How much funding is too much when performance remains poor? Application scenarios are the key.

TechFlow Selected TechFlow Selected

How much funding is too much when performance remains poor? Application scenarios are the key.

As long as retail investors have no dreams, the market manipulators can't reap profits. Buying low and selling high is the ultimate way!

01 Retail Investors Have No Dreams, Whales Can't Profit

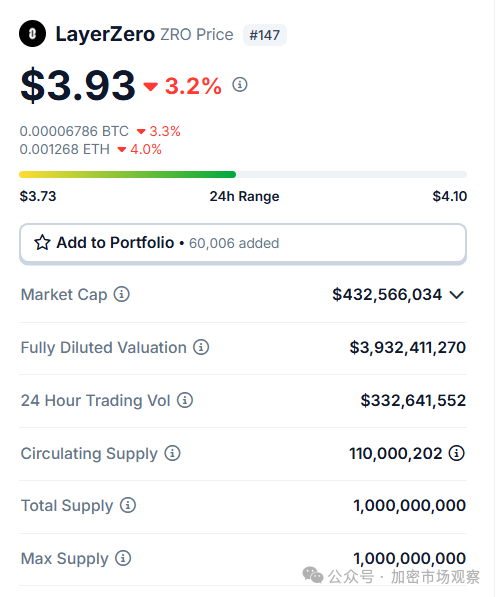

Recently, several high-profile projects have launched tokens and listed on exchanges. Take LayerZero, for example — it raised $260 million and was already valued at $3 billion as early as March 2023.

After its Binance listing last month, the market response was lukewarm:

And even this price reflects a recent pump by whales over the past couple of days:

If we look at prices from just a few days ago—around $2 per token—retail buyers were purchasing at lower prices than VCs who invested last year, and 90% of VC allocations haven’t even been released yet.

Talk about cross-chain interoperability or message passing all you want, but there are barely any real use cases or meaningful transactions happening across chains right now. Naturally, retail investors aren’t buying into the hype.

02 zk Has Fallen From Crown to Hat

Besides LayerZero, another controversial project is Zksync.

Zksync had its moment in 2022, raising $200 million in a single round, with total funding reaching $260 million.

But today, anyone without coding skills can spin up a zk rollup Layer 2 chain in ten minutes using platforms like Lumoz. (How long does it take to launch a blockchain? Turns out, just ten minutes!)

The exact valuation of Zksync wasn’t disclosed back then, but with such massive funding, it certainly wasn’t cheap.

After listing last month, its token price has steadily declined:

Its current market cap is barely over $300 million. Zksync’s questionable airdrop tactics likely alienated both the community and ecosystem projects alike. From here on, its price fate rests on luck.

Another major zk player, Aleo, has yet to launch its token. It raised $200 million in 2022 at a $1.45 billion valuation.

However, since Aleo plans to sell mining hardware, the team still has incentives to manipulate the market. The real question is whether they still have enough funds left from two years ago to actually pull it off.

03 Projects With Massive Funding Rarely End Well

Don’t expect miracles from big funding rounds in crypto. Below is a chart of historical projects that raised over $500 million—most of them have not treated investors kindly:

There have been ten projects historically that raised over $500 million. DCG, which now plays more of an investor role, can be excluded.

Of the remaining nine, only three have launched tokens. The other six remain tokenless.

04 All Tokenized Projects Are Down Post-Launch

Let’s first examine the three projects that did issue tokens. Topping the list is EOS, which raised $4 billion from retail investors during the 2018 ICO frenzy, marketed as the “Ethereum killer” (there seem to be quite a few of those).

Today, EOS has a market cap of just $1 billion—only a quarter of what it raised.

The other two tokenized projects are absolute "disaster-grade"—their founders are currently in prison.

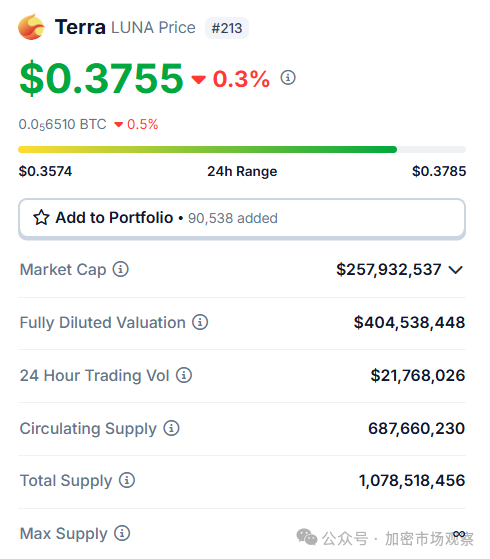

Terra raised $1 billion in early 2022, quickly listed its token, and soon after triggered the infamous “death spiral.”

Judging by this chart, investors were completely wiped out. Its current circulating market cap is $260 million, and tokens aren’t fully unlocked yet—FDV still stands at $400 million.

Had Terra’s team focused on supporting the price instead of reckless spending after fundraising, things might not have turned out so badly.

In 2022, Terra’s equally infamous counterpart was FTX, which raised a staggering $1.8 billion cumulatively. Its investor list read like a who’s who: SoftBank, Temasek, Sequoia—all top-tier names.

As for what happened next, most of you already know (if not, click Another May 19th, A Review of Crypto Disasters!)

Here’s a tribute to these two legendary figures:

05 Half of the Non-Token Projects Are Already Dead

Tokenized projects have all crashed, with market caps below their fundraising totals. Meanwhile, half of the non-token projects aren’t faring much better.

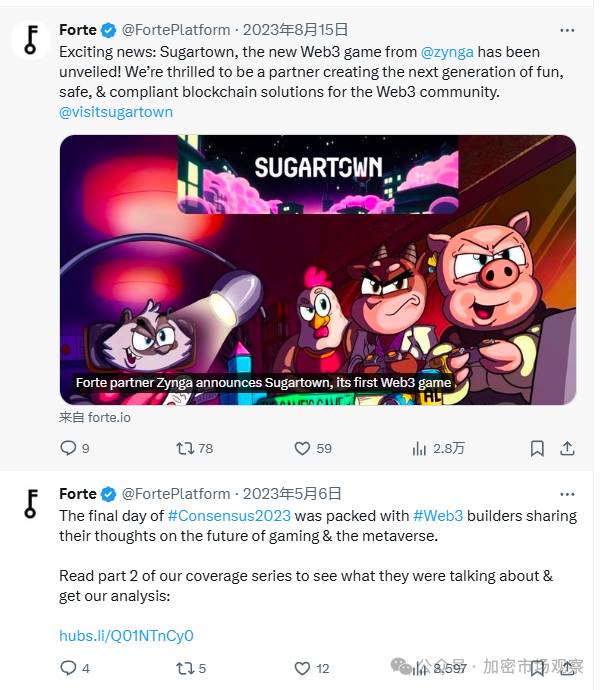

Forte raised nearly $1 billion across two funding rounds in 2021, positioning itself as infrastructure for blockchain gaming.

Yet in this year’s booming gamefi season, Forte has gone completely silent.

The project’s official Twitter hasn’t been active since 2023, and engagement suggests zero momentum.

Sorare emerged during the 2021 NFT boom, securing official licenses from major athletes to mint digital trading cards. But now that NFTs are frozen, Sorare’s situation is grim—recent reports even mention layoffs:

06 ToB Businesses Know Their Own Fate

Some projects fall into a gray zone—I can’t say if they’re doing well or not. These are all B2B-focused.

NYDIG raised over a billion dollars, backed by financial giants like Morgan Stanley and Soros Fund Management.

NYDIG offers institutional clients end-to-end Bitcoin services—from mining to custody—a true enabler for capitalist crypto ventures.

Fireblocks also serves enterprises, specializing in crypto asset custody, reportedly raising over $120 million cumulatively—the last round being in 2022.

According to Bloomberg, Fireblocks has recently laid off staff:

07 Real Use Cases Are King

Among all these well-funded Web3 projects, perhaps the one doing best is MoonPay:

MoonPay raised $555 million at the end of 2021, followed by an additional $87 million in 2022.

The company reportedly turned profitable since entering the market in 2019 and generated over $150 million in revenue in 2022.

However, due to its core business—fiat on/off ramps—being highly regulated, MoonPay chose not to issue a token and instead aims for an IPO path similar to Coinbase.

Whether it's MoonPay, NYDIG, or Fireblocks, the reason these projects are still alive is simple: they serve real-world use cases.

08 Buy Low, Sell High Is Still the Rule

Even with real applications, buying at peak valuations remains dangerous for investors. Let’s revisit some famous fundraising figures—it might shock you:

Ethereum raised only tens of millions in funding, mostly through its ICO:

Solana, currently the closest contender to dethrone Ethereum, raised only $20 million pre-token launch:

Binance’s private fundraising amount was likely small as well:

[Disclaimer] Markets are risky. This article does not constitute investment advice. Readers should consider whether the opinions, views, or conclusions expressed herein are suitable for their individual circumstances. Investment decisions carry responsibility.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News