2024 Mid-Year Outlook for the Crypto Industry: Bitcoin ETF Approval, FTX's Return to Competition, and Circle's IPO Reattempt

TechFlow Selected TechFlow Selected

2024 Mid-Year Outlook for the Crypto Industry: Bitcoin ETF Approval, FTX's Return to Competition, and Circle's IPO Reattempt

Santa Claus rally could start at any moment.

By Matrixport

*Note: This article reflects the personal views of Matrixport analyst Markus Thielen and does not represent the opinions of TechFlow.

Summary

-

In the first half of 2024, there will be five micro events and one macro event in the crypto industry that could have a positive impact and potentially drive up Bitcoin's price.

-

By January 2024, we expect the U.S. Securities and Exchange Commission (SEC) to approve a Bitcoin ETF, with trading expected to begin in February or March.

-

Stablecoin issuer Circle may go public on the stock market in April.

-

Although news of FTX being acquired may be announced in December 2023, we expect the exchange to resume operations in May or June 2024. FTX is expected to regain its position among the top three exchanges within 12 months.

-

These three events, along with the Bitcoin halving cycle, are expected to provide strong momentum for the coming year.

-

Although it may be challenging to view it as a major upward catalyst, Ethereum’s EIP-4844 upgrade is scheduled for the first quarter of 2024.

-

This also coincides with the possibility of the Federal Reserve cutting interest rates by mid-2024, as market pricing indicates the Fed’s first rate cut could occur in June 2024.

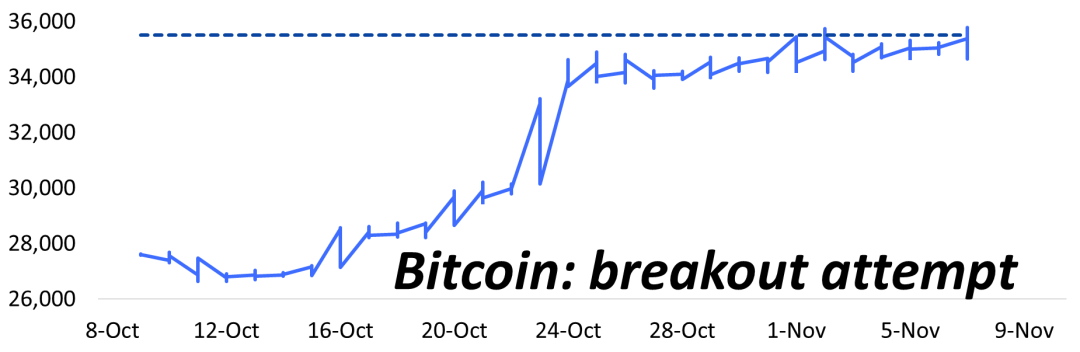

If inflation declines again, next week's U.S. CPI data could trigger another rally in Bitcoin. We anticipate Bitcoin will attempt to break out of its recent trading range of $34,000 to $35,000.

A breakout above $36,000 could push Bitcoin toward the next technical resistance level at $40,000, potentially reaching $45,000 by the end of 2023.

With steadily increasing buyer activity during U.S. trading hours and persistent attempts at a breakout, we could see prices rebounding by the end of this month (and year). The Santa Rally could begin at any moment.

Chart 1: Bitcoin is attempting to break higher—targeting $40,000, possibly even $45,000

Potential Impact of a U.S.-Listed Bitcoin ETF in 2024

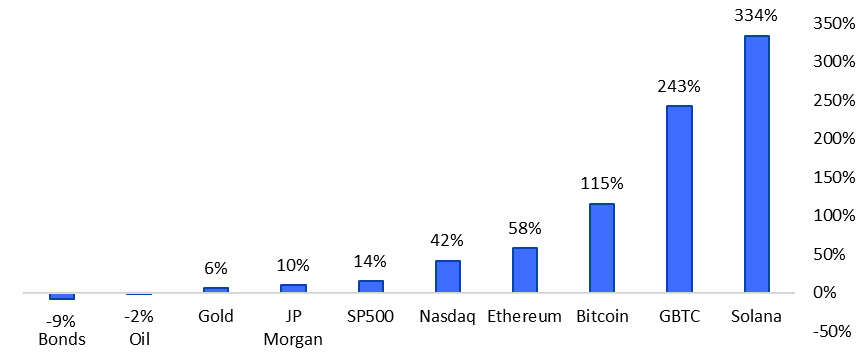

In the first half of 2024, the crypto industry will experience five micro events and one macro event that could positively influence the sector and potentially boost Bitcoin’s price. In 2023, crypto assets performed strongly, outperforming most other asset classes. Our core value proposition lies in a U.S.-listed Bitcoin ETF with the potential for registered investment advisors (RIAs), who collectively manage $5 trillion in assets via ETFs, to adopt Bitcoin as a cornerstone of multi-asset portfolios. Just a 1% allocation would result in $50 billion flowing into Bitcoin.

Chart 2: Year-to-date performance of selected assets

By January 2024, we expect the SEC to approve a Bitcoin ETF, with trading anticipated to start in February or March. Stablecoin issuer Circle may list on the stock market in April. While news of FTX being acquired might be announced in December 2023, we expect the exchange to resume operations in May or June 2024. These three developments, combined with the Bitcoin halving cycle, are expected to provide healthy momentum over the next year. Although viewing it as a major bullish catalyst may be difficult, Ethereum’s EIP-4844 upgrade is scheduled for Q1 2024. Meanwhile, the U.S. Federal Reserve may begin cutting interest rates by mid-2024, as market pricing suggests the first rate cut could come in June 2024. This shift occurs when macro liquidity transitions from tailwinds driven by peak interest rates to double liquidity support through rate cuts.

Our Year-End Price Target: From Ambitious to Achievable

A year ago, we published a report titled “Bitcoin Could Rebound to $63,160 by March 2024.” In that report, we argued that the ideal historical buying opportunity for Bitcoin typically appears 14–16 months before the next halving—around late October 2022—when Bitcoin traded around $20,000. However, our December 2, 2022 report, “Bitcoin Could Reach $29,000 in 2023 Driven by Macroeconomic Factors,” anticipated a 70% rise in Bitcoin based on expectations of declining U.S. inflation and increased liquidity for the crypto market.

Since then, inflation has indeed dropped significantly. Although fundamental metrics such as Ethereum revenue have remained weak, upward momentum in the crypto market may re-accelerate as we enter 2024. A month ago, the market entered another inflection point that could provide sufficient fuel for the continuation of the fifth bull market. When we issued that report, our year-end 2023 target of $45,000—set on February 3, 2023—seemed ambitious, as Bitcoin was trading at $22,500 at the time. Now, with prices approaching $40,000, that target appears achievable.

Unlocking Institutional Investor Potential

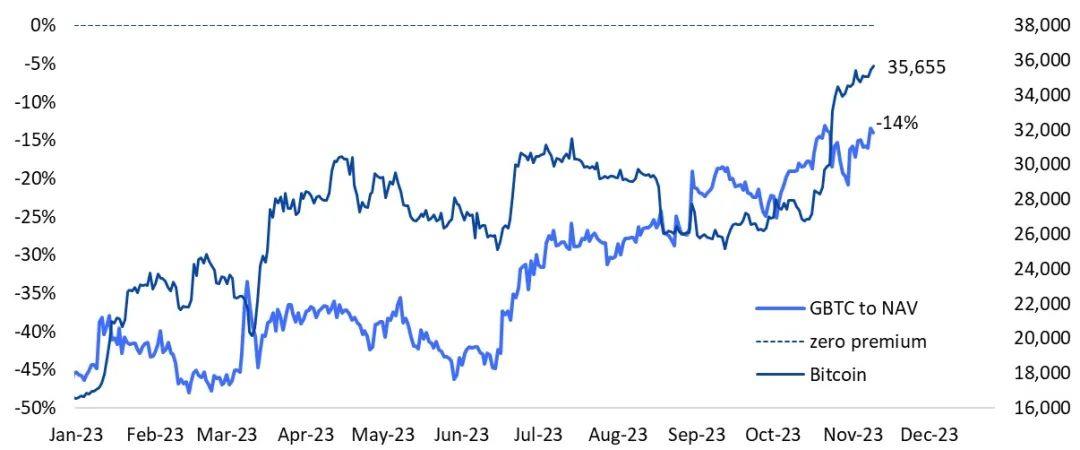

Chart 3: Grayscale GBTC’s discount to net asset value has narrowed from -45% to -14%, outperforming Bitcoin

Grayscale’s Bitcoin Trust (GBTC) shares appear to be held by 61 institutional firms—alongside other investors such as high-net-worth individuals and family offices—anyone with reportable holdings below $100 million. The SPDR Gold (GLD) ETF has 1,090 institutional investors, similar to BlackRock’s iShares Gold ETF. Just BlackRock’s Bitcoin ETF alone could attract over 1,000 institutional investors. While approximately 45 million Americans already hold cryptocurrency, 160 million Americans own stocks. The potential impact of these investors on the crypto market remains enormous, yet often underestimated. Such inflows could significantly improve market liquidity and greatly enhance the fiat-to-crypto onramp, which is currently largely limited to Tether—at least based on real-time data we can monitor.

Spillover Effects: Coinbase IPO and FTX’s New Owner

Ahead of Coinbase’s planned initial public offering (or direct listing) on April 14, 2021, Bitcoin surged to $61,500. Coordinated efforts maximized hype around the event. Market commentator Jim Cramer tweeted, “Our buy-the-rumor price for Coinbase is $475,” assigning the company a valuation comparable to Goldman Sachs. Despite a reference price of $250 per share, many (mainly retail) investors believed they could purchase shares at that level, valuing the company at $65 billion. As media coverage intensified, the IPO generated significant momentum for the entire sector, with Coinbase attracting more new customers during the pre-IPO phase than ever before.

The stock opened at $381, peaked at $429.50, and closed its first trading day at $328. Today, the stock trades at $88, down 77% from its direct listing price, with a market cap of $21 billion. Coinbase has approximately 98 million users, with 9 million active traders monthly.

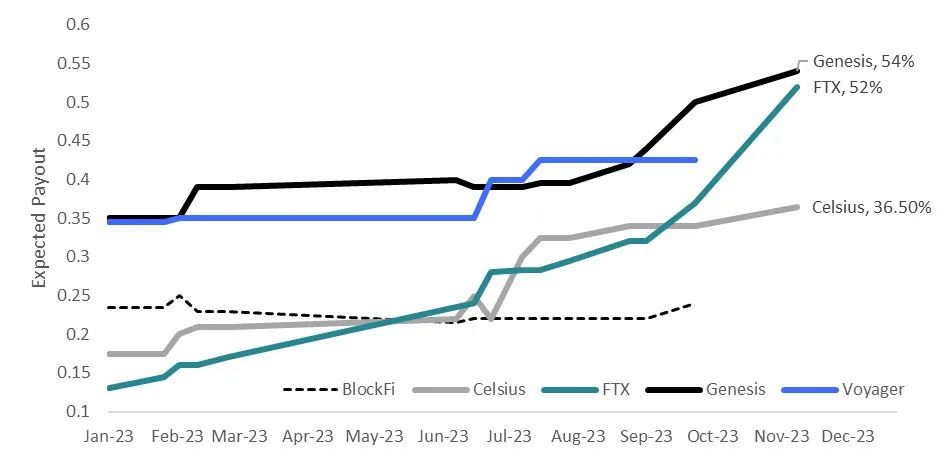

Chart 4: FTX creditor claims have tripled this year, priced as a percentage of claim value

When FTX collapsed a year ago, Coinbase had a market cap of $12 billion. In its last funding round, FTX was valued at $32 billion, reportedly with 8 million registered users and 5 million active ones. Despite Sam Bankman-Fried’s legal troubles and recent conviction, the FTX brand and its user base still hold significant value.

By December 2023, a new owner may take over the exchange. We believe FTX could sell for $200–300 million—an attractive price considering its number of registered users and global brand recognition. Customer attrition was primarily tied to SBF’s inner circle, while the exchange’s brand value remains relatively intact.

Matrix on Target expects the lesser-known crypto exchange “Bullish” to acquire the entity. Backed by Block.one ownership with ample funding and strong connections to well-capitalized investors, “Bullish” suffers from an extremely small active user base (and, in the humble opinion of “Matrix on Target,” desperately needs a better name). The FTX price tag could continue to benefit FTX creditors. Some estimates suggest FTX creditor claims are now trading above 55 cents, and this is before any clear announcement of the exchange being sold to another investor. SEC Chair Gensler also indicated that FTX could restart under new leadership, signaling that crypto will persist and the SEC hasn’t ruled out crypto outright. The new owner may deploy substantial marketing resources and offer incentive fees to retain users, creating strong momentum and boosting overall sentiment in the crypto market.

Circle’s IPO Ambitions and Tether’s Remarkable Market Cap Growth

Stablecoin issuer Circle is also expected to revive its IPO plans. At the end of 2022, a SPAC (special purpose acquisition company) deal aiming to value the company at $9 billion ultimately failed. This renewed effort signals growing confidence among crypto operators that the bull market will continue into 2024 (if not beyond). However, skeptical investors may note that Coinbase’s IPO occurred near the absolute market peak, leaving many investors “holding the bag.”

Over the past 12 months, Circle’s USDC market cap has declined by 47%, falling from $45 billion to $24 billion. Most of this drop occurred in March 2023 when the U.S. government seized three key banks important to crypto investors. Circle itself was caught in the turmoil, as at least one of these banks held billions of dollars for the company. Yet despite (or because of) Circle’s provision of regular audit details and close cooperation with U.S. regulators, investors have favored its larger rival—USDT.

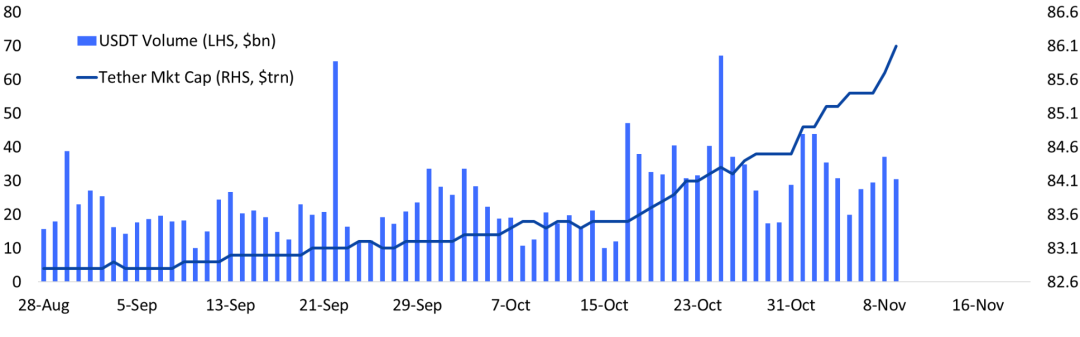

Chart 5: Tether USDT market cap surges—new minting means new inflows, $86 billion

While USDC’s market cap declined last year, Tether’s USDT grew by 30%, rising from $66 billion to $86 billion, reaching an all-time high. Even last month, with market cap continuing to grow, another $3 billion seemed to flow into the crypto market. Since mid-October 2023, these inflows have risen again as investors grow increasingly confident that the macro environment favors crypto liquidity.

Bitcoin on the Brink of Breakout: Inflation and Macro Factors Driving Bitcoin Trading Behavior

Two months ago, U.S. inflation (CPI) unexpectedly rose from 3.2% to 3.7%. This increase broke the trend of consistently declining inflation, perhaps explaining why Bitcoin traded relatively flat between $25,000 and $26,000 in late summer.

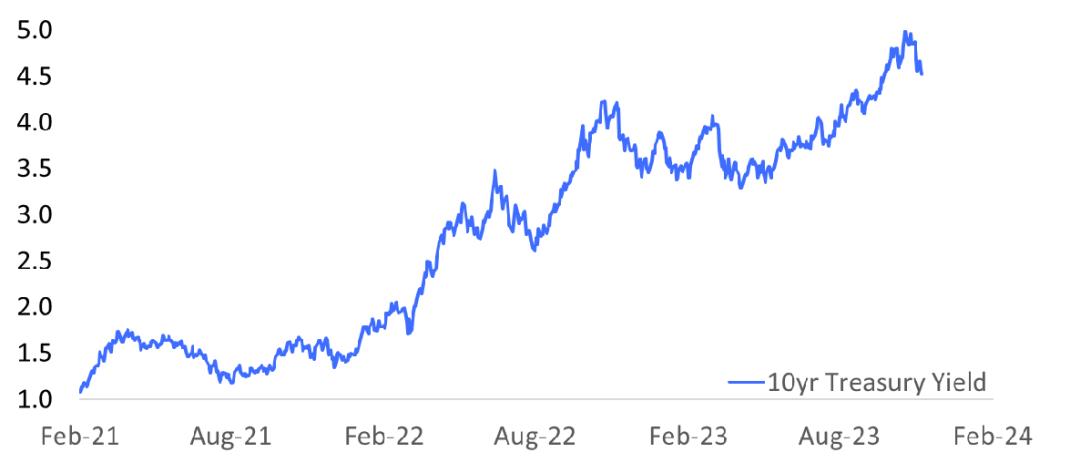

As our readers know, since November 2022, declining inflation has been a major driver of macro liquidity—and a key reason why Bitcoin’s price surged over 113% this year. One month ago, U.S. inflation remained at 3.7%. As traders became more comfortable with this level, viewing it as a temporary spike, Bitcoin rose from $27,000 to $34,000 within a week of the inflation data release.

Chart 6: Alongside inflation, U.S. Treasury yields have been a headwind for crypto since 2022

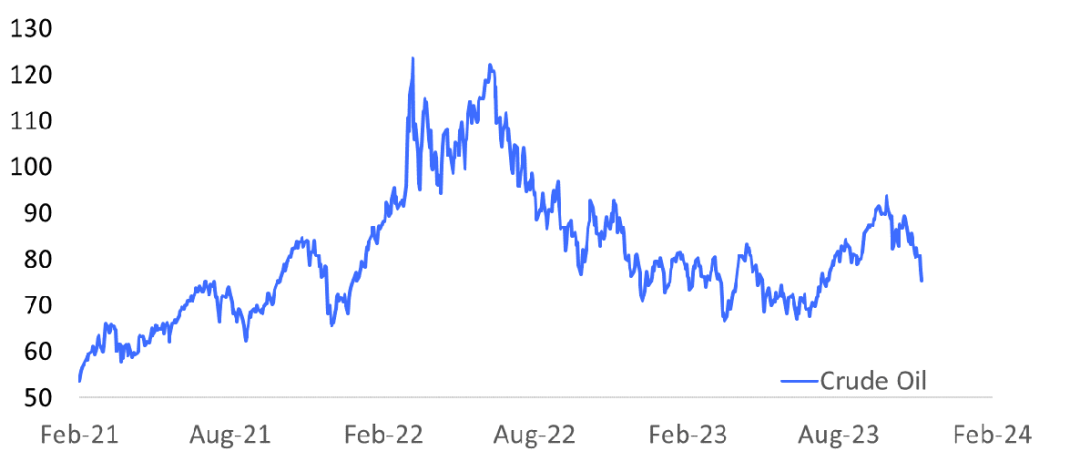

Other factors may also have played a role, such as short-term gamma exposure among Bitcoin options market makers or positive statistical patterns linked to buying Bitcoin on an unlucky Friday the 13th. However, as we’ve shown repeatedly, declining inflation triggered earlier rallies in Bitcoin this year. Crude oil prices rose over 30% from their summer lows, which could affect inflation expectations. Nevertheless, oil prices have since fallen by 20% since late September. Traders likely anticipate another decline in inflation, supporting risk assets from a macro liquidity perspective.

Chart 7: Falling oil prices may trigger another round of lower U.S. inflation

If inflation declines again, next week’s U.S. CPI data could spark another surge in Bitcoin. Ahead of this release, we may see Bitcoin attempting to break out of its recent $34,000–$35,000 trading range. A breakout above $36,000 could propel Bitcoin toward the next technical resistance at $40,000, potentially reaching $45,000 by the end of 2023.

Trading Pattern: Steady U.S. Bitcoin Buying Activity

ies

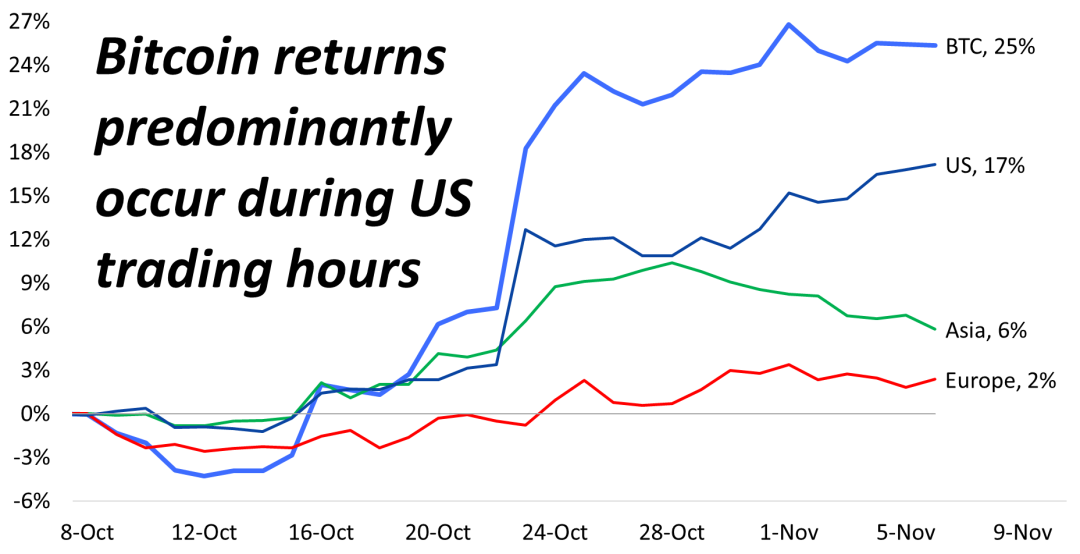

Chart 8: Bitcoin price surges primarily during U.S. trading hours

Notably, although Bitcoin tends to dip during Asian trading hours, there has been consistent and gradual buying activity during U.S. trading sessions. One possible explanation is that Asian traders favor altcoins over Bitcoin.

However, although Ethereum delivered a +16% return, 70% of that gain (equivalent to +11%) occurred during U.S. trading hours. In contrast, Solana has shown a more balanced performance across all three regions. This is surprising given that European capital flows are relatively small compared to trading volumes in the U.S. and Asia. The even distribution may be attributed to Solana’s Breakpoint conference in Amsterdam (Europe).

Last week saw three "macro-positive" data points: 1) The U.S. Treasury slowed long-term bond issuance, suggesting bond yields should fall; 2) Chair Powell’s dovish stance at the post-FOMC press conference signaled the Fed is unlikely to hike rates again in this cycle; 3) Disappointing U.S. jobs data reinforced the first two points.

Chart 9: A slight summer CPI uptick kept Bitcoin range-bound

The next key macro data point will be the U.S. CPI (inflation) data, scheduled for release next Tuesday (November 14). With steadily increasing buyer activity during U.S. trading hours and persistent breakout attempts, we may see prices rebound by the end of the month (and year). The Santa Rally could begin at any moment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News