Breaking Through Crypto ETFs Might Be Hong Kong's Path to Breakthrough

TechFlow Selected TechFlow Selected

Breaking Through Crypto ETFs Might Be Hong Kong's Path to Breakthrough

Can Ethereum get an ETF? What about other tokens?

Author: inpower Wang Jun

Frankly, I'm not surprised that Hong Kong approved spot Bitcoin ETFs—but the fact that spot Ethereum ETFs were also approved actually came as a pleasant surprise to me.

Is crypto the future of Hong Kong? As mentioned before, the Hong Kong government has been going through tough times recently. Approving both Bitcoin and Ethereum spot ETFs at once shows a certain level of boldness.

01 If Ethereum Can Get an ETF, What About Other Tokens?

Globally—including in the U.S.—Bitcoin is widely considered not to be a security.

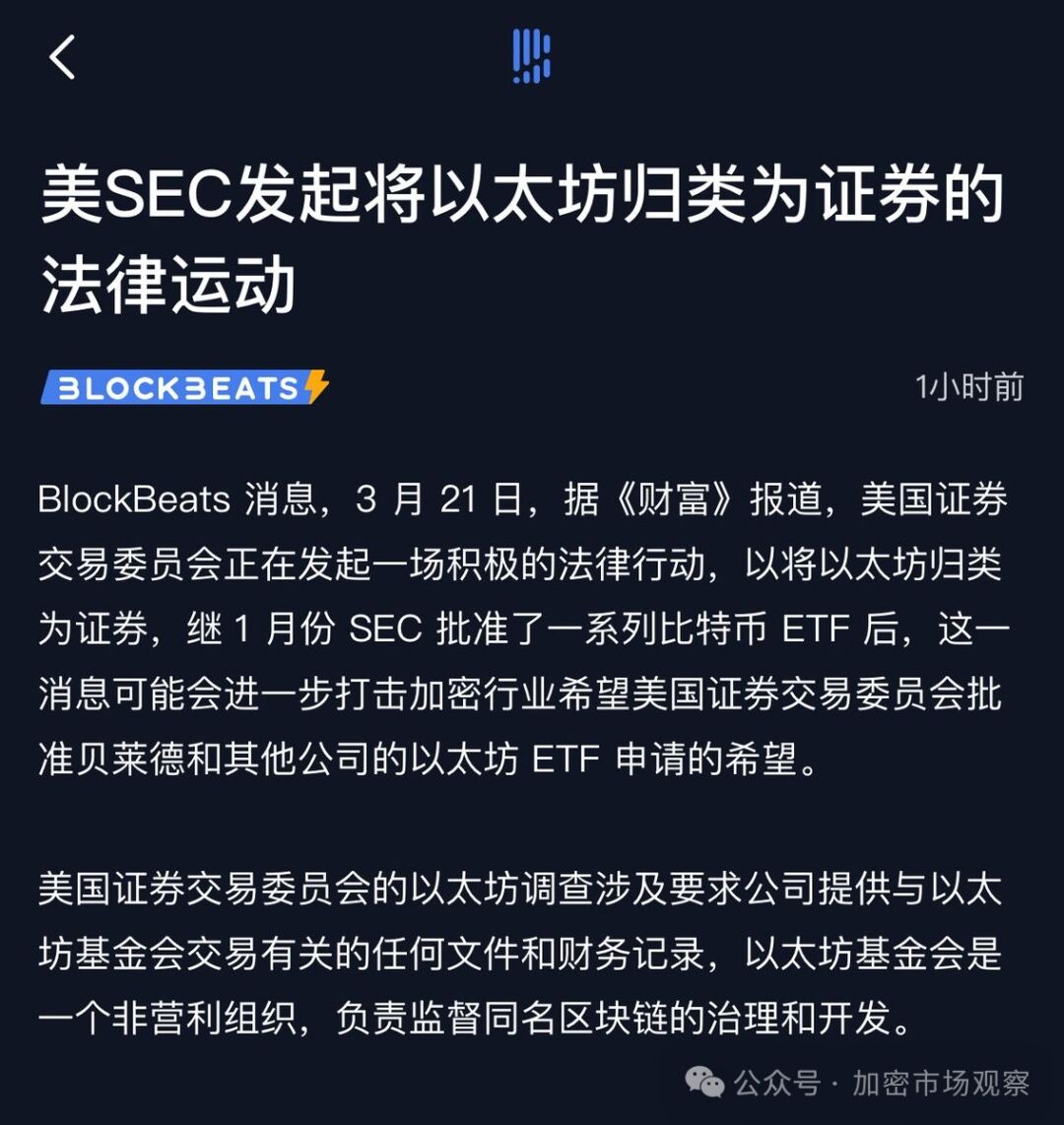

But whether Ethereum qualifies as a security remains controversial.

This is precisely why the approval process for Ethereum ETFs in the U.S. has been slow.

In the U.S., the SEC only has jurisdiction over securities. But why not simply "shelve the dispute and jointly develop"?

If a cryptocurrency is deemed a security, the SEC can regulate it. If it's not a security, can't it still be regulated via the ETF model?

The Hong Kong Securities and Futures Commission clearly grasped this logic, which is why they boldly approved Ethereum ETFs.

Following this reasoning, more types of crypto ETFs are likely just around the corner.

After all, Ethereum is currently facing both external and internal challenges—externally from rising ecosystems like Cosmos and Solana, and internally from various L2 chains operating like independent fiefdoms.

I don’t know how much V God’s personal visit to Hong Kong helped push the spot Ethereum ETF forward, but now that it's approved under a common law framework similar to the U.S., it will be hard for Hong Kong to reject ETF applications from other major public blockchain tokens moving forward.

02 Hong Kong Excels at Being a Gateway

Hong Kong has only a few million residents—its local market alone is too small to sustain any real growth.

But honestly, I’m quite optimistic about Hong Kong’s crypto ETF strategy.

Due to jurisdictional disputes, the U.S. will likely remain stuck in debates for the next three years. Right now, institutions looking to invest in crypto have two options:

1) Open an account with a compliant exchange

2) Buy through crypto ETFs

The first option seems simple, but in practice it's quite complicated for institutions:

-

Many institutions still don’t trust exchanges, especially after high-profile collapses like FTX less than two years ago

-

Institutional personnel are lazy—they’re fine learning new concepts, but actual operational hurdles remain high

The second option—ETFs—is different. It uses familiar platforms and familiar workflows; the only thing that changes is the underlying asset.

The world really is surreal~

Hong Kong should leverage its institutional advantages by listing mainstream cryptocurrencies as ETFs as soon as possible—even allowing fund managers to DIY their own portfolios.

Under current Hong Kong regulations, profits aren't limited to ETF management fees—licensed, compliant exchanges downstream might also rely on this to grow their businesses.

03 This Has Nothing to Do With Ordinary Mainland Chinese

Mainland readers, stop daydreaming. As retail investors ("cabbage"), you need to stay aware of your position.

Ask yourself daily:

1) Can you buy U.S. or Hong Kong stocks?

2) Can you buy spot Bitcoin ETFs in the U.S.?

3) Can you even open an account with a compliant exchange in Hong Kong?

Of course, I believe many of my readers can do all three—but such people usually don’t need ETFs to allocate crypto assets anyway.

But if you’ve never even used Binance or OKX, haven’t opened a U.S./Hong Kong stock account, and still imagine that once Hong Kong approves ETFs you’ll freely access crypto investments—you’ve got quite an imagination.

Although Hong Kong is China’s window to the outside world, its primary goal is to bring foreign capital in, while enabling Chinese goods and services to go out.

Think of it as a semiconductor channel~

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News