Electric Capital: After Researching Over 1,500 Projects, What Did We Discover?

TechFlow Selected TechFlow Selected

Electric Capital: After Researching Over 1,500 Projects, What Did We Discover?

DeFi has become the primary category in crypto, while NFTs underpin the entire ecosystem of crypto applications.

Written by: Electric Capital

Translated by: Peisen, BlockBeats

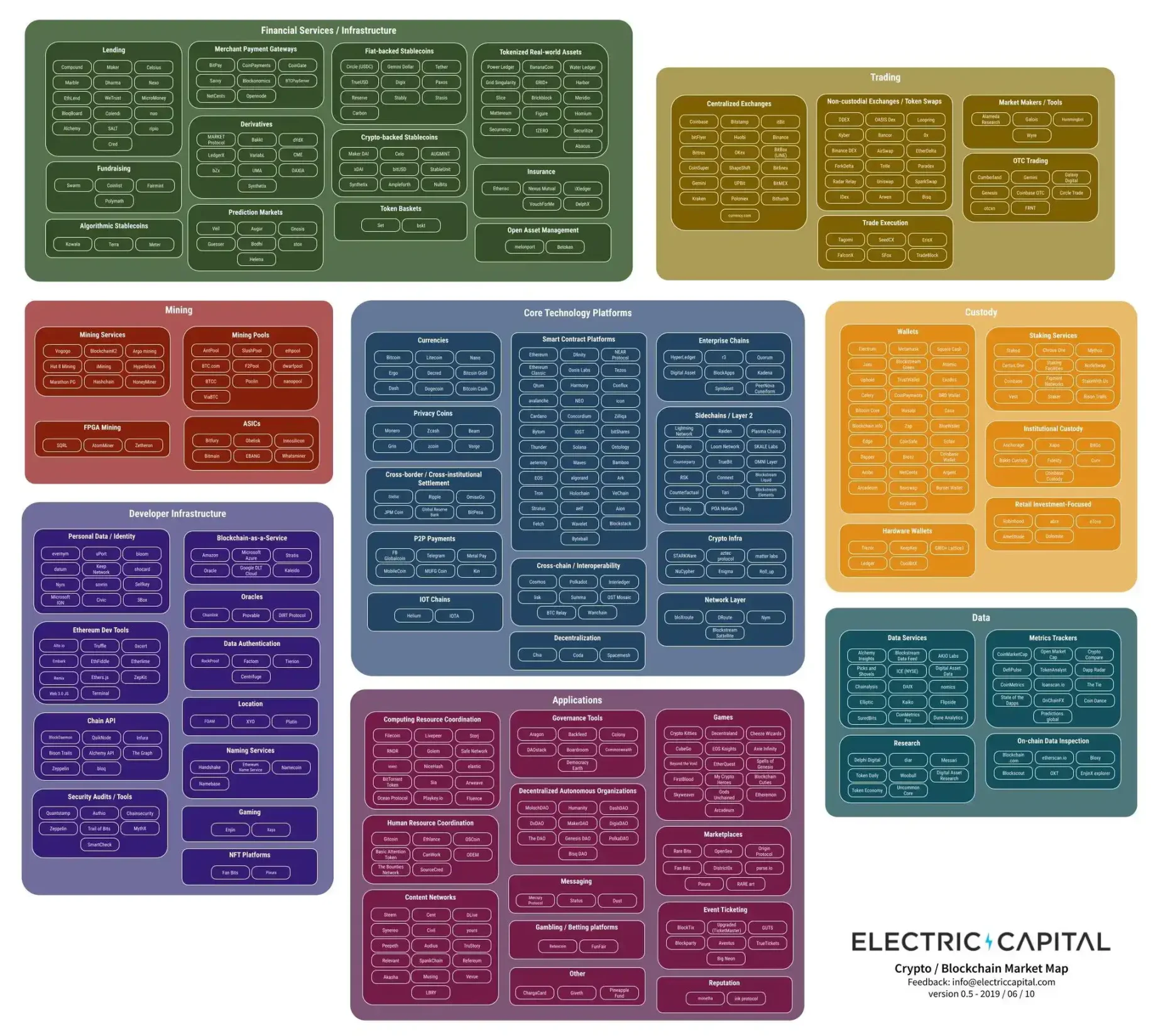

Editor's Note: After tracking over 1,500 projects across the entire crypto space, Electric Capital has created the Crypto Market Map, categorizing crypto projects into six technical layers—core infrastructure, scaling, interoperability, developer tools and services, protocols, and applications. The analysis reveals that DeFi has now become the dominant category in crypto; NFTs underpin the entire ecosystem of crypto applications; scaling and interoperability projects are maturing; consumer-facing applications and protocols are growing; and innovative technologies have transitioned from theoretical concepts to practical implementation.

The Crypto Market Map tracks more than 1,500 projects across the entire cryptocurrency landscape. Its goal is to help people understand and contextualize projects within the broader crypto ecosystem. It clearly illustrates the industry’s structure and the roles played by different companies and initiatives.

This website serves as a vital hub for the community to navigate the ever-expanding crypto space.

The Crypto Market Map is the first tool to place each major project’s role within the ecosystem into clear context. Divided into six technical layers—from foundational infrastructure projects at the bottom to end-user-focused projects at the top—these layers reflect the maturation process of crypto infrastructure.

The six technical layers of the Crypto Market Map are:

Core Infrastructure: This foundational layer includes Bitcoin and other Layer 1 blockchain projects that extend upon Bitcoin’s original design with improvements and different trade-offs. Mining services, hardware manufacturers, and other infrastructure-level projects are included in this layer.

Scaling: As usage of Bitcoin, Ethereum, and other Layer 1 blockchains increased, projects emerged to solve scalability challenges. This layer includes Layer 2, Layer 3, and modular blockchain projects.

Interoperability: With the proliferation of chains, the ability to transfer information across them has become critical. Projects in this layer focus on enabling cross-chain communication, data sharing, and asset transfers.

Developer Tools & Services: This layer lists essential tools, services, and data providers for developers and users. It spans everything from development frameworks to analytics platforms.

Protocols: These projects execute most of their rules on-chain. Multiple distinct front-ends can be built atop these protocols to serve different user segments. They cover use cases including DeFi, NFTs and gaming, social, identity and data sovereignty, privacy, and more.

Applications: These projects execute most of their rules off-chain. They include use cases such as centralized finance, creator platforms, NFTs and gaming, social, identity and data management and sovereignty, and privacy.

The boundary between protocols and applications is not always clear-cut, and many projects may belong to both categories. This is because many crypto applications consist of both on-chain and off-chain components.

In the Crypto Market Map, 138 projects are listed in multiple categories.

The Crypto Market Map aims to visually illustrate where most projects in the crypto space are building. The height of each layer reflects the number of projects, with the tallest layers containing the most projects. Within each layer, categories with more projects appear on the left, while those with fewer are on the right.

As crypto technology matures, the field is becoming increasingly specialized and complex. We created the Crypto Market Map to provide an overview of the rapidly expanding crypto industry.

Since June 2019, the Electric Capital Market Map has included over 500 projects. Though only significant projects are considered, the 2024 Crypto Market Map now includes over 1,500 projects.

Since the release of the first version of the market map in 2019, the crypto landscape has undergone significant changes:

DeFi has now become the primary category in crypto. In 2019, the DeFi category did not appear on the market map because it was not yet substantial enough to be separated from non-protocolized financial applications. Projects like Uniswap and Compound had launched less than a year prior. DAI, today the third-largest stablecoin with $34 billion in circulating supply, had not yet been launched. At that time, the total value locked (TVL) across all DeFi was under $500 million. Today, DeFi holds $85 billion in TVL and is the largest category on the Crypto Market Map, encompassing 394 projects across 14 subcategories—including new specialized areas such as yield, liquid staking, and liquid restaking.

NFTs now underpin the entire spectrum of crypto applications. In 2019, the most well-known NFT collections like Cryptokitties were categorized under "Gaming." Few standalone collectibles existed, and most applications did not utilize NFTs. Today, NFTs have become the standard asset format across gaming, creator platforms, music, art, loyalty programs, finance, identity, and more. Protocols enabling lending, borrowing, and derivatives on NFT assets have emerged as an entirely new category, covering 49 projects.

Scaling and interoperability projects are maturing. In 2019, there were 17 major Layer 2 projects and 8 cross-chain and interoperability projects. Today, scaling and interoperability exist as independent “technical layers” on the Crypto Market Map, comprising numerous categories and subcategories. There are now 73 significant Layer 2 projects. Layer 3 projects have emerged. Modular blockchains form a new category within scaling, with over 60 major projects—more than the combined total of all Layer 2 and cross-chain projects in 2019. Intent-centric architectures and account abstraction form another new category within interoperability, with 11 projects.

Consumer-facing applications and protocols are growing rapidly. Gaming, social, and other consumer-oriented applications are expanding quickly. In 2019, there were only 30 major gaming projects; today, there are 121 across gaming, game platforms, and metaverse domains. Social applications and protocols now include 110 projects.

Innovative technologies have moved from theory to practice. Innovations that were purely theoretical in 2019 now have active implementations. For example, zero-knowledge technology has evolved from a few pioneering projects like Zcash to being used by 159 projects on the Crypto Market Map.

As categories mature, some have experienced consolidation. In 2019, smart contract platforms and exchanges were the two largest categories of crypto projects. However, due to user and developer consolidation onto fewer platforms, these categories have not seen significant growth in project count. As other categories mature, we expect similar consolidation effects to take hold.

Specialization has become crucial in crypto to keep pace with advancements across different categories. Each domain requires unique expertise. As the crypto space expands, achieving comprehensive understanding across all verticals is increasingly challenging. The Crypto Market Map aims to address this by providing an industry-wide overview.

The Crypto Market Map intends to include only major projects and thus underrepresents the total number of projects in the crypto space. Its purpose is to feature projects with significant industry or cultural impact and long-term relevance.

Projects featured in the market map are drawn from a pool of thousands of crypto initiatives. To qualify for inclusion, a project must meet at least one of the following criteria:

-

Raised over $2 million since 2019 and has had active updates since March 2024

-

Raised over $50 million since 2019 and has had active updates since March 2024

-

Had over 50 developers contributing in 2024

-

Ranked in the top 100 by market cap on Coingecko

-

A leading DeFi project on its chain according to DefiLlama

-

An individual project with notable community support, such as over 10,000 Twitter followers

-

An individual project playing a leading or significant role within a specific chain’s ecosystem

Even if they meet the above criteria, projects from hackathons are excluded, as are projects that show no intent to ship their initially announced product or whose roadmap appears too distant.

The Crypto Market Map is incomplete and remains in testing phase. Please help us improve it! This map is still under development and far from finished.

We have reviewed thousands of crypto projects for inclusion, but we anticipate gaps remain. Some projects may be missing due to unavailable data sources. Categorizations may be subjective, so certain projects might be absent from expected categories.

Moreover, as new projects grow in importance over time, keeping the map up-to-date will require ongoing community effort.

By building the Crypto Market Map openly, we aim to provide a valuable, community-driven tool for everyone in the crypto industry.

Missing a project? Incorrect classification? General feedback? Please contribute here to refine and expand the Crypto Market Map.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News