When the traditional world offers respect, cast aside your crypto pessimism

TechFlow Selected TechFlow Selected

When the traditional world offers respect, cast aside your crypto pessimism

As an investor, there are still many opportunities to outperform the market.

Author: MONK

Translation: TechFlow

Over the past year, Crypto Twitter (CT) has become increasingly populated by crypto natives who feel pessimistic about the current state of the industry and disparage innovation within our space and asset class. These complaints do reveal some objective truths, often pointing to real issues across the broader crypto landscape. However, I firmly believe the pendulum has swung too far toward "doomism."

In my view, crypto pessimism is a well-intentioned yet dangerous and misleading mindset that has become overly prevalent. This article aims to reject such pessimism by reflecting on the experiences of our technological predecessors. The situation isn't as dire as some portray it to be.

Let me begin with some common ground.

-

Tokenomics are largely broken

-

An increasing number of low-quality developers distract attention from truly excellent ones

-

Scams and profit-driven behavior are rampant

-

"Real" protocols make up only a tiny fraction of the entire crypto ecosystem

-

Few tokens are genuinely worth investing in

-

Protocol governance is often inefficient

-

The industry still carries many legacy problems to resolve

Most of these issues stem from three core factors:

-

We are in a period of regulatory uncertainty

-

Crypto has made asset creation and access frictionless

-

The industry historically rewarded bad actors

The good news is these problems are solvable—or at least inevitable side effects of an open yet immature industry. But deep down, I think we all know this.

I believe the real reason behind the recent rise and explosion of pessimism in crypto is that market participants are finding it increasingly difficult to achieve outsized returns. This leads to a lingering sense of frustration and impatience.

But this has nothing to do with lack of innovation—it's deeply tied to the structure of our asset class.

Let’s first look at what we’ve already achieved:

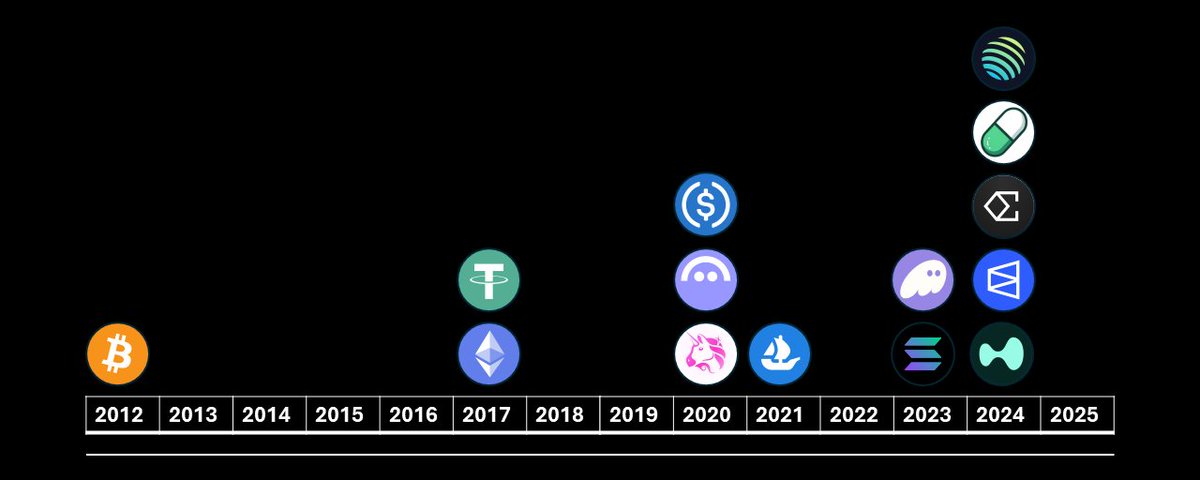

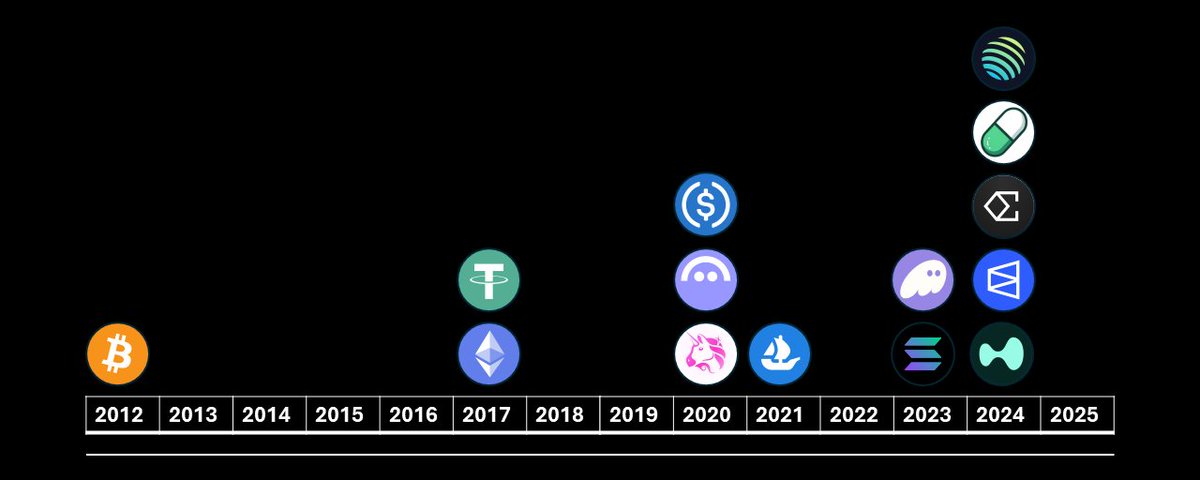

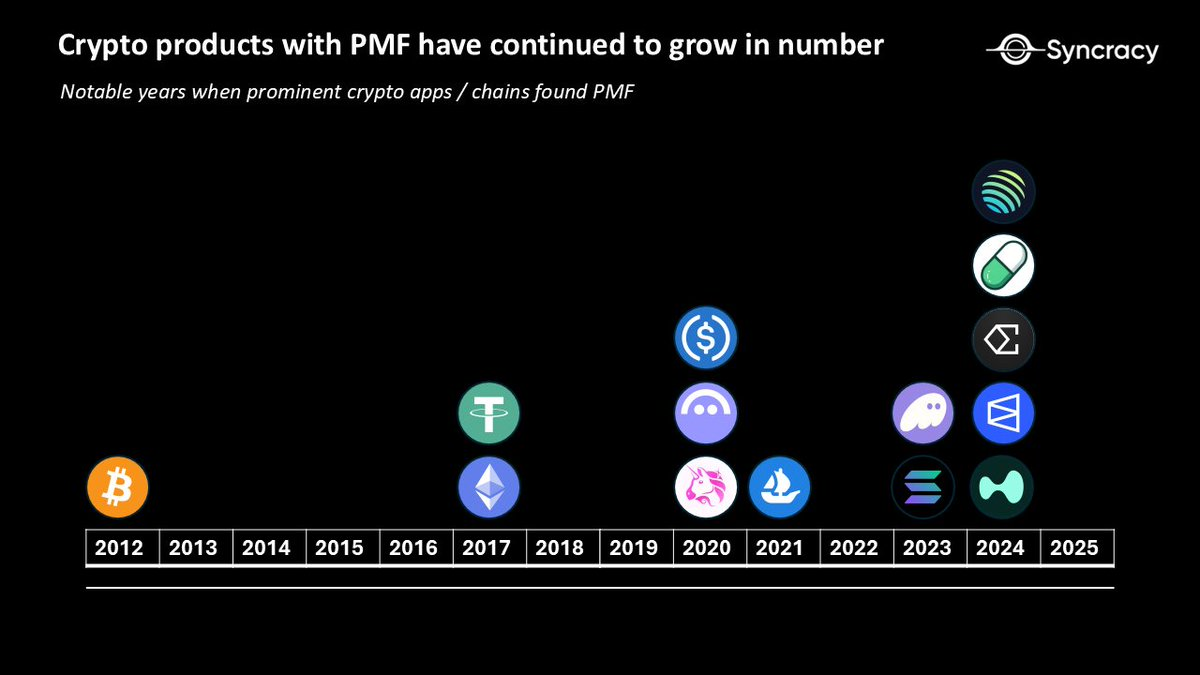

Below are some crypto products I believe have either found product-market fit (PMF) or at least paved the way for PMF in their respective verticals. While the number of such products remains small, with each development “cycle,” we build upon improved infrastructure and accumulated knowledge to create more meaningful products.

Some may look at these outcomes and realize good things take time—perhaps the industry's growth trajectory isn’t as bleak as you initially thought.

Conversely, others might respond: “Well, that’s not impressive.”

To those holding that view, allow me to show you this:

Recognize them? Probably not. These are old homepages of early internet companies during the “dot-com bubble” era. Of course, these pages are entirely different from the internet we know and love today.

Below is a list of publicly traded internet companies that failed after the dot-com bust, sourced from Wikipedia:

Amazon’s stock dropped over 90% in two years, falling from a peak of $107 to a low of $7, not fully recovering until 2010.

In reality, the number of “failed” companies was much larger. Thousands never went public but still likely lost significant returns for venture investors.

The good news is we also got these shining gems:

-

Amazon — founded July 5, 1994

-

Netflix — founded August 29, 1997

-

PayPal — founded December 1998

-

Google — founded September 4, 1998

-

Meta (Facebook) — founded February 4, 2004

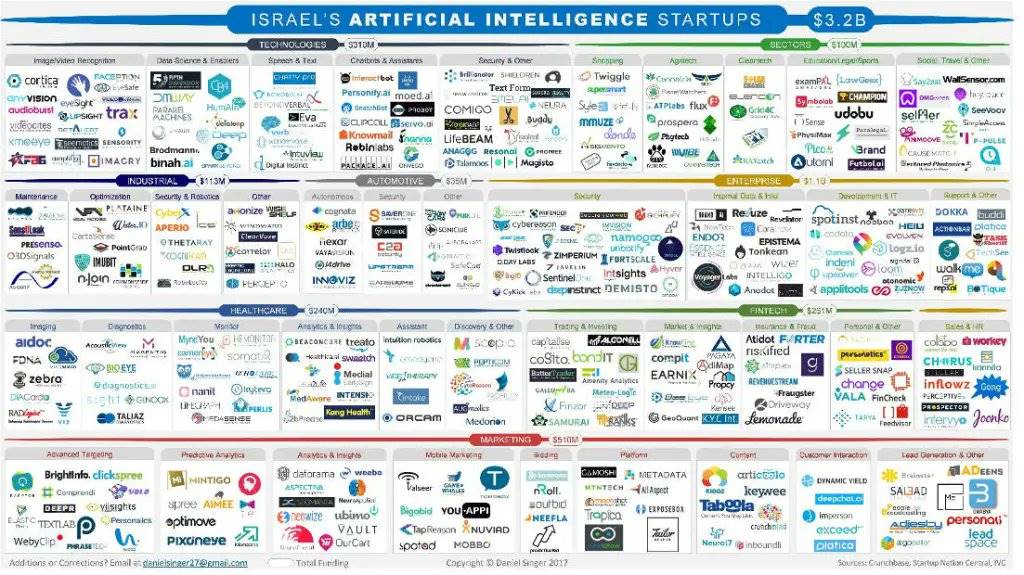

Likewise, although artificial intelligence (AI) is now celebrated as a major innovation category and growth narrative, I wouldn’t be surprised if, ten years from now, we observe a similar “power law survival” pattern—where only a few companies succeed and dominate the market.

These were Israel’s emerging leading AI startups in 2020.

So, if all leading tech fields have a 99.9% failure rate among opportunists, why does failure sting so much more in crypto?

Because by attaching publicly tradable token tickers to every project, we've effectively turned everyone into venture investors. Then, by allowing any developer to launch a viable, investable “startup” without due diligence, we drastically increased the number of investable “companies.” This exposes retail investors to an asset class with extremely low success odds, amplifying negative sentiment toward crypto.

Imagine if every founder during the dot-com bubble could raise funds via ICO from a crowd of enthusiastic, risk-loving retail investors—even if their product barely worked—and skip the seed → private → public funding stages entirely. Add a “Pump.fun”-like mechanism, and even remove the product altogether.

Of course, our asset class would become a minefield of token tickers, many of which eventually crash by 90%.

So again, what exactly have we achieved?

Today, BTC has become a $2 trillion asset—just 16 years since its inception as a marginalized, cypherpunk fantasy from an anonymous founder.

Since we first had programmable smart contract platforms, over the past decade:

-

We built a peer-to-peer internet resilient enough to survive a “third world war,” safeguarding hundreds of billions in value.

-

We developed a higher-performance version enabling users to create permissionless assets with one click, supporting tens of billions in daily DEX spot volume.

-

We enabled tokenized dollars and instant, low-cost transfers of any amount to anyone globally.

-

We brought financial primitives like lending and passive yield on-chain.

-

We created a transparent, borderless, no-KYC derivatives exchange rivaling Robinhood in volume, returning nearly all revenue to token holders.

-

We’re reshaping market structures, creating new ways to buy, sell, go long or short assets, and inventing entirely new asset types (e.g., prediction markets, perpetuals).

-

We made six-figure JPEGs a cultural phenomenon.

-

We spawned absurd internet communities that pushed joke token tickers to valuations surpassing public companies.

-

We pioneered new forms of capital formation like ICOs and bonding curves.

-

We’re exploring how to make finance and money more private.

As I often say, we offer anyone with internet access an emerging alternative financial system—an option distinct from the one they're forced to accept due to nationality. Our alternative is still young, but it's freer, more open, and more fun.

Every year, we present the market with a chance to buy into transformative technology at rock-bottom valuations. All you need to do is filter signal from noise.

At Syncracy, we firmly believe the crypto equivalent of “FAANG” giants has already begun to emerge, with new strong contenders appearing every one to two years.

I often reflect on this quote, which helps me better understand our industry:

"Our intuition about the future is linear. But the reality of information technology is exponential—and this makes a profound difference. If I take 30 linear steps, I only get to 30. If I take 30 exponential steps, I get to a billion."

— Ray Kurzweil, The Singularity Is Near: When Humans Transcend Biology

We always expect crypto to progress linearly and incrementally each year, throwing money at a pile of worthless projects hoping this year yields more than last.

Yet this often leaves many disappointed and out of pocket. But that doesn’t mean we should respond with endless waves of “doom” tweets criticizing our achievements and trajectory—especially when every other “real” tech field endured the same growing pains. The pain just feels sharper in crypto because we’re all financially vested.

Looking ahead ten years, no one can truly predict what will happen, nor do I believe innovation follows our expected timelines. Some years may seem stagnant, while others bring sudden transformation. I think it’s entirely possible that within three years, we’ll grow from seven to twenty protocols with product-market fit (PMF).

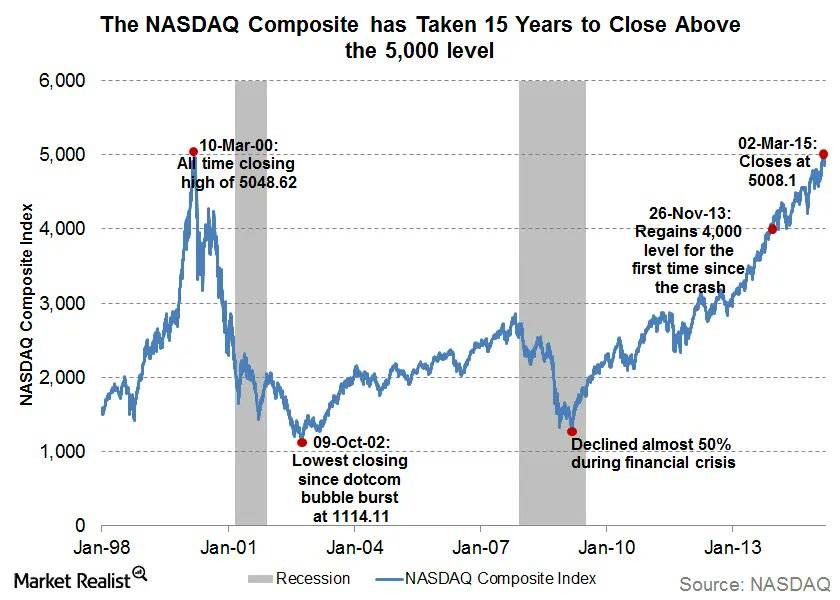

If you're wondering how the story of the dot-com generation ended, it took us 15 years to fully recover:

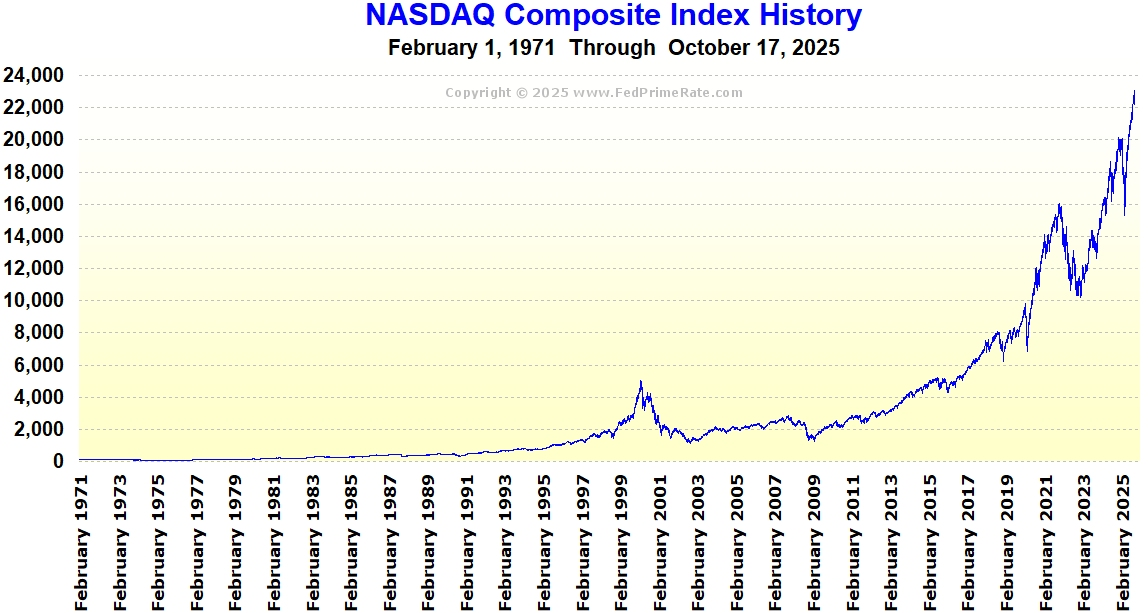

But we all know what happened afterward:

And now, just as the older generation, Wall Street elites, and top levels of the U.S. government finally begin to notice and respect crypto, many of our early users seem to be losing faith in our mission. To that, I completely refuse to accept.

Bitcoin remains digital gold. We continue building new financial primitives. We continue making the world better and more interesting.

For some of us, as investors, there are still ample opportunities to outperform the market.

Choose to remain optimistic about crypto!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News