Celestia: Ethereum's Biggest DA Competitor? Can EigenLayer Strike Back?

TechFlow Selected TechFlow Selected

Celestia: Ethereum's Biggest DA Competitor? Can EigenLayer Strike Back?

Despite controversies over the definition of Layer2, Ethereum's upgrade remains focused on Rollup, where DA is key.

Author: Ac-Core, YBB Capital Researcher

Introduction

According to the Ethereum Foundation, Ethereum's Layer 2 = Rollup. Following Vitalik's recent perspective, if other EVM chains use non-Ethereum systems for data availability (DA), they effectively become Ethereum Validiums—offloading blockchain data availability off-chain while using validity proofs to ensure transaction integrity. Although there remains some debate around the precise definition of Layer 2 due to current DA challenges, Ethereum’s upgrade roadmap continues to center on Rollups, with DA playing a critical role in storing or uploading Rollup transaction data. Whether Optimistic Rollups and ZK Rollups can securely access relevant data via DA will impact their security to varying degrees, even though their dependency levels differ. Amid innovations like Cosmos’ shared security model, Celestia’s growing influence in DA, and market-making momentum, can EigenLayer—a native Ethereum-based protocol inspired by these developments—regain market dominance by elevating middleware security to Ethereum-grade through its re-staking mechanism?

EigenLayer

Source: EigenLayer Whitepaper

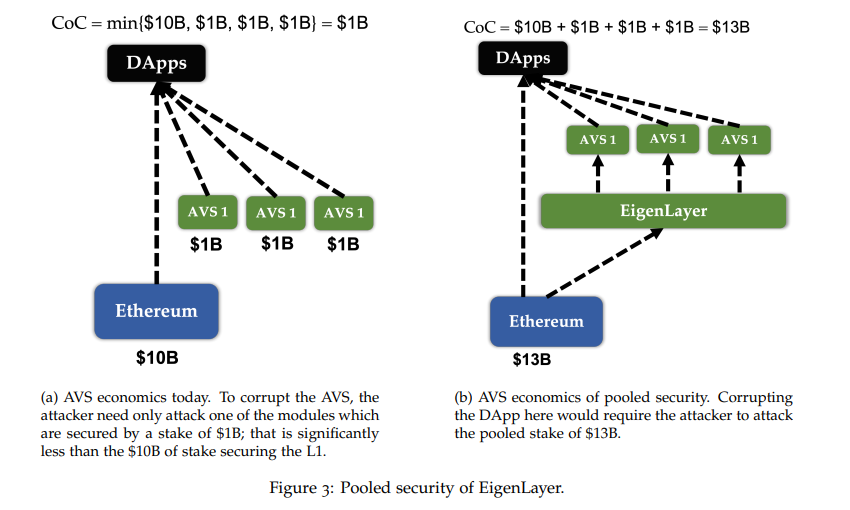

Simply put, EigenLayer is a re-staking protocol built on Ethereum that aims to deliver Ethereum-grade security to the broader Ethereum cryptoeconomic ecosystem. It allows users to re-stake native ETH, liquid staked ETH (LSD-ETH), and LP tokens through EigenLayer smart contracts to earn additional validation rewards. This enables third-party projects to leverage Ethereum’s base-layer security while earning extra yield, creating a win-win scenario.

Ethereum has attracted massive transaction volume and liquidity because it is widely recognized as the most secure first-layer blockchain after Bitcoin. EigenLayer directly taps into Ethereum’s security and liquidity through Actively Validated Services (AVS), essentially delegating the security verification of its token model to Ethereum validators (which can be understood simply as node operators). This process is known as re-staking. This article focuses only on EigenDA—the first AVS developed by the EigenLayer team.

EigenDA: Data Availability for Rollups

Source: Official EigenDA

According to official documentation (though actual supporting data remains limited), EigenDA is a decentralized data availability (DA) service built on Ethereum using EigenLayer’s re-staking infrastructure, and will serve as the first Actively Validated Service (AVS) on EigenLayer. Restakers can delegate their stake to EigenDA operators who execute validation tasks, receiving service fees in return. Meanwhile, Rollups can publish data to EigenDA, reducing transaction costs, increasing throughput, and enhancing the overall security of the EigenLayer ecosystem. Security and throughput are expected to scale with increases in total staked value, growth of associated protocols, and expansion of operator participation.

EigenDA aims to provide an innovative DA solution for Rollups, enabling Ethereum stakers and validators to interconnect and strengthen security, achieving higher throughput at lower cost. To maintain decentralization, EigenLayer’s shared security system employs a multi-node architecture. As revealed in EigenDA’s tweets, currently integrated Layer 2 solutions include Celo (transitioning from L1 to Ethereum L2); Mantle and its suite of products outside the BitDAO ecosystem; Fluent, offering zkWASM execution layer; Offshore, providing Move execution layer; and OP Stack within Optimism (currently using EigenDA testnet).

EigenDA is a secure, high-throughput, and decentralized data availability (DA) service built atop Ethereum via EigenLayer re-staking. Below are key features and advantages designed into EigenDA:

Features:

-

Shared Security: EigenDA leverages EigenLayer’s shared security model, allowing validators (restakers) to participate in validation by contributing ETH, thereby enhancing network-wide security;

-

Data Availability: The primary goal of EigenDA is to ensure data availability on Layer 2 networks. Validators verify and guarantee the validity of Rollup data, preventing malicious behavior and ensuring smooth network operation;

-

Decentralized Sequencing: EigenDA uses EigenLayer’s decentralized sequencing mechanism to ensure transactions within Rollup networks are executed in the correct order, preserving system correctness and consistency;

-

Flexibility: EigenDA’s design allows L2 developers to adjust various parameters based on needs—including trade-offs between security and liveness, staking token models, erasure coding ratios—to suit different use cases.

Advantages:

-

Economic Efficiency: By leveraging EigenLayer’s shared security for ETH, EigenDA reduces potential staking costs. Distributing data validation work lowers operational costs per validator, delivering more cost-effective validation services;

-

High Throughput: Designed for horizontal scalability, EigenDA’s throughput increases as more operators join. In private testing, EigenDA achieved up to 10 MBps, with a roadmap to scale to 1 GBps—enabling support for high-bandwidth applications such as multiplayer gaming and video streaming;

-

Security Mechanisms: EigenDA implements multi-layered security, including EigenLayer’s shared security, Proof of Custody, and Dual Quorum mechanisms, ensuring network security, decentralization, and censorship resistance;

-

Customizability: With a flexible architecture, EigenDA enables L2 developers to fine-tune parameters according to specific requirements, balancing security and performance.

Re-Staking Models

Source: Delphi Digital

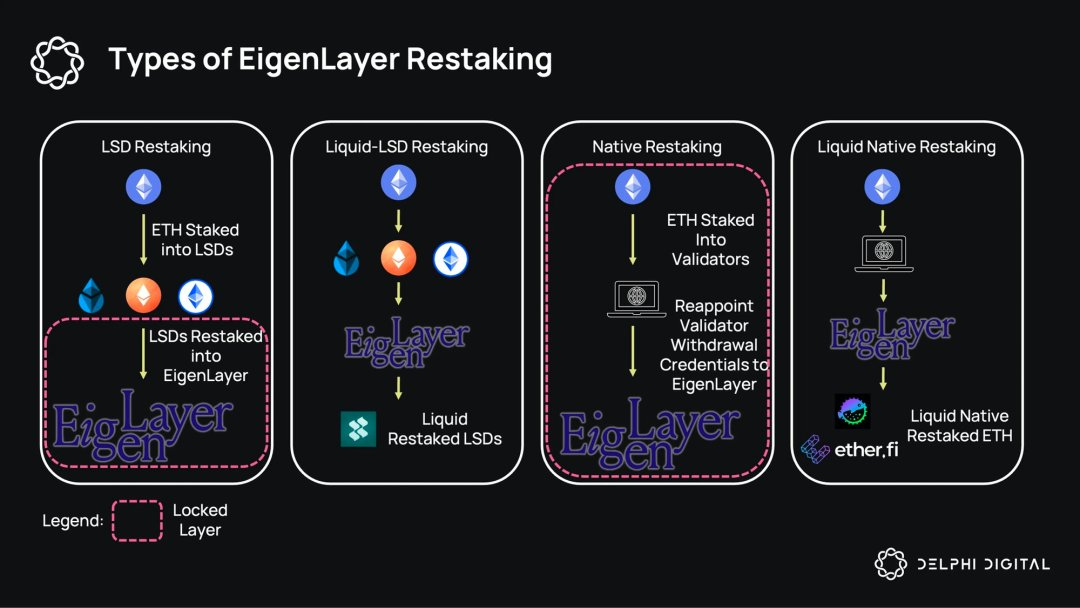

Native ETH Re-Staking:

Designed for independent ETH stakers, this method allows users to redirect their withdrawal credentials from existing staking to EigenLayer smart contracts, re-staking their ETH to earn additional rewards. If a staker behaves maliciously, EigenLayer can directly slash their staked ETH;

LST Re-Staking:

LST stands for Liquid Staking Token. Regular investors—even those without 32 ETH—can “carpool” via liquid staking protocols like Lido or Rocket Pool by depositing ETH into a staking pool and receiving LSTs representing their ETH and accrued staking rewards. Users who have already staked ETH through Lido or Rocket Pool can transfer their LSTs to EigenLayer smart contracts to re-stake and earn additional yield;

LP Token Re-Staking:

LP Token re-staking includes two types: ETH LP re-staking and LST LP re-staking.

-

ETH LP Re-Staking: Users can re-stake LP tokens from DeFi protocols that contain ETH pairs into EigenLayer.

-

LST LP Re-Staking: Users can re-stake LP tokens containing lsdETH into EigenLayer. For example, Curve’s stETH-ETH LP token can be re-staked into EigenLayer.

Celestia in Cosmos

Source: Celestia Official

Currently, no blockchain fully resolves the so-called "impossible trinity" of decentralization, security, and scalability. Cosmos argues that only a multi-chain architectural approach can meaningfully balance these competing demands. Before diving into Celestia, let’s briefly review Cosmos, where blockchains achieve interoperability via the Inter-Blockchain Communication (IBC) protocol. Below is a detailed discussion on security across Cosmos chains:

IBC Protocol Security: IBC is the communication protocol ensuring trust between Cosmos chains. It uses cryptographic signatures and encryption to guarantee message confidentiality and integrity. The protocol includes multiple verification steps to ensure cross-chain messages are trustworthy. With IBC, Cosmos chains can securely transfer assets and messages, preventing fraud and tampering;

Consensus Mechanism Security: Individual blockchains in the Cosmos ecosystem may adopt different consensus mechanisms, with Tendermint being the most common. Tendermint achieves Byzantine Fault Tolerance (BFT), ensuring agreement among nodes even in the presence of malicious actors. The robustness of the consensus mechanism is vital for overall network stability and security;

Hub Security: The Cosmos network features a central blockchain called the Hub, which acts as a bridge between independent chains. The Hub’s security is crucial for ecosystem stability. A compromised Hub could jeopardize the entire network. Therefore, securing the Hub—through strict control over its consensus and node management—is a top priority;

Asset Security: Since assets can be transferred across Cosmos chains, safeguarding them is paramount. Cryptographic techniques prevent attacks like double-spending. Additionally, IBC’s design enhances the reliability and safety of cross-chain asset transfers;

Smart Contract & Application Layer Security: Cosmos supports smart contracts and decentralized applications (dApps). Security at this level depends on code quality, rigorous auditing, and timely vulnerability patching for deployed smart contracts and dApps.

Celestia adopts a modular design that separates consensus from execution, enabling greater scalability and flexibility, fostering a customizable ecosystem suitable for diverse blockchain solutions. In contrast, Cosmos emphasizes neutrality to promote collaboration among independent chains, focusing on interconnectivity and using Tendermint—which tightly couples consensus and execution—to create a cohesive environment. However, this integration comes at the cost of reduced flexibility. Celestia’s modular approach offers enhanced scalability and development freedom, providing tailored solutions for varied application needs. Some even argue that Celestia + Cosmos represents the ultimate form of future appchains.

Celestia’s ICS vs. EigenLayer’s EigenDA

Source: X user @_Gods_1

Notably, a recent proposal within Celestia discusses Interchain Security (ICS). Unlike EigenLayer, which functions as a data availability layer built on Ethereum, comparing ICS with EigenLayer reveals several parallels:

-

Shared Security: Celestia’s proposal explores using ICS to allow validators from the Cosmos ecosystem (e.g., Cosmos Hub validators) to act as Rollup sequencers for Celestia. This would enable multiple Rollups to share the same validator set, achieving shared security—a concept similar to EigenLayer’s shared security model. The difference lies in implementation: ICS leverages Cosmos Hub validators to secure connected blockchains, whereas EigenDA relies on Ethereum-based EigenLayer restakers (ETH holders) to validate data availability for Rollups;

-

Decentralized Sequencers: The idea of decentralized sequencers in Celestia aligns with ICS usage, much like how EigenLayer uses its re-staking primitive to build decentralized sequencers. Both aim to leverage underlying protocol features to achieve more decentralized sequencing;

-

Rollup Composability: Celestia suggests that using the same sequencer (potentially via ICS) across multiple Rollups enables atomic composability between them. This mirrors EigenLayer’s vision of multiple AVSs working together within its ecosystem to achieve higher-level interoperability and composability;

-

Economics: Beyond technical aspects, from a market perspective, users care most about returns. EigenLayer currently holds an edge over Celestia in terms of layered yield stacking (especially with LSTs) and anticipated future airdrops across the broader EigenLayer ecosystem.

Comparison Among DA Layers

Source: Researcher@likebeckett

Data Availability (DA) refers to the ability to access all transaction data generated by Rollups. Ethereum’s current upgrade path centers on Rollups, with DA serving as the layer responsible for storing or uploading all Rollup transaction data. While Rollups solve Layer 1 scalability issues, the method used to access Layer 2 data via DA impacts overall security and TPS. To ensure Layer 2 inherits Ethereum’s security, Ethereum must optimize its protocol to handle large volumes of Layer 2 data efficiently.

In consensus mechanisms, a fundamental trade-off exists between efficiency and security—speed versus accuracy and protection. Different blockchain systems make distinct choices to meet their unique needs. Ethereum, Celestia, EigenLayer, and Avail all aim to provide scalable data availability for Rollups. Based on data provided by Researcher@likebeckett and the Avail team, here is a summary:

Source: Avail Team Official

Celestia:

-

Decentralized Sequencer Proposal: Celestia has discussed a proposal by COO Nick White to implement decentralized sequencers using Interchain Security (ICS) from the Cosmos ecosystem, leveraging Cosmos Hub validators to provide shared security for the DA layer;

-

Atomic Cross-Rollup Composability: By leveraging ICS, Celestia enables atomic transactions across multiple Rollup networks, boosting composability. Shared sequencers allow multiple Rollups to coordinate, addressing liquidity fragmentation and declining composability;

-

Multi-Rollup Interoperability: Using shared sequencers, Celestia enhances interoperability among multiple Rollup networks, improving liquidity and data availability.

EigenLayer and EigenDA:

-

Shared-Security Data Availability Service: EigenLayer provides DA services via EigenDA—not as a standalone blockchain, but as a suite of smart contracts on Ethereum, fully embracing the shared security paradigm. EigenDA can integrate within the Celestia ecosystem to offer efficient, secure, and scalable data availability;

-

Decentralized Sequencing: EigenLayer emphasizes its decentralized sequencing mechanism, which introduces ETH-based staking and slashing conditions into the Rollup sequencer’s PoS process, enhancing Layer 2 security. This enables efficient and secure ordering;

-

Data Availability Service: EigenDA specializes in delivering DA services for Layer 2 networks, leveraging EigenLayer’s shared security and decentralized sequencing to enable high-performance on-chain data transmission.

Avail:

-

Data Availability Design: Avail focuses specifically on DA, introducing data availability sampling (DAS). This allows light nodes to verify data availability by downloading only small portions of blocks instead of relying on full nodes, significantly improving scalability;

-

Inter-Blockchain Interoperability: Avail’s design promotes cross-chain interaction. DAS-enabled light nodes allow more flexible block sizing, increasing overall throughput;

-

EIP-4844 Compatibility: Avail actively participates in Ethereum’s EIP-4844 implementation and is a core component of Polygon’s modular blockchain vision. This proposal increases block size and lays groundwork for Danksharding, allowing Avail to seamlessly adapt to Ethereum’s evolving ecosystem.

Conclusion

For Rollups, beyond the narrative certainty brought by the 2024 Cancun upgrade, debates around DA have reignited discussions about the precise positioning of Layer 2. Setting aside current concerns around legitimacy, security, and cost of Ethereum’s DA, the ongoing discourse between Celestia and EigenDA prompts a deeper question: amid the battle between "Ethereum killers" and "Ethereum defenders," will we see intensified competition in composable modular infrastructure, leading to a new era of flourishing scalability solutions for Ethereum?

While blockchains inherently face numerous limitations, from a financial market perspective, much of any market’s upward momentum stems from "imagined potential"—there must always be fresh narratives to fuel excitement. Beyond maintaining technical correctness, innovation also thrives on unconventional, out-of-the-box storytelling.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News