Ensuring LPs don't lose money is the key to a DEX's survival and growth.

TechFlow Selected TechFlow Selected

Ensuring LPs don't lose money is the key to a DEX's survival and growth.

DEXs must ensure that LPs have sufficient profitability.

Author: @G_Gyeomm

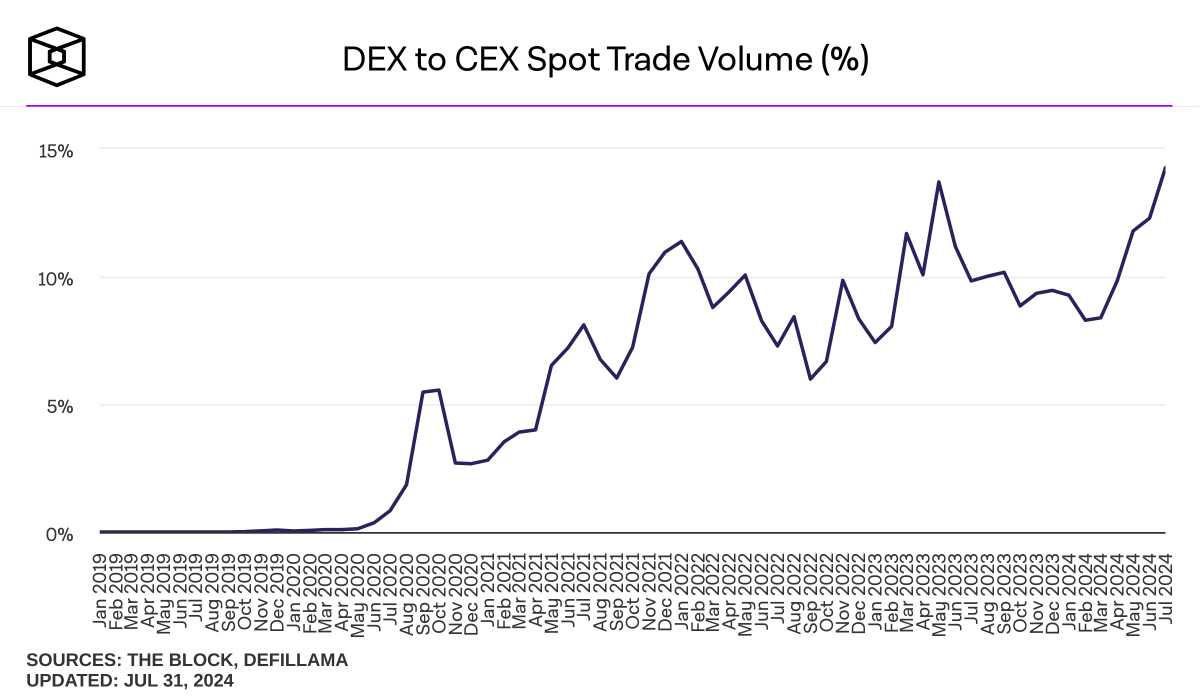

Translation: TechFlow

Regardless of short-term market uncertainty, recent activity in decentralized exchanges (DEXs) gives us reason for optimism about the long-term future of blockchain or on-chain ecosystems. Currently, DEX trading volume has reached its highest level since the inception of blockchain. According to The Block, as of August 2024, DEX spot trading volume accounts for approximately 14% of centralized exchange (CEX) volume. Meanwhile, DeFiLlama reports that around $7 billion worth of transactions were executed via DEXs in the past 24 hours.

In the past, events like the FTX collapse heightened custodial risk awareness among market participants, temporarily boosting DEX usage. Such short-term shocks often lead to temporary spikes in DEX activity. However, the current rise in DEX usage shows signs of a sustained trend. This steady increase in DEX volume relative to CEXs can be seen as evidence of significant progress and continuous improvements in DEX usability and other areas.

Source: DEX vs CEX Spot Trading Volume (%)

Among these developments, the DEX component I want to highlight today is the liquidity provision (LPing) mechanism of Automated Market Makers (AMMs), particularly Constant Product Market Makers (CPMMs), which most DEXs adopt—executing trades through the xy=k formula. Ample liquidity ensures smooth trading by minimizing slippage, so aligning incentives between the protocol and liquidity providers (LPs) is critical to maintaining consistent liquidity—a core requirement for any DEX. In other words, DEXs must ensure LPs have sufficient profitability.

However, a growing issue within AMM-based DEXs is that "LP losses are exceeding expectations." The entities causing these losses are external actors such as arbitrageurs. As value generated within protocols gets extracted by outside parties, the value received by those participating in protocol operations diminishes. Consequently, risks associated with liquidity provision—such as LVR (Loss Versus Rebalancing)—have become an important topic. DEXs that eliminate such risks and quickly adopt newly developed technologies are regaining attention. Next, we will examine various approaches taken by these DEXs and clarify their significance in current DeFi protocol trends.

1. Background – Efforts to Mitigate LP Profitability Risks

1.1 CoW Protocol – MEV-Capturing AMM

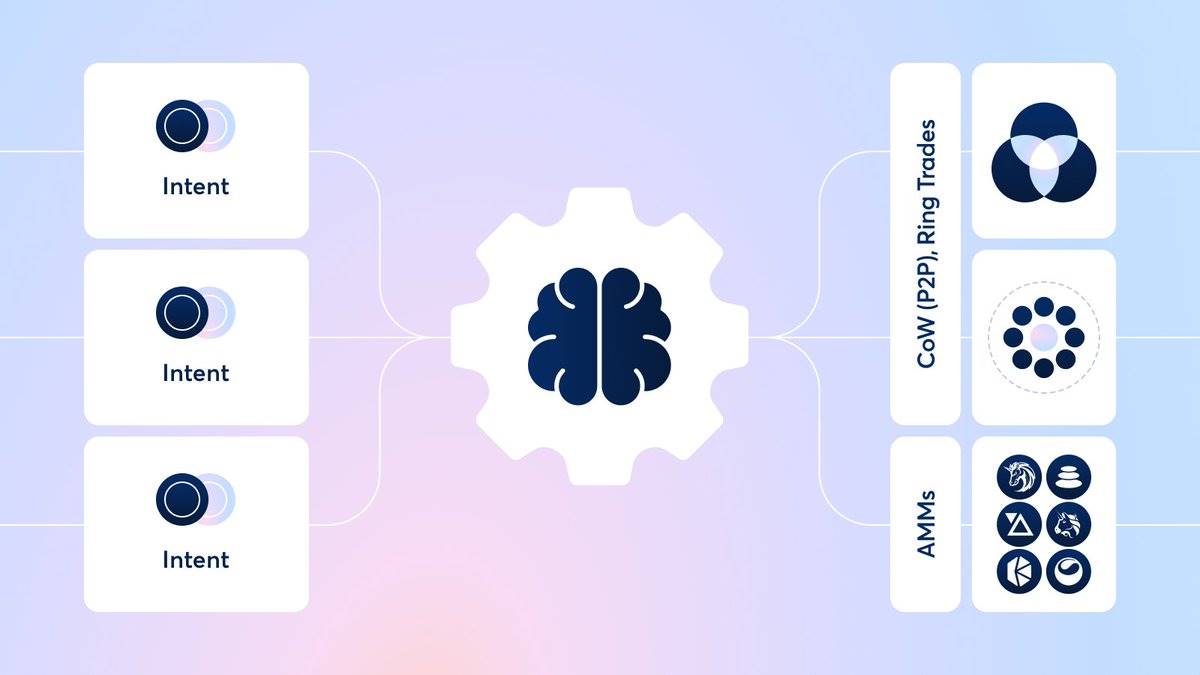

Source: CoW Protocol Documentation

CoW Swap offers an exchange service that protects traders from MEV attacks—such as front-running, back-running, or sandwich attacks—through an off-chain batch auction system. Instead of settling trades directly on-chain, traders submit their intent to swap tokens to the protocol. When multiple trade intents are grouped into a single off-chain batch, third-party entities known as Solvers search for optimal execution paths across AMMs (e.g., Uniswap, Balancer) and DEX aggregators (e.g., 1inch). This allows traders to avoid MEV exposure and execute trades at better prices.

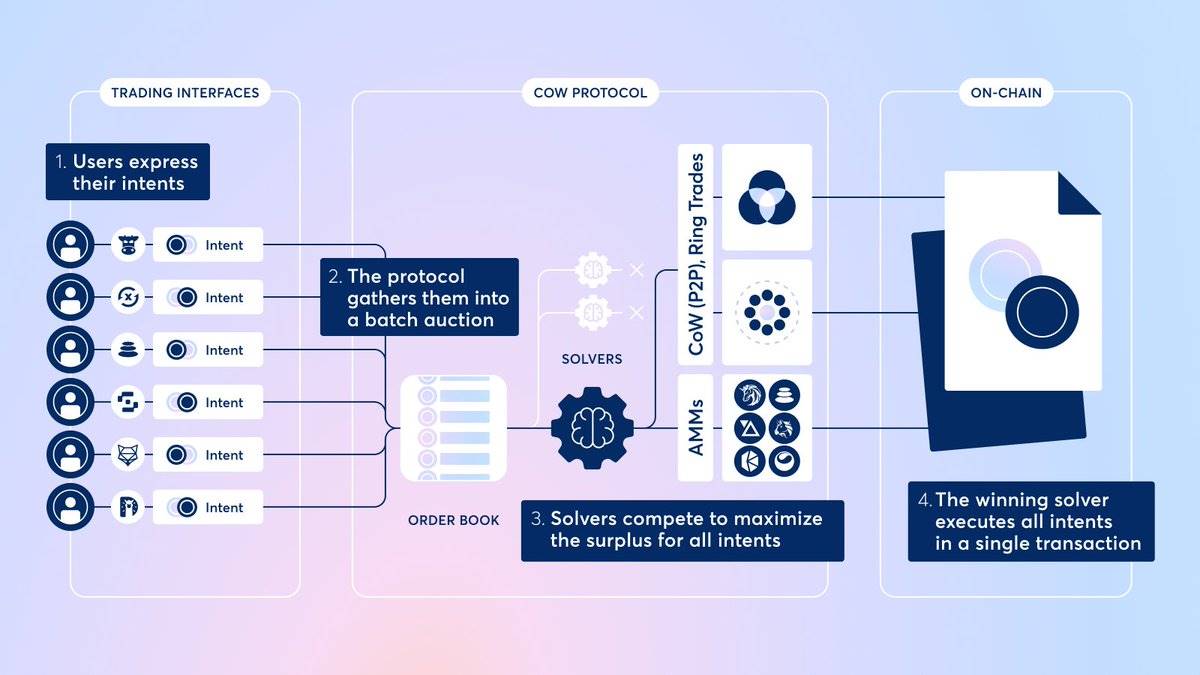

Source: CoW Protocol Documentation

CoW Swap focuses on preventing value extraction by external traders through batch auctions and Solver intervention. Building on this mechanism, CoW Swap introduced CoW AMM as the next step—not only protecting traders from MEV but also safeguarding LPs. CoW AMM was proposed as an MEV-capturing AMM designed to eliminate LVR caused by arbitrageurs.

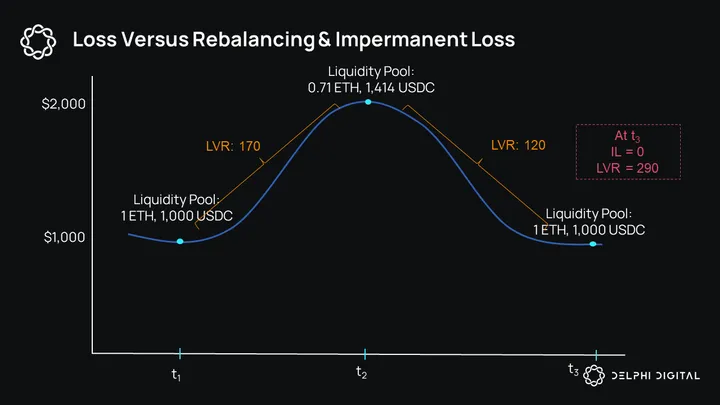

Source: Delphi Digital

Here, LVR (Loss Versus Rebalancing) is a risk metric that quantifies the loss LPs incur due to price volatility while providing liquidity, specifically stemming from discrepancies between internal AMM prices and external market prices. While impermanent loss measures opportunity cost from asset price changes, LVR represents the ongoing cost LPs bear by acting as counterparties to arbitrageurs throughout their participation period. A more detailed explanation is needed, but the fundamental issue to emphasize here is that liquidity providers are negatively impacted by adverse trading conditions imposed by external arbitrageurs.

CoW DAO | Don't get milked: CoW AMM uses a Function-Maximizing AMM (FM-AMM) design, leveraging batch auctions to capture surplus for protected liquidity pools. The Solver offering the highest surplus wins the right to rebalance the pool, thereby capturing LVR for the pool.

To address this problem, CoW AMM is designed to protect LPs from interference by external arbitrageurs and internally capture MEV. In CoW AMM, when arbitrage opportunities arise, Solvers compete by bidding for the right to rebalance the CoW AMM pool. The process works as follows:

-

LPs deposit liquidity into the CoW AMM pool.

-

When arbitrage opportunities emerge, Solvers bid for the right to rebalance the CoW AMM pool.

-

The Solver leaving the most surplus in the pool wins the right to rebalance it. Here, surplus refers to how much the AMM curve shifts upward—in simple terms, the leftover funds in the liquidity pool retained by executing trades under the most favorable conditions for LPs. For a detailed explanation of surplus-capturing AMMs, refer to this article.

-

Through this mechanism, CoW AMM captures internally the arbitrage profits that MEV bots extract from existing CPMMs, eliminating the LVR risk faced by LPs. At the same time, LPs receive the surplus as an incentive for providing liquidity. In contrast to traditional CPMMs, CoW AMM can treat MEV as a revenue source rather than relying solely on trading fees.

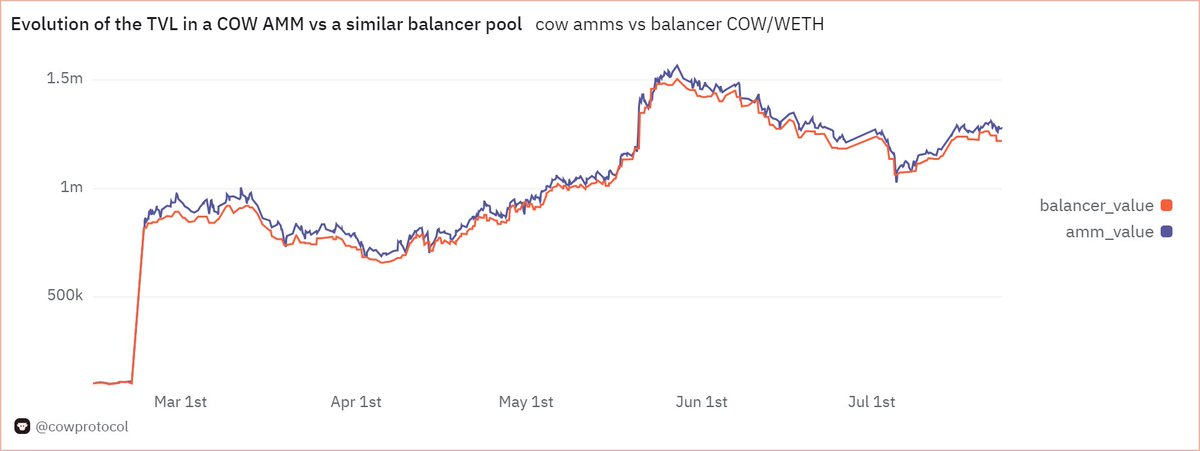

Source: Dune (@cowprotocol)

Similar to CoW Swap, CoW AMM applies a single clearing price to all buy/sell token transactions within a specific batch, ultimately forming one block per batch. This fundamentally prevents MEV based on price differences—such as arbitrage—and minimizes LP's LVR by avoiding stale AMM prices that don't reflect real-time market movements, thus denying exploitable conditions to external arbitrageurs.

1.2 Bunni V2 – Out-of-Range Hooks

Bunni V2 leverages Uniswap v4's out-of-range hooks as another method to enhance LP profitability. These hooks are part of the architectural upgrade in the upcoming Uniswap V4, allowing Uniswap’s liquidity pool contracts to be customized modularly depending on use cases (dynamic fees, TWAMM, out-of-range strategies, etc.).

Bunni V1 originally started as a Liquidity Provider Derivative (LPD) protocol aiming to overcome limitations of concentrated liquidity introduced by Uniswap V3, developing alongside protocols like Gamma and Arrakis Finance. After launching V2, however, it evolved into its own DEX by integrating various hook functionalities—including out-of-range hooks. Concentrated liquidity allows LPs to specify arbitrary price ranges for liquidity provisioning, increasing capital efficiency at desired price levels. While this improves capital utilization, it requires constant manual adjustments to keep the range aligned with fluctuating market prices. Bunni addresses this by automatically managing the liquidity range when LPs delegate their funds.

Source: X (@bunni_xyz)

The out-of-range hook is a novel approach that enhances capital efficiency not by readjusting the liquidity range when it falls outside the current market price, but by interoperating idle liquidity with external protocols. By depositing inactive liquidity into interest-generating lending protocols and vaults such as Aave, Yearn, Gearbox, Morpho, etc., it provides LPs with additional returns beyond standard trading fee income. Of course, since Bunni's implementation is still in testing, potential trade-offs must be closely monitored going forward—such as increased contract risk due to cross-protocol interactions or depletion of liquidity needed for AMM swaps, possibly undermining capital efficiency.

2. Key Takeaways

2.1 Advantages That DEX Can Offer But CEX Cannot

When assessing DEX market share versus the current state of CEXs, a key question arises: Why should we use DEX instead of CEX? Objectively speaking, considering only the convenience and deep liquidity offered by CEXs, it seems difficult to find a compelling reason why DEXs are necessary. Even though DEX usage continues to grow, a 14% market share is frankly not large.

The FTX bankruptcy reminded market participants of the risks associated with custodial exchanges, briefly boosting DEX adoption—but this remains a temporary substitute. Therefore, a crucial path toward gradually expanding DEX market share lies in continuously creating unique value propositions that cannot be experienced on CEXs.

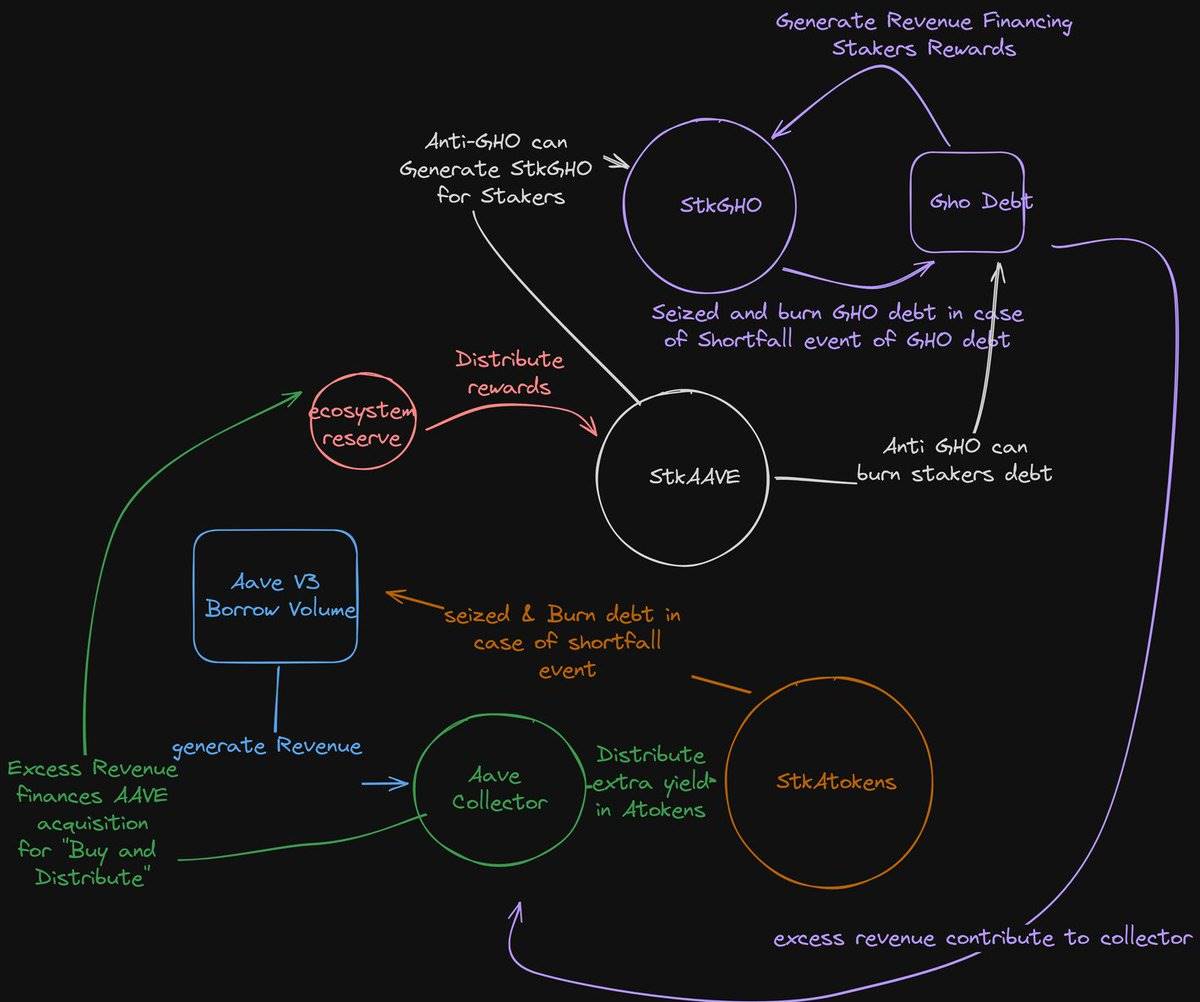

Source: AAVEnomics Update

In this context, liquidity provision (LPing) and profit redistribution mechanisms stand out as uniquely valuable aspects of DEXs. LPing is not just essential for enabling smooth trading experiences; the passive income it generates also serves as an alternative motivation for users to engage with DEXs. Moreover, profit redistribution mechanisms could mark the beginning of a self-sustaining economic system or token economy, where participants contribute to and are rewarded by decentralized protocols according to token-based incentives—an ideal way to maximize the utility of blockchain and cryptocurrency.

2.2 Internalizing Protocol Value Is Becoming Increasingly Important

When the unique value of DEXs lies in liquidity provision and profit redistribution mechanisms, internalizing value previously extracted by external entities—such as arbitrageurs or various forms of MEV—becomes critically important. The features discussed in this article aim precisely to solve this issue. CoW AMM internally captures MEV to eliminate LP risk, while Bunni V2’s out-of-range functionality interoperates liquidity within AMM pools to maximize LP profitability. Although not covered here, some recent DeFi protocols are exploring ways to receive price data via oracles and internally capture OEV (Oracle Extractable Value).

Furthermore, the importance of redistributing captured value back to protocol participants has recently been re-emphasized. For instance, the Aave protocol introduced its new AAVEnomics model, using protocol revenues to buy back $AAVE and distribute it to $AAVE holders. Similarly, Uniswap’s fee switch has regained attention, and even Aevo announced plans to repurchase $AEVO.

As DeFi protocols seek to introduce value redistribution mechanisms, sustainable revenue models and internally accumulated value become increasingly vital. For example, if Uniswap passes a proposal to distribute trading fees to $UNI holders, it would need to share part of the fees previously earned entirely by LPs. In such cases, the protocol must accumulate more value internally to redistribute to participants, highlighting the growing importance of capturing value that was once lost to external entities.

From this perspective, differentiated liquidity provision methods like those proposed by CoW AMM and Bunni V2, or mechanisms that return protocol-earned value to ecosystem participants, are efforts worth close attention. Additionally, various protocols are exploring LP-enhancing innovations—such as Osmosis’ Protorev to prevent back-running, or Smilee Finance’s concept of “impermanent yield” as a hedge against impermanent loss. The process by which DeFi protocols create unique value through these initiatives will continue to be a key factor driving the gradual growth of DEX activity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News