After the merger, which narratives will become the new favorites in the crypto market?

TechFlow Selected TechFlow Selected

After the merger, which narratives will become the new favorites in the crypto market?

The narrative may shift after the event, so it's worth paying close attention in the coming days.

Written by: Jack Niewold

Translated by: TechFlow

The Merge might be the biggest cryptocurrency event in recent years, as it encompasses the most revolutionary network ever created along with its wealth and future.

I bet you're tired of hearing that by now.

According to the famous crypto market saying, "Buy the rumor, sell the news," meaning narratives may shift after an event occurs—making the coming days worth watching closely.

In the long term, being bullish on Ethereum is unquestionable. But the crypto market is fickle—the shift in attention happens faster than TikTok influencers losing popularity.

So what's next? What kind of narratives might emerge over the coming months? Which news events will excite the market? And where will opportunities appear for those who know how to observe?

Today, we’ll try to answer these questions and dive deep into what we believe is most interesting in a PoS Ethereum world.

Alt Layer-1s Make a Comeback

Narratives drive prices—at least at first glance.

I propose a different framework: What if the opposite were true? What if price actually drives narrative—and charts write the news stories?

If so, the following could happen:

- Post-Merge capital sells out of Ethereum;

- Capital flows into other Layer-1 blockchains;

- Other Layer-1s outperform Ethereum;

- Attention shifts from Ethereum to alt Layer-1s;

- An altcoin season begins, creating a positive feedback loop;

It seems the market is ripe for a breakout of new narratives. Regardless of what happens with the Merge, it appears to be a clear inflection point for the crypto market.

Although most L1s have underperformed ETH in 2022, we’ve seen a slight turnaround since mid-to-late August.

Could this be the beginning of a narrative shift?

We’re watching: Solana, ATOM, NEAR.

Doge Coins

Doge, Shiba Inu, Bone, Kibbleswap, and NitroDogeElonMars Inu are all terrible fundamental investments. I don’t think Dogecoin will be the future of finance, nor do I believe Shiba Inu will reach $1 (that would require more money than exists in the entire world).

So no, I don’t like dog coins—I hate them. But there’s no point in wasting a good bubble. While “Dogechain” has launched a series of Ponzi schemes, the better-prepared Shiba Inu community is launching a Layer-2 network built on Ethereum. Meanwhile, Berachain—a project once considered a joke—is also nearing official launch.

Opportunities abound for early explorers venturing into these strange territories. But proceed with caution—memes are wild and unpredictable.

We’re watching: SHIB, BONE, Berachain.

Airdrops

The native narrative in crypto is trading, but the low-risk version in Web3 is airdrops.

Yes, in crypto, people can get free money (though it requires patience, tolerance for uncertainty, and research).

When macroeconomic conditions are uncertain and trending downward, projects still have incentives to release their tokens: Optimism, Hop Protocol, and others have no choice but to airdrop tokens to users.

Who’s next?

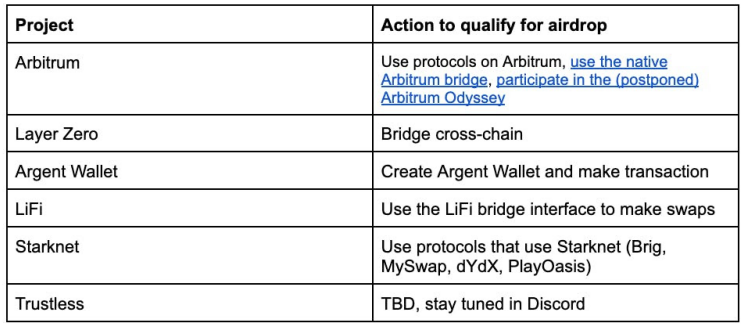

Arbitrum is likely the hottest expected airdrop, but we might also see token launches and community distributions from LayerZero, Argent Wallet, LiFi, Starknet, and Trustless.

How do you qualify? There are no guarantees, but we’ve put together a quick table below:

We’re watching: Arbitrum, Layer Zero, Argent, LiFi, Starknet, Trustless.

Merge-Related Tokens

While the Merge might temporarily overshadow Ethereum, it remains a paradigm shift—one that will benefit new business models such as:

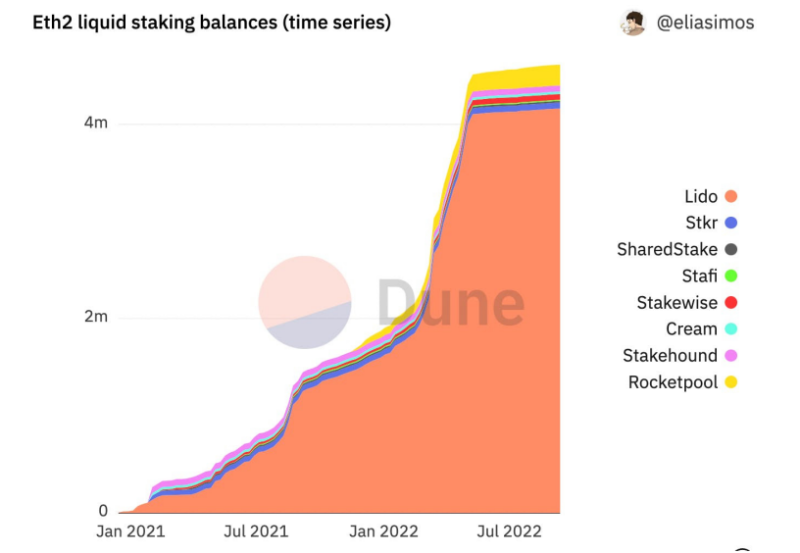

- Liquid staking derivatives, which users will eagerly adopt to earn new staking rewards;

- Liquid staking tokens, which will begin collecting entirely new streams of revenue;

- MEV-focused projects like Manifold Finance and Rook.

Liquid staking derivatives become more attractive—you can unstake anytime—and they’ll start trading at (near) 1:1 with ETH.

As market share and yields grow, revenues surge—liquid staking tokens like Rocket Pool, Lido, and Stakewise will begin reflecting their intrinsic value.

Finally, MEV projects—especially block builders like Manifold Finance—will start redefining their roles within PoS blockchains.

We’re watching: StETH, Lido, Rocket Pool, Stakewise, Rook, Manifold Finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News