The J-Curve Principle of Crypto Investment: Maximizing Returns When Hype Fades

TechFlow Selected TechFlow Selected

The J-Curve Principle of Crypto Investment: Maximizing Returns When Hype Fades

If you're not an experienced sniper, then this short article is for you.

Author: IT4I ᵍᵐ

Compiled by: TechFlow

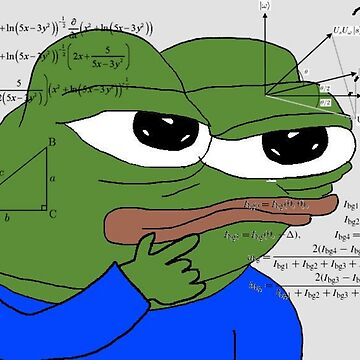

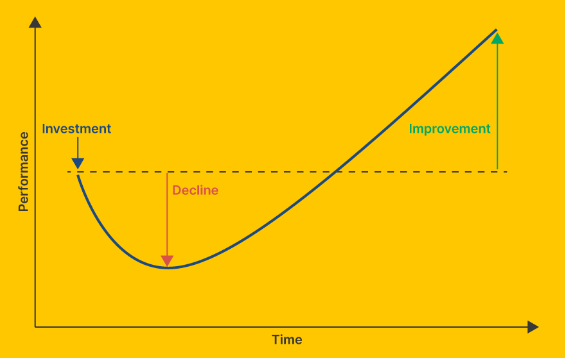

The crypto J-curve might be one of the most important strategies we market traders need to learn.

If you're not an experienced sniper, prefer buying crypto when it's safe, or are just an emotional trader trying to make sense of things, this short article is for you.

Phase One

Main participants include snipers with technical advantages, insiders/presale holders with unfair advantages, and quantity-focused speculators who care little about fundamentals.

In most cases, average traders lose money here—the drop is as fast as the rise when speculators move on to the next shiny thing.

Phase Two

Hype fades, speculators exit, volume shrinks, holders’ average uPNL drops below profit, Indians raid TG with marketing advice, and KOL scammers slowly fade from TL.

This is the most crucial phase because it presents the greatest opportunity.

Phase Two is where "cats turn into tigers." To achieve this, you must assess whether the project is dead or if the sacred J-curve is loading up.

Key indicators to watch:

- Team wallets:

Are they dumping?

Are top wallets selling?

Is treasury (if any) being moved to CEXs or kept/used on-chain?

- Social presence:

Is Twitter/TG management cautious and consistent?

Are social metrics growing or declining?

- Roadmap execution:

Have commitments mentioned in Phase One been delivered?

- New buyers:

Are known wallets buying?

Are new wallets buying?

Are dormant wallets buying?

There are more indicators, but I believe these are the most important ones for evaluating risk/reward in potential Phase Two entries.

Over the past few months, there have been countless examples of J-curves; below are some lazy picks I’ve collected:

Phase Three

Product starts showing results—real revenue generated from actual usage for utility tokens, loud worship and KOL promotion for memes, etc.

This is where you sell, as risks are high and profits should be secured. Focus should remain on Phase Two of the J-curve.

In summary, studying the J-curve creates opportunities for those without advantages (most of my Phase Two buys were done via Uniswap with low gas).

Hunting in Phase Two helps us fight FOMO and avoid becoming bags when snipers and big players dump.

Hope you learned something new. Goodbye.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News