Deep Data Analysis: Has Solana Truly Surpassed EVM Chains? Assessing the Blockchain Competitive Landscape Through Liquidity Pool Quality

TechFlow Selected TechFlow Selected

Deep Data Analysis: Has Solana Truly Surpassed EVM Chains? Assessing the Blockchain Competitive Landscape Through Liquidity Pool Quality

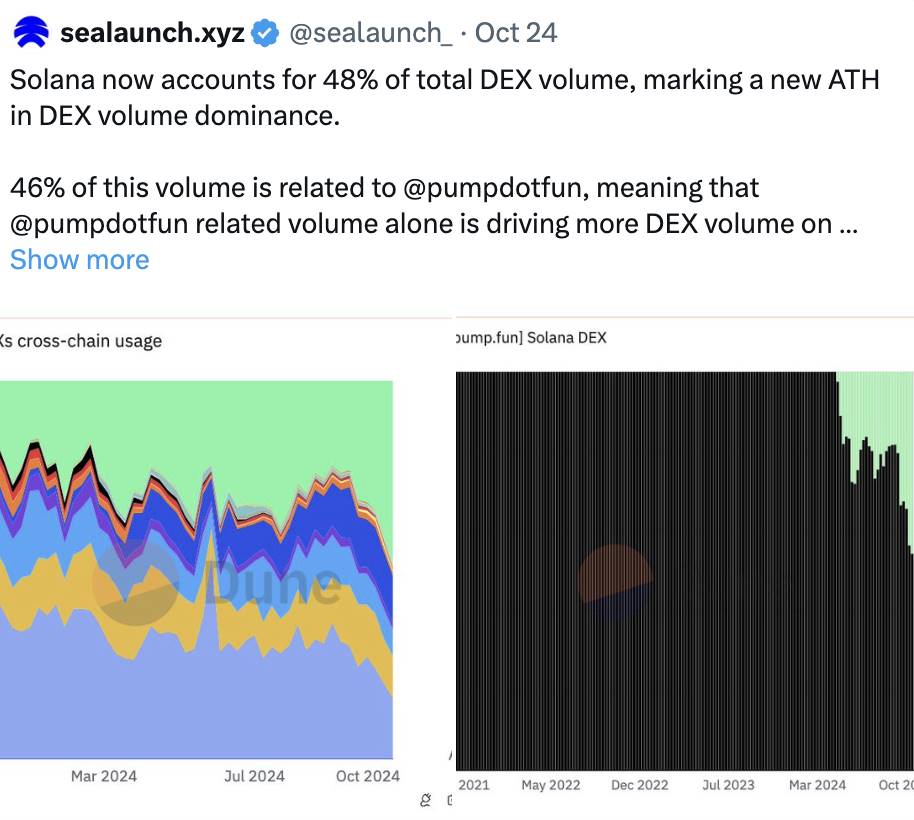

Most of Solana's trading volume comes from pools with poor liquidity, a significant portion of which originates from Pump Fun.

Author: jpn memelord

Translation: TechFlow

There's been a lot of discussion recently about Solana surpassing all EVM chains in trading volume. I decided to dig deeper into the quality of liquidity pools across top blockchains to assess whether this is just a fleeting trend or a genuine disruption to the existing landscape. Join me as we dive in.

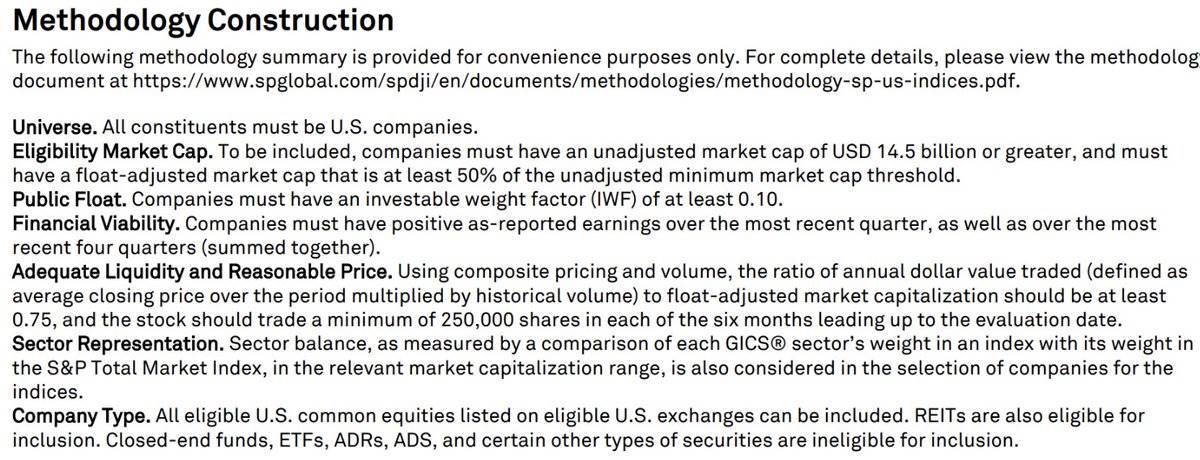

This analysis draws inspiration from stock inclusion criteria used in major equity indices.

The three main criteria are:

-

Established trading history

-

High liquidity

-

Sustained trading volume

These criteria have direct parallels in the context of liquidity pools.

Methodology Framework

The following methodology summary is for reference only. For full details, please refer to the S&P Global methodology document.

-

Eligibility: All constituents must be U.S. companies.

-

Market Capitalization: Companies must have an unadjusted market cap of at least $14.5 billion, and their float-adjusted market cap must be at least 50% of the unadjusted minimum threshold.

-

Public Float: A company must have an Investable Weight Factor (IWF) of at least 0.10.

-

Financial Viability: The company must report positive earnings in the most recent quarter and over the sum of the last four quarters.

-

Sufficient Liquidity and Reasonable Price: Using composite pricing and volume, the annual trading value (defined as average closing price multiplied by historical volume) divided by float-adjusted market cap should be at least 0.75, and the stock must trade at least 250,000 shares per month over the six months prior to evaluation.

-

Industry Representation: Industry representation is measured by comparing each GICS® industry’s weight in the index to its weight in the S&P Total Market Index, with company selection considered within relevant market cap ranges.

-

Company Type: All eligible U.S. common stocks listed on qualified U.S. exchanges are eligible for inclusion. REITs are also eligible. Closed-end funds, ETFs, ADRs, ADSs, and certain other securities are not eligible.

Are there stocks traded outside major indices? Yes, absolutely.

However, these stocks represent the "blue chips" of traditional finance. Identifying their DeFi equivalents can help us understand what traditional finance might prioritize when entering the DeFi space.

I collected trading volume data for all liquidity pools on Ethereum, Solana, BSC, @arbitrum, and @base, aggregating total volume over the past 30 days.

Next, I applied a weighting adjustment to pools created within the past 30 days to reduce their ranking, satisfying the "established history" criterion.

Finally, I weighted each pool by both trading volume and total value locked (TVL) to meet the two remaining criteria.

Specifically, I applied a weighting adjustment to pools created within the last 30 days to lower their rankings, fulfilling the "established history" requirement. Then, I weighted each pool’s volume and TVL using the formula: Ln(TVL)/Ln(MAX(TVL)) * TVL_weight.

This scaling method has minimal impact on highly liquid pools but reduces the ranking of pools with lower TVL.

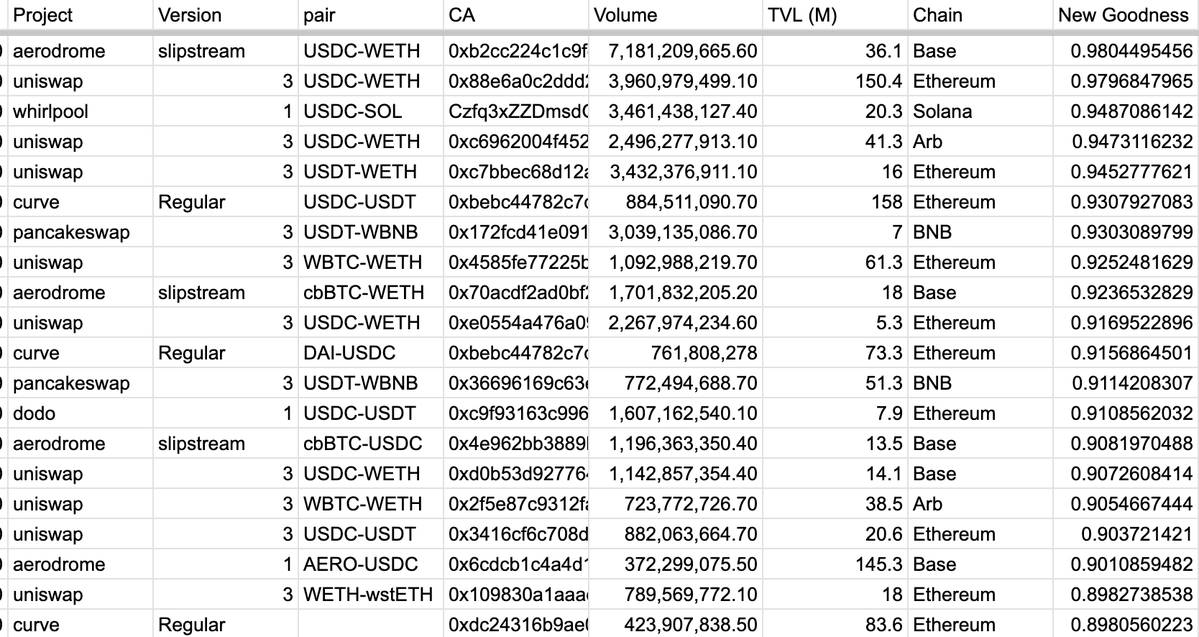

Below are the top 20 rankings under this weighted methodology—our "new premium" tier.

Notably, Ethereum, Solana, Arbitrum, and Base each have one representative among the top 4!

These are all "main" pools trading each chain’s native token against USDC.

Another striking observation: Ethereum remains dominant, occupying half of the top positions. Its combination of high TVL and sustained trading volume sets it apart across all chains.

I strongly suspect this is partly why Blackrock chose to deploy on Ethereum.

Diving deeper, the first two pools stand out particularly:

@AerodromeFi's slipstream WETH-USDC pool has the highest trading volume, while the highest TVL belongs to

@Uniswap's v3 WETH-USDC pool on Ethereum.

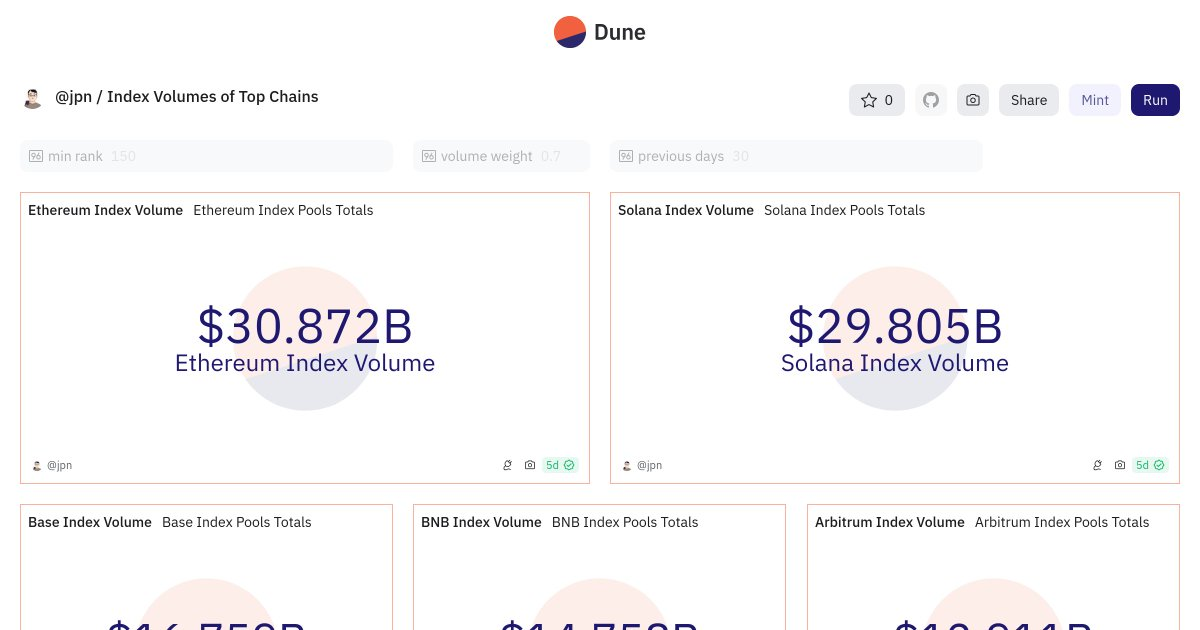

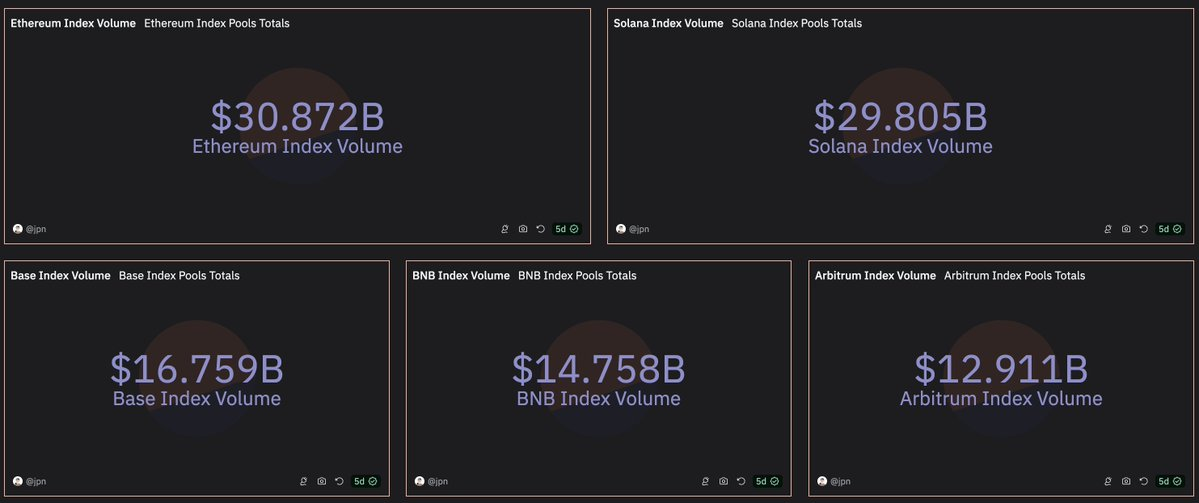

Dune dashboard link:

Trading Volume Index for Top Blockchains

On most blockchains, the primary 0.05% fee liquidity pools rank at the top. However, on BNB Chain, the top pool operates at a 0.01% fee—somewhat surprising.

Additionally, USDC appears more frequently than USDT in top-tier pools, which was unexpected.

How many pools does each chain have in the list?

Ethereum: 10

Base: 5

Arbitrum: 2

BSC: 2

Solana: 1

In this analysis, all other Solana pools failed to rank due to insufficient TVL. Despite high volume, trading occurs with significantly lower liquidity compared to other chains.

When excluding TVL from consideration, Solana shows substantial volume among the top 150 pools, but it doesn't come close to surpassing all EVM chains—nor even Ethereum (though it's quite close).

Top 20 assets traded across all pools include:

Stablecoins: USDC, USDT, DAI, pyUSD

Main coins: ETH, BNB, SOL, cbBTC, WBTC, and wsETH

Others: AERO

Surprisingly, Aero is the only token that is neither a stablecoin nor among the top five cryptocurrencies by market cap.

TVL of top 25 pools per chain:

Ethereum: $1.04 billion

Base: $310 million

BNB: $194 million

Solana: $181 million

Arb: $155 million

Clearly, Ethereum remains the leader, but Base leads among the rest.

Notably, 4 out of Base’s 5 pools belong to Aerodrome, showcasing their strong lead on the chain—even though Uniswap dominates on Arbitrum and Ethereum.

Summary

Much of Solana’s trading volume comes from low-liquidity pools, with a significant portion originating from Pump Fun. (link)

Ethereum remains the DeFi powerhouse, but Base is emerging as an unexpected challenger, hosting the single highest-volume pool.

This surge in attention isn't bad, but I believe sophisticated investors looking to enter DeFi care more about sustained economic activity from deep liquidity pools rather than which animal coin is trending this week—or today.

There are many ways this analysis could be further refined:

-

Automate TVL metric calculations

-

Go beyond TVL to examine liquidity depth (CL pools are highly capital-efficient)

-

Factor in pool fee tiers

I’ll be releasing part two of this analysis in the coming weeks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News