Avalanche doubles down on inscription ecosystem as the "Ethereum killer" embarks on a new redemption

TechFlow Selected TechFlow Selected

Avalanche doubles down on inscription ecosystem as the "Ethereum killer" embarks on a new redemption

In this wave of blockchain inscription enthusiasm, Avalanche's performance is the most noteworthy.

Author: Loopy, Odaily Planet Daily

Recently, the popularity of the inscription market continues to rise, with various blockchains launching their own inscription products. The extremely high enthusiasm from the community has put significant stress on each chain's performance. However, judging by the results, multiple public chains have underperformed—ranging from lags and failed transactions to soaring gas fees, and in severe cases, complete network outages. The high TPS claimed in whitepapers has not been achieved across many public chains.

In this wave of blockchain inscriptions, Avalanche’s performance is the most noteworthy.

How Many Leading Inscriptions Does Avalanche Actually Have?

Yesterday, avav reached 100% minting progress, with 52,367 holding addresses, pushing the Avalanche ecosystem’s inscriptions to a peak.

According to data from Avascriptions, Avalanche’s inscription trading marketplace, as of publication time, avav has a market cap of $47.67 million, making it currently the top-ranked “leading” inscription on Avascriptions in both market cap and trading volume.

Interestingly, the title of “leading inscription” on Avalanche has changed hands multiple times. In terms of trading volume and market cap, aval—not avas, which was deployed earliest—was the first “leading” inscription in this inscription cycle on Avalanche. Afterwards, the leadership baton passed to asct.

As asct’s upward momentum neared its end, the market began searching for new targets this week—the third-generation leading Avalanche inscription, avav.

Gas Fees Surge, Avalanche Earns Nearly $10 Million in One Day

The supply of avav is massive, totaling 21 million units, with each containing 69,696,969 tokens. Currently, the floor price of each avav inscription is about 0.06 AVAX (approximately 2.3 USDT), giving early minter profits ranging from 1x to 10x.

Why such a large variation in profitability among avav minters? Naturally, this comes down to differing gas costs.

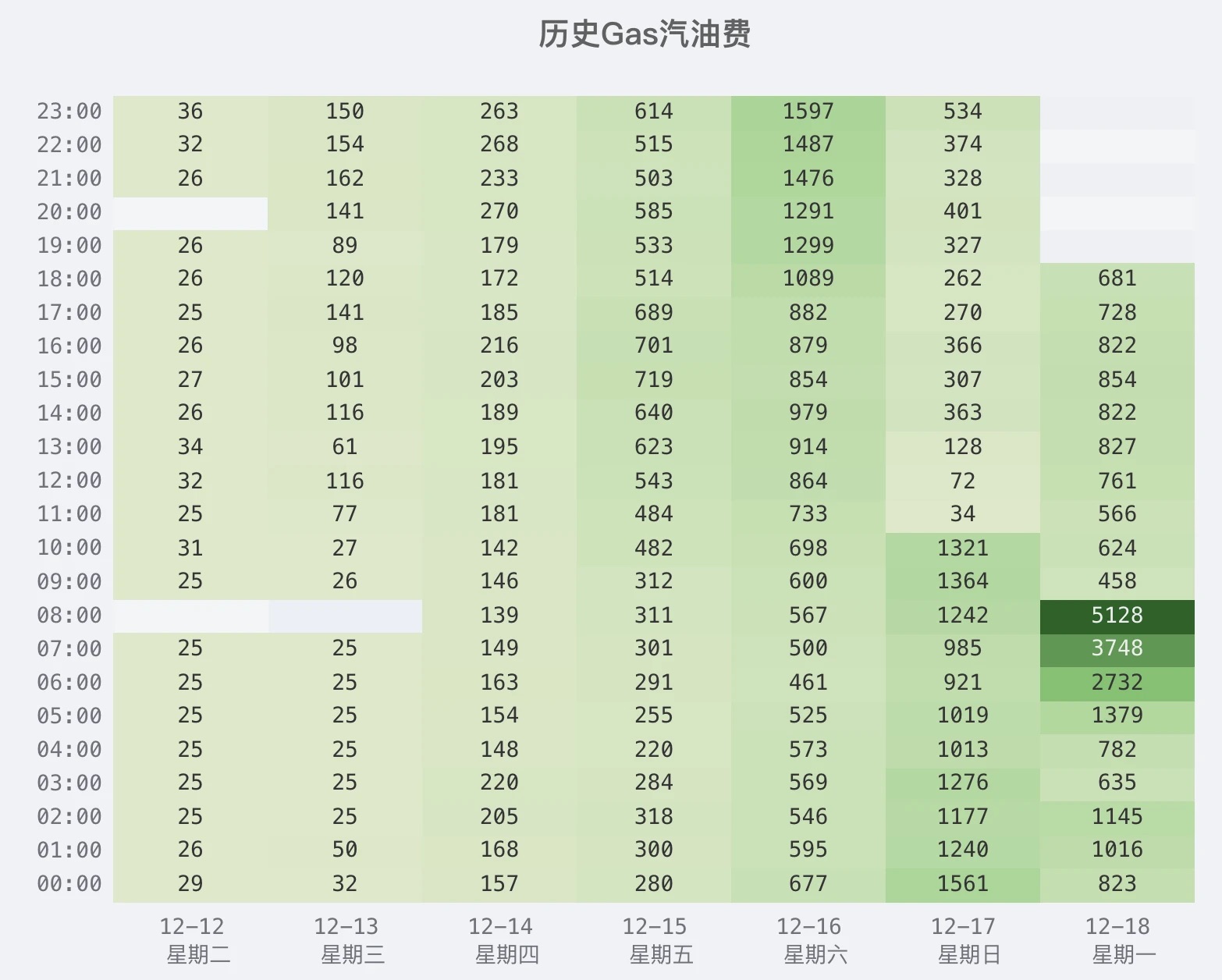

The avav minting started on November 25 but didn’t attract much attention until last Friday when minting volume surged sharply, driving up network gas fees. According to cointool data, at the height of avav minting frenzy, the network gas price briefly exceeded 2000.

Rough estimates suggest that about half of avav minters secured their inscriptions at gas levels far below current rates. Odaily Planet Daily learned from early minters that initial gas costs per inscription were only around $0.1–$0.5; however, during last weekend’s peak excitement, the cost per mint had risen to approximately $1.2–$1.8.

Regardless of individual costs, minters have realized paper profits. Yet in this inscription feast, perhaps no one is happier than the Avalanche network team itself.

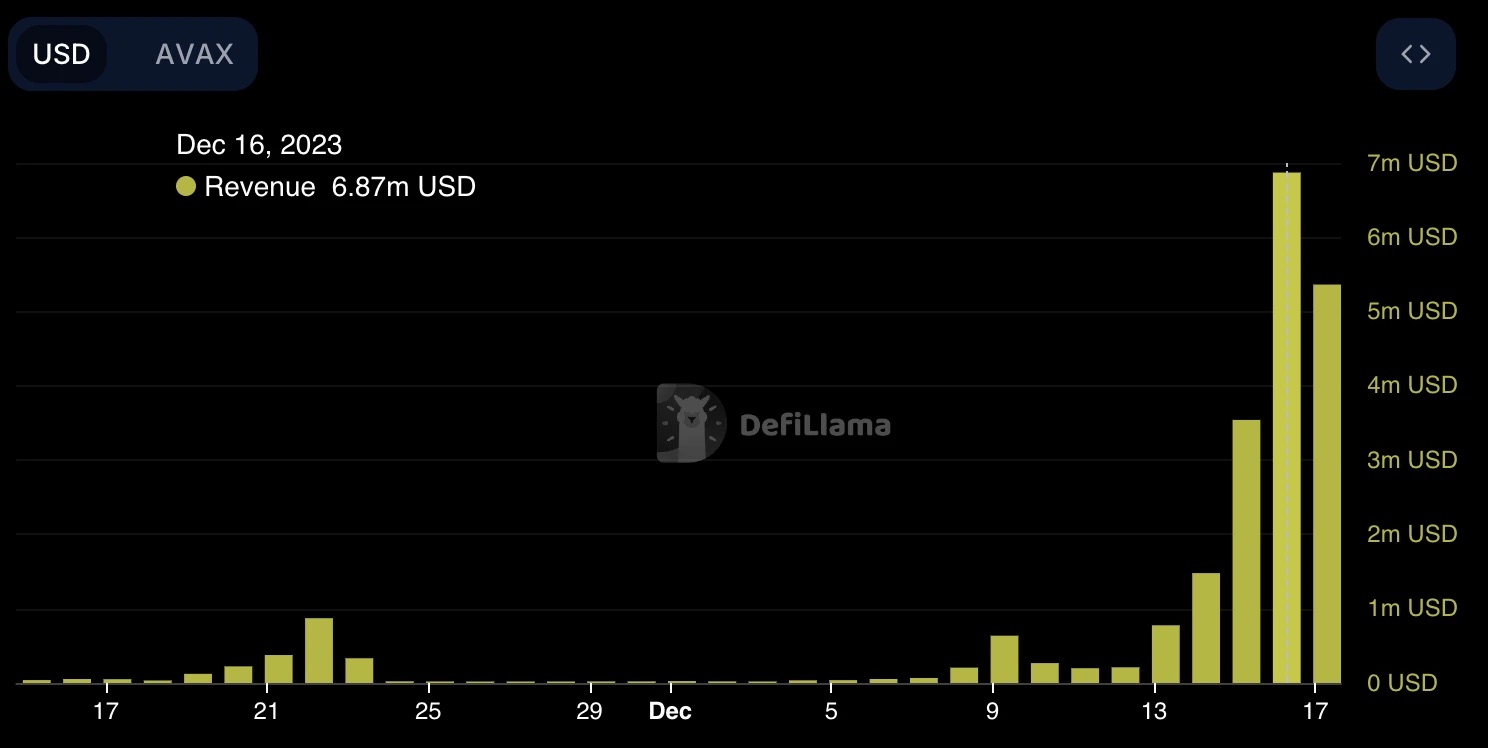

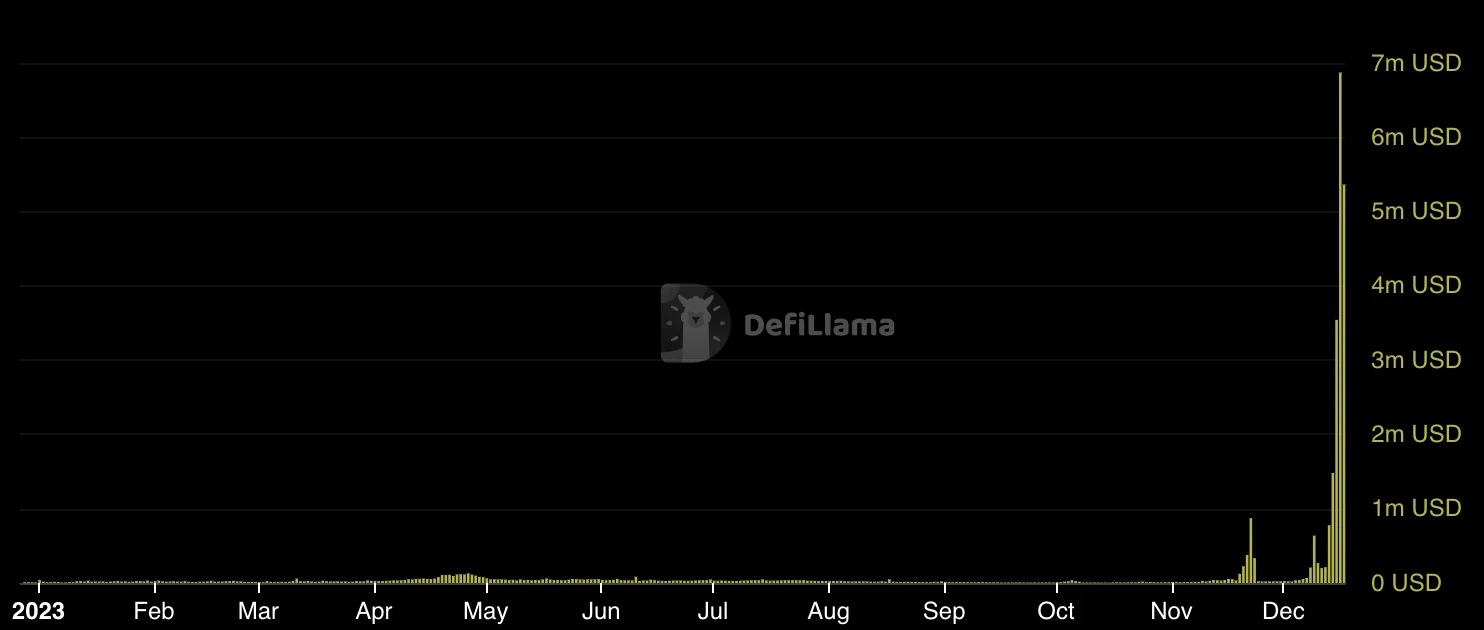

Data from DeFiLlama shows that on December 16 alone, the Avalanche network generated $6.87 million in revenue, mostly from gas fees consumed during inscription minting. With the "takeoff" of the inscription market, Avalanche’s network income has surged dramatically, accumulating $18.44 million over the past seven days.

Extending the timeline reveals even more striking growth—the recent revenue figures for Avalanche have completely overshadowed previous earnings, rendering them nearly invisible in comparison.

For inscriptions, strong community participation enables broader fair distribution and expands the number of token holders. The consumption of gas fees provides narrative support for a baseline valuation. At the same time, these gas fees significantly benefit public chain developers, who earn substantial transaction fee revenues.

The Rebirth of an “Ethereum Killer”?

For former so-called “Ethereum killers,” the current bull market dominated by Bitcoin’s ecosystem has left Ethereum appearing weak, depriving these “killers” of their battlefield. Avalanche might be exploring a different path toward redemption.

Today, cryptofishx, co-founder of TraderJoe, announced the launch of the asc-20 inscription BEEG on the Avalanche network. Within just a few hours, all BEEG inscriptions were fully minted, with over 12,000 unique holder addresses.

When announcing the project, cryptofishx explicitly stated that BEEG has neither a roadmap nor practical use cases—it is purely a social experiment. The emergence of this project is particularly interesting for the Avalanche ecosystem.

Previously, inscription projects were mostly grassroots, bottom-up community initiatives. The arrival of BEEG signals that official “project teams” are beginning to emerge in the inscription space. Regardless of future developments, the entry of established players like TraderJoe into Avalanche’s inscription scene marks a divergence between its ecosystem and competing platforms.

Although there has been no official statement, the community speculates that given the massive revenue and growing热度, the Avalanche network may become increasingly supportive of its inscription ecosystem.

Coingecko data shows that AVAX token prices have steadily climbed this year, gaining nearly 300%, outperforming most other public chains. While still far from its all-time high (ATH) during the last bull run, there remains potential for continued growth.

During the previous bull market, Avalanche and several other Layer 1s benefited greatly from narratives like the “new public chain legend” and “Ethereum killer.” But now, those stories feel outdated.

The recent surge in transaction fee revenue and intense community enthusiasm warrants serious consideration of the inscription space by these established public chains—can older networks do more as the inscription market expands further? Can the booming inscription ecosystem sustain the narrative for an entire Layer 1 network?

For the ecosystem community, there may still be hope to witness more innovative inscription experiments on once-prominent “Ethereum killers,” potentially reviving these once-dormant networks through rebirth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News