Four Pillars: Eigenlayer's Recent Market Dynamics and Future Outlook

TechFlow Selected TechFlow Selected

Four Pillars: Eigenlayer's Recent Market Dynamics and Future Outlook

This report will analyze the fundamental reasons behind $EIGEN's poor performance and explore its future prospects.

Author: Ponyo

Translation: TechFlow

Earlier this year, $EIGEN traded over $13 in the over-the-counter market, but since its official listing on October 1, its price has fluctuated between $3 and $4, implying a fully diluted valuation of approximately $5 billion to $7 billion. This means EigenLayer’s market value has dropped by roughly 70% within just six months. Such a sharp decline has left investors puzzled and sparked criticism that the much-anticipated Restaking innovation has failed to meet expectations. In this report, we will analyze the root causes behind $EIGEN’s underperformance and explore its future outlook.

*For a detailed explanation of the Restaking concept, refer to the report "Restaking Stack: Classifying the Restaking Ecosystem".

1. Background – Reasons for $EIGEN's Post-Launch Underperformance

The weak performance of $EIGEN after launch is primarily attributed to two key factors frequently cited within the community.

1.1 Ambiguity of Token Utility

In its whitepaper released on April 29, 2024, EigenLayer described $EIGEN as a "Universal Intersubjective Work Token." This complex and unfamiliar term made it difficult for investors to grasp the core value of the token.

Source: Youtube (@Curt Explores)

In simple terms, $EIGEN’s primary role lies in mediating and resolving issues within Active Validation Services (AVS), but effectively communicating this remains challenging.

While industry insiders may clearly understand the concept, there is a lack of direct information about the token’s practical use—especially for retail investors—leading to confusion. The complexity of explaining how $EIGEN resolves failures in decentralized systems increases the difficulty of adoption and comprehension, particularly within an ecosystem filled with competing narratives. Let us delve into each component of this explanation.

Universal

"Universal" indicates that $EIGEN is not limited to a specific blockchain network but can be broadly applied across various blockchain infrastructures and applications, such as zk-rollups, cross-chain bridges, MEV solutions, Trusted Execution Environments (TEEs), and even AGI (Artificial General Intelligence) solutions. This flexibility stems from EigenLayer being built on Ethereum while capable of handling staking and validation tasks across multiple networks. Compared to traditional Layer 1 tokens typically tied to a single blockchain ecosystem, this broad applicability is a key differentiator of $EIGEN.

Work Token

A "Work Token" refers to a token staked within the network to perform specific tasks. In blockchain, these tasks include validating transactions, generating proofs, and ensuring network integrity—core functions in Proof-of-Stake (PoS) systems. Within EigenLayer, $EIGEN and its staked form $bEIGEN support performing these tasks across various AVSs. Validators who fail to comply with protocol rules face economic penalties through slashing and confiscation of their staked $bEIGEN. This mechanism resembles traditional PoS systems but extends beyond typical Layer 1 validation, expanding the scope and application of work tokens in decentralized services.

Intersubjective

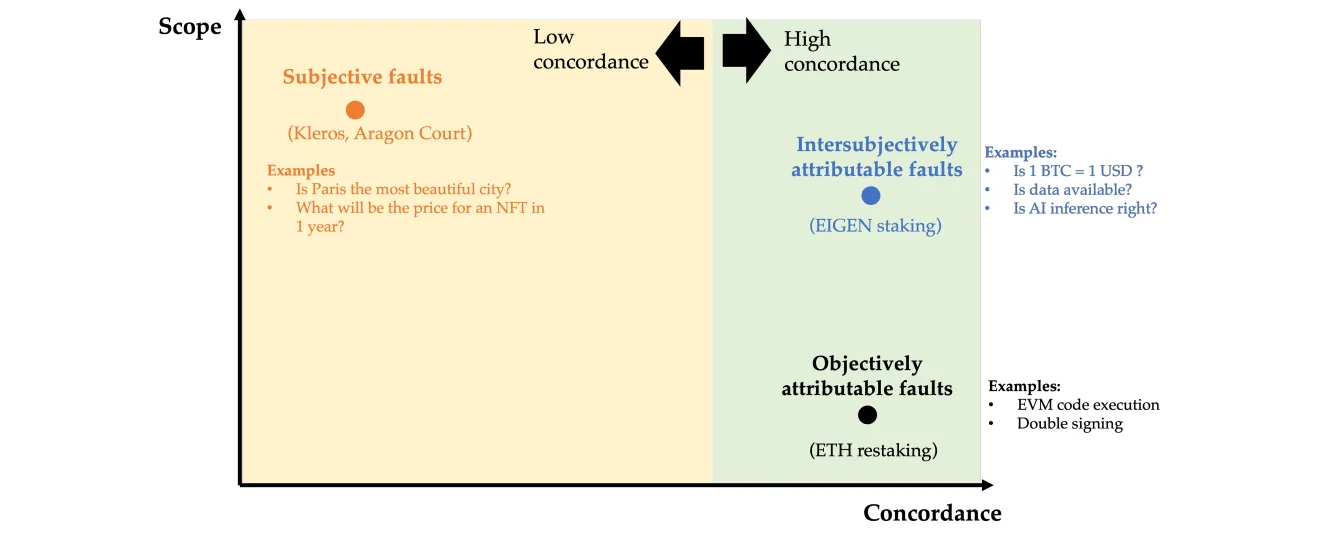

In blockchain environments, failures can be categorized into three types: objective, subjective, and intersubjectively attributable faults. Intersubjectively attributable faults are particularly interesting because they cannot be verified purely through technical means, yet participants widely recognize them as failures. These often arise in cases involving off-chain data or requiring human judgment, such as incorrect price feeds or censorship events. Resolving such faults relies on collective consensus among network participants, forming the core utility of $EIGEN. Its ability to handle consensus-driven errors—especially those involving subjective data inputs—distinguishes $EIGEN from tokens focused solely on technical verification.

Source: EIGEN: A Universal Intersubjective Work Token | EigenLayer

As previously mentioned, $EIGEN serves as a mediation tool specifically designed to resolve subjective faults—issues whose correctness cannot be definitively determined via technology alone but are widely recognized as erroneous by participants. For instance, if a validator intentionally submits false data or violates protocol rules, the malicious party’s staked $EIGEN will be removed from the network through a fork process. Here, the fork does not merely mean separation from the network; it acts as a strong punitive measure that can render the offending validator’s tokens worthless.

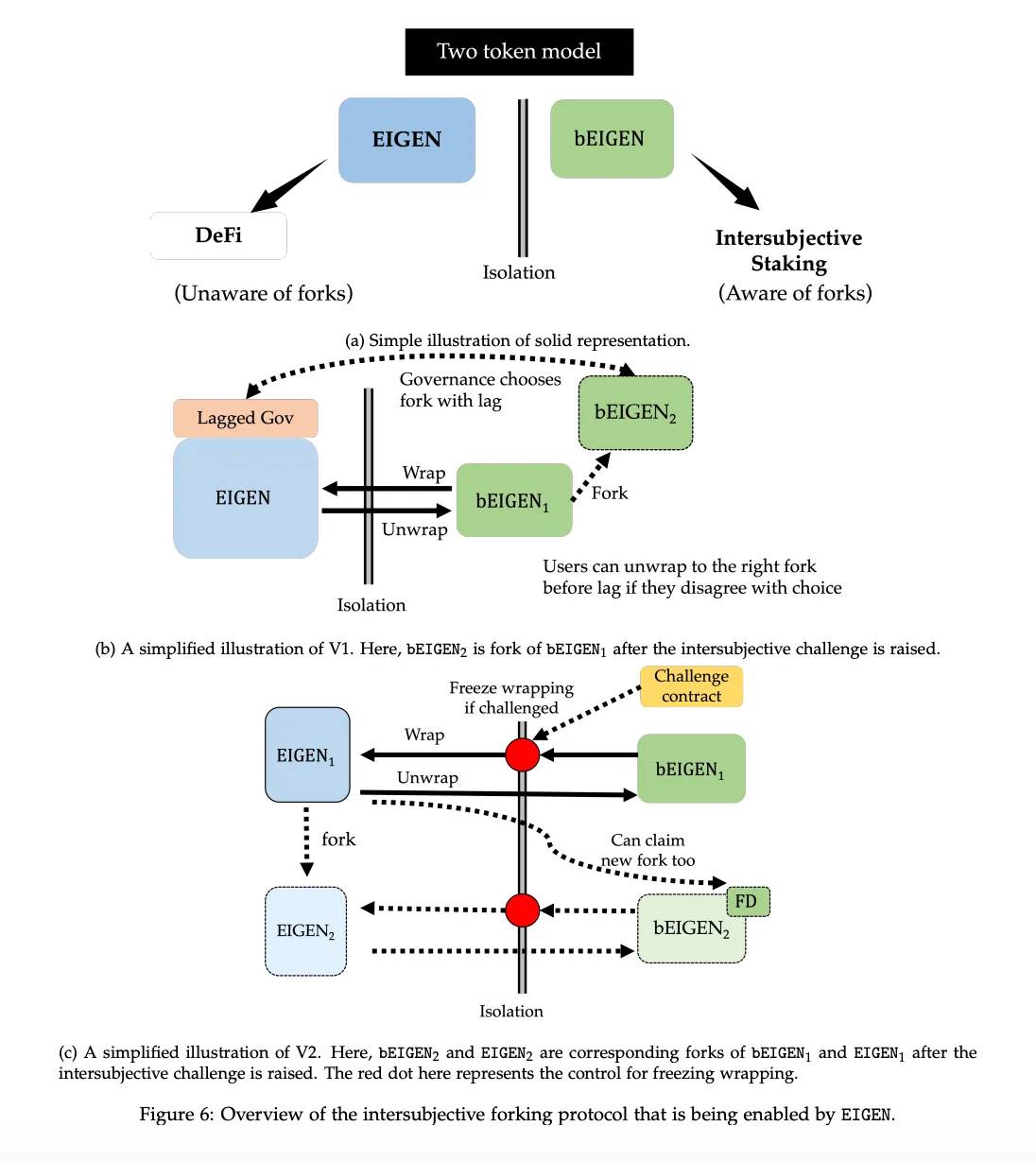

Fork Process

When a fault is detected within a specific Active Validation Service (AVS), a challenger can raise a dispute. To resolve it, the network destroys the original $EIGEN and issues a new forked token, $EIGEN2. During this process, the Fork Distributor (FD) contract allows legitimate $EIGEN holders and stakers to exchange their tokens for the new version, $EIGEN2. However, the malicious actor’s staked $bEIGEN cannot be converted into $bEIGEN2, rendering their assets valueless.

This fork mechanism acts both as a deterrent and a protective measure, ensuring participants contributing to network health are safeguarded while malicious actors see their holdings reduced to zero. It is a powerful economic penalty mechanism designed to maintain network integrity and ensure only honest participants are rewarded.

Source: EIGEN: A Universal Intersubjective Work Token | EigenLayer

At this point, a reasonable question arises: Why not simply use $ETH to handle these faults instead of relying on $EIGEN? The reason is that adding tasks requiring subjective or intersubjective decisions to Ethereum’s consensus mechanism could overload it. Ethereum’s consensus is primarily designed for objectively verifiable tasks like transaction validation and maintaining correct blockchain state.

However, when tasks involve human judgment—such as determining whether an outcome is fair (e.g., in prediction markets or content moderation)—achieving consensus becomes more complex. These tasks risk overwhelming Ethereum’s social consensus mechanisms, which rely on subjective alignment among participants rather than straightforward cryptographic proof verification. By introducing the $EIGEN token, EigenLayer aims to offload these subjective tasks to a separate consensus layer, preserving Ethereum’s cryptographic-economic security for objectively verifiable transactions while handling more complex, socially-consensus-dependent operations elsewhere.

Overall, while the existence of $EIGEN is logically justified, its utility is both evident and somewhat ambiguous. While theoretically clear in enhancing AVS security and resolving intersubjective faults, its practical utility remains obscure to many investors. The value of this token only becomes apparent when intersubjective errors occur within the network—meaning in their absence, its utility may seem less tangible. This makes $EIGEN a niche token, standing in stark contrast to meme coins that gain popularity through hype despite lacking intrinsic utility.

This point was illustrated in a recent survey conducted by DeFiIgnas, CEO of Pinkbrains, where over 60% of respondents (2,314 out of 3,839) indicated they would prefer investing in $MOG over $EIGEN. This result highlights investor preference for assets with simple, easily understandable narratives, further underscoring $EIGEN’s challenge in attracting broader attention.

Source: X (@DefiIgnas)

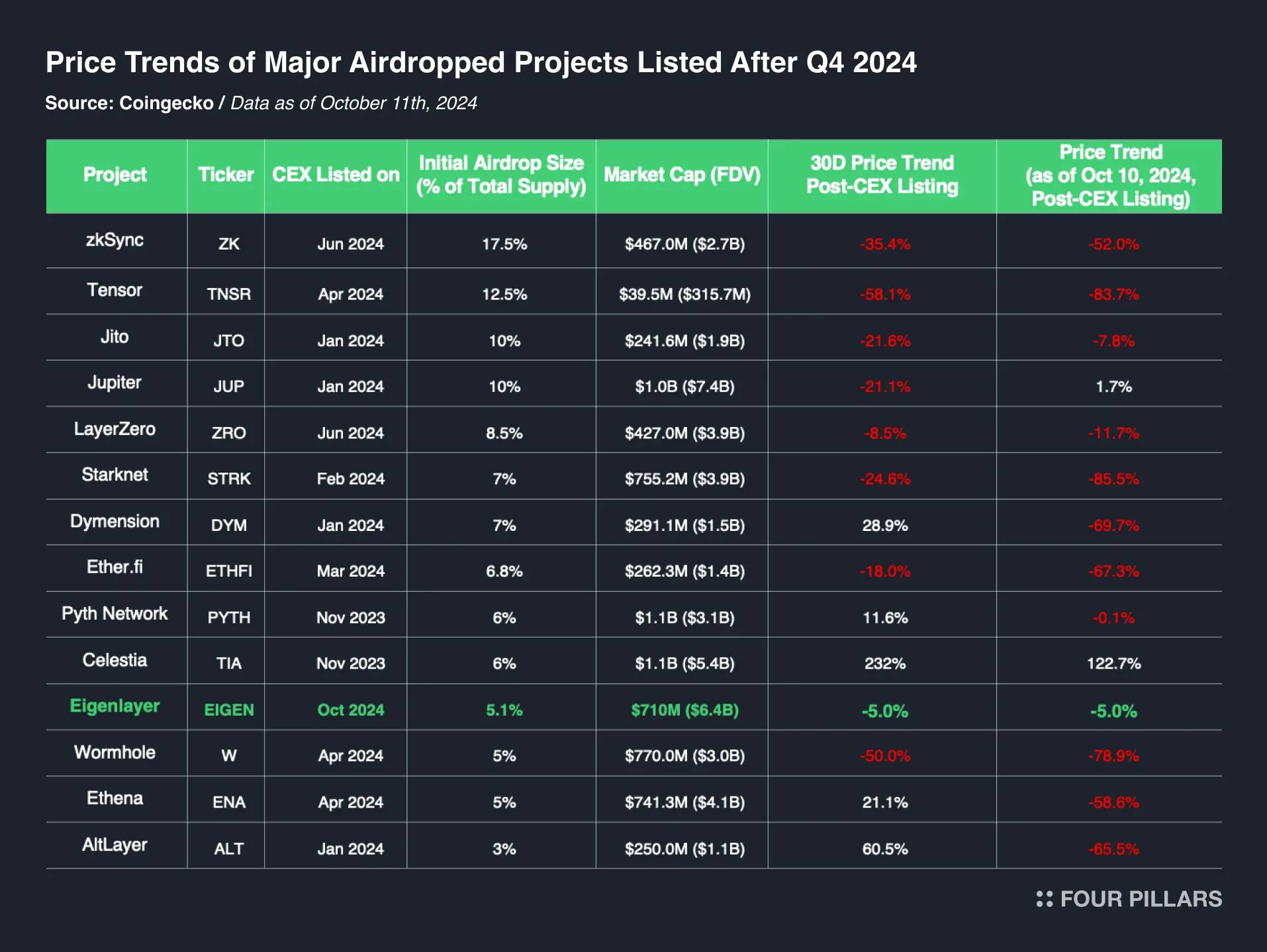

1.2 Selling Pressure from Airdrop Recipients

Another key reason behind $EIGEN’s recent underperformance is the selling pressure exerted by airdrop recipients seeking to realize profits. This phenomenon is common following the listing of many project tokens. Historical data shows that most airdropped tokens experience downward price pressure shortly after launch, as early holders often rush to sell their free allocations. For example, major projects launched over the past year have generally seen significant price drops within the first 30 days post-listing. While macroeconomic conditions, valuations, and tokenomics all influence these fluctuations, the impact of airdropped tokens cannot be overlooked.

In EigenLayer’s case, 46% (approximately 86 million $EIGEN) of the initial circulating supply of 185 million $EIGEN came from airdrops. These included distributions to institutional investors and major crypto whales such as Blockchain Capital and Galaxy Digital. Notably, reports indicate that Justin Sun and GCR transferred approximately $8.75 million and $1.06 million worth of airdropped $EIGEN to centralized exchanges, further intensifying selling pressure. Additionally, the EigenLayer Foundation recently announced that around 1.67 million $EIGEN were stolen in a hack, compounding the situation.

2. Insights – Focus on Strong Fundamentals of AVS Ecosystem Growth

Like any asset, long-term price movements ultimately reflect fundamental growth. In this regard, EigenLayer’s fundamentals remain solid, and the key metric to watch going forward is the growth of its Active Validation Services (AVS) ecosystem.

2.1 Market Dominance Through First-Mover Advantage

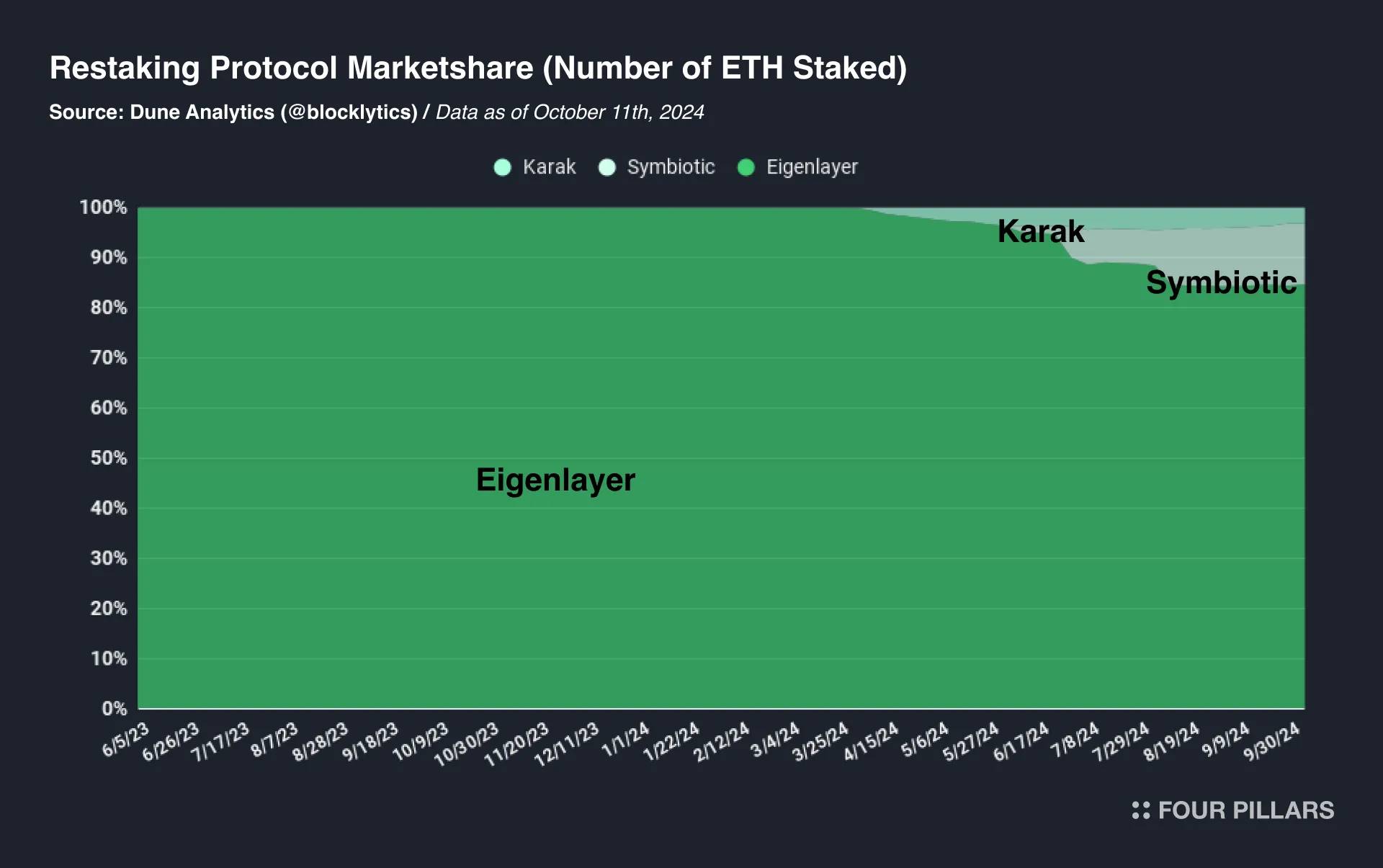

EigenLayer launched its service in June 2023, pioneering the concept of restaking. Since then, numerous innovative projects across various blockchain ecosystems have emerged, inspired by this model. For example, Symbiotic and Karak have made notable progress within the Ethereum ecosystem, while Solayer and Jito have expanded into the Solana ecosystem. In the Bitcoin space, projects like Babylon are exploring similar approaches. Moreover, Liquid Restaking Token (LRT) projects such as Ether.fi and Puffer.fi build upon foundational concepts introduced by EigenLayer. This wave of innovation underscores EigenLayer’s pivotal role in shaping the broader restaking ecosystem and fostering a collaborative, evolving environment.

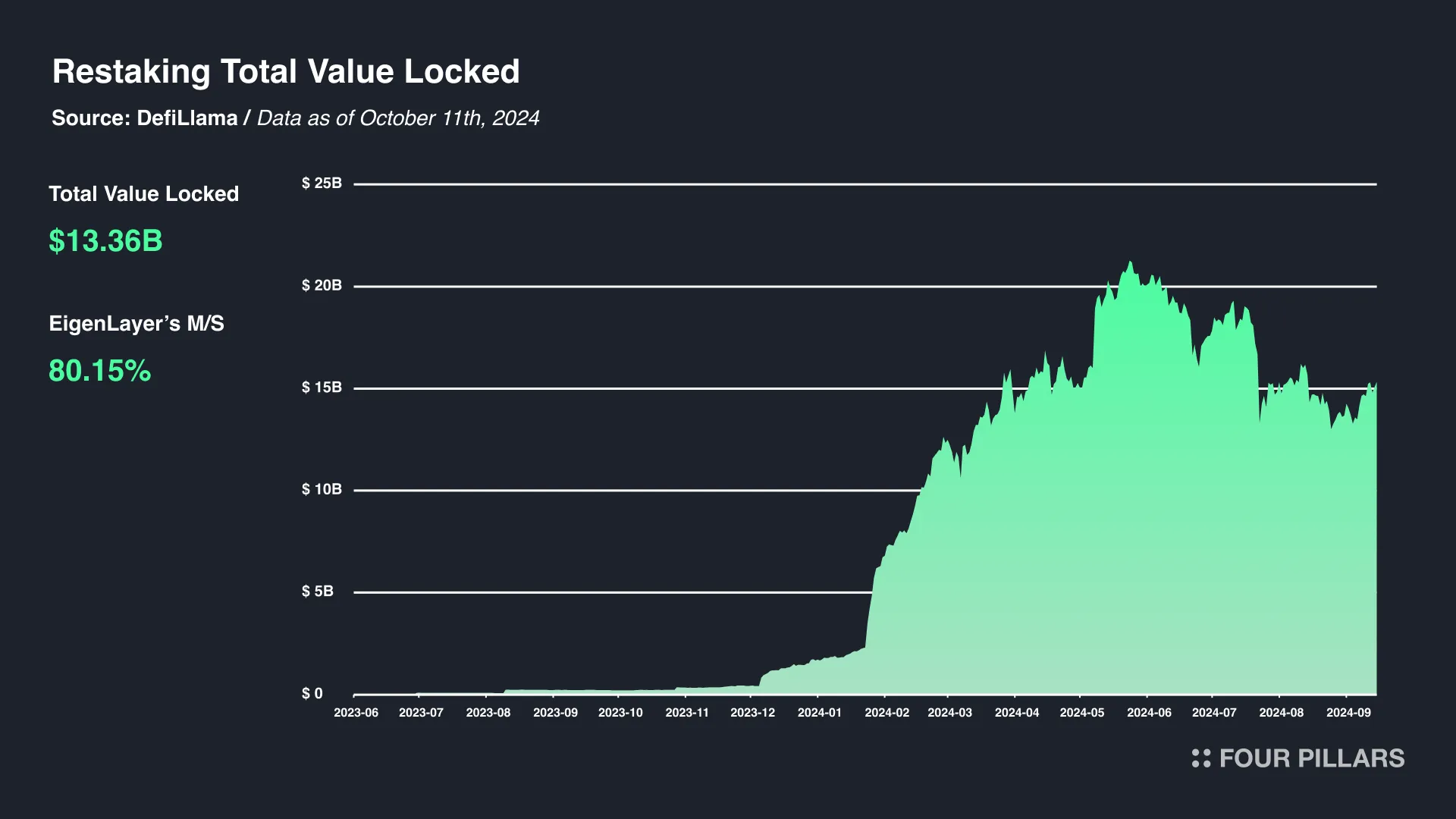

Market data further confirms this dominance. As of October 11, 2024, the total value locked (TVL) in restaking protocols reached approximately $13 billion, with EigenLayer accounting for about $10 billion (equivalent to 4.5 million $ETH), representing an 80% market share. In comparison, Symbiotic and Karak hold 11.7% and 3.7% shares respectively.

2.2 The Key Is Growth of the AVS Ecosystem

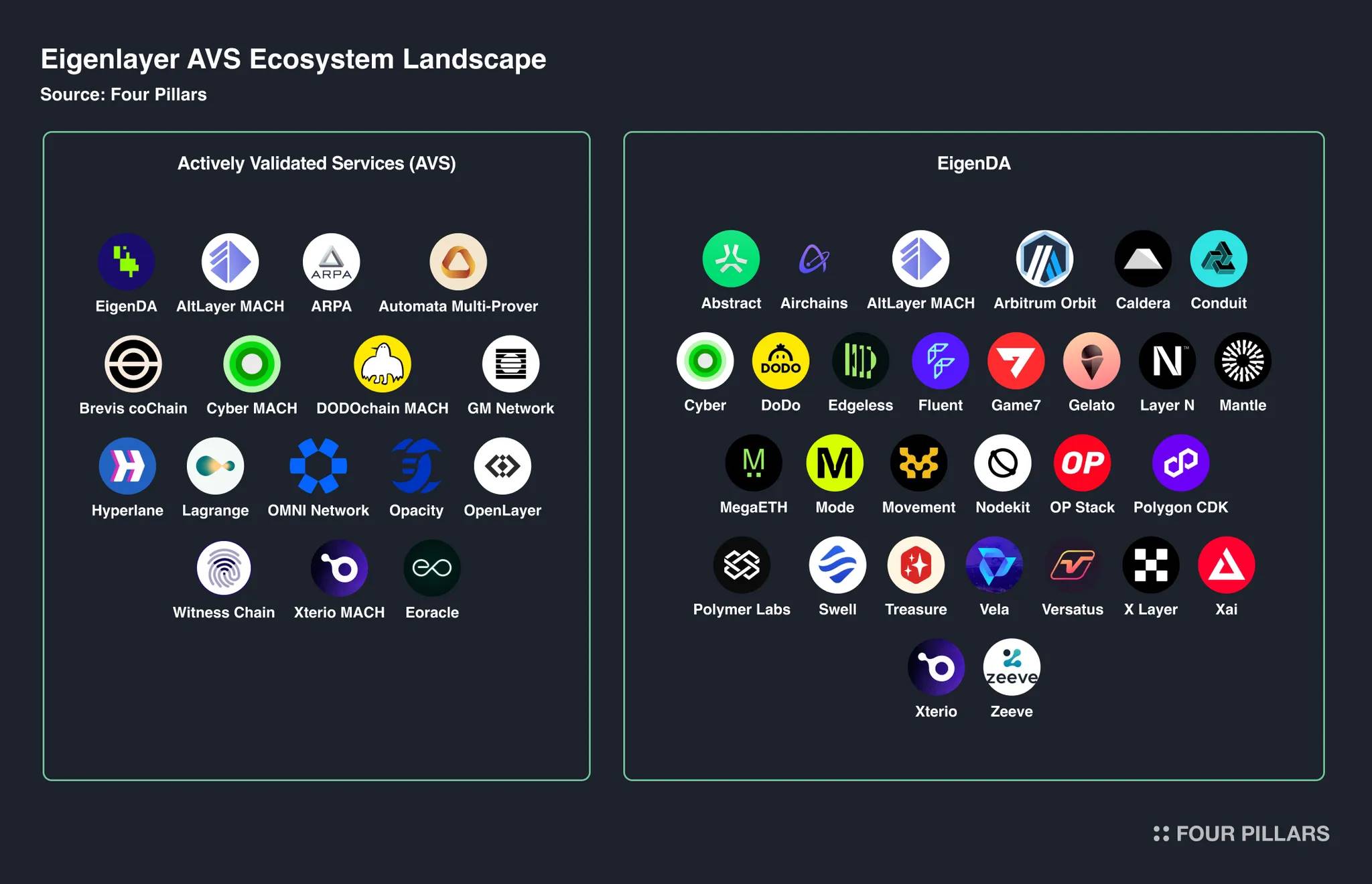

Although EigenLayer maintains a leading market share, the most critical factor to monitor going forward is the pace of growth in its AVS ecosystem. No matter how advanced EigenLayer’s technology may be, its value remains limited without widespread user adoption and real-world applications. If ecosystem growth stalls, EigenLayer risks losing market share to emerging competitors. More importantly, revenue generated by AVSs flows directly to $EIGEN stakers, meaning the success and expansion of AVSs are closely tied to the value of $EIGEN.

Finally, although there is currently no clear narrative driving demand for $EIGEN, a potential catalyst could emerge if market anticipation builds around an “AVS airdrop” token similar to $TIA earlier this year. Once such expectations form, growth in the AVS ecosystem could significantly boost demand for $EIGEN. To date, 17 AVS projects—including EigenDA—are under development on EigenLayer, with more expected to join. Furthermore, 44 major networks including Abstract, MegaETH, Mantle, and Movement already support or utilize EigenDA, demonstrating its expanding influence.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News