Bitwise Launches SOL Staking ETP as Europe Emerges as a Crypto "Compliance Haven"

TechFlow Selected TechFlow Selected

Bitwise Launches SOL Staking ETP as Europe Emerges as a Crypto "Compliance Haven"

Major cryptocurrency custodians are shifting toward the European market and offering investors超额 returns through on-chain staking services.

Author: Pzai, Foresight News

Crypto regulation is advancing rapidly, and ETFs/ETPs as key investment vehicles have drawn significant attention from market investors. On December 17, crypto asset management firm Bitwise launched a Solana staking ETP in Europe, ticker symbol BSOL. Notably, this ETP was issued in partnership with Solana staking service provider Marinade and offers users an annual yield of 6.48%, standing out among existing ETP products. Prior to Trump's inauguration, while regulatory progress unfolded vigorously outside the U.S., Europe took the lead by introducing the Markets in Crypto-Assets Regulation (MiCA), clearly defining rules for crypto asset issuance and custody. As a result, Europe has become one of the few regions enabling compliant financial products to integrate with on-chain economic returns.

First-Mover Advantage

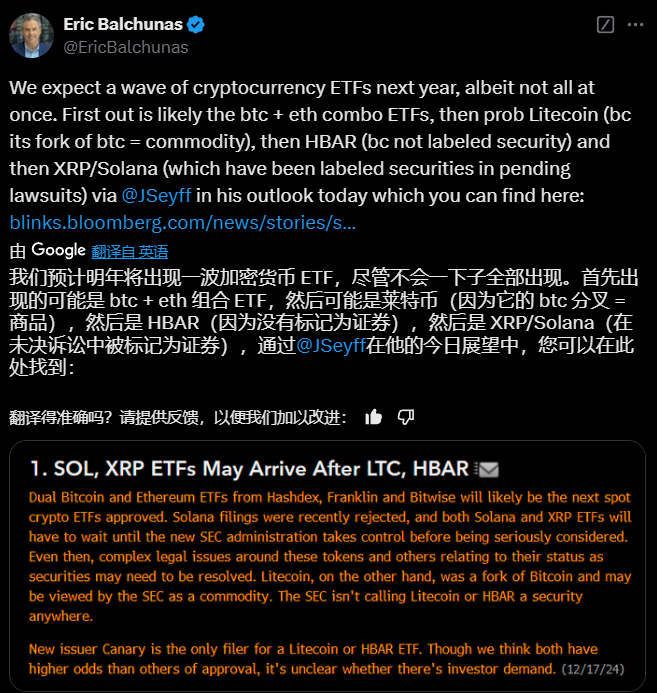

Prior to launching this ETP, Bitwise registered a Solana-related statutory trust in Delaware this past November, aiming to offer potential Solana ETF services to U.S. investors in the future. With spot Bitcoin and Ethereum ETFs approved this year, expectations around a Solana ETF are rising. However, due to current securities laws and the SEC’s ongoing assessment of whether Solana qualifies as a security, there remains no clear timeline for a Solana ETF launch in the U.S., and investors cannot access staking yields through such products. In Bloomberg analyst Eric Balchunas’ ETF rollout forecast, tokens like Solana and XRP—under close SEC scrutiny—are placed at the lowest priority. Given this landscape, major crypto custodians are shifting focus to Europe, leveraging on-chain staking services to deliver enhanced yields and greater flexibility to investors.

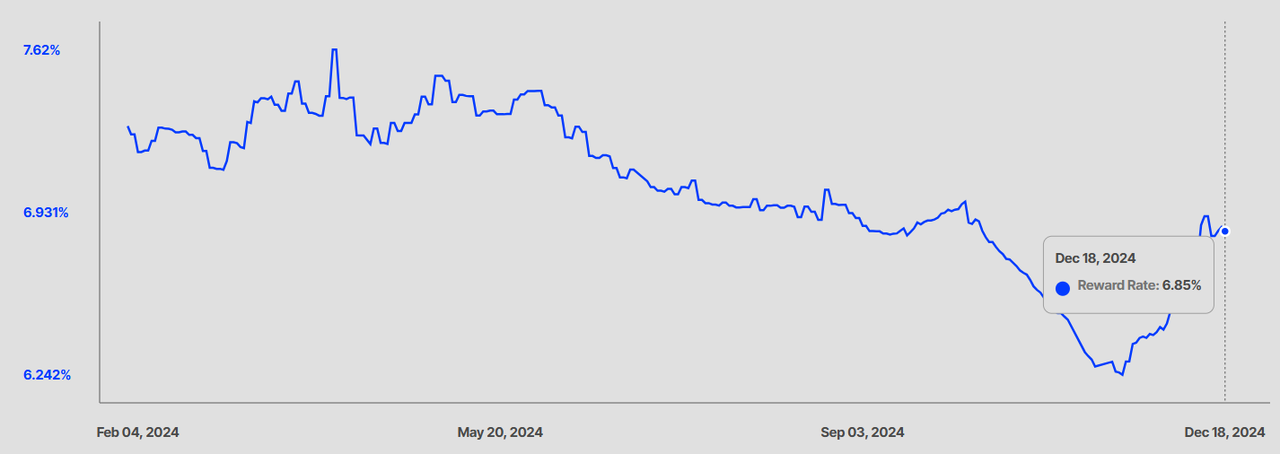

Before Bitwise, VanEck and 21Shares had already entered the market, with 21Shares achieving over $1.2 billion in total assets under management across its Solana ETPs—demonstrating strong investor appetite for Solana. Investment in staking-based products also reflects confidence in network activity. Over the past year, Solana has delivered outstanding performance in on-chain activity, with its staking annual yield peaking above 7.5%, outperforming many traditional ETF products.

Annual percentage yield of SOL staking over the past year (Source: stakingrewards.com)

Annual percentage yield of SOL staking over the past year (Source: stakingrewards.com)

Regulatory Implementation in Europe

At a time of rapid growth in the crypto sector, Europe moved early to address the challenges posed by fast-moving markets by enacting the Markets in Crypto-Assets Regulation (MiCA). Officially adopted into law in 2023, MiCA will fully phase in by June 30, 2026. The regulation aims to establish a unified framework for crypto asset supervision across the EU, clarifying the scope of application, classification of crypto assets, supervisory authorities, and information reporting requirements. This makes the European Union the first jurisdiction globally to implement comprehensive crypto legislation, marking a pivotal milestone for firms seeking to enter the EU crypto market. For ETF providers, operating within Europe’s mature regulatory environment can create regional spillover effects. By establishing ETP products in Europe, these firms set precedents that may influence future regulatory developments—such as under a new U.S. administration and Paul Atkins’ anticipated leadership at the SEC. Market observers expect custodians to replicate their European staking ETP infrastructure in the U.S. once conditions allow.

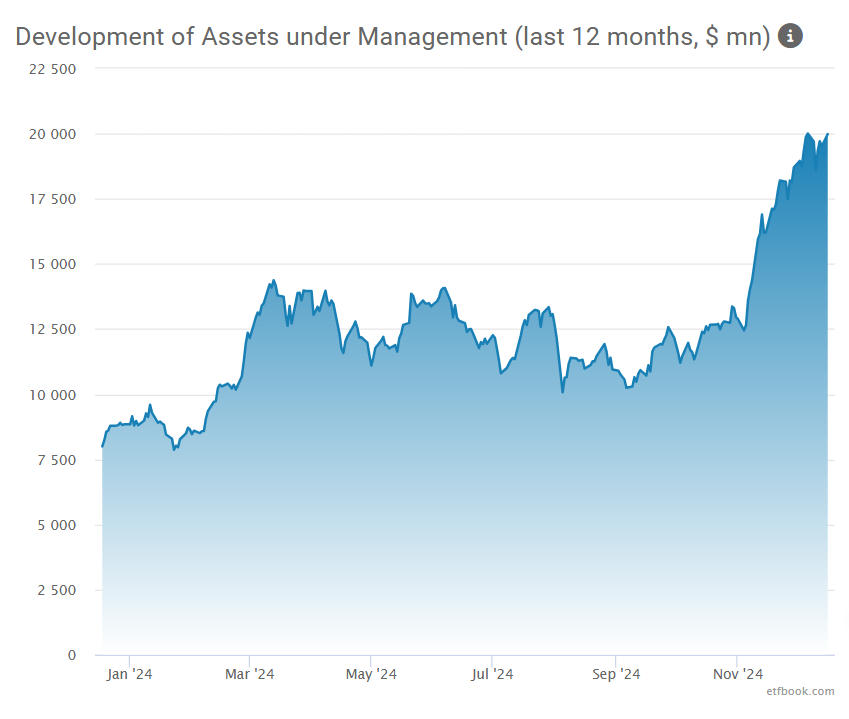

Globally—and particularly in Europe—the number of crypto ETPs and their total assets under management (AUM) are growing rapidly. As of today, there are 222 crypto ETPs in the European market, managing approximately $20 billion in AUM—an increase of nearly 60% over the past month alone. These products provide both retail and institutional investors with convenient, regulated, and low-cost access to a range of underlying assets, including Bitcoin, Ethereum, and other major cryptocurrencies. Moreover, as more traditional financial institutions (such as BlackRock) join native crypto firms in launching ETPs, these instruments not only expand investor access but also accelerate the broader adoption of crypto assets within global financial markets.

With Europe’s regulatory framework now taking shape, more compliant product models—such as RWA tokenization, regulated custody solutions, and stablecoin payments—are expected to debut first in the region. This underscores the EU’s role as a testing ground and incubator for emerging financial technologies, reflecting its open-minded approach and effective regulatory design. It also provides valuable reference points for other jurisdictions navigating their own paths toward crypto regulation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News