Lorenzo: How to Rebuild the Medici Financial Empire by Unleashing the "Babylonian Captivity"?

TechFlow Selected TechFlow Selected

Lorenzo: How to Rebuild the Medici Financial Empire by Unleashing the "Babylonian Captivity"?

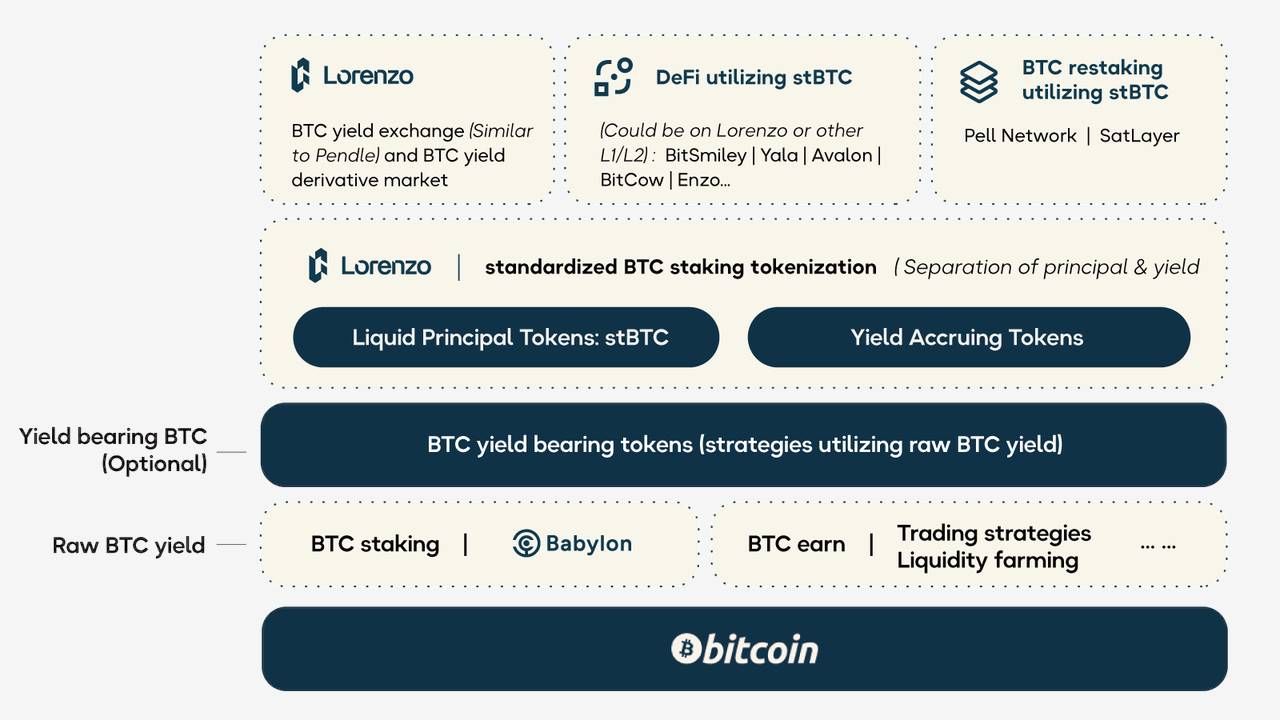

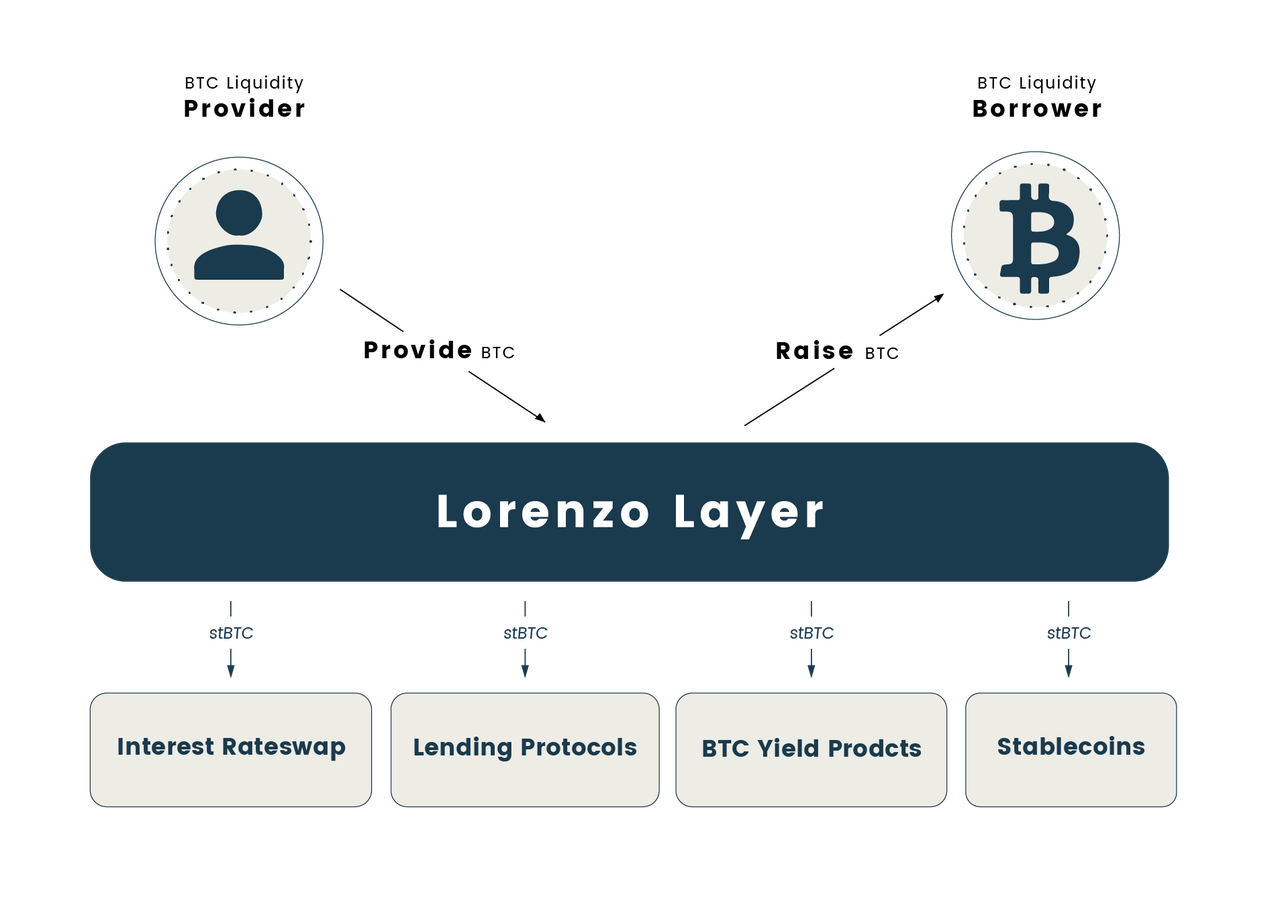

Lorenzo is the first Bitcoin liquidity financial layer based on Babylon, as well as a platform for issuing, trading, and settling Bitcoin liquid staking tokens.

Author: Peng Sun, Foresight News

* Preface: The metaphor of the "Babylonian captivity" refers only to the current liquidity constraints on BTC staked via Babylon. The author holds a highly positive view of Babylon—its native BTC staking providing shared security for PoS chains genuinely opens the door to Bitcoin ecosystem finance. The key question now is how to fully unleash BTC's liquidity atop Babylon and offer users diversified yield sources, which is precisely the direction Lorenzo is actively exploring.

We speak of a Bitcoin Renaissance, yet few understand what lies behind historical renaissances. In fact, the Medici family were the "godfathers of the Renaissance," and the Medici Bank was the financial engine driving it.

If we liken Europe’s medieval noble houses to a star-studded summer night sky, the Medici family would be its brightest star. They were not only de facto rulers of Florence but also produced three popes and two queens of France. They gathered and funded artists including Botticelli, Leonardo da Vinci, Michelangelo, and Raphael. These grand endeavors were largely driven by Lorenzo il Magnifico (Lorenzo di Piero de’ Medici), the fourth-generation heir of the Medici dynasty.

Behind the Italian Renaissance stood the liquidity finance of the Medici Bank; behind the Bitcoin Renaissance stands the same principle—unlocking and unleashing BTC liquidity to build richer, more complex financialized BTC asset scenarios. Babylon enables native staking of BTC on the Bitcoin mainnet, offering shared security to any PoS chain and opening the gates to Bitcoin ecosystem finance. However, BTC liquidity remains constrained. Current liquidity limitations in Babylon resemble a "Babylonian captivity." While many projects aim to solve this issue, none have advanced as deeply as Lorenzo, nor achieved such thorough liquidity liberation.

Today’s Lorenzo positions itself perfectly—it aims to create a Bitcoin liquidity finance layer combining Lido + Renzo + Pendle, delivering yield based on Babylon-native BTC staking, and enabling end-to-end processes including liquid staking, restaking, principal-yield separation, and StakingFi. In short, Lorenzo will become the capital gateway for users to access various BTC financial products. Currently, Lorenzo has received investment from Binance Labs and launched its testnet version, with mainnet V2 expected in June. Additionally, Lorenzo recently initiated a pre-staking and joint mining campaign for Babylon and Bitlayer, setting up incentive pools and multiple reward programs for early supporters participating in pre-staking Babylon, bridging stBTC to Bitlayer for ecosystem participation, and engaging with other Lorenzo partner projects.

So, how will Lorenzo maximize Bitcoin’s liquidity, recreate the Medici Bank’s financial empire, and lead Bitcoin into its own Renaissance?

Lorenzo: The Pope’s Wealth Manager

In the Middle Ages, the Pope was the primary client of Italian banks and trading companies—the only ruler with taxation rights across all of Europe. Banks served as financial institutions managing his wealth, handling tax collection, fund transfers, currency exchange, and lending. The Medici Bank early became the Pope’s wealth manager. In confidential ledgers, the papal treasury account appeared under the Rome branch, much like today’s U.S. Treasury account at a Federal Reserve Bank.

During Lorenzo’s era, the Church, nobility, and royalty believed the Medici Bank could lend unlimited amounts. In reality, the bank overextended credit, while the Church failed to repay. By 1494, the Medici Bank stood on the brink of collapse, with its crucial Rome branch trapped in unrecoverable loans to the papal treasury. As the Pope’s wealth manager, the Medici Bank had become too entangled in politics. Combined with declining wool supplies from England and falling silver prices, reinvestment opportunities dwindled, income sources dried up, and cash reserves fell below 10% of total assets, culminating in a liquidity crisis.

Today, Lorenzo manages “religious wealth.” Bloomberg calls Bitcoin “the first true religion of the 21st century,” and Bitcoin maximalists and holders are its believers. From a financial perspective, today’s blockchains function like banks, spawning various financial products—deposits, lending, collateralization, exchanges, structured products, insurance, etc. Yet due to limitations in Bitcoin’s scripting language and technology, DApps cannot be natively built on Bitcoin, preventing it from establishing its own liquidity finance. This explains a common phenomenon: over the past four years, the number of addresses holding more than 100 BTC has remained stable around 16,000. Although WBTC, the largest wrapped token, has a market cap of about $10.5 billion, this represents only 0.8% of Bitcoin’s $1.3 trillion total market cap. Given the strong “Not your keys, not your coins” ethos within the Bitcoin faithful, few are willing to risk cross-chain activities or DeFi protocols on other chains.

Lorenzo targets these long-dormant BTC holdings. It is the first Bitcoin liquidity finance layer built on Babylon and the first platform for issuing, trading, and settling liquid staking tokens (LSTs) for Bitcoin. It offers Bitcoin users truly secure native yield and issues principal-yield separated LSTs for different Bitcoin staking projects. Think of Lorenzo as a fusion of Lido, Renzo, and Pendle—a supercharged bond market offering integrated services including matching, issuance, settlement, and structured wealth management—fully unlocking staked BTC liquidity, activating financialized BTC asset scenarios, and supporting downstream DeFi ecosystems.

The Competitive LRT Market Built on Babylon

2024 marks the dawn of the Bitcoin ecosystem. After narratives around inscriptions and runes, we’ve entered the era of yield-bearing assets. Historically, Bitcoin’s Nakamoto consensus prevented staking and yield generation. But today, users can deposit BTC into Babylon’s self-custodial deposit address on the Bitcoin mainnet. Through timestamping protocols, PoS validator data is embedded into Bitcoin blocks, enabling shared security for existing PoS chains and earning staking rewards—all without third-party custody, cross-chain bridges, or token wrapping. Meanwhile, Schnorr signatures and Extractable One-Time Signatures (EOTS) make BTC a slashable asset, effectively preventing double-spending attacks.

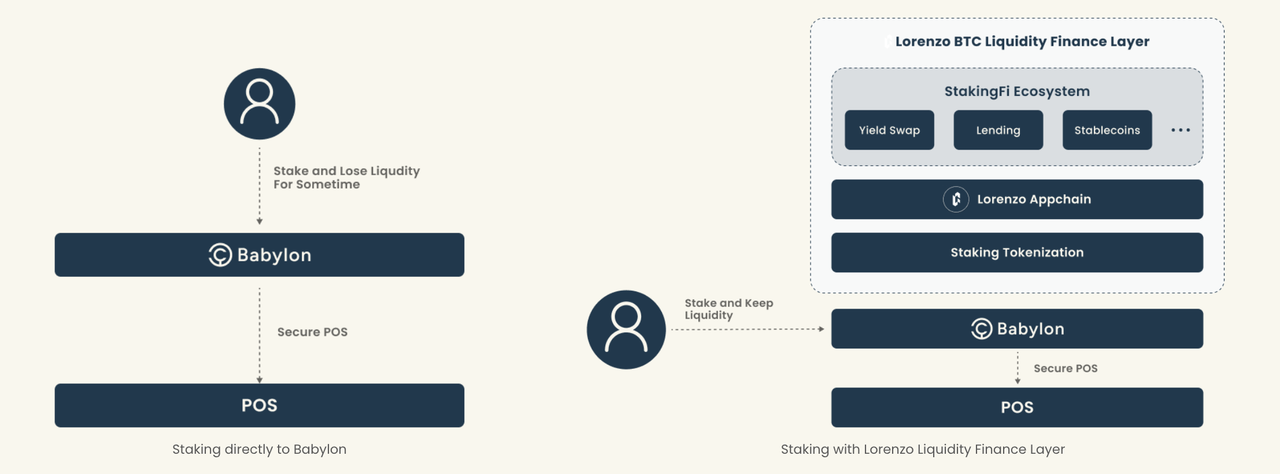

Babylon’s shared security mechanism unlocks vast potential for Bitcoin ecosystem finance. Yet the current challenge is that BTC used to secure PoS chains loses liquidity—the so-called “Babylonian captivity”—reducing capital efficiency and limiting yield sources. So, how can BTC liquidity be maximally unleashed atop Babylon while expanding user yield options?

To address this, several restaking protocols have emerged—Uniport, Chakra, BounceBit, Bedrock, Solv Protocol, StakeStone, and others. Let’s examine each:

-

Chakra is a ZK-based Bitcoin restaking protocol that bridges BTC and ETH from the Bitcoin and Ethereum mainnets onto the Chakra chain, forming an asset settlement hub for BTC Layer 2. Using lightweight client cross-chain tech, ChakraBTC and ChakraETH are deployed across other BTC L2s. Based on SCS (Settlement Consumption Service), Chakra provides restaking services for PoS chains—similar to Babylon—but does not involve native BTC staking on the Bitcoin mainnet. To resolve this, Chakra now integrates Babylon: via trustless settlement services/layers, BTC staked through Babylon can be mapped across ecosystems. Babylon uses Chakra-staked BTC to secure its internal PoS systems, allowing stakers to share validation rewards. Chakra’s generated ZK-STARK staking proofs enable users to obtain liquid assets on Chakra Chain, Starknet, and other blockchains.

-

BounceBit is a Bitcoin restaking infrastructure using a dual-token PoS model based on wrapped BTCB rather than native BTC. BTCB is converted into BBTC, with shared security provided by the LRT stBBTC backed by staked BBTC. BTCB aims to solve low liquidity and limited use cases for Bitcoin on its native chain, but compared to Babylon, it weakens BTC’s native nature. Though its BTC Bridge will allow native BTC to directly cross-chain into BBTC, bridge and oracle risks remain.

-

Uniport is a Bitcoin restaking chain using a Cosmos SDK-built UniPort zk-Rollup Chain to achieve multi-chain interoperability for BTC ecosystem assets. Its cross-chain solution converts native BTC into UBTC, managed via centralized multi-sig cold wallets (to be replaced by multi-sig contracts). UBTC will deeply integrate with Babylon.

-

Bedrock is a multi-asset liquidity restaking project that partnered with Babylon to launch the LRT token uniBTC. Users stake WBTC on Ethereum to receive uniBTC. Bedrock connects to Babylon via proxy staking or direct conversion: proxy staking means when users stake wBTC on Ethereum, an equivalent amount of native BTC is simultaneously staked on Babylon; direct conversion swaps WBTC directly for BTC and stakes it on Babylon. Holding uniBTC grants BTC yield and enables usage in other DeFi protocols.

-

Solv Protocol is a cross-chain yield and liquidity protocol converting WBTC on Arbitrum, M-BTC on Merlin, and BTCB on BNB Chain into interest-bearing solvBTC—not native BTC.

-

StakeStone is a cross-chain liquidity infrastructure that deposits native BTC into Babylon for staking and issues STONEBTC, a cross-chain liquid yield-bearing BTC token.

-

SataBTC is a Bitcoin restaking layer not yet launched.

Overall, competing LRT projects are actively exploring their paths. BounceBit, Bedrock, and Solv Protocol prioritize capturing existing markets using wrapped BTC instead of native BTC to unify liquidity and deliver yield—but inherit the same risks as WBTC and similar wrapped tokens. Others target Babylon’s emerging LRT market: Chakra, Uniport, and StakeStone leverage Babylon as the foundational yield source and issue LRTs to unlock staked BTC liquidity, though they stop at restaking and LRT issuance.

In practice, yield-bearing LRTs still face high volatility, failing to meet diverse risk preferences. Consider Ethereum—every yield-bearing asset eventually flows into Pendle, a missing piece in Bitcoin DeFi. This is exactly what Lorenzo aims to fix—not as competitors, but as future collaborators.

Lido + Renzo + Pendle: How Does Lorenzo Build Bitcoin Liquidity Finance?

Some say Bitcoin will cover Ethereum’s nine-year journey in just nine months. Then Lorenzo can traverse Ethereum’s four-year, three-generation path in yield-bearing assets—all within one protocol.

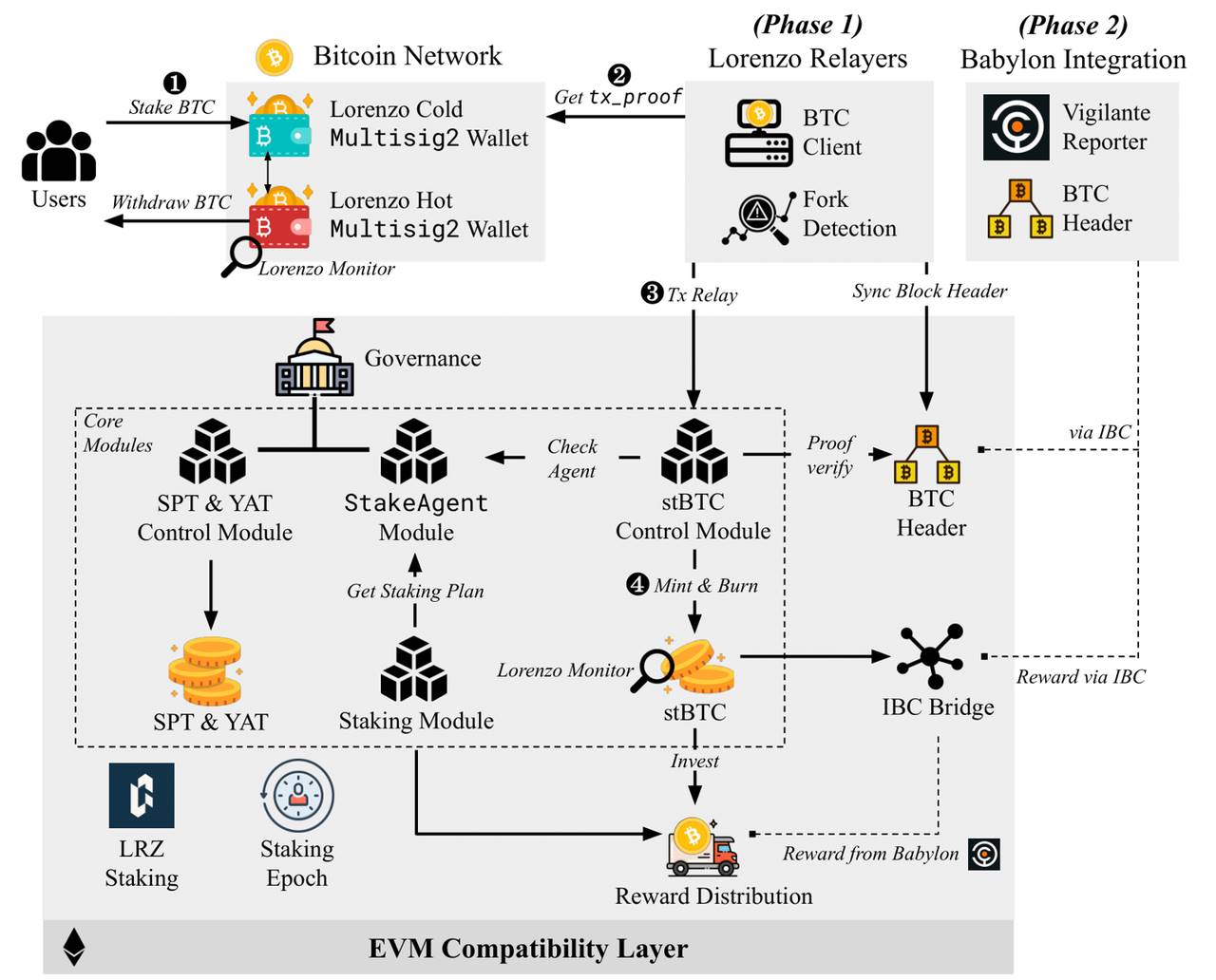

Communication Path Between Bitcoin Mainnet and Lorenzo

Let’s examine Lorenzo’s architecture. As shown below, it consists of three core components: Lorenzo Chain, Bitcoin Relayer, and a suite of smart contracts:

-

Lorenzo Chain (an EVM-compatible layer): a Cosmos appchain built using Cosmos Ethermint, EVM-compatible, primarily providing infrastructure for liquid staking tokens;

-

Bitcoin Relayer: relays information from the Bitcoin mainnet to the Lorenzo application chain;

-

A set of smart contracts verifying off-chain data, managing issuance and settlement of liquid staking tokens.

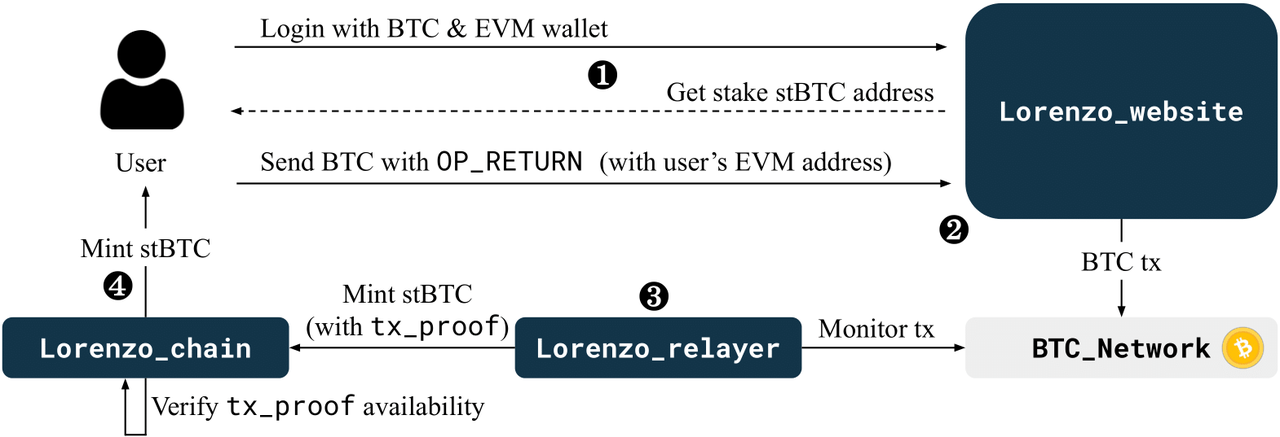

The basic flow works as follows: when a user deposits BTC into Lorenzo’s multisig cold/hot wallet on the Bitcoin mainnet via the Lorenzo website to receive stBTC, the Lorenzo Bitcoin Relayer monitors incoming transactions. Once confirmed, the relayer fetches the transaction’s Merkle proof and submits it to Lorenzo Chain, invoking the mint function in the “Lorenzo YAT_Control_Module.” After internal validation of the transaction proof, Lorenzo mints an equivalent amount of stBTC to the user’s EVM account.

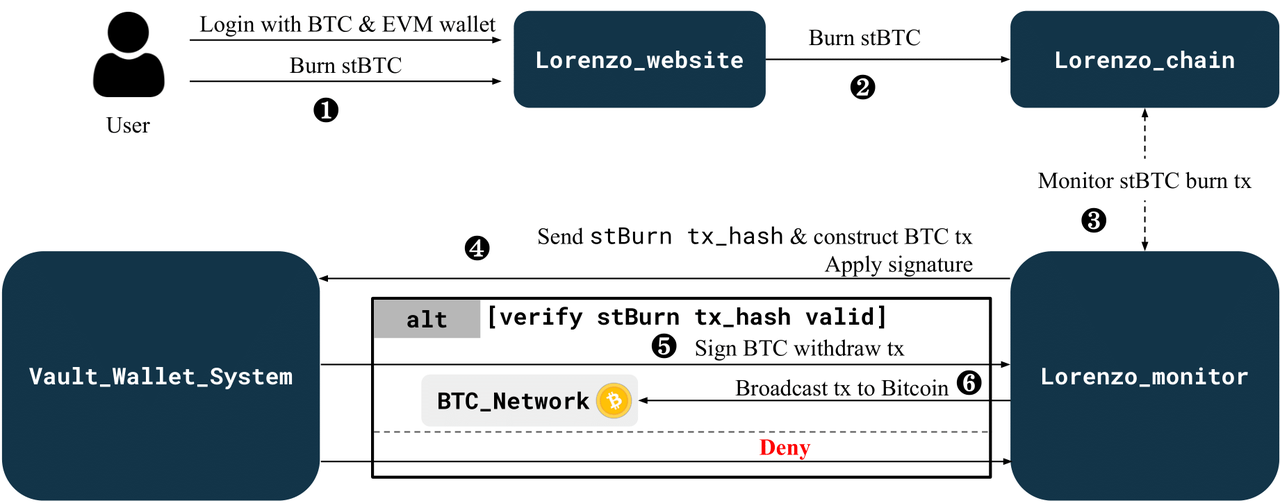

When a user wishes to redeem stBTC back to BTC, they initiate a burn request on the Lorenzo site. The Lorenzo Monitor watches for stBTC burns on the Lorenzo chain, sends the burn transaction hash and constructed BTC withdrawal transaction to the multisig Vault Wallet System, and requests signatures. Upon validating the burn transaction, final signatures are generated and returned to the Lorenzo Monitor. Once received, the signed transaction is broadcast to the Bitcoin mainnet, completing the withdrawal.

Unleashing Liquidity, Freeing the “Babylonian Captivity”

Lorenzo treats Babylon as the base yield layer, providing users with inherently secure native returns and minimal staking risk. Like early EigenLayer, Babylon will impose deposit caps post-launch. As previously noted, Babylon currently suffers from liquidity constraints akin to the “Babylonian captivity,” along with entry barriers.

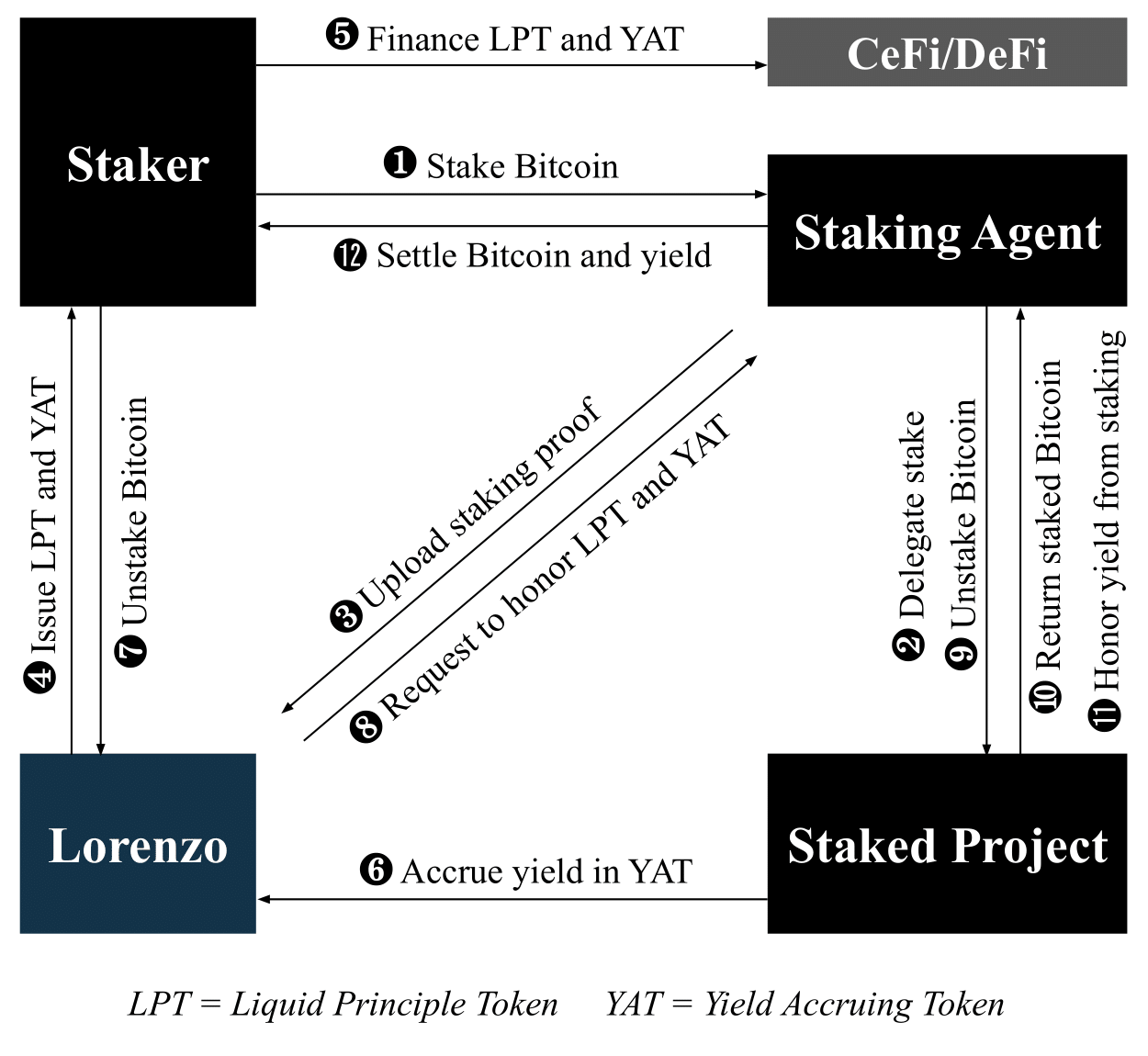

But this isn’t the end of Babylon’s narrative—it’s the financial foundation upon which Lorenzo builds. Lorenzo’s first step is completing Bitcoin’s version of Lido, releasing staked BTC liquidity and overcoming Babylon’s deposit cap. Users can deposit BTC directly into Babylon via Lorenzo, which acts as an issuance and settlement platform, tokenizing BTC stakes into liquid staking tokens—similar to Lido’s stETH, yet distinct in important ways, as detailed next.

Of course, as a Bitcoin liquidity finance layer, like Ethena, Lorenzo can also deploy users’ deposited BTC into other strategies—trading, liquidity mining, and additional yield sources. Currently, Lorenzo has partnered with Bitlayer through the Bitlayer Mining Gala, integrating seven to eight downstream DeFi projects for staking, lending, and other on-chain activities.

Principal-Yield Separated Bonds and Restaking Plans: Unifying Liquidity

Like stETH, Lorenzo’s LSTs are interest-bearing BTC assets—essentially yield-bearing Bitcoin bonds. However, since Babylon staking involves securing various PoS chains (unlike Lido’s ETH-anchored stETH), different staking projects may generate different liquid staking tokens. Issuing separate LSTs per project would fragment liquidity.

How to better solve liquidity fragmentation? Lorenzo adopts a Pendle-like principal-yield separation model, implementing the Bitcoin Liquidity Restaking Program (BLRP) atop Babylon to prevent yield token dispersion caused by differing projects and staking durations. Lorenzo predefines BLRP plans—including PoS chains, start, and end times—allowing users to select preferred plans only before they begin.

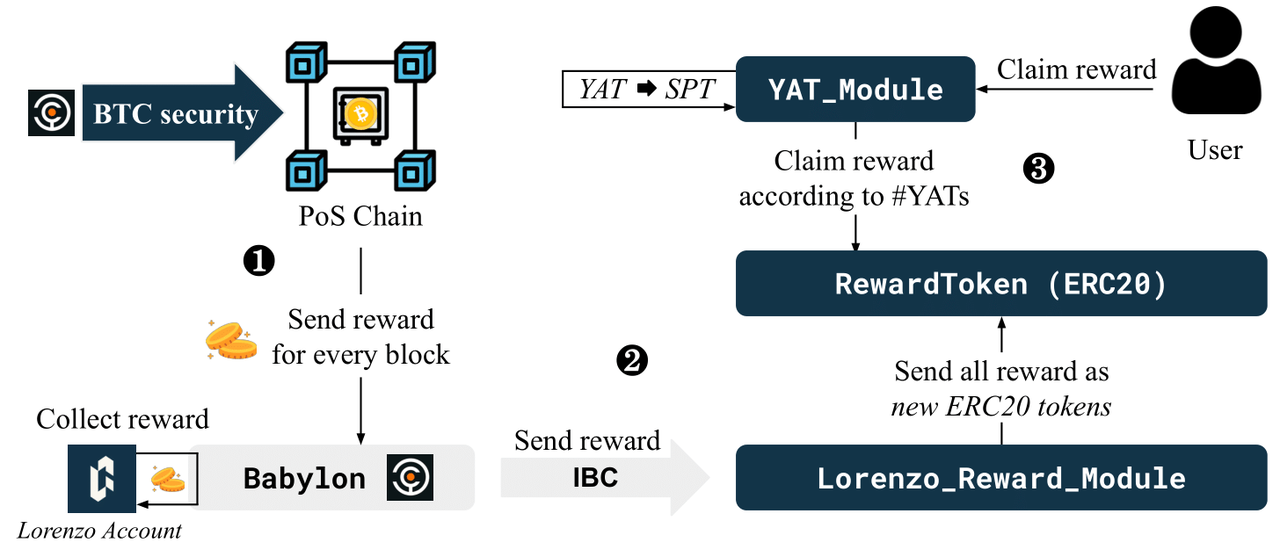

For example, if a user selects the “Babylon-Lorenzo-01” staking plan on Lorenzo, after depositing BTC into Babylon, they receive two tokens: Liquid Principal Tokens (LPT) and Yield Accruing Tokens (YAT). Lorenzo issues identical LPTs across all low-risk staking projects—this LPT is stBTC, pegged 1:1 to staked BTC, unifying BTC liquidity across ecosystems. stBTC holders can redeem their principal BTC after staking ends. YAT is an ERC-20 token issued via BLRP, representing future yield—akin to a forward-looking bond. Each YAT has its own restaking plan, start/end time. YATs are tradable and transferable before maturity; holders claim PoS chain rewards, and YATs from the same BLRP are interchangeable.

{ name: YAT token name symbol: YAT token ticker planDescUri: project description planId: stakePlanId, incremental ID for restaking plan agentId: stakeAgentId, Staking Agent ID subscriptionStartTime: Subscription starts subscriptionEndTime: Subscription ends endTime: YAT maturity time}

Upon maturity, YAT holders receive combined yields from Babylon, the PoS chain, and Lorenzo.

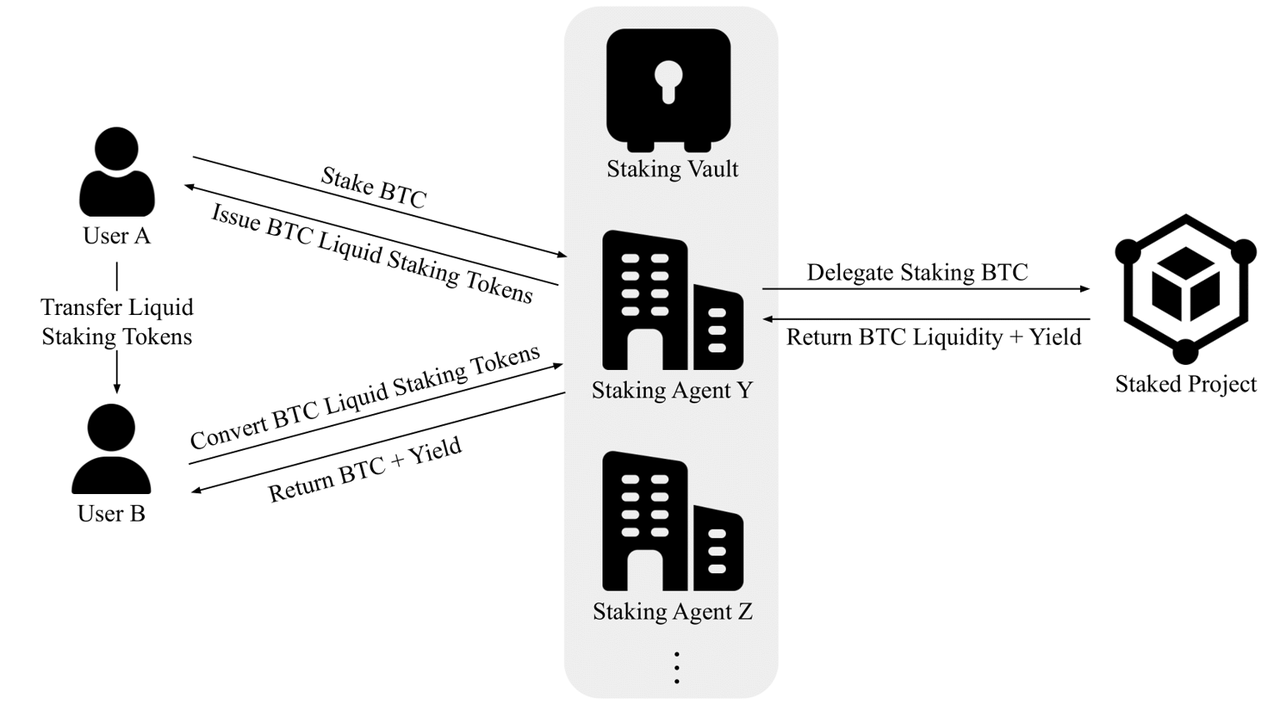

Staking Agents: A CeDeFi-Based Issuance and Settlement System

Both stBTC and YAT belong to Lorenzo’s issuance side, but it also functions as a settlement platform. As mentioned in the author’s previous article, DeFi asset management has entered the active management era due to shifts in issuance-layer paradigms. Lorenzo embodies this generational shift. As an issuer and settler of stBTC, it also acts as a native BTC asset manager, deciding where staked BTC is allocated.

Lorenzo acknowledges it cannot intrinsically guarantee against misuse of managed BTC. Moreover, due to Bitcoin’s limited programmability, building a fully decentralized settlement system isn’t feasible in the short term. Thus, Lorenzo chooses CeDeFi—a middle ground between centralization and decentralization. It introduces a Staking Agent mechanism, where top-tier Bitcoin and TradFi institutions serve as issuance and settlement layers. Lorenzo itself is one such agent. Misconduct leads to revocation of agent status.

Staking Agents manage the full cycle of asset issuance and settlement: creating staking plans, accepting user BTC, depositing into Babylon and PoS chains, sending restaking proofs to the Lorenzo protocol, and issuing stBTC and YAT. At plan maturity, they safeguard returned BTC, settle matured stBTC and YAT, converting them into BTC principal and yield.

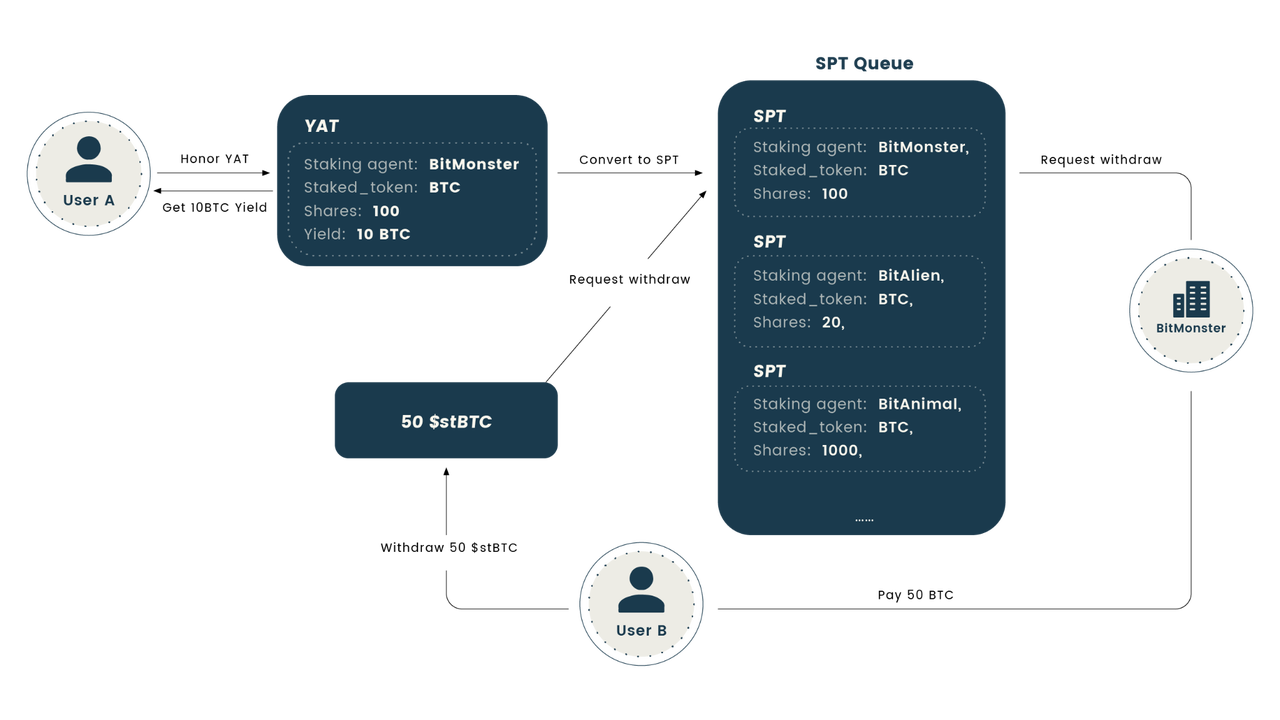

On fund settlement, Lorenzo implements a queuing mechanism. In phase one, without YAT, users simply burn stBTC to redeem native BTC. In phase two—with YAT—users must burn both stBTC and an equivalent amount of Staking Proof Token (SPT) to redeem BTC.

SPT serves as a sequencing, burning, and redemption credential. When YAT matures, Lorenzo’s yield distribution contract pays out earnings and converts YAT into non-tradable SPT of equal value. These SPTs enter a unified queue, placed at the end, determining the order of stBTC redemptions. The agent ID linked to burned SPT dictates which staking agent redeems BTC. Users who convert YAT into SPT gain priority to burn up to that amount of stBTC; they may also claim YAT yield to generate SPT without burning stBTC. Users without YAT must wait for new SPT entries if the queue is empty.

For example, User A stakes 100 BTC, earns 10 BTC yield, and upon redeeming YAT generates 10 SPT under the BitMonster agent—without burning stBTC. User B buys 50 stBTC on-market and wants to redeem BTC but lacks YAT. BitMonster must hold SPT equal to 50 stBTC to redeem 50 BTC; otherwise, B waits for others to generate SPT. Once all BTC in “Staked_token” are redeemed, the corresponding SPT exits the queue.

This staking-agent-based issuance and settlement system fully liberates BTC and expected yield liquidity, allowing users to access and trade yield tokens early. Lorenzo’s SPT settlement means users must have sufficient yield to withdraw BTC—explaining why staking plans exist: no matured yield, no redeemable BTC. We can envision the staking agent structure as a large liquidity pool: the richer and more stable the underlying Babylon BTC yield, and the greater the user deposits, the stronger the liquidity of Lorenzo’s dual tokens.

StakingFi: Financialization Scenarios for BTC Assets

Certainly, Lorenzo doesn’t merely want to unlock staked BTC liquidity—it also aims to provide robust token structures for this liquidity. Due to rate uncertainty, principal-yield separation inherently reduces reinvestment risk. Risk-averse users can buy stBTC—pegged to BTC—to short yield exposure; risk-tolerant users can buy YAT to go long on yield. Compared to other BTC LRT projects, this principal-yield model supports more complex downstream DeFi products beyond simple yield accrual.

Currently, Lorenzo’s stBTC can already be bridged to Bitlayer for use. In the future, stBTC and YAT will support the following financial applications:

-

Interest Rate Swaps: exchanging fixed for floating rates between two loans of same currency, principal, and duration. stBTC can act as another form of wrapped BTC, eventually replacing WBTC in nearly all use cases. YAT derives value from accumulated and speculative future yield. A core trading pair will exist between stBTC and all YATs; YATs from the same plan will be interchangeable, and pairs between stBTC/YAT and major assets may emerge.

-

Lending Protocols: stBTC and YAT can serve as collateral to borrow any desired asset, giving stakers greater control over investments and liquidity.

-

Structured BTC Yield Products: e.g., principal-protected fixed-income BTC products or enhanced-yield options-based derivatives built atop stBTC and YAT.

-

Bitcoin-Backed Stablecoins: stBTC can collateralize stablecoins.

-

Insurance Products: mitigating risks of native BTC being slashed by Babylon.

Roadmap and Future Plans

Lorenzo will roll out testnet and mainnet in phases. The testnet launched at the end of May, with mainnet V2 expected in June. At that time, Lorenzo will introduce principal-yield separation, supporting not only stBTC but also additional Yield Accruing Tokens (YAT). The staking agent model and SPT mechanism will also go live on V2, further decentralizing Lorenzo’s issuance and settlement. Additionally, Lorenzo plans to support more PoS projects within the Babylon ecosystem, offering users broader yield opportunities.

Conclusion

Like all current BTC LRT projects, Lorenzo seeks to activate the liquidity of BTC’s $1.3 trillion market cap—a multibillion-dollar blue ocean market. Building DeFi around BTC LRT holds boundless potential. The “Babylonian captivity” is temporary. What matters is that Babylon lays the foundation for Bitcoin’s entire liquidity finance—and serves as Lorenzo’s base yield source. Unlike other BTC LRT projects, Lorenzo is the first Bitcoin liquidity hub built on the Babylon ecosystem, introducing a Pendle-like principal-yield split to enable more sophisticated liquidity finance scenarios for principal and yield tokens, meeting diverse risk-return demands and fully unleashing BTC liquidity.

However, in the author’s view, the staking agent model still carries centralization risks. Bitcoin’s UTXO opcodes can impose spending conditions on BTC outputs, but cannot enforce security limits on staking agents. The Solv team developed Solv Guard specifically to add an extra security layer for third-party fund managers, potentially constraining BLRP investment strategies—such as defining allowable assets or smart contracts—and separating fund usage from governance rights. Lorenzo may consider adopting similar solutions in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News