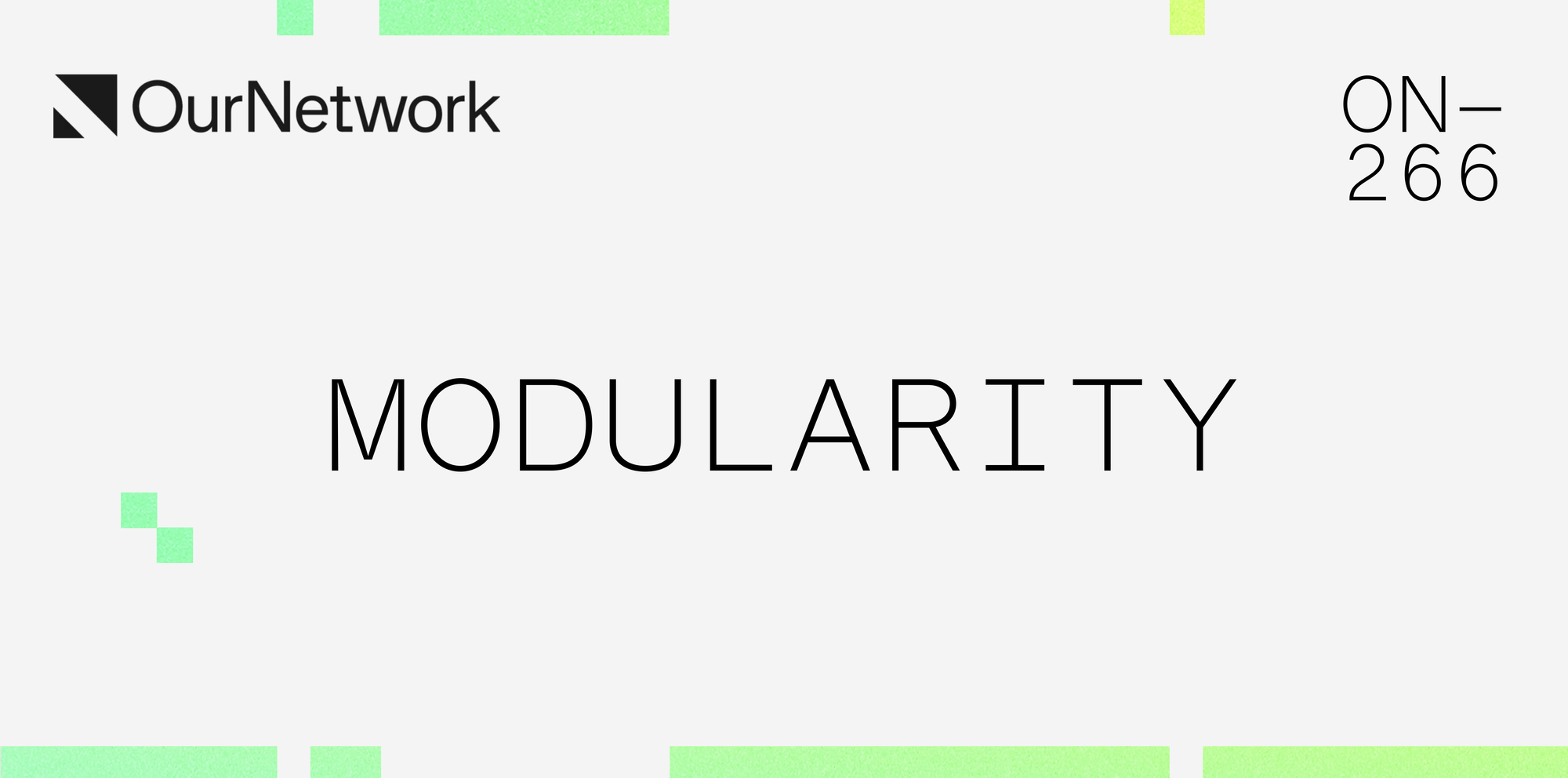

Modularity has long been criticized for fragmentation. Cross-Rollup interoperability is now the central focus for scaling modular expansion—crypto may have reached a pivotal turning point as chain abstraction teams build better user experiences within the modular ecosystem. The chart below shows over 80 teams driving unification in the modular landscape.

-

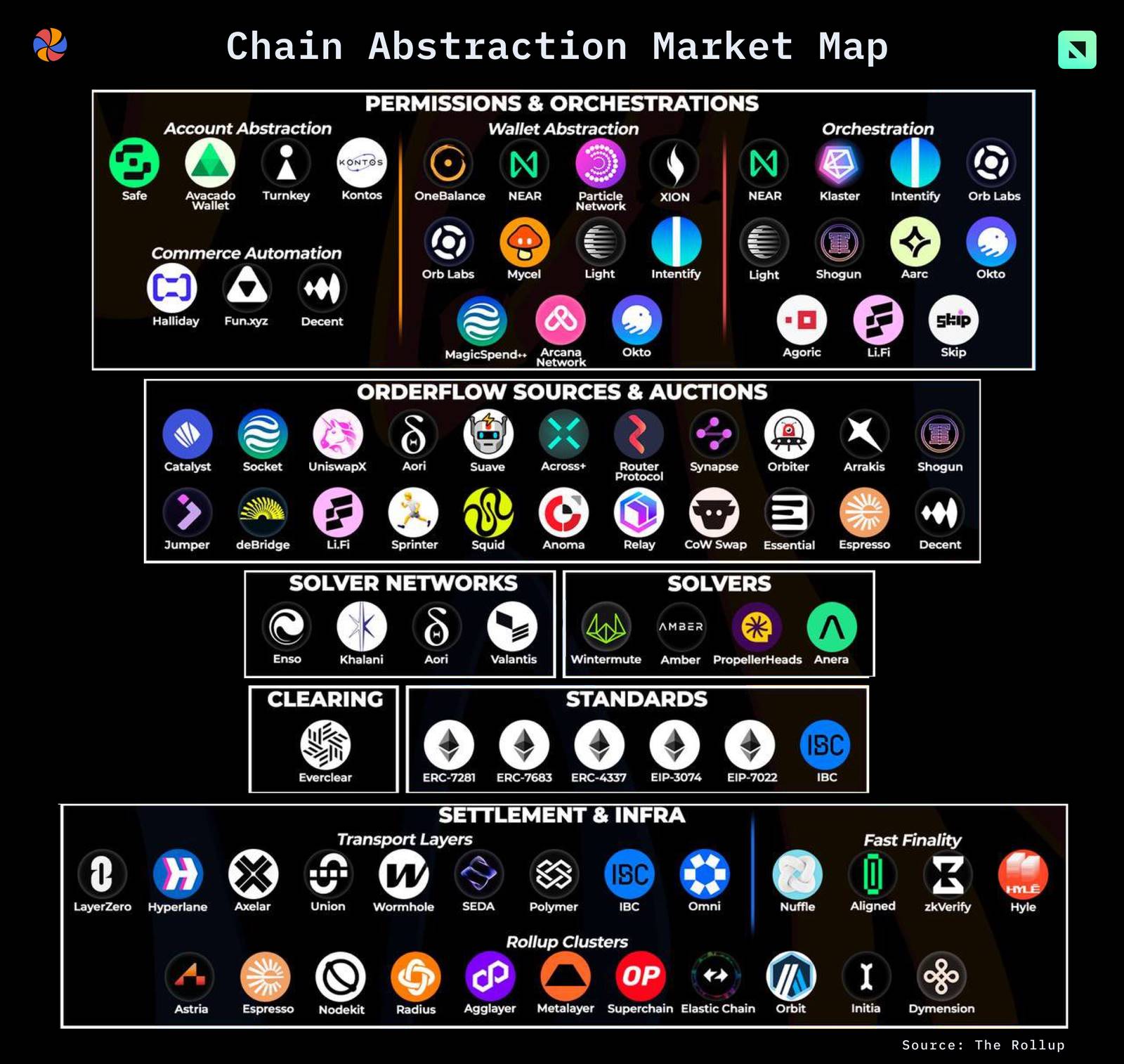

Major players are gaining momentum—Celestia has captured 44% of total data publishing volume among all data availability providers, including Ethereum. Hyperlane, a project designed to facilitate inter-chain interactions, has surpassed 4 million total transactions. Hyperlane’s ability to connect to longer-tail L2s gives it dominance along specific routes.

-

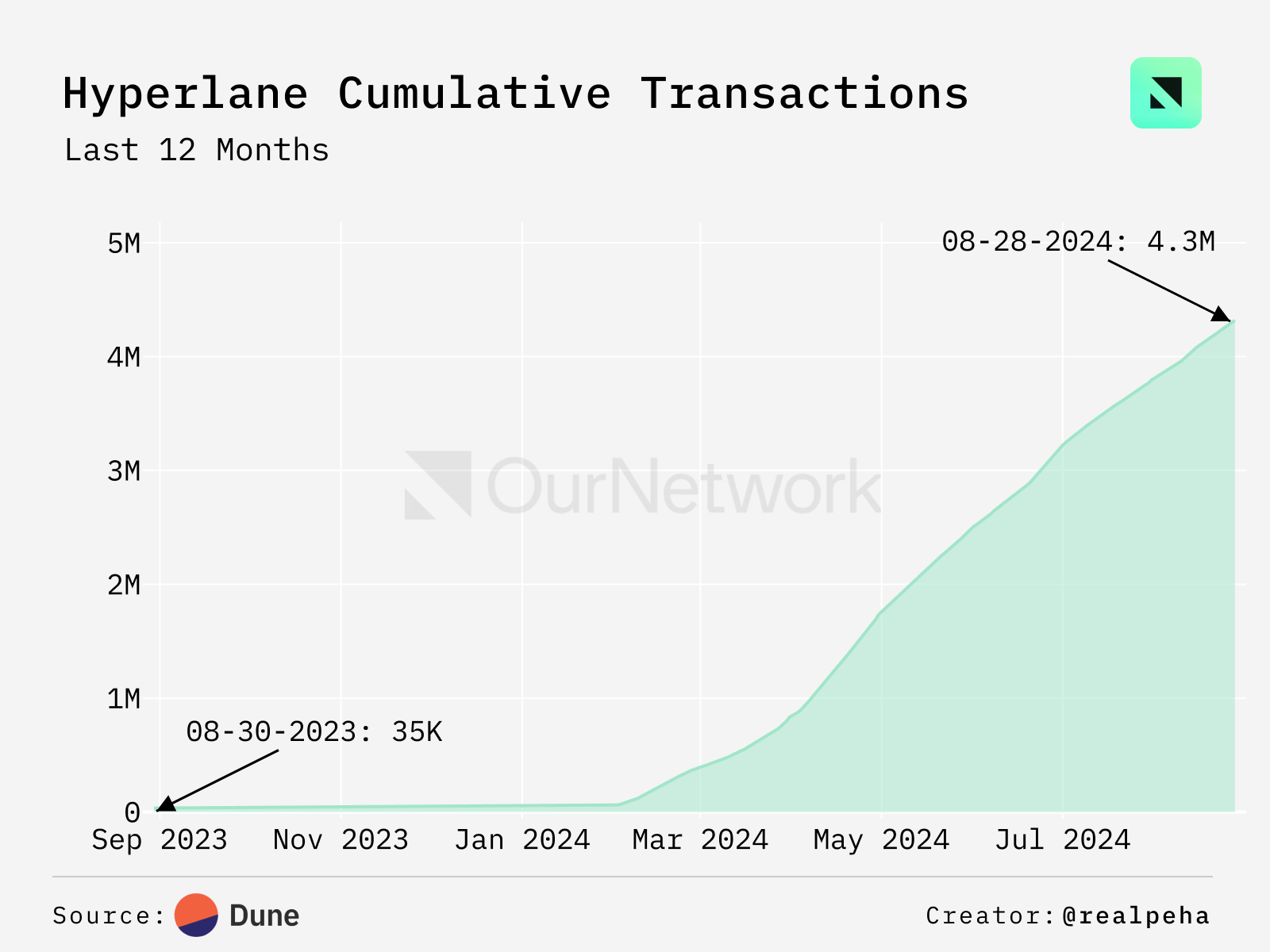

According to Kaito AI’s mindshare metric for modularity, there has been a steady horizontal trend over the past year. Interest increased in February, peaked in July, but declined slightly in August amid broader crypto market weakness at the end of summer.

Celestia

Owen Fernau | Website | Dashboard

In the past three months, Celestia’s share of data availability has grown from around 10% to over 40%.

-

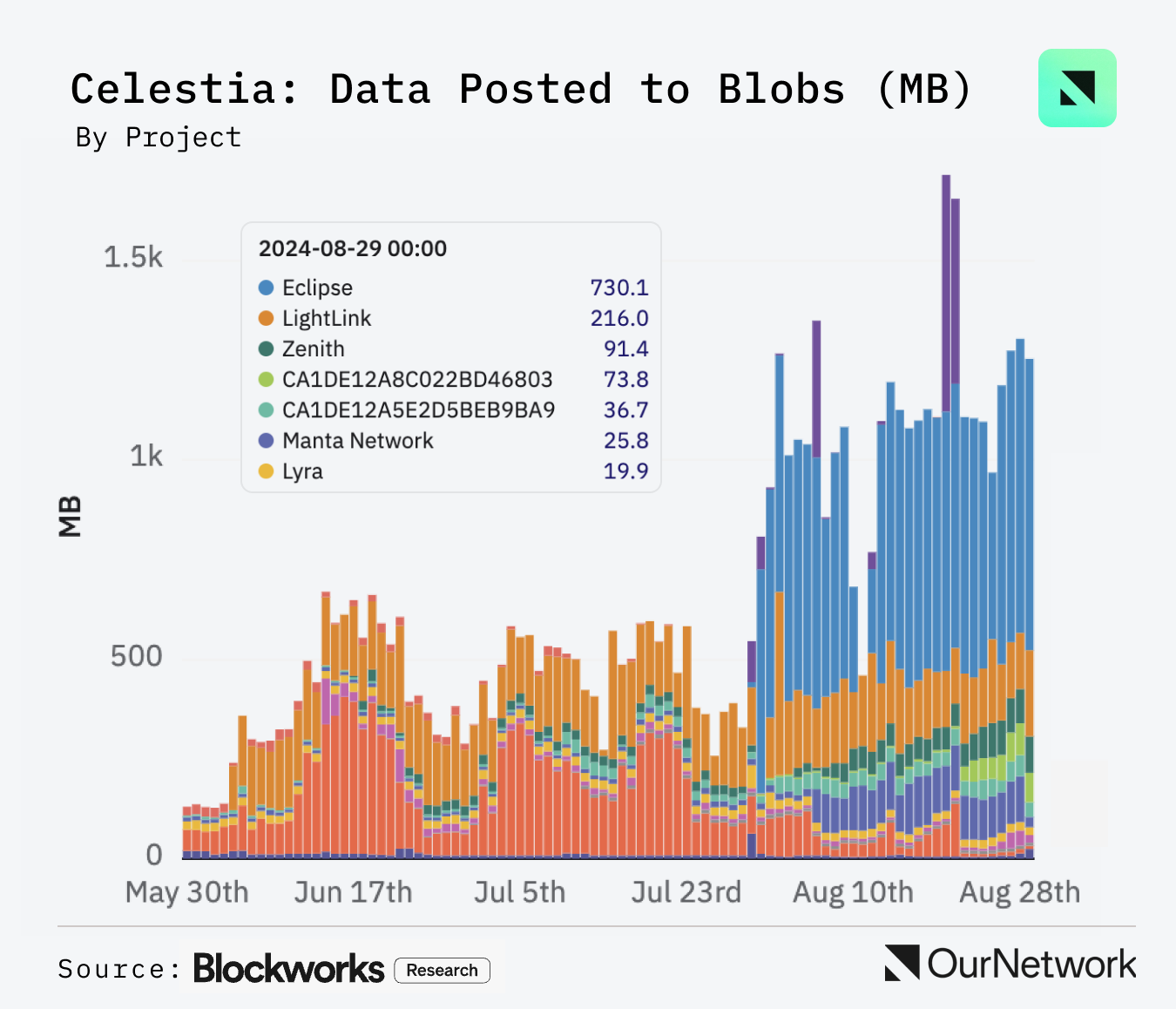

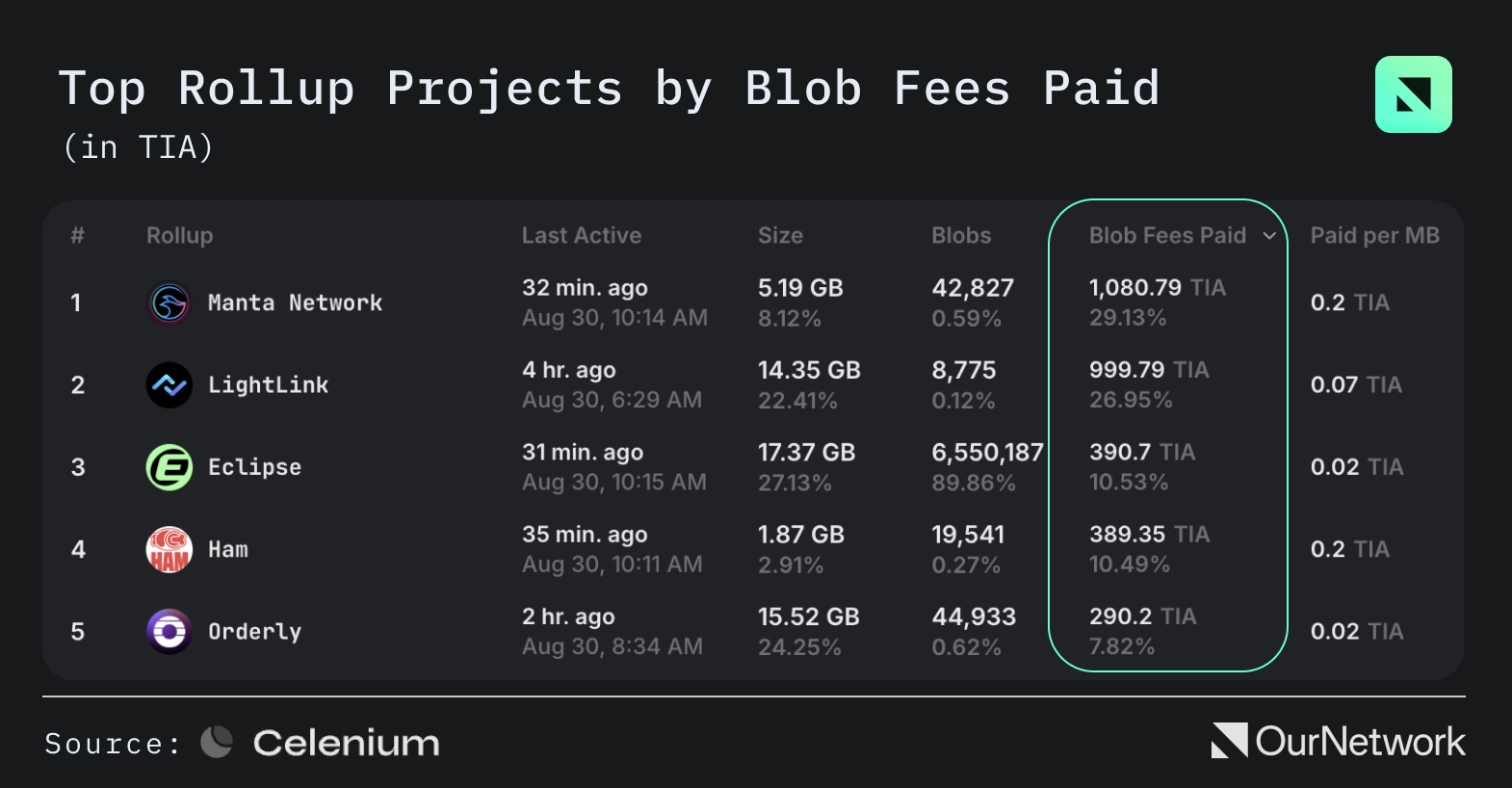

Celestia is a data availability solution for modular EVM blockchains, meaning nodes can verify data without downloading entire blocks. Since its launch on July 31, Eclipse, an emerging Layer 2 project, has become Celestia’s largest user. LightLink, another Ethereum L2, is now the second-largest consumer of Celestia data blobs.

-

Over the past three months, Celestia’s market share has surged from 9.9% to over 40%, measured by volume of data published on its platform. Ethereum data blobs, launched on March 13 as part of the Dencun upgrade, remain the dominant source of data availability, holding over 58% market share.

Omni Network

Chase Devens | Website | Dashboard

Omni provides chain abstraction across Arbitrum, Optimism, and Base, supporting $4.7 billion worth of Rollups.

-

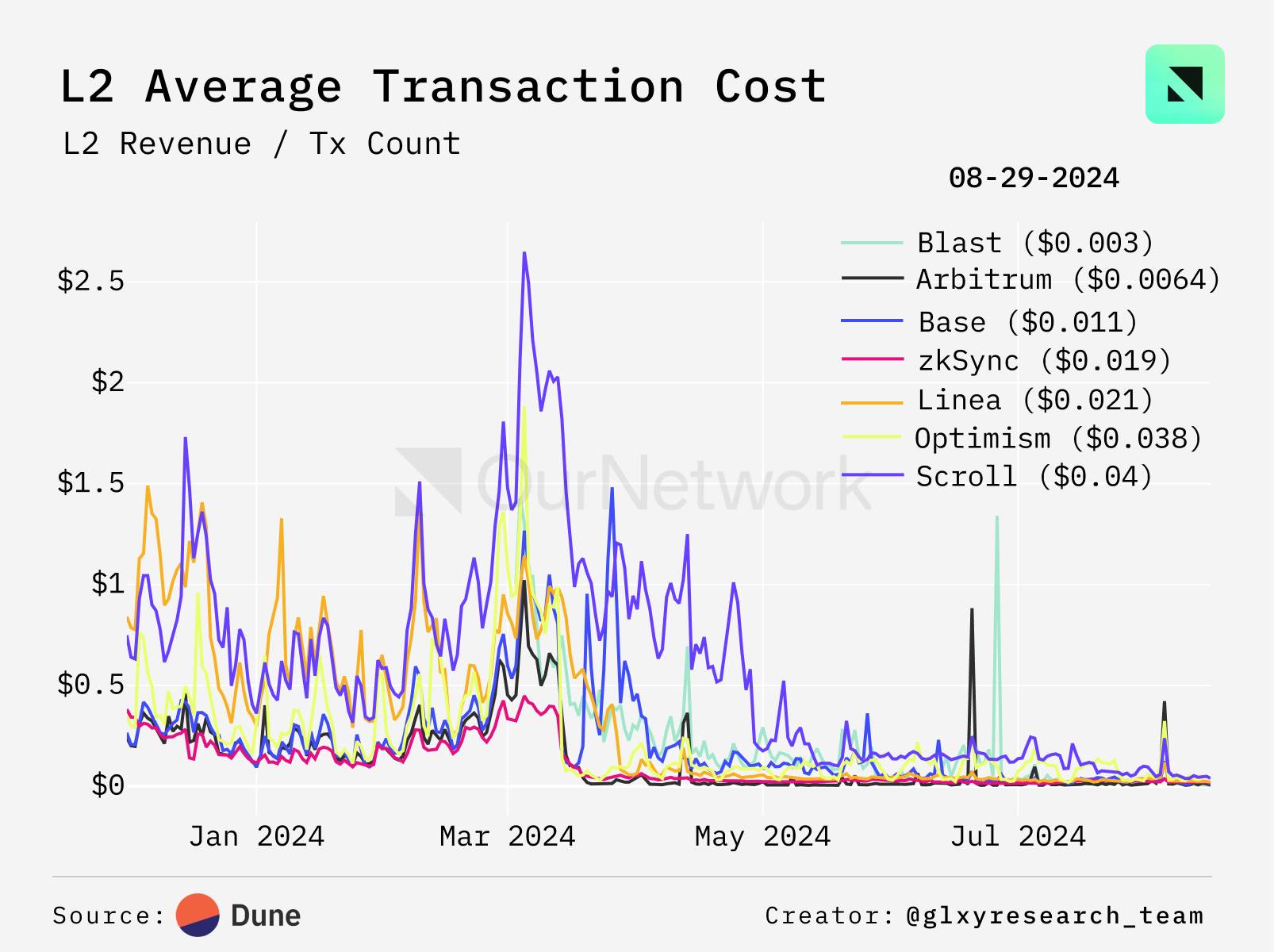

EIP-4844 was implemented on Ethereum in March 2024, introducing a new transaction type called "blobs." These transactions are specifically designed to reduce data storage costs on the network, directly lowering fees for Rollups. Since March, average Rollup transaction fees have dropped by approximately 98%, now costing just a few cents. This significantly improves the user experience for Omni users interacting with cross-Rollup applications.

-

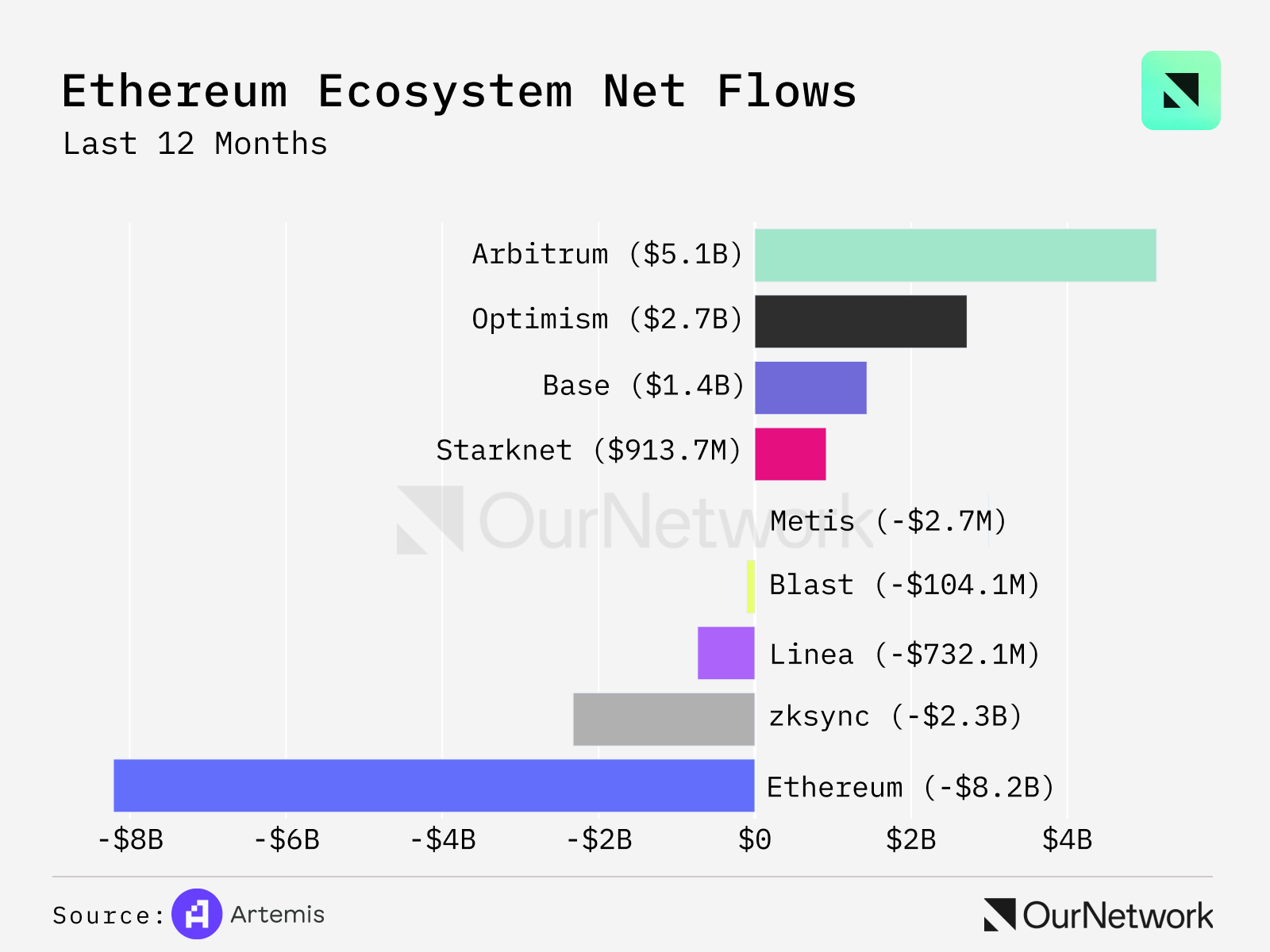

Over the past year, Ethereum TVL has become increasingly concentrated in Arbitrum, Optimism, and Base. These three Rollups account for 91% of net Rollup inflows over the period. Omni is prioritizing support for these three, and its upcoming mainnet V1 deployment will enable unified liquidity and a seamless developer experience for chain abstraction.

-

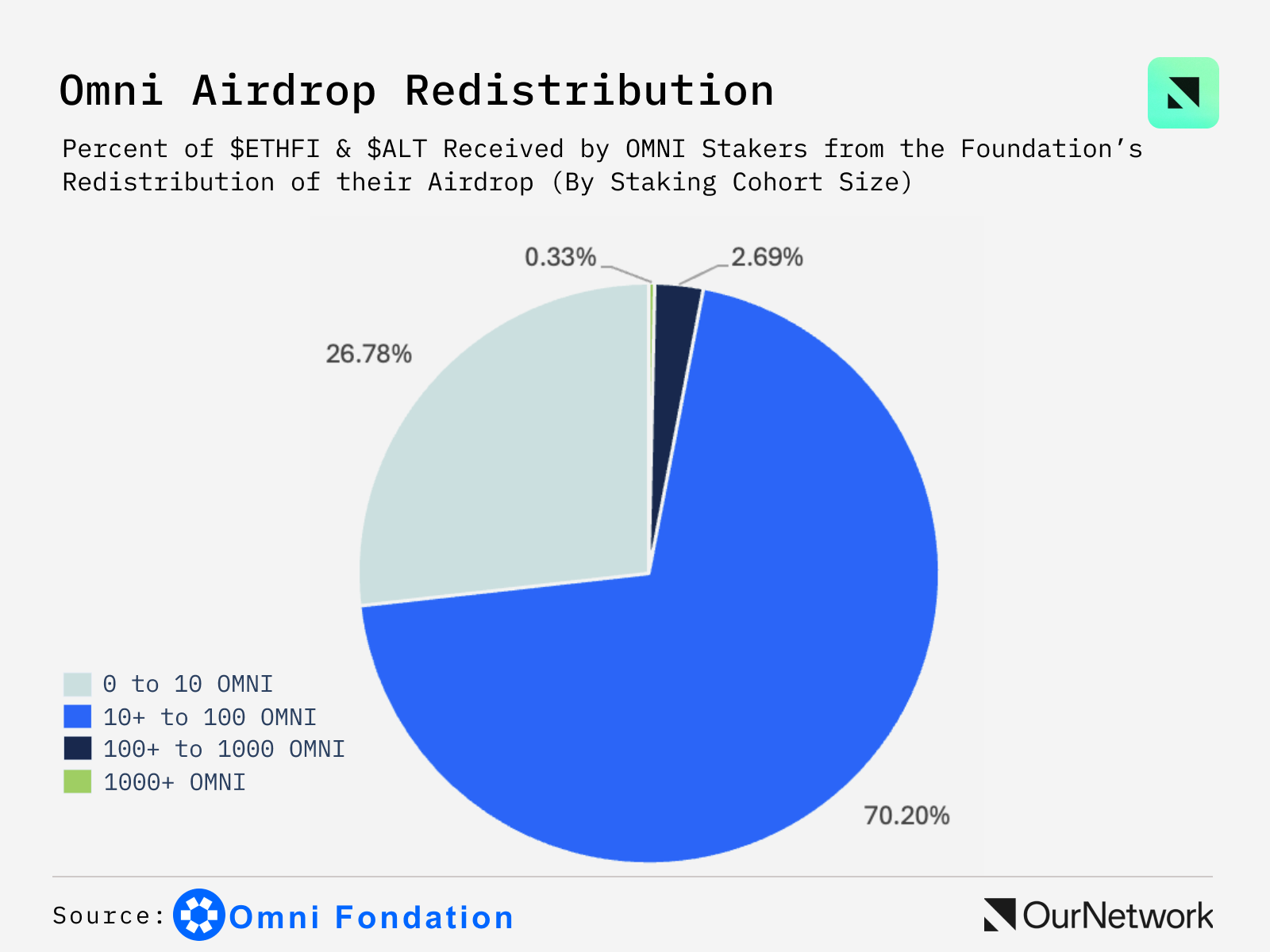

The Omni Foundation recently distributed $ETHFI and $ALT airdrops to 15,735 $OMNI stakers. Collectively, these stakers had locked up 8.7% of the circulating supply and earned a 14.5% annual yield during Omni’s genesis staking period. 97% of stakers held less than 100 $OMNI.

Omni Foundation

AltLayer

Amrit Kumar | Website | Dashboard

AltLayer’s restaked Rollup AVS TVL exceeds $11 billion.

-

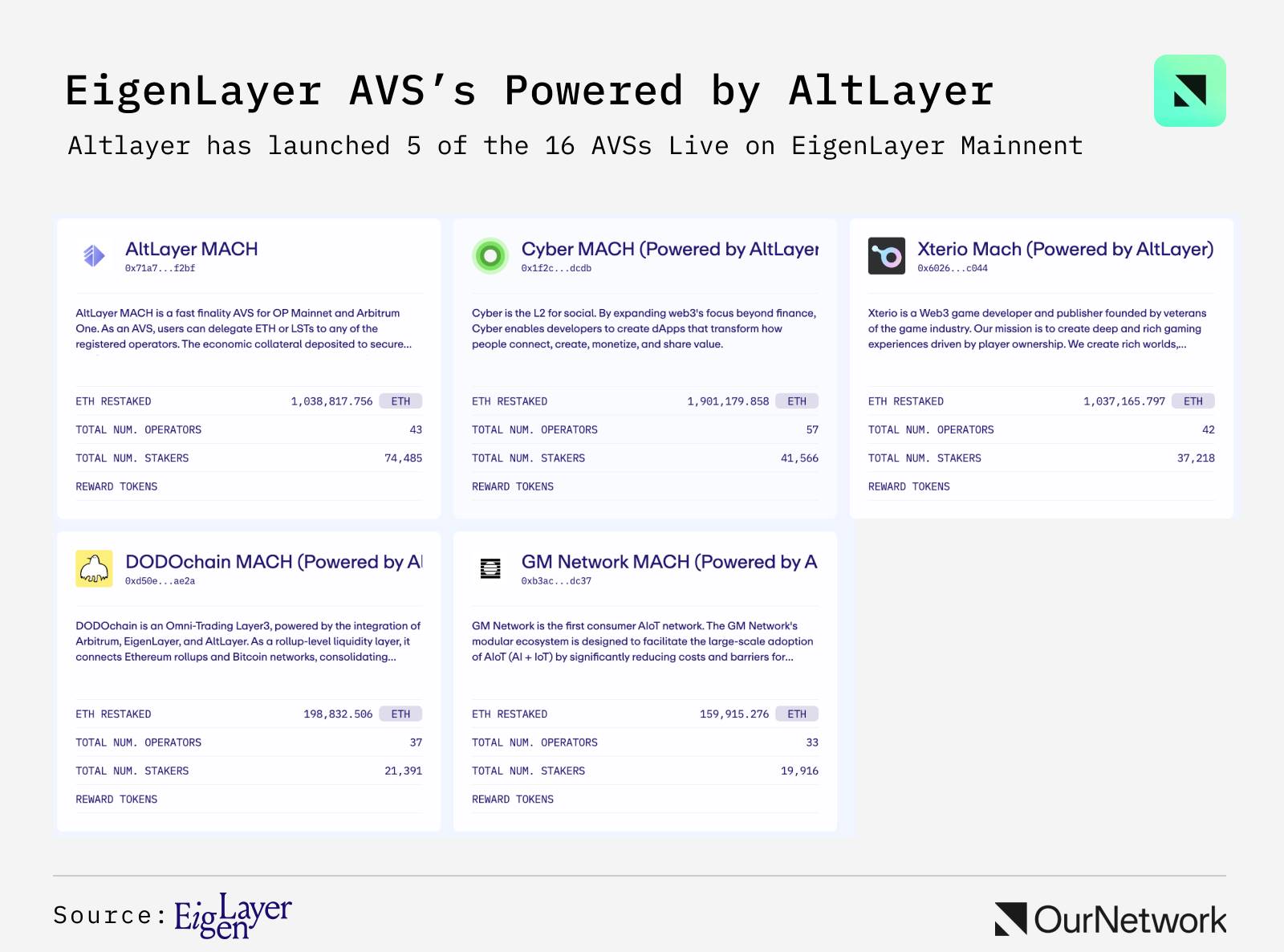

AltLayer’s restaked Rollup framework leverages EigenLayer’s restaking mechanism to deliver enhanced security, decentralization, and cryptoeconomic finality for Rollups. MACH is AltLayer’s Active Validation Service (AVS), providing fast finality for any Rollup. Among the 16 active AVSs on EigenLayer’s mainnet, AltLayer has helped launch 5. These AVSs operate with 33–57 operators and 19,000–75,000 delegators, ensuring strong decentralization.

-

Editor’s Note: Active Validation Services (AVS) are decentralized applications using EigenLayer. EigenLayer is a restaking protocol built on Ethereum that allows users to leverage their staked ETH to secure services on Ethereum and other blockchains.

-

AltLayer’s AVS has recorded $11.45 billion in restaked TVL. The dollar-denominated TVL ranges between $9.3B and $11.45B, indicating stable TVL across these AVSs as slashing is not yet enabled. Cyclical TVL growth aligns with the launch of new AltLayer AVSs.

Conduit

Forrest Norwood | Website | Dashboard

Conduit supports the highest-performance Rollups, recording gas throughput exceeding 65 Mgas/sec.

-

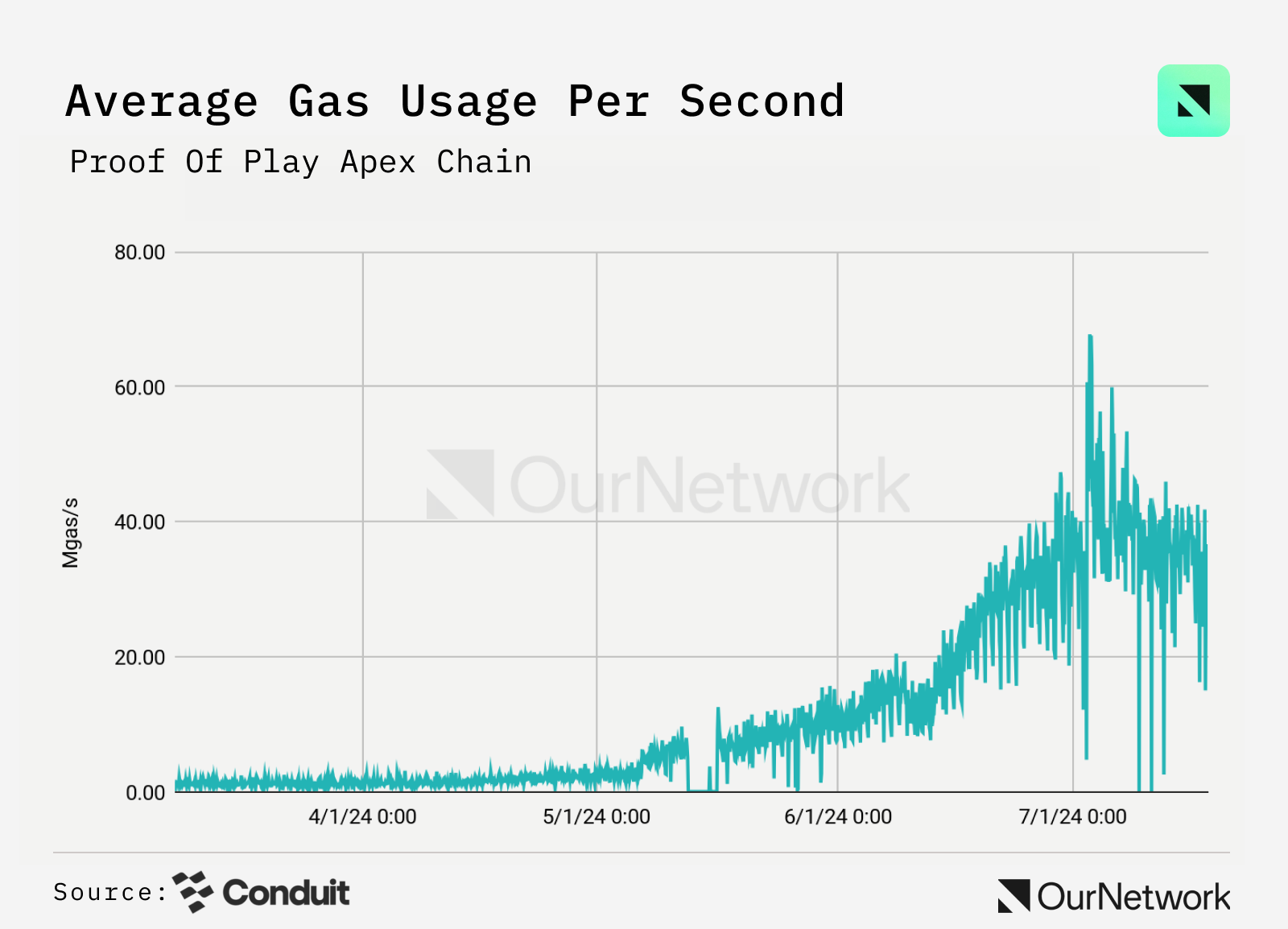

Conduit is a Rollup-native cloud platform powering high-performance Rollups like Proof of Play. Pirate Nation by Proof of Play is the world’s largest fully on-chain game, with tens of thousands of players, all gameplay occurring on Apex Chain—an Arbitrum L3 powered by Conduit. Apex Chain regularly leads all Rollups in data throughput, measured in megagas per second—a metric accounting for both transaction count and complexity—reaching peaks above 67 megagas/sec.

-

This summer, Conduit partnered with Celestia to launch SuperBlobs, a new blob mechanism increasing maximum data per blob to 2.5 times that of ERC-4844 blobs. This delivers massive savings for Rollups—Orderly Network, the largest SuperBlob user, saw daily settlement costs drop by 73% after switching. Overall, Conduit Rollups using SuperBlobs pay just $0.09 per MB for data settlement.

-

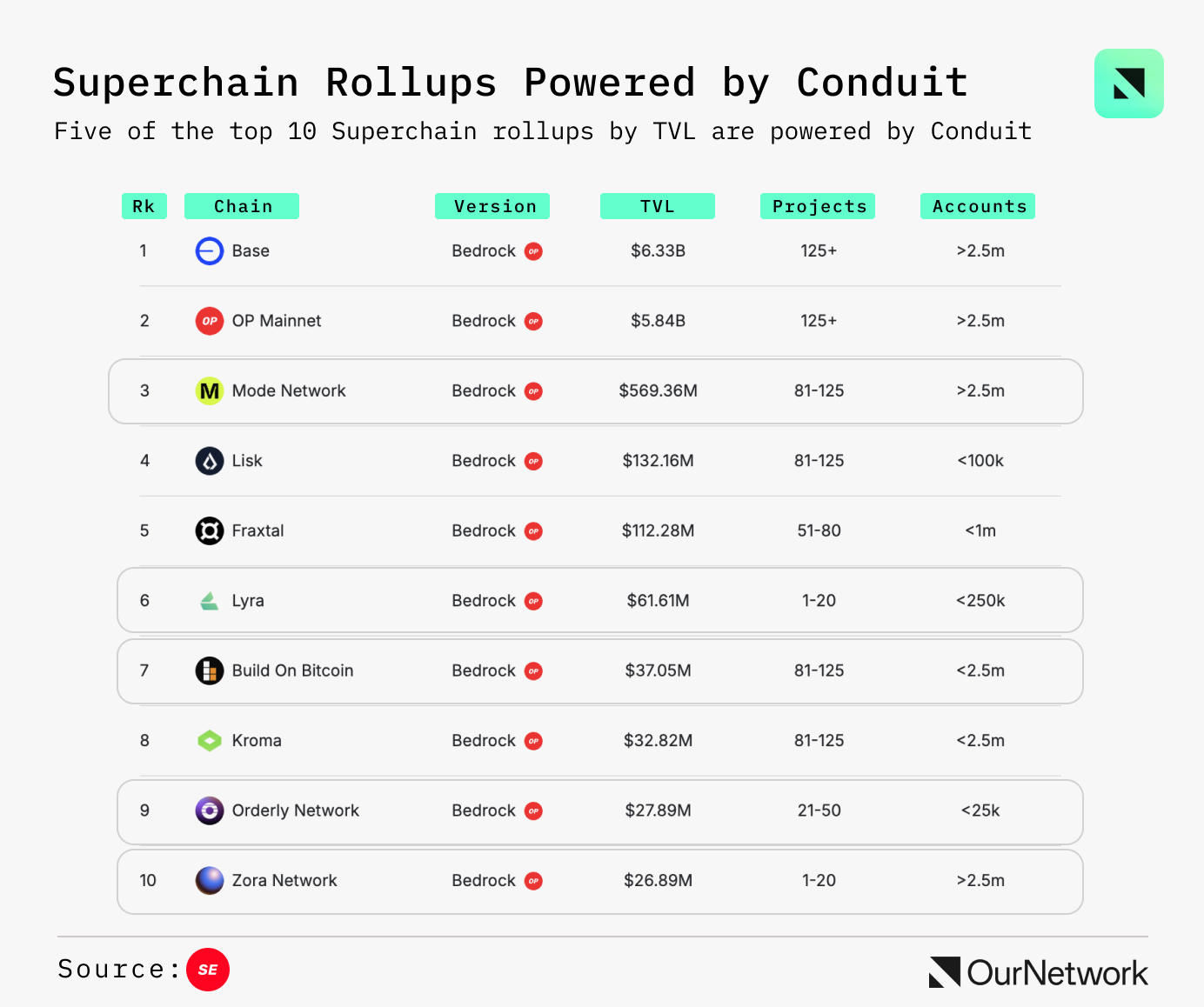

As a leading Rollup platform for teams building on OP Stack, Conduit is a key enabler of Optimism’s Superchain vision. Currently, five of the top ten Superchain Rollups are powered by Conduit: Mode Network, Derive (formerly Lyra), Build on Bitcoin, Orderly Network, and Zora Network.

-

Transaction Spotlight: One of the first transactions on Proof of Play’s Boss Chain, launched on August 29 to balance load alongside the original Apex Chain. Multi-chain represents a new horizontal scaling model for appchain Rollups.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News