Permissionless On-Chain U.S. Treasuries: A Look at Flux/T Protocol/Ribbon

TechFlow Selected TechFlow Selected

Permissionless On-Chain U.S. Treasuries: A Look at Flux/T Protocol/Ribbon

The main contradiction in today's DeFi world is the contradiction between people's growing demand for U.S. Treasuries and the unbalanced, unequal access to acquiring them.

Starting from March 2022, the Federal Reserve initiated a series of consecutive interest rate hikes, rapidly raising the federal funds rate to 4.75%–5%, making it the fastest and largest rate-hiking cycle in history.

A 5% federal funds rate means you can earn nearly a 5% risk-free return simply by parking your money in a money market fund—no effort required.

Meanwhile, in the DeFi world, established protocols like Curve, Aave, and Compound generally offer yields between 0.1% and 2%. To farm that extra 1% yield, users must bear multiple risks: smart contract vulnerabilities, single-point oracle failures, and the risk of USD stablecoins losing their peg. Over the past year, we've indeed seen countless hacking incidents, oracle price errors causing bad debt, and significant short-term de-pegging events involving USDT and USDC.

It's been an incredibly tough year for DeFi farmers. You might as well cash out and buy government bonds—but unfortunately, traditional finance (TradFi) comes with numerous barriers, especially high ones for those based in mainland China. It's already difficult for many people just to open a Class I bank account and then set up a dollar-denominated fixed deposit.

This is where MakerDAO-led DeFi protocols stepped in, striving to bring real-world assets (RWA) on-chain, thereby introducing non-Ponzi real yield into DeFi.

However, ordinary retail investors still couldn't access these opportunities. In fact, the primary contradiction in today’s DeFi ecosystem is: the growing demand for U.S. Treasury exposure among the public versus the unequal and restricted access to such assets. To capture this "holy grail" of DeFi and become a foundational annual yield building block across DeFi legos, projects like Flux Finance, T Protocol, and Ribbon Finance have emerged.

Flux Finance

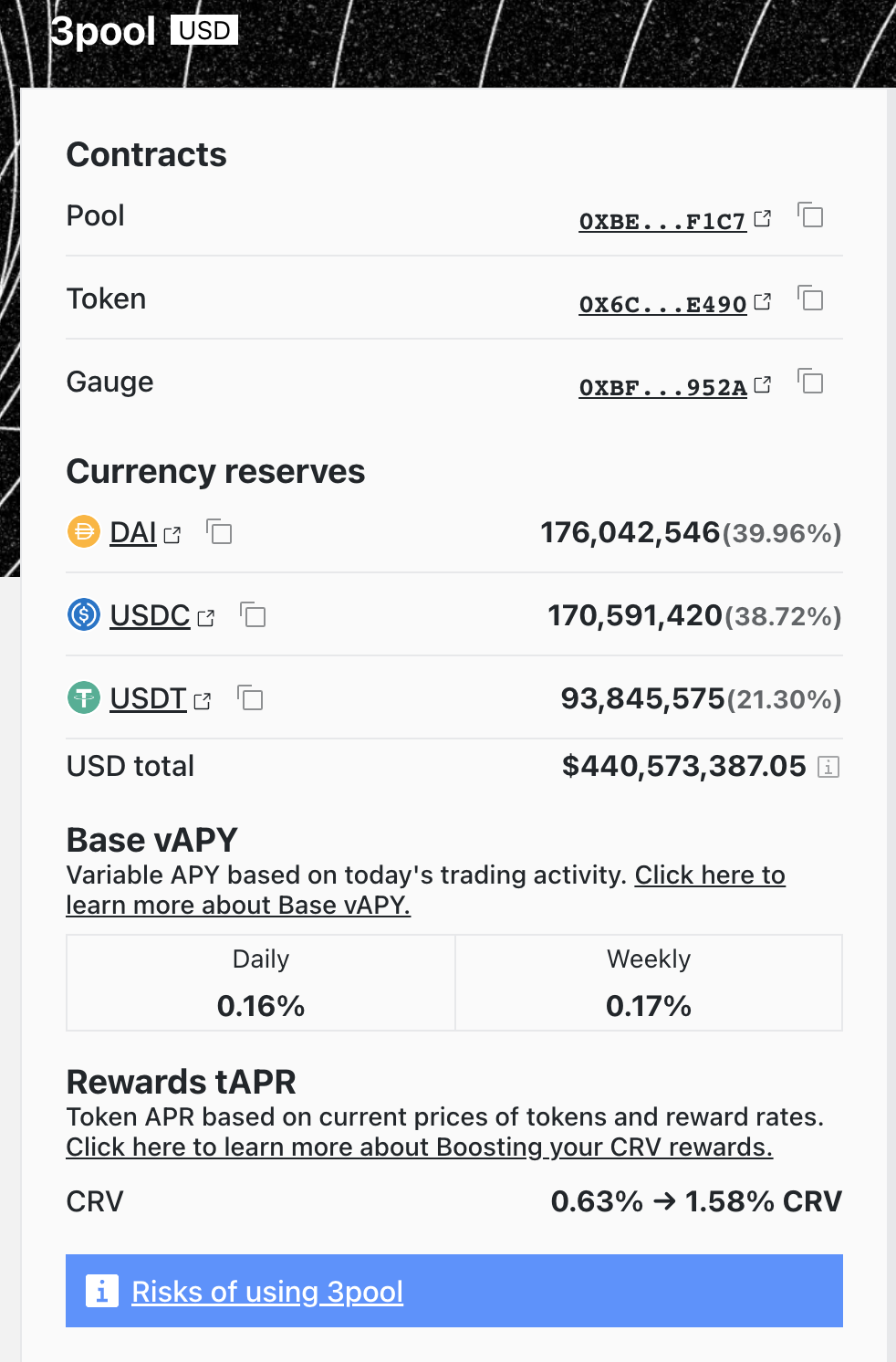

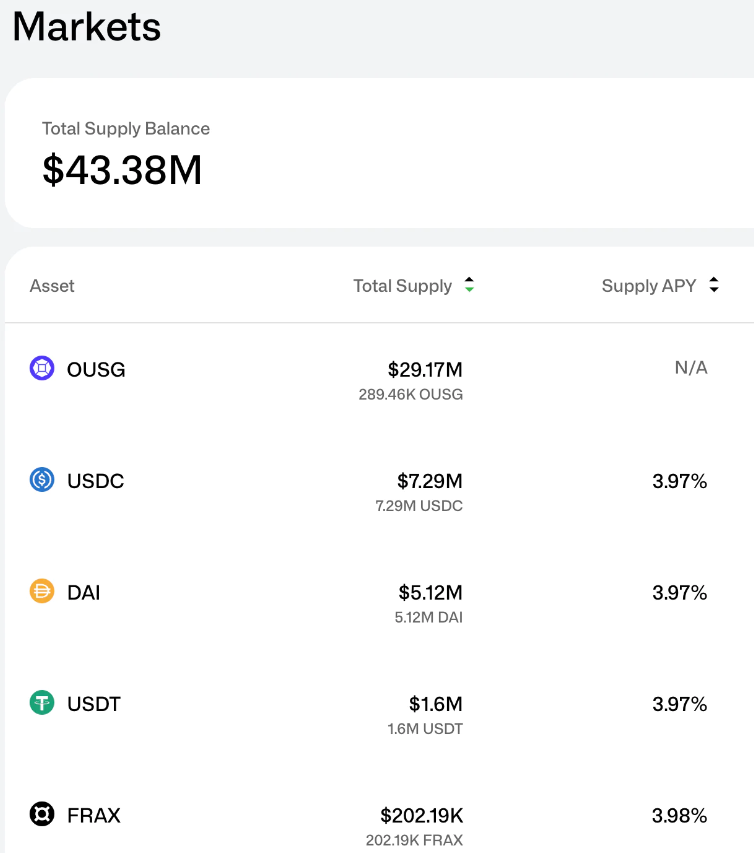

Flux Finance is a decentralized lending protocol developed by the Ondo Finance team. Before discussing Flux, we must first introduce Ondo’s OUSG. Ondo Finance partners with institutions to issue OUSG on-chain—tokens backed by U.S. Treasury ETFs. Only approved institutions can mint or redeem OUSG. At this point, you might ask: Isn’t this still just an institutional playground? Where are retail investors? This is exactly where Flux Finance comes into play. Flux allows institutions to collateralize OUSG and borrow other stablecoins, thereby indirectly bringing U.S. Treasury yields into permissionless DeFi. As a retail investor, without needing an SSN, bank account, or brokerage account, you can now comfortably earn around 4% APY in stablecoins.

Summary

Currently, Flux Finance’s total supply has reached $43 million, and OUSG’s market cap exceeds $100 million—a substantial scale. Flux Finance is merely the first step in the OUSG DeFi Lego set; the future of on-chain U.S. Treasuries is vast. Interested readers are encouraged to explore it.

Pros:

- Zero barrier to entry for retail users—no KYC, fully permissionless;

- Flux Finance is a fork of Compound V2, offering a certain level of security;

- Bad debt is extremely unlikely on Flux because its underlying assets are highly stable. As an added safety mechanism, Flux’s stablecoin oracle will never price them above 1 USDC, reducing the risk of external oracle manipulation.

Cons:

- Available only on Ethereum;

- Whitelist-based liquidation mechanism—only KYCed addresses can perform liquidations.

T Protocol

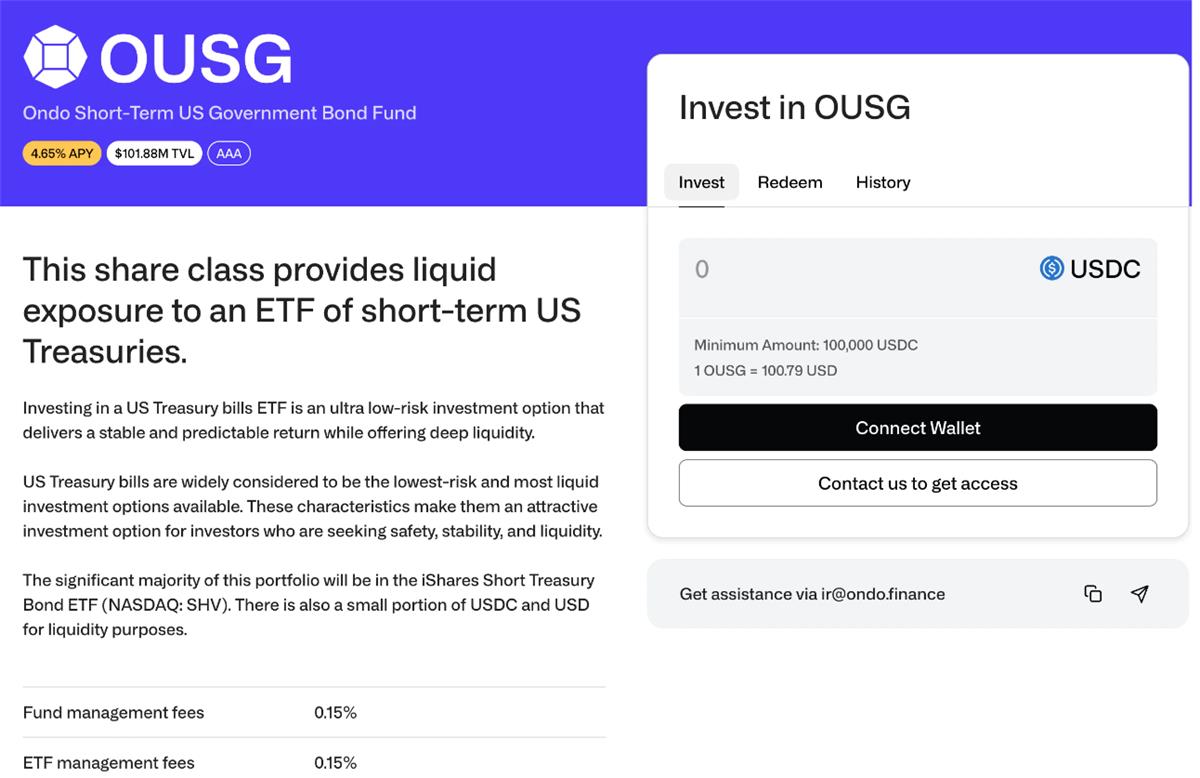

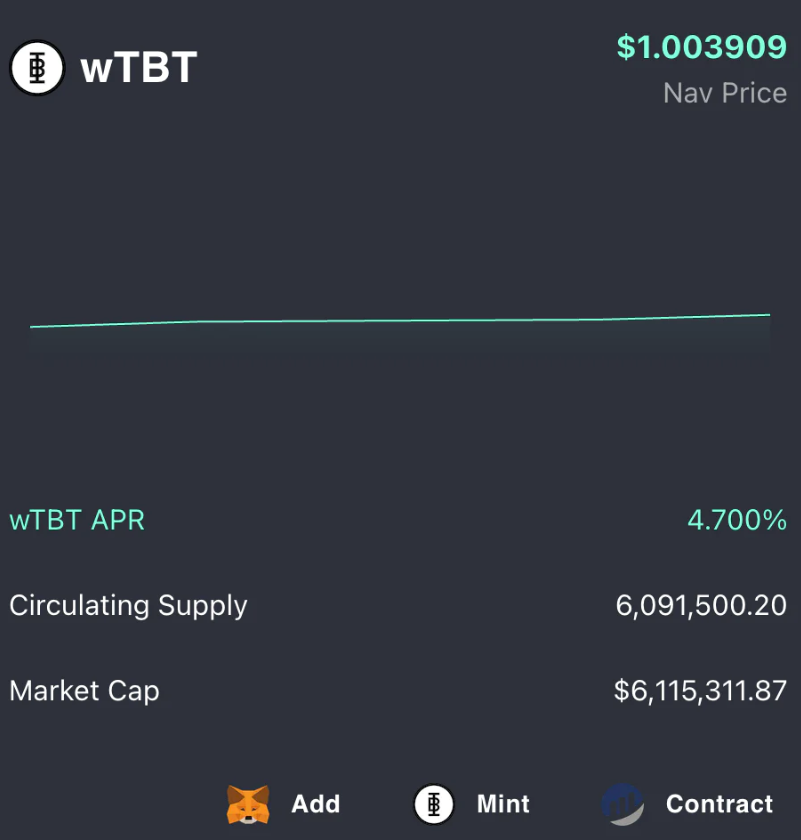

T Protocol is a permissionless on-chain U.S. Treasury product built by the JZ team, essentially a fork of Liquity. The protocol features three tokens: sTBT, TBT, and wTBT. sTBT is a rebasing token issued by KYCed institutions and serves as collateral for TBT. TBT itself is also a rebasing token that retail users can mint permissionlessly. For an explanation of rebasing tokens, consult ChatGPT or refer to stETH. wTBT is a wrapped version of TBT (non-rebasing). Currently, wTBT offers an APY of around 4.7%, effectively functioning as an interest-bearing stablecoin. There is already liquidity for wTBT on Velodrome on Optimism.

Summary

wTBT, as a real-yield cornerstone, has potential applications in CDP stablecoins and PCV allocation. Rumor has it JZ is negotiating with MIM—stay tuned. Link (access not available from Hong Kong, U.S., or North Korean IP addresses)

Pros

-

Permissionless and accessible to all;

-

Higher APR compared to Flux Finance;

-

Currently on Ethereum but plans to expand to Optimism and possibly BNB Chain;

-

Ongoing $TPS token airdrop—early TBT minter may qualify for the drop.

Cons

-

Interface appears rougher than Flux Finance—common issue among Liquity forks;

-

Documentation is poorly organized;

-

One-time minting fee of 0.1%, redemption fee of 0.3%.

Ribbon

I have mixed feelings about Ribbon Finance. Before the FTX collapse, they launched Ribbon Lend (an uncollateralized lending product) and Ribbon Earn (a principal-protected options product). At that time, Ribbon Lend offered interest rates as high as 13%, and I lent 300k USDC to Folkvang (dubbed “mini FTX”). The team promised an airdrop for deposits made before a certain date, but later changed the cutoff date—so I only earned interest and missed out on the RBN airdrop.

The base annual yield for Ribbon Earn came from unsecured loans to market makers. After FTX collapsed, both Ribbon Lend and Earn were effectively terminated—and I narrowly escaped unscathed.

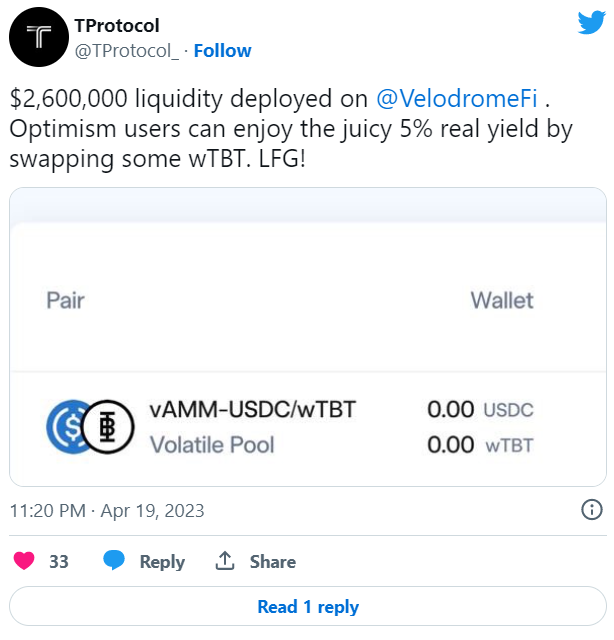

Recently, however, they partnered with BackedFi to launch a principal-protected options product backed by U.S. Treasuries.

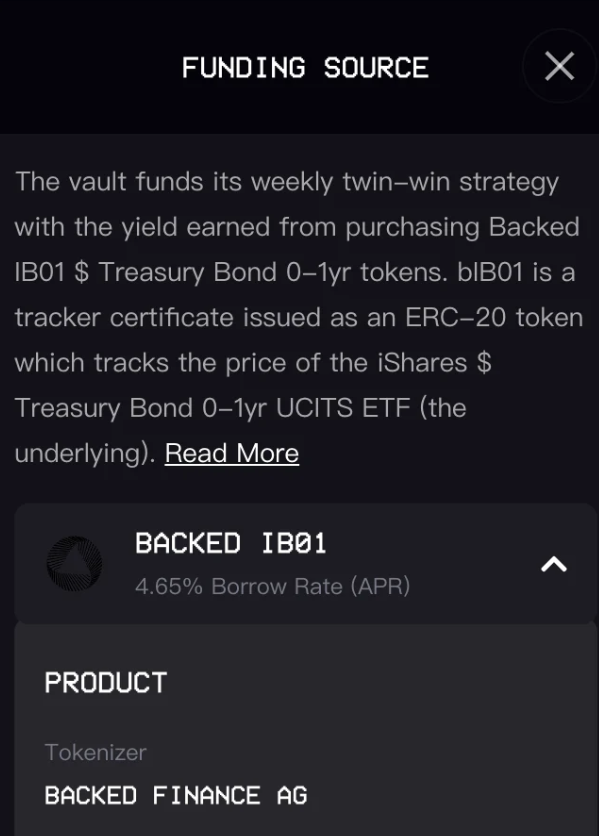

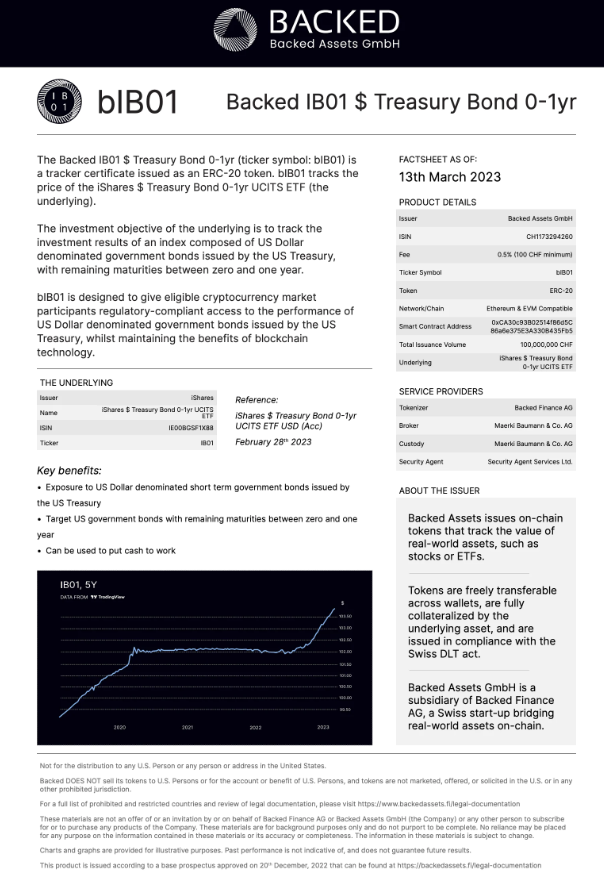

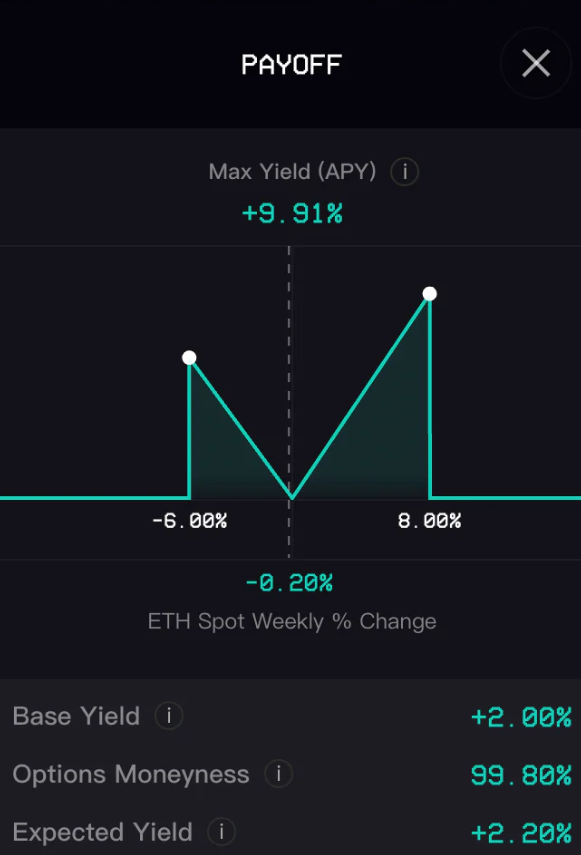

As shown in the chart, BackedFi’s treasury product offers a 4.65% annual yield. Unfortunately, Ribbon Earn’s base yield is only 2%, significantly lower than its purely permissionless treasury-focused competitors.

Many people don’t understand these options products—I don’t either—so here’s a copy-paste from their documentation:

Let’s walk through an example:

-

Step 1: You deposit USDC into the R-Earn vault.

-

Step 2: The vault invests in IB01 U.S. Treasuries and earns interest.

-

Step 3: Ribbon uses that 2% annual yield to purchase weekly at-the-money knock-out barrier options.

Outcome 1: ETH rises or falls but doesn’t breach the barrier, generating profit for the vault;

Outcome 2: ETH breaches the barrier, rendering the option worthless. However, since the option was purchased using the interest generated from the principal, you do not lose any principal.

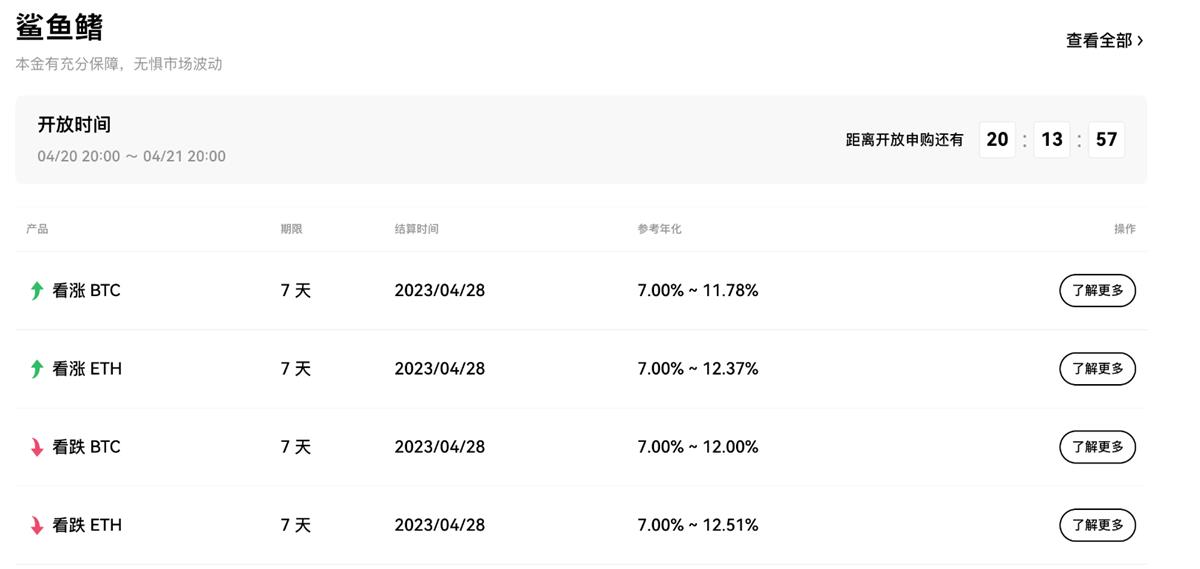

Actually, OKX offers a similar product called Shark Fin. But it’s unclear how they achieve such a high base APY.

Summary

Pros

-

Clean and attractive UI

-

Ribbon Finance is a well-established project, trustworthy

Cons

-

Low base APY

-

Product complexity—not everyone understands options

-

Although Ribbon is deployed across multiple chains, Ribbon Earn is currently only available on Ethereum

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News