Hayes' Fund: The Oracle War — Why Is Flare Undervalued?

TechFlow Selected TechFlow Selected

Hayes' Fund: The Oracle War — Why Is Flare Undervalued?

The "Oracle War" has begun—keep a close eye on Flare.

Author: Maelstrom (family office of Arthur Hayes)

Translation: Felix, PANews

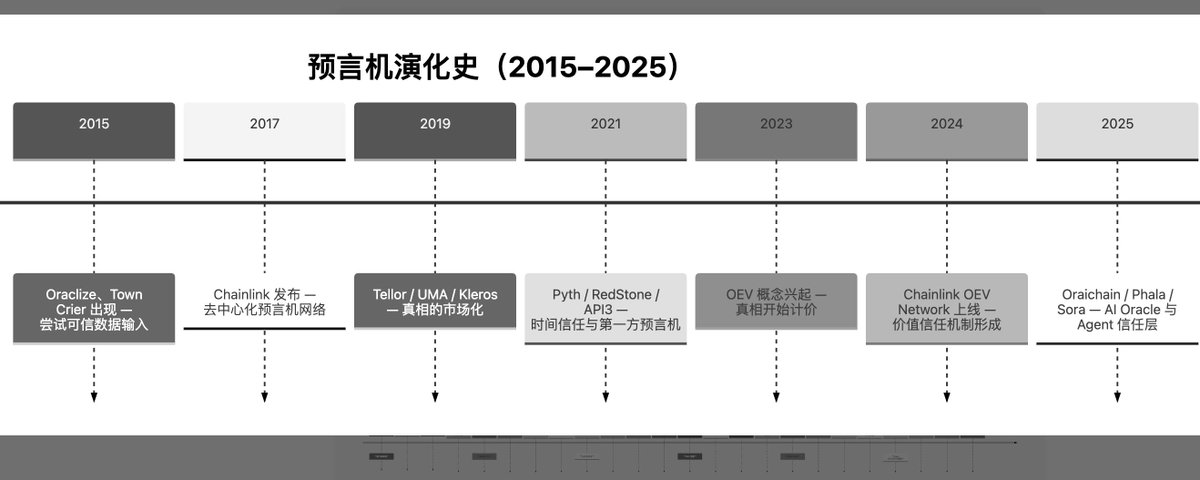

Oracle protocols act as intermediaries between decentralized networks and external data sources, securely and scalably connecting on-chain and off-chain data. This includes Web APIs, databases, sensors from connected devices, real-time data feeds, and even other blockchain networks. As blockchain applications grow increasingly complex, this off-chain data becomes more critical for developing new use cases (such as the recently popular "machine learning").

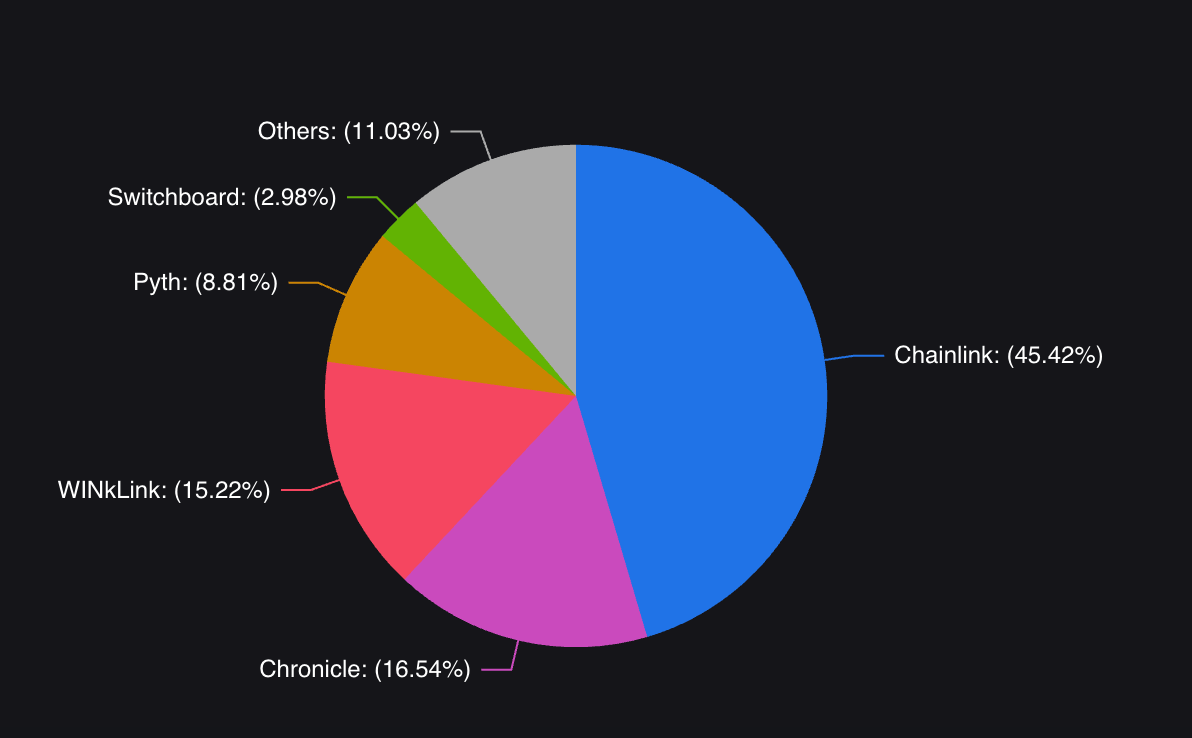

This article dives into three key oracle protocols: Chainlink, Pyth, and Flare. While Chainlink currently leads the market, it faces limitations in latency and high throughput. Pyth focuses on financial institutions and lacks universality. Notably, Flare—a dark horse oracle protocol—combines capabilities comparable to Chainlink and Pyth with a fully sovereign Layer 1, making it a unique (and possibly undervalued) protocol. Below we examine each protocol and explore this so-called "Oracle War."

LINK

Chainlink is synonymous with oracles and remains the undisputed market leader. Its robust decentralized node network makes Chainlink the go-to choice for many dApps, DEXs, and DeFi platforms. Chainlink’s reliability and growing list of partnerships make it the preferred option for both institutional players and emerging projects. Chainlink’s decentralized oracle network operates through a unique consensus mechanism that leverages multiple nodes to fetch and verify real-world data. This multi-party approach ensures transparency and minimizes manipulation risks. However, while the oracle network itself is decentralized, analysts note that Chainlink’s multisig retains significant control over price feeds. To ensure data accuracy and tamper resistance, Chainlink uses economic incentives to align the interests of node operators and users.

As of May 2024, Chainlink has integrated with over 500 DEXs and more than 800 DeFi platforms. Its oracles provide pricing information for over 5,000 trading pairs, with update intervals ranging from minutes to hours depending on the chain and asset. Chainlink heartbeats trigger periodic refreshes or updates when prices deviate beyond a set threshold (e.g., 1%).

Currently, Chainlink oracles secure over $20 billion in value across various data sources and services. The LINK token is used for staking and reputation within the Chainlink network, with a market cap exceeding $7 billion. According to Coingecko, Chainlink tokens account for over 70% of the total oracle market capitalization. Overall, demand for Chainlink’s oracle services benefits token holders, as LINK is required to pay node operators for service fees.

(Total Value Secured (TVS) by oracles, commonly used to summarize the overall economic impact and adoption of oracle networks. Source: DefiLlama)

Notably, the oracle market landscape is far from static, with competitors continuously vying for market share.

PYTH

Pyth is a newer oracle protocol focused on financial use cases, utilizing over 90 traditional finance (TradFi) and crypto financial institutions as data providers (sourcing stock, commodity, and currency price data directly at the source). Pyth's innovations are threefold:

-

Quantifying uncertainty: Introducing confidence intervals into reported prices, allowing users not only to assess price but also its degree of uncertainty—an invaluable feature in volatile markets.

-

Multi-chain compatibility: Pyth’s data can be accessed by applications on nearly any blockchain. Initially launched on Solana and its own Pythnet (a fork of Solana’s codebase), Pyth delivers solutions to non-Solana chains via integrations like Wormhole.

-

Efficient price updates: Another innovation is the Pull Oracle architecture, which enables efficient, on-demand price updates requested by data consumers—contrasting with the inefficient Push Oracles common in traditional systems.

Pyth typically refreshes prices every 300 to 500 milliseconds—orders of magnitude faster than some competitors—and better aligned with modern financial needs (e.g., DEXs). This speed stems from Pyth’s trust model, which relies directly on a few large data providers rather than a decentralized network of nodes. This lower level of decentralization isn’t limited to just this module; Pyth’s reliance on centralized entities like Wormhole has made it vulnerable to disruptions in the past. Pyth is also still working toward implementing staking requirements for data providers to incentivize accurate price feeds.

Despite these concerns, driven by lending protocols, Pyth’s TVS surged from $500 million to over $4 billion in the past six months. Its collaboration with Solana has been highly successful, combining fast data processing with Solana’s high-throughput infrastructure. Following a successful airdrop in November last year, Pyth plans to distribute another $100 million worth of PYTH tokens to its 160+ integrated dApp partners.

While Pyth has succeeded in its niche, it has yet to demonstrate scalability beyond financial applications to broader use cases.

FLR

Flare is an emerging contender in the oracle space, taking a different approach from Chainlink, Pyth, and others. Unlike typical oracle networks, Flare combines oracle functionality with computational capabilities—specifically EVM smart contracts. Flare integrates a smart contract platform with its oracle system, where validators responsible for network consensus and block production also handle data transmission. Validators must successfully deliver accurate data to the network to earn rewards. Recently, Google Cloud joined Flare as a validator and contributor alongside companies like Figment and Ankr.

Data Connectors and the Flare Time Series Oracle (FTSO) are central to Flare’s architecture:

-

Data Connectors: Bring state data from other blockchains and web services onto the Flare blockchain—for example, transaction details.

-

FTSO: Delivers time-series data from multiple chains to Flare. (Ongoing upgrades will eventually enable up to 1,000 data sources updated every 90 seconds, with 1–2 block finality.)

This unique combination sets Flare apart—data feeds and proofs are free for dApps running directly on Flare (though Flare charges for data sourced elsewhere).

In summary, Flare may be undervalued.

Chainlink holds a significant first-mover advantage, with countless projects already integrated. However, as Flare gains increasing attention, it could rapidly catch up. To illustrate FLR’s potential, here is the FDV as of May 1, 2024:

-

FLR: $2.9 billion

-

PYTH: $5 billion

-

LINK: $12.7 billion

Considering the following context, this comparison might look very different:

-

Flare’s number of project integrations is less than 10% of Chainlink’s, and it is still in early stages

-

FLR’s tokenomics incentivize active participation from stakeholders and holders

-

Flare offers both data and computation services, setting it apart from existing oracle protocols—not only generating revenue from data services but also building its own native ecosystem

Flare is still in early development, but assuming it executes its roadmap, here is FLR’s upside potential under various scenarios:

-

Matching PYTH: ~1.7x

-

Half of LINK: ~2.27x

-

Midpoint between PYTH and LINK: ~3.17x

-

75% of LINK: ~3.3x

The winners of the oracle war will be those projects that not only meet current market demands but also address next-generation challenges. While Chainlink leads the market, it still has room for improvement in latency and suitability for high-throughput use cases. On the other hand, Pyth’s focus on financial institutions brings a unique dimension to the oracle space but leaves gaps in cross-use-case versatility. Flare combines the strengths of both with the features of a Layer 1, giving it a distinctive market position worthy of attention. The ultimate victor will be the protocol capable of delivering reliable, up-to-date data, creating strong network effects, and adapting to the evolving needs of the DeFi ecosystem—including emerging areas like artificial intelligence that involve processing large and diverse datasets. While it’s too early to draw definitive conclusions, FLR appears undervalued compared to its peers in the sector.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News