ETHW’s Market Debut Attracts Over $200 Million—What’s Bitwise’s Strategy in the Crypto ETF Race?

TechFlow Selected TechFlow Selected

ETHW’s Market Debut Attracts Over $200 Million—What’s Bitwise’s Strategy in the Crypto ETF Race?

Bitwise doesn't have the same clout as traditional giants like BlackRock and Fidelity, but the asset规模 of its crypto ETFs remains fairly substantial—its underlying "tactics" deserve attention.

By Nancy, PANews

Ethereum’s 10th anniversary marks a milestone breakthrough, with nine spot Ethereum ETFs finally approved after years of regulatory hurdles. Eight issuers have achieved a major victory for Ethereum’s mainstream adoption. On their first trading day, July 23, spot Ethereum ETFs exceeded $1 billion in trading volume—about 23% of the $4.6 billion traded on the first day of spot Bitcoin ETFs in January.

While rising market demand lifts all crypto ETFs, fierce competition among similar products is inevitable, as already evident in the Bitcoin ETF landscape. Among these providers, crypto-native firm Bitwise lacks the brand power of traditional giants like BlackRock and Fidelity, yet its crypto ETFs still attract substantial capital, making its strategy worth examining.

Bitwise is one of the leading U.S.-based crypto index fund managers, launching its first crypto index fund in 2017. It now offers 20 products across ETFs, publicly traded trusts, private funds, hedge funds, and NFT collectibles.

ETHW Attracts Over $200 Million in Inflows on First Trading Day; BITB Held by More Than 110 Institutions

Crypto market recovery and growth are essential prerequisites for ETF development. Since early this year, narratives such as the approval of spot Bitcoin ETFs, the U.S. presidential election, and expectations of Fed rate cuts have driven a V-shaped rebound in the crypto market. As gateways for institutional capital, these ETFs have been among the first to benefit, experiencing strong momentum.

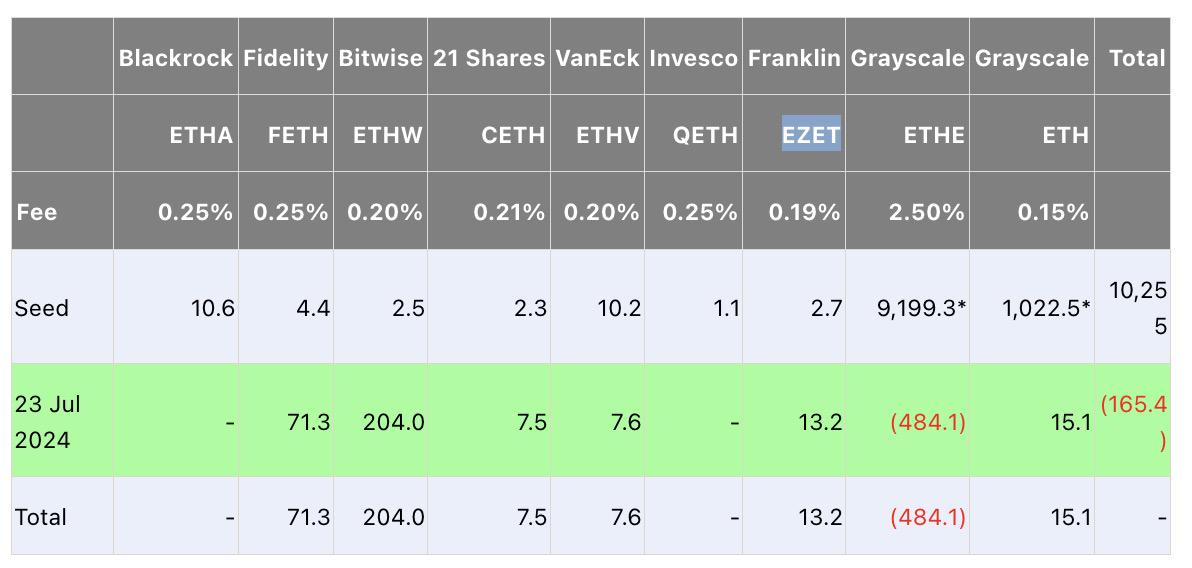

Last night, spot Ethereum ETFs made their market debut, logging over $1 billion in total trading volume on day one, primarily driven by Grayscale’s ETHE, BlackRock’s ETHA, and Fidelity’s FETH. However, according to Farside Investors data, the overall Ethereum spot ETF market saw net outflows on launch day. Grayscale’s ETHE suffered over $480 million in net outflows, while Bitwise’s ETHW attracted more than $200 million in net inflows—far surpassing Fidelity’s FETH ($71.3 million) and Franklin’s EZET ($13.2 million)—making it the top capital magnet.

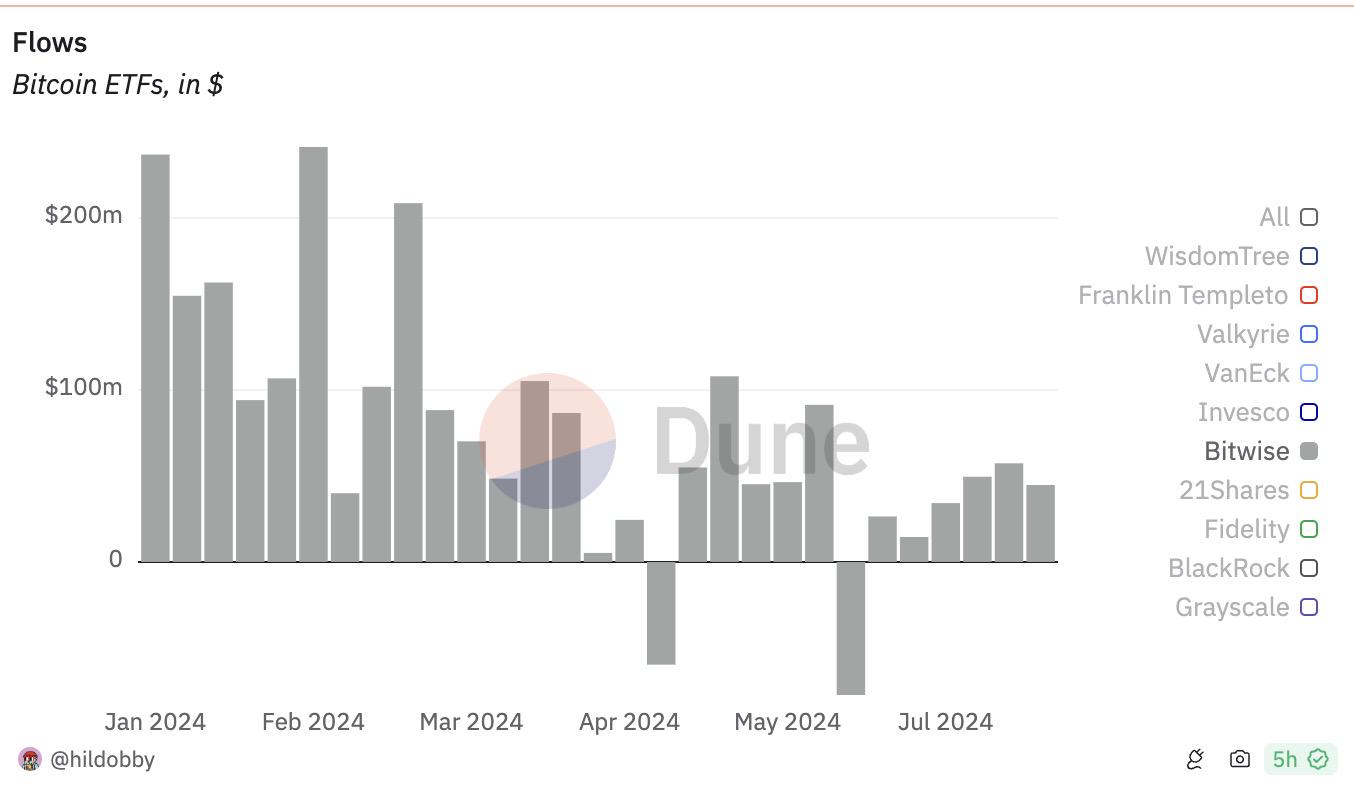

Meanwhile, Bitwise’s spot Bitcoin ETF has also delivered solid performance. According to SoSoValue, as of July 22, the total net assets of U.S. spot Bitcoin ETFs had climbed into the hundreds of billions within just six months, reaching $62.14 billion. Although the Bitcoin ETF market shows clear dominance by top players, investor interest in Bitwise’s BITB remains strong.

SoSoValue data shows that as of July 22, BITB recorded cumulative net inflows of $2.2 billion, ranking fifth—surpassing the combined inflows of the six lower-ranked Bitcoin ETFs. With total net assets of $2.72 billion, BITB ranks fifth among the 11 U.S. spot Bitcoin ETFs, holding a 4.5% market share. While still far behind leaders like BlackRock and Grayscale, Dune data indicates that BITB has seen mostly weekly net inflows, with only rare instances of outflows.

In terms of price performance, BITB has risen nearly 45.7% since listing, reaching $37.2. According to Fintel disclosures, as of July 23, 117 public companies reported holding approximately 1,067 shares of BITB, valued at over $390 million.

Fintel data reveals that BITB’s holders include investment advisory firm Pine Ridge Advisers, major U.S. market maker Jane Street Capital, hedge fund Boothbay Fund Management, offshore giant Millennium Management, and options trading powerhouse Susquehanna International Group. Additionally, Bitwise CEO Hunter Horsley recently revealed that a major U.S. bank holds Bitwise ETFs across 20% of all its wealth management branches—amounting to hundreds of locations.

For a crypto-native asset manager without deep roots in traditional finance, Bitwise has secured an impressive start. The Bitwise Asset Management team comprises over 60 professionals with backgrounds from BlackRock, Millennium, Blackstone, ETF.com, Meta, Google, and the U.S. Attorney’s Office. CEO Hunter Horsley previously served as a product manager at Facebook and Instagram and graduated from the University of Pennsylvania’s Wharton School. Bitwise has raised multiple funding rounds from investors including Elad Gil, Electric Capital, Bridgewater CEO David McCormick, Blackstone executive Nadeem Meghji, Vetamer Capital, ParaFi Capital, and Coinbase Ventures.

Three Key Strategies in ETF Competition: Bitwise Bets Big on Crypto

Racing for first launch, speeding up listings, cutting fees, offering fee waivers—every issuer is quietly competing to gain ground.

To secure greater scale and liquidity amid intense competition, Bitwise has focused on timing, trading costs, and ecosystem support.

The early bird catches the worm—a common dynamic in ETF markets due to strong first-mover advantages. As one of the first approved spot Bitcoin ETFs, Bitwise filed its application as early as October 2021 and persisted through repeated SEC rejections before finally gaining approval in January. For Ethereum spot ETFs, although Bitwise filed later than some competitors, it was still among the first to launch. Notably, Bitwise was the first to disclose a $2.5 million seed fund for its Ethereum spot ETF.

Additionally, to stay competitive in a crowded field, fee rates have become a key differentiator—the most effective competitive lever. BITB boasts the lowest management fee among all spot Bitcoin ETFs at just 0.2%, with zero fees on the first $1 billion in assets for the initial six months. ETHW charges a 0.2% fee—second only to Franklin Templeton’s EZET and Grayscale’s Ethereum Mini Trust (ETH)—and offers a waiver on the first $500 million or first six months. Clearly, low fees are a crucial factor driving capital inflows to Bitwise.

Beyond standard expansion tactics, Bitwise has also cultivated goodwill and recognition within the crypto community by financially supporting the development of the Bitcoin and Ethereum ecosystems.

At the launch of BITB, Bitwise announced it would donate 10% of the fund’s profits to three non-profits supporting Bitcoin open-source development: Brink, OpenSats, and the Human Rights Foundation’s Bitcoin Development Fund—organizations playing vital roles in enhancing Bitcoin’s security, scalability, and usability. These donations will be made annually for at least the next decade to further support the long-term health of the Bitcoin ecosystem. Similarly, ETHW will allocate 10% of its profits to support Ethereum open-source developers through Protocol Guild and PBS Foundation, with the same 10-year annual commitment and potential adjustments based on annual reviews. For transparency, both BITB’s Bitcoin wallet address and ETHW’s Ethereum wallet address have been made public.

Notably, Bitwise remains openly bullish on crypto assets. Bitwise CIO Matt Hougan recently stated that inflows into spot Bitcoin ETFs, the Bitcoin halving, shifting political attitudes toward Ethereum spot ETFs, and expectations of Fed rate cuts have collectively created a favorable long-term environment for cryptocurrencies. Combined with robust growth in stablecoins, Layer 2 development, and increasing institutional involvement from firms like BlackRock, the second half of the year could easily propel Bitcoin toward $100,000. While ETH prices may be volatile in the first few weeks post-ETF launch—due to expected outflows from the $11 billion Grayscale Ethereum Trust (ETHE) converting to a spot ETF—Hougan forecasts ETH will surpass $5,000 by year-end, setting a new all-time high. If inflows exceed many analysts’ expectations, prices could climb even higher.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News