"AMM" vs "CLOB": Which Trading Model Takes the Lead?

TechFlow Selected TechFlow Selected

"AMM" vs "CLOB": Which Trading Model Takes the Lead?

Did Solana win the market because the CLOB trading model is superior to AMM?

Author: 0XNATALIE

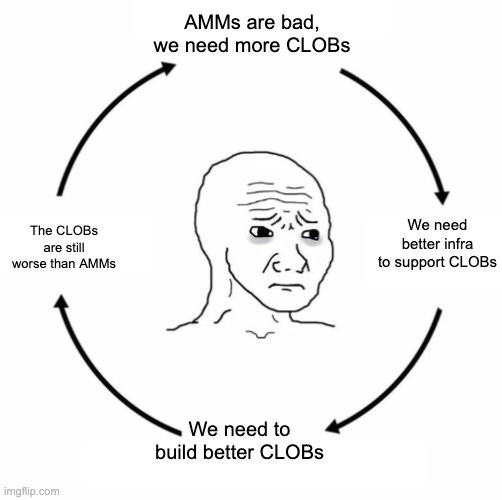

Recently, Hasu, Strategy Lead at Flashbots, pointed out that on Solana, the majority of trading volume is actually facilitated through automated market makers (AMMs), rather than centralized limit order books (CLOBs, or simply "order book models"). This finding came as a surprise to many, since a widely held belief was that one of Solana’s key competitive advantages in capturing market share was its support for CLOBs. As Feng Liu noted: "One of Solana’s core selling points initially was finally being able to build order book DEXs on it, along with the idea that 'order book trading is the future of DEXs.'"

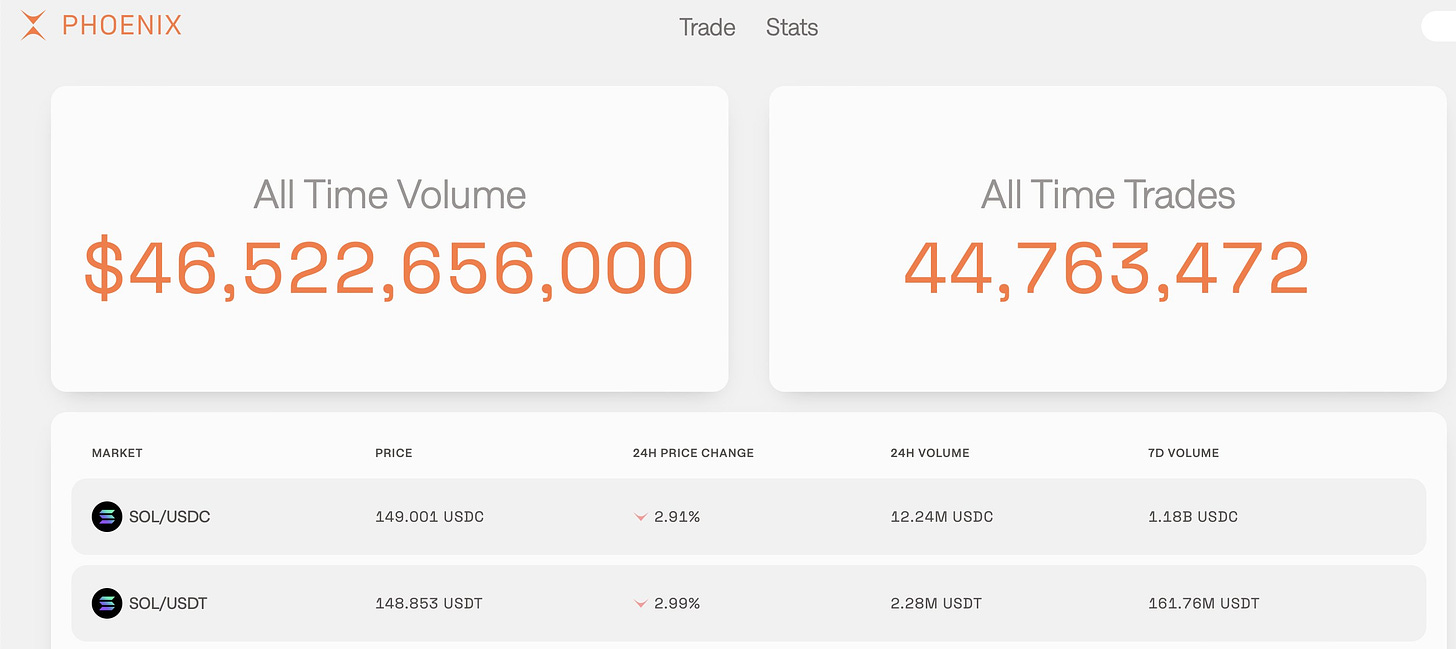

It's worth noting that the debate between AMMs and CLOBs is not new—it has been ongoing for years. Since DeFi Summer, AMMs have rapidly become the backbone of decentralized trading thanks to their algorithm-driven asset pricing, while CLOBs have long been seen as the more mature market mechanism due to their dominance in traditional finance and centralized exchanges. This competition has driven continuous innovation across various blockchain platforms. Particularly on Solana—where speed and low cost are central—Phoenix briefly brought CLOBs into the spotlight.

Is AMM Dominance Solely Due to Long-Tail Assets?

Hasu’s observation quickly sparked widespread discussion within the community. In response, Kyle Samani, Partner at Multicoin Capital, explained that in markets for long-tail assets, there is often a lack of genuine market makers (MMs) to provide liquidity. AMMs fill this gap, leading to the current dominance of AMM-based trading. Solana’s success isn’t solely based on CLOB support, but rather on its ability to consistently deliver fast and low-cost transaction experiences that support all kinds of assets. Additionally, Solana’s no-bridging model is another critical factor in its success, as users generally have negative sentiment toward cross-chain bridges.

Udi Wertheimer, founder of Taproot Wizards, also believes that AMMs hold unique advantages in supporting long-tail assets, enabling smaller communities to quickly bootstrap liquidity for niche tokens. Solana hosts a large number of memecoins, for which AMMs are particularly well-suited.

Krane further categorizes markets into three types: memecoins, major assets (such as SOL/USDC), and stablecoins. He notes that AMMs excel in the memecoin market, where strong passive liquidity is required—a domain where CLOBs underperform. For major assets, while CLOBs have gained some traction in certain cases, AMMs remain highly competitive. In the stablecoin market, CLOB adoption remains limited.

However, Doug Colkitt, founder of Ambient, offered a different perspective, backed by data. He pointed out that many mistakenly assume AMM volume on Solana primarily comes from inactive long-tail assets. Yet his data shows that even for major trading pairs like SOL/USDC, AMM volume far exceeds that of CLOBs. For example, Orca recorded $250 million in 24-hour trading volume, compared to Phoenix’s $14 million. Even under the most favorable assumptions for CLOBs—using Phoenix’s 7-day average daily volume instead of its lower single-day figure, and maximizing estimated CLOB volume—AMM volume still surpasses CLOBs by 50%. Without these optimistic assumptions, the gap widens to nearly 10x.

Community View: CLOB Development Is Constrained by Blockchain Performance

The dominance of AMMs on Solana isn't just about long-tail assets; deeper structural reasons lie in blockchain performance limitations. Many community members believe that CLOB development is fundamentally constrained by blockchain bottlenecks. Sam argues that inherent challenges in blockchains—such as high latency, high gas fees, and poor privacy—make CLOBs ill-suited for effective operation in today’s blockchain environments. In contrast, AMMs are better adapted to the characteristics of blockchains, especially in price discovery and liquidity provision.

Enzo shares a similar view, stating that CLOBs face limitations on Layer 1 due to high latency, expensive gas fees, and lower throughput. However, these constraints can be overcome in Layer 2 solutions, making CLOBs more competitive in such environments. On current Layer 1 chains, AMMs remain the more practical choice.

In fact, a similar viewpoint was raised in Reforge Research’s April report titled *Death, Taxes, and EVM Parallelization*. The report noted that implementing CLOBs on blockchain platforms like Ethereum often results in high latency and high transaction costs due to limitations in processing capacity and speed. However, with the emergence of parallel EVMs, network processing power and efficiency have significantly improved, increasing the feasibility of CLOBs and paving the way for a substantial rise in DeFi activity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News