From the perspective of an RWA project team, let's talk about the real pitfalls we've encountered while launching RWA projects

TechFlow Selected TechFlow Selected

From the perspective of an RWA project team, let's talk about the real pitfalls we've encountered while launching RWA projects

RWA projects have many pitfalls—please be cautious when jumping on board.

Author: Wang Jun, inpower

RWA refers to tokenizing real-world assets (Real World Assets) through blockchain technology.

From the perspective of an RWA project team, this article explains the actual pitfalls encountered when launching RWA projects. For insights on selecting industry entry points, refer to Six Unreliable Observations About RWA.

The trend of tokenizing real-world assets has actually been around for many years.

And now it's gaining momentum again this year.

Theoretically, RWA asset types can be diverse—tangible assets such as real estate and artwork, financial assets like stocks, bonds, and cash, or intellectual property assets such as IP rights and copyrights.

In the previous market cycle, apart from stablecoins (which barely count as RWA), other RWA projects failed to gain significant traction.

This year’s surge is driven by U.S. interest rate hikes, particularly through government bonds.

Local Hong Kong policies also favor bringing Hong Kong-based financial assets on-chain—not only have there been frequent moves toward DLT-based bond issuance, but STO licenses were issued just yesterday.

I know many project teams from the last cycle (many still active)—let’s discuss what pitfalls they’ve encountered?

More importantly: What changes have already occurred or should we pay attention to in this cycle?

01 The Unchanging Basic Steps of RWA

In the article Six Unreliable Observations About RWA, a viewpoint was raised that resonated with some:

RWA = Law + Code

All assets are either supported by law or by code.

For RWA assets, both legal frameworks and code may need to provide support.

Given that, there are several fundamental steps any RWA project cannot avoid:

-

Asset Acquisition

Since RWA involves real-world assets, you must actually possess those assets.

Whether cash, stocks, or real estate, the asset type must be clearly defined before issuing tokens.

Some well-intentioned projects acquire assets in advance, while others only do so after investors purchase the tokens.

Either way, asset acquisition is essential.

If no actual asset acquisition takes place (e.g., synthetic assets in DeFi), then it doesn't qualify as an RWA project.

-

Asset Custody

Custody is often overlooked by both project teams and investors.

However, from a compliance standpoint, all RWA projects and regulators will eventually need to agree on a custody solution.

Without proper custody, project teams could easily abscond—a bloody lesson learned over centuries of Western capitalism.

Physical assets require secure storage at specific locations, while non-physical assets (IPs, financial assets, etc.) require custodians or trust companies.

Even in traditional finance, underlying assets going missing isn’t unheard of—remember how Zhanzi Island’s scallops mysteriously swam away depending on the listed company’s market cap? Such incidents will likely occur even more frequently during early-stage RWA development.

-

Token Distribution

Whether traditional financial assets, RWA, or even meme coins, distribution is a critical phase for any project team.

In traditional finance, asset distribution primarily relies on brokers and fund managers.

In crypto, exchanges and airdrops are the main distribution channels.

Currently, RWA tokenized assets face a dilemma: crypto users find them uninspiring due to limited upside potential, while traditional finance clients remain hesitant due to regulatory uncertainty and unfamiliarity with underlying assets.

-

Ongoing Services

Like traditional financial assets, RWA underlying assets require ongoing maintenance.

For physical assets, this might involve warehousing or logistics—even real estate requires regular upkeep.

For non-physical assets, periodic net value calculations and compliance costs are necessary.

With these basic steps in mind, let’s dive deeper into the pitfalls and opportunities.

02 On-Chain Infrastructure Is a Pitfall

Despite rapid advancements in blockchain technology, on-chain infrastructure still significantly impacts the liquidity of tokenized assets.

Currently, Ethereum probably has the best liquidity among public blockchains?

But Ethereum’s transaction throughput is severely limited, and gas fees are extremely high. Frankly speaking, it may only be suitable for conceptual or toy-like projects—its performance and cost cannot compare with traditional finance at all.

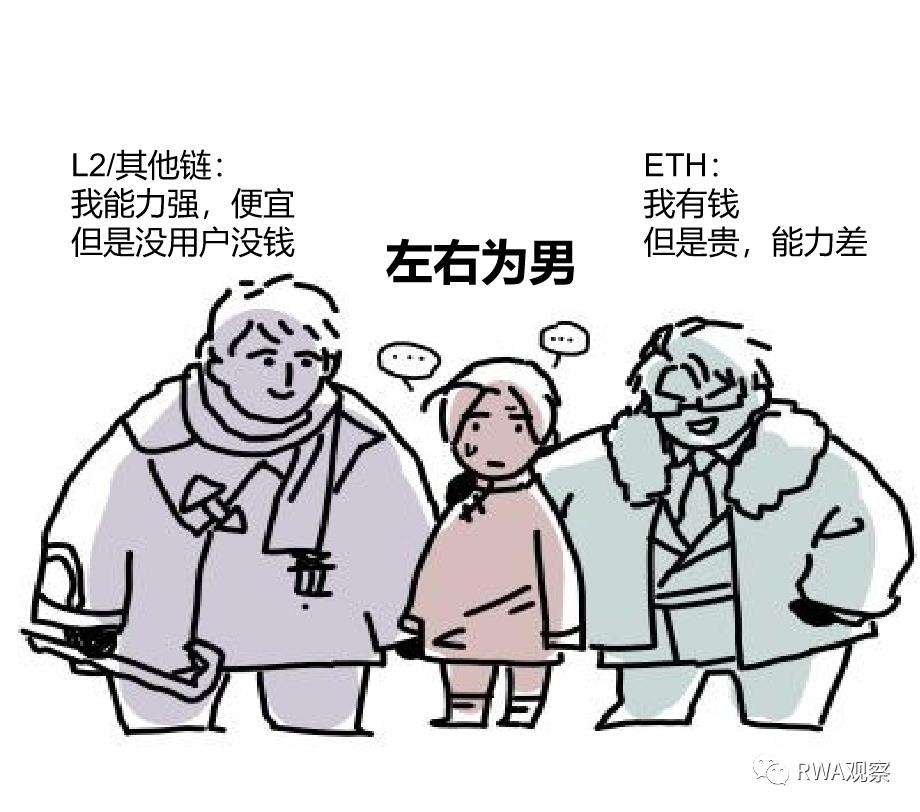

What if we use Ethereum L2s or other public chains?

Then we run into another headache: cross-chain interoperability.

On cheaper, higher-performance L2s or alternative chains, you often find users don’t actually hold funds on those chains.

So either we wait for a future blockchain that’s cheap, high-performing, and widely adopted, or hope some exceptional teams can solve the cross-chain problem effectively.

03 Traditional Financial Intermediaries Are Also a Pitfall

At their core, RWA and traditional financial asset securitization aren’t very different.

One turns assets into tokens, the other into securities.

In theory, tokenization could streamline traditional financial intermediaries—see RWA’s Future Decisive Battle: Revolutionizing Asset Securitization.

But as Ye Kai, a veteran pioneer from Conflux Fund, pointed out:

According to SFC circulars, Hong Kong views RWA/STO as tokenized traditional securities—digital bonds, digital ABS, and digital REITs.

All (RWA) product designs must wrap the asset within a traditional financial structure (a fund), then tokenize that shell.

Extremely conservative—and everywhere demands money: hiring SFC-approved DLT platform providers, wallets, licensed exchanges, custodians, market makers, auditors, law firms, external consultants, etc.

This doesn’t save any steps—in fact, it adds blockchain layers on top of existing processes.

Talk about "taking off your pants to fart"—this is exactly what it looks like.

04 Regulatory Uncertainty Is the Biggest Pitfall

Earlier we mentioned Hong Kong issuing STO licenses, which seems positive for RWA—but upon closer inspection, the restrictions on RWA products are substantial.

Still, this represents relatively clear regulatory guidance.

Other regions (like the U.S.) remain far more ambiguous—SEC remains indecisive on spot Bitcoin ETF applications.

Mainly because the future stakes involved are simply too high.

Today’s global financial system centers on Swift and the Federal Reserve—virtually every dollar transaction can be sanctioned or restricted by them.

Therefore, when new technological solutions emerge, it's difficult to abandon existing interests outright.

Fortunately, current technical approaches can achieve tokenization while preserving U.S. interests (see America’s Grand Strategy? Explaining the Fed and Swift’s Tokenization Plan). However, this solution is still conceptual—implementation could take years, if ever.

Until then, if the U.S. insists on settlement within its centralized systems (e.g., DTCC/Swift/Fedwire), RWA globally will be forced into redundant, inefficient processes.

05 Lack of Market Acceptance

For RWA projects, the advantage lies in having tangible underlying assets, offering stability; the drawback is the lack of speculative appeal compared to other cryptocurrencies.

If regulations become clear, traditional distribution channels (banks, wealth management firms, etc.) would eagerly participate.

If token standards unify and purchase restrictions ease, listing on exchanges becomes feasible.

Yet, even major banks’ own tokenized deposits—backed by real assets—are currently restricted to internal circulation (see Besides BlackRock, What Are Other Financial Giants Doing?). So banks won’t dare sell others’ assets.

Regarding RWA token standard battles, DTCC likely has its own agenda.

Meanwhile, today’s market is flooded with memes and ecosystem play projects—many have chosen to drop biases and embrace the bubble.

06 Is a Growth Flywheel Quietly Spinning Up?

Despite numerous challenges, RWA still represents a potential multi-trillion-dollar market.

Stablecoins alone already exceed $1 trillion in total locked value (TLV).

If RWA breaks into mainstream adoption in the next bull market, what changes would be required?

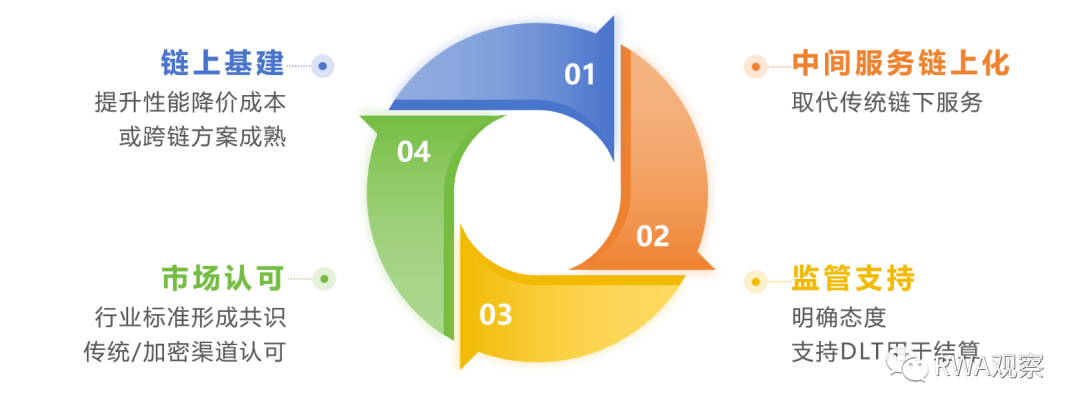

Let me propose a growth flywheel framework for discussion:

Compared to the last bull market, on-chain infrastructure today is significantly more mature.

Especially various Ethereum L2s, which may become top choices for many RWA teams. Additionally, if projects like Chainlink better solve cross-chain issues, that would provide long-term market support.

Improved on-chain infrastructure reduces costs, enabling the migration of financial intermediary services onto the chain.

Projects like Centrifuge are actively moving traditional off-chain intermediaries online. Moreover, numerous specialized on-chain service providers focused on KYC, anti-money laundering, accounting, and auditing are already supporting the broader ecosystem.

We believe future regulation will follow the principle of “same activity, same regulation”—whether services are delivered on-chain or off-chain, they should be treated equally under regulation.

In many jurisdictions, DLT (Distributed Ledger Technology) has already gained legislative recognition—even Swift and the Federal Reserve have proposed their own conceptual frameworks.

Mature on-chain intermediary services will push regulators toward adopting the “same activity, same regulation” principle, legitimizing the entire industry.

Once regulatory stances become clear, industry standards and traditional channel adoption will naturally follow.

As RWA assets leverage these distribution channels, reaching scale comparable to traditional securitization, they will create new business ecosystems and revenue streams for on-chain infrastructure—further accelerating its maturity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News