GCR: The Legend of a Crypto Reverse Trading Master and His Journey

TechFlow Selected TechFlow Selected

GCR: The Legend of a Crypto Reverse Trading Master and His Journey

GCR is one of the most renowned traders in the crypto space, widely known for exceptional investment performance and multiple successful predictions.

Author: Arkham

Translation: Frank Fu, IOSG Ventures Investment Associate

TL;DR

-

Yesterday, GCR—the legendary "Big Short" of the crypto world—resurfaced on social media after a year-long silence, encouraging people not to "give up" during recent market crashes. The post has since garnered over 50,000 likes. Many are curious about this enigmatic trader’s story.

-

This article takes that moment as an opportunity to explore GCR's background, trading philosophy, and his past insights shared on social media. Known for exceptional performance on the now-defunct FTX exchange and uncanny market predictions, GCR gained fame through short-selling strategies, investments in meme coins and NFTs, and high-stakes bets on the 2024 U.S. presidential election.

-

Although GCR reduced public activity in early 2023, his market insights and strategies remain influential within the crypto community. His final public message conveyed optimism about crypto’s future, particularly long-term bullishness on Ethereum’s price. This piece aims to restore confidence in the digital era of cryptocurrency markets and offer valuable lessons and inspiration.

Introduction

-

GCR is one of the most renowned traders in the crypto space. He was known on the collapsed FTX exchange by the alias "Gigantic-Cassocked-Rebirth," and widely recognized on Twitter for consistently sharing verified investment tactics, accurate market forecasts, and sharp commentary.

-

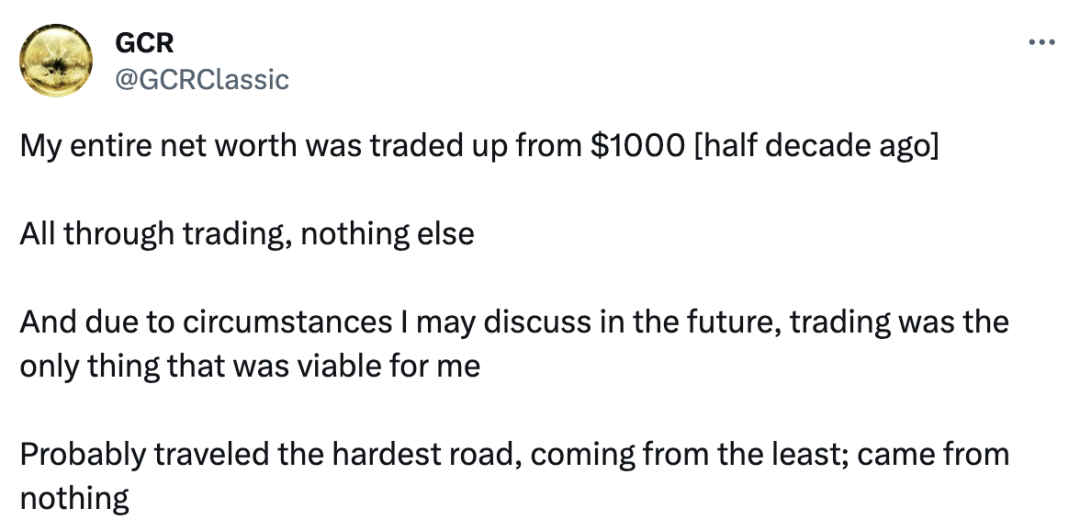

From 2021 to 2022, he frequently ranked among FTX’s top traders, outperforming many peers and becoming one of the exchange’s highest-profit individuals. Despite his identity remaining mysterious, he claims to have started from nearly nothing and built his fortune purely through trading.

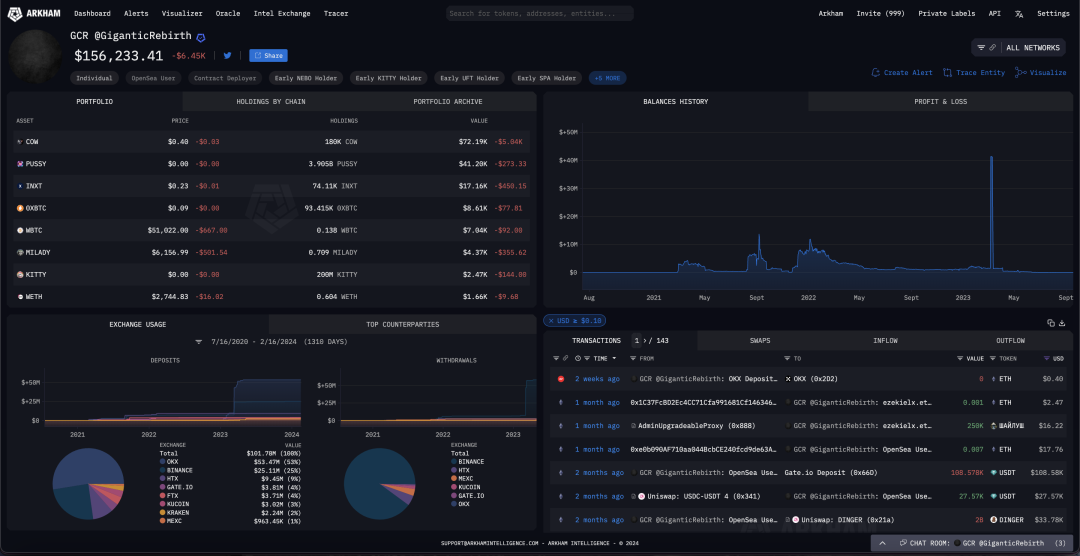

GCR Arkham user profile

One of GCR’s first posts after appearing on FTX leaderboard – posted via @GiganticRebirth

1. GCR’s Background and History

GCR has never publicly discussed his background in depth, but occasionally shares fragments of life before entering the crypto world. On X (formerly Twitter), he mentioned starting with a $1,000 portfolio, calling it his “one shot,” gradually growing it through trading. He first demonstrated predictive abilities through political influence analysis—a practice he often references on X. He also dabbled in sports betting and claimed to have spent “thousands of hours” researching longevity.

GCR’s tweets about his early history

He describes himself as a hard worker. During bullish periods, he encouraged fellow traders on Twitter to dedicate over 120 hours per week to honing their craft. While he advised his followers to take breaks at the end of 2022, he personally said he hadn’t taken a single day off in nearly three and a half years.

GCR’s advice to traders

At heart, GCR is a contrarian operator—he frequently referenced a “Tree of Life” in his 2021 tweets as key to mastering markets. After extensive speculation from other traders about its meaning, he eventually hinted that the “Tree of Life” simply represented a willingness to bet against consensus views. A devoted follower of George Soros, he often cited Soros’ talking points on reflexivity and contrarian thinking.

This contrarian mindset reflects GCR’s deep understanding of market behavior and precise grasp of crowd psychology. He recognizes that majority opinions are often wrong, and real opportunities lie in directions opposite to consensus. This approach allows him to find profit margins amid volatility through unconventional decisions.

George Soros’ theory of reflexivity posits that market participants’ biases affect prices, which in turn shape expectations and behaviors, creating a feedback loop. GCR clearly draws from this concept, applying it directly to his trading strategy by identifying imbalances and opportunities through contrarian positioning.

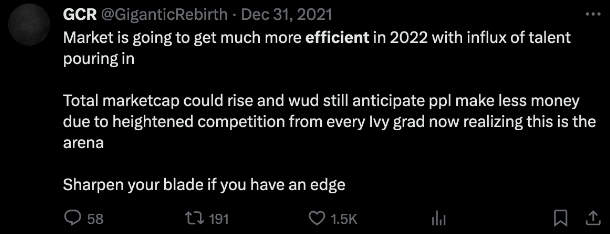

Some of GCR’s contrarian predictions

He became best known for publicly and successfully trading crypto during the 2021–2022 bull run, amassing a loyal following across multiple backup accounts. However, in early 2023, he went silent, posting “this might be my last crypto tweet” before vanishing from X. Since then, his social media presence has remained dormant.

2. Crypto Bull Market – Early 2021

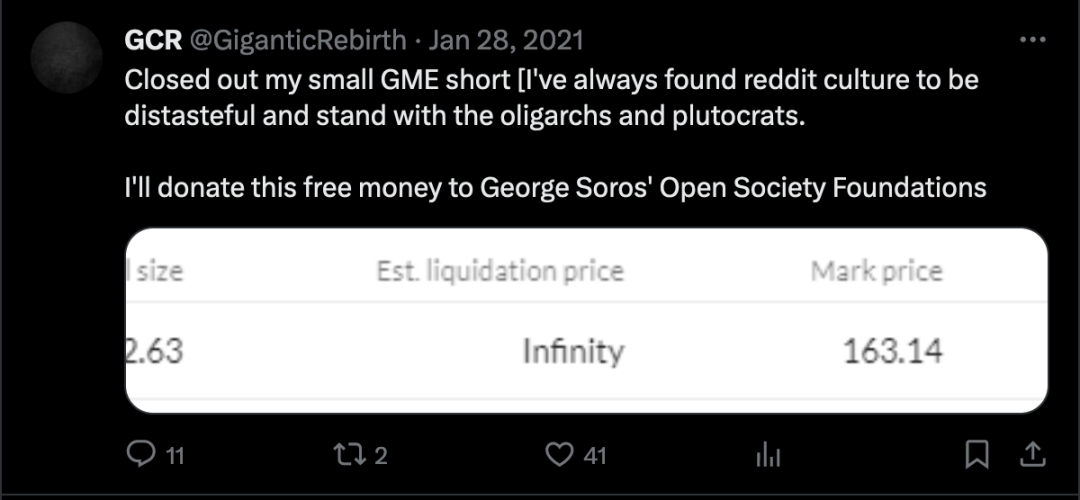

In early 2021, GCR was relatively unknown, with only a small number of Twitter followers, where he shared details about his market sentiment and recent trades. From the start, he favored contrarian views—one of his earliest posts detailed shorting the retail-driven GameStop (GME) stock surge in January 2021. He wrote: “I’ve always found Reddit culture repulsive. I’m siding with oligarchs and billionaires.”

GCR discusses meme stock trading

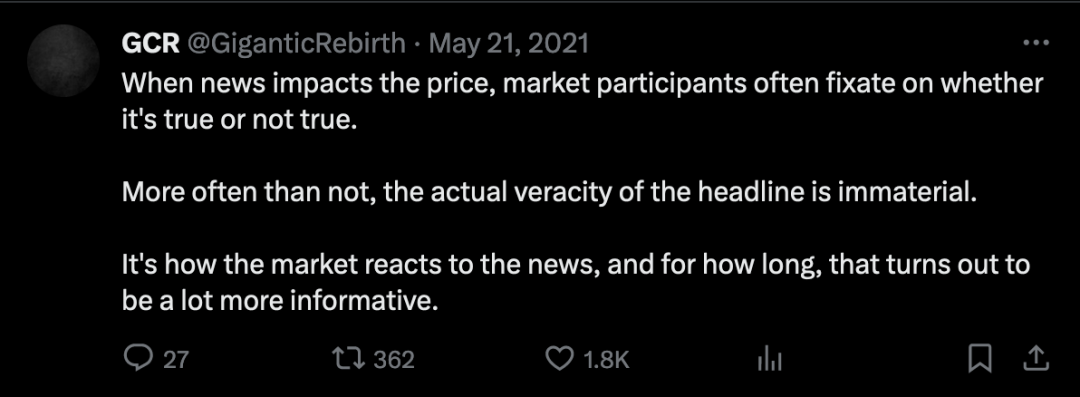

His content in 2021 laid out principles later widely circulated in Crypto Twitter circles—emphasizing patience and seeking niches where one can gain unique edges.

GCR’s advice on news-based trading

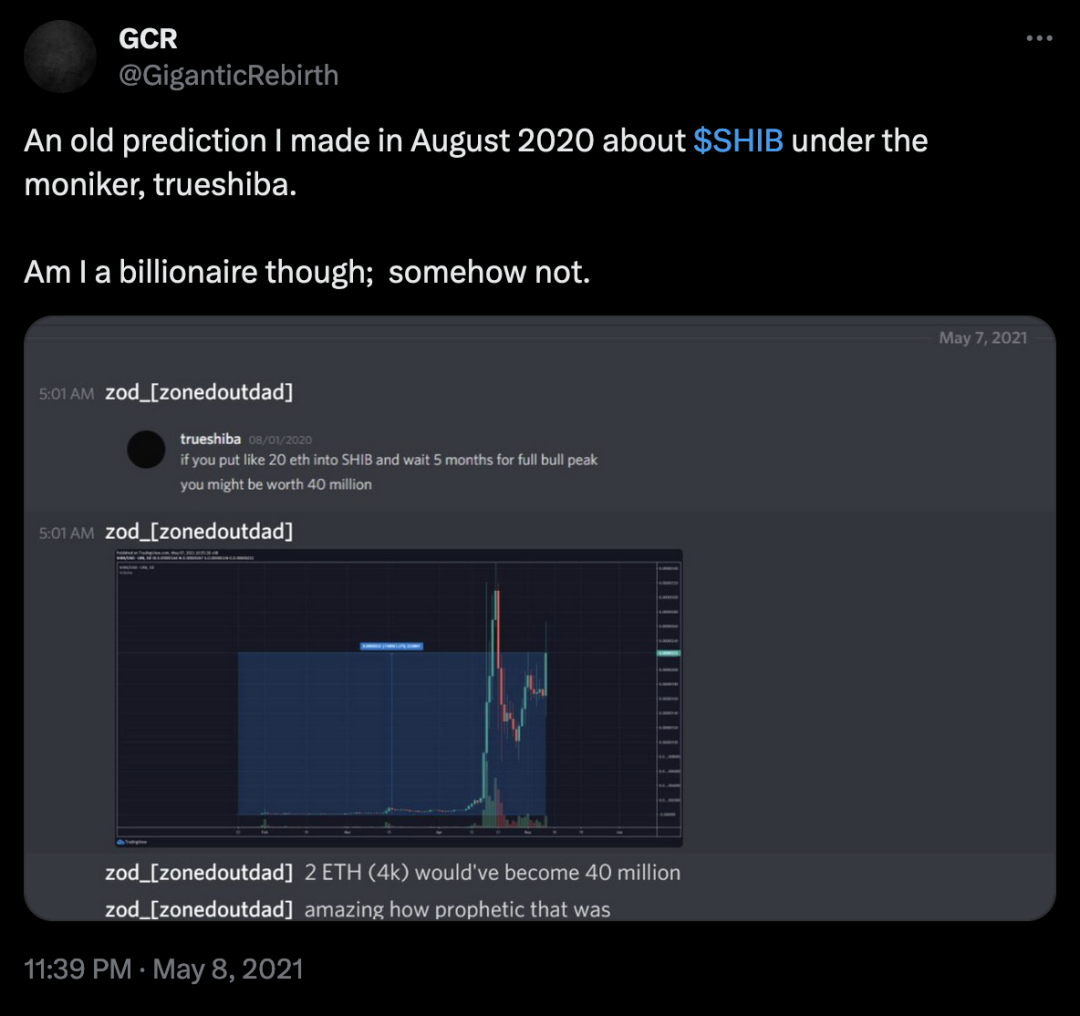

Interestingly, he revealed an earlier prediction: “If you put 20 ETH into SHIB and wait five months until peak bull market, it could be worth $40 million.” By May 2021, reality showed that investors actually needed just 2 ETH invested in Shiba Inu (SHIB) to earn $40 million in profit. This was GCR’s first notable post highlighting his affinity for meme coins—an asset class deeply distrusted by traditional traders at the time.

GCR discusses SHIB coin trade

Between April and May, he issued numerous bearish warnings, strongly opposing popular bullish narratives like the “super cycle” promoted by other 2021 stars such as Su Zhu of 3AC. His reasoning was sometimes straightforward—simply taking positions opposite to mainstream retail-driven sentiment.

GCR’s tweet warning of market correction

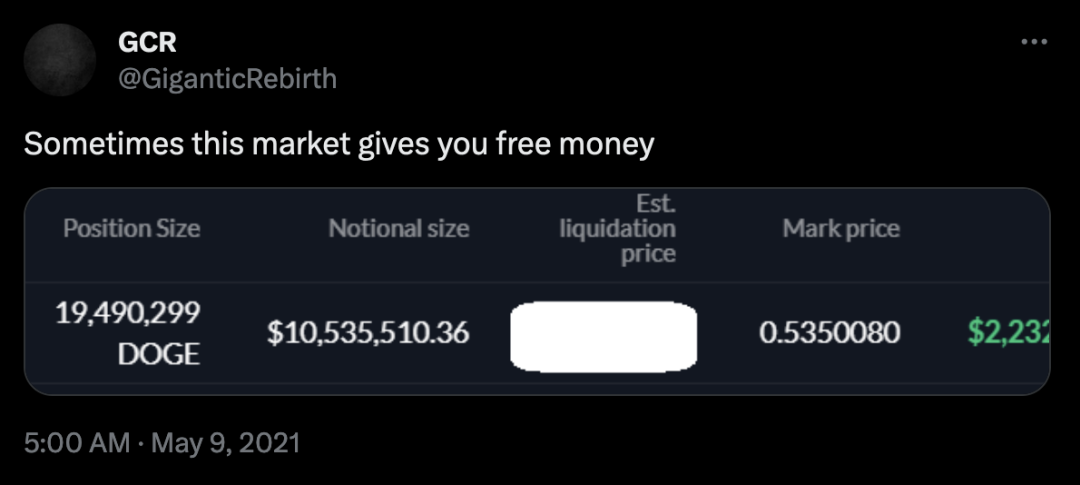

During the early 2021 crypto boom, Dogecoin (DOGE), a meme coin, saw explosive price growth. At its peak in May 2021, DOGE surged 69,136% from 2020 lows. As a “meme coin,” DOGE lacked utility or fundamental backing. It unexpectedly reached a $98 billion valuation after tech billionaire Elon Musk expressed interest and began discussing it on Twitter. Much of its rally was fueled by short squeezes—positions held by traders who doubted a joke currency could achieve such value.

One of GCR’s most famous trades in early 2021 occurred on May 9, 2021—the day Elon Musk appeared on Saturday Night Live—when he publicly shorted DOGE at the top. Over a year later, he explained: “Retail-heavy coins are often hyped for months due to some ‘future catalyst’… Just as retail traders imagine meme catalysts will make them millionaires, market makers use the final liquidity waterfall to distribute [tokens].”

GCR shorting Dogecoin at the peak

3. Going Against the Tide – Second Half of 2021

In the second half of 2021, GCR turned bearish, openly advising traders to heed his prior warnings—reduce trading under unfavorable conditions, and don’t delude yourself into thinking “altcoins can survive independently, swimming in BTC’s goblin town.”

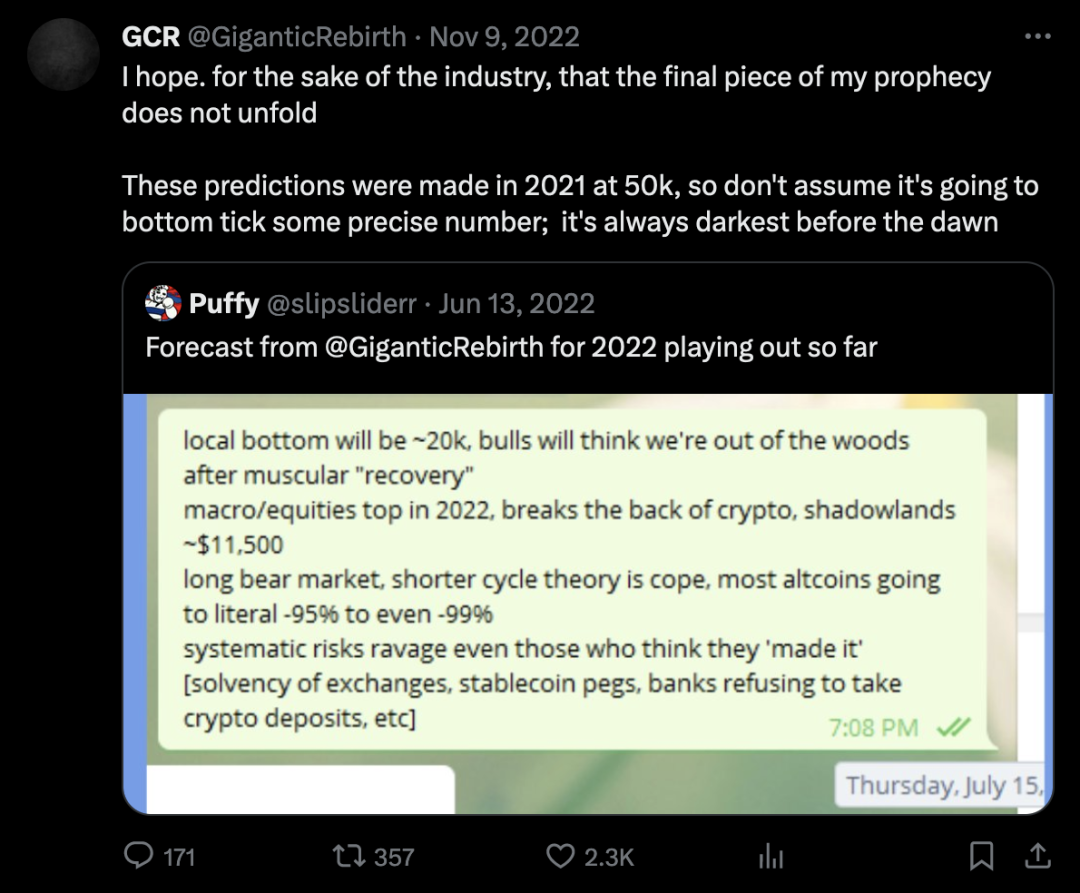

On July 15, GCR made his infamous 2022 bear market prediction in a private Telegram chat, forecasting a long and severe bear market where even the strongest projects would barely survive.

“Local bottom around $20K… macro/stock top in 2022,… most altcoins down 95% or 99%.”

GCR’s bear market prediction

GCR’s bearish stance didn’t mean abandoning crypto—quite the contrary. While still optimistic about remaining opportunities in 2021, his strategy shifted toward shorting outflows using bearish positions. From then on, he heavily shorted altcoins either weak or strong relative to BTC.

GCR discusses altcoin market on Twitter

He also applied his predictive skills to different assets and domains. First returning to political forecasting, he successfully bet on the rise of dark horse Valérie Pécresse during the 2022 French presidential election.

Pécresse ultimately lost—but GCR later clarified his goal was to capitalize on the upside potential when an outsider gains mainstream traction—as he explained, the difference between 5% and 50% odds offers a 10x return, whereas betting on a clear winner in a close race yields only 2x.

GCR’s political prediction

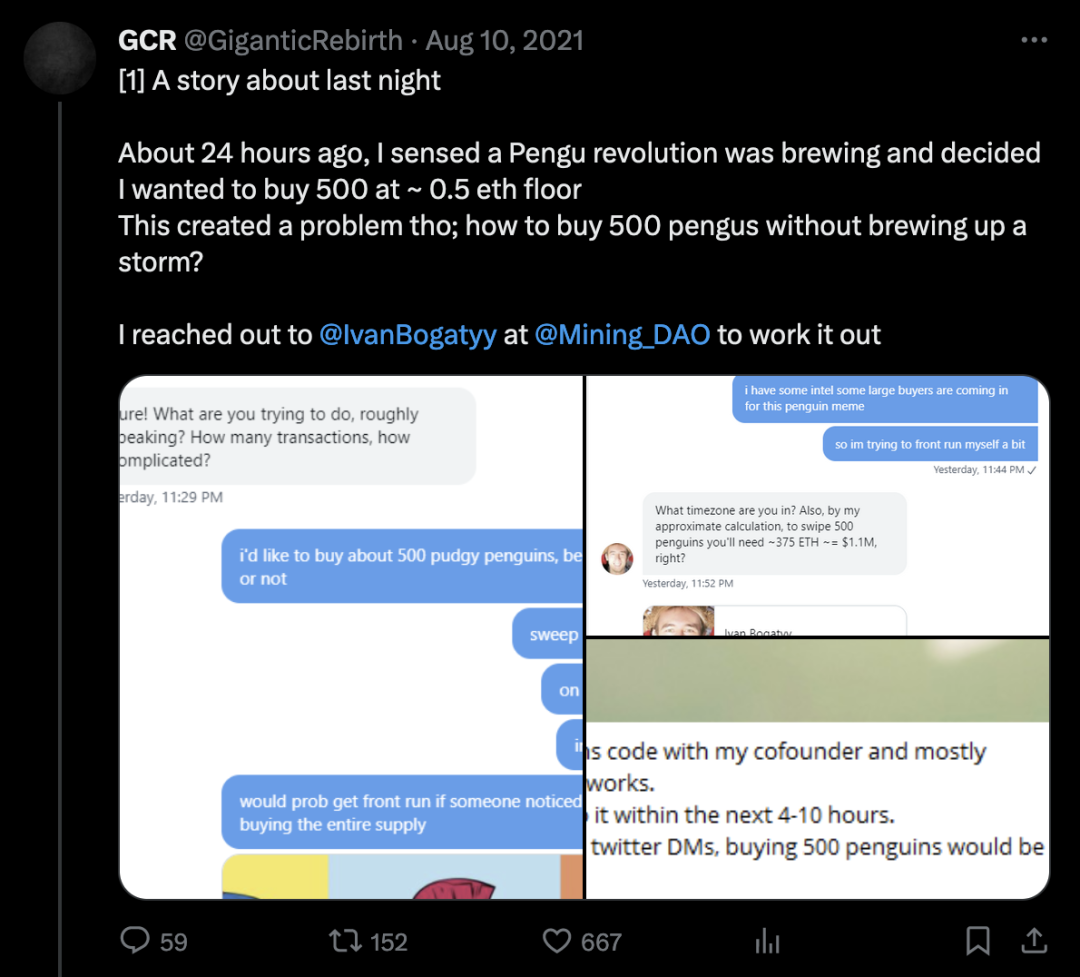

In August, GCR began speculating in NFTs (non-fungible tokens). Compared to meme coins, which he called “altcoins 2.0,” he preferred NFTs due to their lower market caps. Beyond purchasing hundreds of “Pudgy Penguins” NFTs, his address won a “Sad Doge” NFT in an auction, selling it a month later for $2 million in USDC (a dollar-pegged stablecoin). Still, he commented that NFTs are extremely difficult to gain visibility in, saying: “My NFT investment is seven figures, but less than 1% of my net worth, part of a broader barbell investment strategy.”

GCR’s NFT purchases

By October 2021, he began betting on Trump winning the 2024 election. The trade size was so large that obtaining sufficient liquidity on exchanges was nearly impossible, forcing him to resort to direct OTC (over-the-counter) deals with Alameda Research. Just over a year later, Alameda’s balance sheet leaked, revealing they still held $7.3 million in unhedged TRUMPLOSE tokens—likely remnants of GCR’s trade.

GCR’s prediction of Trump’s 2024 re-election

In October, GCR offered advice to young traders: spend time hunting for every possible edge in the market. “Even if you live another 80 years, you’ll never again have such an easy shot at generational wealth.” This state of extreme optimism lasted roughly two months—until late November 2021, when the crypto market hit all-time highs.

GCR’s advice to young traders

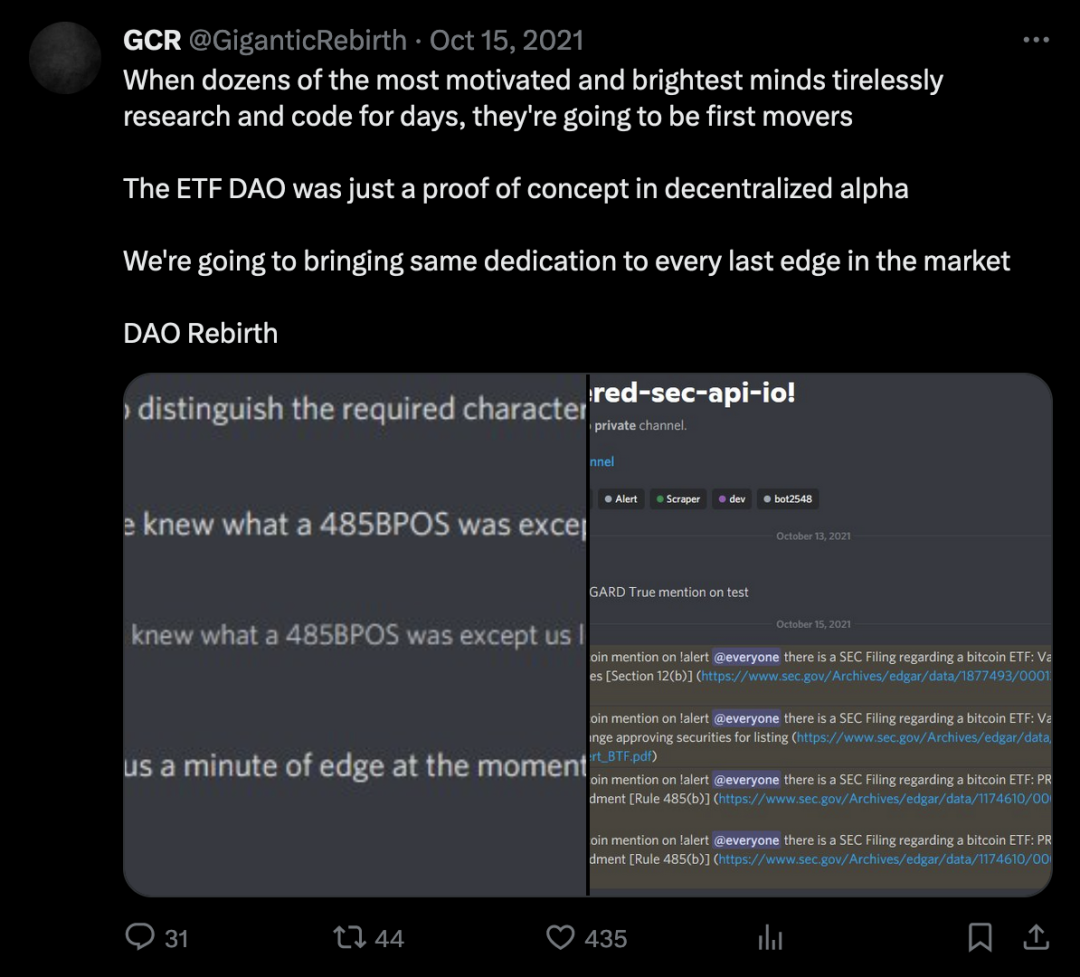

Shortly after, he began recruiting for a new team—named RebirthDAO. Its stated goal was to form a “decentralized hedge fund” by uniting many highly successful crypto traders. Their first trade was an ETF news play in October 2021: anticipating and exploiting the approval of ProShares’ BTC futures ETF. According to GCR, the trade was highly successful—RebirthDAO was among the first public traders to receive alerts pushing BTC from $57.1K to $59K, giving them a crucial few-second advantage over others.

GCR discusses RebirthDAO on Twitter

4. “The Big Short” – GCR in 2022

GCR discusses shorting the market in November 2021

After a busy October 2021, GCR slowed down in November—as the altcoin market reached frenzied levels, he took a break. On November 22, he announced online: “Back, starting to short.” Two days later, he explicitly declared the market nearing a cyclical peak: “I’m very confident we’re at the end of the cycle, and cycles still exist… If you’ve made money, secure your profits now.” Roughly two weeks earlier, on November 10, BTC had already hit its cycle high at $69,000. For traders heading into 2022, he gave one piece of advice:

GCR’s advice to traders

Through RebirthDAO, GCR began devising ways to profit from what he viewed as an overheated altcoin market. With total crypto market cap exceeding $3 trillion, GCR targeted coins with large upcoming token emissions in 2023, having his DAO team gather as much unlock data as possible. Instead of shorting top-tier assets like BTC or ETH, RebirthDAO planned to short the weakest altcoins. GCR said he was most interested in tokens with the largest issuance volumes in the first half of 2022.

The research team used various methods—beyond reading documents, they analyzed on-chain wallets and even contacted project team members directly to learn about 2022 token emission scales.

GCR later noted that many coins deemed ideal shorts were either projects in Solana’s ecosystem—backed by FTX, with large investor token locks—or metaverse-related tokens that had been excessively hyped at the end of 2021.

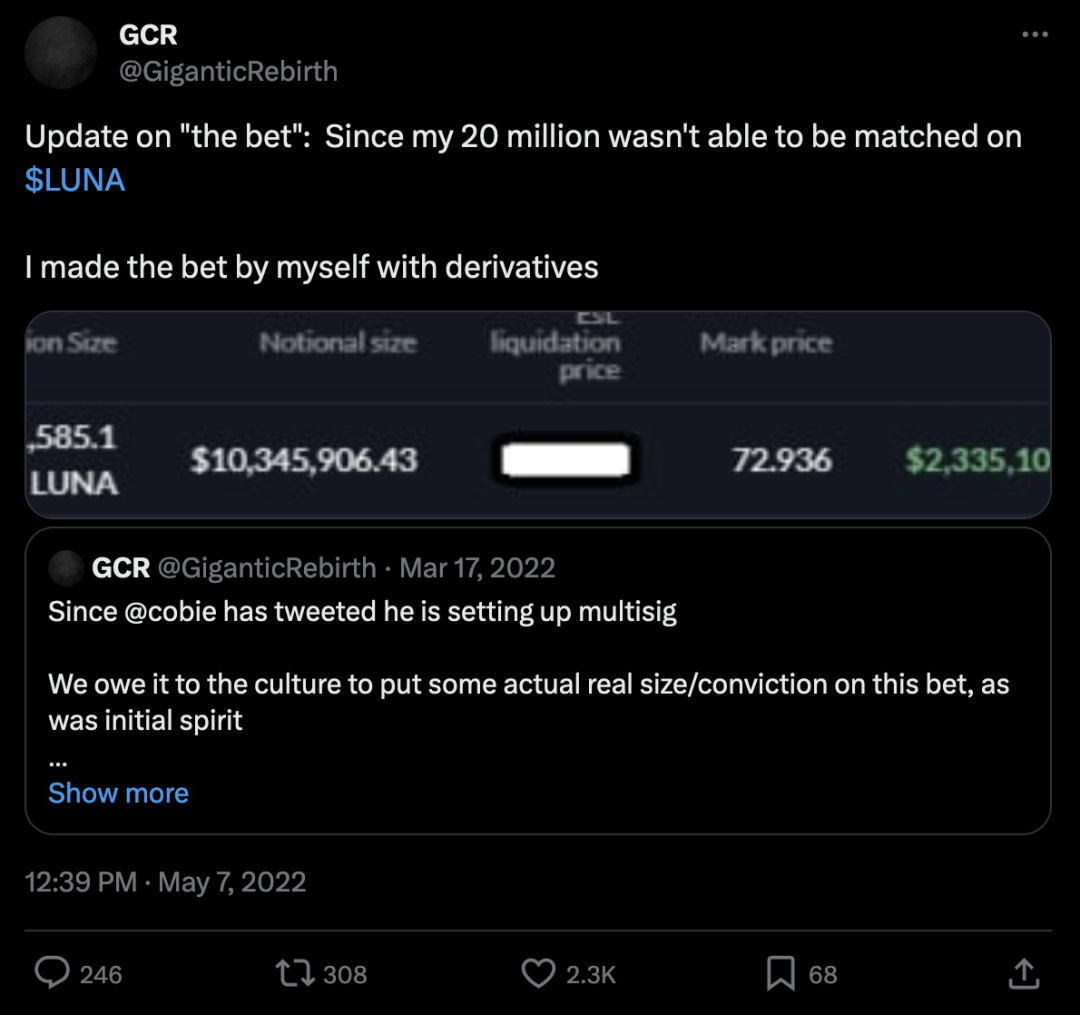

However, GCR’s most famous move was a public bet against Do Kwon, founder of LUNA. On March 14, 2022, GCR proposed a $10 million wager with Do, betting that Terra Luna’s price would be lower a year later. GCR successfully convinced Do Kwon to match the $10 million with his own crypto, with the escrow managed by @cobie, a well-known figure.

GCR bets on LUNA price decline

While GCR succeeded in securing a direct $10 million bet with Do, he wanted larger exposure—so he used derivatives on FTX to go short $10 million in LUNA perpetual futures. Just two months later, on May 7, GCR revealed the position had already gained $2.3 million in profit.

GCR discusses his view on LUNA

LUNA was especially vulnerable to sell pressure—it backed UST, an “algorithmic stablecoin,” whose value depended on market demand for LUNA. Throughout most of the bull market, buyers willing to purchase LUNA absorbed all outflows from the UST system—even surviving a “depeg” event during the May 2021 crypto crash. But by May 2022, over $10 billion in UST existed, compared to just $1 billion in 2021.

When UST was dumped en masse on the market, holders rushed to redeem it for LUNA and sell for real dollars. Long queues waiting to claim and sell LUNA deterred other traders from buying—causing LUNA’s price to plummet.

Eventually, LUNA’s price crashed nearly to zero. GCR offset his entire LUNA risk for just $0.72—effectively hedging his $20 million short position in LUNA for less than a dollar.

GCR closes his LUNA short position

As the 2022 bear market dragged on, GCR anticipated rising cyberattacks, scams, and fraud—originating from bad actors or even project teams themselves. With increasing DeFi projects suffering from code flaws, exploits, and reentrancy attacks, GCR warned traders to pay special attention to incentive structures as a critical factor in investment decisions during bear markets.

GCR comments on scams and fraud in bear markets

By late 2022, GCR repeatedly shorted DOGE’s residual momentum and advised followers to rest or take vacations when market conditions worsened. As global BTC approached its yearly low, GCR reminded traders: “Macroeconomics will never give you an edge; never ever… stick to what you understand.”

On November 8, 2022, FTX collapsed due to massive customer withdrawals. After discovering its sister company Alameda Research had been using customer funds, rapid capital flight led to the exchange’s bankruptcy.

GCR had repeatedly warned traders about custody risks—during bull markets, frequent hacks, scams, and wallet losses prompted him to urge more traders to use top-tier exchanges for custody. Unfortunately, he did not foresee the collapse of the second-largest crypto exchange.

When FTX halted withdrawals, GCR wrote: “I hope, for the sake of the industry, that the last part of my prophecy doesn’t come true.” But sadly, over the next three months, it emerged that FTX itself had about $9 billion in debt and had allowed Alameda to use customer funds to cover losses for years. One item on their balance sheet? $7.3 million in “TRUMPLOSE” tokens. “I thought they were hedging on Betfair,” GCR posted online.

5. 2023 and Beyond: GCR’s Predictions for the Future

After FTX’s collapse, GCR permanently stopped posting on his @GiganticRebirth account. His backup account @GCRClassic provided fewer individual trade updates and instead shared broader outlooks on the future.

GCR’s advice to crypto participants

During the 2022 crypto market lows, GCR’s most important advice may have been about the value of time: “No matter how much money you have left, depth and breadth of market knowledge are invaluable.” Even after losing significant funds on FTX, GCR remained optimistic about crypto’s prospects. He said: “In an increasingly digital world, digital assets are essential.” This tweet was posted on November 23, just two days after BTC dropped to around $15,476.

As uncertainty loomed over crypto’s future and some startups began shifting focus away from the industry, GCR proposed the idea of an “echo bubble” emerging in 2023—occurring after the last optimists in the market were fully wiped out. Interestingly, a broad market recovery in January 2023 actually laid the foundation for BTC’s cyclical bottom.

GCR’s “echo bubble” theory

In early 2023, as markets slowly recovered, GCR seized the chance to elaborate on his long-term beliefs and predictions for crypto’s future. In one of his earliest 2023 tweets, he pointed to China leading the next rally: “Many future pumps will happen on coins nobody in your circle knows.” Within months, the first BRC20 token ORDI was deployed on the Bitcoin network. By November, ORDI’s market cap would reach $1 billion—largely due to its popularity among Asian exchanges and speculators.

GCR’s belief in Asia-driven bull cycles

Remaining cautiously optimistic about crypto’s development, albeit tinged with pessimism and skepticism. In a May 2022 tweet, he predicted humans would become “more desperate, greedy, fallen, lonely, trapped in the metaverse.” Throughout 2023, he maintained this view, while the crypto market cycled through phases including casino coins, meme coins, and even bizarre projects like hamster racing. In 2023, RLB—the token of a top crypto online casino—briefly surged to a $777 million valuation before dropping over half.

GCR’s casino theory

Since late 2021, GCR has predicted a major increase in market efficiency in crypto. He attributed this to factors like top university graduates entering the field, maturing regulatory frameworks, and tighter controls on privacy protocols and private cryptos. While anonymity in blockchain transactions is commonly assumed, GCR cautioned against mistaking on-chain activity as truly private.

GCR’s view on future talent development in crypto

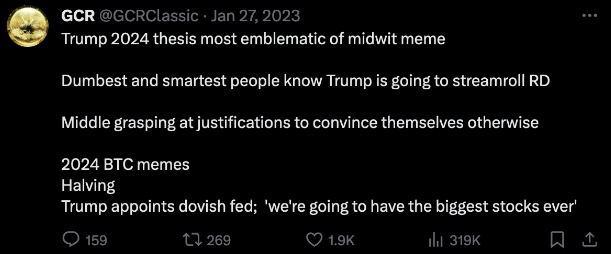

He showed intense interest in the 2024 U.S. presidential election—since late 2021, he placed heavy bets on Donald Trump winning. “The dumbest and smartest people know Trump will win easily,” he said. The former U.S. president remained in the spotlight throughout 2023 with headline-grabbing moves, including turning himself in voluntarily at Fulton County Jail, Georgia, on August 23.

GCR’s view on Trump’s 2024 campaign

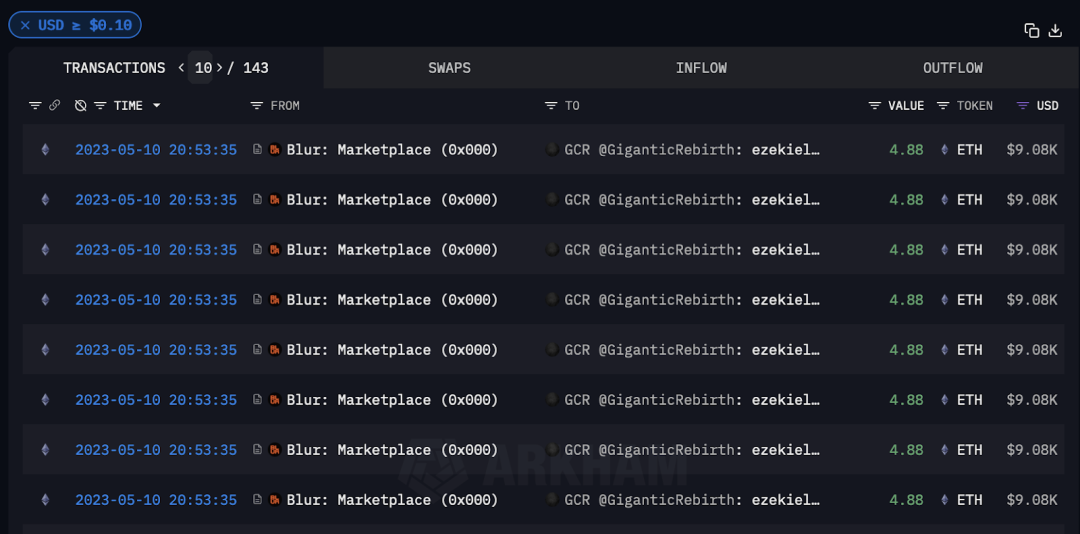

In the first quarter of 2023, GCR invested in over 300 tokens from the “Milady” NFT project, despite some in the crypto community finding it odd. About three months later, after Elon Musk posted a meme related to the project on Twitter, GCR sold roughly half his holdings. Nonetheless, he still holds Milady tokens worth over $890,000 in his public wallet ezekielx.eth.

GCR buys Milady on BLUR

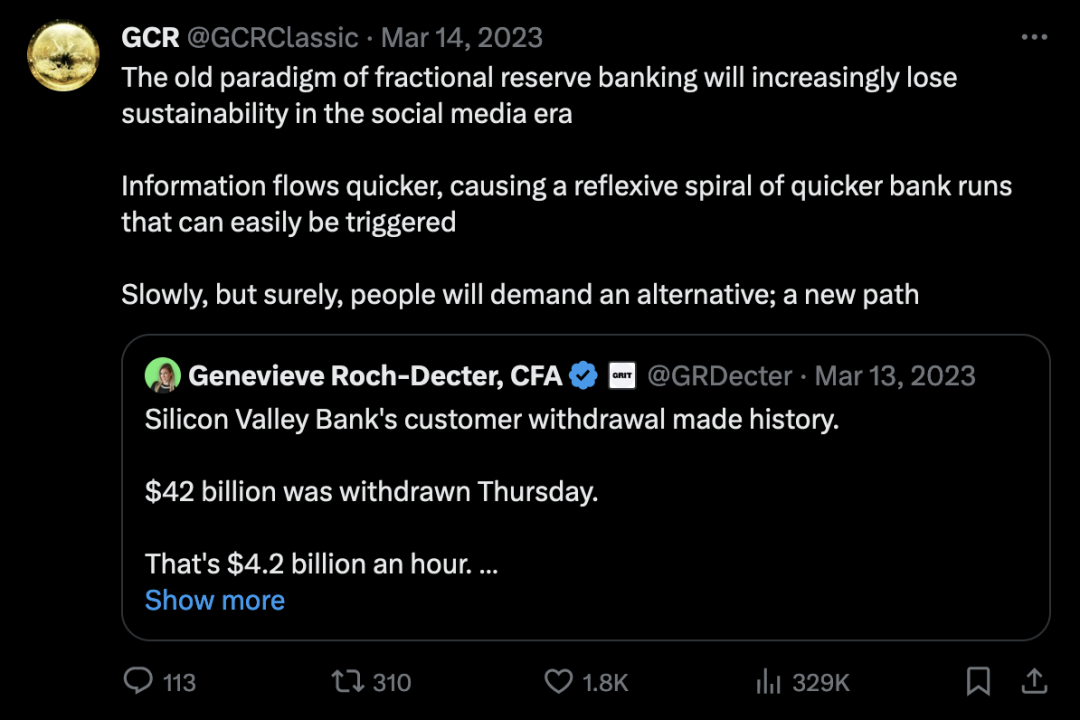

One month before GCR left Twitter, Silicon Valley Bank collapsed—causing USDC, one of crypto’s largest stablecoins, to temporarily depeg, dropping to $0.88. This event didn’t faze GCR—he swapped a total of $4 million in USDT for USDC on-chain.

GCR’s stablecoin trade

On Twitter, GCR expressed his belief that in the digital age, widespread adoption of crypto is inevitable. He said: “People will seek alternatives, new paths.”

GCR’s comment on the future of finance

His final tweet on GCRClassic was positive: “They’ll keep printing more money.” He added: “Ethereum will one day reach $10,000.”

GCR’s final tweet and his Ethereum price prediction

A week later, he liked someone else’s tweet saying “See you when ETH hits $10,000.” Then, he disappeared completely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News