Decoding Maple Finance: While the alt season has yet to arrive, SYRUP—aligned with the current narrative—has already逆势 reached an all-time high

TechFlow Selected TechFlow Selected

Decoding Maple Finance: While the alt season has yet to arrive, SYRUP—aligned with the current narrative—has already逆势 reached an all-time high

Maple Finance is a multi-chain DeFi platform that provides institutional clients with on-chain lending and investment services.

Written by: TechFlow

Do you think the altseason is coming? This has become a daily topic on crypto Twitter.

The prevailing view right now is that a broad altseason remains distant. Most altcoins lack liquidity, and investors are shifting their focus toward U.S. equities, Bitcoin, and RWA (stablecoins).

Yet, just when everyone thinks altseason won't arrive, certain altcoins are rising against the tide.

Take SYRUP, the token of Maple Finance, for example—it’s up 400% since the beginning of the year and has reached an all-time high (ATH) as of this writing.

Grayscale previously included Maple Finance in its list of top 20 tokens to watch in Q2 2025, yet analysis of this project remains scarce in Chinese-speaking communities.

Amid growing information noise, we may have overlooked a clear but often indirect narrative in this cycle—institutional adoption.

Consumer-facing crypto products—such as launchpads and meme coins—are emerging constantly, but competition is intensifying, and declining on-chain liquidity is weakening their fundamentals.

In contrast, serving institutions presents another path. These products are less intuitive and require higher barriers to entry, yet they represent an underappreciated opportunity in this institutional-onboarding cycle.

Maple Finance is clearly capturing this version-specific upside.

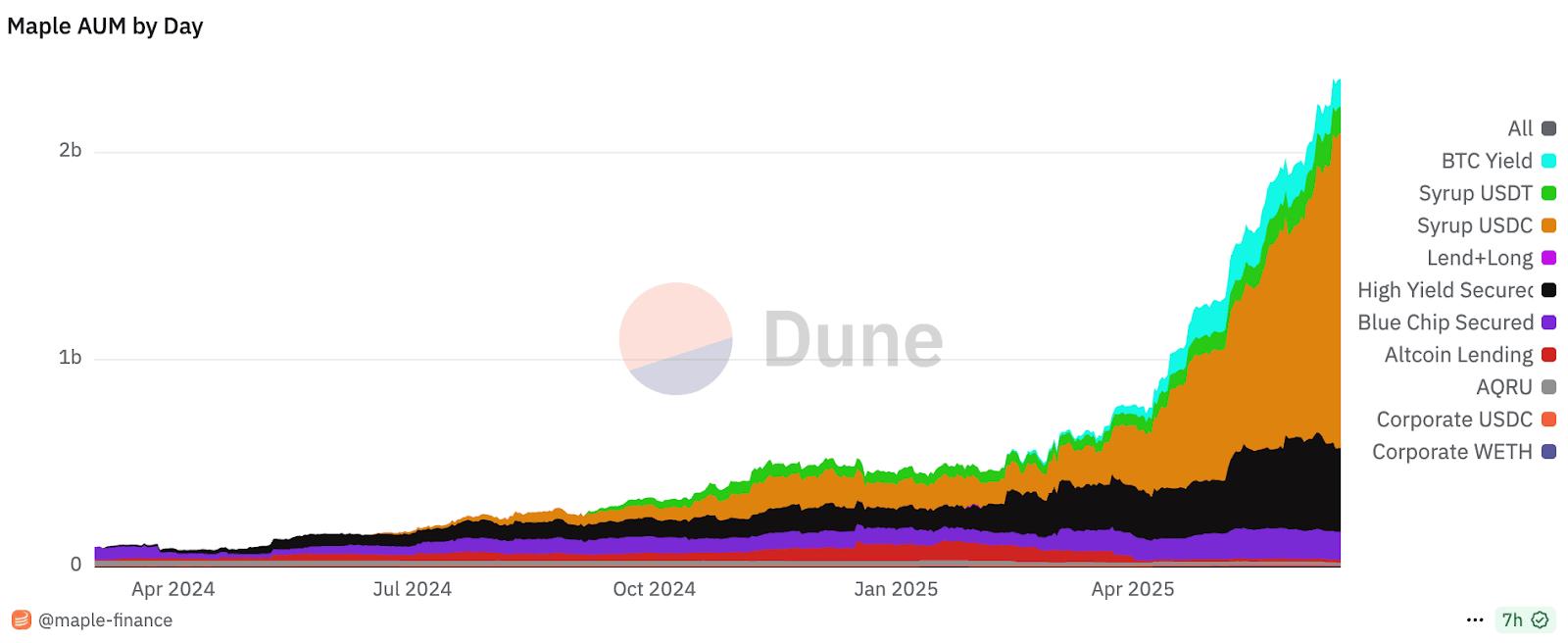

The project specializes in providing under-collateralized loans and RWA investment services for institutions, such as tokenized U.S. Treasuries and trade receivables pools. Its assets under management (AUM) surpassed $2 billion in June 2025, serving traditional hedge funds, DAOs, and crypto trading firms.

The counter-trend rise of SYRUP may reflect the market's rediscovery of Maple’s undervalued potential.

The current market cap of SYRUP stands at around $700 million. Compared to previous cycles where purely sentiment-driven memes easily reached $1 billion valuations, do you think SYRUP is overvalued or undervalued?

Of course, comparing different sectors solely by market cap isn’t fair—we need deeper insight into Maple Finance’s business model.

Providing On-Chain Lending Services for Institutions

Maple Finance is a multi-chain DeFi platform (operating on Ethereum, Solana, and Base), offering on-chain lending and investment services specifically tailored for institutional clients—such as hedge funds, DAOs (decentralized autonomous organizations), and crypto trading firms.

In simple terms, think of it as an asset management tool that helps large institutions borrow, manage capital, or invest on-chain—bypassing the complex processes and low returns of traditional banking.

Since its founding in 2019, Maple has matured into a robust platform. By June 2025, its AUM reached $2.4 billion, with total value locked (TVL) at $1.8 billion.

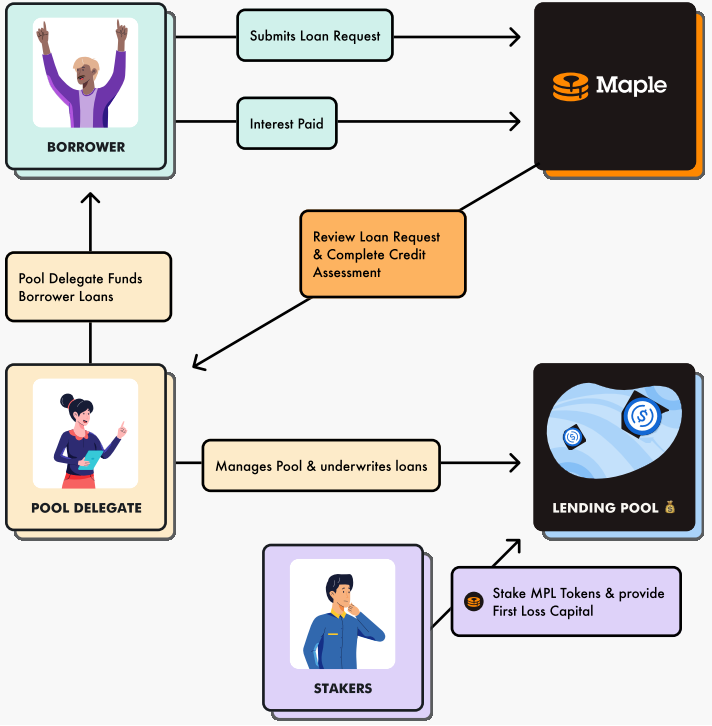

While primarily serving institutional users, participants in Maple Finance take on distinct roles—you can choose to lend, stake, borrow, or act as a pool delegate.

(Image source: consensys)

Borrowers are institutions needing capital—like crypto trading firms—who use digital assets such as Bitcoin (BTC) or Ethereum (ETH) as collateral to borrow stablecoins like USDC. These entities often require fast access to liquidity, which traditional financial systems struggle to provide due to lengthy approval procedures.

Lenders supply liquidity—for example, depositing USDC or ETH—to earn interest. They are essentially the LPs commonly seen in DeFi products. For LPs, Maple’s appeal lies in its relatively high annual percentage yield (APY) and transparent fund management.

Pool delegates are specialized teams responsible for assessing borrower creditworthiness and ensuring loan safety. To reduce risk for lenders, Maple allows pool delegates to conduct rigorous borrower screening and monitor loan performance in real time.

Stakers hold the SYRUP token and stake it to share risk and rewards. If a loan defaults, their staked SYRUP can be used to cover losses; conversely, when no issues occur, they receive additional platform incentives.

Thus, the process works simply: borrowers request loans, pool delegates vet eligibility, lenders provide funds, stakers offer insurance, smart contracts automate disbursement and repayment, and profits are distributed among these roles accordingly.

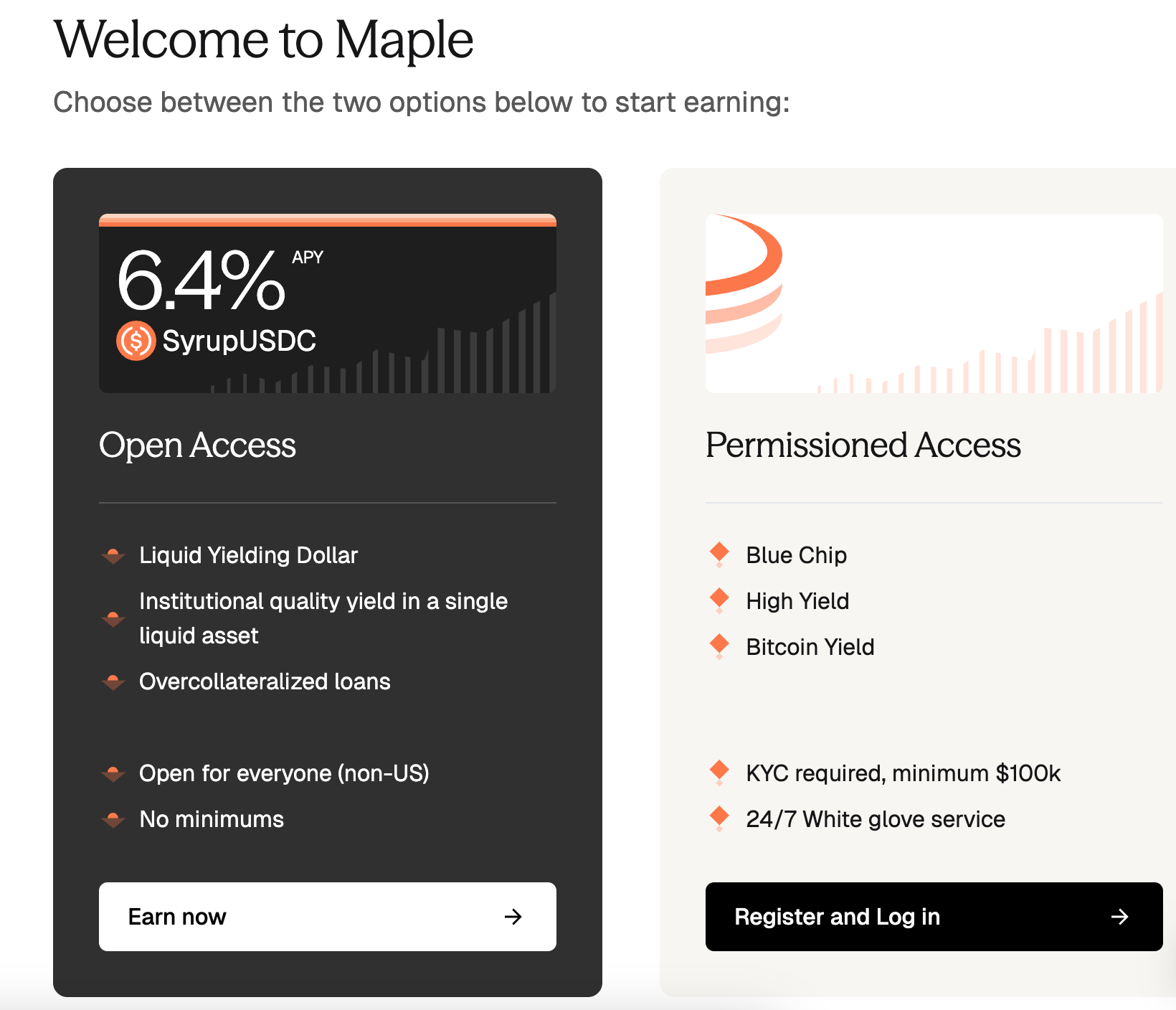

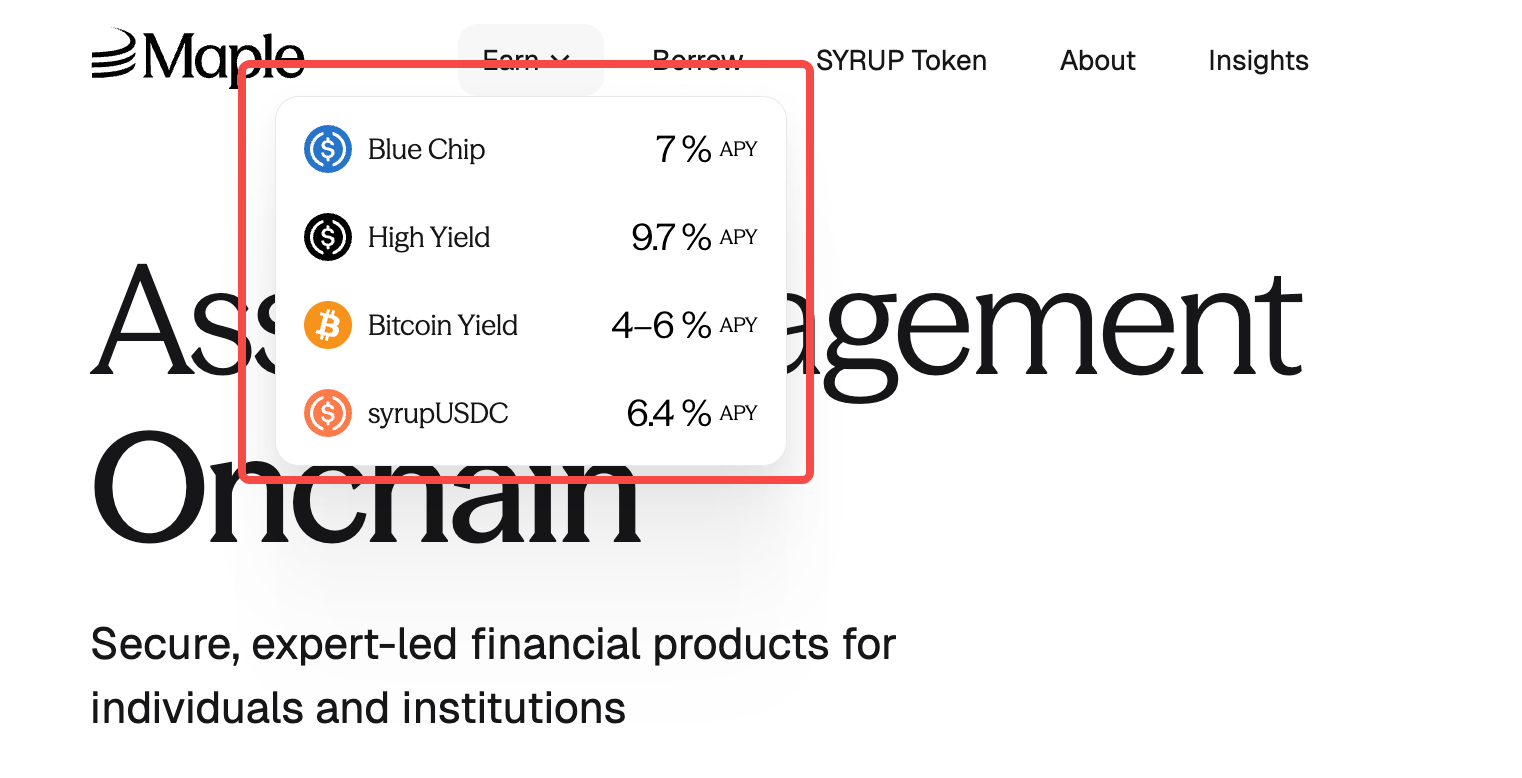

In terms of lending products, Maple offers two types: “open access” and “permissioned access.”

Open access includes SyrupUSDC, offering a 6.4% APY, suitable for individuals and small institutions. SyrupUSDC is a USDC-based yield product where funds enter a liquidity pool and are invested in over-collateralized loans (borrowers must provide assets worth 50% more than the loan amount). There is no minimum investment, emphasizing liquidity and stability.

Permissioned access targets institutional clients and includes Blue Chip (7% APY), High Yield (9.7% APY), and Bitcoin Yield (4–6% APY). KYC verification is required, with a minimum investment of $100,000, and comes with 24/7 white-glove service.

White-glove service refers to premium, customized support—akin to private banking advisors—where institutional clients enjoy round-the-clock one-on-one assistance, including loan structuring, capital management advice, and emergency issue resolution.

Blue Chip focuses on high-credit-quality loans, similar to traditional "blue-chip stocks," carrying lower risk. High Yield targets higher-risk, higher-return loan portfolios. Bitcoin Yield leverages BTC as collateral, enabling holders to generate passive income.

From DeFi Crisis to $2 Billion in AUM

Lending mechanics are central to Maple’s innovation—but its journey wasn’t smooth.

In 2022, the DeFi sector faced a "black storm": the collapse of Terra and the bankruptcy of Three Arrows Capital triggered a liquidity crisis across many DeFi platforms, and Maple was no exception.

In its early days, Maple used a partially collateralized model—loans were granted based not on full collateral but on borrower reputation—making it inherently riskier and more vulnerable during black swan events. At one point, its AUM shrank to just $200 million, and default rates spiked above 5%.

In response, Maple swiftly pivoted in 2023 by introducing over-collateralization (150% collateral ratio) and tri-party agreements: borrowers pledge BTC to borrow USDC, a third party monitors collateral value, and Maple executes via smart contract. If BTC price drops below a threshold, the third party triggers liquidation—protecting lenders’ interests.

This redesign restored trust and created a safer lending environment for institutional clients.

Starting this year, as the dominant crypto narrative shifts from retail speculation to institutional dominance—and more capital seeks low- or zero-risk yields—the following data clearly illustrate Maple Finance’s strong recovery momentum:

Maple’s flagship product, SyrupUSDC—a USDC-based stable yield instrument—saw its TVL surge from $166 million to $775 million within 11 months, reflecting soaring demand for Maple’s offerings.

Additionally, since January 2025, AUM has grown nearly tenfold, with outstanding active loans increasing to approximately $880 million, positioning Maple as one of the largest crypto lenders.

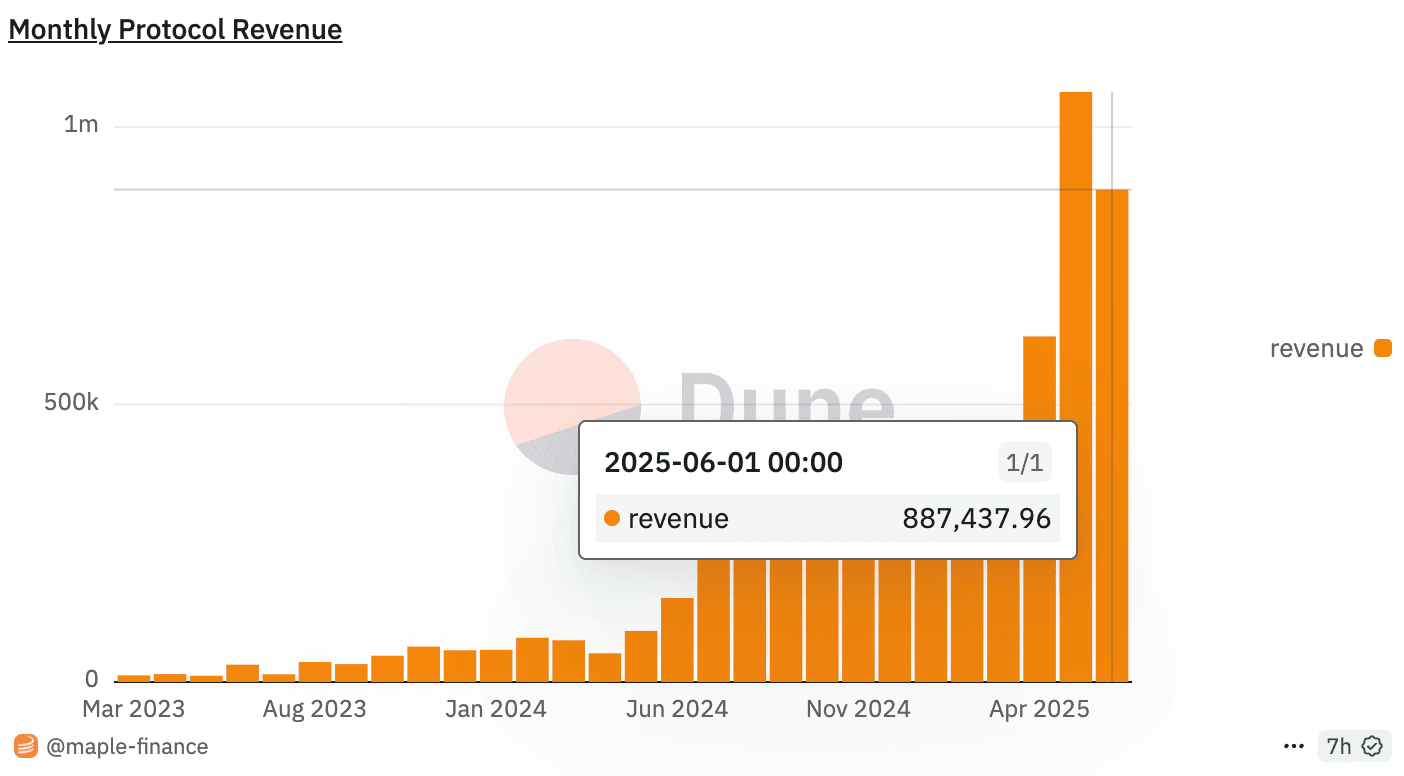

Rising borrowing demand also made the protocol profitable. With Maple charging 0.5–2% fees per loan, monthly revenue exceeded $1 million in May 2025, marking three consecutive months of record-breaking growth.

Within these meaningful cash flows, 20% of fees are allocated to buy back and burn SYRUP tokens for stakers—this may partly explain SYRUP’s counter-trend rally since early 2025.

In May 2025, global financial services giant Cantor Fitzgerald announced a $2 billion Bitcoin (BTC) lending program, naming Maple as its preferred partner.

Founded in 1945, Cantor operates across bond trading, real estate, and fintech—representing traditional finance. Its involvement signals mainstream recognition of on-chain credit markets.

Institutions often need flexible short-term financing, but traditional banks are slow. This makes Maple’s customized services and more accessible entry criteria an attractive alternative for institutional borrowing.

Why Did SYRUP Rise Amid a Broad Market Downturn?

What explains SYRUP’s counter-trend rise?

Institutional borrowing demand answers part of the question. But on a more granular level, SYRUP’s near-full circulation reduces potential sell pressure.

If we analyze the reasons more systematically, “version tailwinds” offer the most concise explanation. Specifically, this advantage breaks down into four key factors:

-

Safe-Haven Characteristics:

During crypto market downturns, investors favor low-risk, high-yield assets. Maple’s RWA products—such as Treasury pools—and over-collateralized loans offer stable returns (5–20% APY), making them ideal safe-haven options.

Its Bitcoin yield product enables BTC holders to earn yield without selling their assets, attracting significant institutional inflows.

-

Direct Beneficiary of the RWA Narrative:

As traditional financial institutions increase blockchain engagement (e.g., BlackRock’s BUIDL and JPMorgan’s digital bonds), the RWA market expands. As DeFi’s “institutional-grade lending engine,” Maple directly benefits from this trend. Institutional capital is larger and more stable, helping offset volatility from retail sentiment.

-

Differentiated Competition:

Compared to retail-focused protocols like Aave and Compound, Maple’s institutional orientation and RWA focus give it a competitive edge in its niche. While rivals like BlackRock’s BUIDL and Ethena are powerful, Maple’s on-chain transparency and flexibility better suit crypto-native institutions.

-

Product-Market Fit Driven by Team Vision:

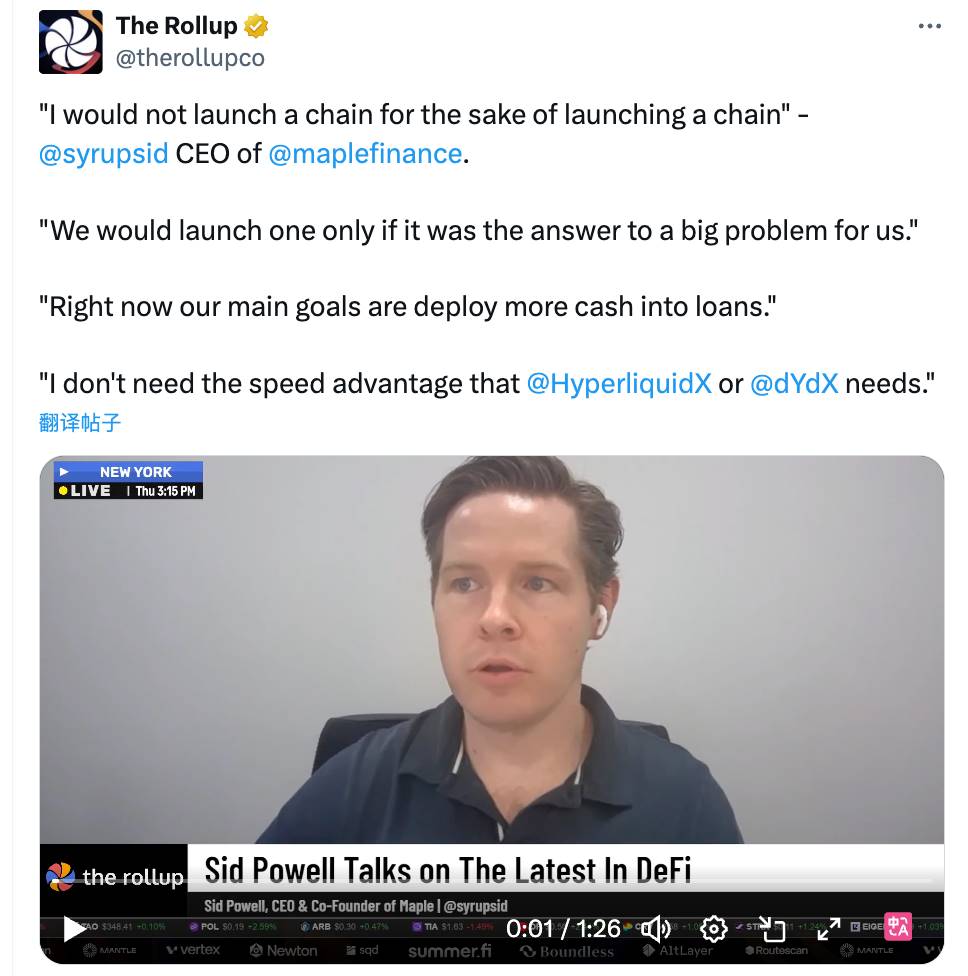

While some DeFi projects chase L1 development, infrastructure, and performance wars, Maple founder Sid Powell expressed a different philosophy in a podcast interview:

“We only build something if it solves a major problem for us... Right now, our main goal is putting more cash into loans. I don’t need Hyperliquid or dYdX-level speed.”

Resist FOMO

Solid fundamentals and rising prices might trigger FOMO—should you jump in?

Not so fast. In crypto, many great products don’t always translate to sustained token outperformance. On-chain movements in SYRUP also suggest early profit-taking.

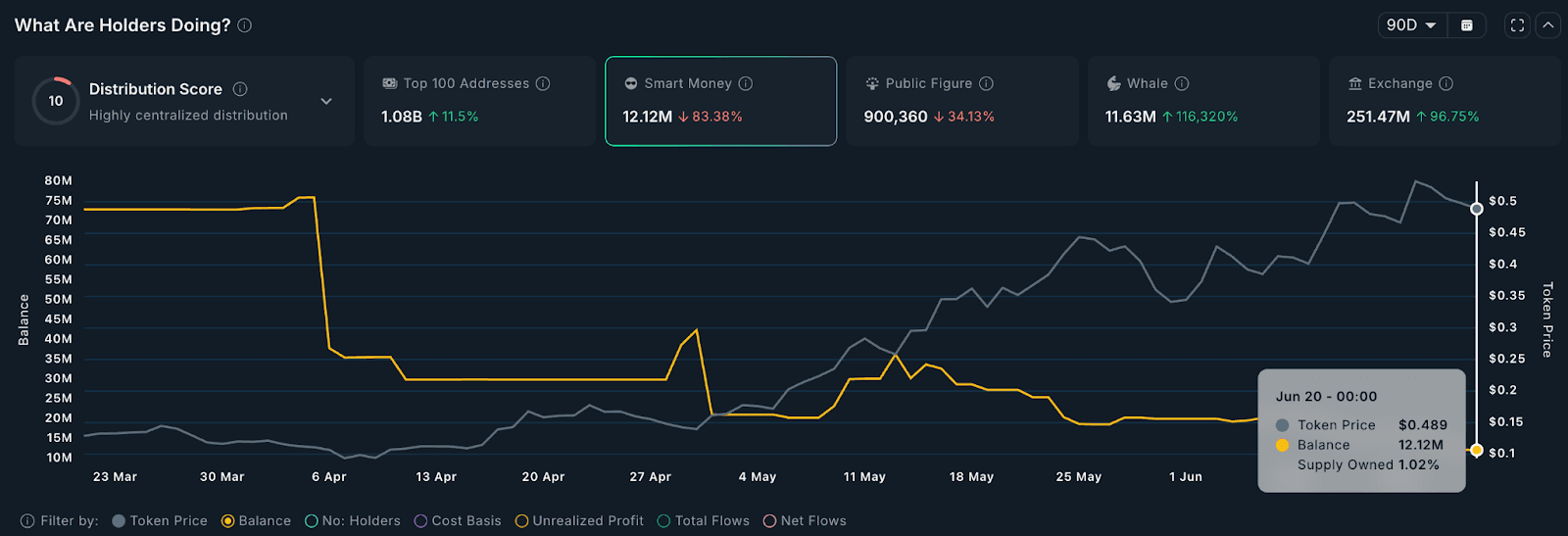

Analysis from Nansen shows significant outflows from smart money and funds.

For instance, Blocktower deposited over 10.5 million SYRUP to Binance exchange wallets in the past 34 days. Dragonfly recently sent over $1.75 million worth of SYRUP to a known FalconX wallet. Similarly, Maven11 transferred SYRUP to an intermediary wallet before routing it to Binance.

Over the past 90 days, holdings of SYRUP by smart money have declined by more than 83%, while exchange balances of SYRUP have surged by 96%—clear signs of early capital exiting.

At the same time, some whales have begun accumulating SYRUP, with whale holdings increasing by 116,000% over the past 90 days.

Taken together, the market appears to be at a turning point marked by rotation and divergence. Following either side carries investment risk.

Overall, Maple’s business model aligns well with this cycle’s macro trends, giving it substantial growth potential. Yet at any given moment, observing rather than acting may be the safer strategy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News