Reviewing the latest developments in the Avalanche ecosystem: Can it follow in Solana's footsteps and experience a surge?

TechFlow Selected TechFlow Selected

Reviewing the latest developments in the Avalanche ecosystem: Can it follow in Solana's footsteps and experience a surge?

Missed this wave of Solana, people often look for the next Solana.

Author: TechFlow

Recently, the Solana ecosystem has performed exceptionally well, with a broad rally across the entire ecosystem. In particular, Jito's recent airdrop has reignited user interest in interacting with Solana. Previously, we published an article discussing potential upcoming airdrops within the Solana ecosystem. Readers interested can refer to our earlier piece: "Jito Is On Fire: Don't Miss These 5 Other Potential Airdrops in the Solana Ecosystem".

After missing out on this "Solana" opportunity, many are now looking for the next "Solana."

Just like how people rushed into ETH/Solana inscriptions after missing BRC-20, whether it’s meaningful or not doesn’t matter—just jump in first.

During the last bull market, among alternative Layer 1 blockchains, Solana led the charge, followed by Avalanche and Polygon, whose native tokens both reached new highs.

Following this wave of Solana momentum, more and more users have started paying attention to Avalanche's ecosystem developments. AVAX recently broke above $30, climbing to rank #11 in the market. This article will review Avalanche's latest ecosystem progress and key projects, aiming to provide valuable insights for those tracking Avalanche.

1. Avalanche Catalysts

From a blockchain development perspective, Avalanche's most significant advancements lie in real-world asset (RWA) integration and enterprise partnerships. The chart below lists financial institutions currently using or testing Avalanche:

1-Fidelity: Based in Boston, a leader in asset management and brokerage services, managing approximately $4.2 trillion in assets.

2-JPMorgan Chase & Co.: Headquartered in New York, a renowned global investment bank and financial services provider managing around $2.6 trillion in assets.

3-Wellington Management: Located in Boston, a major player in mutual funds and institutional management, overseeing about $1.4 trillion in assets.

4-T.Rowe Price: Based in Baltimore, a globally recognized active investment management firm managing roughly $1.31 trillion in assets.

5-KKR: Based in New York, a global investment company influential in private equity, managing approximately $429 billion in assets.

6-Apollo: Based in New York, a prominent alternative asset manager overseeing around $461 billion in assets.

7-WisdomTree: Based in New York, known for ETFs and innovative investment solutions, managing about $75.5 billion in assets.

8-ANZ: Based in Australia, one of the country's largest banks with a strong presence in financial services (not primarily measured by AUM).

9-Citi: Headquartered in New York, holding a significant position in consumer banking and global finance (not primarily based on AUM).

10-Republic: Based in New York, a leading Web3 platform focused on private investments and securities; asset size not specified.

In addition, Avalanche is collaborating with top-tier global enterprises such as IEEE, TSM, and ST.

These partnerships closely align with Avalanche's emphasis on regulatory compliance. Notably, when the SEC released a list of tokens classified as securities—including SOL, MATIC, and other major L1 projects—AVAX was notably absent.

These partnerships closely align with Avalanche's emphasis on regulatory compliance. Notably, when the SEC released a list of tokens classified as securities—including SOL, MATIC, and other major L1 projects—AVAX was notably absent.

Given Avalanche's customizable subnet architecture, we can expect even more enterprise collaborations in the future.

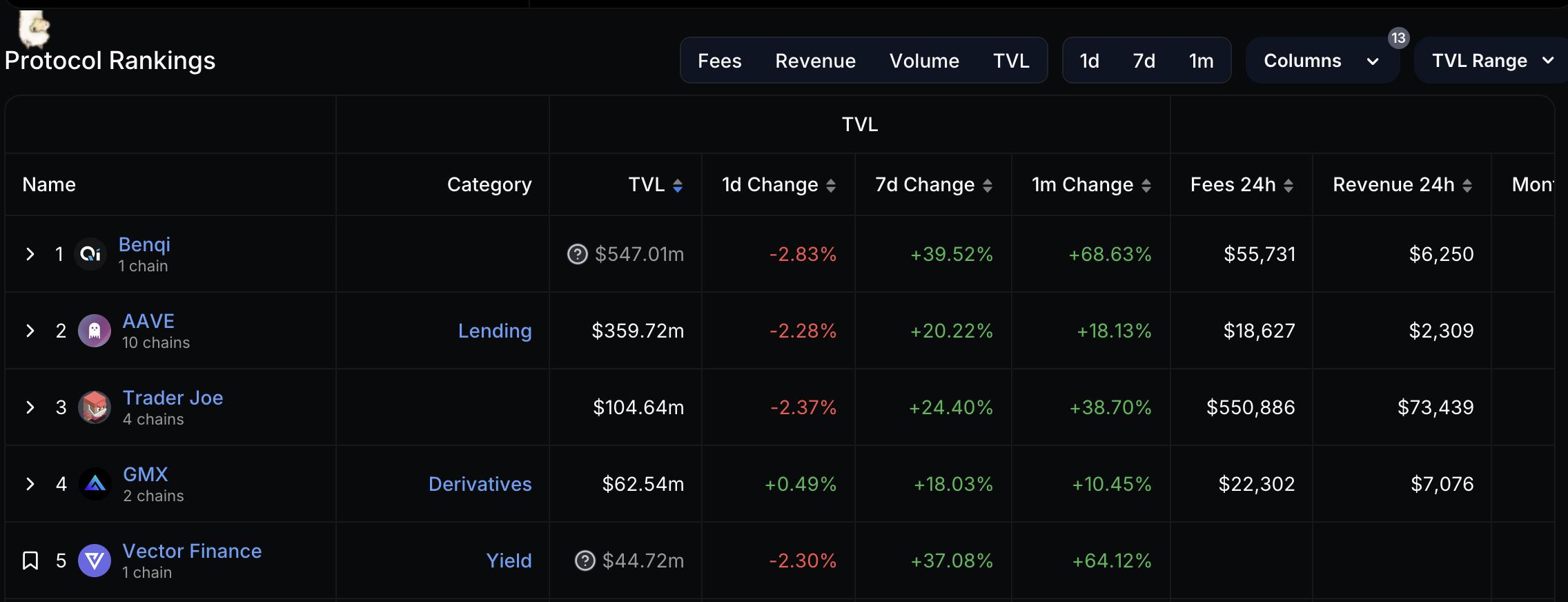

2. DeFi

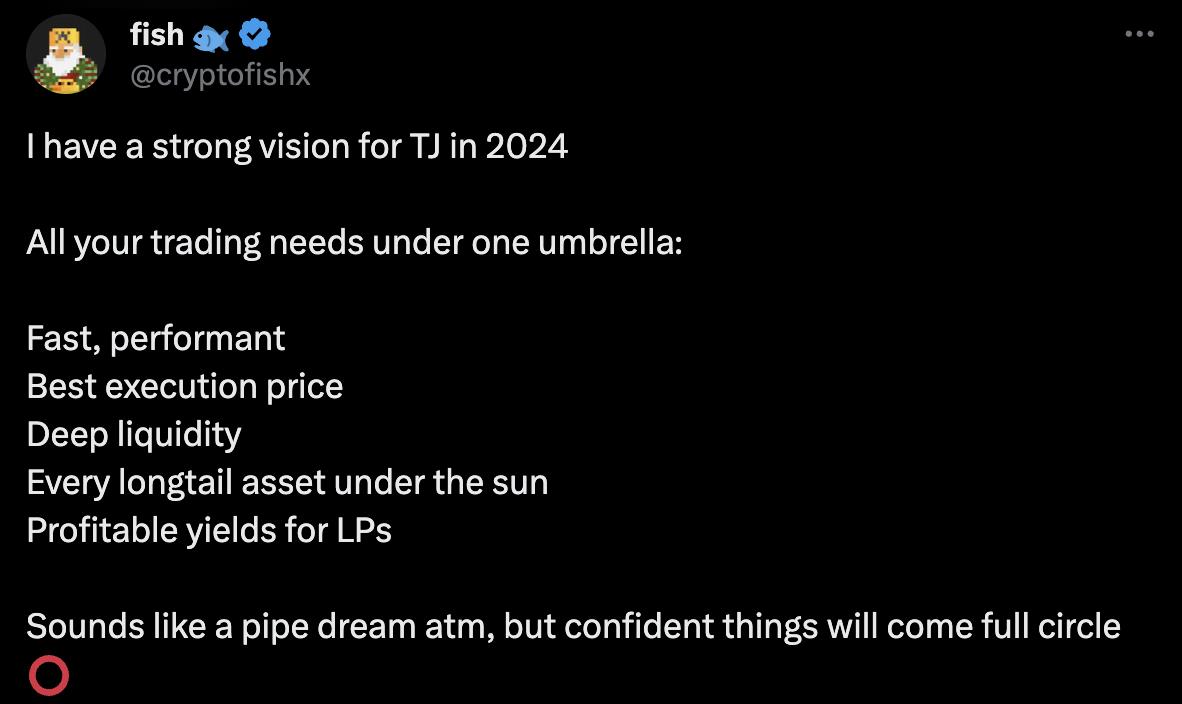

TraderJoe: Largest DEX on Avalanche

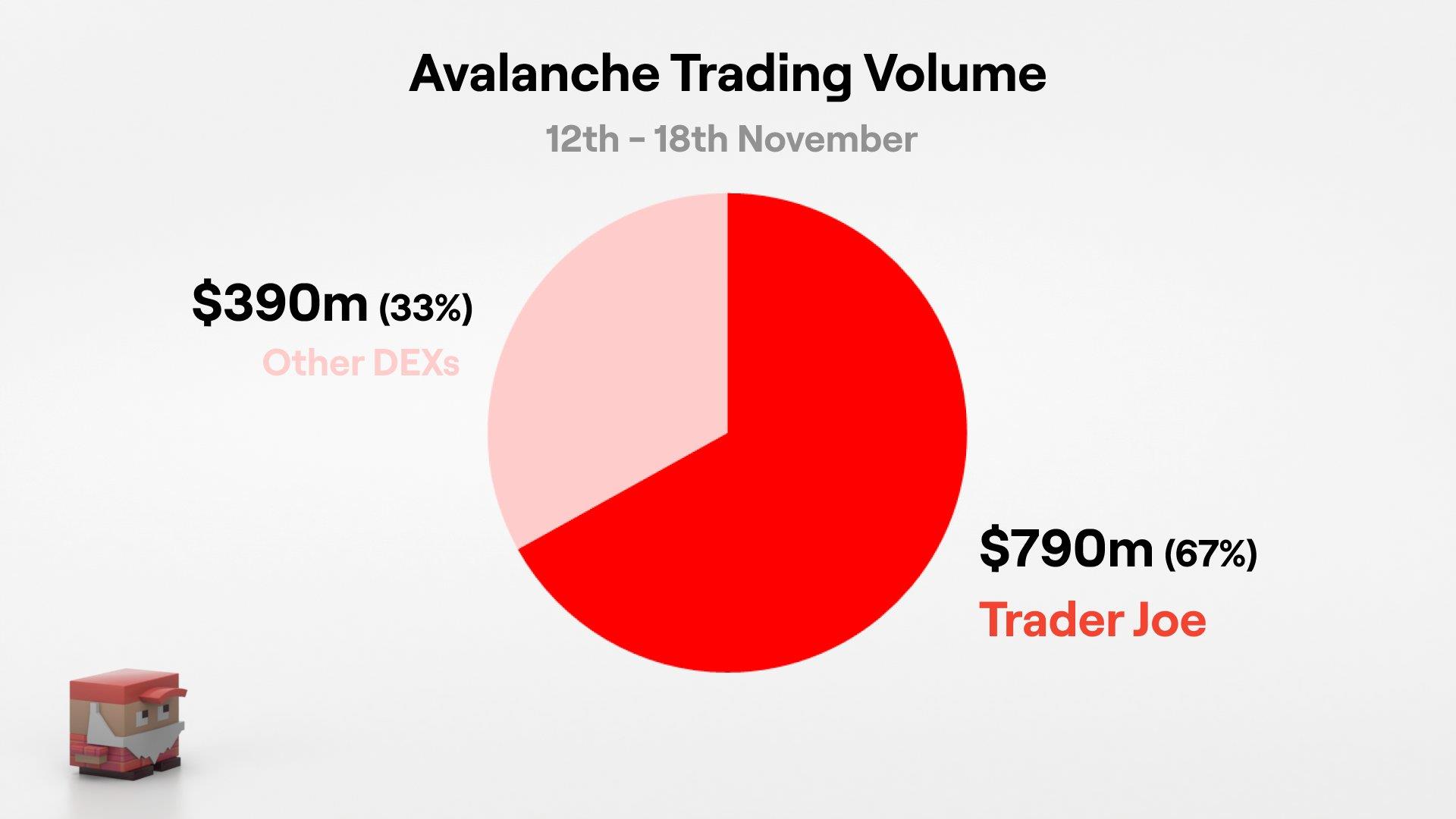

When it comes to DeFi, most of Avalanche’s trading volume occurs on TraderJoe. From November 12–18, TraderJoe accounted for 67% of Avalanche’s total trading volume, solidifying its status as the top DEX.

Launched in 2021, TraderJoe underwent a full brand refresh this year and introduced its Liquidity Book product, which performed notably during Arbitrum’s airdrop campaign. For a detailed explanation of the Liquidity Book, see our article: "Compared with Uniswap V3: What Problems Does Trader Joe’s Liquidity Book Solve?".

Regarding future plans, co-founders recently shared some roadmap updates on Twitter. However, for users, the most immediate opportunity lies in the LayerZero airdrop.

Currently, $JOE is deployed across Avalanche, Arbitrum, and BNB Chain. Users can use the Bridge button on the homepage to transfer their $JOE across chains—the cross-chain infrastructure being powered by LayerZero.

SteakHut: Liquidity Management Solution Built on TraderJoe

SteakHut offers automated liquidity management tools for LPs. Initially focused on serving TraderJoe, SteakHut’s token $STEAK surged 400%-500% over the past month, riding the momentum of TraderJoe’s growth.

Recently, SteakHut completed a seed funding round and expanded its vision to provide enhanced liquidity management solutions across the broader Avalanche ecosystem. For more details, see our article: "Explained: SteakHut – A Liquidity Management Solution Based on TraderJoe".

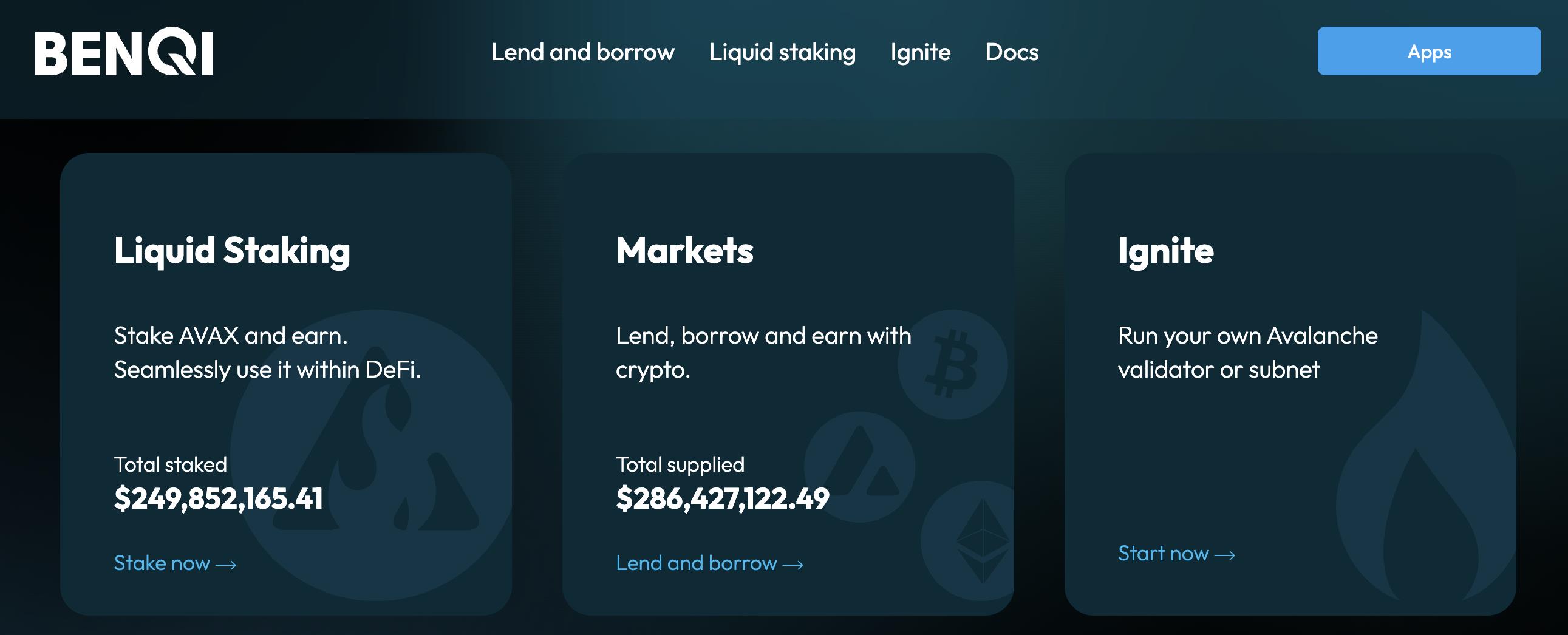

Benqi: Largest Lending and Liquid Staking Protocol on Avalanche

Benqi is one of the most critical protocols in the Avalanche ecosystem, providing lending and liquid staking services. It currently holds the highest TVL among all Avalanche-based protocols.

With a long-standing presence in the Avalanche ecosystem, $QI often gains increased attention whenever $AVAX performs strongly. Additionally, $QI is the only Avalanche-native token listed on Coinbase.

3. GameFi

Shrapnel: Hottest AAA Blockchain Game on Avalanche

Shrapnel was launched in early 2022. At that time, we produced a nearly 30-minute video analyzing its whitepaper and prospects. Interested viewers can watch here: SHRAP | Shrapnel: Avalanche's 3A Shoot-'Em-Up Blockchain Game That Encourages User Creation.

The game has recently gained traction due to the continuous rise of its token $SHRAP, which now boasts an FDV exceeding $1 billion.

Shrapnel previously released promotional videos and conducted offline tests at various Avalanche events, receiving generally positive feedback. Two months ago, the project secured another $20 million in funding led by Polychain Capital.

Driven by Shrapnel’s momentum, growing numbers of users are turning their attention to Avalanche’s gaming ecosystem. Overall, however, no other games stand out significantly besides Shrapnel. Previously hyped titles like DefiKingdoms and Ascenders encountered launch bugs and soft rug incidents, respectively.

That said, current community discussions focus more on upcoming games including Off The Grid (by Gunzilla Games), BloodLoop, and DefiKingdoms.

4. NFT

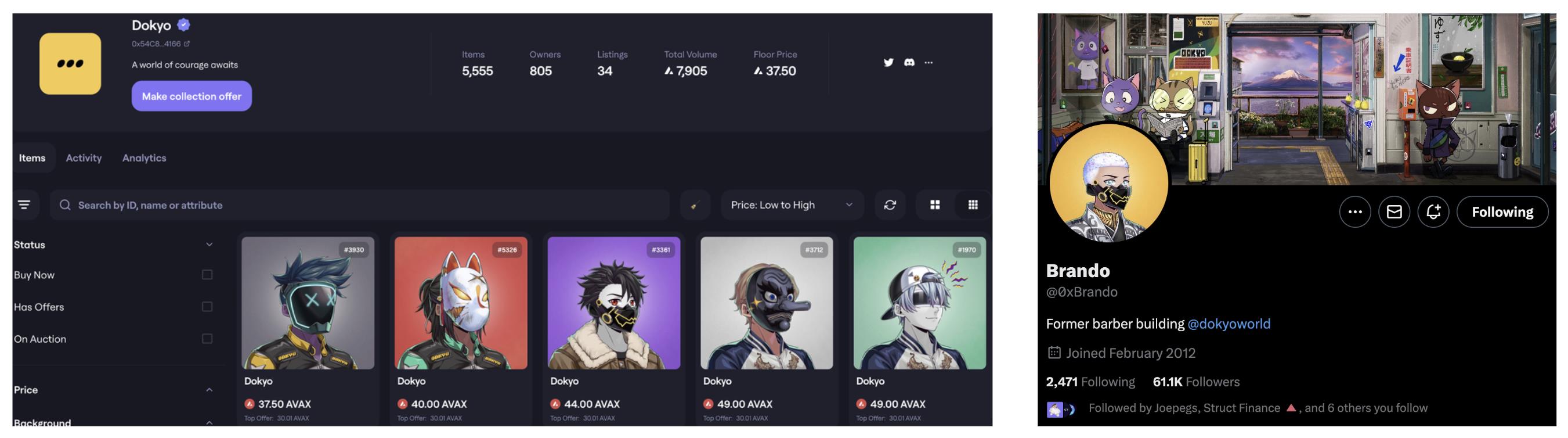

Dokyo: Currently the Hottest NFT Collection in the Avalanche Ecosystem

If you follow the Avalanche ecosystem, you may have noticed many users switching to Dokyo profile pictures. The collection consists of 5,555 NFTs, with a current floor price of 37.5 $AVAX. The only publicly known team member is 0xBrando.

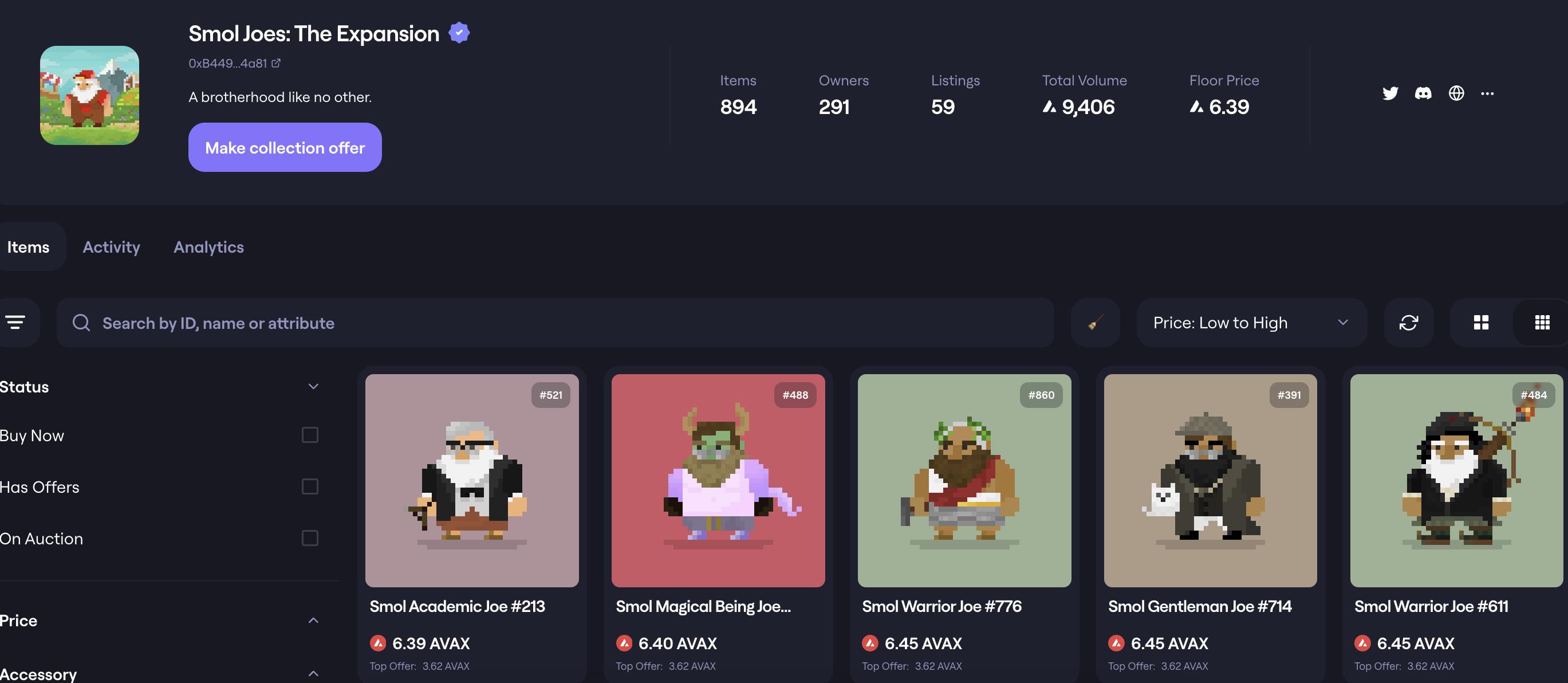

Smol Joes / Joe Hat: NFT Projects Launched by the TraderJoe Team

Smol Joes / Joe Hat: NFT Projects Launched by the TraderJoe Team

The TraderJoe team also launched their own NFT platform, Joepegs, securing several million dollars in funding from FTX and Avalanche. They’ve since launched multiple NFT projects, but currently only Smol Joes and Peon remain core focuses.

Additionally, back in 2021, the TraderJoe team launched the Joe Hat project—a nod to Uniswap’s Unisocks—with only 150 hats minted. Owning $HAT grants eligibility to redeem a physical hat.

Recently, Joe Hat experienced a surge driven by so-called “mysterious forces,” reaching an all-time high and generating significant discussion on Avalanche. However, given high volatility, caution is advised.

5. Meme

Husky: The Bonk of Avalanche

Husky is the first “dog” meme coin on Avalanche and is widely recognized across the community.

The project has been live for over two years, but only recently saw an explosive price surge amid rising interest in Avalanche memes.

Coq: The Latest Meme Coin, Live for Just 3 Days

$COQ was launched on December 8 by @WojakSatoshi. After launch, community enthusiasm soared, driving steady price increases. It currently has an FDV of $28 million, surpassing Husky.

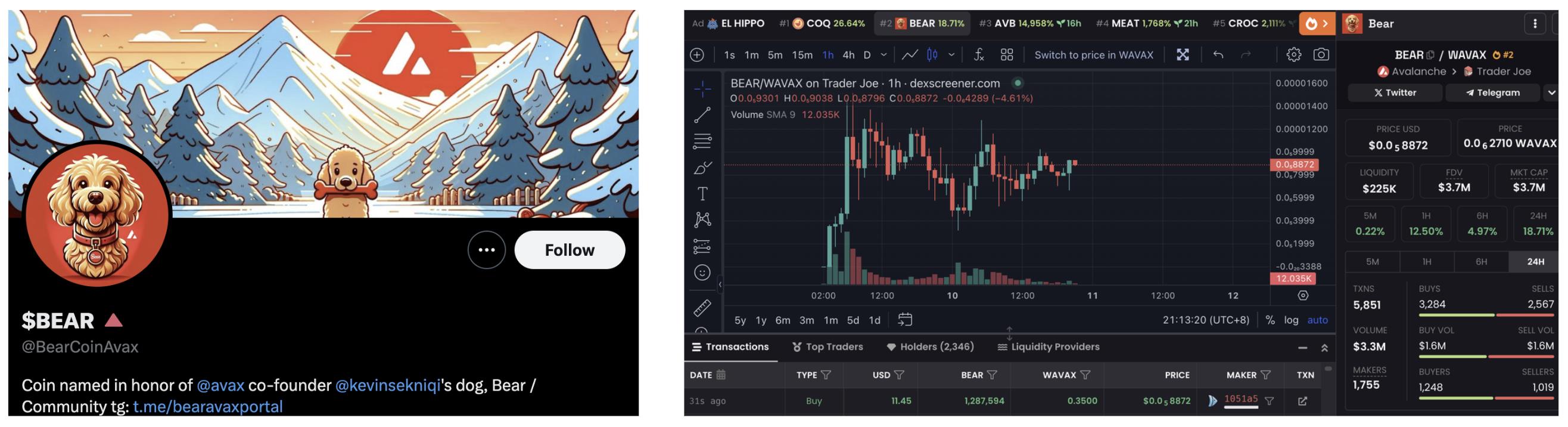

Bear: The “Dog” of Avalanche’s Co-Founder

$BEAR was launched on December 9, inspired by Avalanche co-founder Kevin posting a photo of his dog named “BEAR” on social media, prompting users to create a meme token bearing the same name.

The project has only been live for one day and exhibits extreme volatility. This information is shared purely for awareness and should not be considered investment advice.

6. Others

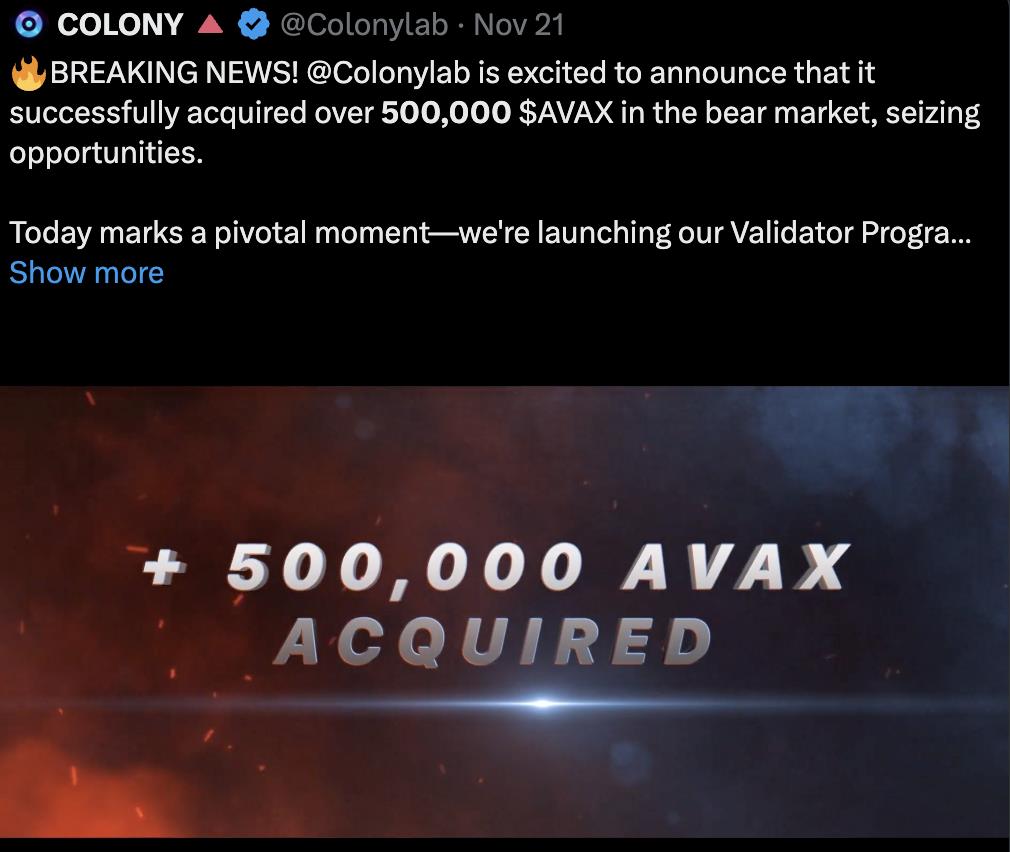

Colony: Aggregation Platform Supporting Early-Stage Projects on Avalanche

Colony, originally launched in 2021, has recently gained widespread attention due to its announcement of a multi-million dollar fund dedicated to supporting Avalanche ecosystem projects. The primary reason for this newfound spotlight is Colony’s launch of a fund exceeding $10 million to foster early-stage projects on Avalanche. This initiative was made possible because Colony accumulated substantial $AVAX holdings during the bear market—currently holding over 500,000 $AVAX in treasury, valued at approximately $15 million.

The Colony token $CLY recently surged 385.5%, reaching a current market cap of $24 million and FDV of $38 million. Staking $CLY grants holders access to several benefits:

1- Opportunity to participate in early investments in Colony-backed projects

2- Eligibility for airdrops from Colony-invested projects

3- Rewards from Avalanche validator incentives

4- Airdrop eligibility for $CAI ($CAI is Colony’s Avalanche index fund)

5- $CLY airdrops (funded from protocol revenues such as unstake fees)

Aval: Most Recognized Inscription on Avalanche

Following the inscription craze on other blockchains, Avalanche introduced the ASC-20 token standard. Among these, "aval" has generated the most community discussion. Current OTC price is around $0.2, though overall热度 remains moderate.

Hyperspace: New NFT Platform Offering Task-Based Point Rewards

Hyperspace is a well-known cross-chain NFT platform that recently launched a task-based point-earning campaign on Avalanche, offering $AVAX rewards. During the recently concluded Season 1, over $1 million in incentives were distributed.

However, prior announcements suggested over one million $AVAX would be awarded, creating a significant gap with actual payouts, leading to some community FUD. Season 2 has already begun.

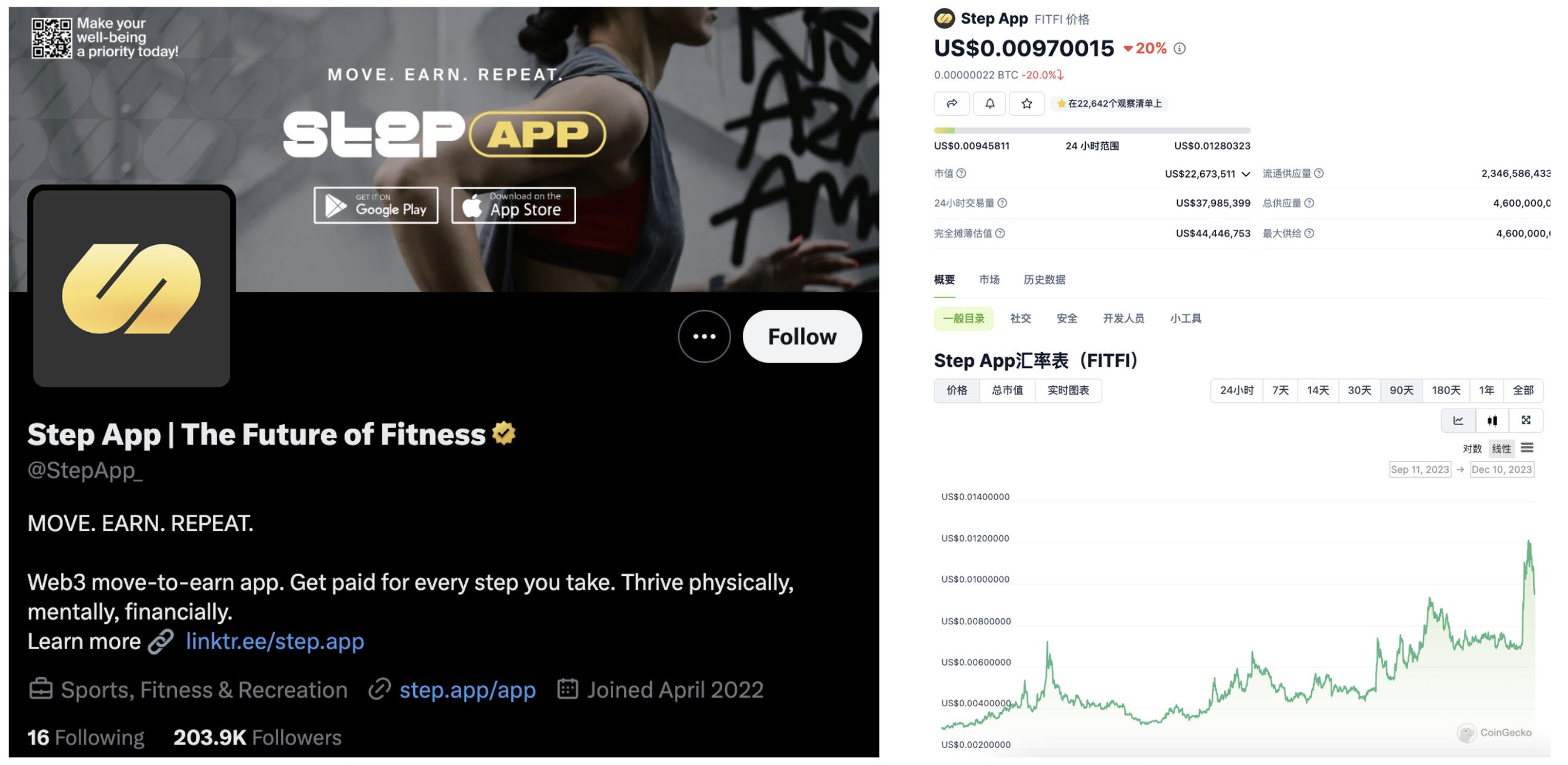

Fitfi: StepN Clone on Avalanche

StepApp is a StepN-inspired move-to-earn app on Avalanche. Recently, due to a rebranding initiative, it has sparked renewed discussions among Avalanche users. Its token $FITFI rose 95% within 30 days.

After several years of development, the Avalanche ecosystem now hosts over 350 protocols and applications. However, many projects have gradually ceased operations or suffered soft rugs. Below is a relatively comprehensive overview of the Avalanche ecosystem.

Note: This article provides informational compilation only and does not constitute any investment advice. Interested readers are welcome to join the Avalanche discussion group (link) to share and discuss further.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News