The Stablecoin Bill in Hand, and the Restless Wall Street Bankers

TechFlow Selected TechFlow Selected

The Stablecoin Bill in Hand, and the Restless Wall Street Bankers

"Green light is on": Can traditional banks buy Bitcoin now?

Written by: Lüdong Xiaogong, kkk

Stablecoins have "come ashore," and the ceiling of U.S. crypto finance has been lifted once again.

Just last night, the U.S. House of Representatives officially passed the GENIUS Act and the CLARITY Act, granting stablecoins formal regulatory recognition and setting a clear regulatory tone for the entire digital asset industry. The White House subsequently announced that Trump will personally sign the GENIUS Act this Friday. From now on, stablecoins are no longer experimental projects in a gray zone but will become official monetary tools enshrined in U.S. law and backed by the state.

Almost simultaneously, the Federal Reserve, FDIC, and OCC—the three giants of financial regulation—jointly issued guidance days earlier, clearly stating for the first time that U.S. banks can offer cryptocurrency custody services to customers. Banks and institutions across Wall Street can barely contain their excitement.

Traditional Banks Raise the Stablecoin Banner

As the second-largest bank in the U.S., Bank of America (BoA) has officially confirmed it is actively preparing its own stablecoin product and considering collaborating with other financial institutions to launch one. It stated, "We're ready, but we're still waiting for further clarity from the market and regulators."

"We've done extensive preparation," said Bank of America CEO Brian Moynihan, adding that they are deeply studying customer needs and will launch a stablecoin product at the right moment, possibly in partnership with other financial institutions.

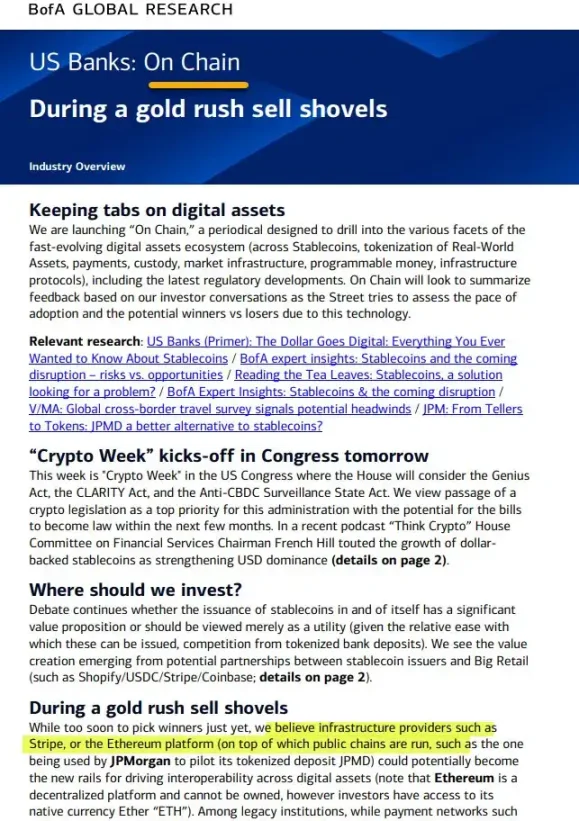

Meanwhile, Bank of America has also launched a weekly on-chain research report titled On Chain, explicitly focusing on stablecoins, RWA, payment settlement, and infrastructure. The release of On Chain coincides with a pivotal week in Washington, as lawmakers debate the GENIUS Act, CLARITY Act, and the anti-CBDC surveillance bill—all of which could shape U.S. policy toward stablecoins and digital infrastructure.

The research team emphasized, "We focus not on hype, but on architectures that can truly transform the foundation of finance," highlighting Ethereum’s potential to play a central role in enabling interoperability across digital assets. They even revealed ongoing pilot collaborations with major retail platforms like Shopify, Coinbase, and Stripe, aiming to break beyond traditional use cases and unlock new business models for stablecoins.

"Once regulation becomes clear, banks are ready to accept crypto payments," said Bank of America CEO Brian Moynihan.

Citibank also appears poised and ready to take flight at the first favorable wind.

Citibank CEO Jane Fraser clearly stated the bank is actively advancing its stablecoin initiatives, viewing them as a cornerstone for future international payments. Behind Citi’s bet lies a critical reassessment of global cross-border payments: high fees and slow settlements. Hidden costs in cross-border transactions often reach as high as 7%, while existing interbank networks lag far behind on-chain solutions in availability and efficiency. Citi’s goal is to build a 24/7 programmable payment rail using stablecoins, enabling corporate clients to transfer money anywhere in the world efficiently and at low cost.

And as an old familiar face in the crypto space, JPMorgan has taken even bolder steps.

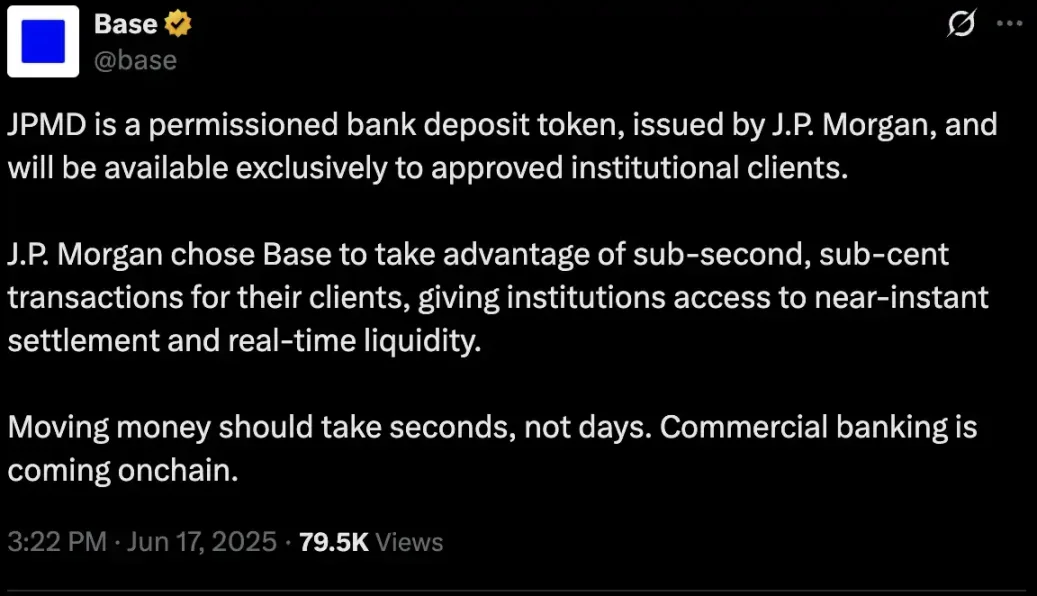

On June 18, JPMorgan announced the pilot launch of a deposit token called JPMD, deployed on the Base blockchain supported by Coinbase. Initially, the token will be available only to JPMorgan’s institutional clients, with plans to gradually expand to broader user groups and additional currencies upon U.S. regulatory approval.

This marks the first time a Wall Street giant has directly issued traditional bank deposits onto a blockchain, signaling a crucial step toward deep integration between traditional finance and the decentralized world. JPMD is a "permissioned deposit token," fully backed 1:1 by JPMorgan’s U.S. dollar deposits, supporting 24/7 real-time transfers at transaction costs as low as $0.01, and benefiting from deposit insurance and interest—traditional financial safeguards.

Compared to existing stablecoins, JPMD offers stronger regulatory compliance and institutional trust, potentially bringing unprecedented capital scale and institutional liquidity to the Base chain. Naveen Mallela, JPMorgan’s blockchain lead, said: "This isn’t about embracing crypto—it’s about redefining banking."

Looking across the entire U.S. banking sector, the speed at which traditional banks are entering the stablecoin space and rushing onto blockchains far exceeds even the most optimistic expectations within the crypto community. A genuine wave of financial transformation has already arrived.

"Green Light On": Can Traditional Banks Now Buy Bitcoin?

"The green light is on, and traditional finance is moving in fast. The barrier between banks and cryptocurrencies is collapsing—and this is extremely positive for crypto."

As Merlijn, founder of Profitz Academy, put it, on July 14, the three major U.S. banking regulators—the Federal Reserve, FDIC, and OCC—jointly issued a statement clarifying that banks must establish comprehensive risk governance systems when offering related services, covering key management, asset screening, cybersecurity, audit oversight, third-party custody, and compliance risk control.

While no new rules were introduced, this guidance marks the first systematic articulation of regulators’ expectations regarding crypto custody services. Crypto finance is transitioning from a "gray experimental field" to a "regulated track," and traditional finance is no longer watching from the sidelines.

This signal quickly sparked market reactions. Wall Street giants are disclosing the latest progress on their stablecoin and crypto businesses, racing to secure advantageous positions in the restructuring of the next-generation financial infrastructure. At the same time, native crypto firms like Circle and Ripple are accelerating their compliance efforts, aiming to solidify their market standing as global regulatory frameworks take shape.

This also means the boundaries between traditional banks, crypto asset managers, and trading platforms are beginning to blur. Traditional banks are even directly competing for market share in crypto asset management and trading.

The Crypto Battlefield: Traditional Banks vs. Native Asset Managers

On July 15, Standard Chartered Bank announced it will offer spot trading services for Bitcoin and Ethereum to its institutional clients—making it the first globally systemically important bank (G-SIB) to do so. The service will initially launch in London, Hong Kong, and Frankfurt, covering Asia and Europe, with plans for 24/5 continuous operation and direct integration with traditional foreign exchange platforms. Corporate clients and asset management firms will no longer need to jump through hoops or set up offshore accounts—they’ll be able to buy and sell BTC and ETH just like forex, with settlement and custody options via in-house or third-party providers.

In fact, Standard Chartered has long been building digital asset custody and trading capabilities through Zodia Custody and Zodia Markets. This move simply represents a public rollout of accumulated expertise. Rene Michau, Standard Chartered’s Global Head of Digital Assets, made it clear: starting with BTC and ETH spot products, the bank will expand into more crypto offerings, including forwards, structured products, and non-deliverable contracts—directly mirroring the service lines of crypto exchanges.

Meanwhile, JPMorgan, Bank of America, and others are preparing to launch crypto custody and related services. What once seemed impossible is now becoming reality. Twelve months ago, you might have doubted whether JPMorgan would ever custody Bitcoin; today, the question is simply which bank will capture the largest market share.

Also worth noting are the "new-gen banks"—such as London-based Revolut, which derives significant revenue from crypto trading and has long-term ambitions to obtain a U.S. banking license and fully enter the mainstream financial ecosystem.

Peter Thiel’s Ambition: Building a New Silicon Valley Bank

Beyond asset custody and capturing market share from native crypto asset managers and exchanges, Wall Street’s ambitious players are finding new entry points in account services and credit support.

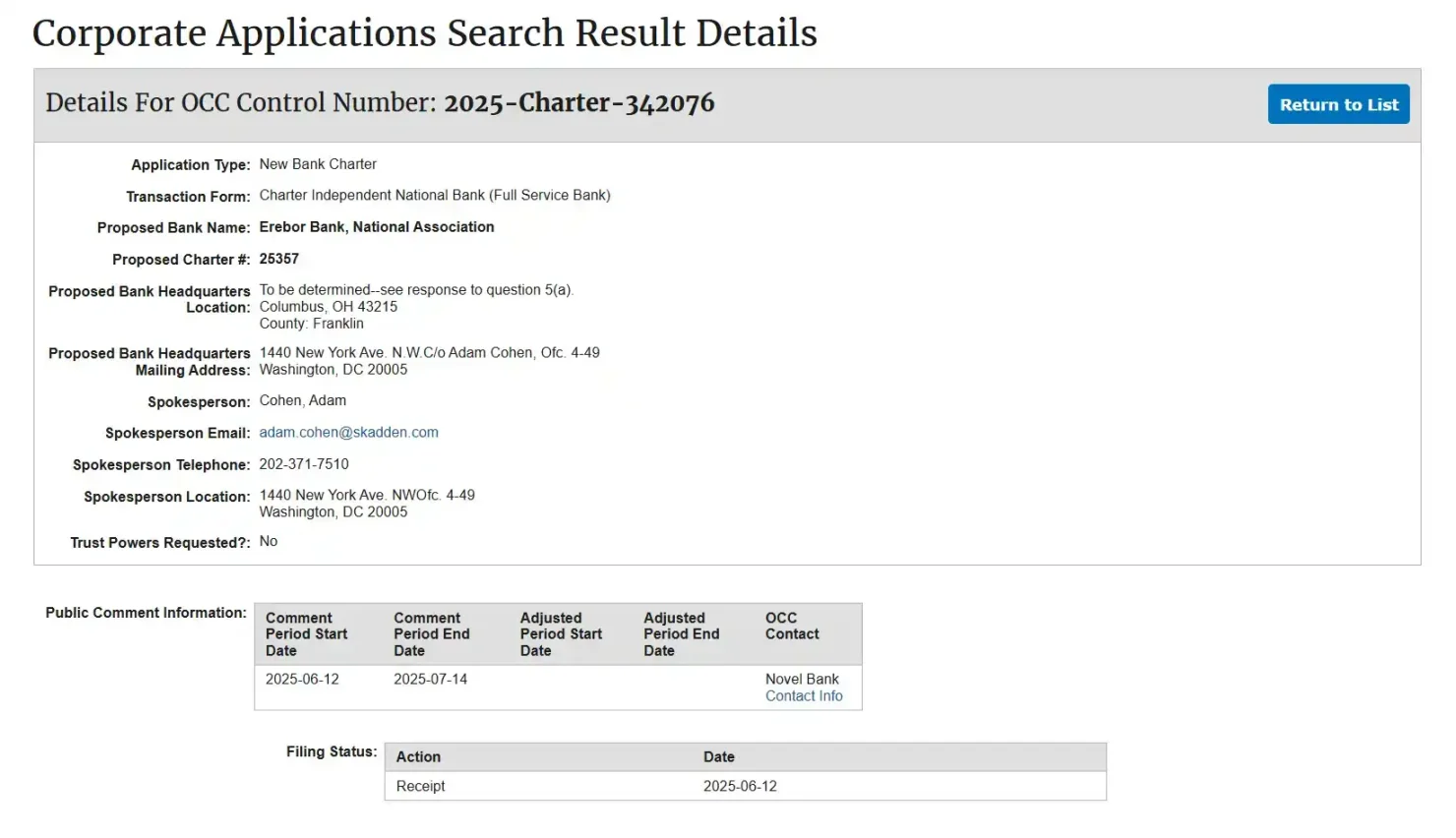

Multiple major financial media outlets have confirmed that Peter Thiel is teaming up with tech billionaires Palmer Luckey and Joe Lonsdale to launch a new bank called Erebor, having formally applied to the U.S. Office of the Comptroller of the Currency (OCC) for a national bank charter. The bank’s target clients are startups in cryptocurrency, AI, defense, and manufacturing—sectors traditionally shunned by mainstream banks—positioning itself as a successor to the collapsed Silicon Valley Bank.

The founding team embodies a distinct "Silicon Valley political capital nexus": Peter Thiel (co-founder of PayPal and Palantir, leader of Founders Fund), Palmer Luckey (founder of Oculus, co-founder of Anduril), and Joe Lonsdale (co-founder of Palantir, founder of 8VC). All three were major political donors to Trump in the 2024 U.S. presidential election and are closely linked to the ongoing congressional push for the GENIUS Act.

According to Erebor’s application filed with the OCC, Founders Fund will serve as the primary capital backer. The three founders will not participate in day-to-day operations, serving only as board members to ensure governance separation. The bank’s executive team includes a former Circle advisor and the CEO of compliance software firm Aer Compliance, signaling a deliberate effort to separate politics from operations and emphasize its institutional, regulated positioning.

Learning from the collapse of Silicon Valley Bank, Erebor explicitly proposes a 1:1 reserve requirement and aims to keep its loan-to-deposit ratio below 50% to prevent maturity mismatches and credit expansion. Its filing identifies stablecoin services as a core business line, planning to support custody, minting, and redemption of compliant stablecoins such as USDC, DAI, and RLUSD, aiming to become the "most comprehensively regulated stablecoin trading institution" and provide enterprises with legal fiat on/off ramps and on-chain asset services.

Its client profile is equally precise: targeting innovative firms in crypto, AI, defense tech, and advanced manufacturing—industries deemed "high-risk" by traditional banks—as well as their employees and investors. It also serves "international clients"—overseas institutions excluded from the U.S. financial system yet reliant on dollar clearing or seeking to reduce cross-border costs via stablecoins. Erebor plans to act as a super-interface connecting these entities to the U.S. dollar system through correspondent banking relationships.

The business model also carries strong native crypto characteristics: deposits and loans secured by Bitcoin and Ethereum, avoiding traditional mortgage or auto lending; holding small amounts of BTC and ETH on its balance sheet for operational needs (e.g., gas fees), without engaging in speculative trading. Notably, Erebor draws a clear regulatory boundary: it will not offer asset custody requiring a trust license, limiting itself to on-chain fund settlement without direct custody of user assets.

In short, this is an upgraded version of Silicon Valley Bank. With supportive crypto-friendly policies in place, Erebor stands a strong chance of becoming one of the first "dollar relay banks" to legally hold mainstream stablecoins like USDC and RLUSD, providing federal clearing pathways for stablecoins.

National Trust Bank Charter: The Future of Crypto Banking

With stablecoin legislation settled and Washington flashing green lights, it’s clear that the next round of ranking among Wall Street bankers has quietly begun.

And the "National Trust Bank Charter" is emerging as a key battleground in this race. One of the highest-tier licenses in the U.S. financial system, it represents the most realistic path for crypto asset firms, custodians, and stablecoin issuers to enter the mainstream financial arena.

The U.S. banking system rests on three core federal charters: National Bank, Federal Savings Association (FSA), and National Trust Bank. The first two serve traditional banks and savings associations, with long histories, high barriers, and extreme entry thresholds. The National Trust Bank charter, however, is specifically designed for trust, custody, and pension services—perfectly aligning with crypto-native players seeking compliant ways to "hold assets."

Its value exceeds most people’s expectations. First, it functions as a multi-state operating license: once obtained, the holder can operate across all 50 U.S. states without needing individual state approvals. Additionally, it allows licensed institutions to offer institutional-grade asset custody, digital currency custody, corporate trust, and pension management services. While it does not permit retail deposit-taking or lending, this limitation actually aligns perfectly with the core needs of crypto custodians—security, fiat custody, and transparent, compliant credentials.

More importantly, it is a federal banking license directly issued by the OCC. Holding this charter enables crypto companies to apply for access to the Federal Reserve’s payment and clearing systems, significantly enhancing liquidity and settlement efficiency.

Anchorage Digital: The First Crypto Custody Bank to Take the Leap

The first crypto asset manager to take this leap was Anchorage Digital.

Founded in 2017 and headquartered in California, Anchorage Digital is a fintech company specializing in "digital asset custody," offering secure and compliant storage and custody solutions for institutional clients such as funds, family offices, and exchanges.

Prior to 2020, crypto firms could only legally offer custody services through state-level trust licenses (e.g., New York’s BitLicense or South Dakota’s trust license), severely limiting their operational scope and reputation.

But in 2020, the OCC welcomed a "crypto ally"—Brian Brooks, former Coinbase executive, took leadership. Upon taking office, he clearly stated for the first time: innovative digital asset firms are welcome to apply for federal bank charters. Anchorage seized the opportunity, submitting a full application with dozens of documents and hundreds of pages detailing KYC/AML, compliance, technical risk controls, and governance structures. On January 13, 2021, the OCC officially approved it—Anchorage Digital Bank National Association launched, becoming the first true federally-compliant digital asset national trust bank in the U.S.

After becoming the first "federally certified" crypto custody bank in U.S. history, Anchorage Digital's status soared, positioning it as a Wall Street-tier institutional custodian for major financial institutions such as BlackRock and Cantor Fitzgerald.

Unfortunately, the good times didn’t last. Regulatory leadership changed, scrutiny tightened, and new applications for digital asset trusts were effectively frozen overnight. Anchorage became the sole survivor, and this pathway remained frozen for over three years.

Now, with Trump back in power and pro-crypto officials in charge, Jonathan Gould—a crypto-friendly appointee—has been named interim head of the OCC, rolling back some of the Biden-era "banking guidelines" targeting the crypto industry.

Earlier this month, the newly appointed OCC head Jonathan Gould, previously Chief Legal Officer at blockchain infrastructure firm Bitfury, demonstrated strong expertise across business, legal, and regulatory domains. His appointment sent a clear signal to the market: the federal compliance window is opening slightly once again. Entrepreneurs, funds, and project teams across the industry are stirring, anticipating a new round of licensing opportunities.

The Ultimate Game: Access to the Federal Reserve Clearing System

For the crypto industry, merely obtaining a "National Trust Bank Charter" isn't enough. What truly excites everyone is gaining access to the Federal Reserve’s clearing system—specifically, securing a legendary "Master Account" at the Fed.

This is an even greater prize for the crypto sector.

Direct settlement, clearing, transfers, and deposits with the Federal Reserve—without relying on third-party mega-banks. For crypto firms, obtaining a Master Account means placing stablecoin reserves directly at the central bank, fully integrating into U.S. financial infrastructure. No longer outsiders or second-class citizens, they become legitimate, officially recognized participants in the U.S. financial system.

Insiders understand this is the real "formal recognition"—a leap from being treated as outsiders by the banking system to becoming full-fledged members acknowledged by U.S. finance. That’s why crypto leaders like Circle, Ripple, Anchorage, and Paxos are simultaneously pursuing federal trust bank charters and aggressively pushing for Master Account approval.

However, due to the Fed’s concerns that crypto firms might abuse the "Master Account," posing financial stability risks (e.g., sudden large-scale liquidations of risky assets disrupting system liquidity), along with potential challenges around money laundering, illicit flows, and technical security, no pure-play crypto company has ever been granted a Fed Master Account. Even Anchorage, the pioneer, obtained the federal trust bank charter but still hasn’t been approved for a Master Account.

So who else is chasing bank charters?

Circle submitted its application at the end of June 2025, aiming to establish a new bank called First National Digital Currency Bank, N.A., to directly custody USDC reserves and offer institutional custody services.

Shortly after, Ripple publicly announced in early July that it had submitted an application to the OCC, boldly applying for a federal Master Account at the same time—seeking to place RLUSD reserves directly within the central bank system, a highly aggressive stance.

Legacy custodian BitGo is also waiting for OCC approval. Public records indicate BitGo is one of the designated custodians for the "Trump USD1" reserve.

Besides these three representative crypto "main forces," Wise (formerly TransferWise) has also submitted an application positioning itself as a non-deposit custody bank. Tech newcomers like Erebor Bank are openly declaring their intent to serve new economy sectors including AI, crypto, and defense. First Blockchain Bank and Trust, a first-generation blockchain bank, attempted a trial during the Biden era but quietly withdrew due to tight regulatory conditions. Rumors suggest Fidelity Digital Assets also plans to file, though this remains unconfirmed.

If Circle, Ripple, or BitGo secure these charters, they can bypass state-level compliance hurdles, operate nationwide, and potentially gain access to the Fed’s Master Account. Once achieved, stablecoin dollar reserves could be stored in the central bank vault, allowing their custody and clearing capabilities to compete directly with traditional Wall Street giants.

It appears regulators remain both hopeful and cautious about crypto firms turning into banks. On one hand, personnel changes at the OCC and warming policies have indeed created a "window of opportunity" for crypto firms. On the other, these charters don’t grant full banking rights—no retail deposits or lending allowed.

The new window is open, but the bar remains high. Who will be the first to knock open the door to the Federal Reserve? This will be the most thrilling battle in the next phase between Wall Street bankers and crypto titans—one whose winner may reshape the financial landscape for the next decade.

For the crypto industry, the formal landing of stablecoins and the official opening of bank doors mean that what were once parallel worlds—the crypto sphere and Wall Street—are finally converging under the sunlight of regulation. Digital assets, once repeatedly debated and rejected by regulators, banks, and capital markets, are now entering everyday American accounts and the balance sheets of global financial institutions as "mainstream assets."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News