A Brief Analysis of Celestia's Business Strategy: Can Driving Traffic to Ethereum Layer2 Succeed?

TechFlow Selected TechFlow Selected

A Brief Analysis of Celestia's Business Strategy: Can Driving Traffic to Ethereum Layer2 Succeed?

Celestia may not be fully recognized by the market or the industry, and its attempt to attract liquidity from the Ethereum Layer2 ecosystem is likely to face resistance.

Author: Faust, Geeker Web3

This article does not involve much technical interpretation, but rather focuses on analyzing Celestia's current business strategy and its position.

Celestia positions itself as the "best DA layer" within the modular blockchain narrative. Celestia has built a public chain specifically to provide data publication services for Rollup projects—what’s known as Data Publication. The key goal of “data publication” is simple: ensuring that parties needing the latest data can quickly access it. Many people previously conflated data publication with data availability, even mixing it up with historical data retrievability—an incorrect use of terminology. This misunderstanding is now being actively corrected by both the Ethereum Foundation and Celestia’s official team.

If you have basic knowledge of Rollups, the following will be easy to understand: Celestia believes Ethereum Layer2 scaling solutions can publish their newly generated data onto the Celestia chain instead of directly onto Ethereum, saving over 90% in transaction fees.

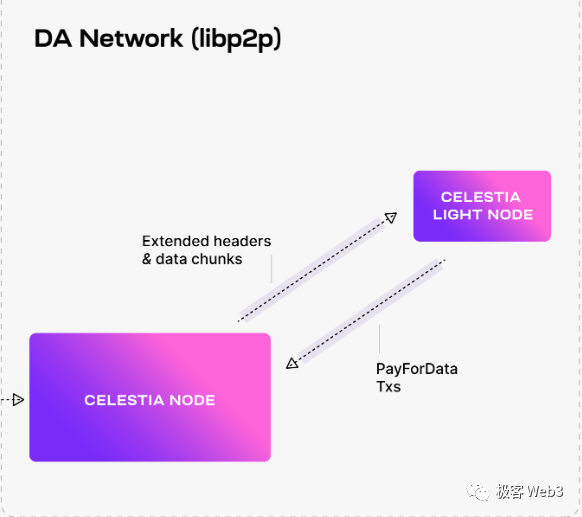

Take Arbitrum Orbit as an example: Orbit’s sequencer can post Layer2’s latest data into Celestia blocks. Then, nodes requiring this data (e.g., Orbit full nodes) can run Celestia light nodes to retrieve the published data from Celestia full nodes.

As for Celestia’s token TIA, its primary uses are paying data publication fees and staking for POS validator nodes. If a Rollup project chooses Celestia as its DA layer, it must pay transaction fees each time it publishes data. Meanwhile, the Celestia mainnet—specifically designed to host Rollup data—supports only around 200 validator nodes, and TIA tokens are the assets validators must stake upfront.

Although Celestia’s documentation mentions TIA could also serve as gas payment tokens for Rollups within its ecosystem, this is not mandatory. TIA will also be used in future governance decisions—for instance, voting on adjustments to certain network parameters.

Comparing TIA with ARB or OP, one can see that TIA has an additional, seemingly higher-frequency use case: paying data publication fees. If many scaling projects eventually adopt Celestia as their DA layer—and these projects maintain strong liquidity and user activity, creating sustained demand for TIA—then TIA could indeed strengthen in value. Even if TIA ends up like ARB, serving merely as a governance token, it could still be well-priced by the market—as long as Celestia gains sufficient recognition and builds a successful ecosystem.

But this article argues precisely the opposite: Celestia may not gain full recognition from either the industry or the market, and its attempt to draw liquidity from the Ethereum Layer2 ecosystem will likely face resistance, putting it in a situation similar to EigenLayer.

Image from TokenInsight’s article — “EigenLayer: A Brilliant Business Model or a Flawed One?”

Success isn’t determined by tech or narrative first—it’s about reading the moment

Discussing whether Celestia will gain broad market and industry recognition is essentially asking a philosophical question: What are the most critical factors determining a project’s success? And does Celestia possess them?

To explore the first point briefly, consider public chains like Polygon, Flow, Avalanche, Dfinity, Solana, and Nervos—all launched around the same time. Among them, Polygon stands out as clearly the most successful, despite being widely regarded as the weakest technically. Yet there’s no denying its dominance.

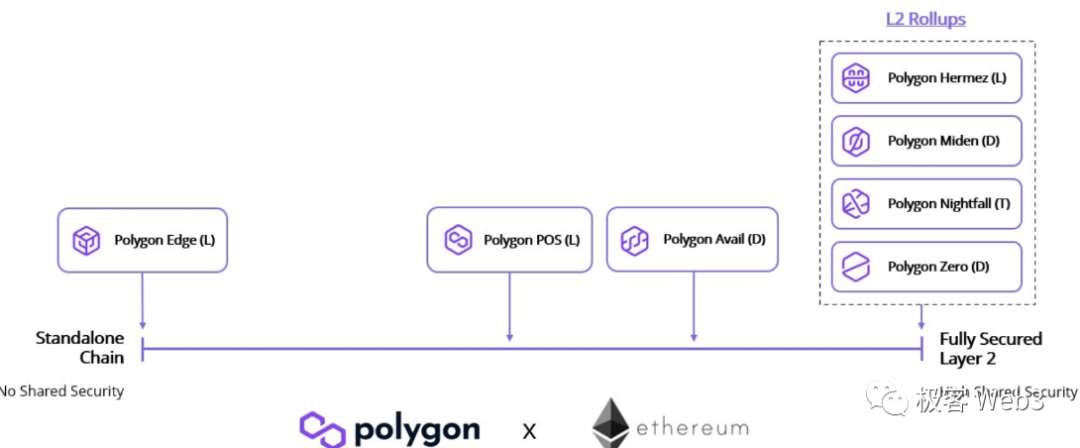

Polygon has outperformed others in ecosystem development: its token market cap, number of hosted dApps, and various metrics lead the pack. Even Donald Trump chose Polygon to launch an exclusive NFT. Its “full-stack” offering includes Ethereum Layer2 (Polygon zkEVM), standalone blockchains (Matic), DA networks (Avail), and multiple ZK-focused teams such as Polygon Zero, Polygon Miden, and Polygon Nightfall, each exploring different technical paths. It also offers an open-source modular blockchain toolkit, Polygon CDK, which appears more comprehensive than Celestia’s modular stack.

(Source: Messari)

Polygon excels at “riding major trends.” In 2020, it rebranded itself as a Plasma solution to align with Ethereum Foundation’s vision, attracting massive liquidity and resources. Despite weak initial technology, Polygon leveraged this momentum to rapidly elevate its status, then invested heavily in acquiring ZK and modular blockchain teams to gradually build its commercial empire.

In contrast, Flow, Avalanche, Dfinity, and Solana had stronger foundational technologies than early Polygon, yet lag behind in overall strength today. Solana succeeded largely due to long-term support from FTX (Anatoly aggressively pitched his project to SBF); Avalanche gained traction through overseas capital backing, EVM compatibility, and aggressive business development. Yet neither fully embraced the Layer2 narrative nor made significant investments in it—unlike Polygon, they weren’t particularly good at “going with the flow.”

Dfinity, Flow, and Nervos, meanwhile, have weakened for various reasons:

Dfinity aimed to become a decentralized AWS, introducing real-world applications and a “reverse gas” model allowing users to transact without gas fees. But constrained by timing—from 2021 until now, blockchain hasn’t been ready for mass adoption due to incomplete upstream infrastructure and limited user access—it failed to succeed.

Flow achieved native account abstraction early and had a simple layered design akin to modular blockchains; Nervos promoted a layered scaling and Layer2-centric narrative as early as 2018, branding itself as “Layer1 designed for Layer2.” Yet both ultimately failed—Layer2 only matters when the underlying Layer1 already carries excess liquidity. Technical alignment with Layer2 needs alone is not enough.

Ultimately, for any project, success hinges not on technical brilliance or compelling narratives, but on the ability to read the times and find the right commercial path. This is where many academic teams fall short. In the cutthroat world of business, there’s no room for “technical superiority” or “moral high ground”—only “winners and losers.” Many technically advanced or visionary teams fail to achieve their deserved status simply because they lack flexibility in commercial execution.

What’s wrong with Celestia’s business approach?

Now let’s examine Celestia: does it have flaws in its commercial strategy? Has it truly “read the moment”? It’s important to note that Celestia’s modular blockchain and DA layer narrative depends on a highly liquid settlement layer experiencing data overflow—and that layer is Ethereum. If Celestia becomes completely detached from the Ethereum ecosystem, its entire modular narrative loses meaning, as Nervos’ fate already demonstrated.

However, trying to attract liquidity from Ethereum without directly strengthening Ethereum itself seems illogical. Anyone closely observing the Ethereum Foundation’s evolving stance toward Layer2 should recognize this.

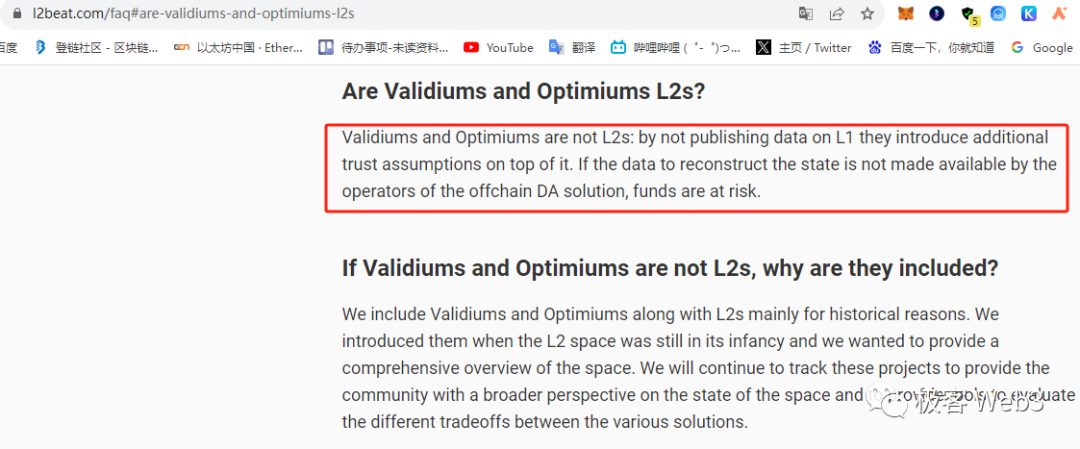

As previously emphasized in Geeker Web3 articles, the Ethereum Foundation and L2BEAT have clearly stated: scaling projects that don’t use Ethereum for DA are not considered Ethereum Layer2s, since off-chain DA layers cannot offer the same level of data availability assurance as Ethereum. They introduce trust assumptions (Celestia assumes its mainnet won’t halt, but with only ~200 validators, its availability differs from Ethereum’s; EigenDA is fundamentally independent of Ethereum’s native DA).

In other words, aside from true Rollups, other scaling solutions aren’t Ethereum Layer2s (we can ignore Plasma and state channels, as these approaches have nearly vanished from the Ethereum ecosystem).

(Source: L2BEAT)

Many believe the Ethereum Foundation’s stance isn’t purely technical—it’s also about protecting its own commercial interests. The reasoning is clear: if external DA layers like Celestia and EigenDA become widely adopted, Ethereum’s dominance would weaken, and efforts like EIP-4844 and Danksharding would lose relevance. Moreover, these independent DA layers do nothing to strengthen Ethereum—they might even introduce systemic risks.

While some Ethereum ecosystem projects like Arbitrum Orbit have announced integration with Celestia, this doesn’t mean Celestia will be “fully recognized”—rather, it increases competitive pressure on the Ethereum Foundation. For an entity with ultimate authority, leveraging its advantages to consolidate power is straightforward (much like how Jewish elders easily eliminated Jesus). As long as Ethereum Layer2 projects care about the Layer2 title, they won’t seriously consider Celestia or EigenDA. Thus, Celestia is essentially “swimming against the current,” unlike Polygon’s “going with the flow.”

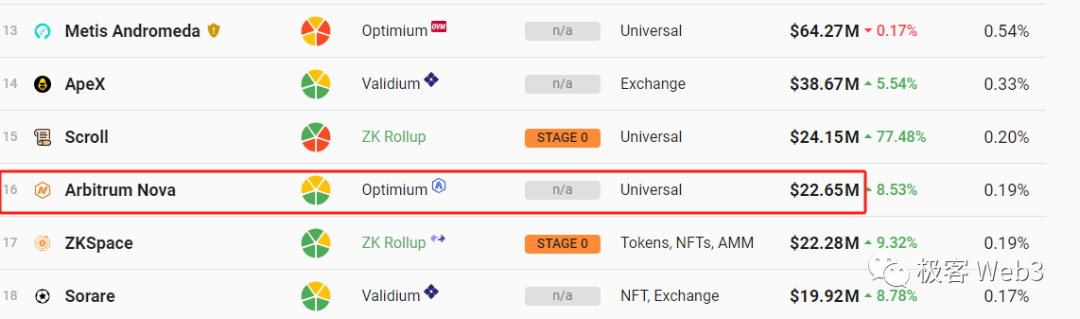

Today, the vast majority of Ethereum Layer2 liquidity is concentrated in canonical Rollups like Arbitrum and Optimism. Their main versions will never integrate with Celestia. Arbitrum Orbit is more like Arbitrum Nova—a secondary version unlikely to rival major “canonical Layer2s.” Even if Celestia manages to attract such “secondary Layer2s,” the value capture potential remains low. (Arbitrum Nova currently has only about $22 million in TVL.)

Furthermore, as a purely B2B-focused DA layer, Celestia lacks the consumer-facing appeal of platforms like Solana, which can attract dApps and liquidity through end-user applications. Without widespread adoption by Rollup projects, its ecosystem will remain weak. Celestia also appears to lack powerful financial backing. While its technical narrative makes sense, without deep roots in the Ethereum ecosystem, its grand vision risks becoming a castle in the air (Sui, once reliant solely on technical storytelling after losing FTX’s support, still shows little progress).

The author would like to share two interesting anecdotes:

First, according to an insider, at an offline event at Stanford, shortly after Ethereum Foundation’s Dankrad stated, “scaling solutions not using Ethereum for DA are not Layer2s,” a Celestia representative claimed, “xxx project is an Ethereum Layer2 using Celestia as its DA layer,” prompting laughter from the audience.

Second, Eclipse, a project backed by Celestia and self-proclaimed as “the fastest Ethereum Layer2,” has not been listed on the L2beat website (missing from both Active Projects and Upcoming Projects). Eclipse uses Solana VM for execution, Celestia for DA, and Ethereum for settlement (Layer1).

These two stories reflect Celestia’s current standing. While idealistically, Celestia’s modular blockchain narrative benefits Web3’s long-term evolution, practical constraints make the outlook far from optimistic.

Intent could change everything

But this assessment is based on current conditions. In a future Web3 world centered on Intent, things could change dramatically. Under a new paradigm defined by Intent, chain abstraction, and cross-chain interoperability—where users no longer need to perceive individual chains—Celestia’s ecosystem challenges could dissolve.

The current popularity of Ethereum Layer2 stems from widespread recognition of Ethereum itself, which brings abundant—even excessive—liquidity. Why do people trust Ethereum? Because they understand it. But what if Intent-based solutions abstract away the underlying infrastructure, making newcomers unaware of Ethereum or Solana? Could liquidity then shift from base-layer protocols to dApps themselves?

In other words, our current understanding of blockchain evolution assumes “fat protocols, thin applications,” but this principle may soon be overturned.

Imagine a future blockchain landscape dominated by Intent and omnichain operations: users won’t need to know about Ethereum or Layer2s at all—they’ll interact only with dApps or their frontends. Everything changes. Liquidity drivers would no longer be Ethereum or other chains, but the dApps themselves. As long as major dApps choose to build on modular blockchains with Celestia as the DA layer, Celestia’s ecosystem growth wouldn’t depend on siphoning liquidity from Ethereum Layer2s. At that point, not just Celestia—but the entire Web3 landscape—would undergo a radical transformation.

Perhaps as someone once said: a person’s (or project’s) success depends not only on hard work, but also on historical momentum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News