2026 Outlook: After Retail Traffic and Institutional Participation, Where Is BNB Chain Headed Next?

TechFlow Selected TechFlow Selected

2026 Outlook: After Retail Traffic and Institutional Participation, Where Is BNB Chain Headed Next?

Why Did Top Global Asset Management Firms and Hundreds of Millions of Retail Investors Unite on BNB Chain in 2025?

Author: Viee I Biteye Content Team

Recently, news of Twitter integrating transaction features has sparked renewed discussions around entry points. Amid increasingly fierce competition for traffic gateways, BNB Chain has quietly charted a different course—and will continue to double down on this path through 2026.

Looking back over the past few years, BNB Chain has consistently been a popular hub for retail traders. Low fees, fast speeds, seamless trading experience, and user traffic naturally funneled from Binance have made it the starting point into crypto for countless users. In 2025, meme coin activity on BSC heated up once again. Yet rather than cooling off after the hype, BNB Chain attracted more traditional institutions. BlackRock, Franklin Templeton, CMB International (CMBI), Circle, and others began deploying assets onto BNB Chain, creating a new ecosystem where institutions, retail investors, and projects coexist.

Next, we’ll reconstruct this evolution across multiple dimensions and examine how BNB Chain has become a key platform for the convergence of TradFi and crypto.

I. In 2025, BNB Chain Is No Longer Just a Playground for Crypto Retail

If you look at the numbers alone, BNB Chain delivered comprehensive growth in 2025:

- Total unique addresses surpassed 700 million; daily active users exceeded 4 million

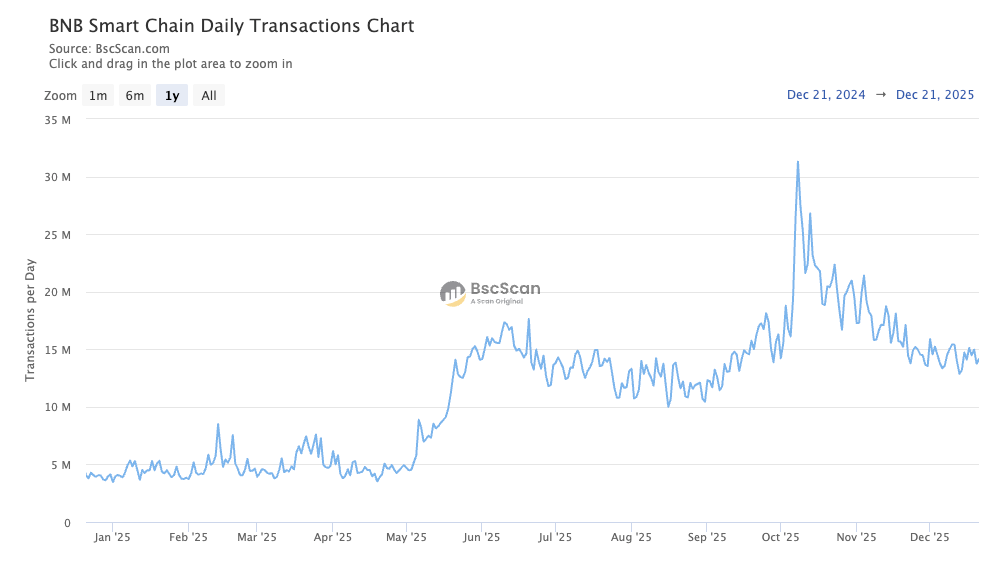

- Daily transaction volume peaked at 31 million in October

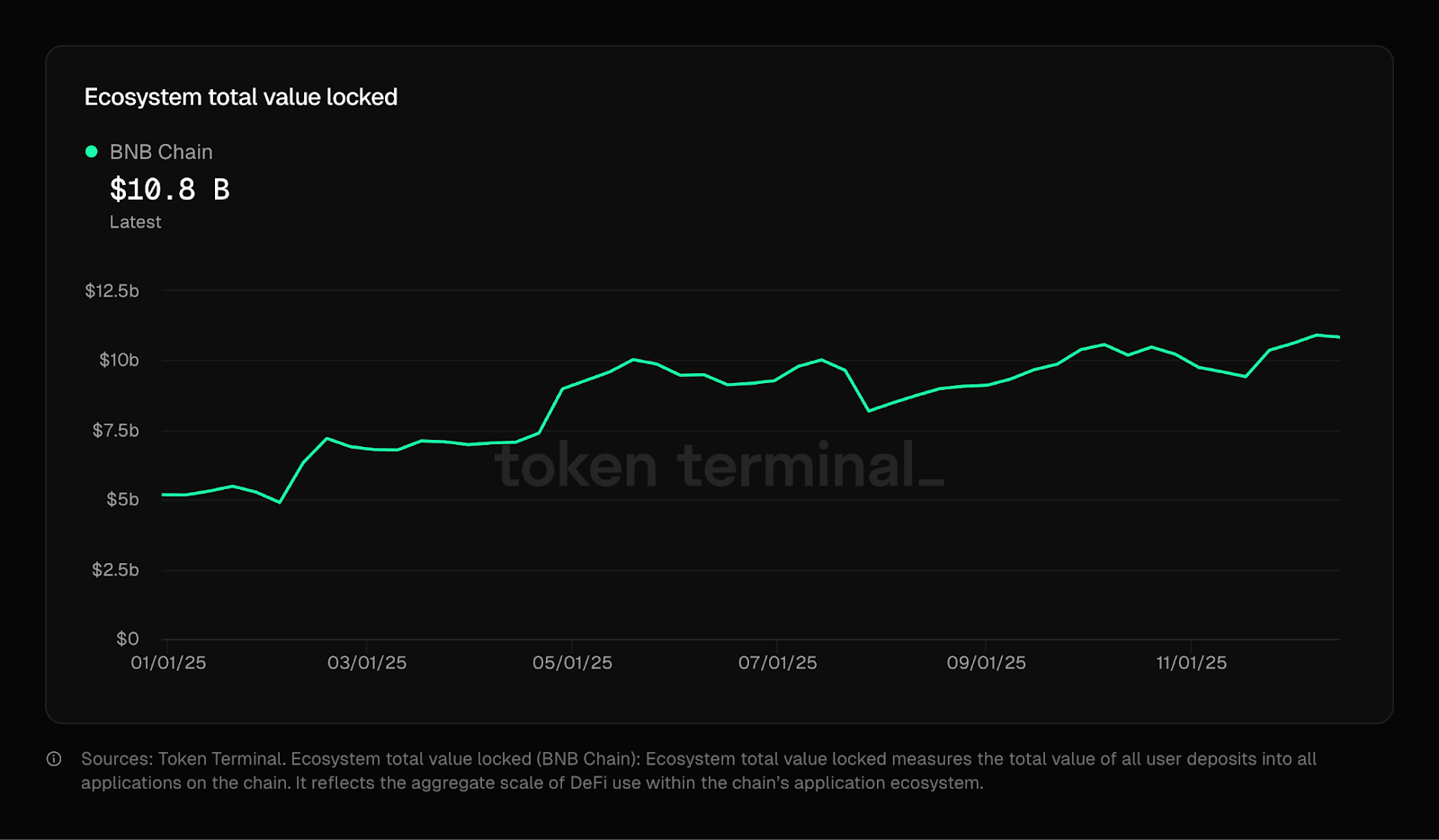

- TVL grew 40.5% year-on-year

- Total stablecoin market cap doubled to $14 billion

- On-chain compliant RWA assets reached $1.8 billion

Figure: Daily Transaction Volume on BNB Chain

Figure: TVL (Total Value Locked) on BNB Chain

These figures demonstrate that BNB Chain has withstood long-term validation across real-world use cases—stablecoin transactions, asset transfers, and high-frequency interactions.

Beyond raw data, what users feel most is the vibrant on-chain atmosphere. In the first half of 2025, multiple meme coin rallies emerged via platforms like @Four_FORM_, triggering rapid surges in tokens such as $FLOKI, $Cheems, and $BROCCOLI, making BNB Chain a hotspot for retail traders once again. In the second half, a new wave led by Chinese-language meme coins like $BinanceLife ignited enthusiasm within the Chinese-speaking community.

After the heat subsided, meme trading volumes declined—but interest in stablecoins kept rising. Stablecoins like $USDC, $USDT, $USD1, and $U became widely used across payments, lending, and yield-generating products. Meanwhile, institutions like Circle and BlackRock began bringing stablecoins or money market funds on-chain, with BNB Chain serving as one of the first hosting platforms—indicating that these assets are not just passing through but establishing long-term presence.

In 2025, BNB Chain experienced dual-track growth: cyclical bursts of meme-driven traffic on one side, and steady inflows of traditional financial assets, expanding usage of stablecoins and real-yield products on the other. This signals that BNB Chain’s ecosystem is now capable of supporting long-term capital applications.

II. Why BNB Chain? Three Reasons Traditional Institutions Chose It

In 2025, several heavyweight financial institutions launched operations on BNB Chain, spanning stablecoins, money market funds, and yield-bearing assets:

- BlackRock: The world’s largest asset manager tokenized its USD cash management fund BUIDL via Securitize and deployed it on BNB Chain.

- CMB International (CMBI): Launched CMBMINT, a money market fund token worth $3.8 billion, enabling qualified investors to subscribe and redeem on-chain.

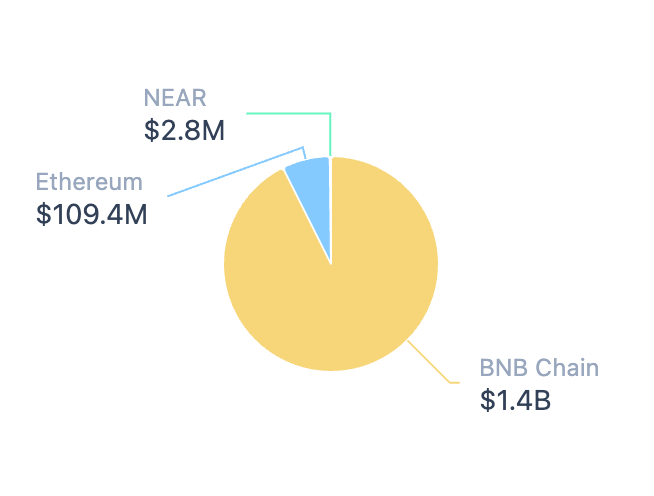

- Circle: Deployed its yield-bearing stablecoin USYC on BNB Chain. According to RWA.xyz, total supply of Circle's USYC has surpassed $1.5 billion, with over $1.4 billion deployed on BNB Chain.

Figure: BNB Chain USYC Surpasses $1.4 Billion

Why did traditional institutions favor BNB Chain? From these cases, three core reasons emerge:

1. Low Cost, High Performance: Known for high throughput and low gas fees, BNB Chain is ideal for high-frequency financial applications. Compared to Ethereum’s expensive and often congested mainnet, BNB Chain offers a more efficient environment, allowing institutional products to operate smoothly on-chain.

2. Massive User Base: Leveraging Binance’s years of global expansion, BNB Chain boasts one of the most diverse user bases, especially strong in Asia and emerging markets. This gives institutional assets immediate access to a vast audience. For example, BUIDL can be used as collateral within Binance’s CEX system, instantly reaching tens of millions of users.

3. Mature Infrastructure & Seamless Capital Flows: After years of development, BNB Chain’s DeFi ecosystem is robust—featuring stablecoins, DEXs, lending, derivatives, and more. This allows newly issued institutional tokens to plug directly into existing on-chain applications. For instance, CMBMINT is supported as collateral on @VenusProtocol and @lista_dao.

In short, BNB Chain combines technical strengths with solid ecosystem foundations—meeting TradFi demands for performance and compliance while offering broad user reach and application scenarios. It’s no surprise it became the go-to blockchain platform for traditional institutions in 2025.

III. BNB Chain’s Symbiotic Ecosystem: How Retail, Institutions, and Projects Coexist

With the arrival of TradFi players, BNB Chain’s user composition has grown more complex. By 2025, an interesting phenomenon emerged: retail users, institutions, and project teams operate independently yet harmoniously on the same chain.

Retail Users: Still Active, Driven by Profit

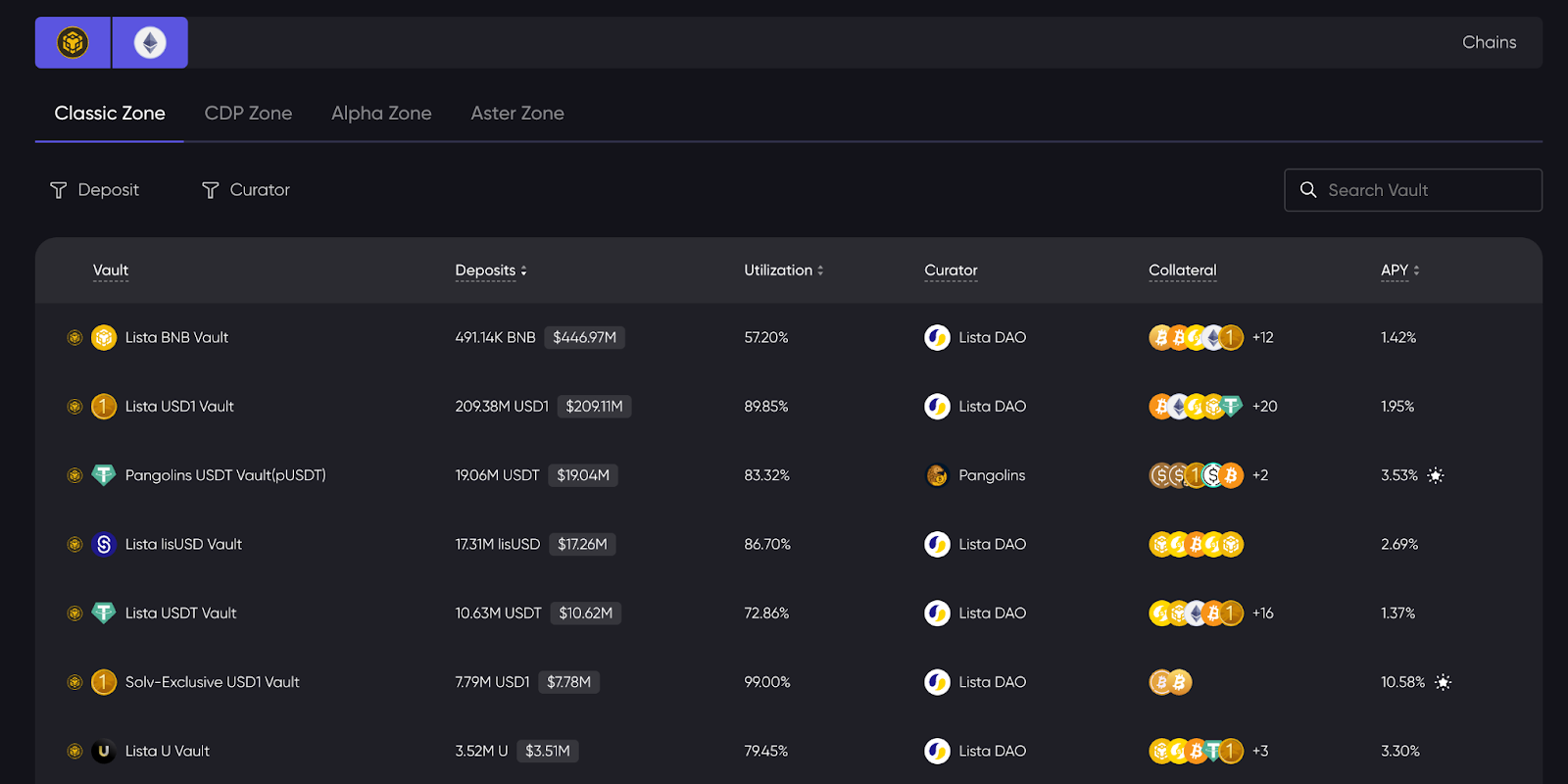

Despite growing institutional presence, retail activity on BNB Chain remains undiminished. In 2025, meme coin rallies on platforms like Four.meme significantly boosted on-chain transaction volume and even pushed BNB price to a record high near $1,300. PerpDex platforms like Aster offer high-leverage tools, and the low-gas, high-TPS environment enables frequent intraday trades. Beyond trading, retail users also earn passive income via on-chain vault strategies—for example, ListaDAO has launched over ten vaults including BNB, USD1, and USDT.

Figure: ListaDAO Vault Interface

The presence of institutional products hasn’t disrupted retail experience—in fact, deeper liquidity pools and richer asset offerings have opened up new strategy combinations.

Institutions: Issuers Anchored in Yield

Upon entering BNB Chain, TradFi institutions primarily act as issuers and capital providers, bringing real-world assets (such as fund shares, bonds, stablecoins) on-chain.

Their role extends beyond product subscriptions. For example, Venus Protocol allows RWA and stablecoins to serve as collateral for on-chain lending, reducing idle capital. Through automated liquidation, real-time settlement, and disintermediated processes, BNB Chain dramatically cuts down operational complexity and time costs inherent in traditional finance.

Projects: Bridging Retail Traffic and Institutional Assets

Native projects like PancakeSwap, Lista DAO, and Venus continue serving retail and crypto-native investors with decentralized trading, lending, and yield aggregation. At the same time, they’ve begun integrating institutional RWA assets and yield-bearing stablecoins, creating utility for traditional assets on-chain. For example, Venus quickly added CMBMINT as collateral, while Lista DAO deeply integrated institutional stablecoin USD1. Crucially, this integration doesn't conflict with retail users—it expands the entire ecosystem.

Overall, BNB Chain stands out as one of the few ecosystems where retail users, institutions, and projects can coexist, each fulfilling their own needs without interference, while still enabling synergy:

- Retail drives activity and engagement;

- Institutions bring scale and asset diversity;

- Projects design yield structures that connect both.

This balance is possible because BNB Chain embraces maximum openness and compatibility—it isn’t built for one type of user, but serves as an open platform for all roles.

IV. Project Transformation on BNB Chain: From Traffic Games to Real Revenue

After meme coin hype faded, projects on BNB Chain adapted by introducing more sustainable, real-yield models:

- ListaDAO: Built a full-cycle system of collateralization, borrowing, and yield generation using stablecoins like USD1 and U, achieving over $2 billion in TVL.

- Aster: Expanded from perpetual futures to on-chain U.S. stock derivatives and launched its USDF series of stablecoins. Aster is shifting from reliance on trading fees to becoming a diversified financial platform.

- PancakeSwap: As the longest-standing DEX on BNB Chain, it’s quietly transforming—reducing CAKE inflation, retiring outdated staking products, launching stock perps, and announcing AI-powered prediction market Probable.

Behind these shifts lie three clear signals of ecosystem restructuring on BNB Chain:

1. Meme-driven traffic is fading; users now prioritize viable yield models

The old playbook—launching tokens for hype and volume—is no longer enough to retain capital. Users now care whether yields are genuine, not just how compelling the narrative sounds.

2. Integration with real-world assets to build sustainable product structures

We’re seeing on-chain products actively incorporate traditional capital to meet dual demand: retail desire for stable returns and institutional need for compliant assets.

3. Protocols begin collaborating, moving toward organic symbiosis

A single stablecoin can now be used across lending, farming, and collateral—asset paths are no longer siloed. This indicates that BNB Chain projects are working together to build a powerful, interconnected on-chain network.

V. Outlook for 2026: BNB Chain’s Next-Phase Role

As 2026 approaches, the landscape around BNB Chain is subtly shifting. The decline in meme coin hype is only surface-level—the deeper challenge lies in the reshaping of competitive dynamics:

New user growth may plateau. Past reliance on memes to drive traffic is hard to repeat, and newly introduced institutional yield strategies haven’t fully matured yet—potentially slowing user acquisition.

Against this backdrop, BNB Chain’s trajectory for 2026 is becoming clearer:

1. Preferred Gateway for Real-World Asset Onboarding

BNB Chain has already proven its ability to support high-frequency trading and stable asset management, offering institutions a “safe, controllable, low-friction” path to on-chain asset deployment.

With rising stablecoin market caps, concentrated RWA project launches, and increasing openness from regulators and financial institutions worldwide, BNB Chain is poised to become a top-tier infrastructure choice across Asia-Pacific and beyond.

2. Testbed for Emerging Sectors: Prediction Markets, Privacy Modules

Beyond stablecoins and RWA, BNB Chain is exploring more forward-looking frontiers.

Prediction markets are experiencing diversified growth on BNB Chain: @opinionlabsxyz focuses on macro trading and has risen to become a leading platform; @predictdotfun innovatively uses prediction positions within DeFi to boost capital efficiency; @0xProbable offers zero-fee trading, emphasizing lightweight, high-frequency events; @42 tokenizes real-world events into tradable assets, pioneering the “event asset” model; and @Bentodotfun is gamifying prediction markets to create composable, social interaction formats.

Additionally, privacy coins outperformed the broader market in 2025, with on-chain usage steadily increasing. In 2026, BNB Chain is expected to integrate zero-knowledge proofs and other privacy technologies, enabling financial institutions to isolate and manage sensitive data on-chain.

3. Ongoing Protocol Optimization to Lower Barriers

Technically, BNB Chain will continue upgrading its base layer in 2026. For example:

- Targeting 20,000 transactions per second, with confirmation times reduced to nearly instantaneous—and potentially even lower gas fees.

- Privacy Framework: Configurable, compliance-friendly privacy mechanisms supporting both high-frequency trading and regular transfers, while preserving DeFi composability.

- AI Agent Framework: Offering identity registration, reputation scoring, and more for AI agents.

What happens when retail capital meets long-term institutional funds? When on-chain native yields meet real-world cash flows? BNB Chain’s 2025 performance offers a promising answer.

Moving into 2026, a new chapter begins.

Coexistence may become the defining theme of the next phase of crypto—and BNB Chain is undoubtedly one of the most watched testbeds.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News