Most similar to security BNB, now officially no longer considered a security

TechFlow Selected TechFlow Selected

Most similar to security BNB, now officially no longer considered a security

It seems the SEC's actual criterion might be whether they can make money through fines~

Author: Observer Lao Wang

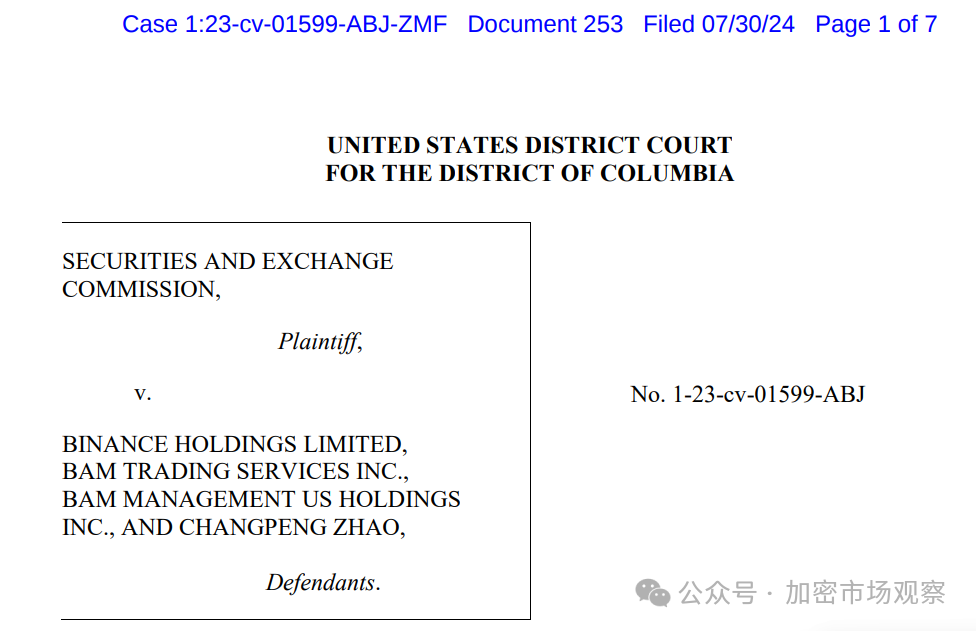

Today, a U.S. court in Washington, D.C. released a court filing showing that the SEC has informed Binance that $BNB and $BUSD are not considered securities!

Among all cryptocurrencies, Binance Coin ($BNB) was arguably the one most resembling a security—not only because Binance is one of the few cash-generating powerhouses in the crypto industry, but also because, like many U.S. public companies, it has consistently conducted buybacks (through token burns).

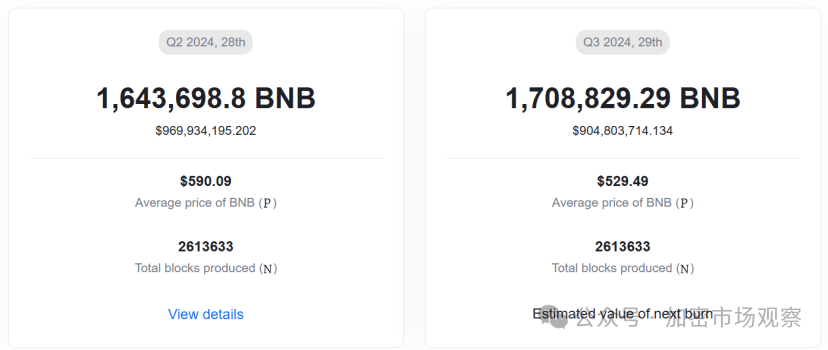

For example, earlier this month the BNB Foundation announced the completion of its 28th quarterly BNB burn, destroying approximately 1.643 million BNB tokens worth around $970 million.

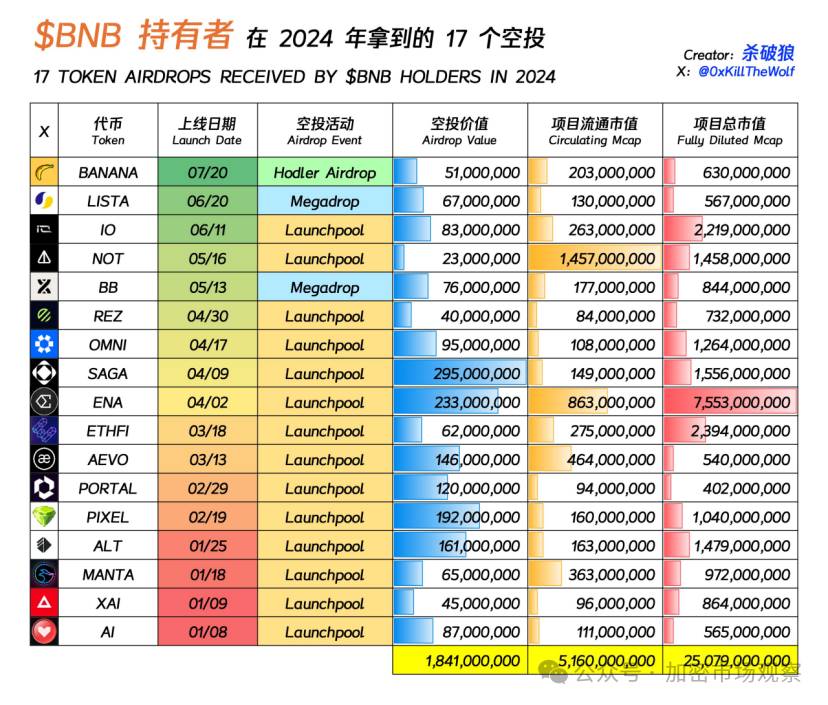

Moreover, BNB holders receive more frequent airdrops than traditional stock dividends. According to analysis by a well-known influencer, during just the first half of 2024, BNB holders received project token airdrops valued at $1.841 billion—equivalent to 2.16% of $BNB’s current market cap.

Given all this, how could such an obviously security-like asset no longer be classified as a security?

The U.S. legal standard for defining a security consists of four criteria:

-

Investment of money

-

Common enterprise

-

Expectation of profit

-

Profits derived from the efforts of others

At first glance, BNB seems to meet all four:

-

Purchasing BNB requires investment of money

-

Isn’t it precisely for Binance’s crypto-related business?

-

Isn’t the whole point of buying tokens to make a profit?

-

Aren’t investors relying on Binance employees and various project teams to generate returns?

In fact, to improve compliance, Binance discontinued its profit-based buyback mechanism back in late 2021, replacing it with an automated token burn system.

Under the new automated burn mechanism, the number of BNB tokens to be burned each quarter is calculated automatically based on the current BNB market price and the number of blocks generated on the BNB chain during that period.

In theory, this means BNB burns are no longer tied to Binance Exchange's profits, but rather to on-chain activity within the BNB ecosystem.

Additionally, users must actively participate to claim Binance’s various airdrops.

Through these strategic adjustments, the expected returns for BNB investors can now arguably be seen as “not derived from the efforts of others.”

Meanwhile, the SEC still insists that tokens like Solana qualify as securities…

It seems the SEC’s real criterion might simply be whether they can collect fines.

The SEC has effectively reached a settlement with Binance, which will likely involve a fine against Binance itself.

Many readers ask: Didn’t they already pay over $4 billion in penalties before?

That was a penalty against CZ personally—it doesn’t conflict with this new fine against Binance!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News