Is an AI bubble crisis looming? How tech giants could reenact the 2008 financial crisis

TechFlow Selected TechFlow Selected

Is an AI bubble crisis looming? How tech giants could reenact the 2008 financial crisis

Standing at the crossroads of genuine innovation and financial illusion.

By Bruce

Introduction: The Hidden Shadow Beneath the AI Boom

We live in an exhilarating era—the AI revolution is rapidly permeating every facet of life, promising a future that is more efficient and intelligent than ever before. Yet recently, a troubling signal has emerged: OpenAI, the world’s most prominent AI company, has publicly requested federal loan guarantees from the U.S. government to support its infrastructure expansion—a project potentially costing over one trillion dollars. This is not merely an astronomical figure; it is a stark warning. If the financial blueprint underpinning this AI boom bears a striking resemblance to the architecture of the 2008 financial crisis—which nearly collapsed the global economy—how should we respond?

Although the AI industry’s prospects and its potential for technological transformation are undeniably exciting, recent market developments have revealed unsettling signs of financial stress. Its underlying capital structure bears remarkable similarities to several historical financial crises—especially the 2008 subprime mortgage crisis. This article will dissect the capital flows, leverage mechanisms, and risk-transfer dynamics behind these warning signals, cutting through market narratives to conduct a stress test on the financial architecture supporting today’s AI valuations. Finally, we’ll assess the nature of the risks, outline plausible outcomes, and propose actionable strategies for investors.

Early Warning Signals: Oracle as the Canary in the Coal Mine

In this AI-driven boom, market sentiment remains broadly optimistic, with tech giants’ stock prices repeatedly hitting new highs. Yet, just as experienced miners once carried canaries into coal mines to detect toxic gases, anomalies in individual companies’ financial metrics can serve as early indicators of systemic risk across the entire sector—the “canary in the coal mine.”

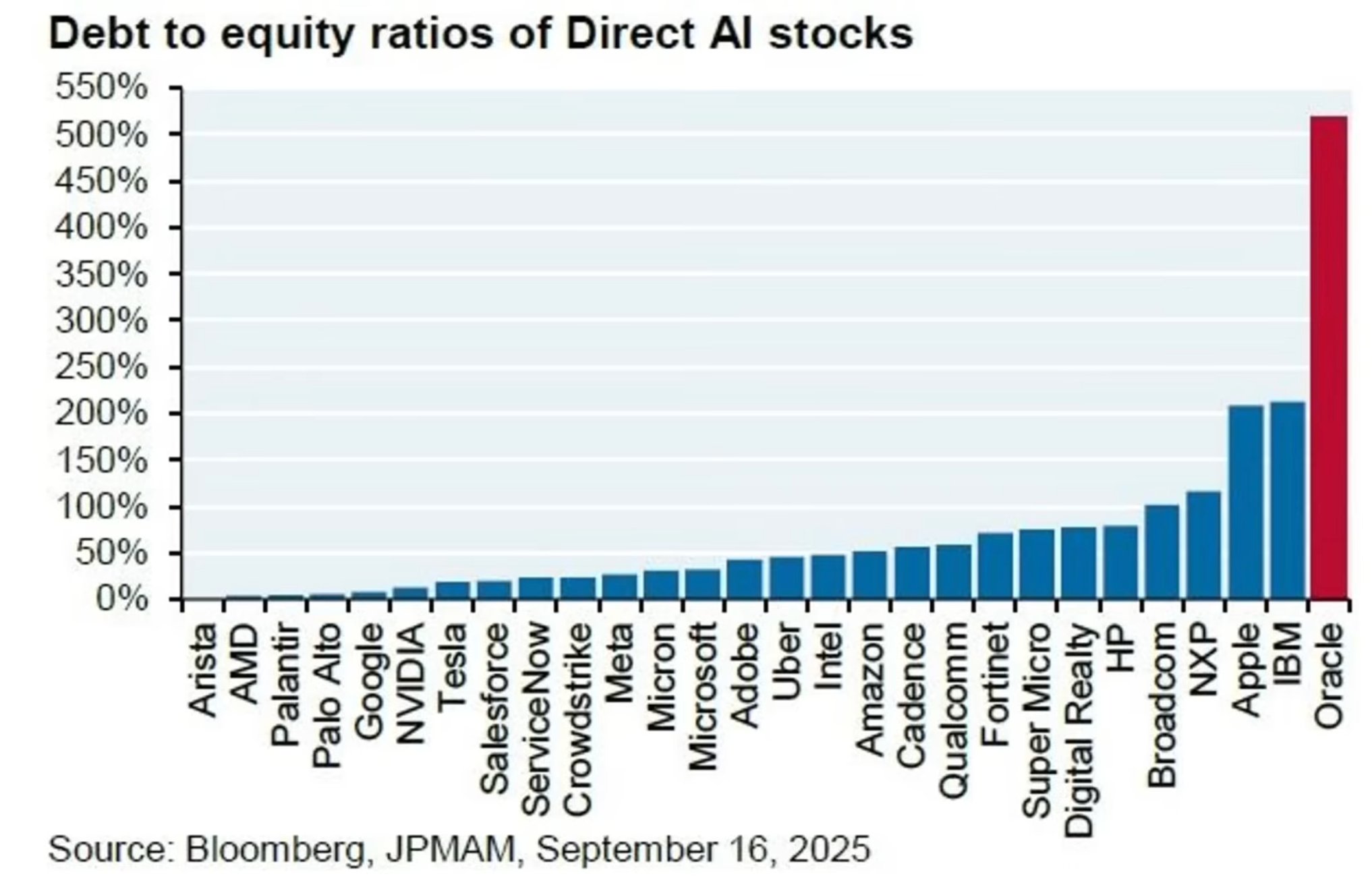

The Canary in the Coal Mine

Oracle, a veteran tech giant, is placing a high-stakes bet. To challenge Amazon, Microsoft, and Google’s dominance in the AI data center space, it is spending hundreds of billions of dollars—largely financed by debt—including its joint “Stargate” super data center initiative with OpenAI. Its debt-to-equity ratio has soared to a staggering 500%, meaning its total debt is five times its net worth. By comparison, Amazon’s debt-to-equity ratio stands at only 50%, and Microsoft’s is even lower. In simple terms, Oracle has essentially staked its entire corporate balance sheet—and its future value—on winning the AI race.

U.S. Tech Giants’ Debt Levels

This alarm is sounded via Credit Default Swaps (CDS). The most critical recent signal is the sharp rise in Oracle’s CDS spread—the insurance premium investors pay against the risk of Oracle defaulting on its debt. Think of CDS as financial fire insurance: imagine your neighbor (Oracle) piles highly flammable materials (mountains of debt) daily in their basement. You worry their house might catch fire—and even spread to yours. So you buy fire insurance on their home from an insurer, paying a premium—the CDS spread. A surging premium means the insurer sees dramatically heightened fire risk.

This phenomenon sends a clear message: the world’s top, most sophisticated financial institutions widely believe Oracle’s default risk is rising sharply—rooted squarely in its balance sheet, laden with “explosive” debt. Oracle’s debt alarm may look like a small crack on the surface—but it hints at violent tectonic shifts deep underground. What structural vulnerabilities does the very capital model driving the AI industry conceal?

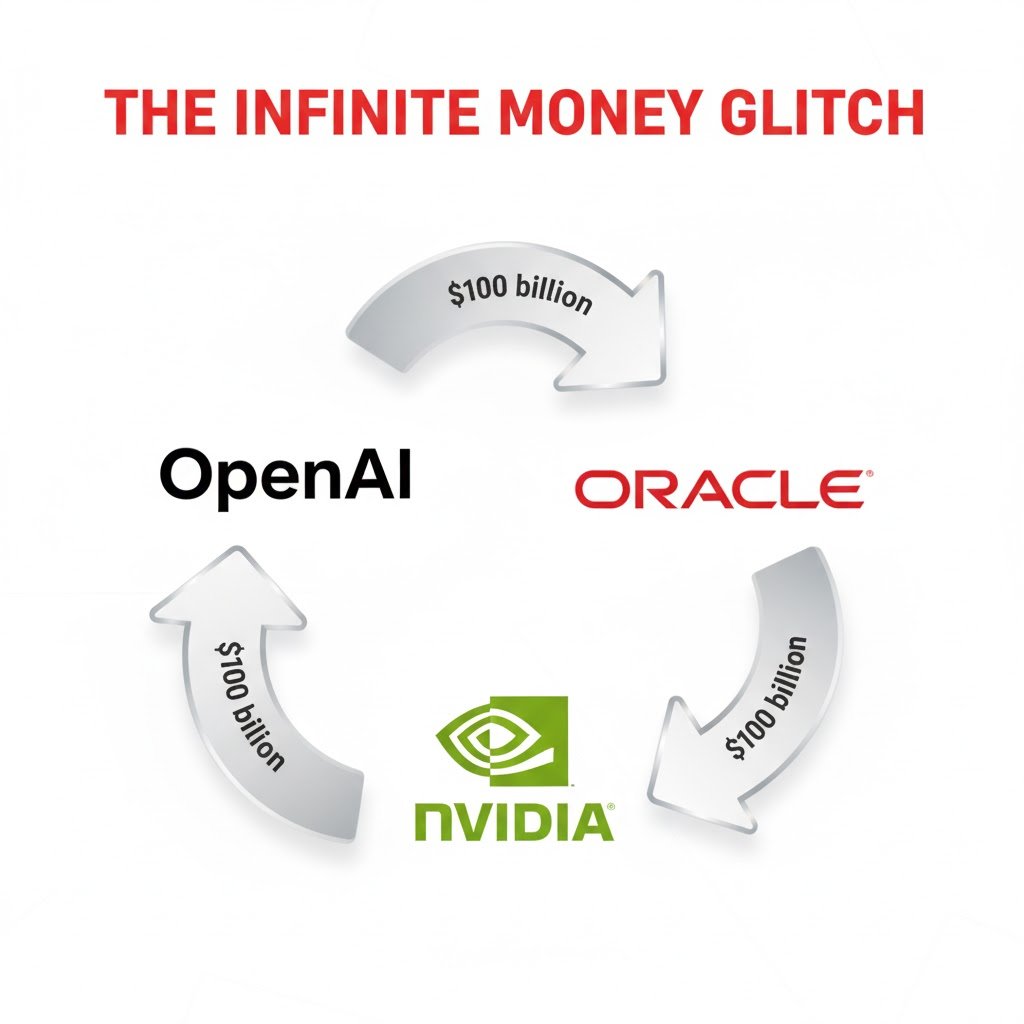

Deep Financial Architecture: The “Infinite Money Loop” Among AI Titans

The financial stress of any single company is merely the tip of the iceberg. When we zoom out from Oracle to examine the broader AI ecosystem, a deeper, structural risk emerges. The real danger lies in a unique capital operation among AI industry titans—a financial game that appears to transmute lead into gold but is, in fact, extremely fragile. This is the so-called “infinite money loop”: a closed-loop capital game that artificially inflates revenue, constructing a seemingly robust yet fundamentally brittle financial system.

To better grasp this model, consider a simplified “three friends starting a business” analogy:

- Step 1: Chipmaker Nvidia (Person A) invests $100 in AI star OpenAI (Person B).

- Step 2: OpenAI (Person B) immediately pays that full $100 to Oracle (Person C), ostensibly for expensive cloud computing services.

- Step 3: Oracle (Person C) then uses that same $100 to purchase high-performance AI chips from Nvidia (Person A), the original investor.

The Infinite Money Loop

After this cycle, the $100 returns to Nvidia. Yet although the money merely circulates internally—with zero revenue derived from external customers—all three companies report $100 in revenue on their financial statements. Their earnings appear miraculously strong, powerfully supporting lofty stock prices and market valuations.

The fatal flaw lies in the foundation: this entire game rests not on solid customer demand, but entirely on mutual commitments among participants—and on ever-expanding credit. Should any link in the chain break—for instance, if Oracle defaults due to excessive debt—the entire seemingly prosperous edifice could collapse instantly. This closed-loop capital circulation, where internal transactions jointly inflate revenue, is no financial innovation. Its structure eerily mirrors tactics used before certain past financial crises—prompting uncomfortable echoes of the storm that nearly destroyed the global economy.

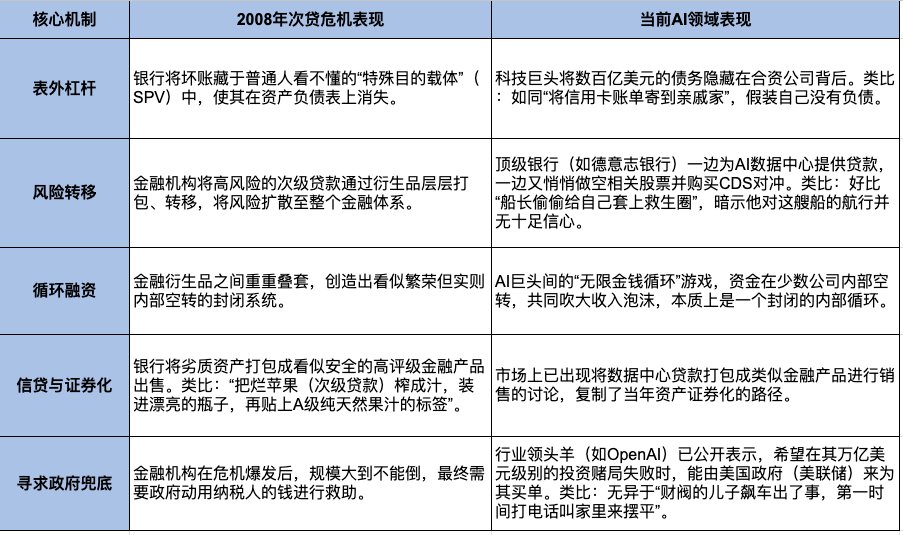

Historical Echoes: Five Striking Parallels Between Today’s AI Finance and the 2008 Subprime Crisis

Today’s financial phenomena are not isolated. Piecing together Oracle’s debt alarm and the AI titans’ capital loops evokes a disquieting sense of déjà vu for observers who lived through the 2008 financial tsunami. Below, we systematically analyze five key parallels between current AI-sector financial practices and the core drivers of the 2008 global financial crisis—revealing how history may be repeating itself in a new guise.

Comparing the 2008 Subprime Crisis and Today’s AI Bubble

These five startling parallels paint a disturbing picture. Yet history never repeats itself simply. Before hastily equating the AI bubble with the subprime crisis, we must confront a central question: what is the fundamental nature of the “collateral asset” at the heart of this storm?

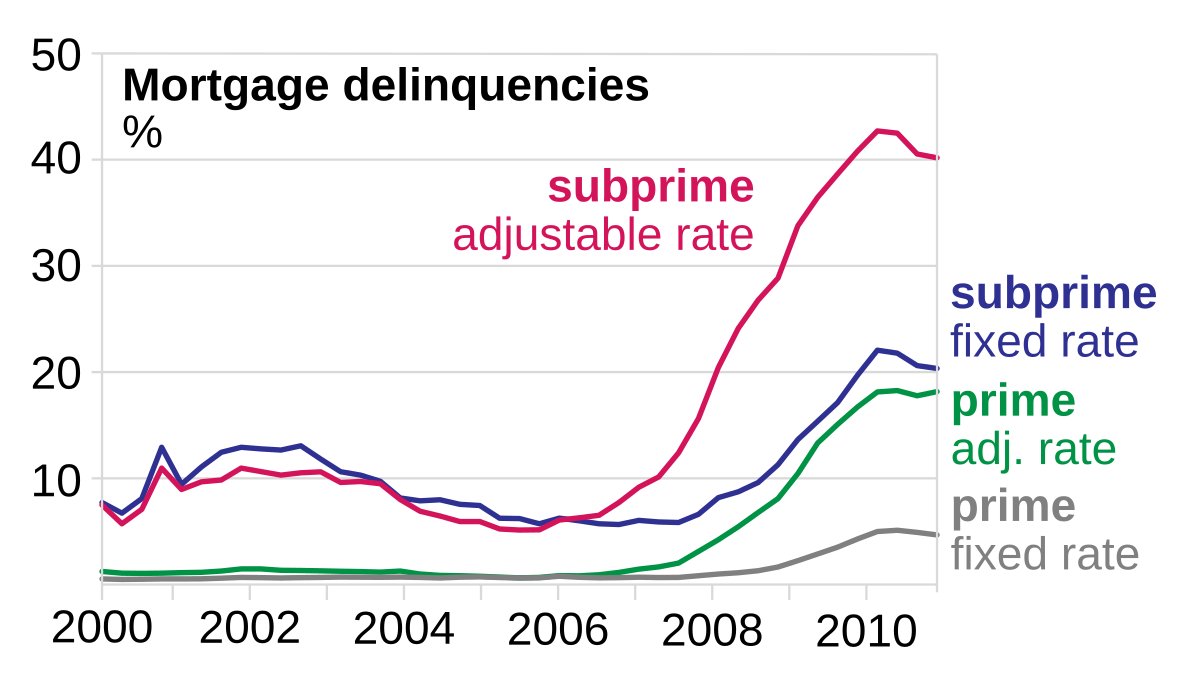

The 2008 Subprime Crisis

Key Differences: Why This May Not Be a Simple Replay of 2008

While the above parallels are alarming, equating today’s AI wave directly with the 2008 subprime crisis is reductive. History has rhythm—but never repeats verbatim. Beneath the surface similarities lie three fundamental differences that could decisively shape the trajectory and scope of any potential crisis.

Nature of the Core Asset: 2008 Core Asset: Non-productive residential real estate. For most homeowners, property generated no cash flow to service mortgages. The entire system relied on a fragile belief: “House prices will always rise.” Once that belief shattered, the credit chain snapped instantly.

Current AI Core Asset: Productive data centers and GPUs. Data centers and GPUs are quintessential productive assets—“golden geese” that lay eggs. They exist solely to generate direct cash flow by providing computing power. Thus, the critical question shifts from “Will asset prices fall?” to “Can these assets generate cash flow fast enough to cover financing and operating costs?” This fundamental shift is precisely what differentiates this potential crisis—from a “systemic threat to the global banking system” to a “tech-industry-wide internal shakeout.”

Creditworthiness of Borrowers: 2008 Borrowers: Subprime individuals. The crisis was ignited by borrowers with unstable incomes and abysmal credit histories—individuals who lacked genuine repayment capacity from day one.

Current AI Borrowers: Top-tier tech companies. Today’s aggressive AI borrowing is led by the world’s wealthiest, most profitable firms—Amazon, Microsoft, and Google. Their repayment capacity dwarfs that of subprime borrowers in 2008.

Regulatory Environment: A Post-2008 World: We inhabit a “post-2008” world. After that global crisis, international financial regulation received critical upgrades: banks now hold larger capital buffers against potential losses, and regulators—including central banks—are far more inclined to “watch closely and intervene early,” rather than react belatedly as they did back then.

Considering these three key differences, we reach an important conclusion: even if the AI bubble bursts, the outcome is unlikely to be a 2008-style systemic financial crisis that collapses the global banking system. Instead, it will more likely resemble another historic crisis pattern: a “2000 Dot-com Bubble 2.0”—a tech-industry-specific reckoning.

Risk Assessment & Outlook: A “2000 Dot-com Bubble 2.0” for the Tech Sector?

Integrating our analysis of both the parallels and distinctions between AI finance and the 2008 crisis enables a more precise characterization and forecasting of the AI sector’s latent risks. Conclusion: Should a crisis erupt, its pattern will align more closely with the 2000 dot-com crash—not the 2008 global financial tsunami.

Based on this assessment, the ultimate outcome would likely be a crisis largely confined to the technology sector. Upon bursting, we may witness mass failures of AI startups propped up solely by “storytelling” and debt; brutal declines in tech stocks; and the vanishing of countless investors’ wealth. The “pain will be severe”—but it will “likely not drag the entire world down with it.” This relative containment stems from risk being concentrated among equity investors and the tech supply chain—not, as in 2008, diffused across global bank balance sheets via complex derivatives, thereby avoiding systemic credit freeze.

Having clarified the nature of the risk and its probable outcome, the most crucial question for investors is no longer “Will it collapse?” but rather “How should we respond?”

Investor Response Strategies: Seeking Opportunity Amid Vigilance

Facing a potential intra-industry crisis, investors’ core task is not panicked liquidation—but rational risk management and portfolio optimization. Now is not the time to flee; it’s time to prune your portfolio like a seasoned gardener. Below are three concrete, actionable strategies designed to help investors protect existing gains and position themselves for the future—while maintaining prudent vigilance.

Strategy One: Audit and Categorize Your AI Holdings:

- Begin by clearly classifying your AI-related stocks to assess individual risk levels:

- Core Players: e.g., Nvidia, Google. These firms possess deep balance sheets; their AI investments are funded primarily by strong profits and cash flow—making them the most resilient participants.

- High-Risk Challengers: e.g., Oracle. These firms attempt “leapfrogging” via massive debt—offering potentially high returns but extreme fragility, making them the most vulnerable group in any crisis.

- Investment Caution: Avoid “bottom-fishing” stocks like Oracle—already subjected to a prior “pump-and-dump” cycle—unless a genuinely new, valuation-supporting narrative emerges. Prior selling pressure from trapped holders creates exceptionally high entry risk.

Strategy Two: Think Like a Bank—Buy “Insurance” for Your Portfolio:

- Adopt the hedging mindset of savvy financial institutions. For retail investors, the simplest and most effective hedge isn’t complex options trading—it’s partial profit-taking. Sell portions of your highest-gaining positions, especially those driven purely by “narrative.” Converting paper gains into cash isn’t bearish on AI’s long-term future—it’s a mature investor safeguarding hard-won victories.

Strategy Three: Diversify—Don’t Put All Eggs in One Basket:

- Allocate proceeds from AI stock gains into more stable asset classes to diversify risk. Options include defensive assets such as high-dividend stocks—or traditional safe havens like gold and government bonds. For investors wishing to retain tech exposure while mitigating concentration risk, broad-based instruments like the Nasdaq-100 ETF (QQQ) offer superior diversification versus overexposure to single, high-risk names.

Conclusion: At the Crossroads of Real Innovation and Financial Illusion

AI is undoubtedly a transformative technological revolution—one that will reshape all our lives. That much is indisputable. Yet its current trajectory is supported by fragile financial structures. We thus stand at a pivotal crossroads. The true question is: Will we build this bright future upon foundations of authentic innovation and sound finance—or upon a precarious sandcastle erected from circular credit and financial illusion? The answer will not only determine the final course of this AI feast but also profoundly shape the financial fate of each of us over the coming years.

In summary, the AI industry is exhibiting signs of debt-driven financial fragility, and its capital operations echo historical financial bubbles in unsettling ways. This demands an immediate strategic pivot—from opportunity-oriented investing to risk-management-first investing. Stay vigilant—but avoid panic. The priority now is optimizing portfolio structure, locking in substantial realized gains, and elevating overall holdings’ quality and resilience.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News