Union Square Ventures: One chart, four possible directions for the future of AI technology

TechFlow Selected TechFlow Selected

Union Square Ventures: One chart, four possible directions for the future of AI technology

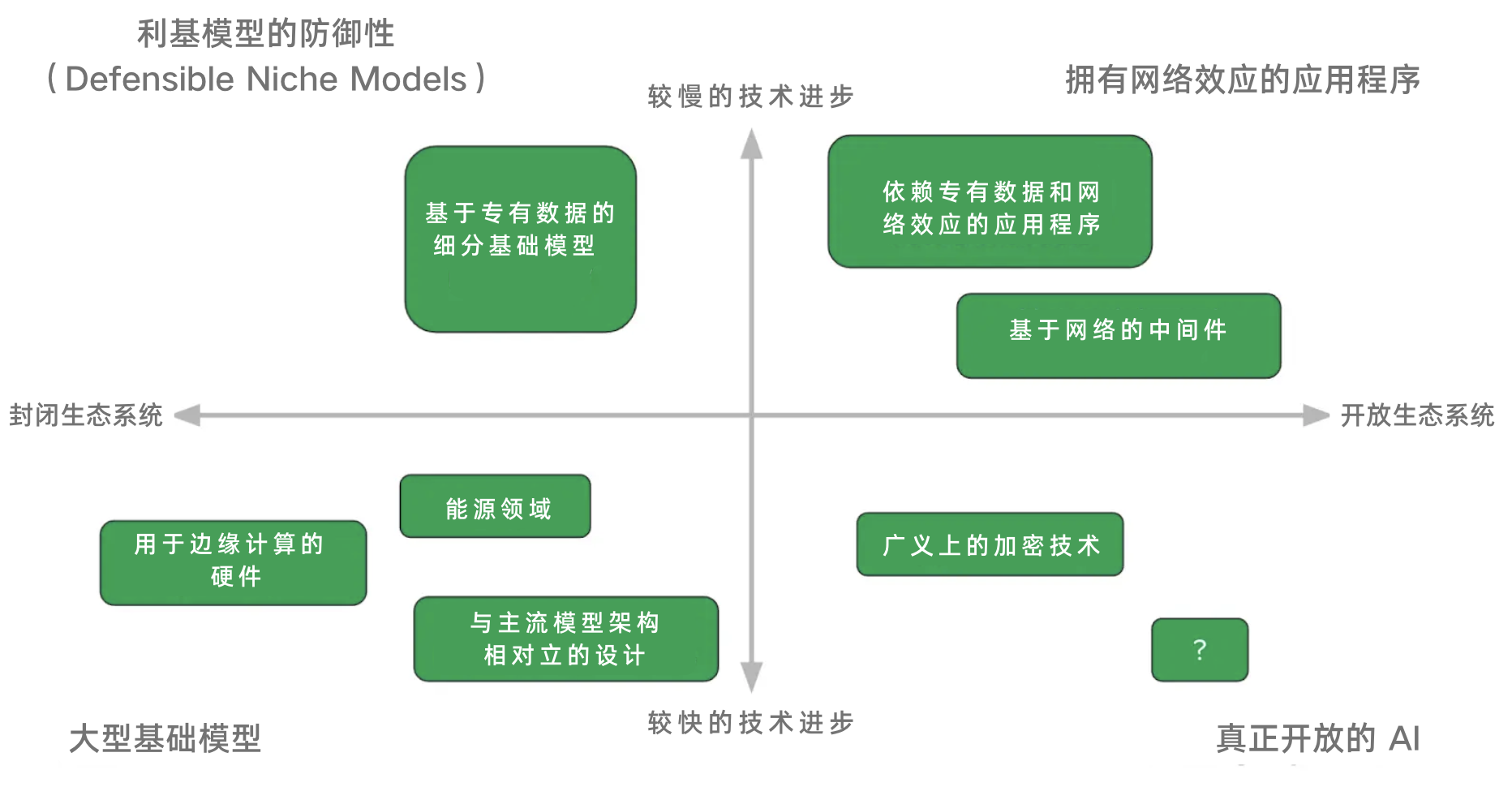

The direction of the future and the greatest opportunities depend on the pace of technological advancement and the openness of frontier models.

Authors: Grace Carney, Matt Mandel, Rebecca Kaden & Nick Grossman

Translation: TechFlow

In this era of immense opportunity and uncertainty, the rapid advancement of artificial intelligence has opened countless possibilities—yet it also brings profound and still-unanswered questions. Will we continue along the exponential growth curve of technology, even achieving a leap toward self-improvement? Or will progress slow due to emerging technical bottlenecks? Are the limits of technological development just around the corner, or still far out of reach? Will the future world be dominated by a few giants operating closed ecosystems, or will it be an open ecosystem characterized by multi-party competition and collaborative coexistence?

The direction of the future—and where the greatest opportunities lie—may depend on two key factors: the pace of technological advancement and the openness of frontier models.

-

Pace of technological advancement: This reflects how quickly AI model capabilities evolve. If progress is rapid, we may reach a "intelligence explosion" tipping point within just a few years; if it slows, technical bottlenecks could delay such outcomes by a decade or more.

-

Openness: This measures the concentration of power over AI models and the economic value extracted from them. In an open scenario, open models perform nearly as well as closed ones, or numerous high-quality closed models compete intensely—preventing any single model from monopolizing economic gains. In a closed scenario, a few dominant players pull far ahead with proprietary models and capture most of the value creation.

While new opportunities will emerge in each scenario, we believe the quadrant we ultimately land in will determine which projects, strategies, and business models hold the greatest advantage.

Large Foundation Models: Bottom-Left Quadrant

Within the technology stack, there's always tension over how value is distributed between infrastructure and application layers. In 2016, USV analyst Joel Monegro wrote in his blog post “Fat Protocols” that “traditional internet tech stacks exhibit ‘thin protocols’ and ‘fat applications.’ Market developments show higher returns from investing in applications, while direct investment in protocol technologies typically yields lower returns.” However, in blockchain tech stacks, this relationship reverses—most value concentrates at the protocol layer. As AI becomes the next dominant platform, we must re-examine this dynamic: Will value reside primarily in the models themselves, or in the applications built atop them?

In the bottom-left quadrant, technological progress accelerates continuously, eventually forming a closed ecosystem where models capture nearly all the value. The more capable the models become, the less we need applications—or other models—built on top of them.

In this scenario, dominance will rest with a few massive foundation models and their required infrastructure. To sustain the scaling of these models, enormous amounts of energy will be needed—including next-generation, more efficient energy sources. Infrastructure development around hardware, software, and energy production will become major areas for value creation. For example, companies in USV’s portfolio like Radiant, Blixt, Lydian, and Glow are innovating in energy generation and management. Additionally, opportunities exist for supporting alternative technical approaches to model architecture—such as decentralized training—that might emerge as winners in future markets.

The Rise of Niche Models: Top-Left Quadrant

(TechFlow note: Niche Models refer to AI models specialized in meeting specific domain needs or use cases. Unlike general-purpose models (such as large language models), niche models are typically optimized for particular industries, tasks, or datasets, offering greater specificity and expertise.)

In the top-left quadrant, despite a closed ecosystem, slower technological progress creates room for niche models to fill gaps left by foundation models. We’re already seeing this trend across multiple domains today—biotechnology, healthcare, robotics, sentiment analysis, personalized datasets, and physical-world data. Some of these areas have already received investments from USV. In this case, data becomes more concrete and targeted, and model utility becomes clearer. By narrowing scope and increasing focus, accuracy and practicality of models can significantly improve. In this quadrant, we’ll see dominant niche models grow across many fields, becoming important building blocks in their own right.

Applications with Network Effects: Top-Right Quadrant

In the top-right quadrant, progress in foundation models slows, but the ecosystem remains open. With inherent limitations in model capability and more constrained application scopes, startups gain opportunities to productize AI and build applications on top of models.

This outcome isn't unfamiliar to the venture capital ecosystem. Success here depends not only on technical breakthroughs but also on imagination. The opportunity lies in reimagining how we interact with AI—transforming how we work and live. We can expect entirely new applications, support layers, and interfaces that revolutionize how we learn, conduct research, deliver healthcare, create, entertain, socialize, execute tasks, and manage businesses. With more direct access paths to users, learners, patients, or customers, costs will drop dramatically and usability will greatly increase.

As in previous tech cycles, many developers will race for the same opportunities. Thus, network effects—whether through user growth or data accumulation—will become critical for companies to accumulate and protect core value.

Truly Open AI: Bottom-Right Quadrant

If models advance rapidly within an open ecosystem, we enter the most imaginative scenario: a world teeming with superintelligent, rapidly evolving models interacting frequently at high skill levels.

In this scenario, many open models will dominate their respective market segments—but they’ll require tools to interact efficiently with one another. In a world led by AI agents, these agents will need to transact frequently. Cryptocurrency could become the simplest and most flexible form of digital money for agent-to-agent transactions, benefiting tokens themselves, decentralized infrastructure, and interaction protocols like Farcaster. Imagine a future filled with intelligent agents equipped with wallets and budgets, conducting frequent transactions within a digital economy.

Conclusion

This framework is simplified, yet undoubtedly provides a starting point for thinking. The approaches favored in each quadrant may shine under specific conditions. Especially those products that inspire new user behaviors, generate novel value, and drive active adoption will have the potential to create tremendous value.

These quadrants help our team deeply reflect during this uniquely uncertain period: “What conditions would need to exist for a given approach to truly gain the upper hand?”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News