BlackRock is making moves again, this time launching a blockchain-based fund

TechFlow Selected TechFlow Selected

BlackRock is making moves again, this time launching a blockchain-based fund

After launching a Bitcoin spot ETF, BlackRock is now looking to bring traditional financial assets into the crypto world.

Author: inpower Wang Jun

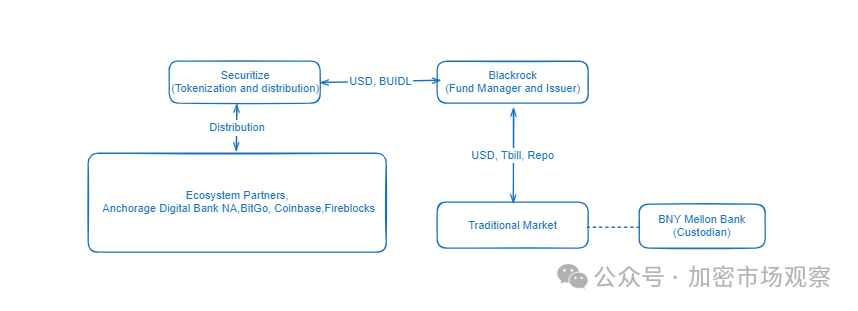

This morning I saw major news: BlackRock officially launched its tokenized asset fund on the Ethereum network and made a strategic investment in Securitize, a tokenization firm. The fund is called the BlackRock USD Institutional Digital Liquidity Fund, represented by blockchain-based BUIDL tokens, fully backed by cash, U.S. Treasuries, and repurchase agreements, and will distribute daily earnings to token holders via the blockchain. Securitize will serve as the transfer agent and tokenization platform, while BNY Mellon acts as custodian of the fund’s assets.

The CEO of BlackRock—the man who pushed BTC into ETFs

BlackRock is playing this really well. It's only been a little over two months since spot Bitcoin ETFs were approved—bringing crypto assets into traditional finance—and now they're flipping it around by bringing traditional financial assets into crypto.

How are certain places that claim to “embrace crypto” and build themselves into “policy hubs” supposed to compete? (I’m looking at you, HK.) These regions are essentially middlemen with no real financial markets of their own, dragging their feet on policy while trailing behind others.

In a future where crypto accelerates financial globalization, they might truly be left out in the cold.

The remainder of this article draws primarily from my friend’s Twitter thread. His insights on RWA are highly professional—you should check out his original posts when you have time:

Clearly, BlackRock aims to make a strong push into public chain tokenization. Naming the fund BUIDL is pretty cool too (an acronym formed from the first letters of BlackRock USD Institutional Digital Liquidity Fund). Previously, spot BTC ETFs were essentially Web3 assets sold through Web2 structures to Web2 investors. This time, it’s Web2 assets being offered through Web3 mechanisms—to both Web3 and Web2 audiences. Just like the regulatory and technical groundwork laid for BTC spot ETFs, such products must bridge both Web2 and Web3 ecosystems. With a minimum investment threshold of $5 million, the product targets qualified investors, maintains a 1 BUIDL = 1 USD peg, uses a daily rebase mechanism to distribute interest (keeping token price stable while increasing token quantity), and restricts token transfers to a whitelisted group.

As shown in the diagram below, the most crucial aspect is securitization. Securitize Markets holds an ATS (Alternative Trading System) license in the U.S. and is a FINRA-registered broker-dealer; Securitize LLC is also a SEC-registered Transfer Agent, with systems deployed on public blockchains. This is similar to @DigiFTTech’s Capital Markets Services and Recognized Market Operator licenses in Singapore—leveraging public blockchains for primary issuance and secondary trading.

For asset managers like BlackRock entering this space, partnering with institutions capable of handling tokenization is essential. Traditional custodians like BNY Mellon Bank, along with ecosystem partners such as BitGo, support custody and distribution of these tokenized assets.

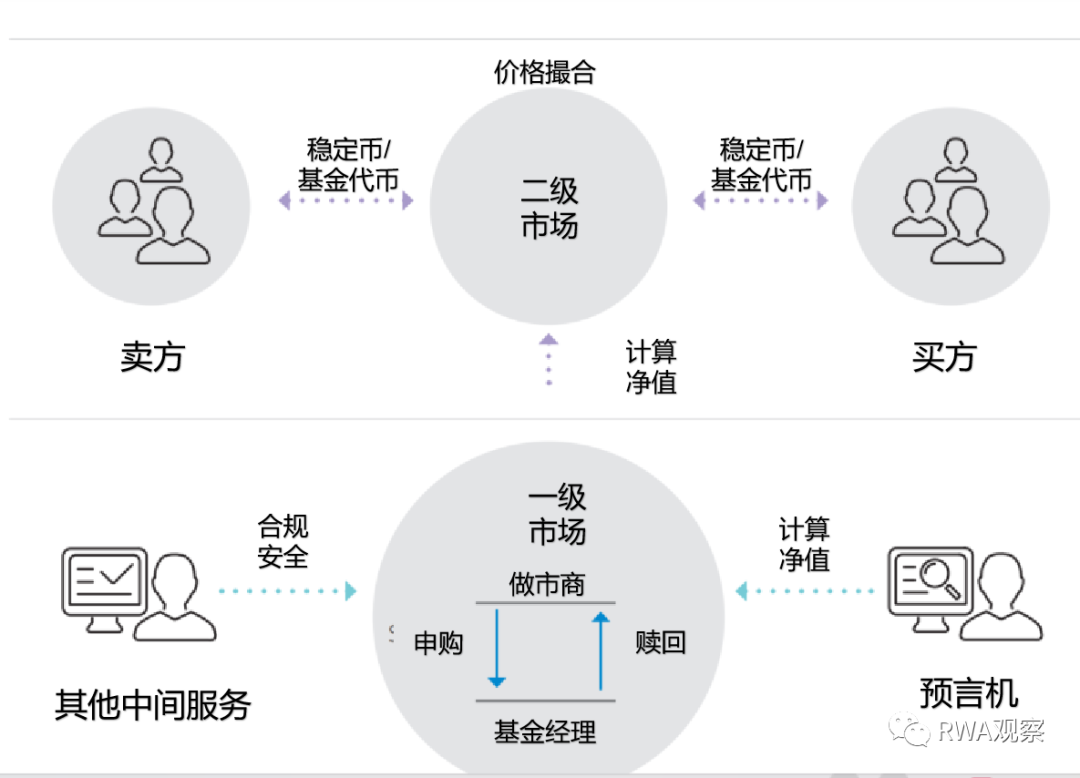

Compared to previous RWA offerings, the standout feature of this fund is real-time subscription and redemption—a capability highly desired by traditional financial institutions. In the Web3 world, earning 10% APY on Aave with instant deposits and withdrawals highlights one of the most attractive aspects of public chains for financial firms: real-time clearing and settlement. In contrast, traditional channels suffer due to fragmented ledgers across institutions, requiring lengthy clearing and settlement processes involving multiple external parties and internal steps—T+2, T+3, or even T+5 settlements are common.

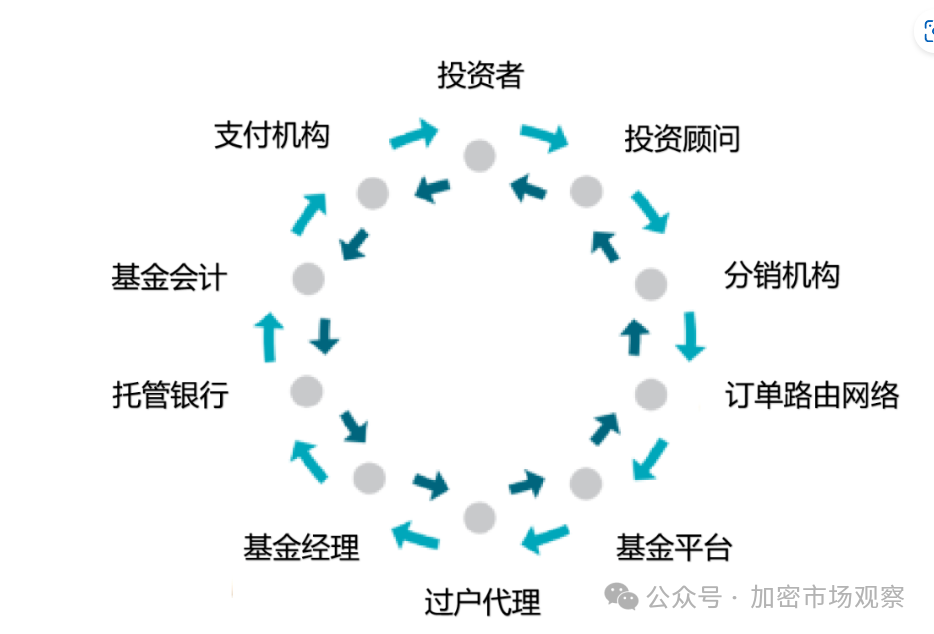

Traditional fund transaction process

While real-time subscriptions and redemptions are claimed, integration with legacy fiat systems still introduces friction and delays. There are numerous bottlenecks and prerequisites involved. Without actual testing, here are some hypotheses about current limitations and unresolved challenges in traditional channels:

1. Securitize supports both USDC and USD for subscriptions and redemptions, similar to the DigiFT platform. If users subscribe using USDC, Circle must still convert it (currently relying solely on Circle’s banking partner). Unless both Securitize and BlackRock hold accounts at the same bank—or access an interbank real-time payment network—real-time completion isn’t possible.

2. For USD subscriptions, funds must first be deposited into the Securitize platform. Cross-bank transfers introduce timing lags and costs unless both parties use the same bank, in which case real-time settlement could occur.

3. Real-time subscription means BlackRock can instantly mint new fund shares, but deploying the received USD into underlying assets takes time—similar to stETH, potentially diluting overall APR. For large redemptions exceeding available cash reserves in the fund, liquidating underlying assets would take even longer. However, given its status as the world’s largest asset manager, BlackRock can still provide substantial liquidity.

Currently, there are 40M BUIDL tokens issued, held by two addresses—one holding 35M and the other 5M BUIDL. With a $5M minimum investment requirement, few Web3-native institutions can participate. On-chain data shows no evidence of USDC-based purchases so far—investors appear to be predominantly traditional institutions.

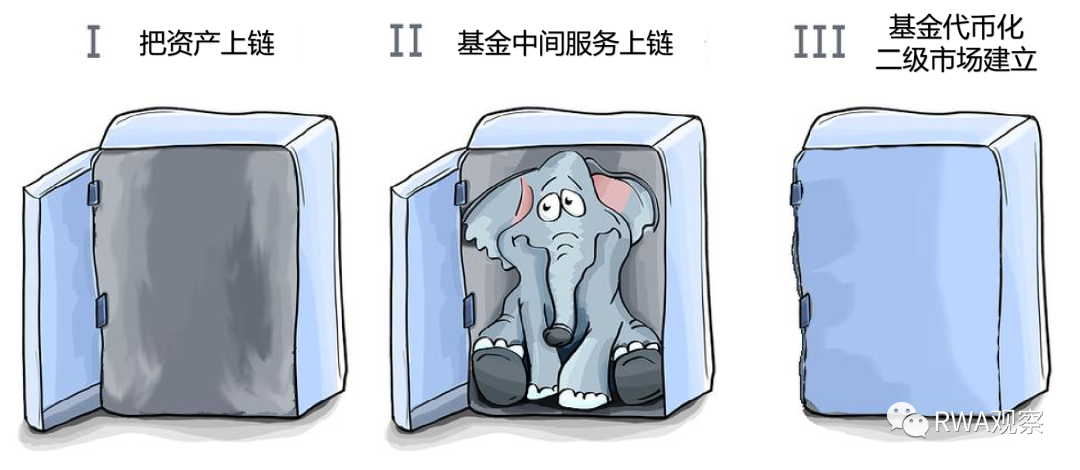

Looking at the above workflow, only the fund shares themselves are tokenized—the rest remains off-chain (still just step one). "Real-time" functionality merely refers to BlackRock’s ability to instantly mint new shares upon subscription via Securitize, dependent on pre-established integration between the two parties. Redemption depends entirely on BlackRock’s internal liquidity management. The entire structure relies heavily on traditional institutions’ advance capital reserves, automated system integrations, extensive coordination, and negotiation—only then achieving a fragile approximation of “real-time.” Compared to Web3, despite Web2’s massive scale, accomplishing this requires enormous effort and years of work—whereas in Web3, such transactions happen effortlessly in seconds.

Nevertheless, regardless of the complexity behind the scenes, this is an excellent attempt—an important leap forward in the convergence of Web2 and Web3. The actual scale may not matter much right now; what’s key is how different players drive infrastructural progress during this process, exploring deeper integration between traditional systems and emerging infrastructure. As more assets enter Web3—especially those natively issued on-chain—and as more stablecoins (including bank-backed stablecoins and even CBDCs) become available for direct token-to-token exchange within Web3 environments, we’ll finally see true transformation of the financial world by Web3.

Future on-chain fund (currently only the primary market component completed)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News