Neo Bank Outlook 2026: The Triumvirate Battle Among Superform, Veera, and Tria—Who Will Become the Alipay of Crypto?

TechFlow Selected TechFlow Selected

Neo Bank Outlook 2026: The Triumvirate Battle Among Superform, Veera, and Tria—Who Will Become the Alipay of Crypto?

These three major projects represent different approaches to solving the same problem: how to make cryptocurrency as simple and user-friendly as traditional banking, while preserving the core feature of self-custody.

Author: Mesh

Compilation: TechFlow

January 6, 2026

I've been tracking the "wallet to bank" trend for several months now, and honestly, the pace of progress is astonishing.

By the end of 2025, three projects had reached significant transaction volume milestones—achieving what Metamask could not: converting your cryptocurrency into real spending power without touching a centralized exchange (CEX). Superform, Veera, and Tria are no longer just crypto wallets; they’re building real banks.

The data speaks for itself. By November last year, Tria was processing $1 million in daily transactions, with over 150,000 users and an annual recurring revenue (ARR) of approximately $20 million. Veera had expanded to 108 countries, reaching 4 million users. Superform’s total value locked (TVL) surged 300% in just six months, hitting $144 million.

This isn’t another DeFi 2.0 hype cycle. It’s an infrastructural shift—one everyone saw coming, but no one expected to arrive this fast.

Let’s dive deeper into these three projects, along with other potential contenders worth watching.

What Is an Onchain Neobank?

Let me break it down, because this term gets thrown around loosely.

An onchain neobank combines three traditionally hard-to-integrate elements:

- DeFi's Power: Yield optimization, staking, and cross-chain swaps.

- Traditional Banking UX: A debit card you can use at Starbucks, instant payments, and cashback rewards.

- Blockchain Abstraction: No exposure to gas fees, bridge interfaces, or network switching.

How is it different from Revolut or Coinbase? You control your private keys! How is it different from Metamask? You can spend crypto as easily as fiat—without worrying about which chain your USDC is on.

In short, this is the evolution that occurs when DeFi protocols realize ordinary users don’t want to manually bridge assets or calculate gas fees. They just want a card they can swipe.

One of the Big Three

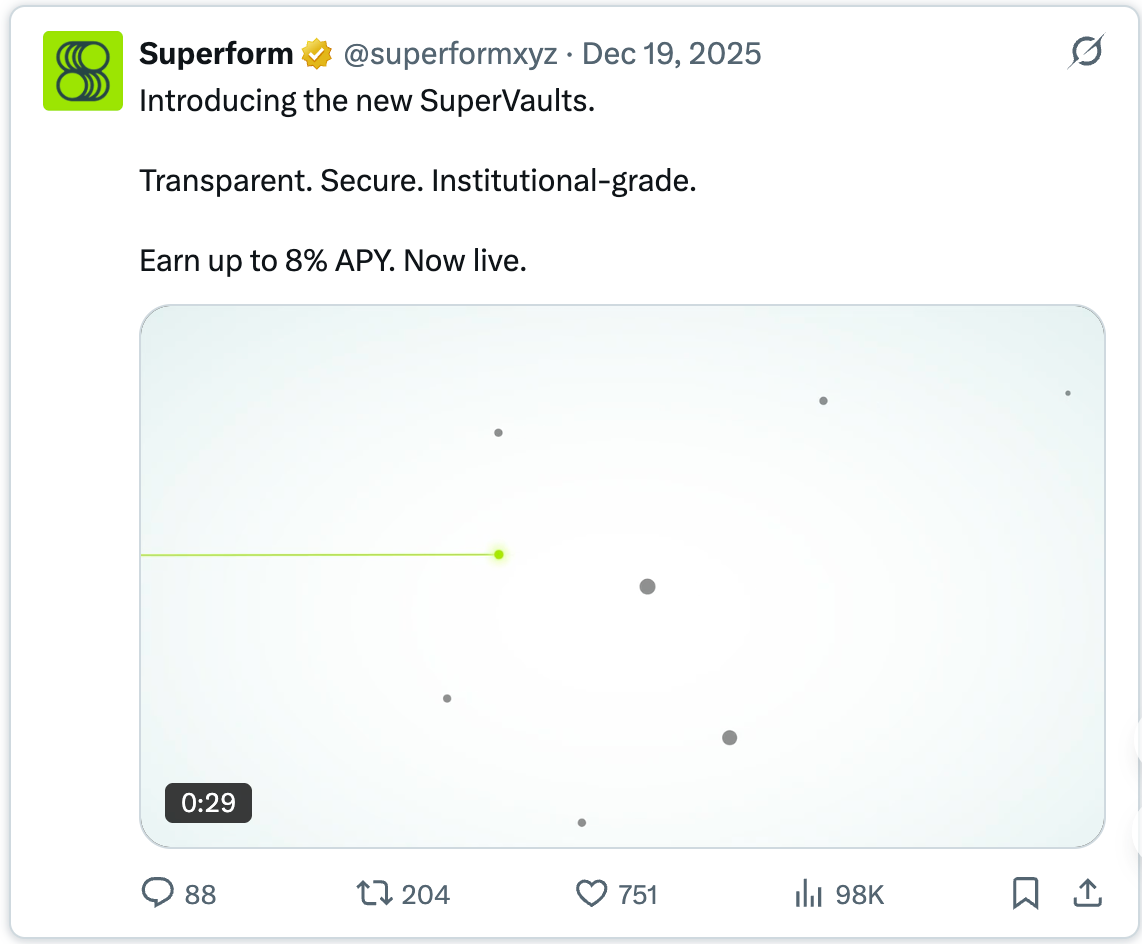

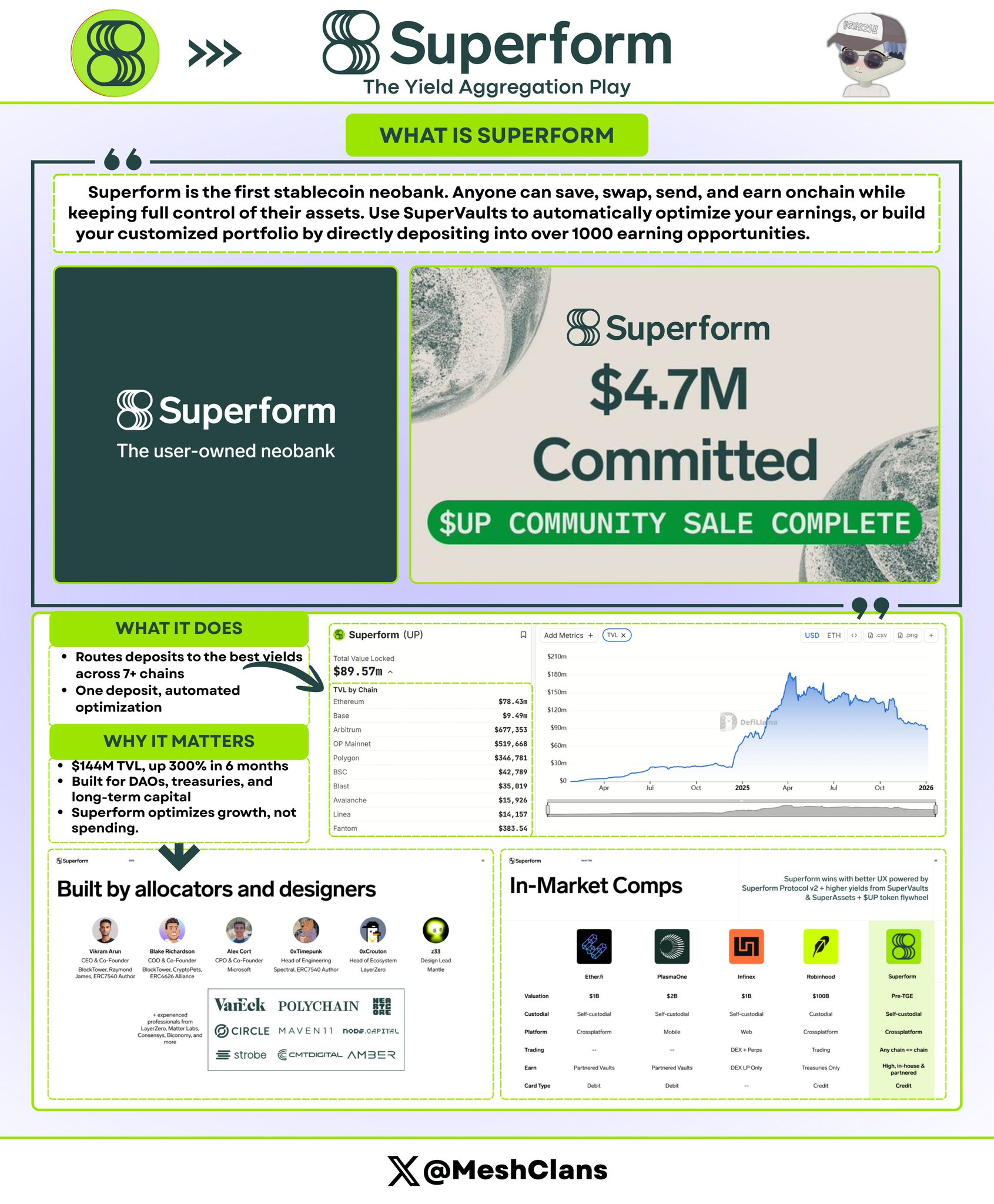

@superformxyz caught my attention back in mid-2025, when their primary users were institutional investors. Now, they’re positioning themselves as the “savings account” for onchain finance.

What Are They Doing?

Superform automates routing your funds into high-yield vaults across seven+ chains. Deposit USDC, and Superform finds the best APY—whether from Aave, Curve, or niche yield farms you’ve never heard of.

Performance Data (End of 2025):

- TVL: $144 million (up 300% in six months)

- Funding: $12.9 million raised across seed, strategic, and public rounds

- FDV: ~$90 million

Why It Matters?

Superform’s SuperVaults v2, launched in Q4 2025, changed the game. The “instant cross-chain deposit” feature lets you deposit on Base while Superform deploys funds to Arbitrum vaults in the background—no manual bridging, no waiting, all automated.

Previously, yield optimization required expertise: tracking APYs, calculating gas, timing bridges. Superform reduces it all to one click.

What Sets Them Apart?

Superform isn’t trying to be your spending app—it’s the savings backend layer of onchain finance. Unlike Tria, which focuses on capital flow efficiency, Superform prioritizes capital growth.

Additionally, Superform offers institutional-grade security (audited by Zellic and Omniscia), making it a “safe funds” option. Many DAOs and protocol treasuries park capital here—a strong signal of market trust.

Veera’s Trajectory Is Fascinating

@On_Veera has followed an interesting path. Starting as a reward browser (Brave-style), it evolved into a full financial operating system. Today, it serves over 4 million users across emerging markets largely ignored by Western VCs.

Key Stats:

- User Base: Over 4 million users across 108 countries

- Funding: $6 million seed round from Ayon Capital in February 2024

- Core Markets: India, Southeast Asia, Africa

Product Evolution:

From a simple “earn crypto by browsing” browser to:

- Browsing Rewards → Wallet → Staking/Yield → Payment Card (Q1 2026) → Credit (Q1 2026)

Roadmap for Q2 2026 includes physical debit cards and desktop wallet. Their iteration speed is rapid.

Why Veera Could Be a Giant?

Traditional banks won’t serve rural Indian users with $50 in savings. Revolut rarely enters much of Africa. Veera solves distribution by meeting real needs: mobile-first, low-balance friendly, deeply integrated into everyday browsing.

Their growth loop is clever: users earn small crypto rewards by browsing, then discover they can stake for yield or spend via payment cards. The onboarding is frictionless because value is immediate.

Competitive Angle:

Veera isn’t competing with Coinbase—it’s going head-to-head with Paytm, MTN Mobile Money, and M-Pesa. These fintechs dominate emerging markets where crypto adoption is rising fast but infrastructure remains weak.

Four million users in these markets are a dream for most crypto projects. If they execute the physical card rollout in Q2, they could scale like Paytm did.

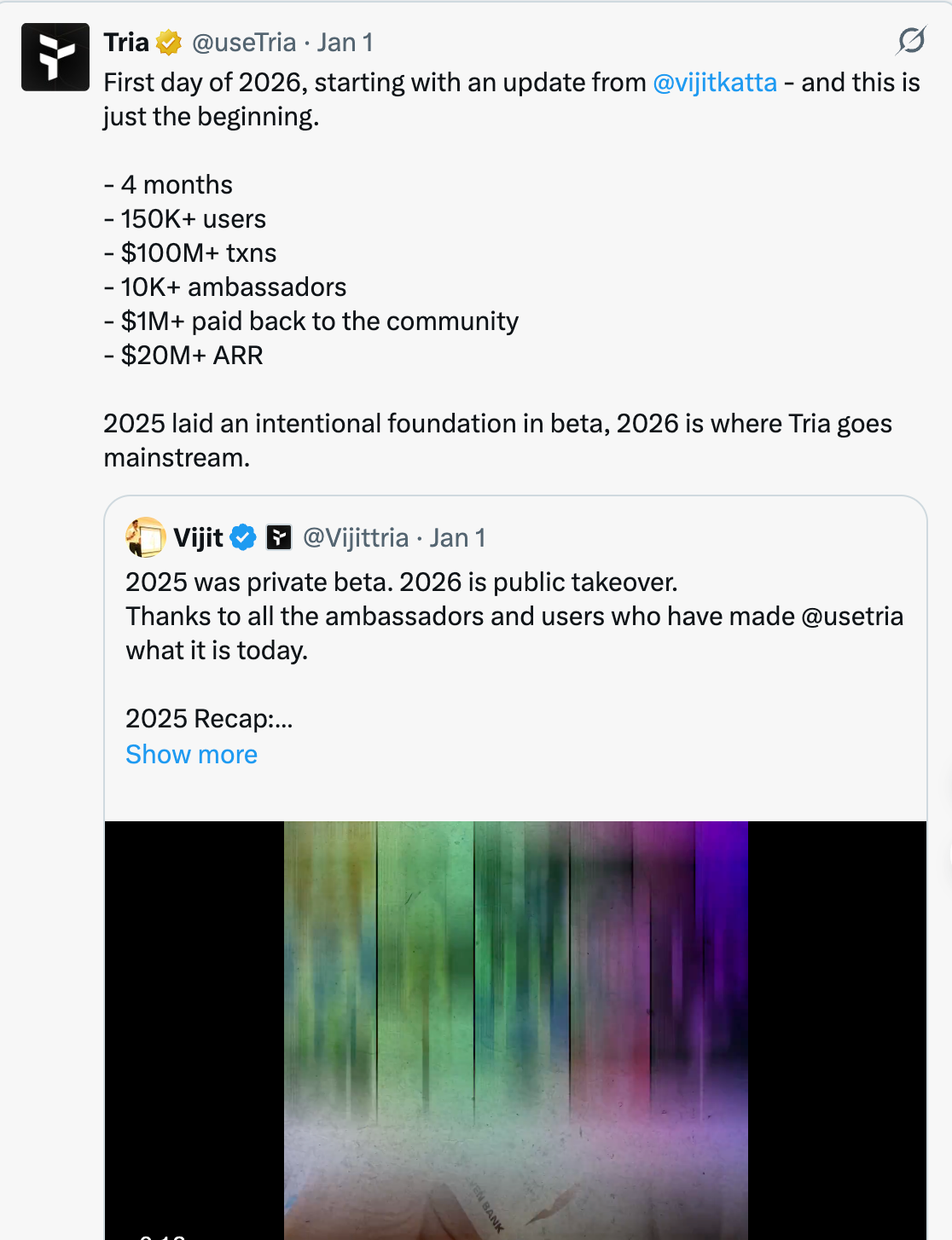

Tria: The Winner in Chain Abstraction

@useTria is one of the few projects I actually downloaded and tested in beta. The UX is refreshingly different.

Current Data (Early 2026):

- Active Users: 150,000+

- Beta Transaction Volume: $20M+

- Daily Spend: Breached $1M in November 2025

- ARR: ~$20 million

- Funding: Raised $12 million in October 2025

- FDV: Valued between $100–200 million

How Does It Work?

Tria’s “Unchained” infrastructure makes blockchain complexity invisible. Users maintain a unified balance across multiple chains. When spending, Tria’s “BestPath” engine:

- Checks your assets across chains;

- Finds the optimal liquidity path;

- Executes swaps or cross-chain moves in the background;

- Completes payment in seconds.

The experience is seamless: open app, tap pay, done. Blockchain operations happen silently behind the scenes.

Tria’s holiday campaign, Triasmas (their loyalty program), proved native crypto rewards can rival traditional credit card points. Users spent daily and earned cashback—proof of product-market fit.

Why It Matters?

Chain abstraction is key to making crypto usable for regular people. Other solutions still force users to think about networks, gas, and bridges. Tria eliminates all that friction.

A $1M daily spend proves real consumer demand—not yield farming or speculation, but actual spending: coffee, groceries, bills. With 150k+ users and $20M ARR, this is more than beta hype.

Positioning:

Tria is currently the closest thing to a traditional bank account in crypto. It wins on speed and simplicity, not blockchain complexity—making it the strongest candidate for mainstream adoption, even if hardcore crypto users may desire more control.

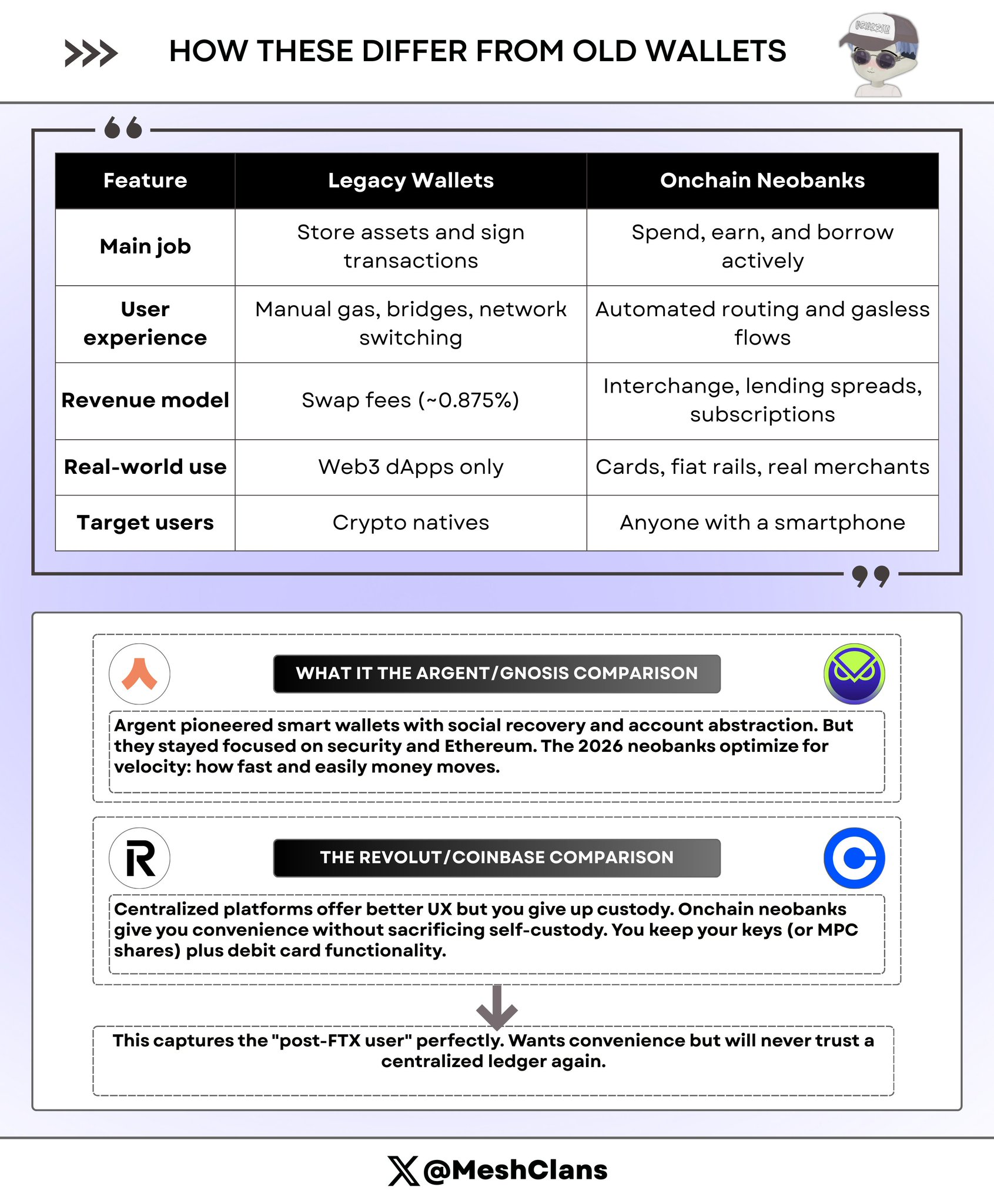

vs. Argent and Gnosis:

Argent pioneered smart wallets with social recovery and account abstraction—but focused on security and Ethereum. In contrast, 2026’s new onchain banks prioritize capital velocity: how to move money faster and easier.

vs. Revolut and Coinbase:

Centralized platforms offer better UX but require surrendering asset control. Onchain neobanks deliver similar convenience without sacrificing self-custody. Users keep their private keys (or MPC shares) and get debit card functionality.

Beyond the Big Three

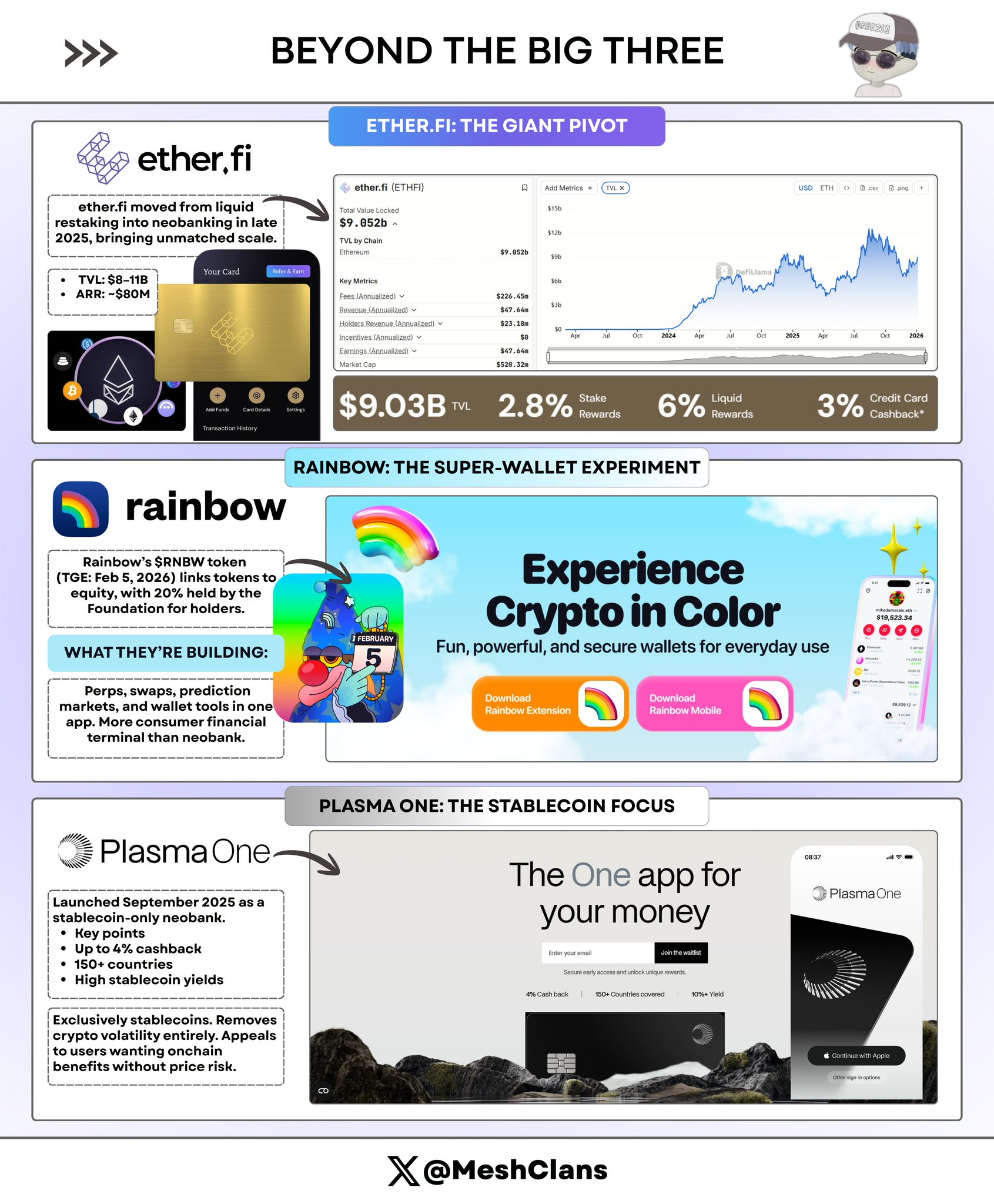

ether.fi: A Giant’s Strategic Pivot

@ether_fi started as a liquid restaking protocol but pivoted dramatically into onchain banking by late 2025—on a scale unlike any other.

Data (Late 2025 / Early 2026):

- TVL: $8B–$11B

- ARR: $80 million

- Product: Cash card with 3% crypto cashback

Innovation Highlights:

ether.fi’s cash card allows users to borrow against re-staked ETH (eETH) at ~4% APR without unstaking—earning re-staking yields while accessing liquidity for spending.

This elegantly solves the liquidity crunch for yield farmers.

With $8B–$11B TVL, ether.fi has become the “Chase Bank” of onchain neobanking. Its scale and liquidity support serious consumer lending, making it a major industry player.

Challenges:

Pivoting from DeFi infrastructure to consumer banking is tough. Despite its capital, ether.fi lacks Tria’s UX finesse or Veera’s distribution muscle. Execution matters more than TVL here.

Rainbow: Experimenting with the Super App

Rainbow plans to launch its $RNBW token (TGE) on February 5, 2026, with an innovative structure: the Rainbow Foundation will hold 20% equity to reward token holders.

What Are They Building?

Rainbow is developing a multi-functional mobile interface with perps, swaps, prediction markets, and wallet features. Think of it as a consumer-facing “Bloomberg Terminal,” not a traditional neobank.

Equity-Token Linkage:

This equity-backed token model is experimental. If successful, others may follow. If not, it could become a cautionary tale of overpromising.

Risks:

High risk of feature overload. Trying to do everything may dilute focus and weaken competitiveness against specialists. The upcoming February TGE will reveal whether the market values this model—or sees it as a gimmick.

Plasma One: Pioneer in Stablecoin-First Banking

Launched in September 2025, Plasma One positions itself as the “first stablecoin-native neobank.”

Features:

- 4% cashback

- Available in 150+ countries

- High yield on stablecoin balances

Unique Positioning:

By focusing solely on stablecoins, Plasma One eliminates crypto price volatility—appealing to users who want onchain benefits without market risk.

Core Question:

“First stablecoin-native” sounds more like marketing than a moat. Any competitor can add stablecoin-only modes. Ultimately, success depends on execution, not positioning.

Risks to Watch

Sustainability of Yields

Let’s be real. High returns like Veera’s browsing rewards or 15% APY are largely subsidized by VC funding and token emissions.

Remember Anchor’s 20% UST rate? We know how that ended—the collapse of the entire Terra ecosystem.

The same core question looms over 2026’s onchain neobanks: What happens when subsidies end?

Sustainable onchain banks need real revenue: card transaction fees, loan spreads, subscriptions. Projects burning token reserves to boost APY may not survive until the next funding round.

Tria’s $20M ARR sets a template: real revenue from real transactions, not token incentives.

Watch This: Whether projects disclose revenue sources and distinguish organic income from token subsidies. If they won’t share it, that’s telling.

Regulatory Uncertainty

Discussions around the 2025 Stablecoin Act introduced major uncertainty. If U.S. regulations require KYC for self-custodied “banks,” the industry could split:

- Compliant hybrid models (with institutional backing and regulatory infrastructure) will thrive in the U.S.

- Pure self-custody apps (like Tria and Superform) may geo-block U.S. users or add compliance layers—potentially undermining their core value proposition.

Europe’s MiCA regulations (2024–2025) brought clarity. Clear rules help legitimize projects but raise barriers to entry.

Key Question: Can these protocols adapt to regulation without losing their decentralized essence?

The Metamask Threat

Metamask has 30 million monthly active users (MAU) and massive brand recognition. For Veera or Tria to reach 10 million users, they must be vastly better—not just slightly.

Chain abstraction is a standout feature, but not an insurmountable moat. Metamask could roll out gasless transactions and unified balances within six months. If so, onchain banks’ edge shrinks to payment cards and yield optimization.

Defenses:

- Tria: Payment network (hard to replicate quickly).

- Superform: Yield optimization algorithms (more sustainable).

- Veera: Focus on markets Metamask hasn’t penetrated (geographic moat).

Who will win? Only time will tell.

Outlook for 2026

Most Likely to Hit 1M DAU First: Tria

Tria’s UX is already mature. $1M daily spend and 150k+ users prove strong consumer demand. If rumors of a Q1 Mastercard network integration come true, Tria could pull far ahead.

Chain abstraction matters most to mainstream users who don’t care about blockchain tech. They just want to buy coffee with crypto—no technical details needed.

$20M ARR shows Tria has achieved real product-market fit, not just beta buzz.

Safest Bet for Sustained Growth: Superform

Yield optimization survives every market cycle. Even if consumer-focused neobanks struggle, institutions (DAOs, protocols, treasuries) will keep funds in optimized vaults.

Superform’s focus on “stable funds” means lower volatility and steadier growth. Less flashy, more sustainable.

Most Likely Dark Horse: Veera

Four million users in India and Southeast Asia is unmatched in crypto. If Veera successfully launches physical payment cards in Q2, it could become the “Paytm of crypto.”

Its expansion in markets underestimated by Western VCs gives it massive untapped potential.

Most Likely to Be Acquired: ether.fi

With $8B–$11B TVL and $80M ARR, ether.fi is a prime acquisition target for Coinbase, Kraken, or traditional banks entering crypto. By late 2026, as legacy finance opts to acquire proven infrastructure rather than build from scratch, ether.fi is likely to be consolidated.

Common Traits of Onchain Banks

These three projects are fundamentally building a new kind of financial super app: combining DeFi’s power with traditional banking UX, all in a self-custodied onchain ecosystem.

Shared DNA:

- Non-Custodial Core: Users control keys and assets, avoiding risks of freezing or seizure on centralized platforms.

- Integrated Operating System: Earn, spend, and trade across chains in one app—no more juggling dozens of dApps like traditional wallets.

- Mass-Market Focus: Replace “read 47 docs on liquidity pools” with “earn more, do less.”

- Perfect Timing: Emerging in late 2025, they mark the post-DeFi 2.0 era. Better L2s, account abstraction, and real-world demand have converged to enable this shift.

Different Paths, Same Goal

- Superform: Yield optimization and institutional-grade infrastructure

- Veera: Global credit and yield operating system

- Tria: Consumer-facing payments and spending platform

Together, they’re defining a new category. “Onchain neobanks” are increasingly seen as an industry in their own right—not just isolated projects. This narrative momentum matters for fundraising, partnerships, and market perception.

Final Thoughts

Self-custody is becoming effortless. These three projects represent different approaches to the same challenge: making crypto as easy to use as traditional banking—while preserving self-custody.

Who Will Dominate?

Probably all three, serving different user segments. The crypto economy is vast enough to support multiple financial operating systems.

The real test: Can they move beyond crypto-natives to achieve mass mainstream adoption?

Late 2025 data suggests yes:

- Tria: $20M ARR

- Veera: 4M users

- Superform: $144M TVL

These metrics indicate sustainable growth—not just speculative hype.

2026 will determine whether this sector can fulfill its promise.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News