Detailed Explanation of the Federal Reserve and Swift Tokenization Initiatives

TechFlow Selected TechFlow Selected

Detailed Explanation of the Federal Reserve and Swift Tokenization Initiatives

In a complex financial system, it is inherently challenging for a nascent entity to be compatible with the existing framework.

Author: inpower Wang Jun

Asset tokenization is one of the hottest topics within RWA.

However, apart from stablecoins, other asset tokenization projects currently have relatively small asset scales and low market recognition among users.

Regulatory compliance may be a major factor here. In complex financial systems, it's inherently challenging for new entities to integrate with existing frameworks. As mentioned in the previous article Besides BlackRock, what moves are other financial giants making?, even a giant like JPMorgan faces significant resistance when attempting to roll out deposit tokenization.

But today’s featured proposal comes from an even more influential source—none other than the Federal Reserve and the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

The Federal Reserve and SWIFT Are the Key Nodes of the Centralized System

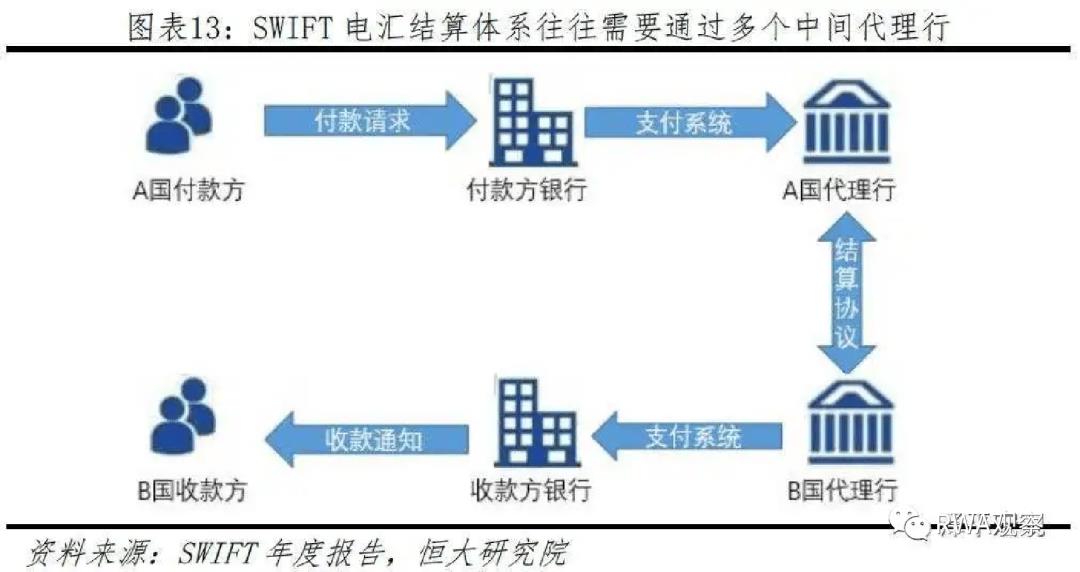

Let’s start with a quick diagram explaining how the current payment system works:

In cross-border trade, transactions under the current system must go through SWIFT.

For domestic U.S. payments or any dollar-settled cross-border transactions, access to the Federal Reserve’s Fedwire is mandatory.

These are the critical core nodes highlighted by red circles in the diagram above.

When crypto payments constantly talk about decentralization, everyone should have a clear idea of exactly who they’re trying to disintermediate.

Is Traditional Finance Self-Revolutionizing via RLN?

Everyone shouts about asset tokenization, but without supporting crypto payments, true liquidity cannot be achieved.

Likewise, if there are no tokenized assets, crypto payments have nowhere to be applied.

To ensure they retain control over the next generation of payment infrastructure, certain parties (specifically SWIFT and its members) have proposed a concept called the Regulated Liability Network (RLN).

Under this model, traditional financial institutions tokenize their liabilities (which represent user assets—essentially deposits) and place them into the RLN.

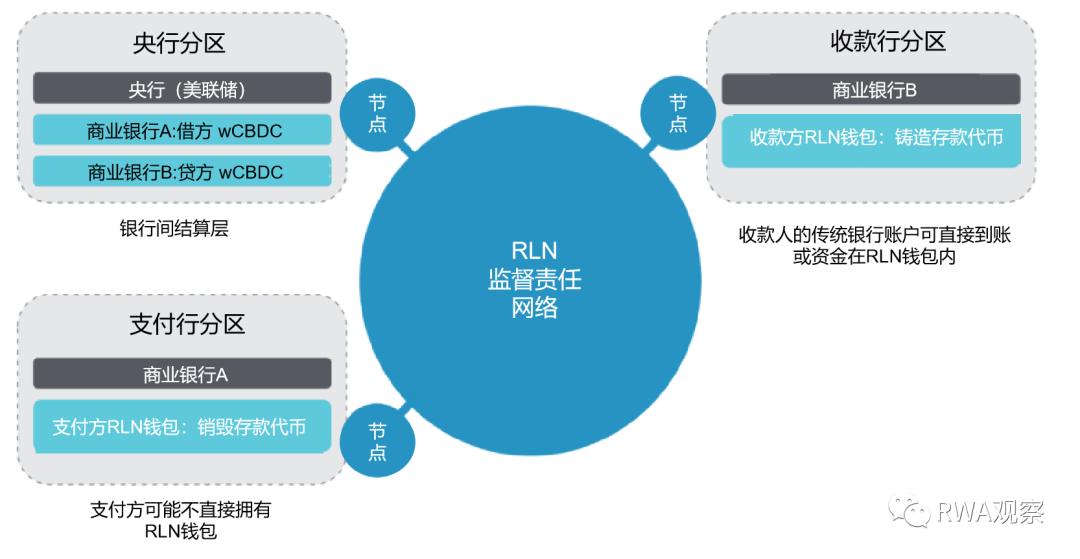

A simplified version of a payment process via RLN would look like this:

This certainly looks like a decentralized solution, doesn’t it?

Actually, it isn't!

Even under this scheme, the Federal Reserve can still act as the central settlement node, maintaining full control over the entire system just as it did in the centralized past.

Because interbank settlements still rely on wholesale central bank digital currencies (wCBDCs).

Yet, all the proclaimed benefits of decentralization can still be realized.

For example:

- Financial settlements can achieve greater precision and cooperation thanks to a shared ledger and recordkeeping

- Each payment is unique and immutable, recorded on a shared ledger

- Settlement confirmation can be nearly real-time

- The shared ledger operates 24/7

- The shared ledger can be programmable via smart contracts and shared technical infrastructure

Why Is SWIFT So Proactive?

From the diagram above, some might think that central banks appear to be the biggest winners in the RLN network.

So why would SWIFT work so hard to build something that primarily benefits others?

Here’s where we need to understand SWIFT better. Its full name is the Society for Worldwide Interbank Financial Telecommunication.

Interestingly, it functions as a global cooperative among peers—does that sound familiar, almost like a DAO?

SWIFT is owned and governed by shareholders representing around 3,500 global institutions (financial firms). A country’s volume of SWIFT message usage determines both its shareholding allocation and the number of board seats it can appoint.

If SWIFT didn’t issue shares but instead distributed tokens, charged gas fees for messages, and treated participating institutions as mining nodes… wouldn’t that feel awfully familiar?

In the proposed RLN network, SWIFT aims to play this very organizational role—bringing all its member institutions into the fold.

After all, if cryptocurrencies continue growing unchecked, and everyone starts receiving payments in stablecoins, then SWIFT—and most of its member banks—could become irrelevant.

However, as a legacy financial institution, SWIFT may genuinely lack deep expertise in blockchain technology.

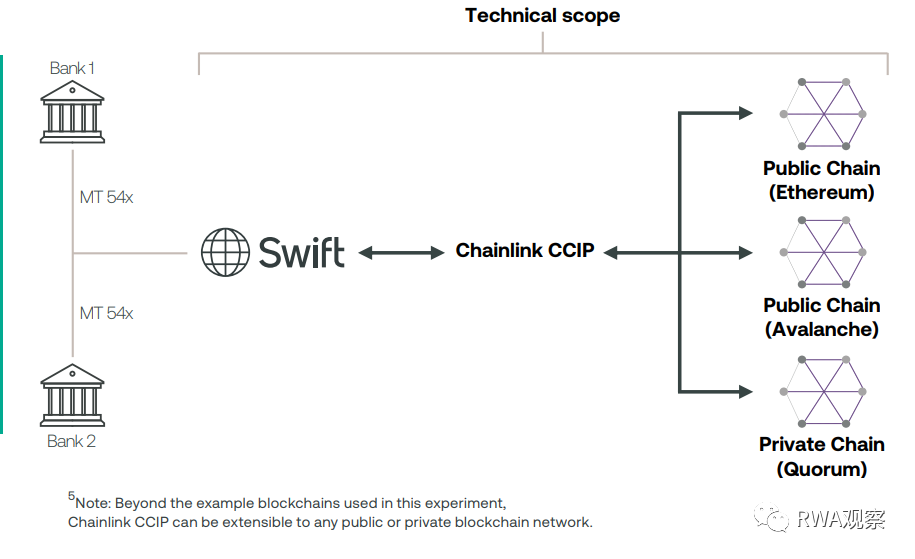

That’s why, during its European pilot tests, SWIFT partnered with Chainlink.

The general division of labor is: SWIFT handles institutional asset deployment on distributed ledger technology (DLT), while Chainlink manages cross-chain interoperability.

If this model eventually takes off, Chainlink’s prospects could truly be limitless...

Will Traditional Banks Support RLN?

The RLN proposal appears capable of helping traditional financial institutions improve efficiency using blockchain technology.

More importantly, if they don’t adopt such a solution and the payment market gets overtaken by cryptocurrencies,

then numerous SWIFT-member financial institutions could face serious risks.

Within the traditional financial system, money operates under a two-tier structure:

- Central bank money constitutes M1, including physical cash and funds lent to commercial banks

- Broad money constitutes M2, primarily consisting of funds held in banks or payment platforms (WeChat, Alipay, PayPal, etc.)

In the traditional system, the average person only directly accesses central bank money in the form of coins and paper bills.

All other slightly complex operations must go through commercial banks or payment intermediaries.

Many current cryptocurrencies (like Bitcoin) operate entirely outside the traditional financial system—neither issued by central banks nor settled through financial institutions.

Stablecoins (such as USDT and USDC) are somewhat better off, since they require USD collateral. As long as these dollars aren't held at central banks (in practice, they're usually held in commercial banks or used to purchase government bonds), they can still be considered part of M2.

Frankly speaking, if traditional financial institutions don’t unite and band together, they may prove defenseless against cryptocurrencies.

Their share of the payment market could visibly erode at an accelerating pace, replaced by crypto-based payments.

Crypto vs. RLN: What Will the Future Landscape Look Like?

The future is hard to predict, but some principles are likely to persist and help us judge emerging trends:

- Regulation is not a dinner party

Global regulation is backed by law—or other forms of enforceable power.

Current trends indicate that compliance requirements such as user identification and anti-money laundering checks aren’t just inevitable—they’re also effective tools for protecting investor rights.

After all, in a wild-west market filled with scams, long-term sustainability is impossible.

We can expect increasingly detailed regulatory demands on cryptocurrencies going forward.

- Technology neutrality is the way forward

Currently, regulators do not arbitrarily restrict technologies (though exceptions exist, e.g., encryption printing tech).

I believe regulations will focus more on the nature of business activities rather than the underlying technology used.

For instance, in the 19th century, banks used paper ledgers.

In the 20th century, they transitioned to electronic databases. Regulatory rules evolved continuously, without drastic changes due solely to shifts in accounting technology.

Now in the 21st century, accounting technology can advance to blockchain-based shared ledgers.

The prevailing regulatory principle in major countries today is “same activity, same regulation.”

This principle may favor the adoption of RLN across traditional financial institutions.

After all, legal definitions around cryptocurrencies may take years to settle, whereas traditional institutions already have extensive experience complying with regulations.

- Free competition creates a better future

In 1976, Hayek advocated in "The Denationalisation of Money" for private banks to issue currency, promoting free competition.

Private banks ultimately yielded under the iron fist of regulation.

Little did he know that this mission would later be taken up by blockchain-based cryptocurrencies.

Hayek believed that to truly solve inflation, banks should be allowed to freely issue currencies, enabling different monies to compete in the marketplace. Driven by self-interest and profit motives, banks would then strive to maintain stable value.

Therefore, for traditional financial institutions to truly win future markets, they must learn to manage their own balance sheets responsibly—no reckless behavior.

Let’s welcome a brighter future~ haha

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News