Key milestones in Ethereum's history and what to position for beyond ETH after the Cancun upgrade?

TechFlow Selected TechFlow Selected

Key milestones in Ethereum's history and what to position for beyond ETH after the Cancun upgrade?

This article will review and summarize the major hard forks and upgrades in Ethereum's history, as well as introduce potential changes brought by the upcoming Cancun upgrade.

Even today, blockchain technology can still be considered an emerging field. Although the foundational concepts behind blockchain—cryptography, decentralization, peer-to-peer networks, and transactions—have been studied for decades, it wasn't until Bitcoin's creation in 2008 that people truly believed these ideas could be combined into a functional product. Ethereum, in particular, didn't enter public view in a usable form until 2015. Despite shifts in expected timelines and details, Ethereum has continued advancing according to plan, consistently upgrading its protocol to enhance usability, security, functionality, and decentralization.

This year, Ethereum is scheduled for two major upgrades: the Shanghai upgrade, completed on April 12, and the upcoming Cancun upgrade expected in the fourth quarter. According to Ethereum’s official documentation, there have been 24 milestone events since the release of its whitepaper in 2013, most of which were fork upgrades, with 12 being particularly significant. This article reviews key hard forks and upgrades in Ethereum's history and outlines potential changes introduced by the upcoming Cancun upgrade.

Frontier Upgrade – July 30, 2015

July 30, 2015, marks the date of Ethereum's genesis block and the beginning of its first phase. The launch of Frontier signified the official activation of the Ethereum blockchain network. This phase primarily targeted blockchain developers, with node participants engaging via mining. Smart contract deployment was already supported at this stage.

Key features of the Frontier protocol include:

Block rewards: Miners who successfully mined a block on the Ethereum blockchain received ETH as a reward. During the Frontier phase, the block reward was set at 5 ETH per block.

Gas: Initially, the gas limit per block was hardcoded at 5,000 gas. This limited activity on the network, providing a buffer period for miners to begin operating on Ethereum and for early users to install clients. A few days later, the gas limit was automatically lifted, allowing the network to begin processing transactions and smart contracts as planned.

Canary contract: This contract alerted users to chains that had suffered or were vulnerable to attacks. The canary contract held a value of either 0 or 1. If set to 1, clients recognized the chain as invalid and avoided mining on it. Essentially, this feature allowed Ethereum’s core development team to pause the network if problems arose. In Ethereum’s early days, the canary contract served as a highly centralized yet essential safeguard.

Usability: All developer operations were executed via command line due to the absence of a graphical user interface. While the network was functional, the user interface was extremely rudimentary, accessible only to those familiar with Ethereum and experienced in its operation.

The Frontier version hardcoded a 5,000 gas limit per block. Just two months later, the Frontier Thawing upgrade removed this restriction, set the default gas price at 50 gwei, and introduced the “difficulty bomb”—a mechanism designed to facilitate the network’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). The difficulty bomb would make mining increasingly difficult, eventually halting PoW mining altogether and triggering the switch to PoS. This indicates that plans for transitioning to PoS were present from Ethereum’s earliest stages.

From this point onward, Ethereum officially entered the PoW mining era, with ETH priced at $1.24 each.

Homestead Upgrade – March 14, 2016

The Homestead upgrade was Ethereum’s second major release and marked its first hard fork—the beginning of the second phase of its roadmap. Its most important features included optimizations to smart contracts and the introduction of new code for the Solidity programming language. Additionally, the desktop wallet Mist was launched, enabling users to hold and trade ETH and write and deploy smart contracts. The Mist project was later discontinued in early 2019.

The Homestead upgrade was one of the earliest implemented Ethereum Improvement Proposals (EIPs), including three EIPs: 2, 7, and 8.

EIP-2: Increased the cost of creating smart contracts via transactions from 21,000 gas to 53,000 gas. Previously, creating a contract via another contract (the recommended method) was more expensive than doing so via a transaction. By increasing the gas cost of transaction-based contract creation, EIP-2 incentivized users to revert to the more efficient contract-creation method.

EIP-7: Introduced the new DELEGATECALL function to facilitate code reuse. Similar to CALLCODE, this opcode differs in that it preserves the sender and value from the parent scope in the child scope—meaning the created call inherits the same sender and value as the original call.

EIP-8: A forward-looking network upgrade proposal ensuring backward compatibility for the devp2p network protocol. This improvement ensured all Ethereum client software could adapt to future network protocol upgrades.

At this time, ETH was priced at $12.50.

DAO Fork – July 20, 2016

Beyond scheduled upgrades and hard forks, one unplanned fork remains historically significant. In 2016, a decentralized autonomous organization (DAO) called The DAO raised $150 million through a token sale. In June, a hacker exploited a vulnerability in The DAO’s smart contract, stealing millions of dollars worth of ETH. Most of the Ethereum community decided to execute a hard fork to recover the stolen funds and patch the vulnerability. However, the hard fork did not gain unanimous approval. Some participants continued mining and transacting on the original chain, where the stolen ETH remained unrecovered. This original chain became known as Ethereum Classic (ETC). Thus, Ethereum split into two networks—ETH and ETC—explaining the existence of both today.

At this time, ETH was priced at $12.54.

Metropolis: Byzantium Upgrade – October 16, 2017

By this point, Ethereum had undergone the Frontier and Homestead milestones. The next planned step was the Metropolis upgrade, which was divided into two phases—Byzantium and Constantinople—due to its complexity.

This hard fork included nine improvement proposals (EIPs 100, 658, 649, 140, 196, 197, 198, 211, 214). Beyond low-level updates related to opcodes and smart contracts, it postponed the difficulty bomb by one and a half years and reduced block rewards from 5 ETH to 3 ETH. Prior to removing the difficulty bomb, block times approached 30 seconds. The upgrade also added the ability for non-state-changing calls between contracts and introduced cryptographic methods to support Layer 2 scaling on Ethereum.

At this time, ETH was priced at $334.32.

Metropolis: Constantinople Upgrade – February 28, 2019

The second phase of the Metropolis upgrade, Constantinople, was originally scheduled to go live in mid-January 2019 at block 7 million. On January 15, ChainSecurity, an independent security auditing firm, released a report identifying a critical flaw in one of five proposed system upgrades that could allow attackers to steal funds. In response, Ethereum core developers and community members voted to delay the upgrade until the issue was resolved.

Ultimately, the Ethereum Foundation rescheduled the final step of "Metropolis"—the hard fork named "Constantinople"—for February 28, 2019. It included six improvements: ensuring the blockchain wouldn’t freeze before PoS implementation; optimizing gas costs in the Ethereum Virtual Machine (EVM); and adding interactive address creation capabilities. Notably, a simultaneous hard fork called "Petersburg" removed one of the previously included EIPs (EIP-1283). Among the five main updates, technical adjustments aside, the difficulty bomb was delayed another 12 months, and block rewards were reduced from 3 ETH to 2 ETH.

Additionally, EIP-1014 introduced a new instruction called CREATE2, which allows pre-computation of a contract’s address before deployment. This brought Bitcoin’s Lightning Network-style state channel concept to Ethereum, enabling off-chain computation followed by on-chain settlement.

At this time, ETH was priced at $136.29.

Istanbul Upgrade – December 8, 2019

With Ethereum 2.0 scheduled to launch its first phase (Phase 0) in 2020, most users and developers would continue relying on Ethereum 1.x until the full transition. Therefore, subsequent 1.x updates remained crucial. The Istanbul hard fork activated on December 8 and included six improvements: further optimization of EVM gas costs; enhanced resilience against distributed denial-of-service (DDoS) attacks; improved performance for Layer 2 solutions based on SNARKs and STARKs; interoperability between Ethereum and Zcash; and enabling more creative functionalities within smart contracts.

Vitalik Buterin stated that after this upgrade, standard transactions per second (TPS) would increase by approximately 5% to 10%, while Layer 2 rollup technologies could see up to a 4x improvement. At this time, ETH was priced at $151.06.

Muir Glacier Upgrade – January 2, 2020

Less than a month after the Istanbul upgrade, Ethereum underwent an emergency hard fork—an unusual occurrence. Users and developers observed a slight increase in block intervals, which threatened to reduce the network’s TPS. After discussions, developers proposed a hard fork codenamed "Muir Glacier" at block 9,200,000 to remove the difficulty bomb, initially expected around December 31, 2019. Data from developer forums indicated that block times would continue rising before the bomb’s removal, potentially reaching 25 to 30 seconds by January 6.

At this time, ETH was priced at $127.18.

Berlin Upgrade – April 15, 2021

Starting with this version, upgrade codenames began following the sequence of Ethereum developer conferences (Devcon), with the first Devcon 0 having taken place in Berlin. Many improvements originally planned for the Istanbul upgrade were deferred due to various reasons and moved to Berlin. This upgrade further optimized EVM gas costs and added support for multiple transaction types.

At this time, ETH was priced at $2,454.

London Upgrade – August 5, 2021

This upgrade involved five proposals: EIP-1559, EIP-3198, EIP-3529, EIP-3541, and EIP-3554. One of the most impactful was EIP-1559, which restructured Ethereum’s fee market by splitting transaction fees into a base fee and a priority fee (tip), with part of the base fee burned to reduce ETH supply.

It fundamentally changed Ethereum’s economic model. Previously, block inclusion operated as an auction where higher gas prices won and all fees went to miners. EIP-1559 split gas fees: part goes to validators, and part is burned, ushering Ethereum into a deflationary era.

At this time, ETH was priced at $2,621.

Paris Upgrade (The Merge) – September 15, 2022

This upgrade, known as "The Merge," directly modified Ethereum’s execution and consensus layers, marking the critical transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Key changes included:

Validator nodes: Miners were replaced by validators. Validators must stake 32 ETH and run specific software to participate in block validation and production.

Rewards: Block rewards were eliminated. Instead, validators earn income from transaction fees.

Fee mechanism: Transaction fees are now paid directly to validators, not to the Ethereum Foundation.

Dynamic fee improvements: The upgrade incorporated EIP-1559, which dynamically adjusts fees, enabling faster transactions and reducing excessive fees.

State storage optimization: The network adopted "Rollups," storing large volumes of data on sidechains and batching them onto the mainchain, reducing mainchain load and improving scalability.

Contract execution improvements: Introduced "EVM 384," a new virtual machine aimed at enhancing contract execution efficiency and security.

Overall, the Paris upgrade significantly enhanced Ethereum’s scalability and efficiency through consensus mechanism improvements, fee structure optimization, state storage enhancements, and better contract execution.

At this time, ETH was priced at $1,472.

Shanghai Upgrade – April 12, 2023

The Shanghai upgrade marked the first major post-Merge enhancement and a key milestone in Ethereum’s roadmap. Its primary changes were threefold:

-

Unlocked staking withdrawals on Ethereum. This helps maintain network vitality and supports long-term sustainability, encouraging more validators to join.

-

Reduced gas fees for Layer-2 solutions operating on Ethereum, making transactions faster and cheaper. The upgrade further optimized gas costs for Ethereum transactions.

-

As the largest smart contract-capable blockchain, Ethereum reinforced its leadership by introducing EOF (EVM Object Format).

At this time, ETH was priced at $1,917.

Cancun Upgrade – Q4 2023 (expected)

The Cancun upgrade follows the Shanghai upgrade as an additional enhancement to the Ethereum blockchain. Centered around EIP-4844 and possibly EIP-6969, it aims to reduce costs and increase speed for Ethereum’s Layer 2 solutions—potentially boosting L2 speeds by 10x or even 100x while lowering costs.

Ethereum’s Layer 1 fees have long remained high, necessitating improvements to lower operational costs. Currently, Ethereum’s main scaling solutions are Layer 2 Rollups. Rollups have already saved users significant gas fees—for example, Optimism typically charges only 0.001 gwei, far below Ethereum’s mainnet. ZK Rollups offer even better data compression and don’t require signature data, reducing fees to as little as 1% of Ethereum’s base layer. However, for many users, even these reduced fees remain a burden. Additionally, Ethereum’s parallel transaction processing efficiency remains low, handling only double-digit transactions per second—highlighting the need for further scalability improvements.

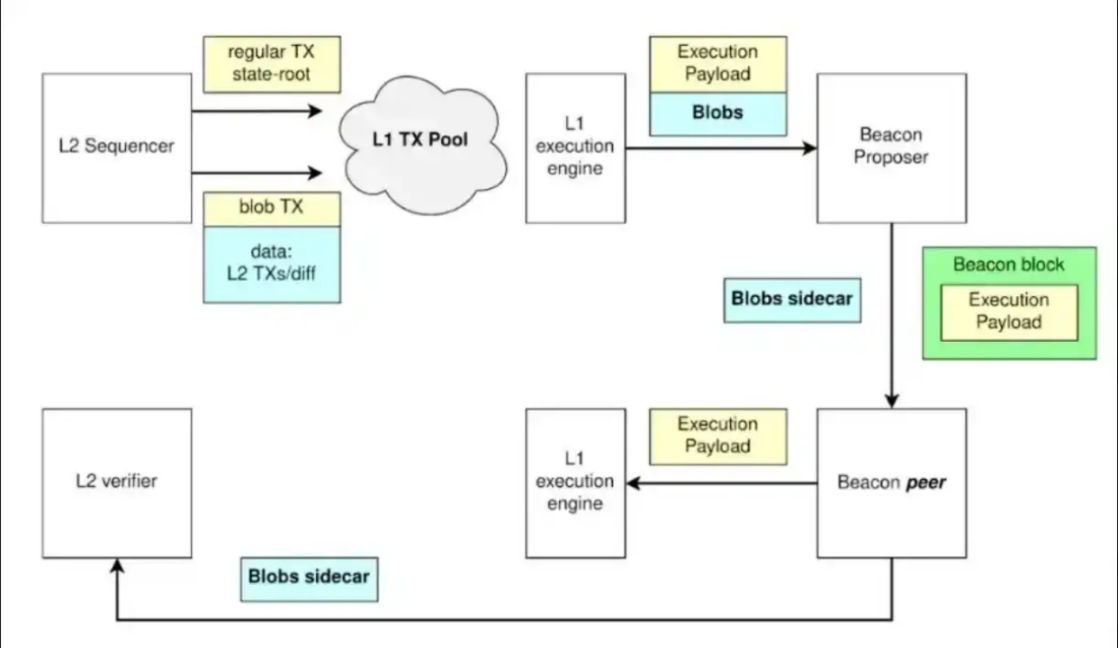

Sharding is a powerful solution to these issues, but full sharding isn’t yet feasible. EIP-4844 offers a pragmatic compromise—bridging current needs with future sharding goals—and lays the technical groundwork for full data sharding. Hence, EIP-4844 is often referred to as “Proto-danksharding.”

EIP-4844 introduces a new transaction type that stores data in a space called a "blob" at a much lower cost. This allows Layer 2 data previously stored on Layer 1 to be moved to blobs, drastically reducing L2 fees.

In addition to the highly anticipated EIP-4844, confirmed improvements in the Cancun upgrade include:

EIP-1153: Adds transient storage opcodes—a solution designed specifically for intra-block communication.

EIP-6780: Modifies the SELFDESTRUCT opcode in preparation for Ethereum’s future adoption of Verkle Tree architecture.

Beyond ETH itself, several projects stand to benefit from the Cancun upgrade:

Layer 2

The biggest beneficiaries of the Cancun upgrade will undoubtedly be Layer 2 projects. Leading L2 platforms like Arbitrum and Optimism, with strong first-mover advantages, warrant attention. Applications such as GMX, RDNT, and Magic—top players in the Arbitrum ecosystem—are likely to grow alongside L2 expansion. Additionally, projects like Metis, built on and improving upon Optimistic Rollup, and Boba Network, which mimics Optimism, may also capture some of the upgrade’s benefits.

ZK-Rollups

ZK-Rollups, widely regarded as a superior scaling solution, are also poised to shine with the Cancun upgrade. zkSync, StarkNet, and Scroll are the most prominent projects in this space—none of which have issued tokens yet, but all possess significant potential.

zkSync is a ZK-Rollup scaling solution developed by Matter Labs. It includes a payment-focused 1.0 mainnet and a fully EVM-compatible 2.0 testnet. Recently, zkSync upgraded its 2.0 entrypoint to allow any token to pay network fees, greatly enhancing user flexibility.

Starknet is a decentralized Validity-Rollup operating as an L2 on Ethereum, enabling applications to scale massively without compromising composability or security.

Scroll is a zkEVM-based zkRollup on Ethereum, serving as an L2 solution to alleviate network congestion.

Others

Beyond the above categories, the Cancun upgrade will also benefit other types of projects, including cross-chain protocols with functions similar to L2, and data availability layer projects—since blob data has a short retention period. Notable examples include:

LayerZero: Currently the most popular cross-chain protocol. It enables the transfer of “messages” from one chain to another through a series of smart contracts (Endpoints) deployed across chains, offering decentralized cross-chain communication.

Celestia: A data availability layer project built on Cosmos architecture. It provides data and consensus layers for other L1s and L2s, enabling modular blockchain design. With principles similar to Ethereum’s sharding, Celestia can help reduce the current bottleneck in Rollup transaction fees—data storage costs.

With the implementation of EIP-4844, L2 solutions will become more competitive compared to other L1s, offering greater growth potential. Beyond significantly lowering transaction fees, EIP-4844 also lays fertile ground for future Danksharding applications, paving the way for seamless data sharding. Lower fees, better user experience, and the emergence of new use cases make the Cancun upgrade a turning point for Ethereum’s Layer 2 ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News