From JD's Foray into Stablecoins to the Next Growth Frontier for Web3 Practitioners

TechFlow Selected TechFlow Selected

From JD's Foray into Stablecoins to the Next Growth Frontier for Web3 Practitioners

We are experiencing the "Suez moment" of stablecoins.

By Niu Xiaoqing

How Much Is a Channel Worth?

Let’s begin with an ancient yet epoch-making story.

In 1859, construction began on the Suez Canal. It took ten full years to dig an artificial waterway connecting the Mediterranean and Red Seas. The project cost 416 million francs—equivalent to 1.5% of France's GDP at the time. By today’s standards, it was an investment comparable to national infrastructure.

Why did they spend such enormous effort digging an "artificial river"?

The numbers tell the story:

-

Each ship passing through Suez pays about $250,000;

-

Between 18,000 and 21,000 ships pass annually;

-

Annual revenue exceeds $6 billion;

-

Average daily earnings exceed $15 million.

This isn’t just any river—it’s a “golden channel” linking Europe and Asia.

Without this canal, every ship would have to sail around Africa’s Cape of Good Hope, adding four to five days to their journey and increasing costs by 2–3.7 times. Each detour could cost hundreds of thousands or even millions of dollars more.

So this isn’t about water—it’s about the “channel.” An efficient, secure, legal channel doesn’t just save time and money; it becomes the key to controlling global trade.

The Channel Value of Stablecoins Is Being Rediscovered

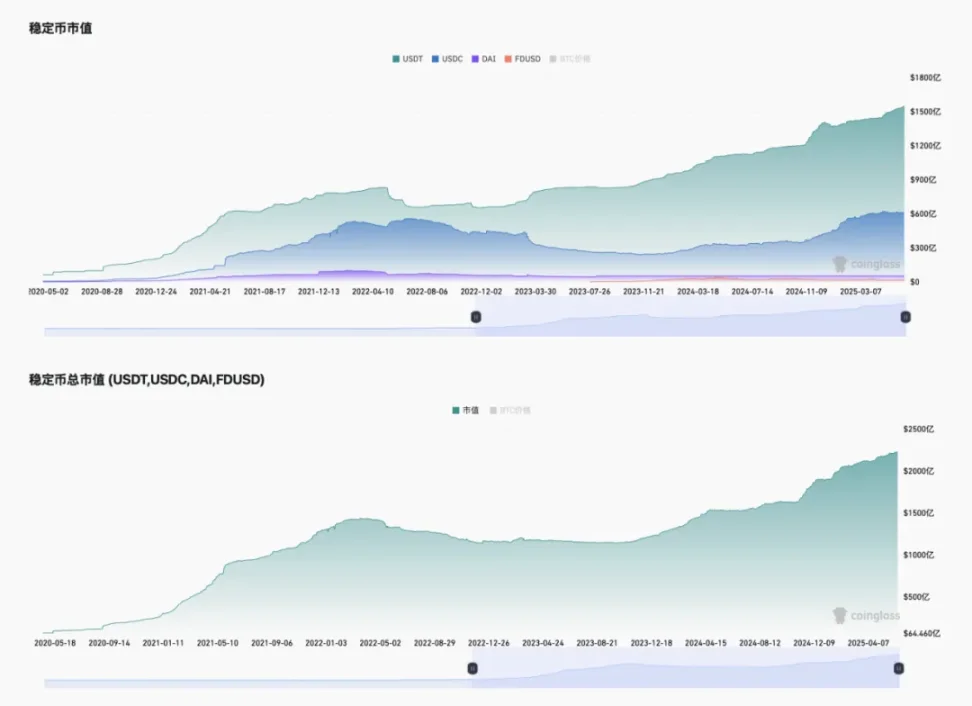

We’re now standing at the beginning of a new “channel revolution.” Countries worldwide are advancing stablecoin legislation, building main arteries that connect the on-chain world to real financial systems—or opening fast lanes from traditional business into on-chain finance. It’s predicted that by 2025, the global market cap of stablecoins will reach $250 billion; Standard Chartered is even more optimistic, forecasting potential growth up to $2 trillion, unlocking $10 trillion in capital flows.

More importantly: regulators are beginning to recognize the legitimacy of stablecoins.

Just as the Suez Canal wasn’t just for moving water but for enabling commerce, the moment stablecoin legislation passes, capital can finally enter the blockchain legally and directly—no more relying on offshore entities, no more navigating gray channels, less cost, greater efficiency.

This is a landmark moment: the compliant channel has officially opened.

The USDT Story: It Was Never About Issuing a Coin—It Was About Capturing a Structural Position

Before discussing JD, let’s look at the “elder brother”—Tether, issuer of USDT.

What opportunity did Tether seize? Bitcoin was originally designed for peer-to-peer payments, but its extreme volatility made it impractical for everyday settlements. USDT filled that gap perfectly. It didn’t appear out of thin air—it emerged from real market demand: serving as a price-anchored asset on-chain, a liquidity hub, and a safe haven during turbulence. As one observer put it: after every bull market bubble bursts, stablecoins remain in the market as “embers,” allowing capital to stay partially deployed and ready for the next wave. Tether’s returns are staggering:

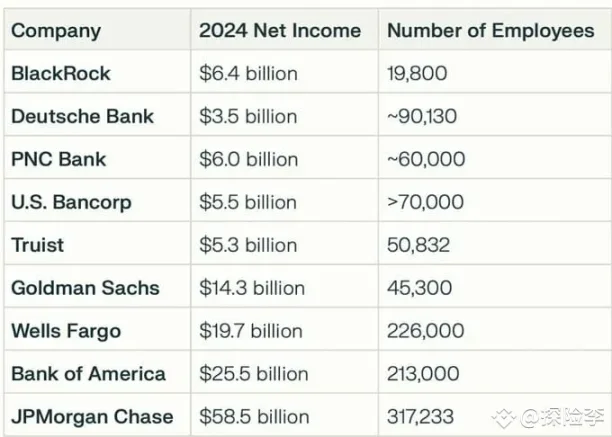

In 2024, it reported a net profit of $13.7 billion, generated by a team of just over 100 people—an average output per person exceeding $68 million, far surpassing JPMorgan, American Express, and Berkshire Hathaway.

Was this due to technology? No. It was due to structural positioning—Tether sits at the critical chokepoint of on-chain capital flows. Even when investigated and fined by regulators, it didn’t evade compliance; instead, it evolved while operating, gradually earning trust from hundreds of millions globally. That’s structural advantage. And now, a new window of opportunity has opened.

Why Is JD Launching a Stablecoin?

Many say JD is entering Web3. But I don’t see it that way.

JD isn’t launching a stablecoin simply to “issue a coin.” It aims to solve long-standing problems in cross-border e-commerce:

-

Long settlement cycles

-

High costs

-

Severe capital lock-up

-

Complex bank procedures

The value of stablecoins lies in being the shortest bridge between reality and the blockchain. They enable:

-

Instant settlement

-

Intermediary-free cross-border payments

-

Drastically reduced transaction fees

-

Automatable, auditable systems

Stablecoins aren't exclusive to Web3—they're a new tool for Web2 companies to build financial infrastructure.

This isn’t just an opportunity for JD. It’s an opportunity for every Chinese enterprise aiming to go global and connect internationally.

The Era of Stablecoin 2.0: System-Level Solutions

Past stablecoins served traders. Today’s stablecoins serve enterprises. They’re no longer just a “coin,” but a system module—an integral part of financial settlement, user incentives, supply chain closure, and cross-border payment processes. The next stage of stablecoins is systematic, compliant, and structurally integrated development. The real opportunity behind this shift is providing “stablecoin infrastructure” services to businesses.

The Transformation of Web3 Practitioners: From “Speculators” to “Architects”

The real opportunity isn’t whether you can issue a token, but whether you can:

-

Design payment systems that integrate stablecoins

-

Build cross-chain settlement bridges

-

Implement automated revenue sharing and risk control strategies

-

Help enterprises achieve regulatory compliance

If you understand blockchains, system structures, and enterprise needs, then you stand exactly at this intersection.

Merely operating within Web3 isn’t enough—you must become a service provider, architect, and channel builder for more Web2 enterprises.

We Are Experiencing the “Suez Moment” of Stablecoins

Back to our original question: How much is a channel worth?

No one complains about Suez tolls because everyone knows: taking the long route is expensive, slow, and risky.

It’s the same with stablecoin channels. You can use gray-market routes, arbitrage tricks, or makeshift workarounds—but those risks offer only temporary gains, not sustainable moats.

What’s truly valuable is structure, is the channel itself. The next breakthrough in this industry won’t be flashy token launches, but quiet, solid infrastructure building. Those who earn lasting value will be the ones constructing these channels for enterprises.

“I built this canal so ships may sail straight to Persia—that was my wish.” The vow of Darius the Great still holds true today. Now, it’s our generation of Web3 builders who must carve the next great channel.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News