Interpreting Azuki from a Data Perspective: What Magic Can a Single Red Bean Hold?

TechFlow Selected TechFlow Selected

Interpreting Azuki from a Data Perspective: What Magic Can a Single Red Bean Hold?

This report provides a comprehensive analysis of Azuki and Beanz's performance in the NFT market, with a focus on their community strength, lending dynamics, and strategic collaborations driving their resilient growth.

Text: NFTGo

Introduction

What kind of magic can a single red bean possess?

Azuki is a collection of ten thousand non-fungible tokens (NFTs) inspired by anime aesthetics. Since its launch by Chiru Labs in 2022, it has become a dominant force in the Web3 space. The project sold out within minutes of launch, raising over $29 million. Its success stems largely from its diverse and loyal community. Beyond impressive metrics, Azuki stands out due to the team's ambition to build a gamified metaverse—specifically, a world called Hilumia designed to offer immersive experiences for holders.

This report provides a comprehensive analysis of Azuki and Beanz in the NFT market, focusing on community strength, lending dynamics, and strategic partnerships driving their resilient growth. We examine transaction activity, holder patterns, loan volumes, and cross-platform appeal from a data-driven perspective, illustrating how both projects have carved out strong positions amid market volatility.

Latest Updates

IPX x Chiru Labs: A Revolutionary Web3 Expansion Initiative

Source: Tweet@Azuki

Chiru Labs, the creative force behind Azuki, has announced a major partnership with IPX, a renowned global IP platform known for successful collaborations with brands like BTS, Netflix, and Starbucks. This alliance marks a significant breakthrough for LINE FRIENDS—the popular sticker characters originating from the LINE messaging app—into the Web3 domain.

This collaboration represents a groundbreaking fusion between Web3 and established intellectual property (IP), spanning co-created content, retail distribution through LINE FRIENDS stores, and immersive offline events. With BEANZ already linked to LINE FRIENDS, this partnership could expand to include other IPs managed by IPX and its designated Web3 partners.

The implications are substantial: BEANZ’s IP will now be exposed to millions of LINE FRIENDS consumers. This expansion successfully unites overlapping user bases while significantly broadening their audience in ways few NFT projects achieve. Endorsement from influential brands such as BTS further validates and strengthens this collaboration.

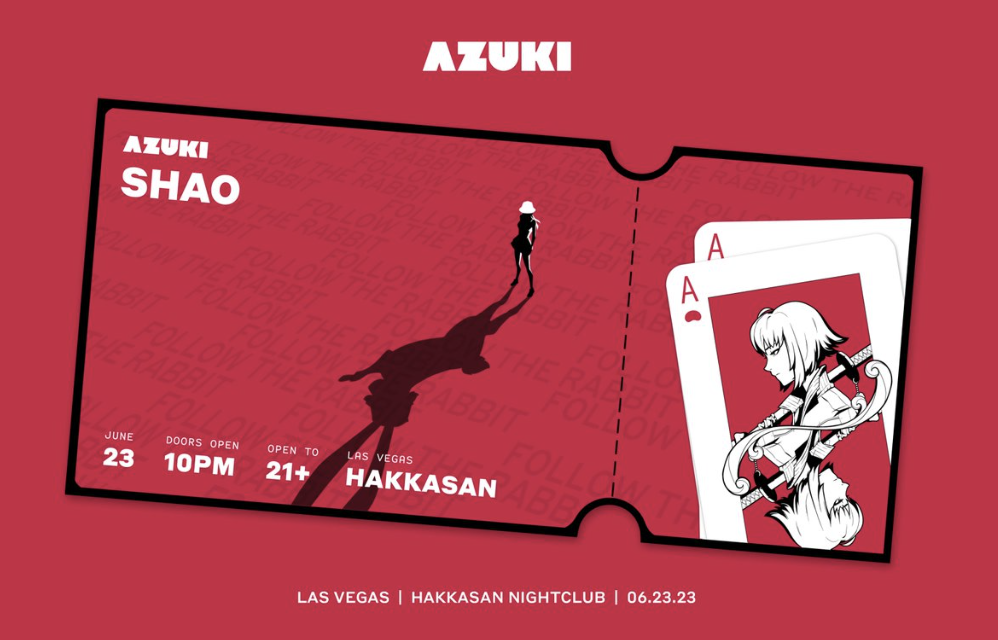

Follow The Rabbit: Hype, Mystery, and Details

Source: Tweet@Azuki

Azuki is back with an exciting event—“Follow The Rabbit”—set to take place at Hakkasan Nightclub in Las Vegas on June 23, 2023. Following the acclaim of previous events like “Check Your Wallets” and their NYC NFT gathering, Azuki promises another immersive experience for attendees.

Registration opened in mid-April, prioritizing Azuki and BEANZ token holders. Due to overwhelming demand, Azuki reopened registration, which officially closed on May 28, 2023. Tickets are free, though non-holders must pay a $100 refundable deposit. Registration was handled via the Tokenproof application, and attendees must be 21 years or older.

Given Azuki’s prior impact in the NFT world, this event holds special significance. Since January 2022, Azuki sparked a buying frenzy during the bull market. Later, their Los Angeles party in March revealed a surprise airdrop—two NFTs for every one Azuki held—further fueling excitement. Despite ongoing controversies, Azuki continues to grow and maintain a prominent position in the NFT landscape.

“Follow The Rabbit” may serve as a platform for unveiling major future plans. As speculation intensifies, some Azuki whales have begun trading rare Azuki NFTs at floor prices—a strategy hinting at potential upcoming airdrops or token distributions. As anticipation builds around the event, attention on Azuki is rising, creating an atmosphere of suspense and excitement within the NFT community. Zagabond, Azuki’s enigmatic founder, excels at engaging the community without revealing too much, further amplifying curiosity.

This event encapsulates the mystery and hype that define Azuki, making it one of the most anticipated gatherings in the NFT space. While it remains unclear whether a new NFT series will be launched, expectations are undeniably high.

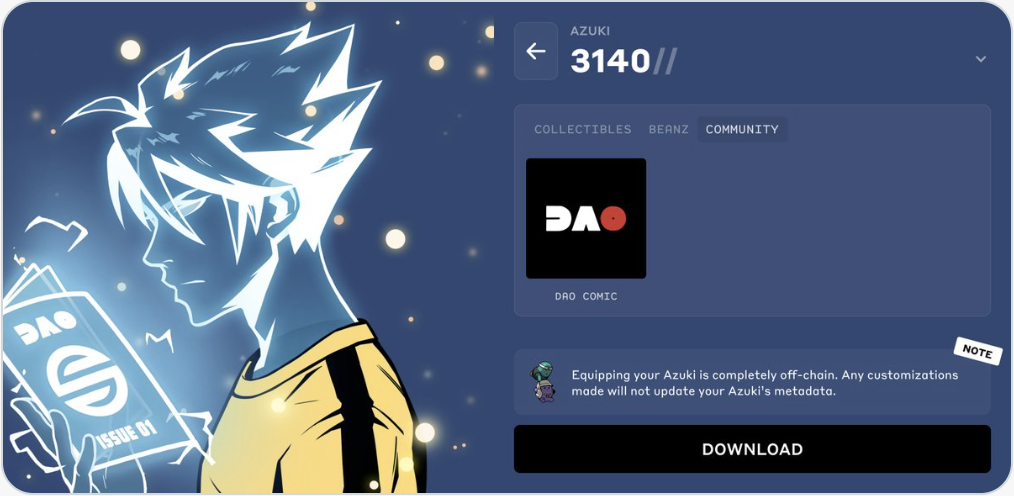

Azuki Enhances Engagement Through Spirit DAO’s Comic Book Token Trait

Source: Tweet@Azuki

In a notable development, Spirit DAO—a private group composed of Azuki NFT collectors—has been granted a coveted comic book token trait by Azuki. Members of Spirit DAO can equip this trait to enhance their Azuki experience and distinguish themselves from regular community members.

This move highlights synergy between Azuki and Spirit DAO, reinforcing Azuki’s commitment to fostering creativity, collectibility, and immersive engagement. Comprised of dedicated Azuki collectors, Spirit DAO aims to solidify Azuki’s reputation in the emerging metaverse as a powerful cultural force. The comic book token trait reinforces this vision while increasing benefits for Spirit DAO token holders.

The Azuki comic book token trait is accessible through the Azuki collector profile. This further underscores Azuki’s dedication to dynamic community participation. This new feature ensures personalization of Azuki tokens can be a creative off-chain experience without altering on-chain attributes.

Essentially, the collaboration with Spirit DAO via the comic book token trait marks a significant step toward enhancing user interaction and collector engagement within the Azuki ecosystem. This development is poised to catalyze Azuki’s goal of establishing a distinctive brand presence in the metaverse.

Data Analysis

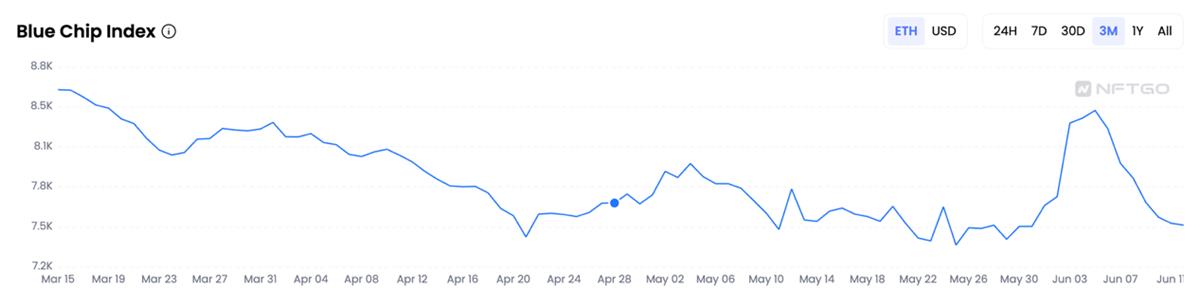

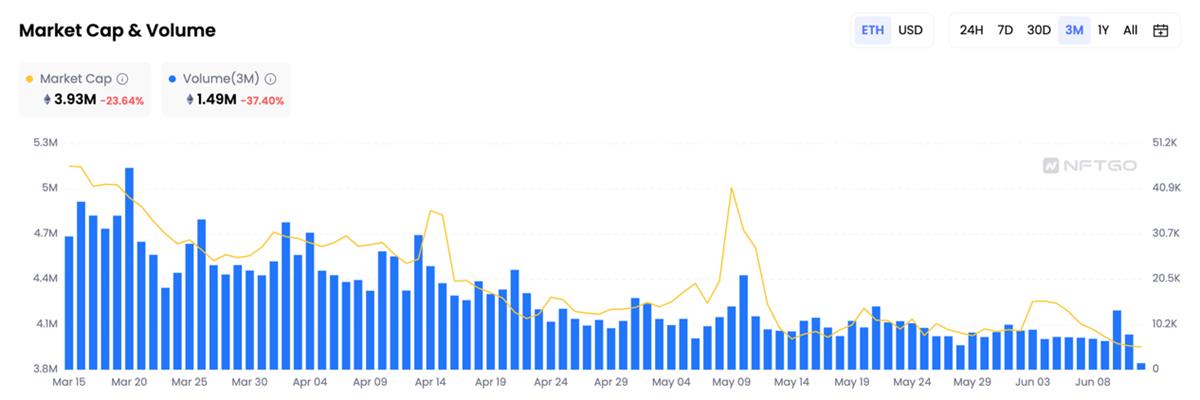

Reviewing NFT market performance over the past three months reveals a downward trend. Market capitalization dropped sharply by 23.64%, falling from 510,000 ETH to 390,000 ETH. The blue-chip index also followed a declining trajectory—down 12.22% from 85,000 ETH to 75,000 ETH—despite a brief rebound between May 31 and June 5.

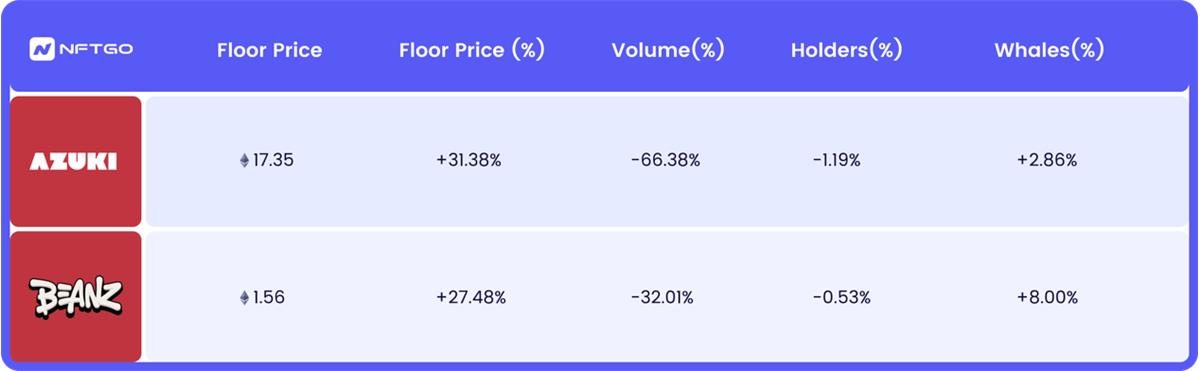

However, Azuki and Beanz have defied market trends, emerging as resilient and strong projects thanks to robust community support and compelling product appeal.

Azuki

Despite bearish market conditions, Azuki has delivered impressive performance. This resilience stems from a series of strategic initiatives, including frequent events, the dynamic partnership with IPX, and a strong community foundation. Although the number of holders has slightly declined, its market cap has surged, accompanied by an increase in whale investors—reflecting the strength of its follower base. Transfer volume far exceeds sales volume, with a surge in high-value transfers, signaling a "diamond hands" pattern indicative of long-term value perception. In essence, Azuki’s counter-trend growth reflects not only its strong market standing but also its vibrant community and strategic collaborations that continue to drive momentum.

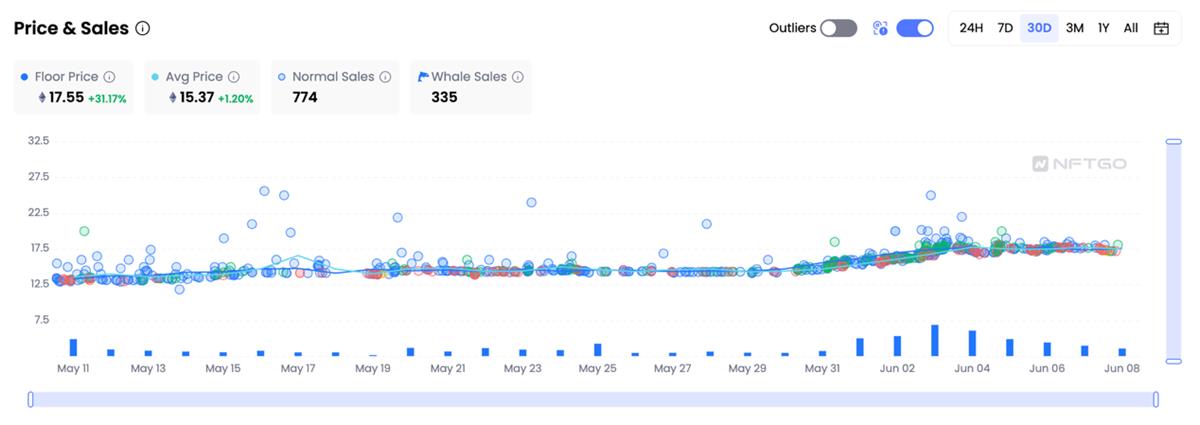

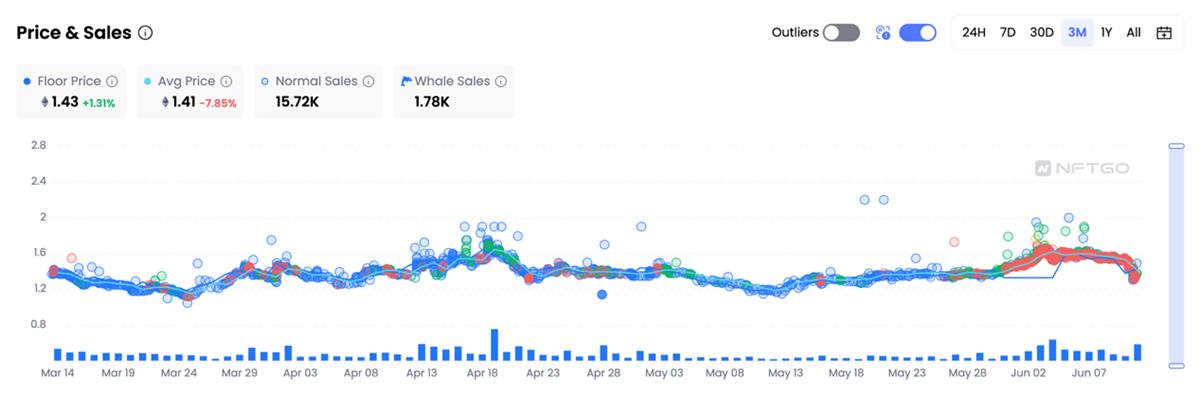

Price and Sales: Balanced Participation Drives Stable Growth

Azuki’s recent market performance has been stable and steadily upward. Last month, its floor price rose 31.38%, climbing from 13.34 ETH to 17.54 ETH. Additionally, the average price reached a year-to-date high, marking a significant milestone. Despite minor fluctuations on May 17, the overall trend remains positive, with average prices up 28.6%, increasing from 13.6 ETH to 17.49 ETH. The volume of bulk transactions serves as a key indicator of Azuki’s market dynamics.

Notably, the number of whale buyers and sellers remains well balanced, indicating market stability and absence of manipulation pressure. It is extremely rare for the same entity to act as both buyer and seller, proving that the Azuki market isn’t dominated solely by heavyweight investors but includes active participation across all collector tiers. This positive market performance is driven by Azuki’s consistent brand-building strategy and community planning. These combined factors not only sustain existing collectors’ interest but also attract new participants to the Azuki NFT marketplace.

Market Cap and Volume: Trading Activity Stalls, But Marketing Events Propel Market Cap

Over the past three months, Azuki’s market cap has grown amidst volatility. Most notably, between May 29 and June 1—coinciding with the announcement of additional tickets for the highly anticipated “Follow the Rabbit” Las Vegas event—investor sentiment appeared positively impacted, pushing market cap to a record high of 177.77K ETH. Even after a slight dip, the current market cap stands at 175.55K ETH, reflecting an overall increase of 21.66%.

However, it’s important to note that while market cap has seen substantial growth, last month’s total sales volume was relatively lower compared to previous months. This may suggest that although investors remain optimistic about Azuki’s value, trading activity has somewhat plateaued—possibly due to anticipation surrounding the Las Vegas event, with investors preferring to wait for outcomes before engaging in further transactions.

In summary, the divergence between market cap and sales volume indicates that Azuki’s strategic partnerships and event-driven marketing are positively influencing investor sentiment and strengthening the project’s overall market position. This reinforces the brand’s prominence in the NFT space and its potential for continued growth.

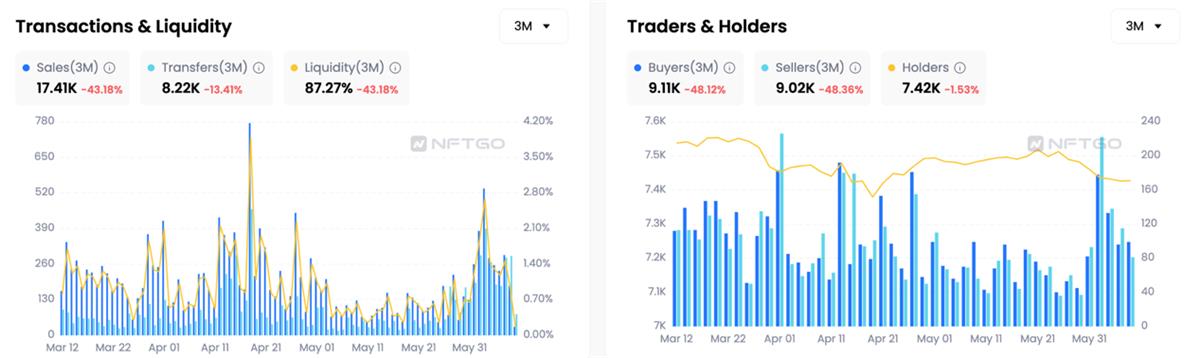

Transactions, Liquidity, and Holders: Loyal Community and Whale Confidence Fuel Market Resilience

Last month, Azuki’s ecosystem showed an intriguing trend: despite reduced liquidity compared to the previous three months, transfer counts consistently exceeded sales counts. This not only demonstrates strong community cohesion but also reflects a diamond-handed mentality among Azuki holders who are committed to long-term ownership and future value appreciation—likely influenced by the “Follow the Rabbit” event.

At the same time, the number of holders decreased slightly by 1.97%, yet market cap increased dramatically by 21.66%. This counterintuitive phenomenon suggests that while participant numbers dipped slightly, remaining holders increased their stakes, driving up market cap. This aligns with our observation of a 2.86% rise in whale count.

Over the past three months, the number of users holding Azuki for over a year has steadily increased, while those holding between three months and one year have correspondingly decreased. From a data standpoint, the number of NFTs held for more than a year surged by 100.36%—growing from 2.1K to 4.4K. Meanwhile, NFTs held between 3 months and 1 year plummeted by 41.37%, dropping from 5K to 2.9K.

This near-equal shift from short-term to long-term holding reveals an interesting trend: many holders who previously owned Azukis for 3–12 months chose not to sell, instead transitioning into the over-one-year holding category. This signals strong confidence in Azuki’s long-term value and growth potential, reaffirming that the community is not driven by short-term gains. They appear focused on long-term development and deeply trust Azuki’s roadmap and the team’s strategic decisions.

At its core, Azuki’s ecosystem consists of a loyal and optimistic community. Despite market fluctuations, they remain steadfast in their belief in Azuki’s potential and strategy, eagerly anticipating a bright future for the project.

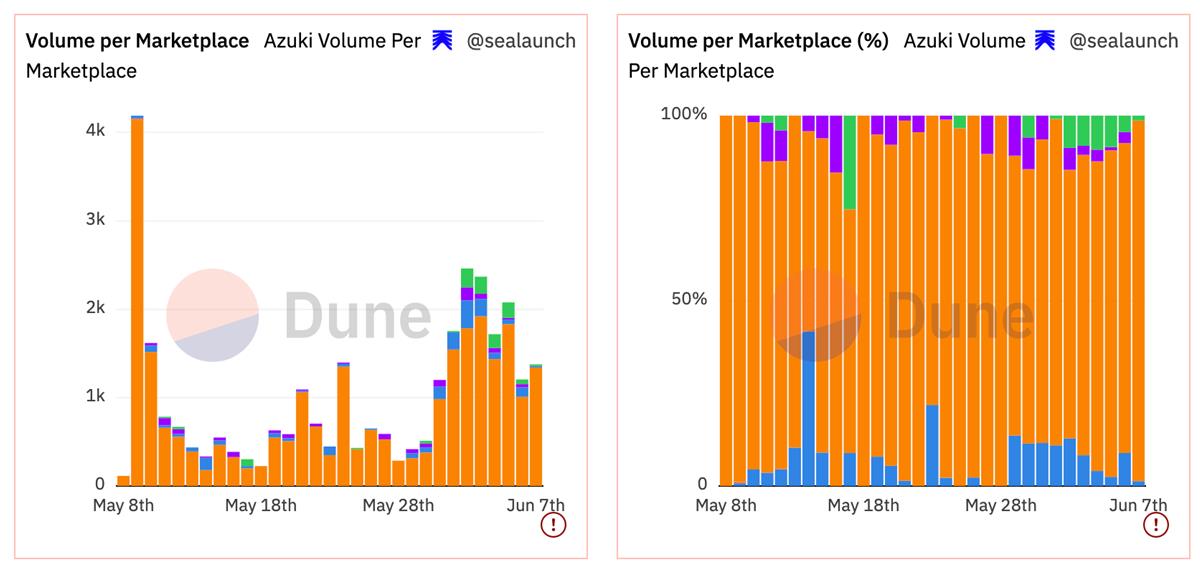

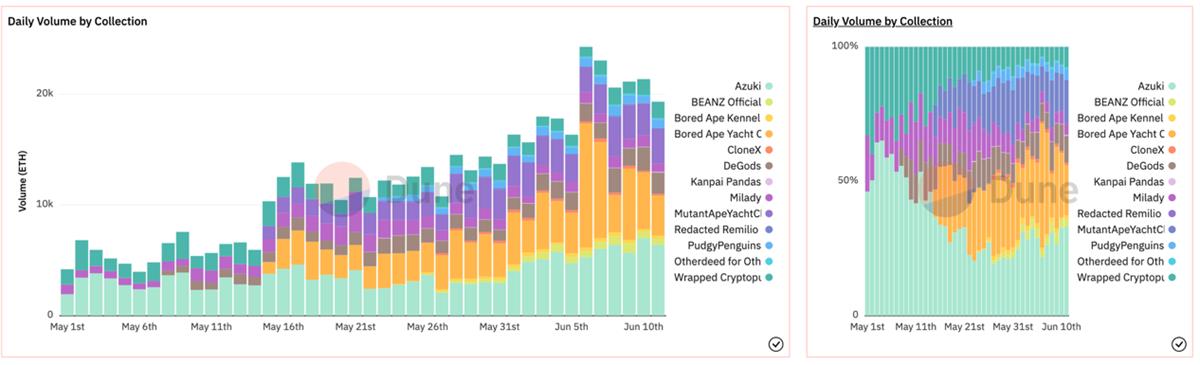

Trading Platforms: Blur Emerges as the Primary Marketplace for Azuki NFTs

According to data from Dune Dashboard @sealaunch, Blur has clearly become the dominant marketplace for Azuki trading. Key reasons include:

First, Blur’s Blend (Blur Lending) feature allows traders to maximize NFT liquidity. Given the high price point of Azuki NFTs, this offers significant advantages for new collectors who believe in the project’s long-term potential. Blend enables buyers to use their tokens as collateral, creating a more flexible trading environment.

Second, Blend does not charge royalties—a major draw for traders. In contrast, OpenSea charges a 0.5% royalty fee per transaction. Overall, Blend offers greater cost efficiency.

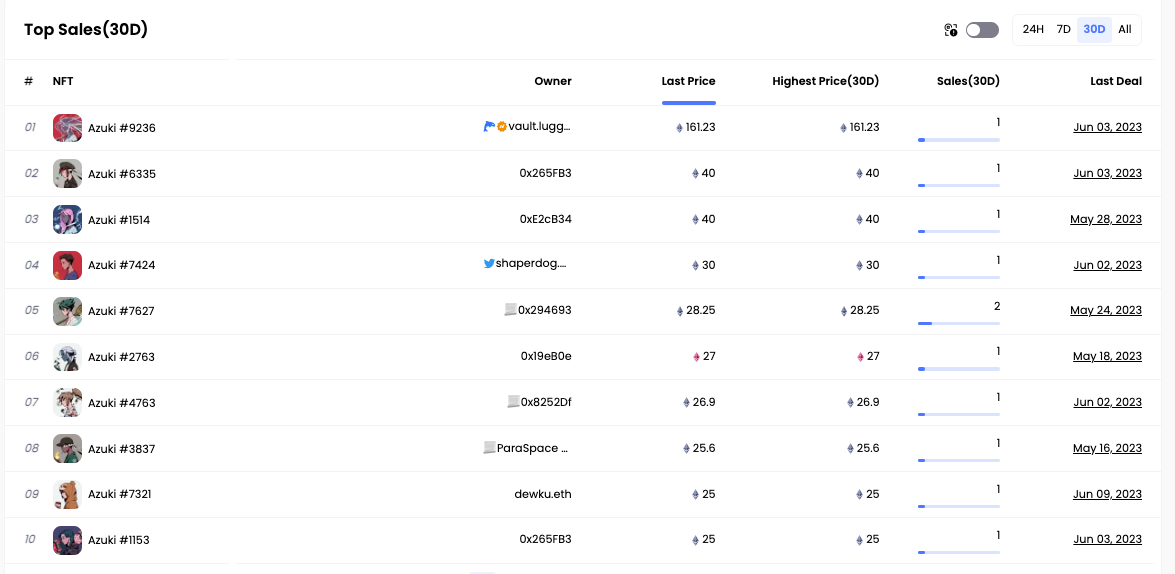

Third, Blur is perceived as a premium trading platform, a reputation supported by strong sales data. For example, Azuki #9236 sold on Blur for a staggering 161.2345 ETH, setting a new record and further cementing Blur’s status. This influx of high-value trades attracts new collectors and elevates Azuki’s overall standing in the NFT market.

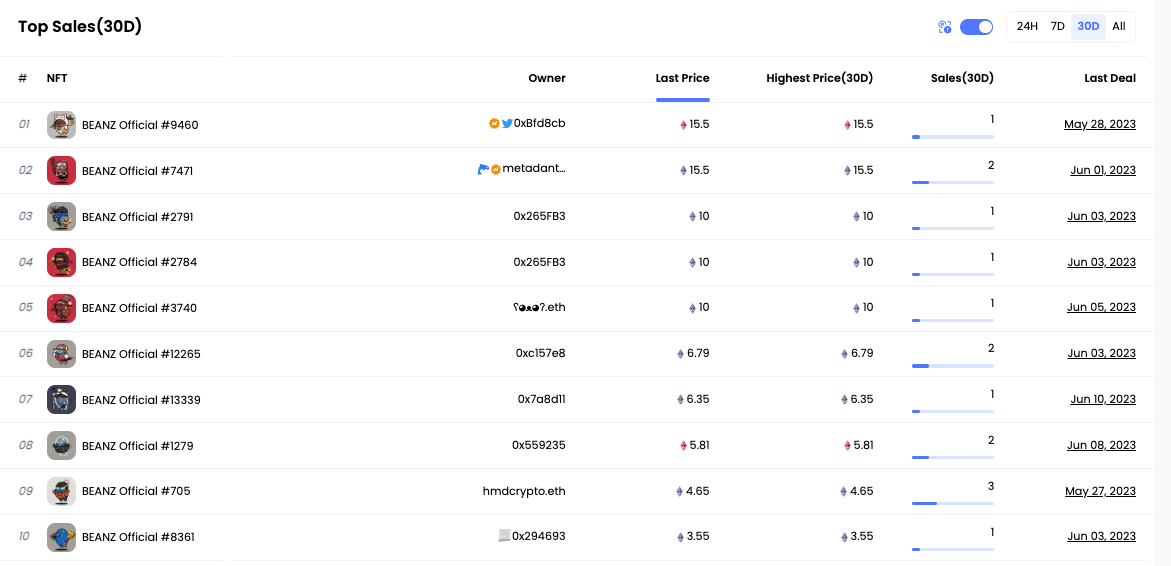

Sales Rankings

BEANZ

Lowering Barriers, Boosting Performance Across the Azuki Universe

Within the Azuki universe, BEANZ serves as a reliable companion—a more cost-effective alternative. The growing number of BEANZ NFT collectors is primarily driven by their affordability, significantly lowering the entry barrier to the Azuki ecosystem. The strategic partnership with LINE FRIENDS gave rise to the BEANZ IP and characters like “Jay” and “Jelly,” expanding BEANZ’s reach. This collaboration introduced BEANZ to millions of new consumers, driving substantial user growth and unlocking new revenue streams through merchandise and event partnerships.

Immediately after the partnership was announced, trading volume surged from 143.32 ETH to 679.29 ETH—an increase of 373.97%. Another notable spike occurred on April 18, when it was officially announced that access to register for Azuki’s “Follow the Rabbit” event would be available to wallets holding either Azuki or BEANZ tokens. Naturally, attendees opted for the more affordable BEANZ, causing volume to jump from 256.58 ETH to an astonishing 1289.19 ETH—a 402.45% increase. This trend pushed both trading volume and market cap to three-month highs.

Interestingly, following the first whale trade on May 27, a brief period of whale accumulation was quickly followed by mass whale selling. As a result, after a low-liquidity phase in early May, BEANZ liquidity began oscillating at a higher baseline. Despite a relative decrease in holders, market cap remains near its highest level in nearly three months.

Sales Rankings

The Lending Journey of Azuki and BEANZ

From the lending volume of Azuki on Blur, it’s evident that over the past month, Azuki has dominated the top tier of the market, even showing fluctuating upward momentum. Starting in May, Azuki’s lending volume surged significantly from 3,437 ETH to 6,408 ETH—a robust 86.44% increase. This trend indicates escalating demand for Azuki NFTs, solidifying its position as a strong contender in the NFT ecosystem.

In early May, Azuki accounted for over 50% of daily lending volume on Blur. Though it later dipped slightly, it has remained consistently among the top three projects, maintaining a stable share of 20–30% in trading volume. This consistency not only boosts confidence among Azuki holders but also enhances the appeal of both Azuki and BEANZ to potential collectors, increasing their market visibility. This trend underscores the resilience of Azuki and BEANZ amid adversity and signals their potential for sustained future growth.

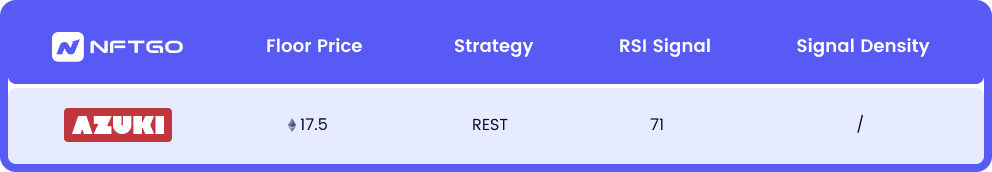

Azuki Trading Signals

Upside/Downside Probability (NFA)

RSI Strategy: Trading signals based on the relative strength characteristics of RSI. Signals below the volatility range indicate buy opportunities, while those above indicate sell signals. The greater the deviation, the stronger the signal.

Azuki Pricing and Listings

Finding promising NFTs is where opportunity lies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News