What NFTs did Whale do bottom-feeding on? What's their bottom-feeding logic?

TechFlow Selected TechFlow Selected

What NFTs did Whale do bottom-feeding on? What's their bottom-feeding logic?

What is Whale's bottom-fishing portfolio and average bottom-fishing price?

Author: NFTGo

Key Takeaways

● During the mid-June downturn, whales followed this buying order: Bored Ape Yacht Club > Other Yuga Labs NFTs > Other blue-chip and emerging projects, with purchase types, entry prices, and capital size all playing a role.

● Among super-whales investing over $500,000, some focused on accumulating single NFTs while others built diversified portfolios. Most whales chose investment sizes between $100,000–$250,000, acquiring NFTs at varying average costs.

● By reconstructing specific whale purchases, we identified common strategies such as: buying in batches, increasing purchases during deeper declines, and employing unique “tactics” for bottom-fishing.

From June 7 to June 18, both the crypto market and NFT sector experienced sharp declines. Recently, however, the NFT market has begun to rebound. So, which NFTs did whales accumulate during this low point? What strategies did they use? Which whales participated in this buying opportunity, and what were their portfolio compositions and average entry prices?

Transaction Volume Increased During Market Lows

Since the beginning of this year, the cryptocurrency market has been in a downtrend. Over the past two weeks (June 7 – June 18), BTC prices continued to fall, dropping more than 40% within two weeks. Affected by Celsius, ETH also fell below $1,000 at one point.

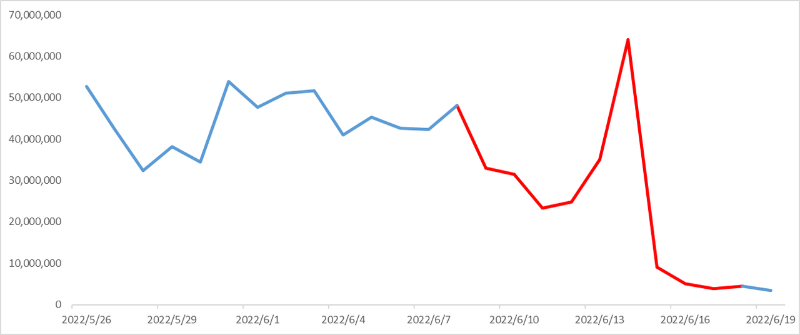

BTC Market Cap, Data Source: CMC

Likewise, the NFT market was impacted. OpenSea’s trading volume has generally trended downward recently. However, we observed unusual activity between June 7 and June 18. Despite the overall decline, there was a brief surge in NFT transactions, indicating significant turnover during this period. Therefore, we selected this timeframe for our analysis.

OpenSea Trading Volume Trend (6.7–6.18), Data Source: NFTGo.io

Which NFTs Did Whales Buy at the Bottom?

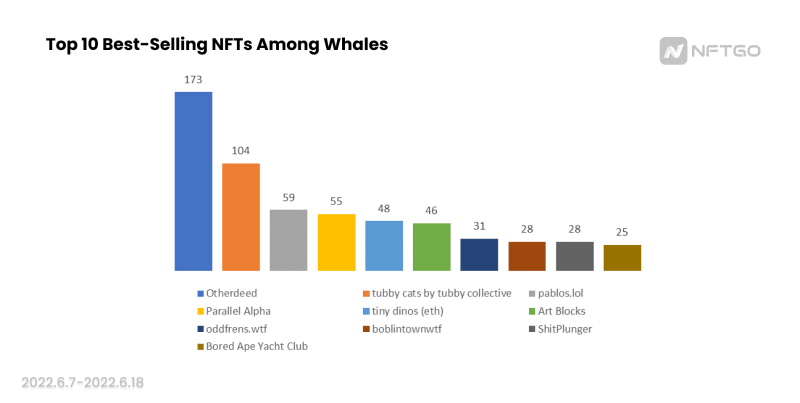

Top 10 NFTs Purchased by Whales (by Quantity)

After analyzing thousands of whale wallets, we first focus on the top 10 NFTs purchased by quantity. Notably, Otherdeed ranked first, with whales collectively buying 173 units at an average price of 6.22 ETH (~$9,410). Bored Ape Yacht Club ranked tenth, with whales purchasing 25 units at an average cost of 135 ETH (~$179,849).

In addition to blue-chip NFTs, we see several non-blue-chip projects in the list—such as Tubby Cats by Tubby Collective in second place, with whales buying 104 units. On-chain data reveals that most of these purchases were made by individual whales buying in bulk, possibly to accumulate supply or establish control. Most whales continued executing their NFT strategies even amid a 40% drop in BTC.

Top 10 NFTs Purchased by Whales (by Quantity, June 7 – June 18), Data Source: NFTGo.io

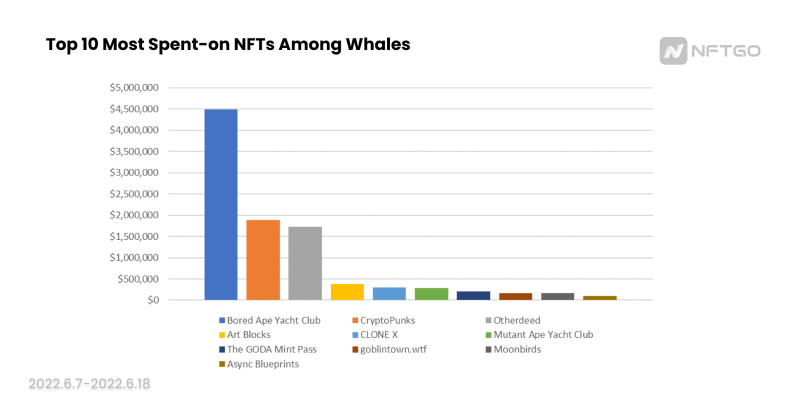

Top 10 NFTs Purchased by Whales (by Capital Invested)

By calculating quantity × price (USD) at time of purchase, we derive the top 10 NFTs by total capital invested—a ranking more aligned with general NFT market consensus. Between June 7 and June 18, despite BTC nearly halving, whales alone purchased $4.5 million worth of Bored Ape Yacht Club, $1.88 million of CryptoPunks, and $1.72 million of Otherdeed.

Notably, the top three are still NFT series from Yuga Labs, and Bored Ape Yacht Club's investment volume exceeds the combined total of second and third place. This clearly shows whales’ buying preference during market crashes: Bored Ape Yacht Club > Other Yuga Labs NFTs > Other blue-chip and emerging projects.

Top 10 NFTs Purchased by Whales (by Capital Invested, June 7 – June 18), Data Source: NFTGo.io

Which Whales Were Buying at the Bottom?

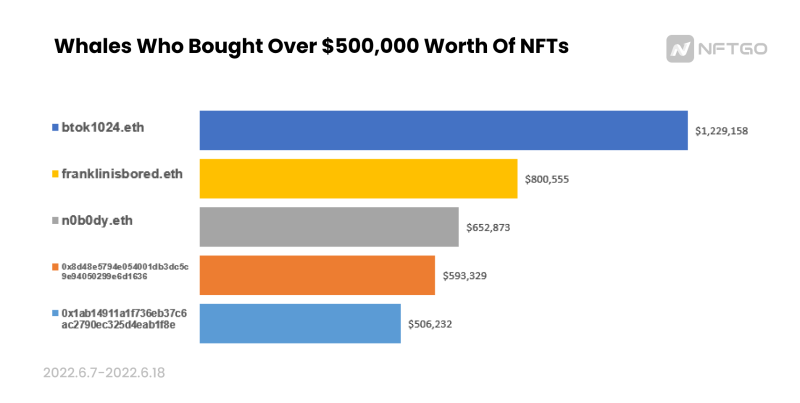

Given the high volatility of ETH during this period (June 7 – June 18), we use USD-denominated values to identify the largest buyers.

Super-whales purchasing over $500,000 in NFTs, Data Source: NFTGo.io

As shown above, five super-whales bought over $500,000 in NFTs. The top three focused on relatively few NFT types.

For example: btok1024.eth ranked first, buying only one Bored Ape Yacht Club for 1024 ETH—an extreme outlier case. Second, franklinisbored.eth bought seven Bored Ape Yacht Club NFTs. Third, n0b0dy.eth acquired 17 Otherdeed NFTs.

Starting from the fourth whale, diversification begins: one whale bought a combination of [2 Meebits + 6 Doodles + 9 Bored Ape Kennel Club + 3 Bored Ape Yacht Club + 5 Clone X + 2 Moonbirds + 2 Otherdeed]. The fifth whale chose [4 Murakami.Flowers + 4 Bored Ape Yacht Club + 2 Clone X].

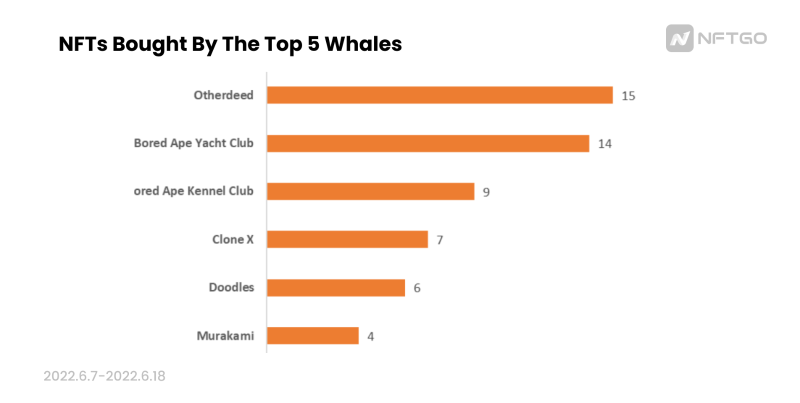

NFTs Purchased by Top 5 Super-Whales, Data Source: NFTGo.io

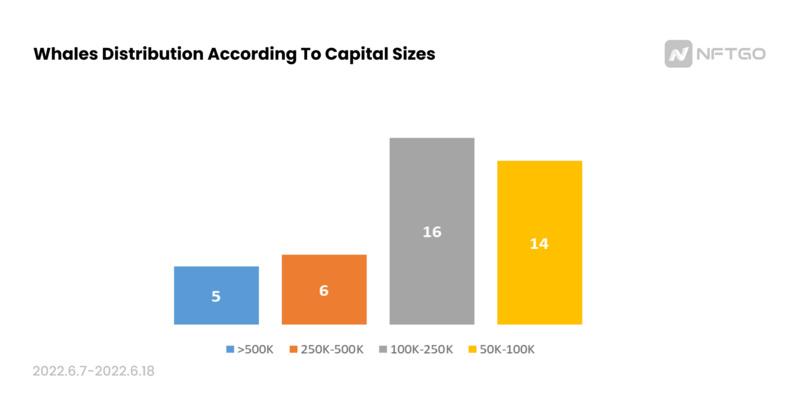

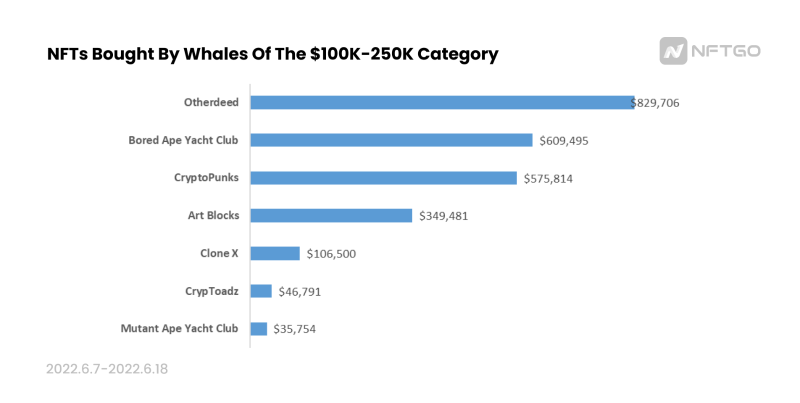

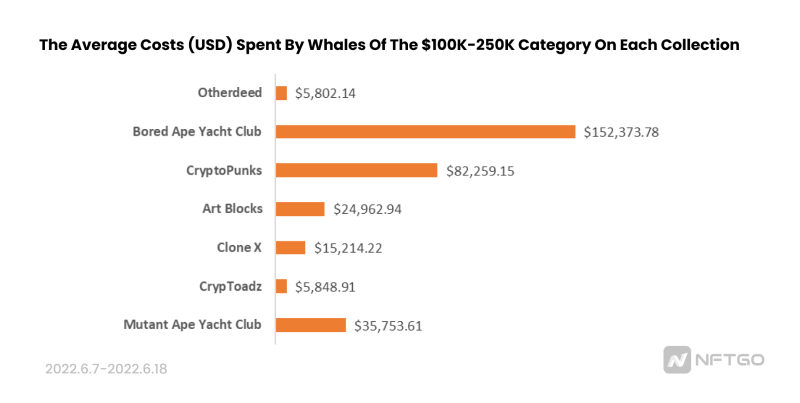

Among whales investing over $50,000, excluding the top five super-whales, those deploying $100,000–$250,000 were the most numerous, totaling 16. The NFTs they bought, ranked by investment amount, were: Otherdeed, Bored Ape Yacht Club, CryptoPunks, Art Blocks, and Clone X, with average entry prices of $152,373.80, $82,259.15, $35,753.61, $24,962.94, and $15,214.22 respectively.

Distribution of Whales by Investment Size, Data Source: NFTGo.io

NFTs Purchased by Whales ($100K–$250K), Data Source: NFTGo.io

Average Entry Prices for Whales ($100K–$250K), Data Source: NFTGo.io

What Strategies Did Whales Use to Buy the Dip?

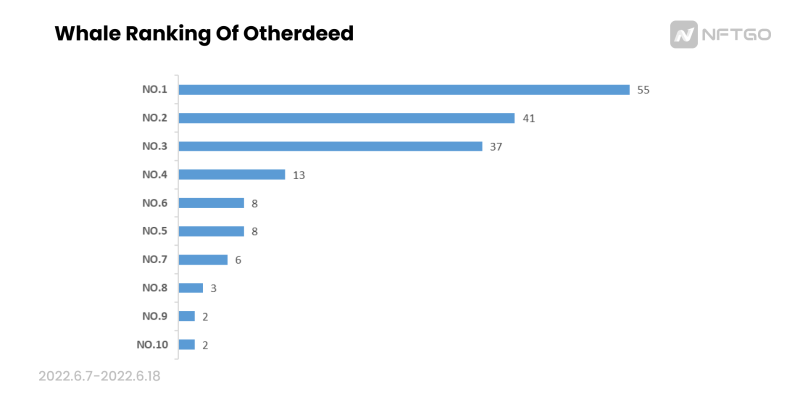

Among the top 10 whales who bought the most Otherdeed NFTs during the selected period, the top buyer acquired 55 units for 112.97 ETH (~$160,000 at the time). As of June 21, the floor price of Otherdeed was 2.4 ETH, giving this whale an unrealized profit of 19.25 ETH (a 17% return). Let’s examine how this whale executed his $160,000 accumulation strategy.

Top Whales by Otherdeed Purchases (June 7 – June 18), Data Source: NFTGo.io

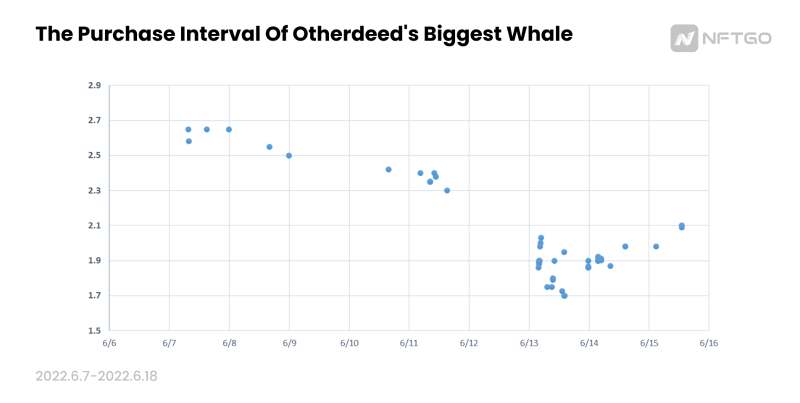

Starting June 7, as the floor price of Otherdeed declined, this whale began gradual purchases. From June 7 to 8, he bought 6 units near the floor price, averaging 2.596 ETH each.

On June 9, when the floor dropped below 2.5 ETH, he bought 10 more at an average of 2.368 ETH, reducing his short-term average cost to 2.45 ETH.

On June 12, as prices accelerated downward to 1.8 ETH, he completed his final batch, purchasing 39 units at an average of 1.89 ETH, bringing his overall short-term cost down to 2.05 ETH.

Purchase Timeline of Top Otherdeed Whale, Data Source: NFTGo.io

Otherdeed Price Chart (6.7–6.18), Data Source: NFTGo.io

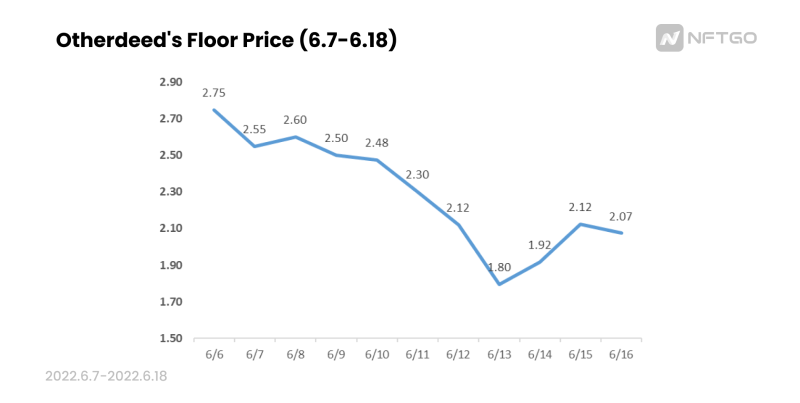

Overall, his strategy was progressive accumulation: the deeper the drop, the larger the purchase. He divided his buys into three price ranges: 2.5–2.7 ETH (6 units), 2.3–2.5 ETH (10 units), and 1.7–2 ETH (39 units), successfully controlling his average cost around 2.05 ETH.

Notably, when Otherdeed prices started recovering from June 13 to 15, he didn’t stop—he kept buying. This suggests the whale had his own valuation model and believed prices were still within his “accumulation zone,” allowing continued purchases even after the lowest point.

Interestingly, of his 55 purchases, 34 were made via offer bids and 21 through direct buys—this is his “little trick.” It also implies that during downtrends, sellers are more likely to accept offer bids.

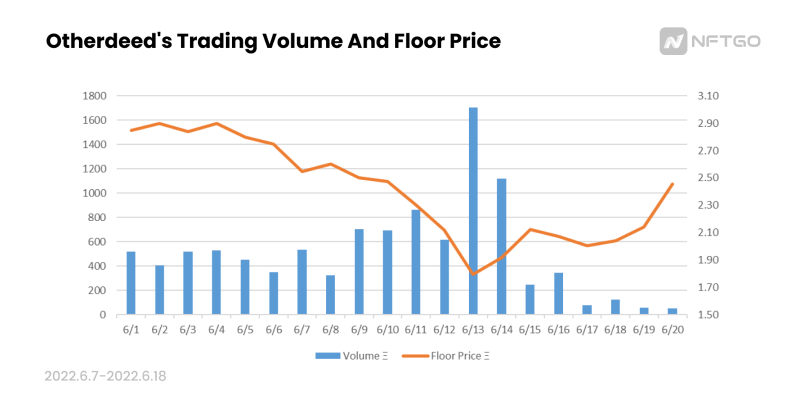

Looking at Otherdeed’s price action, on June 13, the floor hit its low of 1.8 ETH while trading volume peaked—confirming that not just whales, but many others also chose to buy the dip at this level.

Otherdeed Price and Volume, Data Source: NFTGo.io

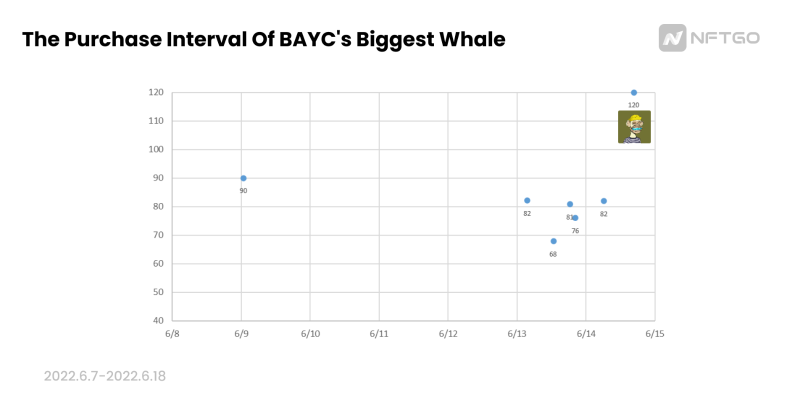

Now let’s examine the whale who bought the most BAYC during June 7–18 and analyze his “bottom-fishing” approach.

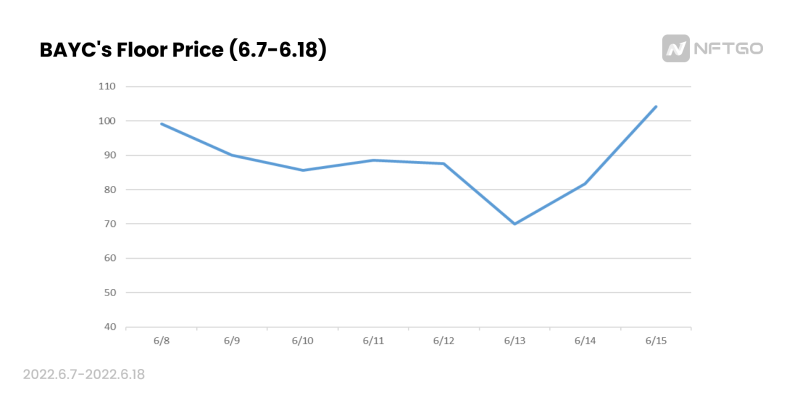

Starting from June 7, when BAYC dropped 10%, he bought 1 unit. On June 13, when the decline reached 20%, he resumed buying, purchasing 5 units in the 20%–30% drop range, keeping his short-term average cost around 80 ETH. On June 14, he acquired a top 10% rarity BAYC from LooksRare for 120 ETH.

Purchase Timeline of Top BAYC Whale, Data Source: NFTGo.io

BAYC Price Chart (6.7–6.18), Data Source: NFTGo.io

This whale used a tiered strategy, buying floor-priced BAYCs in stages based on price drops. He purchased incrementally every time prices fell another 10%. Additionally, he selectively accumulated higher-rarity BAYCs.

Based on this analysis, we can summarize several whale accumulation principles:

1. For individual NFTs, buy in batches (typically 3 tranches) once prices enter your estimated value range.

2. Buy based on price decline, not timing—the deeper the drop, the larger the purchase.

3. Try using offer bids to acquire NFTs at discounts.

4. For major blue-chips, accumulate by rarity tiers; for newer blue-chips, build diversified portfolios.

5. Consider using multiple platforms like X2Y2 and LooksRare, not just OpenSea.

Note: This article is for research purposes only. The views expressed are solely those of the author and do not necessarily reflect or represent the opinions of NFTGo.io. Investing in digital assets (such as NFTs) carries risks. Please consult a financial advisor before making any investment decisions. NFTGo does not provide investment advice and assumes no responsibility for losses resulting from digital asset investments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News